Craft Ventures: Operating during a downturn

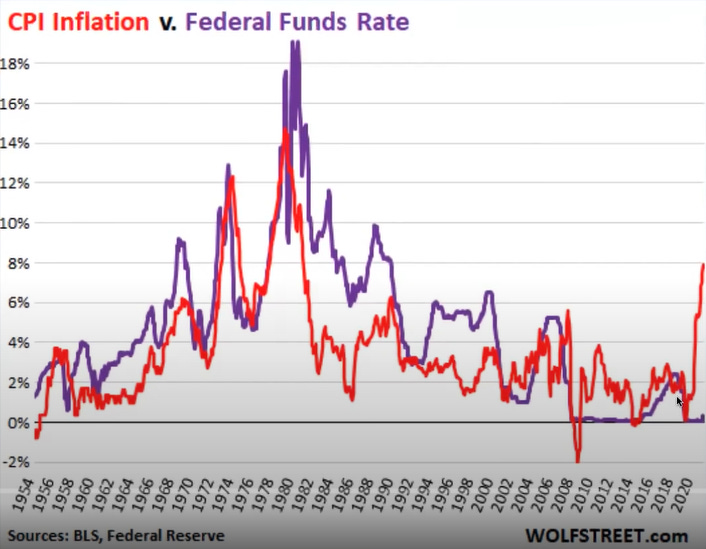

Hey, Nick here! In this newsletter, I curate insights and timeless principles on how to build great products. You’ll improve your product skills with every issue. Here’s a video for you today… Craft Ventures: Operating during a downturn What’s happening in public markets Starting in the summer of 2021, inflation spiked and has continued into 2022. In order to counter a rising inflation rate, the Fed has communicated that they will raise interest rates, even though this will cause pain. Interest rates have been at historic lows after the Great Recession and were cut again due to COVID. The market has been running hot and needs to cool. The rising interest rates hit growth stocks the hardest because their earnings are further into the future and are discounted back at a higher interest rate. The start of 2022 has been a fundamental value reset. Companies have posted strong earnings so far, but the market is forward looking and is expecting growth to slow. What’s happening in private markets Venture capital firms take their cues from the public comps. Public multiples are their exit prices, so as valuation drops in the public markets, the private markets follow. Liquidity has left the ecosystem. The market was flooded with cheap dollars from low interest rates in 2020 and 2021 which VC funds deployed. Due to the hotness of the market, funds would raise their capital and deploy it all in the same calendar year. The demand for deals was greater than the supply, bidding up the valuations. Firms are now frozen while awaiting the uncertainty. The deployment of funds are slowing down to a more normal pace of being deployed over a 2-3 year period rather than 6 months. Investors are now focused on keeping their portfolio afloat rather than adding to it. We’ve been here before Since 2000, we’ve gone through 3 major market correction periods:

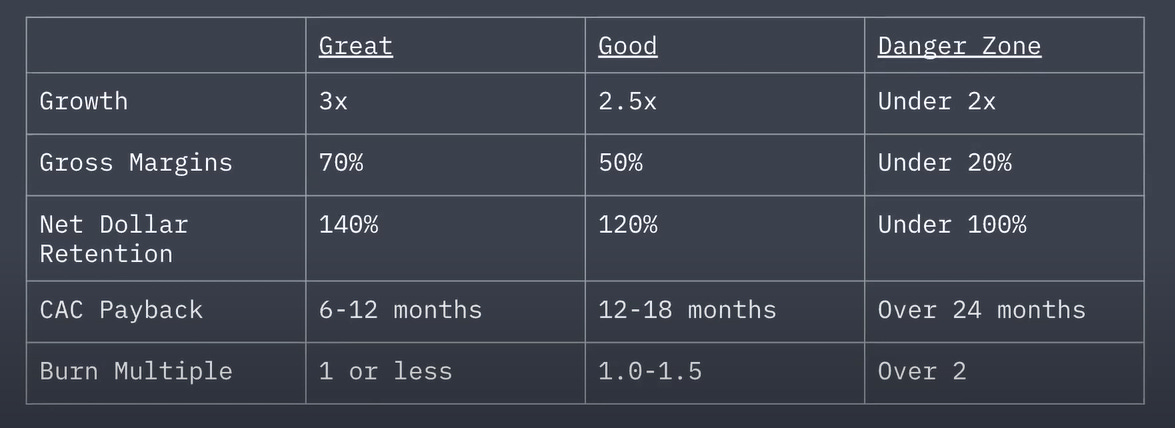

This time is more similar to the Dot com bubble rather than the Great Recession, as it stands right now. There are similarities between the involvement in tech companies between the two periods. The Dot com bubble was hyper focused on eyeballs on a web page and Post-Covid was all about revenue growth. Both are important to businesses, but there needs to be cash produced to create a sustainable long term business. What you can do about it Funding is still possible now, but harder. The bar has been raised for what companies will be funded. They put together a great chart of some key metrics indicating the quality of a company. It would be ideal to be in the “Great” column to get capital. Just because your company might not meet all of the “Great” criteria doesn’t mean you won’t be able to raise, it will just be more difficult. Their main message David Sacks and Jeff Fluhr communicated was everyone should try to lower their burn rate and extend your runway. It’s a difficult choice, but it is probably worth sacrificing potential growth for adding more months to your run rate. The ideal state for startups would be to have a 30 month runway because it typically takes 6-9 months to raise capital. If a company has a year or a year and a half long runway, before leadership knows it, they need to raise money again. They wouldn’t have real time to fix and stabilize their company. Some things might actually get easier during this time. There should be less competition for hiring top talent. Spend could decrease on customer acquisition costs due to less competition. Link to the full video by David Sacks and Jeff Fluhr. End Note Thank you for reading. If this was shared to you, you can subscribe here. For bite-sized product tips in your twitter feed, follow @ProductPersonHQ. Have a great day, Nick Enjoyed this? Please share it with a friend or two. |

Older messages

How to Ask for Feedback from an Interviewer

Thursday, May 12, 2022

Hey, Nick here! In this newsletter, I curate insights and timeless principles on how to build great products. You'll improve your product skills with every issue. Here's an article for you

The Good-Better-Best Approach to Pricing

Wednesday, May 4, 2022

Hey, Nick here! In this newsletter, I curate insights and timeless principles on how to build great products. You'll improve your product skills with every issue. Here's an article for you

The Unconventional Franchise Model Behind Chick-fil-A’s Success

Wednesday, April 27, 2022

Hey, Nick here! In this newsletter, I curate insights and timeless principles on how to build great products. You'll improve your product skills with every issue. Here's a video for you today…

Reed Hastings on Building a Streaming Empire

Wednesday, April 20, 2022

Hey, Nick here! In this newsletter, I curate insights and timeless principles on how to build great products. You'll improve your product skills with every issue. Here's a video for you today…

The 18 Mistakes That Kill Startups

Thursday, April 7, 2022

Hey, Nick here! In this newsletter, I curate insights and timeless principles on how to build great products. You'll improve your product skills with every issue. Here's an article for you

You Might Also Like

Daily Coding Problem: Problem #1707 [Medium]

Monday, March 3, 2025

Daily Coding Problem Good morning! Here's your coding interview problem for today. This problem was asked by Facebook. In chess, the Elo rating system is used to calculate player strengths based on

Simplification Takes Courage & Perplexity introduces Comet

Monday, March 3, 2025

Elicit raises $22M Series A, Perplexity is working on an AI-powered browser, developing taste, and more in this week's issue of Creativerly. Creativerly Simplification Takes Courage &

Mapped | Which Countries Are Perceived as the Most Corrupt? 🌎

Monday, March 3, 2025

In this map, we visualize the Corruption Perceptions Index Score for countries around the world. View Online | Subscribe | Download Our App Presented by: Stay current on the latest money news that

The new tablet to beat

Monday, March 3, 2025

5 top MWC products; iPhone 16e hands-on📱; Solar-powered laptop -- ZDNET ZDNET Tech Today - US March 3, 2025 TCL Nxtpaper 11 tablet at CES The tablet that replaced my Kindle and iPad is finally getting

Import AI 402: Why NVIDIA beats AMD: vending machines vs superintelligence; harder BIG-Bench

Monday, March 3, 2025

What will machines name their first discoveries? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

GCP Newsletter #440

Monday, March 3, 2025

Welcome to issue #440 March 3rd, 2025 News LLM Official Blog Vertex AI Evaluate gen AI models with Vertex AI evaluation service and LLM comparator - Vertex AI evaluation service and LLM Comparator are

Apple Should Swap Out Siri with ChatGPT

Monday, March 3, 2025

Not forever, but for now. Until a new, better Siri is actually ready to roll — which may be *years* away... Apple Should Swap Out Siri with ChatGPT Not forever, but for now. Until a new, better Siri is

⚡ THN Weekly Recap: Alerts on Zero-Day Exploits, AI Breaches, and Crypto Heists

Monday, March 3, 2025

Get exclusive insights on cyber attacks—including expert analysis on zero-day exploits, AI breaches, and crypto hacks—in our free newsletter. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚙️ AI price war

Monday, March 3, 2025

Plus: The reality of LLM 'research'

Post from Syncfusion Blogs on 03/03/2025

Monday, March 3, 2025

New blogs from Syncfusion ® AI-Driven Natural Language Filtering in WPF DataGrid for Smarter Data Processing By Susmitha Sundar This blog explains how to add AI-driven natural language filtering in the