May 25: Super Group shares crash on forecast warning

May 25: Super Group shares crash on forecast warningSuper Group Q1, Scout Gaming cash call, Esports Entertainment earnings warning, Better Collective analyst update +MoreGood afternoon. Here is today’s agenda.

Warning. Click below: Super Group Q1

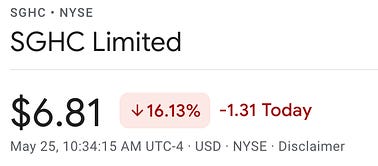

There may be trouble ahead: Super Group shares tanked by over 16% in early trading after the company effectively pre-announced a profit warning on its Q1 earnings call. Citing regulatory changes in Germany, Austria and the Netherlands, it said they had led to a €4m drop in Q1 revenues.

High wire: COO Richard Hasson said the business is “made up of numerous different markets that are all at different stages, so it’s very much a balancing act between finding how best to invest for the long term and balancing that with short term profitability”.

Different worlds: CEO Neal Menashe said “the world today is a very different world than it was 12 months ago”, but Super Group’s broad international reach also gave it many opportunities.

Little miss earnings: Asked what had changed and if there would be ”a little miss on 2022 revenues or a big step down”, management said hold levels in March were hit by unfavorable results and “it can take a while to catch up”.

Waiting for launch: The group didn’t provide much insight into its Ontario activities other than to say it had been certified for sports betting and was waiting to shortly switch over to the regulated offering.

**Sponsor's message: Spotlight Sports Group (owned by Exponent Private Equity) is a leading technology, content and media business specializing in sports betting. Join Spotlight Sports Group and The Parleh for a live webinar on Wednesday, May 25, as we take a deep dive into the launch of Ontario’s online sports betting market. Register for the event here. Esports Entertainment profit warningA new low: “A failure to monetize” esports assets has led Esports Entertainment to warn that revenues for the full year would be lower than forecast at between $55m-$60m.

Changes afoot: Johnson said Esports Entertainment would be “dramatically simplifying” its esports offering to focus on SAAS-based technology under the ggCircuit brand, in-person tournaments under the EGL brands, and our peer-to-peer wagering platform.

Extinction rebellion: The company's FYQ3 earnings showed revenue up 8% sequentially to $15.7m. In March the company raised $13.6m from a sale of shares. Johnson said the Lucky Dino igaming brand had generated “record-breaking” quarterly revenue.

Scout Gaming cash callScout Gaming says its working capital is below the level required by the Nasdaq First North Growth Market after its Q1 results showed EBITDA losses doubling to €30m.

Blame the war: Q1 saw revenues dip 20% to SEK6.7m which the company ascribed to the effects of the war in Ukraine. B2B revenues rose 23% to SEK2.4m but B2C revenues declined by 34% to SEK4.3m.

Further reading: A Scout Gaming skeptic lets fly on Twitter. Better Collective analyst updateBuy the dip: The team at Redeye predict that the gaming affiliate will see a pronounced dip in US revenues for the gaming affiliate giant in Q2 and Q3 as the low season for sports takes effect before a strong bounceback in Q4.

Positive thoughts: Redeye say revenue growth will hit 44% in FY22, raising their target to €255m with organic growth amounting to 24%.

Earnings in briefZeal Q1 revenues were up 11% to €25.1m, billings were up 10.9% to €181m due to stronger jackpots and to a special promotion for the Freiheit+ charity lottery. Customer numbers were slightly down to 154K, acquisition costs were up 13.8% from €33.48 to €38.09.

Cirsa said Q1 EBITDA came in at €118.1m, €3.1m ahea do forecasts The company said a “good evolution” in revenues during the period (unstated) was the driver. Over 555 of EBITDA came from Spain with Colombia the next biggest market, worth 12.3% of the EBITDA total. NewslinesDo you want a flake with that? Canadian-listed King’s Entertainment said it had entered into an “arm’s length business agreement” with SVH, the holding company behind Bet99, a gray market operator in Canada. Demerger: The Tabcorp demerger has closed with the Lottery Corporation debuting on the Australian stock exchange. Bet365 has been warned about its anti-money laundering policies by the Danish gambling regulator Spillemyndigheden after it failed to carry out any KYC or background checks on a young player who was able to deposit around €25.5K ($27.2K) into their account over a 12-month period. Paysafe's affiliate network management division Income Access has expanded its agreement with the Ontario Lottery and Gaming Corporation (OLG). Paysafe has been processing payments for OLG since 2015 and managed its affiliate activities through Income Access since 2002. Baltic in here: Gaming Innovation Group has launched William Hill’s new online casino in Latvia. The two groups collaborated to rebrand the 11.lv icasino site which William Hill acquired in 2019. Meanwhile, William Hill has been fined €138K by the Swedish gambling regulator Spelinspektionen for breaching its reporting obligations. The group’s subsidiaries Mr Green and Evoke agreed to pay the penalty. Wynn probe: The 2012 licensing process for Wynn Resorts’ Encore Boston Harbor is again facing investigation over alleged ties to organized crime relating to the purchase of land for the project. US Integrity will provide its analysis and integrity monitoring services to the sports-betting solutions provider SB22. US Integrity will provide its full suite of betting analysis solutions to the Texas and Belgrade, Serbia-based SB22. What we’re readingAre consumers… just fine. Luna eclipse: Dark side of the moon. On social Bovada @BovadaOfficial Thank you for your patience as we work to fix issues that some players have experienced on our site. We have identified a potential solution and will update you on our progress by Thursday 6pm ET.

Calendar

Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

May 23: Catena considers breakup

Monday, May 23, 2022

Catena Media strategic review, Sportradar analyst reaction, Startup Focus - Fliff, the shares week +More

May 20: Weekend Edition #47

Friday, May 20, 2022

Playtech TTB deadline, Aristocrat H122, MGM analyst update, Sportradar analyst reaction, sector watch - payments +More

Wagers.com Earnings+More podcast #9

Thursday, May 19, 2022

Watch now (29 min) | Everything FanDuel, all at once

May 19: ‘We live in a big data world’ says Sportradar

Thursday, May 19, 2022

Sportradar Q1, DraftKings investor presentation, Acroud Q1 +More

May 18: US icasino ‘when not if’, says LNW

Wednesday, May 18, 2022

Light & Wonder investor day, Better Collective and Catena Media Q1s, Penn National analyst update +More.

You Might Also Like

The Biggest News of 2024!

Friday, December 27, 2024

Over the past year, there has been some pretty big SEO and digital marketing news that has impacted bloggers and content creators. Since its the end of the year, Jared and I decided to sit down and

Online Sales Grew This Much During the Holidays [Crew Review]

Friday, December 27, 2024

You're an Amazon whiz... but maybe not an email whiz. Omnisend makes setting up email for your brand as easy as click, drag, and drop. Make email marketing easy. Hey Reader, Merry belated Christmas

A strategy for more prospects in 2025

Friday, December 27, 2024

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's Make Cut Out Snowflakes Day, Reader... Let your inner child out to play!

Influence Weekly #369 - TikTok At A Crossroads: 23 Experts Weigh In On The Ban, ByteDance, And What’s Next

Friday, December 27, 2024

Social Media as a Recruitment Tool: School Bus Driver Influencers

Issue #48: When Hardware Hits Reality

Friday, December 27, 2024

Issue #48: When Hardware Hits Reality

The UGLIEST website ever? (He paid $55k for it)...

Friday, December 27, 2024

You have to hear this story, it's crazy. View in browser ClickBank Day 3 of Steven Clayton and Aidan Booth's '12 Day Giveaway' celebration has just been published. Click here to find

"Notes" of An Elder ― 12.27.24

Friday, December 27, 2024

Life is too precious to be lived on autopilot.

10 busiest VCs in supply chain tech

Friday, December 27, 2024

9 VCs that ruled 2024 fundraising; aircraft parts market becomes a hotbed for PE; EMEA's 10 biggest buyout funds Read online | Don't want to receive these emails? Manage your subscription. Log

🔔Opening Bell Daily: Housing Outlook 2025

Friday, December 27, 2024

Mortgage rates have climbed as the Fed has cut borrowing costs, and unaffordability will likely persist in the new year.

There's no point in being Data-Driven if your data actually sucks

Friday, December 27, 2024

On strength of schedule, better decision-making and a major trend of 2024