The Pomp Letter - VIX Creator Wants GBTC Converted To ETF

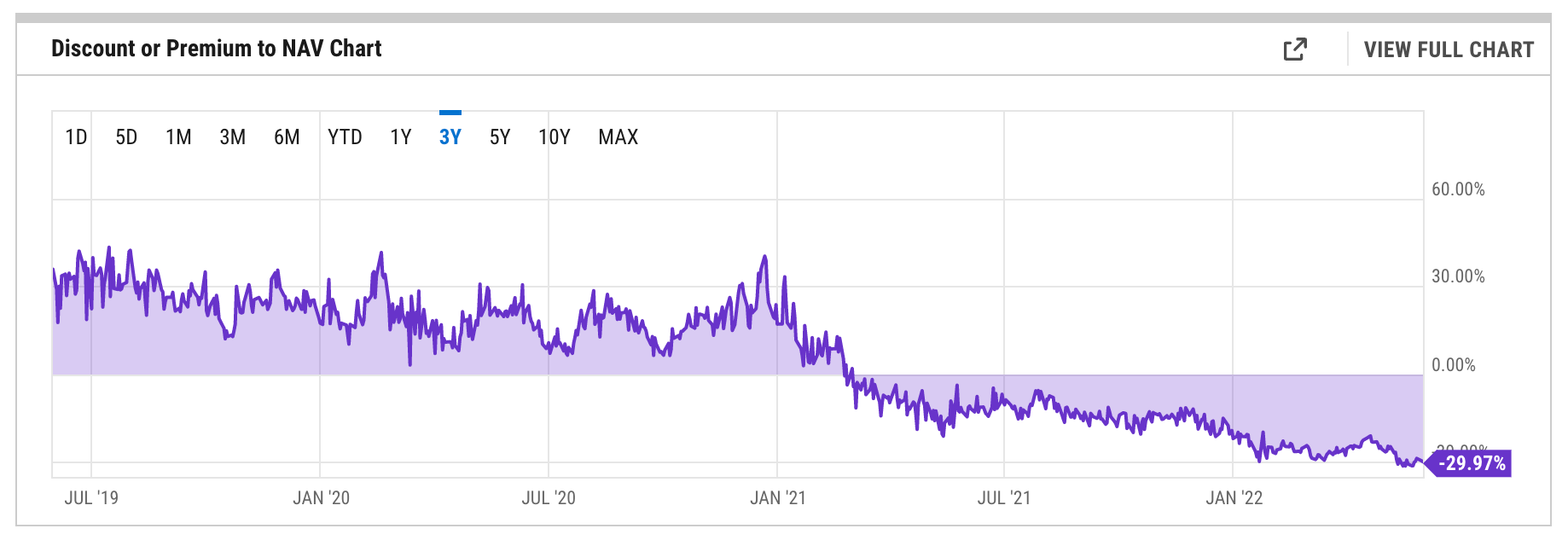

To investors, Many people may not realize though — GBTC was a major driver in bitcoin’s increase in price from ~ $10,000 in October 2020 to $64,000 in March 2021. Without getting too deep into the details, GBTC does not have a redemption functionality. This means that you could go to Grayscale and give them money in the private market. They would take your money to go purchase bitcoin for the fund. In return for your money, Grayscale would give you shares in GBTC under one condition — you were not allowed to trade those shares for 6 months. So a bunch of very smart investors started giving Grayscale millions of dollars in the private market. But why would they do that? Well, at the time, if you gave Grayscale $1 in the private market, then waited for 6 months and 1 day, you would be able to sell that sale at a premium in the stock market for approximately $1.20. This means that the GBTC shares were trading at ~ 20% premium to the value of bitcoin in the fund (NAV). You can easily understand why so many people were giving them money to exploit this detail. Here is Grayscale’s bitcoin holdings over the years and the ramp up in 2020-2021 is very obvious. The premium percentage went up and down, including reaching as high as 40% at one point, but it was always positive. It doesn’t take a genius to understand that giving someone $1 and being able to sell it for $1.20 about 6 months later is a good investment. This wasn’t risk-free though, so what was the risk? What happens if so many people realize that you could do this that the premium went away and eventually became a discount? That couldn’t happen, right? You guessed it — it happened. Grayscale’s Bitcoin Trust now trades at a 30% discount to the value of the fund. No one wants to give Grayscale $1 and get $0.70 for it 6 months later, so the fund has stopped taking inflows at the moment. Now here is where things get a little weird. Grayscale has about $20 billion of assets (at current BTC price) sitting in a fund, but the shares are trading at 30% less than that value. So if you’re holding the shares, which have gone done significantly, you would just want to tell Grayscale “hey, I’ll give you my shares and you give me back the equivalent bitcoin.” That sounds like a good idea but Grayscale doesn’t have a redemption feature. This is one of the big reasons why the company has been spending so much time trying to get the SEC to approve a conversion from the trust structure to a bitcoin spot ETF structure. If they are successful, investors will rush to buy the shares at a discount so they can redeem the bitcoin, which is worth more, driving a profit. As more investors buy the shares, the price will go back up towards the value of the fund and everything in the world will be good again. The problem is that the SEC hasn’t been too interested in this idea. SEC Chairman Gary Gensler and his team have approved bitcoin futures ETFs in the United States, but there is no bitcoin spot ETF yet. Other countries have them. The United States does not though. So this brings me to a development yesterday that is very interesting. There is a man named Robert Whaley who wrote a letter to the SEC about the Grayscale ETF conversion issue. He isn’t just a random guy, but rather Whaley created the Cboe Volatility Index (VIX) in the early 1990’s. It would be an understatement to say that Robert Whaley understands financial markets, indexes, and trading products or structures.

Robert’s argument breaks down into three distinct categories:

Makes sense, right? Robert Whaley ends his letter with a synopsis of why Grayscale’s Bitcoin Trust should be approved in his opinion:

Hope each of you has a great day. I’ll talk to everyone tomorrow. -Pomp If you are not a subscriber of The Pomp Letter, join 220,000 other investors who read my personal opinion on finance, technology, and bitcoin each morning. SPONSORED Badges translate your wallet activity into web3 achievements. Before, these stories were buried in transaction logs, making them difficult to find, read, and understand. Now with Badges, it’s easier than ever to celebrate and share your crypto story. Since Badges are issued based on a wallet’s transactions, they’re a fun and easy way to build your portable, on-chain reputation just by supporting whatever projects interest you. In this conversation my brother, John Pompliano, breaks down the business of Walmart and their recent earnings report. Is Walmart in trouble with their sales? John explains Walmart's history, why the founders who aren't involved anymore so wealthy, and the future prospects for this behemoth retail business. How To Get A Job During A Recession Podcast SponsorsThese companies make the podcast possible, so go check them out and thank them for their support!

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re a free subscriber to The Pomp Letter. For the full experience, become a paid subscriber. |

Older messages

Jerome Powell Is Being Called To The Principal's Office

Tuesday, May 31, 2022

Listen now (6 min) | If you are not a subscriber of The Pomp Letter, join 220000 other investors who read my personal opinion on finance, technology, and bitcoin each morning. To investors, President

Ransomware Is A Growing Problem

Friday, May 27, 2022

To investors, There has been an increasing threat of cyber attacks on critical infrastructure in the United States. Remember the Colonial Pipeline attack or meat processor JBS Foods? This problem was

Special Message From Pomp 🙏🏼

Wednesday, May 18, 2022

Hey! What a wild ride the last two years have been. Thanks for being a free subscriber to The Pomp Letter. Hopefully this has helped you understand what is currently transpiring across assets and

Non-Dilutive Funding Becomes Incredibly Important During Market Downturns

Tuesday, May 17, 2022

Listen now (6 min) | To investors, Asset prices have been drawing down in every market over the last few months. You can see it in stocks, bonds, real estate, commodities, and crypto. There have been

Some Thoughts On LUNA / UST

Friday, May 13, 2022

If you are not a subscriber of The Pomp Letter, join 220000 other investors who read my personal opinion on finance, technology, and bitcoin each morning. To investors, I've been traveling today so

You Might Also Like

10x more leads (powerful)

Monday, March 10, 2025

Launching a product? I'm helping startups build better products and reach product-market fit. To do that, we've built ProductMix and you should use it: https://rockethub.com/deal/productmix

🥒 Now you’re in a pickle

Monday, March 10, 2025

This upstart grew sales by 29% YoY in a stalling industry View in browser mim-email-logo-2025-2 As liquor sales stagnated last year for nearly the first time in two decades, one segment of the market

I launched the ULTIMATE seo chrome extension (free)

Sunday, March 9, 2025

You are so very welcome ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s Bitcoin Reserve, Tokyo Beast’s $1M Championship & King of Destiny’s 2M $GOD Showdown – Your Ultimate Crypto & Gaming Update!

Sunday, March 9, 2025

PlayToEarn Newsletter #263 - Your weekly web3 gaming news

The Profile: The man who wants to know everything & the med spas offering balding treatments

Sunday, March 9, 2025

This edition of The Profile features Tyler Cowen, Lalisa Manobal, Zhang Shengwei, and others. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Marketing Weekly #222

Sunday, March 9, 2025

Why Faceless Social Media Accounts Don't Work — Lessons From Someone Who Tried • How We Cut Lead Costs by 75% with Facebook Ads (and How You Can Too) • The True Art of Being Customer-Centric • The

Why The Per-Seat Model Isn’t Dead (Yet)

Sunday, March 9, 2025

And the top SaaStr news of the week To view this email as a web page, click here The Per-Seat Model Isn't Dead. But Also, Surprisingly, It Was Never Dominant. The Per-Seat Model Isn't Dead. But

Startups gear up for EU defense surge

Sunday, March 9, 2025

Also: Female founder face anti-DEI wave, our Global Markets Snapshot wraps up February's action & more Read online | Don't want to receive these emails? Manage your subscription. Log in The

Sunday Thinking ― 3.9.25

Sunday, March 9, 2025

"Whenever honesty is missing, walls slowly start appearing."

🚨 Weekend Wrap-Up: Chatbots Are Stealing 96% Of Your Clicks

Sunday, March 9, 2025

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏