Decentralized Finance | Decentralized Law

Dear Crypto-Legal Observers, Decentralized Law is going to try something new; we’re going thematic. For the next three issues, Web3’s go-to legal newsletter will ship entire issues based around the major playgrounds of our blockchain-based world: decentralized finance, non-fungible tokens, and decentralized autonomous organizations. We’re going to kick off this new format with DeFi, arguably the juiciest intersection of the crypto-legal space and Web3. Decentralized finance is defined in many different ways, but at its core is an immutable, censorship resistant, and permissionless decentralized public ledger that enables users to access a spectrum of new financial opportunities — from tokenization of assets to the minting of stablecoins, from self-repaying loans to degen yield farming. Much of what we do in Web3 touches on DeFi. DeFi is the economic primitive of Web3. Unlike early file-sharing protocols, all DeFi transactions are recorded on chain, and these trustless and novel ways of transacting enable anyone who can read and track blockchain transactions to follow the flow of digital assets around the cryptoverse. To lawpanda’s point, the opacity is gone and the disinfecting sunlight of transparency is one of DeFi’s great promises. But we have some way to go to fulfill that promise. DeFi is so new, and the ‘code as law’ mentality so entrenched within its culture, that it’s still not ready for mass adoption. The industry uses terms like ‘exploit’ to mean theft, and we know regulations are coming. At Decentralized Law, we’ve worked to highlight the importance of educating our lawmakers to ensure our jurisdictions adopt sensible regulations that promote innovation but limit the damage wrought by bad actors. It’s a tough balance, and most of us lean towards the sovereign side of the security spectrum. Fortunately, there are other ways to elevate DeFi that don’t involve industry oversight, and that could work to soften future regulatory overreach. One way to realize the promise of DeFi is to focus our work on building great DeFi protocols. To build a leading DeFi protocol you need dedicated contributors and super-powered teams. And you need dynamic leaders to bring it all together, leaders like Tracheopteryx. Decentralized Law had the pleasure to interview Tracheopteryx for this inaugural thematic issue. Tracheopteryx is a long-time DAO builder best known for his work at Yearn, one of the OG DeFi lending and borrowing protocols, and for co-founding Coordinape, the ubiquitous DAO contributor compensation tool. At Yearn, Tracheopteryx helped develop new models of coordination and governance. He believes that you have to embrace the demon of coordination failures, rather than slay Moloch, and that organizations should adopt a fluid hierarchy to improve decision making; to wit, he often uses biological systems to discuss organizational theory. Tracheopteryx also earned a following for his innovative ideas around team building and his advocacy for a ‘sense and respond’ organizational philosophy.  trach.lens @tracheopteryx Making the jump to working for a DAO can be a challenge. I've helped dozens of newbies into the space over these past 18 months and the thing that is often most difficult for them is this simple question: "What should I do?" 🤔 Here's a thread on how to figure that out: https://t.co/XeiVTEdMajSpeaking of responding, also in this issue we discuss trustlessness, disintermediation, and counterparty risk, dissect degrees of protocol decentralization, analyze whether governance tokens are securities under MiCA, review the OECD’s new cryptoasset reporting framework, provide an overview of cryptoassets within the scope of MiCA, learn about tax-optimized staking, develop a framework for tax-optimized token compensation, and summarize news and articles from throughout the cryptoverse. Although this newsletter may help to familiarize readers with the legal implications arising out of blockchain technology, the contents of Decentralized Law are not legal advice. This newsletter is intended only as general information. Writers’ opinions are their own; therefore, nothing in this newsletter constitutes or should be considered legal advice. Contact a legal expert in your jurisdiction for legal advice. Welcome to Decentralized Law. Contributors: eaglelex, lion917, hirokennelly.eth, COYSrUS, Trewkat, lawpanda, Tromso, DAOLAW, Jay the Legal Wizard, Jason Schwartz, RedHatRoss, teresacd, MDLawyer, G0xse, B(3,A)Rhunter, Cosmic Clancy This is the official legal newsletter of BanklessDAO. To unsubscribe, edit your settings. 🙏 Thanks to Our Sponsor

🎙 InterviewTracheopteryx on Why DAOs Put the Decentralization in DeFi

Some Yearn contributors are currently testing a new compensation system where each person suggests what they should be compensated (their request) and what outcomes others can expect (their motivation). They then receive feedback and can adjust their request and motivation. In this way more workstreams and expectations are surfaced while keeping self-sovereignty and personal responsibility.

Two of our main tools are the advice process and conflict resolution process, both used often in Teal organizations. They root the power to execute work and responsibility for one’s own experience collaborating directly to each contributor themselves, rather than outsourcing them to a managerial layer. They are wonderful processes, though after heavy use over the past year and seeing how these processes can fail, I believe more is needed to support autonomous, remote, and occasionally anon coordination.

Decentralized protocols can only be governed in a decentralized manner, i.e. by DAOs, or else they aren’t really decentralized.

Tracheopteryx is a combination of trachea (the human organ of sound) and the archaeopteryx (the first feathered dinosaur). It is a resonant and potent combo to me. The song of change.

Certainly! It is super hard to organize decentralized work. The world has spent the last 400 years figuring out how to operate centralized businesses. We are just starting to figure out how to work effectively in a decentralized way.

It’s similar to corporate governance in that powers are delegated to small groups — key differences are that there is no corporate entity, contracts, or bosses, it’s transparent, highly permissionless, and token-holders have ultimate authority for how powers are used with low-friction levers for making changes.

I advocate for delegated powers and multi-channel decision making (e.g. not just token-voting). Some decisions are better suited for small groups or the specific experts on the ground.

For sure. In a high enough trust environment no tokens or process is needed. The collaborators can just ‘make decisions’ together. When trust isn’t that high (99.9% of the time) process is needed — trust then moves to the process. Tokens are high trust. Nothing happens without trust. It’s either in systems or people.

Hierarchy is a fundamental feature of reality. The sun is bigger than the moon. Ideally what we want in DAOs is fluid hierarchy where the “leader is the one who knows what to do next”. (via https://twitter.com/fifthworldzach) ⚖ DevelopmentsDeFi Employs Disintermediation by DesignAuthor: lawpanda

Financial services regulation is complex and growing more complex each day. Regulators do not always understand which transactions, derivatives, or other financial instruments give rise to the need for regulatory intervention to prevent systemic risk or impact. Complicated financial products precipitated the financial crisis that began in 2007. Those that grew up during or in the wake of the crisis were understandably disillusioned. Legacy financial institutions and other market participants’ avaricious, self-serving, and predatory behavior arguably led to the U.S. federal government’s 700 billion USD bailout of Wall Street intermediaries, while normal people were left with an economy for a period that is now termed the ‘Great Recession’. As a result, developers began to imagine a financial services industry without traditional intermediaries, sparking ‘FinTech,’ and eventually decentralized finance. A core goal of DeFi is to eliminate legacy financial market intermediaries such as investment banks, depository banks, exchanges, clearinghouses, and broker-dealers, and to increase overall liquidity, transparency, velocity of money, and decrease transaction friction. DeFi allows developers to create new types of financial products and services, eliminating aspects of counterparty risk, by allowing financial assets to be exchanged in a trustless way. DeFi[ned]

DeFi is a commonly used term to describe the ecosystem of financial services built on decentralized blockchain technology, which replace traditional financial intermediaries with freely accessible, autonomous, and transparent on-chain contracts. DeFi protocols adhere to values of permissionless-ness and transparency. DeFi allows people all over the world to lend, borrow, send, or trade assets using non-custodial wallets and without having to involve a bank, broker, or other intermediary. Users can also explore more advanced financial instruments such as leveraged trading, structured products, synthetic assets, insurance underwriting, and market making while always retaining complete control over their assets. As of February 2022, DeFi total market cap continued to reach new all-time highs, and cumulative revenue has grown to over 4.2 billion USD since June 2020. As new DeFi services recreate and reinvent elements of Traditional/Centralized Finance (interchangeably ‘TradFi’ and ‘CeFi’) services, and billions of dollars of digital assets are pledged to DeFi capital pools, policymakers and regulators are faced with challenges in balancing the risks and opportunities presented by this more transparent and permissionless financial system. While DeFi might offer greater efficiencies and opportunities for inclusion, there are also attendant considerations such as the extent of actual decentralization, governance complexities, technical risk, and ultimately systemic risk throughout a burgeoning composable ecosystem. Disintermediation Is a Feature, Not a BugDeFi was developed as a peer-to-peer method of transacting without reliance on a system of intermediaries that has historically allowed artificial manipulation of markets and opaque redistribution of risk. DeFi represents an affirmative attempt to eliminate intermediaries in financial transactions. Instances where intermediaries have failed to appropriately manage counterparty risk often result in systemic market disruption where the costs of self-interested misconduct are generally externalized to the market and taxpayers. Notwithstanding the goals of decentralization and the dynamic attributes of distributed digital ledger platforms, many cryptocurrency broker-dealers, clearinghouses, and exchanges currently operating in mainstream markets still rely on elements of traditional financial intermediation. For example, some platforms rely on centralized order books; others centralize aspects of trade execution or settlement. True decentralization is more often than not merely aspirational. An alternative way to look at DeFi is that it does not actually eliminate financial intermediation, but enables new ways of performing those same intermediary functions through trustless codes and contracts which are programmed to reduce transaction costs and information asymmetry. Based on continuing infrastructure developments, DeFi platforms have the capacity to adapt, reduce, and possibly eliminate institutional intermediation in trading and transactions. The Synthetix ecosystem is one of the earliest examples of a fully decentralized protocol eliminating traditional counterparty intermediation in derivatives trading. Two more recent innovative composable protocols in the Synthetix ecosystem are Lyra and Kwenta.

There are no direct counterparties for a trade in the Synthetix protocol, but it does use a counterparty-like model where SNX stakers assume a proportion of the Synthetix debt pool when they mint sUSD (synthetic U.S. dollars). While these protocols arguably include aspects of the traditional intermediation process in their code, this automation and decentralization does not require the involvement of a self-interested counterparty or allow transactional opacity. Counterparty Risk ManagementDespite centralized financial institutions’ demonstrated lack of transparency, consumers and markets seem to place the utmost trust in them. Proponents of the traditional TradFi/CeFi regulatory regime highlight incidents involving technical failures and attacks on DeFi services resulting in loss of capital as reasons for implementing analogous regulation. However, this seems to be a simplistic argument and purposefully ignores repeated systemic failures in TradFi that have resulted from a lack of transparency and appropriate risk management. Counterparty risk is the possibility that the other party to a transaction, the ‘counterparty’, will default on its obligations to a financial instrument. This could include failure to repay a loan creating a credit risk, or failure to settle a transaction by delivering the specified asset creating a settlement risk. TradFi industry and regulatory ‘initiatives’ to manage counterparty risk generally involve centralized control and regulation. Due to the interconnected contractual and economic nature of the relationships among the largest market participants, one financial institution’s default on its obligations adversely affects the financial institution’s trading partners, hindering their ability to meet their obligations, and so on down the chain. Systemic risk may also occur if an exogenous shock to the financial system causes widespread, contemporaneous losses across financial markets that trigger the collapse of one or more systemically significant financial institutions or a series of financial institutions. To mitigate the classic ‘run on the bank’ scenario, regulatory efforts have historically focused on prudential measures such as board risk oversight, safeguarding solvency by imposing mandatory capital requirements, limiting the size or types of assets held, and limiting the types of permissible transactions. While regulators have established these mandates, authorities have generally delegated most counterparty risk management oversight to the self-interested market participants themselves. Despite these efforts at regulation and oversight, centralized systems seemingly allow artificial manipulation of risk constraints to benefit the very intermediaries that have been charged with preventing excessive systemic risk. This was recently demonstrated by the Archegos implosion. Archegos’s TradFailureIn April 2022, Coindesk contributor David Z. Morris somewhat presciently highlighted the potential systemic impact of counterparty failures in the crypto market — using Archegos as an example and Luna/Terra as an analogous potential risk case. The Archegos example also highlights ongoing issues with opacity and TradFi disclosure and reporting ‘requirements’. In March 2021, the family office fund Archegos Capital Management imploded, causing billions in losses to the prime broker intermediaries (including Goldman Sachs, Morgan Stanley, UBS, Nomura, Deutsche Bank, and Credit Suisse). The quick summary of what occurred is that Archegos duplicatively pledged collateral to multiple brokers to continually leverage-up trades on a portfolio of approximately ten stocks including Viacom, Discovery, and Tencent. The firm utilized total return swaps, which are functionally contracts between the broker and fund providing exposure to an underlying asset. The client gains — or loses — from any changes in asset price, and the broker, not the client, shows up in filings as the registered holder of the shares. As Archegos’ assets increased in value with the bull market, the leveraged position was continually increased. In March 2021, an unexpected drop in Viacom price forced a margin call, and the positions began to unwind as the underlying stock held by the brokers was sold into the market. The market impact of unwinding the heavily leveraged positions eventually led to billions in losses for the involved intermediary banks and impacted the market as a whole — albeit only briefly. Archegos purposefully utilized various regulatory loopholes — or just ignored reporting requirements — to obfuscate their positions. Even though total return swaps are a legitimate financial instrument, the Archegos incident has focused regulatory attention on the processes and controls used by prime brokers to extend leverage. Archegos betting on certain stocks using total return swaps made it difficult for prime brokers to understand the full extent of Archegos’ positions and leverage. In addition, because Archegos was a family office — as opposed to a traditional fund — it was exempt from registration as an investment adviser with the U.S. Securities and Exchange Commission (SEC). The SEC and other regulators have suggested they could now start to scrutinize risk management systems more thoroughly, particularly if counterparties use synthetic structures to not only increase leverage but also to avoid disclosing it. The most concerning aspect of the Archegos implosion is that the intermediaries involved appear to have been highly culpable in allowing Archegos to take the positions that it did. Wall Street firms invented the swap derivatives used, provided Archegos with as much as 85 percent margin debt on the derivative trades and were collecting a huge amount of fees while also profiting on the stock underlying the leveraged swaps. Archegos is a prime example of where a failure to properly evaluate counterparty risk, due largely to lack of transparency, caused significant systemic risk. Standard practices for evaluating risk failed because the firms involved were not incentivized to appropriately monitor Archegos, at least until they sustained 10 billion USD in losses. More Terra/Luna Stuff, Really?Contrast Archegos’ implosion with UST’s depeg on the Terra blockchain and Luna’s consequent debasement. Allegedly, on-chain data showed significant selling of UST into other stablecoins for no clear reason — though it seems like it could be because the entire market was precipitously dropping at the time and investors were de-risking. There are already a variety of semi-conspiracy theories regarding Luna/Terra’s downfall. However, the algorithmic stablecoin structure and UST’s fast growth, seemingly without scaled backing funds, are also just as likely the cause as a concerted attack by an imagined bad actor. While both Archegos’ 10 billion USD implosion and Luna/Terra’s 40 billion USD collapse caused significant pain in the markets, an important distinction is that Luna/Terra’s algorithm, contracts, inflow/outflows, funding, etc. have always been open and on-chain. Arguably, there were no self-interested intermediaries allowing unmitigated counterparty risk to exist in exchange for profit. The fallout from the Archegos and Luna/Terra incidents will, unfortunately, be what you would expect: more regulation. More centralization will always be the solution offered by regulators. If DeFi cannot protect against counterparty risk through decentralized means, it will be forced to adhere to standards set by centralized regulators. As DeFi evolves, which, and to what extent, regulators attempt to exercise jurisdiction will become increasingly relevant. In the U.S., the DOJ, CFTC, FinCEN, FINRA, and SEC may all attempt to implement some oversight on decentralized platforms and their customers. It is likely that many DeFi tokens will be considered securities and the SEC will mandate increased disclosure requirements. DeFi platforms may also be considered ‘exchanges’ under SEC jurisdiction and be required to submit to ongoing examinations. The relative lack of centralized governance and intermediaries in DeFi arguably prevents or limits artificial manipulation of markets to redistribute counterparty risk. Given full transparency, decentralized markets may be better suited to assess risk and respond accordingly. DeFi systems should preclude the possibility of being as artificially risk-controlled as TradFi systems, helping limit the potential for poor management and irresponsible trading practices. That said, we also watched Luna/Terra go to zero — dragging Anchor with it — as the result of manipulation or breakdown of the algorithm and despite active intervention to prevent a digital bank run. Notwithstanding, DeFi’s major value lies in its ability to address systematic counterparty risk through disintermediation and transparency. The lawpanda is a U.S. attorney with an active litigation and counseling practice. He is a member of BanklessDAO's Legal Guild, LexDAO, the LexPunkArmy, and member/consultant/contributor to a variety of DAOs and protocols. When he’s not writing for Decentralized Law, he is working to reduce friction between on chain and legacy entities through entity structuring and common-sense legal solutions. Putting the Decentralized in DeFiAuthor: Tromso

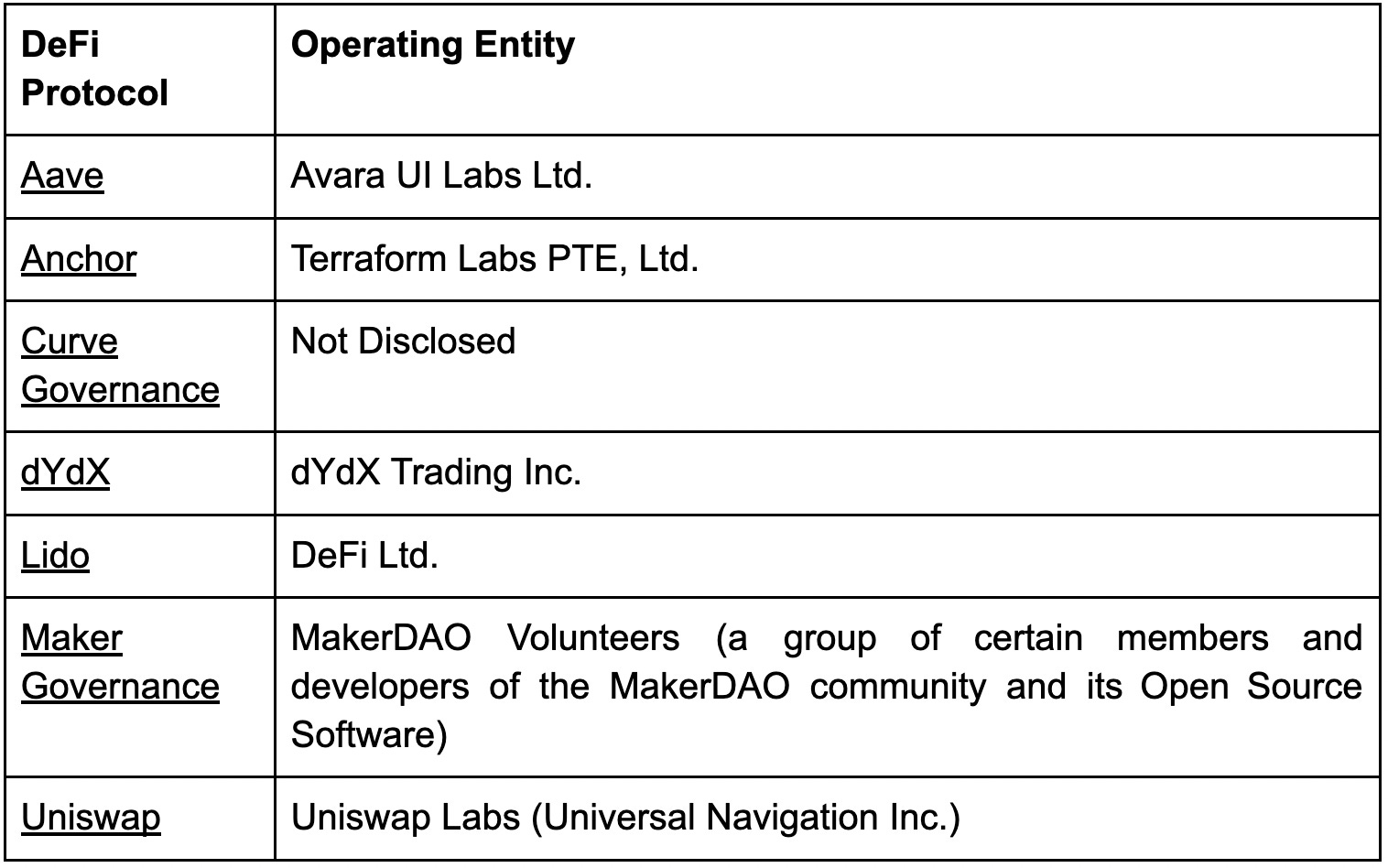

Recently some decentralized finance protocols are facing legal challenges on their decentralization feature. Uniswap (allegedly operated by Universal Navigation Inc.) and PoolTogether (allegedly operated by PoolTogether Inc.) are two protocols that have been sued by their users for breaching local laws or regulations. One of the possible defenses these entities may raise is that the protocols are decentralized and thus they should not be liable for how their protocols are used. Then the question is how decentralized these protocols really are. Based on the data of total value locked (TVL) from DeFiLama (as in early May 2022, before the UST-Luna crash happened), this article picks a few popular DeFi protocols that have their terms and conditions published on the websites, which may shed some light on the relationship between the protocol and the entity behind it. Entities Behind DeFi ProtocolsAmong these seven protocols, five of them disclosed the name of their related legal entities. One of the possible reasons that Curve Governance and Maker Governance’s terms do not name any entities is that the terms are more related to the DAO governance rather than the operation of DeFi protocols. Relationship Between Entities and ProtocolsAfter looking into the texts of the terms, one may find that most entities claim to be independent from the underlying decentralized protocols that are deployed on blockchain networks. These terms mostly govern the use or access to the websites or interfaces, which outline a relationship among entities, interfaces, and protocols. Under this arrangement, it seems that how much control the entity has over the protocol partly depends on whether the interface is the only gateway to the protocol. If the entity provides an exclusive access to the interface while the interface provides an exclusive access to the protocol, arguably the entity itself is able to decide whether the protocol can be accessed by users. One exception appears to be Aave, whose terms provide that “Aave.com is not one of the available access points to the Aave Protocol”. In addition to ‘control of access’, there are other factors that may be relevant to the question of how much control the entity has over the protocol, some of which have been raised in the class action complaint against Uniswap:

Some of these factors have also been reflected in the terms of these protocols. For example, dYdX Trading Inc. is entitled to update dYdX-developed smart contracts, modify access to the service, and at its sole discretion suspend or disable its service. Further, the entities behind Aave, Anchor, and Lido have sole discretion to restrict user access to their services, especially if there is any suspected illegal activity. How Permissionless Is DeFi?All of these clauses and arrangements under the terms make one wonder how ‘permissionless’ DeFi is. The preliminary observation is that although many blockchain networks are permissionless, DeFi protocols are less so. The terms of many DeFi protocols provide that they are only open to “eligible users'', though the current threshold is often very low (the eligible requirement most often relates to age, legal capacity, and sanctions). Certain protocols, such as dYdX, expressly decline to offer their services to U.S. persons (possibly due to regulatory reasons). Further, as discussed above, the entities operating the interface may be able to block certain users or transactions. From this perspective, the difference between mainstream DeFi protocols and traditional banks is not a matter of kind, but a matter of degree, since both have certain requirements for their counterparties (users) under relevant laws and regulations. Despite this, one may expect that DeFi still has the potential to offer more accessible financial services to those unbanked populations. Control TweakThe terms published on these DeFi websites suggest that the relationship between the operating entity and the underlying protocol is not clear-cut. A non-exhaustive list of relevant factors includes governance structure, profit flow, and intellectual property. Given that the existing legal framework tends to look for a party to be held accountable for the acts, a parallel may be drawn between smart contracts and artificial intelligence (AI) algorithms to provide some helpful guidance. For AI, the EU has taken the view that the party who is best capable of controlling and managing a technology-related risk shall be held liable. Similarly, how much control the operating entities have on DeFi protocols is expected to be the core issue in the DeFi-related legal actions moving forward. Tromso is a lawyer in Hong Kong, focusing on Web3 innovations in the financial and legal sectors. He received legal education in mainland China, Hong Kong, Singapore, and the UK. 🏛 RegulationsGovernance Tokens May Be Securities Under EU LawAuthor: DAOLAW

Many DAOs and DeFi applications are initially developed and put into operation by companies or individuals with the plan of eventually decentralizing. Holders of the DAO or protocol governance tokens can propose and vote on changes that, if approved, are then generally implemented by deploying a new or modified smart contract. In contrast to actual equity, governance tokens usually do not attempt to represent a company’s value through the token, but only the non-binding ability to propose or vote on changes. A few individuals may hold a relatively large number of governance tokens, which can call decentralization into question. In some cases, the voting processes are also subject to certain thresholds so that participants with a small number of governance tokens do not even get a chance to vote. Governance Tokens as Securities Under MiFID IIGovernance tokens are critically important to the implementation of change in DeFi ecosystems. Legally, the question arises as to their classification as securities within the meaning of the Markets in Financial Instruments Directive and associated Regulation (MiFID II). Classifying these tokens as securities for this purpose has drastic consequences, such as the applicability of the Market Abuse Regulation or the existence of prospectus obligations under the Prospectus Regulation. Under MiFID II, ‘transferable securities’ means securities that are negotiable on the capital market, with general characteristics such as transferability, tradability, and standardization that are comparable to the ideal/typical securities contemplated by the legislation. Governance tokens are likely to fulfill the characteristic of transferability due to the ability to transfer ownership. They are also likely to satisfy the tradability requirement, as there is a lively market that brings together supply and demand. The standardization requirement is also likely to be met, as governance tokens for a DeFi project will typically come with the same rights in each case and are therefore interchangeable. However, it is not clear that governance tokens are functionally comparable with the ideal/typical securities of MiFID II, which provides a non-exhaustive list. This provision allows for instruments to avoid being classified as securities if they are not comparable to traditional financial instruments from a regulatory perspective. In any case, governance tokens — unlike shares and bonds — do not convey any participation in future payment flows and are not associated with investor-like expectations. Furthermore, for these and claims of governance rights there is often no claim defendant since even the initiators of DeFi projects would not be able to fulfill certain claims due to lack of influence on the smart contract set in motion. In any case, the fact that governance tokens serve investment purposes is irrelevant. Ultimately, the better arguments speak against a classification as a security within the meaning of MiFID II. The exception would be for a DAO with a legal entity structure with governance tokens providing co-determination rights, cash flow rights, or a shareholder position. What About the Upcoming Mica Regulation?The DeFi community is currently waiting for the European plan to issue a Markets in Crypto-assets Regulation (MiCA), which provides that cryptoassets must be issued by a legal entity. Although these would not be subject to a licensing requirement under the current proposal, the mandatory involvement of a legal entity calls into question the basic idea of decentralization. This becomes relevant for DeFi because, even if the classification of governance tokens as securities under MiFID II is uncertain, the tokens will be a digital representation of rights that can be electronically transmitted and stored using distributed ledger technology or a similar technology. The tokens thus should qualify as cryptoassets under MiCA. Therefore, their issuers would have to be legal entities, prepare a white paper, provide notice to the regulatory authority, and publish it. Therefore, it may be difficult for DeFi projects that do not have a legal entity, as they will no longer be allowed to serve the European market. Whether this can really be enforced remains to be seen. Against this background, it also remains to be seen whether the European Parliament will continue to insist on these requirements despite (or precisely because of) the implications for DeFi projects, or whether it will make adjustments in this respect in the further legislative process. Dr. Biyan Mienert is an attorney whose practice focuses on crypto and fintech. He currently lectures on Digitalization Law at the University for Applied Science in Hessen (Germany). He primarily conducts research and advises on the legal issues and structuring of DAOs, NFTs, Web3, and Token offerings. In his Ph.D., he developed a comprehensive legal framework for DAOs. He is a frequent speaker at international conferences and political working groups, and has advised numerous well-known crypto startups. Cryptoasset Reporting Framework May Hinder Growth of DeFiAuthor: Jay the Legal Wizard

Life has never been easy for DeFi enthusiasts. Onboarding to the DeFi world requires a decent amount of self-study to understand how to onramp fiat into the system, how to connect to DeFi protocols, and what functionality is offered by these. Such barriers, while clearly surmountable for the tech-savvy, often pose too great a challenge for retail investors. But up until now, government regulations have generally not created a barrier to exploring the world of DeFi. After a straightforward KYC/AML process with a centralized crypto exchange, you could buy your first crypto, transfer it to a crypto wallet, and go down the rabbit hole. Now imagine a world where you can no longer use your favorite DeFi protocols such as Uniswap or Maker without first revealing your sensitive personal data — date of birth, tax residence, or tax identity number to the protocol — so that your jurisdiction can check that all your taxes are paid. This idea may give you the heebie-jeebies even if you aren't a tax evader using DeFi to hide from your national revenue service, as each obstacle on the way to DeFi holds potential users back from exploring this space. Nonetheless, this world may soon become a reality if jurisdictions across the world adopt a newly proposed Crypto-Asset Reporting Framework (CARF) developed by the Organization for Economic Cooperation and Development (OECD). CARF, BrieflyThe initial public consultation document on CARF was published by the OECD on March 22, 2022, and the public consultations ended on April 29, 2022. The goal of CARF is to provide for the automatic exchange of tax information on transactions in cryptoassets in a standardized manner. As the OECD puts it, the cryptoasset market poses a significant risk that recent gains in global tax transparency will be gradually eroded. Legacy global financial institutions are already subject to extensive tax reporting under the Common Reporting Standard (CRS). However, as the CRS definitions do not usually apply to crypto market players, CARF builds an entirely new framework specifically designed for tax reporting of transactions in a crypto world. The OECD fears that cryptoassets could be exploited to undermine existing international tax transparency initiatives, such as CRS. CARF is intended to help national tax administrations track down non-compliant taxpayers. This goal certainly deserves support since crypto should not facilitate tax evasion. Yet the measures proposed in CARF are so drastic that they are likely to throw the baby out with the bathwater. The baby here is not only a crypto user, but also DeFi protocols and DAOs that may find it impossible to comply with such a broad scope of reporting. Types of Reported TransactionsWhat transactions will be reported? CARF will apply to four types of transactions. These are exchanges between cryptoassets and fiat currencies, exchanges between one or more forms of cryptoassets (crypto-to-crypto transactions), retail transactions with the use of crypto as a means of payment, and transfer of cryptoassets between wallets. A 'cryptoasset' is a digital representation of value that relies on a cryptographically secured distributed ledger or a similar technology to validate and secure transactions. That definition is purposefully broad to ensure that all assets covered under CARF also fall within the scope of the Updated Guidance for a Risk-Based Approach to Virtual Assets and Virtual Asset Service Providers as proposed by the Financial Action Task Force in October, 2021. Notably, this definition will capture most NFTs and governance tokens, unless the latter represent a security, in which case they fall within the scope of CRS. The only two types of cryptoassets expressly excluded from CARF’s scope are central bank digital currencies and closed-loop cryptoassets. In simple terms, the closed-loop cryptoassets are utility tokens that can only be used to pay for the purchase of goods and services. Reporting ResponsibilityThe reporting under CARF will be the responsibility of any individual or entity, that, as a business, provides a service effectuating exchange transactions (i.e. fiat-to-crypto and crypto-to-crypto) for or on behalf of customers, including by acting as a counterparty, or as an intermediary, to such exchange transactions, or by making available a trading platform (Crypto-Asset Service Provider). This appears to catch non-custodial wallet providers, decentralized exchanges and various DeFi protocols that allow for converting one type of crypto into a different crypto with additional features such as interest or a pegged exchange rate to some legacy world asset. In addition, CARF defines ‘entity’ to ensure that a chosen legal form of running a business will not escape reporting obligations. Apart from obvious instances of entities such as corporations and partnerships, an entity under CARF is also a legal arrangement. While CARF does not explicitly include DAOs, DeFi protocols operating as DAOs may want to err on the side of caution. Scope of ReportingSince we already know what will be reported and who will report, the natural question that comes to mind is who will be subject to disclosure? Basically, it will be any individual or entity (again, a broad term potentially encompassing DAOs) that is a customer of a business providing a service effectuating exchange transactions (i.e. of a Crypto-Asset Service Provider). There are some exclusions from the scope, but they are irrelevant for most crypto users, unless they are a governmental entity, international organization, central bank or financial institution other than an investment entity. The requirement applies not just to an entity, but also persons controlling the entity. Those are supposed to be natural persons exercising control over an entity. In case of corporations, that would usually be individuals with shareholdings over a particular threshold. But who would it be in the case of a DAO? Token holders with voting power exceeding a certain percentage? Genesis squad? Members of a certain level with particular functions within DAO? And most importantly, how are DAOs supposed to identify their controlling persons if the whole community is inherently pseudonymous and few members go by their real names, let alone reveal other personal data? The scope of reporting obligations under CARF is extensive. In the case of individual cryptoasset users, a reporting Crypto-Asset Service Provider needs to report the name, address, jurisdiction(s) of residence, tax identification number (TIN), and date and place of birth. In the case of an entity, a reporting Crypto-Asset Service Provider needs to report the name, address, jurisdiction(s) of residence, and TIN(s) of the entity as well as personal data of each controlling person. To gather the data, a reporting Crypto-Asset Service Provider must obtain a self-certification from individual cryptoasset users and controlling persons. In order to be valid, the self-certification must be signed or otherwise positively affirmed by an individual cryptoasset user and controlling person. What happens if a self-certification has not been made or a Crypto-Asset Service Provider has reasonable doubts about its validity? That’s simple — the Crypto-Asset Service Provider must refuse to effectuate a transaction. Now imagine effecting an exchange transaction for a DAO that has thousands of token holders residing around the globe. Would that DAO be successful in making its members provide written representations on their tax jurisdictions and other sensitive data to successfully go through the self-certification process? What would a DAO choose as its jurisdiction of residence? Internet? Discord? Ethereum smart contract? Since CARF is designed to ensure that cryptoasset users pay their fair share of taxes, Crypto-Asset Service Providers will most importantly report on financial details of transactions in scope. The goal is that all dispositions and acquisitions (including dispositions to pay for a good or service) of cryptoassets are presented at their fair market value expressed in fiat currency. Additionally, in case of transfer of cryptoassets with respect to which Crypto-Asset Service Providers have no knowledge of consideration, the providers will also report wallet addresses to which transfers have been made. Effects and EchosThe burden placed on DeFi and DAOs by CARF is immense, and the protocols may — despite genuine efforts — fail at self-certification. To find a way out, DeFi may soon resort to establishing legal wrappers in jurisdictions that will most likely not participate in CARF. Will that help to ensure tax compliance? Quite the contrary, as some crypto users may tend to choose crypto service providers established in tax havens, thereby ensuring their tax information regarding crypto transactions will not be transferred to their respective national tax authorities. CARF, once officially adopted by the OECD, will then be implemented into national laws by participating jurisdictions. The DeFi community has been so far remarkably silent in the recently concluded public consultations of CARF, since of 78 documents with comments on the proposal, none was delivered by a member of the DeFi community. Perhaps it is time that the community becomes more vocal before national legislation bodies start to convert CARF into binding legislation. Jay is a tech-savvy attorney-at-law from Poland specializing in tax and corporate matters. He has 10 years of professional experience in the legal and consulting industry gained both in Poland and abroad. Clarifying Cryptoasset Treatment Under MiCAAuthor: RedHatRoss

On March 14, 2022, the Economic and Monetary Affairs Committee of the European Parliament voted to negotiate on new rules related to cryptoassets in a draft law titled Markets in Crypto-Assets Regulation ('MiCA'). This legislation would be directly binding in all EU member states and would not require formal implementation — the same rules would apply in Berlin, Lisbon or Warsaw. MiCA was first proposed in September 2020 and is part of a wider digital finance package of the European Commission which includes digital finance strategy and legislative proposal on digital resilience. The vote opened formal negotiations between the Parliament, the Council and the European Commission, where the draft may undergo further changes. The draft was substantially modified following publication of the first draft in September 2020, which included, for some time, the unrealistic Proof-of-Work ban which was subsequently abandoned. Addressing DeFiMiCA would apply to persons and entities that are engaged in the issuance or offering of cryptoassets for the purpose of trading or providing services related to the trading of cryptoassets in the EU. MiCA was not specifically drafted to address DeFI. While certain categories of DeFI may be in scope, others do not seem to be covered. Additionally, existing EU regulations might still apply and MiCA' scope would be excluded in such occasions. In particular, this might be possible in relation to certain cryptoassets that are considered:

MiCA also introduces a definition of cryptoasset service provider and imposes certain requirements on such providers. In particular, only legal persons that have a registered office in an EU Member State and that are authorized to do so in accordance with MiCA would be permitted to provide cryptoasset services. A possible exception would be where an EU based client initiates the provision of cryptoasset services. Categories of Assets Covered by MiCAIn order to capture the wide variety of cryptoassets on the market and apply different levels of requirements to them, MiCA recognizes three categories of such assets:

Asset-referenced tokens are tokens tied to a basket of assets (such as a basket of currencies) while e-money tokens are basically stablecoins pegged to the value of a single fiat currency such as EUR or USD. The third category are other cryptoassets, including utility tokens defined as a type of cryptoasset which are intended to provide digital access to a good or service, are available on distributed ledger technology, and that are only accepted by the issuer of these tokens. As a consequence, issuing or offering of any of these categories of cryptoassets in the EU would be subject to certain requirements, including authorization and a white paper. Additionally, certain strict rules are foreseen in relation to storing funds, reserve assets, information requirements, marketing communications, reporting obligations to European Securities Markets Authority, complaint procedures, conflicts of interest and others. As the full analysis of all requirements is outside of scope of this article, let's focus on the most important ones in relation to each category of cryptoassets distinguished by MiCA. Offering of Asset-referenced TokensOffering of asset-referenced tokens or seeking admission on a trading platform in the EU would only be possible when the issuer has been authorized by the competent authority of its home EU Member State. The authorization would be valid in all Member States on the basis of so-called 'passporting' known from MIFID or PSD2 regimes, which allows the authorized entity to provide services in any other Member State. Only legal entities that are established in the EU may be granted such an authorization. MiCA provides an exception from these obligations if the average outstanding amount of tokens does not exceed 5 million EUR or if the offer is solely addressed to qualified investors (defined in accordance with relevant EU laws) and tokens can only be held by such investors. Issuers of asset-referenced tokens must also produce a cryptoasset white paper and provide the white paper to their home regulator. Certain other requirements would also apply, in particular relating to marketing communication that refers to asset-referenced tokens, ongoing information requirements to holders of such tokens, as well as ESMA reporting obligation, complaint handling rules, conflict of interest, governance arrangements, storing funds, and reserve assets requirements. Offering of Other CryptoassetsOffering of other cryptoassets or seeking admission of such cryptoassets to trading on a trading platform is only possible when the offeror is an entity established in the EU (legal or an entity subject to the rights and obligations of the EU) or, according to the most recent draft of MiCA, is a DAO (sic!). Offerors of other cryptoassets must also produce a cryptoasset white paper, have it notified and published and receive authorization from a competent authority (though MiCA does not explain how a DAO would obtain such authorization). Although the first draft of MiCA did not refer to AML measures, the most recent one does so and requires the offerors of other cryptoassets to have adequate AML measures. It also prohibits such offerors from having a parent subsidiary in a high risk third country or non-cooperative jurisdiction for tax purposes that has a 0% corporate tax rate or no taxes on company profits. MiCA provides an exception in case of other cryptoassets if, among others, when such cryptoassets are offered for free, are automatically created through mining as a reward for the maintenance of the ledger or the validation of transactions, are unique, not fungible, not fractionable and not transferable directly to other holders without the issuer's permission. Also, the requirements do not apply when cryptoassets are offered to fewer than 150 natural or legal persons per Member State or when over a period of 12 months, the total consideration of an offer to the public of cryptoassets in the EU does not exceed 1 million EUR. Nevertheless, the exceptions does not apply to the entity requirement, so in any case, a person offering such other cryptoassets must be a legal entity established in the EU, a natural person having its residence in the EU, an entity established or having a seat in the Union and subject to the rights and obligations of the EU, or be a decentralized autonomous organization. Offering of Electronic Money TokensElectronic money tokens are treated differently than other categories of cryptoassets, since they may be offered to the public or admitted to trading on a trading platform in the EU only if the issuer is authorized as a credit institution or is an entity exempted by the capital requirement directive, or is authorized as an ‘electronic money institution’ within the meaning of e-money directive. An issuer of electronic money tokens must also comply with certain requirements applying to electronic money institutions set out in the e-money directive. The MiCA exception for electronic money tokens applies when e-money tokens are marketed, distributed and held by qualified investors and can only be held by qualified investors or when the average outstanding amount of e-money tokens does not exceed 5 million EUR over a period of 12 months. One of the most important requirements established by MiCA is that holders of such tokens will be entitled to a claim for redemption at any moment, and at par value, of the monetary value of the e-money tokens held. Conditions of redemption must be described in the cryptoasset white paper, but in any event, redemption must be immediate or take place within no more than two working days. One of the more interesting solutions provided by MiCA is what happens when offerors of e-money tokens do not fulfill legitimate redemption requests from holders of tokens within the time period specified in the cryptoasset white paper. In such case, redemption obligation would apply to any third party entities that have been in contractual arrangements with issuers of e-money tokens, i.e. entities ensuring the safeguarding of funds, any natural or legal persons in charge of distributing of such tokens on behalf of issuers or offerors or issuers of e-money tokens, if they are different from the offeror. Additionally, issuers or cryptoasset service providers would be prohibited from granting interest or any other benefits related to the length of time during which a holder of e-money tokens holds such tokens. Significant TokensApart from the already robust regime relating to certain categories of cryptoassets, MiCA provides additional rules on tokens that are considered significant. Classification will be done by the European Banking Authority (for significant e-money tokens) or ESMA (significant asset-referenced tokens). Additional rules cover, among others: specific remuneration policy, custody requirements, liquidity monitoring requirements, stress testing and reserve assets requirements. MiCA may become applicable as early as in 2023. There seems to be no doubt that a robust regime relating to cryptoassets and cryptoasset services will be part of the regulatory landscape in the EU. The question still remains to what degree certain rules are going to be shaped and to what extent current market conditions and development will be taken into consideration. But there is no doubt that while we are all heading west, the law seems to inexorably enter the frontier. RedHatRoss is an EU-based attorney-at-law/compliance officer/MLRO with 10+ years background in the financial supervision and payment services industry. BanklessDAO Legal Guild and LeXpunK_Army contributor. 👮♂️ TaxationThe Latest DeFi Alpha Is Tax-Optimized StakingAuthor: Jason Schwartz

Staking is a core DeFi activity, but there is no formal guidance on how staking rewards are taxed in the United States. Because tax can turn a good investment into a bad one, it pays to think about how to report staking transactions and whether they are all taxed alike. In short, unless you are sitting on a pile of highly appreciated crypto, swapping into a token that represents a proportionate share of a changing pool of assets (e.g. wstETH or cTokens) is likely to be more tax-efficient than receiving streaming rewards (e.g. stETH or aTokens). DefinitionsStaking involves depositing your tokens into a smart contract in exchange for yield. Broadly, staking comes in two flavors: liquid and illiquid. 1. Liquid staking: Yield accrues inside a new ’liquid staking token’ that the smart contract issues to the depositor. Examples:

2. Illiquid staking: Yield is credited periodically to your wallet or an online portal. Examples:

Under a variant of illiquid staking, the smart contract instantiates your deposit in the form of a ‘bailment token’. The bailment token differs from a liquid staking token in that it represents a one-to-one claim to the deposited token, not a claim to a proportionate share of a changing pool. The bailment token is transferable, arguably making ‘illiquid staking’ a misnomer, but I’m a tax lawyer, not a marketer. Examples:

AnalysisIn the absence of guidance, U.S. tax lawyers typically determine how a new type of product is treated by analogizing it to another type of product for which guidance exists. 1. Liquid Staking Because liquid staking tokens represent interests in a joint venture for profit (albeit an automated one), their most straightforward comparison would be to equity in an entity. By default, entities that are not organized in the United States are treated as foreign, and foreign entities are treated as partnerships unless: (1) all members have limited liability under a statute; or (2) the equity is readily tradable and less than 90% of the entity’s income is ‘passive’. Liquid stakers don’t have limited liability under a statute. However, most liquid staking tokens are readily tradable, and income earned by the protocols typically doesn’t fit the statutory definition of passive income. Accordingly, liquid staking tokens are probably best treated as equity in a foreign corporation. Foreign corporations are subject to U.S. corporate tax only if they are ‘engaged in a U.S. trade or business’. One way for developers to mitigate the risk of the IRS asserting that a smart contract protocol is engaged in a U.S. trade or business is to ensure that the ultimate decision to deploy the smart contract is made and executed outside of the United States. U.S. taxpayers can be subject to onerous consequences for investing in foreign corporations that are ‘passive foreign investment companies’, or PFICs. But the businesses of virtually all smart contract protocols — e.g. consensus-layer staking in the case of Rocket Pool or Lido, or active financial activities in the case of Compound or Uniswap — seem to keep them out of PFIC status. The tax consequences of swapping ETH for foreign corporate stock in a non-PFIC that doesn’t pay dividends are that you have capital gain or loss on entry and exit, but do not have income inclusions during your holding period. The IRS’s paltry crypto guidance to date supports the above analysis. Under that guidance, crypto is property for U.S. tax purposes. Property includes stock. As a general rule, an exchange of property for materially different property triggers capital gain or loss. 2. Illiquid Staking The most straightforward real-world analog for illiquid staking is a pledge of fungible property as collateral. Normally, pledging fungible property as collateral is not taxable to the pledgor if they can reacquire identical property within a reasonable time after demand. That rule is codified for securities, and it seems sensible to apply it to other fungible property like crypto. An exchange of property for identical property generally is not taxable, even if the exchange is deferred. Significant staking lockups could put pressure on the analysis. Proposed regulations for securities loans would require reacquisition within 5 days after demand. On the other hand, it is hard to see a better comparison, and treating illiquid staking as a taxable event would require staking rewards to be treated as part basis recapture, part gain, which would be very difficult to administer. The issuance of a bailment token in connection with an illiquid staking transaction shouldn’t change the tax treatment. A bailment token simply makes the staker’s position more readily assignable, but doesn’t otherwise change the transaction economics. Assuming illiquid staking does not trigger gain or loss, stakers likely are taxed at ordinary rates on the fair market value of their staking rewards, determined at the time of receipt. That’s how income from securities loans is taxed as well. The IRS’s crypto guidance supports the above analysis. Under that guidance, crypto miners, who are analogous to illiquid stakers, must include their mining rewards in income as they receive them. At least one taxpayer, in Jarrett v. United States, has argued that consensus-layer inflationary staking rewards should instead be treated like crops or other self-created property and taxed only on sale. Although the IRS issued a refund to Jarrett, the IRS didn’t concede its position. More recently, the New York State Bar Association’s Tax Section issued a report supporting current taxation of staking rewards at ordinary rates. 3. Delegated Staking The above analysis makes sense for decentralized protocols, but might not apply equally to staking services offered by centralized exchanges or other custodians. U.S. crypto custodians appear to treat their illiquid staking arrangements as custodial relationships, not pledges. That treatment is sensible by analogy to TradFi custodial transactions. Taxpayers who custody stock with a broker generally are treated as owning that stock, not as pledging it to the broker, even if the broker commingles stock of multiple clients. Similarly, investors in American depository receipts, or ADRs, are treated as owning the shares referenced by those ADRs, not as pledging them to the issuing bank. While I’m not aware of crypto custodians issuing liquid staking tokens, it seems reasonable to expect custodians not to treat a client’s conversion of an illiquid staking position into a liquid staking token as a taxable event, because the conversion would be merely a formalistic change. In that case, the custodian would continue to report staking rewards as ordinary income to the client on an IRS Form 1099. However, the client’s treatment on withdrawing those liquid staking tokens into self-custody and swapping out of them would raise a number of tax characterization and information reporting questions for the buyer. We’ll cross that tax quagmire when we come to it. Parting ThoughtsIt’s hard to apply our current tax rules, which assume the existence of financial intermediaries, to a decentralized world. Finding a sensible and consistent reporting position for even basic DeFi transactions like staking often requires developers and investors to make an unacceptable choice: divert resources to expensive tax lawyers or close their eyes and hope for the best. Pension plans and other institutions that require a high degree of certainty on tax treatment are often sidelined entirely, further limiting capital inflows to innovators. Crypto isn’t going anywhere. Modern finance needs a modern tax system, and policymakers should start thinking creatively about what that might look like. One straightforward option might be to let all U.S. taxpayers ‘mark to market’ their crypto holdings and pay tax only on appreciation measured at the end of the year (and receive a deduction for economic losses). A mark to market election currently exists for professional securities and commodities traders, but not for investors, and the threshold for trader status is high. Failure to adopt common-sense rules that give crypto natives greater tax clarity could put the financial and technological primacy of the United States at risk. Jason is a tax partner and co-head of the Digital Assets and Blockchain Practice at Fried, Frank, Harris, Shriver & Jacobson LLP. Tax-optimized Token CompensationAuthor: Jason Schwartz

Founder compensation in TradFi is highly tax-optimized. Founders typically pay little to no tax up front when they receive restricted stock or carried interests, and pay tax at preferential long-term capital gains rates only on an exit. The crypto space hasn’t yet figured out how to replicate that tax efficiency with token grants to core developers. Here I present a proposal for doing so. BackgroundU.S. founders usually earn tax-optimized compensation in one of two ways: restricted stock or carried interests. 1. Restricted stock. Founders who elect to report the value of their corporate stock at grant aren’t subject to tax when vesting restrictions expire. A founder’s entire compensation can be long-term capital gain if the stock they receive is worth zero at grant, it goes up in value, and the founder holds onto it for more than a year before selling. 2. Carried interests. A carried interest is issued by a partnership instead of a corporation and entitles the grantee to an interest in the partnership’s future profits but not its current capital. U.S. tax law allows carried interests to be valued at their ‘liquidation value’, which is the amount that would be distributed to the grantee if the partnership liquidated immediately after the grant. Because partnerships are pass-through entities for U.S. tax purposes, if a partnership recognizes current income that economically benefits a grantee, the grantee is taxed on the income even if that income is not distributed. But that usually doesn’t happen in private equity or venture capital, where the carried interest entitles the grantees only to a portion of the gain (if any) recognized by the partnership on eventual sales of its portfolio companies. Unvested TokensIn the crypto space, core developer compensation often mimics restricted stock. But tokens aren’t actually subject to a traditional vesting schedule; instead, a smart contract or treasury management team pays the tokens out periodically, and U.S. developers have to include the tokens’ fair market value in income as they receive them. If the tokens have appreciated by the time they are paid out, the devs are in a worse after-tax position than their TradFi counterparts. ProposalMy proposal draws from the SushiSwap protocol. The SushiSwap protocol uses a portion of trading fees it generates to acquire its native token, SUSHI, on the secondary market, and then locks the SUSHI up in an on-chain treasury. Investors can purchase xSUSHI, which represents a share in the treasury, and do not pay U.S. tax on the xSUSHI until they sell it, even though it economically represents a share of streamed trading fees. Assume that the core developers for a new protocol are issued a similar xToken when the protocol launches. The xToken is valueless on issuance, but represents a share in a treasury that is entitled to streamed rewards denominated in the protocol’s native tokens if the protocol generates sufficient fees to acquire its native tokens on the secondary market. Notwithstanding the streamed rewards to the treasury, the core devs likely would not report taxable income until they eventually sell or redeem the xTokens, and then would report capital gains instead of ordinary income. Future developers might even be issued new xTokens (e.g., ‘2023 xTokens’, ‘2024 xTokens’, etc.) that represent a share in a new treasury. The new treasury would start with no assets, so that the new xTokens wouldn’t have much taxable value at issuance, but the protocol’s native tokens would be streamed to the new treasury (as well as the old treasuries) if the protocol generates sufficient fee income in the future. Immediate redeemability might open the door for the IRS to ‘look through’ xTokens and tax the streamed fees currently, so it might be prudent to restrict redeemability for at least a year and a day to support long-term capital gain treatment. Tax StructuringMy proposal’s allure depends on taxing developers at ordinary rates only on the value of their xTokens when they receive them (which should be minimal), deferring additional taxes during their holding period, and taxing them at long-term capital gains rates on disposition. Is that tax treatment supportable? With appropriate structuring, I believe so. Recall, a joint venture for profit is treated as an entity for U.S. tax purposes, even in the absence of a juridical entity. Holders of xTokens are in a joint venture for profit because their tokens represent shares in protocol fees, denominated in the protocol’s native token. Entities that are not organized in the United States are treated as foreign. A smart contract, like one that issues xTokens, is not organized in the United States, so the smart contract likely would be treated as a foreign entity. U.S. tax law prescribes different classifications for foreign entities, and an entity’s classification affects how its equity holders are taxed. Partnership treatment would be problematic in this context, because it would tax U.S. xToken holders on their share of undistributed protocol fees. But foreign entities are treated as corporations instead of partnerships if less than 90% of their income is ‘passive’ and their equity interests are readily tradable. Tokenized fee income doesn’t meet the statutory definition of passive, and developers can make xTokens readily tradable by setting up a Uniswap pool. Foreign corporations are subject to U.S. corporate tax if they are ‘engaged in a U.S. trade or business’. Developers can mitigate the risk of the IRS asserting that a smart contract is engaged in a U.S. trade or business by ensuring that the ultimate decision to deploy the contract is made and executed outside of the United States. U.S. taxpayers can be subject to onerous consequences for investing in foreign corporations that are ‘passive foreign investment companies’, or PFICs. But protocol fee income doesn’t seem like the type of income that would cause an xToken smart contract issuer to be a PFIC. Thus, xTokens likely can be structured to be treated as stock in a foreign corporation that is not engaged in a U.S. trade or business and is not a PFIC. If so, U.S. developers should be taxed on the value of the xTokens on receipt, but should not have income inclusions during their holding period, even as protocol fees are streamed into the xToken treasury in the form of the protocol’s native tokens. Jason is a tax partner and co-head of the Digital Assets and Blockchain Practice at Fried, Frank, Harris, Shriver & Jacobson LLP. 🌐 News and Selected Articles

Five Guidelines for Maintaining Attorney-Client Privilege in the MetaverseAuthors: Elizabeth Shubov and Scott Stevenson J.D. 🔑 Insights:

Tether Withdrawals Top $10 Billion as Regulators Raise Alarm About StablecoinsAuthor: Ryan Browne 🔑 Insights:

Panama Passes Bill to Permit Use of CryptoassetsAuthors: Valentine Hilaire and Elida Moreno 🔑 Insights:

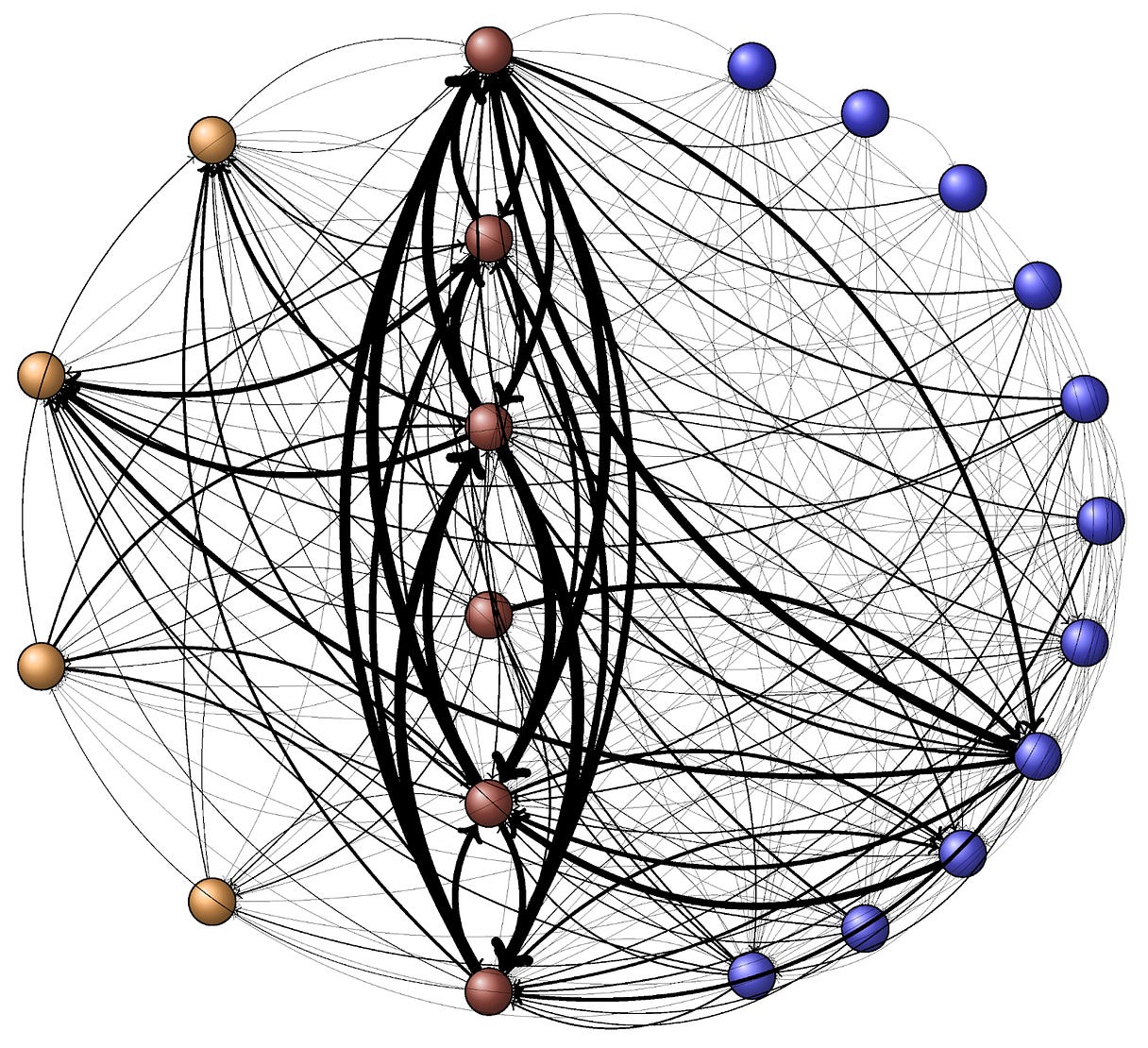

How the Cryptocurrency Market Is Connected to the Financial MarketAuthor: Sang Rae Kim 🔑 Insights:

Portugal Considering Capital Gains Tax for CryptocurrencyAuthor: Callan Quinn 🔑 Insights:

Enforcement and Adoption: What Do UK’s Recent Regulatory Aims for Crypto Mean?Author: David Attlee 🔑 Insights:

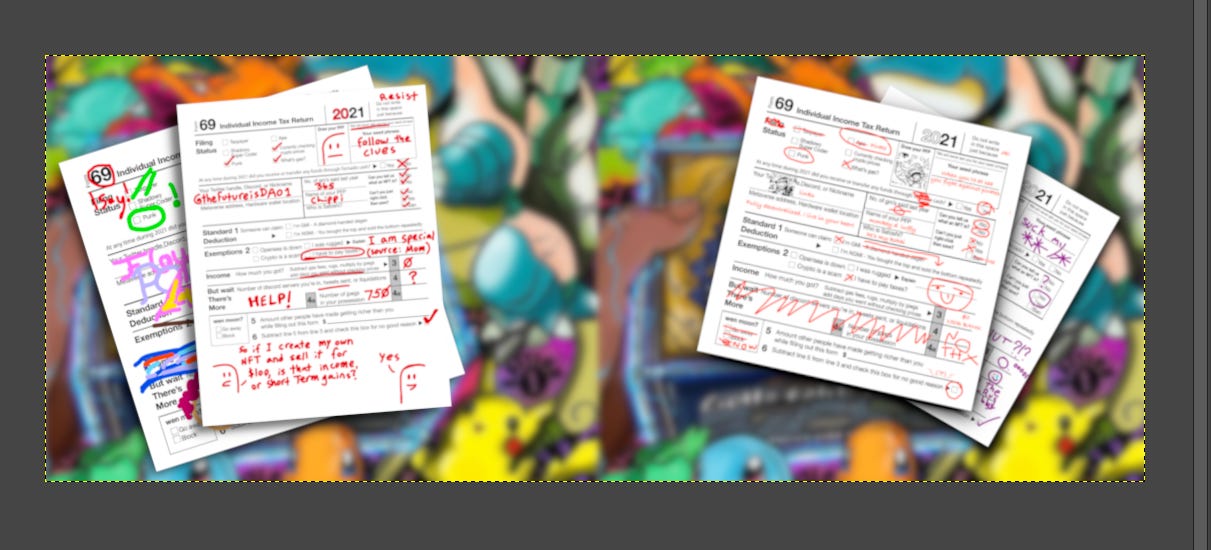

🧰 Legal ToolsThe Global Tax GuideAuthor: Metaversal Revenue Service

BanklessDAO’s Legal Guild has been hard at work building the future of crypto-tax information, and the Global Tax Guide produced by the Metaversal Revenue Service is the result of these efforts. The Global Tax Guide will provide general introductory information regarding virtual currency-related income tax laws from major jurisdictions throughout the world. Access to the Global Tax Guide will be granted by minting Form 69. Anybody will be able to mint the NFT and access the Tax Guide for the mint fee. Access has no expiration date, and the Tax Guide will be updated as laws change and jurisdictions are added. Please follow the Metaversal Revenue Service on Twitter to get up-to-the-date information on the mint, which is scheduled for June 1, 2022 at 2pm EDT/1800 UTC. Minting will occur at www.globaltaxguide.xyz. The Global Tax Guide will initially cover nine jurisdictions, with new jurisdictions regularly added. The initial jurisdictions include:

The Global Tax Guide plans to add Italy, India, UAE, Canada, Singapore, and Nigeria in its next update. One last reminder to follow Metaversal Revenue Service on Twitter — and see you on June 1! ✅ Action Items📚 Read The BANK Token - A Legal Assessment👩⚖️ Join the BanklessDAO Legal Guild 🏴⚔ Join LexDAO🐵 Join the LeXpunK Army🚨 Contact your Representatives or Senators🙏 Thanks to Our SponsorGro ProtocolGro Protocol unlocks stablecoin yield farming for users across different risk appetites. Gro is a stablecoin protocol that empowers everyone to easily create and share wealth. It brings together the best of DeFi and traditional finance to offer easy-to-use stablecoin products: PWRD stablecoin with protection, Vault with super-charged yields, and Labs with automation. It is now available on its dApp and Argent wallet. Gro has completed three audits and code reviews with Trail of Bits, Peckshield, and Kurt Barry and currently hosts a $1,000,000 Bug Bounty program on Immunefi. Check out BanklessDAO's introduction on Gro 👉 ‘Miracle’ GRO, A Protocol Overview See what we offer 👉 Gro dApp Learn more about Gro 👉 Directory of Gro universe If you liked this post from BanklessDAO, why not share it? |

Older messages

The Brave Pixel Artist Who Could | Decentralized Arts

Tuesday, May 24, 2022

BanklessDAO Weekly NFT and Cryptoart Newsletter

BanklessAfrica Seizes the Day | BanklessDAO Weekly Rollup

Saturday, May 21, 2022

Catch Up With What Happened This Week in BanklessDAO

DAOs Give Fans a Sporting Chance | State of the DAOs

Wednesday, May 18, 2022

You're reading State of the DAOs, the high-signal low-noise newsletter for understanding DAOs.

Murat Pak is the Perfect Amount of Nothing | Madonna X BEEPLE | Decentralized Arts

Monday, May 16, 2022

BanklessDAO Weekly NFT and Cryptoart Newsletter

Bankless to Banned: A Rallying Point for Permissionless Education | BanklessDAO Weekly Rollup

Saturday, May 14, 2022

Catch Up With What Happened This Week in BanklessDAO

You Might Also Like

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask