The Daily Gwei - Layer 2 Symbiosis - The Daily Gwei #494

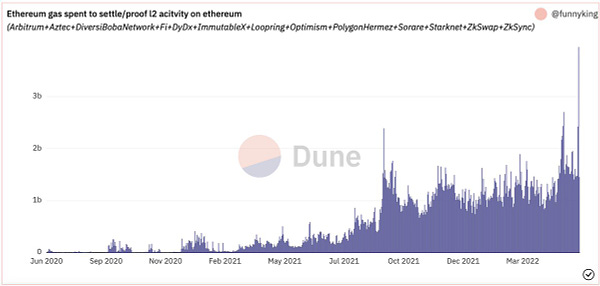

There’s been a weird narrative circling around lately that layer 2’s are somehow parasitic to Ethereum and don’t drive value back to ETH. This couldn’t be further from the truth as every layer 2 needs to pay fees to Ethereum in ETH for its security and then 70-80% of that is burned directly driving value back to ETH. This is all verifiable on-chain and you can see from the tweet below that 3.95% of Ethereum’s daily gas limit was used to settle layer 2 activity yesterday.   People will sometimes bring up the fact that in the long-term layer 2’s won’t pay Ethereum for security because they’ll just become their own sovereign blockchain. I think this idea is silly for a number of reasons. Firstly, what a layer 2 is actually paying for it the ability to not have to worry about bootstrapping security and consensus via a validator set and paying for it which would essentially make them a layer 1 chain. What do layer 1 chains have to do to secure themselves? Pay out new issuance as inflation which dilutes all non-validators share of the network. Secondly, this new soverign chain would likely never be even remotely close to as decentralized and secure as Ethereum due so it just makes sense to pay Ethereum. Of course, layer 2’s are going to have tokens but they won’t be used the same way layer 1 tokens are used. For example, I think that the recently launched OP token will be used to decentralize the sequencer (the software that processes transactions) and people will be able to stake OP to have a claim on fees paid (and possibly MEV too). But this form of “staking” is very different to something like Ethereum PoS as Optimism is not coming to consensus on anything - it is still outsourcing this job to Ethereum layer 1. Lastly, current layer 1 blockspace usage by layer 2’s is still quite low - I mean the record is just 3.5% of total daily blockspace after all - but this will change gradually over time as more layer 2’s come online and as more activity flows to them. Eventually, layer 2’s should become the majority user of layer 1 blockspace as they will crowd out everyone else though I don’t think this will happen for a long time. I’m also curious to see what MEV looks like at layer 1 in this world - in theory, MEV shouldn’t exist at all on layer 1 if all the blockspace is just used for layer 2 activity! All in all, the future is so bright for layer 2’s on Ethereum and I’m so excited to see how it all plays out over the next few years. I’m also very much looking forward to bad narratives around layer 2’s dissipating as they continue to prove themselves and users continue to get value out of them. Layer 2 summer is here; it’s just not evenly distributed yet!

Enjoyed today’s piece? I send out a fresh one every week day - be sure to subscribe to receive it in your inbox! Join the Daily Gwei EcosystemAll information presented above is for educational purposes only and should not be taken as investment advice. If you liked this post from The Daily Gwei, why not share it? |

Older messages

EVM Supremacy - The Daily Gwei #493

Thursday, June 2, 2022

It may be "old and clunky" but it sure is popular!

Excess Supply - The Daily Gwei #492

Wednesday, June 1, 2022

What happens when there's more available blockspace than demand?

The Merge is Coming - The Daily Gwei #491

Tuesday, May 31, 2022

Are you ready?

Shifting Thesis' - The Daily Gwei #490

Monday, May 30, 2022

A thesis may ebb and flow like the markets.

Choose Your Own Adventure - The Daily Gwei #489

Thursday, May 26, 2022

Giving users the benefits of decentralization without them even knowing it.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏