Accelerated - 🚀 Navigating a new market

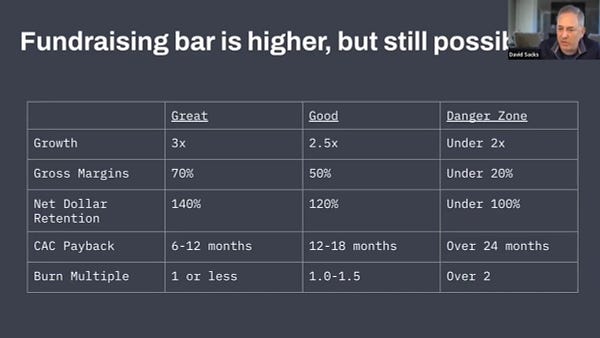

trending 📈There was one big story this week: how the economic downturn is impacting startups. While the recent turbulence started in the public markets, the last few weeks have made it clear that startups and crypto may also feel some pressure. In what’s being called the “RIP Good Times” piece of this generation, accelerator Y Combinator sent founders an email titled “Economic Downturn” (full version here). The crux of their advice? Cut costs as much as possible in the next 30 days, and try to reach “default alive,” as fundraising may be challenged for the next 24 months. YC’s advice echoes what many VCs are telling their portfolio companies. A few months ago, having 12-18 months of runway (cash required to operate the company) was considered “good.” Now, many investors are advising founders to target two to three years of runway. This means refocusing on sustainable, high margin growth - in contrast to a market that previously rewarded growth at all costs.   Another common piece of advice? Raise an extension round to build a cash “cushion” - often at a flat valuation or a slight uptick compared to the previous raise. Gusto and Faire both recently raised extensions. In more normal markets, founders often want to avoid extensions as it increases dilution they take from investors. But in this new market phase, many founders feel that the more cash they have, the better!   On the other hand, some investors feel the current volatility is being overhyped - and may not have that much of an impact on early stage founders, particularly at the seed and Series A. Neo CEO Ali Partovi cautioned founders against killing their companies with “self-inflicted wounds,” by slowing down and preserving cash when it’s not necessary, preventing them from reaching important growth milestones.  How can founders know if they need to make changes to their business in order to adapt? The growth investing team at a16z shared some frameworks for re-evaluating valuation and burn multiple, as well as scenario planning for different outcomes.   While it’s a time of turmoil, it’s also a time of opportunity! It’s already gotten easier for startups to recruit talent, as large companies institute hiring freezes and comp packages come back to earth. And, as YC told founders, you can capture huge market share “just by staying alive.” The competitive landscape tends to clear, creating space for founders with real insights and compelling business models. And as a side note - we are still very much open for business at a16z! If you’re working on a company or know of a company we should meet, send us a DM on Twitter (Justine and Olivia). what we’re following 👀Apple has delayed return-to-office plans for employees amidst rising COVID cases. TikTok is launching games - and is already testing them with users in Vietnam. Lots of news from the a16z team this week! Check out the 2022 State of Crypto report, and the announcement of a new $600M games fund (the hype video is 🔥). 🎉 Investment announcement! This week, our team at a16z led the seed round of Locale - a marketplace that allows consumers to buy products from local merchants, delivered in one order for a flat $5 fee. How does Locale differ from all the other food delivery companies? First, it operates via a unique pre-order model. As a Locale customer, you place your order by Thursday and items get delivered on Saturday. This allows merchants who may not be able to keep up with on-demand orders to offer delivery for the first time! Locale also expands a merchant’s delivery range to 300+ miles, allowing them to reach fans of their products who may not live locally. The Locale network makes a merchant “discoverable” to a new set of potential customers, who will take a chance on them because of the platform’s curation - they take only the best! 😋 Batching orders allows the company to operate more efficiently, and improves the consumer experience. You can shop for products across merchants, and everything gets packaged together and delivered in a Locale box at one convenient time. Locale founders Chris Clark and Jonathan Friedland started the company in their hometown of Los Gatos, spending nights and weekends fulfilling orders themselves - and running the company on a Google Form! Locale is now live throughout the Bay Area and LA, and is coming to San Diego this month. The company has a slate of more than 150 merchants offering products to thousands of customers. Read more from the founders here, and check out Locale here! jobs 🎓Pulley - Founding Engineer (Remote) Insurify - Product Analyst, Data Analyst (Cambridge, Remote) Airtable - Strategic Finance Associate (SF) Faire - Strategy Associate (SF) First Round Review - Writer (SF) Persona - Community Lead, Product Partnerships Manager*, PM* (SF, Remote) Standard Metrics - Product Designer, Product Manager, Venture Data Ops (Bay Area) a16z - Crypto Deal Partner*, Crypto Deal Analyst, Bio Growth Deal Partner*, Healthcare Deal Analyst, Venture Biz Ops Analyst (Menlo Park) Wing - Strategy Associate (Palo Alto) Kalshi - Product Engineer (NYC) Graphite - Developer Advocate, Chief of Staff* (NYC) Snipfeed - Growth Marketing Associate (NYC) *Requires 3+ years of experience. internships 📝Cider - Marketing Intern (Remote) Robinhood - Fall External Affairs & Community Intern (Remote) Marqeta - Global Expansion Intern (Remote) LTK (LiketoKnowIt) - Creator Expansion Intern (Remote) Marble - Ops Intern (Remote) Notion - Community Intern (SF, NYC) Volta Charging - Finance Intern (SF) Twist Bioscience - PM Intern (SF) Stytch - Marketing Intern (SF) SVB Capital - Data Science Intern (Menlo Park) Symphony - Biz Ops Intern (NYC) puppy of the week 🐶Meet Alice and Shelby, two Shar Pei sisters who live in Stockholm. They enjoy chasing birds, asking for treats, and cuddling on the couch. Follow them on Instagram @wrinkle_wrinkle_little_star! All views are our own. None of the above should be taken as investment advice. See this page for important information. If you liked this post from Accelerated, why not share it? |

Older messages

🚀 Grindr preps for its public debut

Sunday, May 15, 2022

Plus, the scariest AirDrop ever...

🚀 TikTok shares its ad revenue

Sunday, May 8, 2022

Plus, how to find startups that are still hiring!

🚀 Twitter and the battle for "free speech"

Sunday, May 1, 2022

Plus, announcing our newest investment - Bounce!

🚀 Netflix's "first in a decade" slip

Sunday, April 24, 2022

Plus, how many creators actually make a full time income?

🚀 The battle for Twitter

Sunday, April 17, 2022

Plus, the top 100 consumer marketplace companies of 2022!

You Might Also Like

AI Assistants Will Be Great (Especially for the Biggest Companies)

Friday, February 14, 2025

Plus! Short Selling; Crypto Treasury Gresham's Law; The Joy of Higher Rates; Labor Substitution; Pricing Black Swans AI Assistants Will Be Great (Especially for the Biggest Companies) By Byrne

🏈 The Super Bowl flight that upped tariffs

Friday, February 14, 2025

The US stamped 25% tariffs on key metal imports, France is coming for America's AI reputation, and chocolate tinned fish | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Why Economists Got Free Trade With China So Wrong

Friday, February 14, 2025

“The China Shock” gets revisited View this email online Planet Money “The China Shock” Revisited by Greg Rosalsky By now, many economists are hoarse screaming that higher tariffs and a trade war will

FinTech is People - Issue #508

Friday, February 14, 2025

FTW Opinions: When fintech principles shape government finance, the stakes go beyond efficiency—trust, security, and oversight are on the line ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Special Announcement From Harry Dent

Friday, February 14, 2025

Harry Dent February 11, 2025 Many of you have heard me talk about John Del Vecchio, one of our trusted partners at HS Dent. He runs two highly successful programs, Microcap Millions and FAST Profits,

Using AI as a Retirement Vision Board

Friday, February 14, 2025

This tool paints a picture of your financial future ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Get a life insurance quote in seconds

Friday, February 14, 2025

And get approved just as fast ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

❌ Altman dissed Musk's OpenAI bid

Friday, February 14, 2025

Musk bid nearly $100 billion for OpenAI, Europe prepared its own diss for the US, and the egg undercurrent | Finimize TOGETHER WITH Hi Reader, here's what you need to know for February 12th in 3:04

Fossicking in the dark or twenty-twenty foresight?

Friday, February 14, 2025

Rishi Khiroya and Lydia Henning If you asked people what skill they would most love to have, you might receive answers like 'to fly', 'to be invisible' or even 'predicting the

I love you(r high credit score)

Friday, February 14, 2025

plus Benson Boone + pizza perfume ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏