Regulatory Certainty and the Rule of Law | Decentralized Law

Dear Crypto-Legal Observers, Those in the crypto-legal space spend a lot of time talking about regulatory uncertainty. In fact, it’s been one of the favorite topics of Decentralized Law — the lack of regulatory certainty is bad for projects, disadvantageous for builders, and allows for ‘regulatory arbitrage’ by projects and people who seek crypto-friendly jurisdictions in which to set up shop.    But what if we are looking too narrowly at these issues and viewing regulatory certainty through the wrong prism? Perhaps a better way to analyze crypto regulations is by measuring a certain jurisdiction’s adherence to the rule of law while realizing that regulations aren’t uncertain; instead, they are clear and just need updating to account for modern technology. Welcome to the mind of Stephen Palley. Besides having one of the most irreverent crypto-legal Twitter accounts … … he also has the mind of a legal magician — seeing facts where others see illusion. Decentralized Law had the pleasure of speaking with Palley about regulations, the potential for a U.S. CBDC, and what it means to be a creative problem solver. On regulatory uncertainty, Palley provides this insight:

Indeed. The remainder of this issue of Decentralized Law is devoted to exploring crypto influencers and disclosures, reviewing the recent class action lawsuit against Uniswap, analyzing the state of crypto in the EU, examining SEC rulemaking, digging into the UK’s regulatory sandbox, and summarizing recent news from throughout the cryptosphere. Although this newsletter may help to familiarize readers with the legal implications arising out of blockchain technology, the contents of Decentralized Law are not legal advice. This newsletter is intended only as general information. Writers’ opinions are their own; therefore, nothing in this newsletter constitutes or should be considered legal advice. Contact a legal expert in your jurisdiction for legal advice. Welcome to Decentralized Law. Contributors: eaglelex, lion917, hirokennelly.eth, COYSrUS.eth, Trewkat, ComeBackKid, lawpanda, MDLawyer, G0xse, permioth, terumask, B(3,A)Rhunter, Cosmic Clancy, Tayy, Puretayo, AriesLaw This is the official legal newsletter of BanklessDAO. To unsubscribe, edit your settings. 🙏 Thanks to Our Sponsor

🎙 InterviewLegal Magician Stephen Palley Pulls Back the Curtain on Regulations and the Rule of Law

I'm a trial lawyer and litigator by training. I started my practice in the Midwest (Missouri and Illinois) and moved to D.C. in the mid 2000s. I was in law firms that collapsed because of the 2008 financial crisis. For reasons connected with a software project I was working on, I discovered Bitcoin and then Ethereum circa 2014/15. My interest was in finding technology that would help reduce the need for human trust in dispute resolution.

Well, what's funny is that I didn't realize at first that you could trade the stuff, that you might make money if you engaged in speculative trading. What interested me was the idea of a decentralized programmable money and that's kind of what got me engaged in the space. And I just went down that rabbit hole and now six or seven years later, something like ninety-five percent of my practice is somehow connected with crypto.

I'm still a disputes person. I like solving problems, and I like working on disputes, those involving regulators and those involving private parties, that are made easier by an understanding of the asset itself. For me, that's fun. I also do a lot of front-end advisory work, providing people with regulatory advice to help them avoid problems. It's fun helping people design software that is compliant and that avoids problems.

I am not sure that regulations are necessarily unclear. Rather, they are enforced in a way that is sometimes too broad or, alternatively, no longer make sense. As an aside, one of the strange things about the modern administrative state is that agencies have the ability to run their own investigations, and have their own courts under the APA — the Administrative Procedures Act. So you can have a case where — from the inquiry to the investigation to the hearing — none of it is heard by an Article III judge. None of it is heard in a court. You are faced with a prosecutor and a judge who are all part of the same agency. Maybe that's a necessary evil of a large nation state with a very complicated legal system, where we regulate everything from dairy cows to broadband spectrum. But it's uncomfortable.

I do think that one of the reasons the United States is a good place to do business is because we have a robust appreciation for the rule of law. You know that if you’re a lender and you secure your interest in property correctly, then if there's a problem, you could go to court and satisfy the indebtedness by a lien on the property. That's very powerful, and that's why we have the ability to have a massive mortgage system, massive home ownership, or a system where you can walk into a car dealership and buy cars, and that is a product of having a strong rule of law. And it's something that people in countries all over the world have attempted to model. I think that a lot of what happens in crypto is actually quite predictable; I don't think that things are as uncertain as they're often made out to be. You know, the question is not whether or not things are certain or uncertain. The question is whether or not there's some type of regulatory or enforcement overreach, whether the way regulators interpret existing laws make sense when applied to modern technology. And maybe the question is: we might be certain what certain assets are under current securities laws, for example, but maybe the laws should change? Maybe the state of play is such that it was structured in the 1930s in a very different economic circumstance and conditions that don't neatly apply to digital assets, magic internet money, in the same way that they apply to stock promoters in the 1920s and 30s. That's kind of my take, it's not that we don't have legal certainty, it's that we do, but maybe the laws that we have on the books need to change.

I’m not sure. Also, I think there's a misunderstanding about the role that lawyers play in the space and the power that we have. I don't write the laws. I'm not a politician and not a policy maker. I'm just a simple country lawyer. My job is to help clients navigate existing laws, and my opinion about what policy should be is perhaps no more or less important than someone who doesn't have a law degree. I guess I have more exposure to certain things because of the nature of my practice, but I don't think lawyers have a monopoly on policy opinions.

The value proposition for cash in the form of paper money is that you don't have to have a bank account to use it. And from a privacy standpoint, it's pretty good. I mean, yes these things have serial numbers on them. And I suppose people can leave fingerprints on them, I'm assuming, but anybody can use a ten dollar bill. But that aside, they're basically fungible and don’t leave a record when used. The bigger problem is that not everybody has access to bank accounts. So the interesting question is, how do you create digital money that is legal tender that can be available to everyone, even people that don't have bank accounts? It could be that CBDC solves this I suppose, though you’d still have a system where not everyone has devices that can be used for CBDC. So instead of people being unbanked they are ‘un-deviced’. CBDC would have to solve for that too to be at all useful.

I have no idea. Would it be a public/private partnership? I just don't know what policy makers are thinking. My assumption is, if I'm a policy maker, I'm thinking money is too important to be controlled by anonymous people over whom we have no power. We want to make sure the code is perfect. We want to have some control over supply. So I think that from a policy standpoint, from the way the United States is currently constituted, I'm skeptical that there will be a great deal of enthusiasm for turning over money supply to a kind of public/private partnership or something that's fully decentralized. I could be wrong, but it seems like wishful thinking. And whether or not it's a good idea is a different question. You know, fiat legal tender is a fictional narrative, right? The idea of going to a store and buying two jars of herring for a ten dollar bill is kind of insane. It’s paper; the only real use, or value, that it has is that you can burn it and create heat for a few seconds. The fact that I could take paper in exchange for food is kind of insane. So the notion that a dollar is more real than a bitcoin … well intellectually, it's not. It's not true. I mean, I guess you could say that you can always burn the dollar. But maybe the fact that you can't burn a bitcoin makes it more valuable, right?

I like solving problems, which is not really a function of crypto. If you don't like helping people, law is not a good business to be in. You know, helping people find elegant solutions to complicated problems. So what I liked about law before crypto is what I like about it now.

It's creative problem solving. It's human relations, diplomacy, creative thinking, all of that. I suppose it would be better if I could say that it was unique to crypto, but it's not. There are basic lawyering skills and some basic people skills, too. That's what I enjoy. I like the technology. I always have. I had computers way before most folks. I was using the World Wide Web before the graphical browser, using the old text-based browser and Unix. So that's part of what's cool about it. I like seeing ‘the new’. The rewarding part is a happy client who has a problem solved. That, to me, is rewarding.

I'd like to admit publicly once and for all that I actually don't like herring. I never liked it. It's a joke that I have, that goes back to one of the early ICO’s, and I find it hilarious, but I know nobody else really does. But I would like people reading this to stop sending herring to my office. I don't like it. ⚖ DevelopmentsWhy #NFA #DYOR Doesn’t Cut ItAuthor: lawpanda

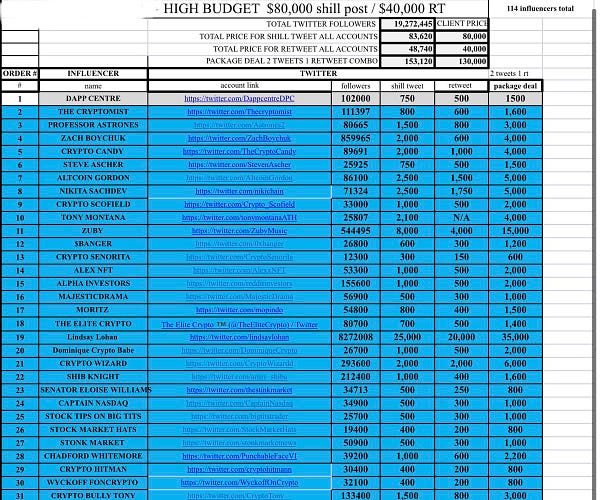

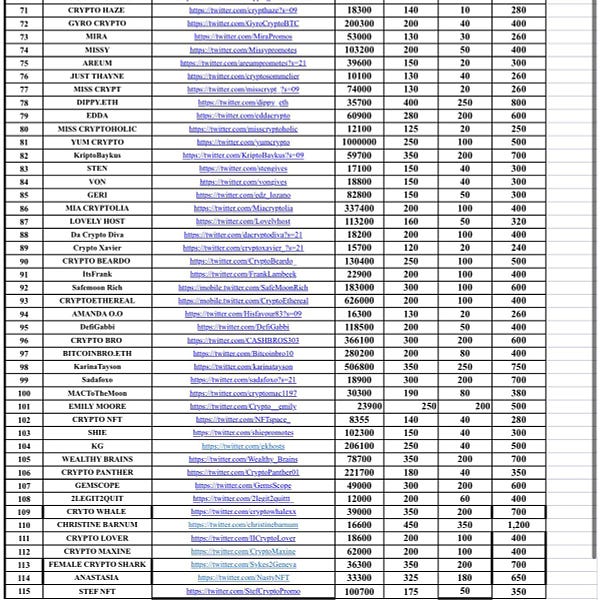

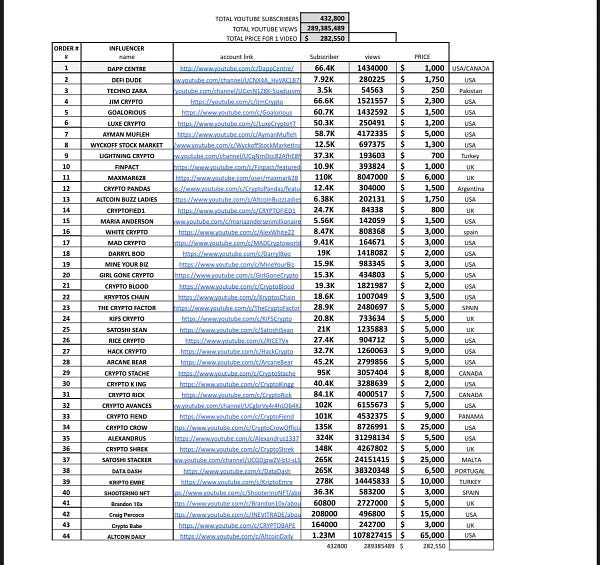

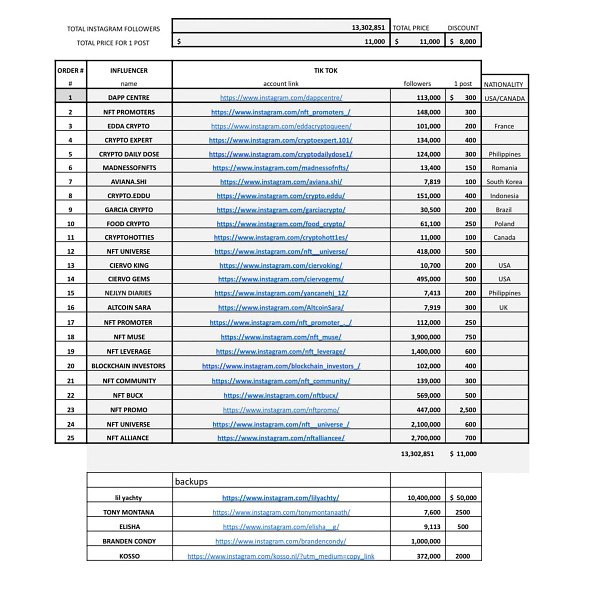

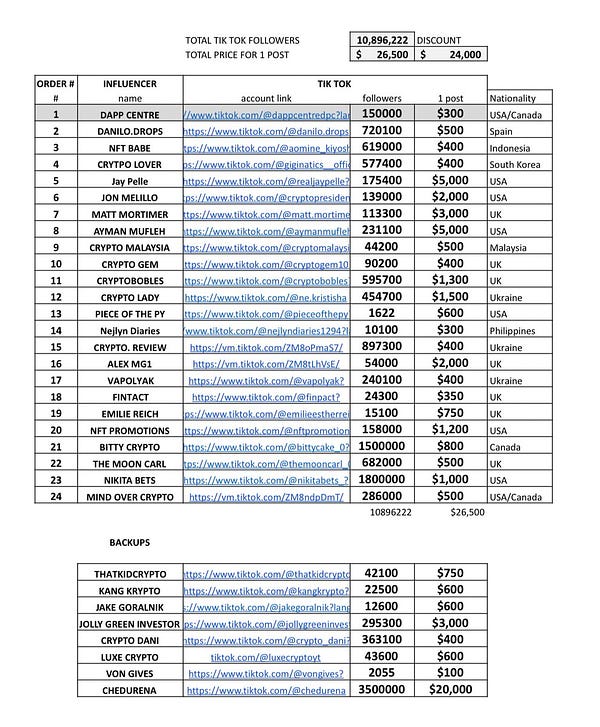

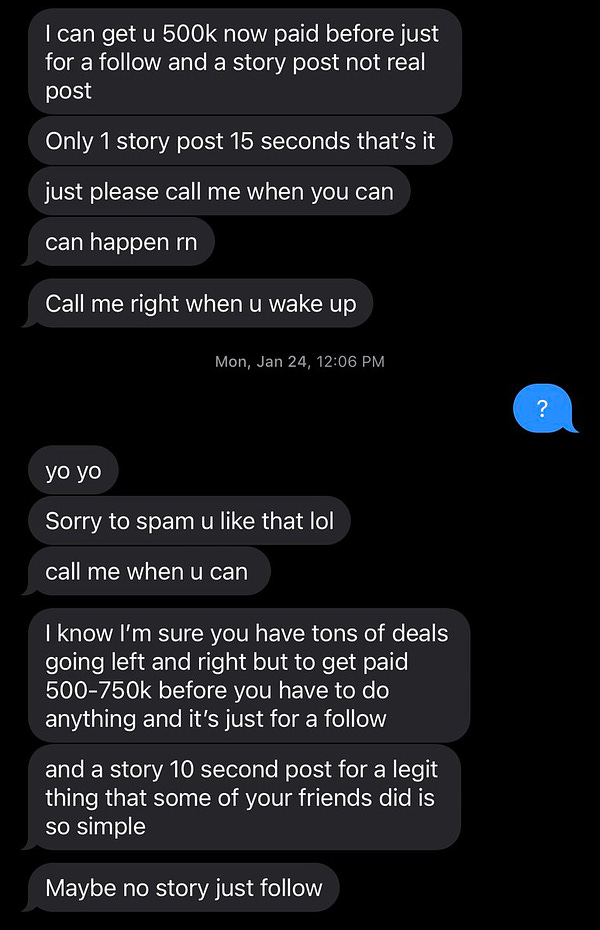

Social media influencers have become a pipeline for branding, product promotion, and advertising campaigns to persuade the masses across a range of platforms. Advertising campaigns through social media are incessant and inescapable. This form of native advertising is designed to fit into the flow of content and can be difficult to discern. Due to limitations on where and how crypto projects can advertise compared to other industries, influencers arguably play an outsized role in advertising and promotion of crypto, DeFi, and Web3 projects. This in turn leads to what feels like an unreasonable amount of shilled promotional content where the business relationship between the brand and influencer is, at best, unclear. The lack of clarity can be particularly deleterious to new, or even experienced, crypto users and shines a negative light on the industry as a whole. Most jurisdictions have one or more agencies mandated to ensure that advertising and promotion is truthful, not misleading, and in some instances is subject to explicit disclosures. In the United States, that agency is the Federal Trade Commission (“FTC” or “Commission”), which monitors advertising on television, radio, print media, and the internet. The Commission has asserted that most consumer protection laws implicated by advertising are not medium-specific; they apply not only to traditional advertising media, but also to native advertising and influencers on the internet. However, while the FTC Act’s prohibition on ‘unfair or deceptive acts or practices’ encompasses all forms of internet advertising, enforcement of violations of these standards seems to be sorely lacking, at least with respect to social media influencers. Crypto Influencers: You’re Getting Paid?What is an influencer? The name is generally self-explanatory and correlates with audience size and reach on various internet fora. FTC regulations require clear disclosure of any relationship with a promoted brand or project. The FTC’s Endorsement Guide, for example, places the burden on influencers to make it ‘simple and clear’ when they have a relationship with a brand. For influencers, appropriate disclosures can include hashtagging ‘ad’ or ‘paid promotion’ in captions for posts endorsing goods or specific brands. However, a quick search of content by potential and actual influencers quickly reveals that appropriate disclosures are few and far between. On-chain sleuth @zachxbt recently published a long list of known Zach does caveat that not everyone on these lists does undisclosed promotions, but the ‘vast majority’ do. It is probably a good rule of thumb to take discussion or potential endorsement of new projects by large accounts with a grain or two of salt. In the last several years, @zachxbt has been doing at least part of the FTC’s job by identifying scammers and warning of the dangers of unscrupulous influencers. For Zach a key issue is ‘not disclosing paid ads’. He says this is common in the crypto space and is increasing in the NFT space. Over time, @zachxbt’s threads have highlighted non-disclosure issues from crypto influencers like @moon_guurl and @HelloImMorgan, as well as more ‘mainstream’ influencers like Lindsay Lohan. George Floyd and Logan Paul’s involvement with the Bored Bunny NFT project is one of the more recent egregious examples of undisclosed shilling gone wrong, where the influencer promoters, whether gifted NFTs or paid in fiat as the tweet below suggests, clearly did not disclose their relationship with the project that ultimately rugged users for over 21 million USD.   Influencers posting about crypto or other financial products often try to limit their liability by including disclaimers like #DYOR (do your own research), #NFA (this is not financial advice), or similar. These ‘disclosures’ are seemingly meant to advise followers to be cautious. However, this type of disclaimer can at most only alert the audience the influencer is not a licensed financial professional who would be required to conform to specific standards when discussing financial products. Hashtagging #NFA or #DYOR like a mantra has minimal actual function, and does not in any way constitute, or eliminate, FTC disclosure obligations or related liability. A recent article by @DazaiCrypto provides a good overview and further insight regarding some of the ongoing problems in the crypto-influencer community, such as failure to disclose affiliation with projects or pump-and-dump issues. If the FTC won’t regulate influencers, then disclosure of this type of information by individuals like @zachxb and @DazaiCrypto becomes increasingly important and necessary, particularly as crypto becomes more mainstream. Podcast AdsAs with influencers’ social media postings, the majority of ads within podcasts come directly from the host, whether they are read live or pre-recorded. As with most native advertising, this form of communication can be particularly effective because listeners are generally more likely to believe something said by a trusted host as opposed to pre-produced ads from a company. Ads delivered in this way are likely to come across as testimonial by the host; the sense is that they believe what they are saying about whatever they are promoting. If there is a ‘material connection’ between a podcaster and the product or service — in other words, a connection that might affect consumers’ perception of the credibility of the endorsement — then that connection should be clearly and conspicuously disclosed. Unfortunately, there are regular examples of non-compliant ads in the crypto podcasting community. Crypto podcasts, in particular, often discuss a variety of dApps, protocols, programs, brands, and projects. If the host is an investor, holds a significant position in the token or protocol, or acts as an advisor, any lack of disclosure, or even a discussion where the relationship is not apparent, likely violates FTC requirements. FTC Requirements: Laws or Guidelines?The FTC does not make laws. The FTC issues ‘rules’ and ‘guidance’, often called ‘policy statements’ or ‘business guidelines’. Through the FTC Act, FTC rules and guidance have the backing of existing laws, including the Fair Credit Reporting Act, the Telemarketing and Consumer Fraud and Abuse Prevention Act, the Children’s Online Privacy and Protection Act, the Do-Not-Call Registry Act, and the Dot Com Disclosures Act. Violations of FTC rules can result in prosecution under the laws mentioned above, including the associated civil — and in some cases criminal — penalties. FTC rules can be enforced at the federal or state level by the Department of Justice or state Attorneys General. The applicability of FTC law to Internet advertising is addressed in “Dot Com Disclosures: Information about Online Advertising”, one of many guidelines provided to the public. The FTC uses enforcement actions to identify non-compliant individuals and entities, as a model for other advertisers or influencers to follow, and to illustrate which actions to avoid in future advertising. The FTC has traditionally been aggressive when deploying its delegated authority and has used Section 5(a) of the FTC Act, in tandem with its interpretive definition of ‘deception’, as a sword. Successful FTC enforcement actions for deceptive advertising, endorsements, and claim substantiation have been brought against a range of industries and entities including Google and Facebook. Everyone Asks ‘Wen Disclosure’, But No One Asks ‘What Disclosure’?The FTC requires influencers to place disclosures in such a way that someone viewing or hearing the content will not miss the information. This is meant to ensure that the average consumer can easily tell the difference between sponsored content and non-sponsored content. Endorsement messages should make it obvious that there is a material connection with the brand. A material connection to the brand includes a personal, family, or employment relationship, equity ownership, or a financial incentive. Testimonials and endorsements must reflect the typical experiences of consumers, unless the ad clearly and conspicuously states otherwise. A statement that not all consumers will get the same results or ‘DYOR’ is not enough to qualify a claim. Testimonials and endorsements by influencers can't be used to make a claim that the advertiser itself cannot substantiate. Will the FTC Hold Those Who Breach the Rules Accountable?Brands and influencers should understand that FTC rules generally allow an enforcement action against the brand, the influencer, and anyone in between or associated with the improper promotion. There isn’t really a safe harbor or ‘mea culpa’ option. That said, in the face of the widespread successes of influencer marketing, the FTC has struggled to regulate influencer commercial speech and improve compliance with FTC rules. At the close of 2020, the FTC had issued only one ruling against individual influencers, supplementing its previous issuance of 90 educational letters, and 21 follow-up letters. The FTC has generally focused its enforcement efforts on larger entities, i.e. on brands rather than individual influencers. This is likely because targeting a company is far less difficult and resource intensive than the multitude of online influencers who don’t have readily apparent addresses and can’t be easily served with a subpoena or cease and desist letter. Whatever the reason, the FTC appears reluctant to engage in the type of enforcement tactics it regularly deploys in other areas, which in turn seems to have contributed to rampant non-compliance by influencers. With an immeasurable volume of native advertising content appearing on an ever-increasing number of platforms, the FTC does not have the bandwidth to review every instance where disclosure would be needed, or even respond to specific complaints. However, more recent and egregious activities by high-profile influencers may elicit sufficient consumer outrage to draw the FTC’s attention or spur changes in the enforcement posture. There is also the potential that certain NFT and DeFi projects that allegedly constitute securities will give rise to increased promoter liability through SEC enforcement actions, as with Bitconnect. However, until something changes, such as the FTC allowing a private right of action under Section 5 of the FTC Act, DYOR, this is NFA, and don’t expect the FTC to enforce influencer disclosure requirements. Exchanges and Decentralization: Risley v. UniswapAuthor: terumask

Decentralization is one of the greatest advantages of cryptocurrencies. Decentralization allows for, among other things, the creation of financial platforms away from the excessive regulation and bureaucracy that has always characterized large banks and financial institutions. However, these platforms have a number of challenges ahead. A key question to be answered is to what extent can a platform such as Uniswap be considered decentralized and operate independently of all financial regulation. A class action suit that will help the industry answer that question has recently been filed against Uniswap Labs and some of its investors, such as Paradigm, Andreessen Horowitz, and Union Square Ventures, in a U.S. federal court. Uniswap describes itself as a decentralized peer-to-peer protocol that people can use to create liquidity and trade ERC-20 tokens. Before analyzing the lawsuit filed, it is important to distinguish the different pieces of Uniswap:

The LawsuitThe Plaintiff, Nessa Risley, alleges that the defendants are unlawfully promoting, offering, and selling unregistered securities on the Uniswap exchange and that the exchange has failed to comply with regulatory obligations such as providing disclosures and verifying the identity of customers. The Plaintiff seeks restitution of what was paid for her tokens and all fees and expenses charged by Uniswap. Let us now analyze where the Plaintiff is right and where she is wrong. First, the Plaintiff argues that Uniswap and its investors have designed, created, and implemented a commission structure that has earned them enormous profits. It is one thing for commissions to be generated within the Uniswap protocol for transactions made through the smart contract, but it is another thing for Uniswap Labs and its investors to benefit directly from those commissions. The current fee structure of the Uniswap protocol is to charge 0.3% of each token swap, a fee that goes to the liquidity providers, not to Uniswap Labs. It is true that there is a possibility in the code to activate, through the governance token, changing the fees to 0.25% for liquidity providers and 0.05% for UNI token holders. Given that the initial Genesis UNI Allocation distributed 21.266% of the tokens to members of the Uniswap Labs team and 18.044% to investors, it is possible that some day Uniswap Labs and its investors may benefit from the presence of unregistered securities on the platform. However, as of today, the protocol fee has not yet been activated in favor of UNI token holders. Therefore, the Plaintiff's argument that Uniswap Labs and its investors have benefited from the transactions made on the Uniswap protocol cannot be considered valid. Second, the Plaintiff contends that Uniswap Labs has control of the exchange and the user interface by hosting them on a domain it owns, such as ‘app.uniswap.org’. Does providing a user interface to interact in a simpler way with the smart contract that allows exchanging tokens constitute ownership of an exchange? In some regards, yes. Uniswap Labs could be considered the owner of an exchange insofar as it is the host of the user interface and it has the ability to determine which tokens can and cannot be traded on the ‘app.uniswap.org’ front end, as it already demonstrated when it restricted access to certain tokens on that website. The Plaintiff alleges that Uniswap Labs enables token issuers to scam investors by facilitating the creation of thousands of digital tokens on the exchange, such as EMAX, BEZOGE, or MATRIX SAMURAI. In addition, the Plaintiff argues that Uniswap is fully aware of the existence of these scams and that it makes no effort to curb them. Clearly, there are tokens tradeable on the Uniswap protocol that are essentially scams; this is true of every exchange. But in the end, if we want decentralized and permissionless platforms to exist, we have to assume that these types of tokens are going to be traded there. A Challenge for All ExchangesUniswap Labs has a big problem, and it was only a matter of time before a lawsuit of this sort would be brought. The problem comes from owning the domain on which the interface runs, because in the eyes of regulators and the courts, that won't be something very different from being an exchange. In addition, the exposure that the Uniswap Labs team has from using venture capital funds means that governments and plaintiffs have a target to aim and shoot at. It will be interesting to see how the courts resolve these types of claims, because there are sure to be many more, particularly if this suit is successful. In the meantime, developers and investors may want to consider alternative formulas for financing and structuring their exchange protocols if they want to avoid the sort of liabilities that this lawsuit may create. 🏛 RegulationsThe EU Needs To Empower the PeopleAuthor: MD Lawyer

The cryptoasset transaction volume in the EU is steadily going up, as data from the European Commission’s European Financial Stability and Integration Review shows. The Review discusses the risks related to decentralized finance, notably the security of smart contracts, pump-and-dump schemes, rug pulls, and the heavy reliance on collateral. Yet, it does not fail to highlight DeFi’s benefits — security, efficiency, transparency, accessibility, openness, and interoperability. The European Commission adds that these provide substantial opportunities for financial integration across the EU. It has been stated by top officials that the EU intends to be a leader in blockchain technology, and the strategy is to be among the first to regulate it (where it does not fall within the laws already in place). The highly anticipated Market in Crypto Assets Regulation (“MiCA”) is at the core of the new EU legislation package and sets out measures to strengthen the rules on combating money laundering and terrorist financing. It purportedly aims to address the shortcomings of the existing framework, notably the insufficient detection of suspicious transactions, since there are currently no rules allowing cryptoasset transfers to be traced or to oblige parties of such transactions to provide information on the originator and/or beneficiary. For those unfamiliar with EU law, regulations such as MiCA are legal acts that apply automatically and uniformly to all EU countries as soon as they enter into force, without needing to be transposed (as opposed to directives, which are not automatically applicable). Therefore, the intention is to harmonize the rules applicable to cryptoassets throughout the EU — which should be welcomed and has been done successfully with, for example, financial institutions (if authorized to render services in the European Economic Area, a financial institution may do business in any other EEA state by merely notifying the local regulator, i.e. without the need for further authorization). The EU Must Innovate to CompeteThe approach is aligned with the EU’s goal to build and further develop a single market, which is key to competing economically with the U.S. and China. The U.S. and China have historically adopted a more positive stance with regards to the promotion of innovation, with crystal clear results in the Web2 era (none of the top 20 technology companies by revenue are based in the EU). Also, one should note that the biggest EU technology company, SAP, cannot be compared in size to its American or Chinese counterparts. To achieve this goal and be a leader in the field, the EU knows that it has to take a careful approach so as to not jeopardize the technology’s development in the Union. However, Members of the European Parliament (“MEPs”) have not been entirely aligned with this vision. First, the so-called ‘proof-of-work ban’ was proposed. In a draft version of MiCA, cryptoassets using a proof-of-work consensus mechanism were prohibited from being offered in the EU, mostly due to environmental concerns. This proposal would ultimately prohibit the most prominent cryptoassets, notably bitcoin. Luckily, this proposal was not adopted. Unworkable RequirementsHowever, following that scare, a concerning proposal was added to the draft. The MEPs from the Committee on Economic and Monetary Affairs and the Committee on Civil Liberties proposed and voted in favor (93 votes to 14 and 14 abstentions) of the famous ‘travel rule’, first recommended by the Financial Action Task Force in 2019. Under the new requirements, all transfers of cryptoassets will have to include information on the originator and the beneficiary, notably the name, account number, originator’s address, official personal document number, customer identification number or date, and place of birth. This information has to be verified by cryptoasset service providers (“CASPs”) and made available to the competent authorities when requested. Every transaction above 1,000 EUR must also be reported to the relevant AML regulator, even if there is no sign or suspicion of money laundering or terrorist financing activities. The aim is to ensure that all crypto transfers (as there is no minimum transaction threshold) can be traced and suspicious transactions blocked. Unhosted Wallets May Be in the CrosshairsOnly transfers between ‘unhosted wallets’, which are cryptoasset wallets that are in the custody of private users, conducted without a CASP or transfers among CASPs acting on their own behalf, will be exempt from these rules. Accordingly, at the time of a transfer of cryptoassets between an unhosted wallet and a custodial wallet, the CASP will have to collect and retain all required information with respect to the originator or beneficiary behind the unhosted wallet, verify its accuracy, and make it available to the competent authority, if requested. After MiCA has been in force for one year, the EU Commission will assess the need for “additional specific measures to mitigate the risks posed by transfers from or to unhosted wallets, including the introduction of possible restrictions” (emphasis added). The EU’s intention seems to come from a reasonable place, since there is a consensus that there is a need to ensure cryptoassets are not used for illicit purposes. Hence, the EU intends to adopt similar rules to what is standard in traditional finance, notably through the SWIFT payment system. All of the above may encourage banks to enter into the crypto market, the lack of which has been a barrier for Web3 businesses in many jurisdictions. However, the current requirements may be extremely difficult or onerous to implement. It is not clear how a CASP would be able to verify the self-custodied counterpart — a critical part to the travel rule’s efficacy. As a consequence, one can foresee that, lacking an effective solution for this problem, CASPs may simply reject and be unwilling to transact with unhosted wallets to stay compliant with MiCA. In South Korea, where the travel rule has been in force since March 25, 2022 on cryptoasset transfers over 1 million Won (830 USD), these difficulties have flourished. Traceability Is RealIn addition, one should consider that cryptoassets present a limited money laundering and terrorism financing risk. Multiple reports have shown that cash or wholesale banking are still the preferred methods. Blockchain technology is not particularly ideal for nefarious purposes as it allows for the traceability of cryptoassets that even mixers can't hinder. MiCA is currently under discussion in the EU legislative process, and the final draft will have to be agreed to by representatives of the Parliament, the Council, and the Commission. Therefore, there is still hope that these rules can be crafted into a solution that accommodates all parties’ concerns without unduly hindering innovation. Catch That TrainLeadership is about empowering others, and the EU is doing quite the opposite. If the regulations actively restrict users from having self-custody wallets, then innovation will simply grow where conditions are most favorable. Blockchain technology has proven time and time again that it can resist sanctions and barriers from the most powerful states because it is inherently borderless and decentralized. Given the draft legislation, the EU faces the serious risk of not only seeing the innovation train depart (again), but also that it will be left standing on the platform with no other train left to catch. SEC Rulemaking Is Running AmokAuthor: COYSrUS.eth

In January 2022, the U.S. Securities Exchange Commission (the “SEC”) proposed an expansion of the definition of an ‘exchange’ that could be bad news for decentralized exchanges with U.S. customers. In the SEC's view, because ‘communication protocol systems’ (not defined, but essentially technology that brings together buyers and sellers of securities) have a similar function as securities exchanges, they should be regulated like a national exchange or an alternative trading system (an ATS is a lighter touch regulatory regime for trading systems run by broker-dealers). Investors using these unregulated systems do not receive the same protections, fair and orderly markets, transparency, and oversight benefits as compared to a regulated exchange or ATS. While the proposal does not specifically say so, many legal experts believe this change could bring decentralized exchanges (“DEXs”) and automated market-makers (“AMMs”) into scope for the rules and would require them to register as a broker-dealer and as an ATS. Such a requirement would be a radical departure from existing U.S. law and could result in decentralized finance (“DeFi”) protocols shutting down or prohibiting U.S. investors from accessing their services. In response, multiple industry groups and participants, including the DeFi Education Fund, LeXpunK, Delphi Digital, Coin Center, and Coinbase, among others, submitted comment letters to the SEC explaining why the proposed amendment does not achieve its stated purpose, is unworkable, and is unnecessary. The comment letters demonstrate both a deep understanding of the regulatory framework and the technologies underlying the DeFi protocols. The letters are well written and appear to be somewhat coordinated in approach; the themes are consistent albeit with different focus areas. The crypto bar is clearly up to the task of defending the industry from regulatory overreach. The Comment Letters to the SECThe DeFi Education Fund’s letter explains that because DeFi protocols typically lack a central operator or governing body, the regulatory regime intended for centralized intermediaries is inapplicable to them. AMMs allow participants to trade using liquidity pools and algorithmically determined prices, in contrast to a traditional securities exchange where buyers and sellers make and match orders. Typically, a liquidity pool holds assets in a single pair of tokens. Liquidity comes not from the willingness of traders to buy, but from participants who deposit assets into the pool and receive tokens representing a share of the pool's assets. These deposits are locked in smart contracts, not under the control of any single person, and are released only in accordance with the code. There is no traditional negotiation between buyers and sellers; instead, prices are set by the algorithm, and the participants receive a share of the trading fees as compensation. A software developer that contributes code to an open-source project has no ability to supervise or restrict participants using the protocol. There is no single ‘operator’ that can intercept or restrict orders. Their letter notes that "these regulations can be applied only to entities that operate centralized markets and not to a loosely affiliated, hyper-specialized constellation of independent parties and systems". The letter also points to potential legal obstacles to the enforcement of the new rules, if they were enacted, as potentially violating the U.S. Administrative Procedures Act, due to insufficient cost-benefit analysis and notice, and the first amendment of the U.S. Constitution (software code as speech). LeXpunK’s letter explains how the proposal could create liability and compliance obligations for individuals, entities, or decentralized autonomous organizations, including people who write and publish smart contract code as a hobby or business, act as miners or validators on a blockchain that operates an AMM, investors who provide liquidity to AMMs, people who operate websites that facilitate the use of AMMs, including block explorers, and people who write blockchain software used by the miners or validators. LeXpunK also points out that it would be technologically impossible for DeFi protocols to comply with these requirements and would essentially amount to a de facto ban on their business. Delphi Digital’s letter echoes these themes and argues that regulating AMMs in the same manner as an ATS does not achieve any policy objective. Broker-dealer registration (a requirement to be an ATS) is not applicable to digital asset businesses, since they are not buying or selling securities for their own account. Other requirements to be an ATS, including reporting, order display, execution access, fair access, fees, and system integrity, simply have no applicability in this context, as AMMs are not controlled by any particular person, can't block access for any participant, and all relevant information is freely available on blockchains. Coin Center’s letter focused on free speech concerns. In their view, the proposed expansion of the definition of ‘exchange’ would "create an inappropriately broad standard for registration that would impose an unconstitutional prior restraint on the protected speech activities of countless software developers and technologists". The effect of the overly broad standard would, based on a review of prior Supreme Court precedents, make the rule immediately eligible for a pre-enforcement challenge on First Amendment grounds. The letter argues that actions taken by a DEX developer (e.g. maintaining a website or building a user interface) are protected speech activities and do not constitute regulatable professional conduct. Coin Center's conclusion is that a pre-enforcement facial challenge to the rule would likely succeed. Coinbase was the only centralized crypto exchange to submit a comment letter. Compared to DeFi protocols that could be effectively shut down or barred from operating in the U.S., Coinbase has less to complain about. Coinbase's letter focused on similar themes to those discussed in other letters, including that the proposal is overly expansive, insufficient notice and cost benefit analysis were provided, and implementing these rules would be impractical or impossible for a DEX. Coinbase also reminded the SEC that greater clarity is needed on the extent to which any digital asset may be a security and that, irrespective of the uncertainty, "Coinbase does not currently trade or facilitate trading in digital assets that are securities". In arguing that the SEC exceeded its authority with this proposal, Coinbase pointed out somewhat sarcastically that "One would expect, had Congress intended to grant the Commission such authority, it would have said so explicitly, or at least suggested as much in the nearly ninety years since the statute was passed". What Next?The next step in the rulemaking process will be for the SEC staff to read through all of the comments and either issue a final rule or come up with a new proposal which would necessitate another comment period. If the final rule is as overly broad as the proposal, the comment letters provide numerous bases on which industry participants could attack its legality and constitutionality in court. Given the persuasiveness of those arguments, it is not unreasonable to think the SEC will back down rather than lose in court. Regardless of how this rulemaking turns out, there is more work to be done on the U.S. regulatory front to clarify which agencies will regulate crypto and how they will do so. An argument can be made that centralized intermediaries such as Coinbase should be more closely supervised by federal agencies and be subject to extensive prudential regulation and rules on how they treat their customers, just like banks. The same arguments, though, do not apply to truly decentralized protocols. As explained in the comment letters, those regulatory regimes do not make sense when there is no central ‘operator’ running everything. Nonetheless, needed changes to the regulatory framework should come from Congress rather than from an overreaching SEC. UK: The OG of All Regulatory SandboxesAuthor: ComeBackKid

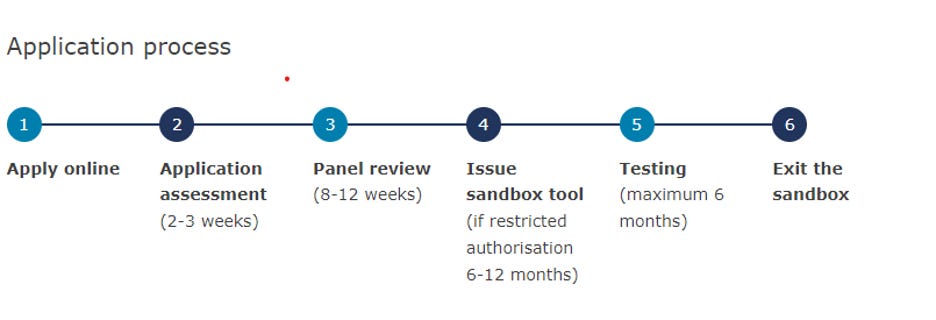

When it comes to regulatory sandboxes, the United Kingdom was first out of the gate, soon to be followed by numerous similar initiatives in other jurisdictions across the globe. The following is a summary of the UK initiative and its evolution. The UK initiative was launched in 2016 by the Financial Conduct Authority (“FCA”) based on industry input. It aimed “to remove unnecessary barriers to innovation for businesses involved in banking and finance in the United Kingdom”, by allowing “select fintechs to test their services on a small group of consumers and get support from the FCA in identifying appropriate consumer protection safeguards”. The resulting regulatory sandbox was further refined in 2021 with the creation of a ‘scale box’ to support growing financial technology companies and a new sandbox specifically for companies using distributed ledger technology. This evolution was a result of a recommendation from the Kalifa Review of UK Fintech, an influential independent review which argued that while the UK has been successful in launching new fintechs and attracting global investment into the sector, it still needed to prove itself as a location for scaling up young companies, allowing fintech companies to test out new ideas and business models not fully covered by existing regulations. Regulatory Sandbox Eligibility Criteria and ExamplesA company applying to test in the Regulatory Sandbox must demonstrate that it meets the following five eligibility criteria: Scope: Innovation must be intended for the UK market. Examples include a payments service using Open Banking and aimed at UK customers, UK expansion of a share trading app, or KYC / AML technology to FCA-regulated firms. Genuine innovation: Project must be ground-breaking or significantly different. Examples include a payments solution making use of stablecoins, a debt advisor using Open Banking data to assess a consumer’s financial position, or a distributed ledger to speed up share settlement and execution. Consumer benefit: There must be a new or improved service or something that helps individuals or businesses, and they must be protected against risks from the innovation. Examples include a savings platform aimed at unbanked or underbanked consumers, a technology solution using social media and banking data to detect vulnerable consumers, or a platform for low-cost, high-speed cross-border remittance. Readiness: The project must work with existing rules, be explainable, and ready to be tested with real customers. Examples include a technology provider that is supporting a financial services firm and has secured the partners needed for the test or a firm conducting credit broking activities while acting as an Appointed Representative of a regulated firm. Need for support: The innovation must demonstrate a genuine need to test in the Sandbox, such as something that doesn't fit well in the existing regulatory framework, needs to be tested in a live environment, or the full authorization process would not be viable. Examples include a test of a firm’s technology with live clients to determine if a novel payment method works in practice, or testing a debt advice model at a small scale to determine if there is sufficient demand for the service. Regulatory Sandbox StepsExamples of Successful ApplicantsFor the most recent applicants in Cohort 7, dated June 2021, the FCA focused on innovation and testing from firms developing businesses, products, or services intended to:

Helpful ResourcesFind out how to apply for participation. See samples of proposals that may meet the criteria. Check the list of the firms making up Cohorts 1-7. 🙏 Sponsor: Gro Protocol - empower everyone to easily create and share wealth through DeFi. 🌐 News and Selected Articles

New York to Vote on Crypto Mining Ban Amid Heavy BacklashAuthor: Varinder Singh 🔑 Insights:

Ripple vs SEC: Resolution Likely to Come in 2023 – Ripple’s Stuart AlderotyAuthor: Yuri Molchan 🔑 Insights:

Crypto-assets: Risk Management Expectations and Policy RoadmapAuthor: The Australian Prudential Regulation Authority 🔑 Insights:

Crypto Assets: New Rules to Stop Illicit Flows in the EUAuthor: European Parliament 🔑 Insights:

Crypto Industry Can’t Hire Enough LawyersAuthor: Mengqi Sun 🔑 Insights:

Diamond Fortress Technologies, Inc. and Charles Hatcher II v. EverID, Inc.Author: Paul R. Wallace, Judge 🔑 Insights:

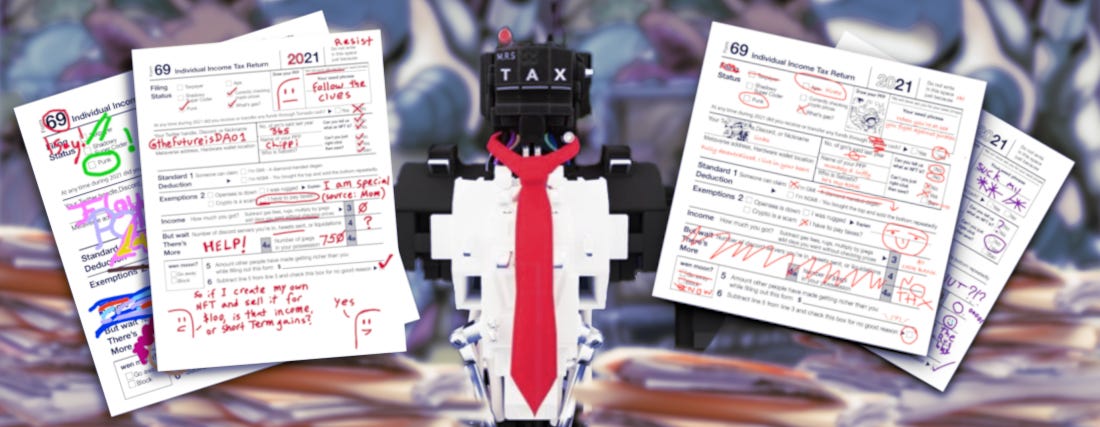

🧰 Legal ToolsGlobal Tax GuideAuthor: Metaversal Revenue Service

BanklessDAO’s Legal Guild has been hard at work building the future of crypto-tax information, and the Global Tax Guide produced by the Metaversal Revenue Service is the result of these efforts. The Global Tax Guide will provide general introductory information regarding virtual-currency-related income tax laws from major jurisdictions throughout the world. Access to the Global Tax Guide will be granted by minting Form 69. Anybody will be able to mint the NFT and access the Global Tax Guide for the mint fee. Access has no expiration date, and the Global Tax Guide will be updated as laws change and jurisdictions are added. Minting will open on May 12, 2022. Please follow the Metaversal Revenue Service on Twitter to get up-to-the-date information on the mint. The Global Tax Guide will initially cover nine jurisdictions, with new jurisdictions regularly added. The initial jurisdictions include:

The Global Tax Guide plans to add Italy, India, UAE, Canada, Singapore, and Nigeria in its next update. And it's not too late to submit Form 69. Submitted forms will be used as the final NFT artwork. Each submission will be placed into the minting pool and randomly drawn at mint. Someone will receive your Form 69 as their NFT and your OG crypto status will be forever etched on the blockchain! Get creative with your form — there is no wrong way to fill it out. After you complete it, upload it to the Metaversal Revenue Service. One last reminder to follow Metaversal Revenue Service on Twitter — and see you on May 12th! ✅ Action Items📚 Read The BANK Token - A Legal Assessment👩⚖️ Join the BanklessDAO Legal Guild 🏴⚔ Join LexDAO🐵 Join the LeXpunK Army🚨 Contact your Representatives or Senators🙏 Thanks to Our Sponsor Gro ProtocolGro Protocol unlocks stablecoin yield farming for users across different risk appetites. Gro is a stablecoin protocol that empowers everyone to easily create and share wealth. It brings together the best of DeFi and traditional finance to offer easy-to-use stablecoin products: PWRD stablecoin with protection, Vault with super-charged yields, and Labs with automation. It is now available on its dApp and Argent wallet. Gro has completed three audits and code reviews with Trail of Bits, Peckshield, and Kurt Barry and currently hosts a $1,000,000 Bug Bounty program on Immunefi. Check out BanklessDAO's introduction on Gro 👉 ‘Miracle’ GRO, A Protocol Overview See what we offer 👉 Gro dApp Learn more about Gro 👉 Directory of Gro universe If you liked this post from BanklessDAO, why not share it? |

Older messages

The Art of Photogrammetry & Financial Data as Music NFTs | Decentralized Arts

Monday, April 25, 2022

BanklessDAO Weekly NFT and Cryptoart Newsletter

Our Decentralized Selves | BanklessDAO Weekly Rollup

Saturday, April 23, 2022

Catch Up With What Happened This Week in BanklessDAO

Having The Hard Conversation: Building Better Compensation Frameworks in DAOs

Wednesday, April 20, 2022

You're reading State of the DAOs, the high-signal low-noise newsletter for understanding DAOs.

Bored Apes and Polygoonz and Legends of Cypher, oh my! | Decentralized Arts

Monday, April 18, 2022

BanklessDAO Weekly NFT and Cryptoart Newsletter

Science Fiction Comes to the Metaverse | Decentralized Arts

Monday, April 11, 2022

BanklessDAO Weekly NFT and Cryptoart Newsletter

You Might Also Like

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏