Apr 28: Evolution: ‘We should take a bigger cut’

Apr 28: Evolution: ‘We should take a bigger cut’Evolution Q1, Kindred Q1, Betsson Q1, Las Vegas Sands Q1, Churchill Downs Q1, Rivalry Q4, March US sports-betting estimates +MoreGood morning. A busy schedule today as the Q1 earnings season hits its stride:

Expansions. Sign up now. Evolution Q1

Raising the roof: Towards the end of the call this morning, Carlesund spoke about what he sees as the value that evolution brings to its customers and suggested this was running ahead of how much the company actually charges.

Pound of flesh: EBITDA margins hit over 70% for the quarter, within annual guidance of between 69%-71%. Asked about room for further improvement, CFO Jacob Kaplan said “we won’t say there is upside today”.

Global outlook: CEO Martin Carlesund said “demand for our product is global”. He noted the company was actually underserving the market, suggesting this would remain the case for a while.

The fly in the ointment: The RNG performance was flat but Carlesund said the “path to growth in RNG is a high priority”. “It could be much better,” he added. A record number of games have been released this year and Carlesund said the ambition is double-digit growth, but he didn’t put a timeline on that.

**Sponsor's message: Spotlight Sports Group (owned by Exponent Private Equity) is a leading technology, content and media business specialising in sports betting. Its industry-leading Superfeed is used by the biggest betting brands in the world including bet365, Flutter and Entain. The content engine powers on-site engagement by delivering impartial expert betting insight for 20 sports in 70 languages. For more information visit: spotlightsportsgroup.com Kindred Q1

The long game: CEO Henrik Tjärnström said the impact of the Netherlands exit had been “more severe than expected” but insisted that the situation was of a “temporary character”.

Mixed bag: Performance was also affected by headwinds in the UK and France. Succor came from the Nordics (up 9% YoY) and Australia (up 30%).

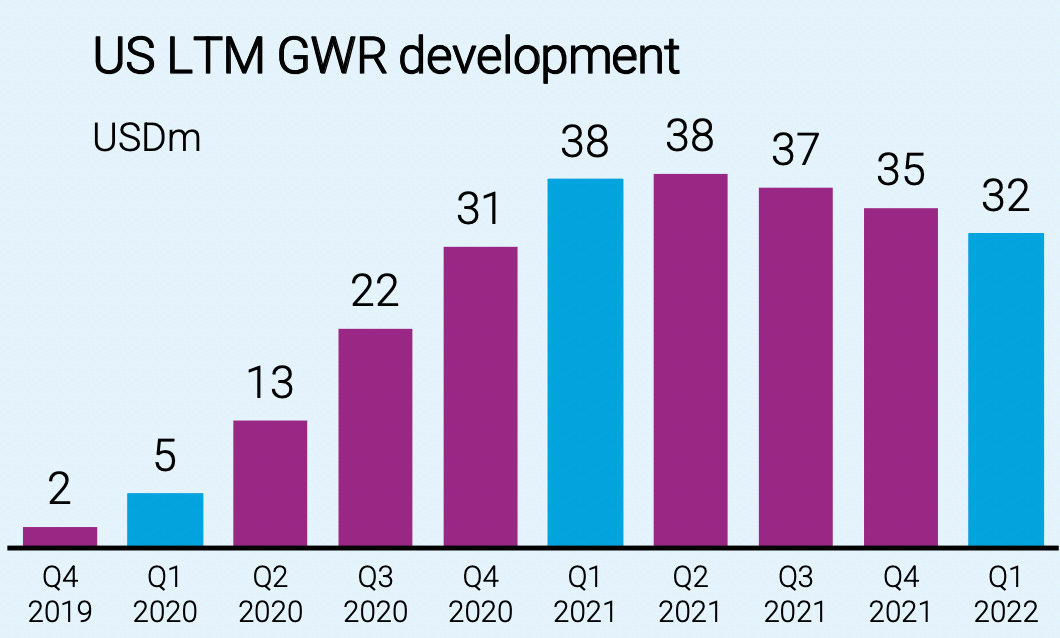

Not happy: Tjärnström said Kindred was ”not satisfied” with its North American performance. He added that despite the current “unsustainable” marketing environment, the group remains convinced about the long-term prospects. Gross win revenue in North America was down 26% to £5.6m.

Up the hill and down the slope: Affordability: Asked about the extra affordability measures the company has introduced in the UK, Tjärnström said the most impact was with higher-value customers. “It’s a bit blunt, as we see now. It needs to be more surgical”. Gers-tcha: Kindred announced it is donating its shirt sponsorship for Rangers’ upcoming Europa Cup semi-final tonight to the club’s mental health project ‘Team Talk’. Betsson Q1

Diversify this: Betsson said successful geographic diversification of its activities had made the company “less sensitive to disruptions in individual markets”.

New, new markets: Betsson will be active in Ontario in the summer and plans to launch in Mexico with its partner Big Bola Casino later in the year. In Latin America it has launched in the City and Province of Buenos Aires, Argentina.

License issues: The ongoing conflict in Ukraine led the company to return the local license it held in Belarus and completely shut down its operations there. With regard to the Netherlands, the group applied for a local license in February and the review usually lasts six months.

Las Vegas Sands Q1

Uncertain timing: CEO Rob Goldstein said with business reopening in Singapore he was confident the business there would generate strong cash flow.

Build project: In terms of long-term growth, LVS said it wanted to focus on building rather than outright acquisitions, as per its recent investment in the igaming compliance services supplier U.S. Integrity.

Churchill Downs Q1

Capital projects: During the quarter CDI announced a definitive agreement to acquire the casino and racetrack operator Peninsula Pacific Entertainment for $2.48bn, securing a $1.2bn revolving credit facility, $800m senior secured loan, both due in 2027, and issuing $1.2bn in senior secured notes due in 2030 to finance the acquisition.

Note: Churchill Downs will hold its Q1 investor and analyst call at 9am EST today. Rivalry Q421

Speed: The Toronto-listed esports and OSB operator said it enjoyed a “tremendous” year having listed in Toronto late last year. With $35.5m of cash on the balance sheet, CEO Steven Salz said the business had the financial resources to accelerate its momentum.

NewslinesSpend, spend, spend: Advertising platform provider Viamedia reported a 3,399% increase in California political adverts over the last four years due "an explosion of issues spending around climate change and gambling." The November 2022 California ballot could have three sports betting measures on the ballot, as a result advertising spend linked to gambling could increase even more in the next eight months. Exclusion zone: Louisiana lawmakers have introduced a bill that would expand the state's casino self-exclusion list to also include online sportsbooks. Senate Bill 290 proposes that players that opt-in to the state's self-exclusion program from land-based casinos would also be banned from wagering at legal online sportsbooks. What we’re reading‘Where to find refuge? In sports and sports betting, that’s where.’ Bloomberg’s John Authers looks for trading lessons from betting. “It turns out that sports betting provides useful practice for financial markets, as it is a great laboratory for quants and academics to study market inefficiencies.” On social

Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

Apr 27: Kambi: clients up, profit down

Wednesday, April 27, 2022

Kambi Q1, Boyd Q1, Morgan Stanley SB Q1 preview, Ontario app update, BlueBet US launch +More

Apr 25: Fuel prices cloud gaming outlook

Monday, April 25, 2022

Sub-head: IGT UK lottery lawsuit, the week ahead, the week in shares, startup investor focus - Benjie Cherniak +More

Apr 22: Weekend Edition #43

Friday, April 22, 2022

Q1 US regional preview, Simplebet analyst meeting, Texas gaming, sector watch - esports, earnings in brief +More

Earnings +More podcast #5

Thursday, April 21, 2022

Watch now (32 min) | Back in the game

Apr 21: Ontario on course for $1.1bn

Thursday, April 21, 2022

Ontario app and GGR data, DAZN-Pragmatic sportsbook plans, Rank and Monarch Q1s, EKG app testing.

You Might Also Like

🔥 20 Spots: Private Chat with Flippa's CEO (This Might Not Happen Again)

Monday, January 6, 2025

Just locked in an intimate session with Flippa's CEO (20 spots only)... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Crystal ball 🔮

Sunday, January 5, 2025

Marketers' 2025 predictions View in browser hey-Jul-17-2024-03-58-50-7396-PM I went to a psychic when I was 22. She told me I was "about to take a long journey across the Atlantic." While

🦄 WTF is a pattern interrupt

Sunday, January 5, 2025

A stop you in your tracks style of attention grabbing and why you need to implement it. 👀

🦅 Masterclass with Jesse Pujji

Sunday, January 5, 2025

Add the event to your calendar ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 He built a $20 million company through social posts

Sunday, January 5, 2025

Discover Jesse Pujji's growth system ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🎙️ New Episode of The Dime How Do We Get to a $100 Billion Market? Growth Predictions, Market Consolidations ft Ben Burstein

Sunday, January 5, 2025

Listen here 🎙️ How Do We Get to a $100 Billion Market? Growth Predictions, Market Consolidations ft Ben Burstein Why does it feel like the hemp industry is exploding while regulated cannabis remains

Why 2025 Should Be Better Than 2024

Sunday, January 5, 2025

And the top SaaStr news of the week To view this email as a web page, click here This edition of the SaaStr Weekly is sponsored by Stripe 2025 Should Be Better Than 2024 For Almost All Leading Public

Marketing Weekly #213

Sunday, January 5, 2025

I Tried All Social Media Platforms for My SaaS, Here's What Actually Works • If Your Emails Aren't Printing Money, You're Doing This Wrong. • How to Build a RELEVANT Audience • How I Found

Sunday Thinking ― 1.5.25

Sunday, January 5, 2025

"You don't have to be perfect to help people. All you do is have to be real."

TA #178: ✅ ❌ What's In, What's Out in 2025

Sunday, January 5, 2025

[Ann's version] Click here to read this on the web. Ann Handley's biweekly/fortnightly newsletter, "Total Annarchy" What's in, what's out: Ann's list Welcome to Issue 178