Who will survive when the 'everything bubble' pops?

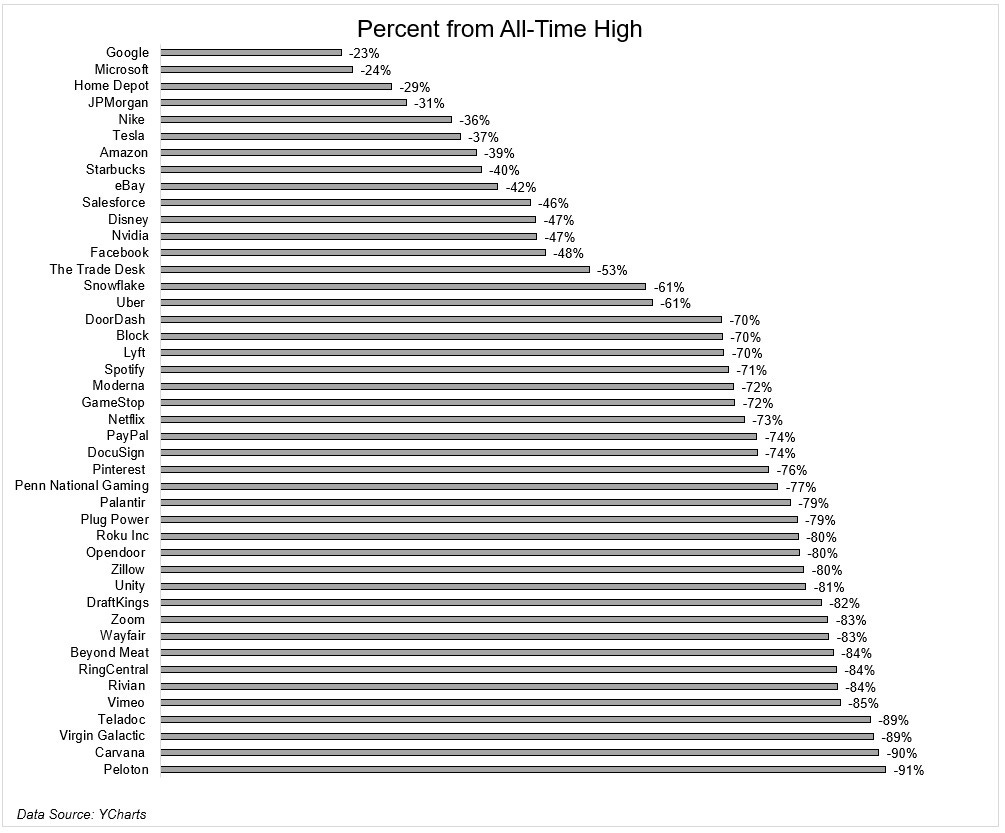

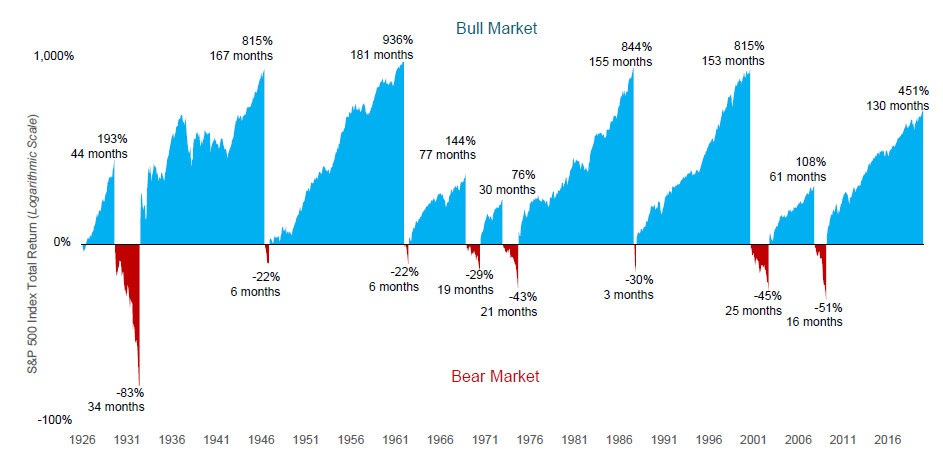

To investors, Below is a guest post from Raphael Schoen, Content Lead at the Bitcoin-only startup Relai and author of the Substack newsletter Future Money. Enjoy! We live in uncertain times, and the cheapest money in history is coming to an end. Let's look at what that means for the 'everything bubble.' When the first Covid lockdowns started in March 2020, the stock market and bitcoin tanked. No one knew how dangerous or harmless this virus would turn out to be and what the implications of shutting down a globalized economy would entail. What followed in the course of the next two years was unprecedented on many levels. Governments and central banks jumped in, fresh money became accessible to literally anyone who could to put a signature under a document, and what we got was the cheapest funding environment ever. This resulted in an ‘everything bubble,’ where anything from real estate, to meme stocks, index funds, bitcoin, and thousands of cryptocurrencies blew through their all-time highs and put people in euphoria. It didn’t matter what you invested in, just buy something and wait for the ‘number to go up.’ Everyone’s a genius. Happy times. Things got so crazy that every idiot who made some money with the above-mentioned investments started to look into investing in LEGO sets, buying a Rolex watch, spending ridiculous amounts of money on vintage Nintendo games, and hell, there are now even startups where you can buy fractions of Nike sneakers. And then we also have pictures of pixelated rocks or randomly generated monkeys. If you thought the ICO mania of 2017 was crazy, you weren’t ready for 2021 and beyond. This is definitely some stuff for the history books, even if things like vintage collectibles and NFTs are probably here to stay in a less mania-driven way. Cheap money is (probably) coming to an endWhat happens when endless cheap money stops pouring in and interest rates for dirty fiat goes up? Risky assets start to bleed. Coinbase, the most popular crypto broker in the world, already announced that it's laying off 18% of its workforce. But also tech and especially growth stocks are going down. As Izabella Kaminska wrote in her excellent analysis, things are quite similar to when the dotcom bubble started to pop: The Fed started to tighten in May 1999 and the dotcom bubble peaked in March 2000.

Now, the Fed announced the biggest hike in two decades, the ECB will raise interest rates for the first time in 11 years. Of course, there are a lot of uncertainties. Super loose monetary policy is definitely a factor (don’t forget that inflation was at 7.9% in the US before the war in Ukraine started and Biden’s team invented “Putinflation”), but there are supply chain and war-related factors as well. Sanctions against Russia; Russia weaponizing its energy; the possibility of the war escalating; China’s stupid Zero-Covid strategy (that could also be economic warfare, but who knows) … there is A LOT of uncertainty in the air right now. The Fed and the ECB are in a tricky position: Keep interest rates low, and inflation will run even hotter. Stagflation with high-interest rates and a shrinking economy is what follows. Meaning prices of stuff continue to rise while you have a lot of unemployed people. No one wants that, especially not short-term-gain politicians. As history has taught us, extreme political positions become more popular, which will end in suffering for all of us. We don’t want that. The alternative is to raise interest rates and risk a recession, which is also painful but probably needed in order to not finally fully blow up the financial system. The problem is that in a recession you’ll also have a lot of unemployed people, failing businesses, and a shrinking economy. The solution is usually to lower interest rates and follow good old Keynes’ fiscal and monetary counter-cyclical policies, aka spend more government money when the economy is shit and less when the economy is good. You see: It’s complicated and no one really knows, even though politicians and their favorite economists tell you so. This time it’s different … not reallyThis brings us back to Izabella Kaminska’s article: The wipeout in the crypto market could actually be good, similar to how the dot-com burst wasn’t the end of internet companies. To be clear: I’m very skeptical about nearly all the crypto assets out there (except bitcoin and the handful of things with an actual use-case, mainly exchange utility tokens). “The market must acknowledge some uncomfortable truths first. The key one is that some 95% of the market, or more, is probably worthless — largely the product of a ridiculously cheap funding environment driven by excessively loose central bank policy,” Kamiska writes. The chance of survival for this industry depends on whether it will be able to solve real-world problems. We’re seeing de-globalization and governments heading in a more authoritarian direction, with a bloody war raging in Europe. “Any crypto that can help build bridges with enemies, protect privacy, better allocate resources to those in need or generate energy savings will prove successful in the long run. But expect a very rough ride in the interim,” concludes Kaminska. A new monetary orderThe big picture is what excites me the most. Zoltan Pozsar’s Bretton Woods III thesis says that we’re entering a new monetary order. The seizing of Russia’s foreign exchange reserves marked a turning point in geopolitics. It showed everyone: Your dollars are only worth something as long as the G7 (and especially the US) say so. China, India, and others took notice. Pozsar writes: “We are witnessing the birth of Bretton Woods III – a new world (monetary) order centered around commodity-based currencies in the East that will likely weaken the Eurodollar system and also contribute to inflationary forces in the West. (...) After this war is over, ‘money’ will never be the same again…and Bitcoin (if it still exists then) will probably benefit from all this.” Sorry to disappoint, but I have no clue what’s next —which stock to buy or who’ll win this crypto race and who the next Amazon or Google will be. There are 20k cryptocurrencies out there, and countless NFT projects. Pick some, and you may be lucky. Just know that 99% of them will eventually go to zero, maybe more. Note that the remaining 1% out of 20k crypto assets are still 200, which is A LOT for my taste. Bitcoin is risky as well of course, but as Pozsar has pointed out there is a chance that it could come out as a winner out of all this uncertainty. By the way, Poszar thinks that the Fed will continue with Quantitative Easing in Summer 2023. So maybe our rock JPEGs will moon again by then. Hope you enjoyed this guest post from Raphael Schoen, Content Lead at the Bitcoin-only startup Relai and author of the Substack newsletter Future Money. Highly suggest signing up here. -Pomp If you are not a subscriber of The Pomp Letter, join 225,000 other investors who read my personal opinion on finance, technology, and bitcoin each morning. SPONSOR: Brave Wallet is the first secure wallet built natively in a web3 crypto browser. No extension required. With Brave Wallet, you can buy, store, send, and swap assets. Manage your portfolio & NFTs. View real-time market data with an integrated CoinGecko dashboard. Even connect other wallets and DApps. All from the security of the best privacy browser on the market. Protect your crypto. Whether you’re new to crypto, or a seasoned pro, it’s time to ditch those risky extensions. It’s time to switch to Brave Wallet. Download Brave at brave.com/Pomp, and click the wallet icon to get started. THE RUNDOWN:Fed Chair Powell Says Soft Landing Will Be 'Challenging,' Calls for Crypto Regulation: Federal Reserve Chair Jerome Powell told Congress that the U.S. central bank must "go ahead" and keep raising interest rates to get inflation down, even if that means that the economy faces higher unemployment and a potential recession. During a hearing before the Senate Banking Committee on Wednesday, Powell said that a soft landing “is going to be very challenging,” and that a recession is “certainly a possibility.” Sen. John Kennedy (R-La.) called Powell the “most powerful man” in the world right now. Read more. Coinbase Phasing Out ‘Pro’ Exchange for ‘Advanced’ Mode in Main App: Crypto exchange Coinbase said Wednesday it will phase out its trader-focused “Coinbase Pro” in favor of “Advanced Trade,” a similar exchange service that unlike Pro lives alongside Coinbase’s other crypto investment products. The “sunsetting” will happen later this year, a blog post said. Advanced Trade, which is now live on desktop but not on mobile, is already prompting users to migrate their funds over from Pro, a reporter found Wednesday. Read more. Nexo Hires Citigroup to Advise on Acquisitions: Nexo is working with banking giant Citigroup (C) as it pursues a consolidation of other crypto lenders hit by the recent market downturn, according to an announcement shared with CoinDesk. The company also later announced the information in a blog post. The news comes weeks after rival lending platform Celsius Network halted customer withdrawals, spurring speculation of insolvency. Read more. Digital Dollar Would Secure Greenback as Global Reserve Currency, Lawmaker Argues: A digital dollar would support the greenback's role as the global reserve currency, could support underbanked individuals and may be more trusted than another type of cryptocurrency, U.S. Rep. Jim Himes (D-Conn.) argued in a white paper published Wednesday. Read more. Max Keiser is a Bitcoin OG, popular podcast host, and has a new book "The Book Of Max". In this conversation we discuss Max moving to El Salvador, helping El Salvador build on the Bitcoin standard, and the progress that has been made in the country. We also go over Michael Saylor's 10 points on how Bitcoin can be strengthened over time. Listen on iTunes: Click here Listen on Spotify: Click here Hedge Fund Manager Is Worries About Further Price Drawdown Podcast SponsorsThese companies make the podcast possible, so go check them out and thank them for their support!

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re a free subscriber to The Pomp Letter. For the full experience, become a paid subscriber. |

Older messages

Podcast app setup

Thursday, June 23, 2022

Open this on your phone and click the button below: Add to podcast app

Podcast app setup

Thursday, June 23, 2022

Open this on your phone and click the button below: Add to podcast app

Listen To Earn & Bitcoin

Wednesday, June 22, 2022

Listen now (4 min) | To investors, The best companies create categories. They are able to identify new technology and apply it to solve large problems globally. These category creators are able to

Podcast app setup

Saturday, June 18, 2022

Open this on your phone and click the button below: Add to podcast app

Markets Take The Stairs Up And The Elevator Down

Friday, June 17, 2022

Listen now (5 min) | To investors, Below is a guest post from Nik Bhatia, financial researcher and Adjunct Professor at the University of Southern California Marshall School of Business and author of

You Might Also Like

🦸🏻#13: Action! How AI Agents Execute Tasks with UI and API Tools

Saturday, March 8, 2025

we explore UI-driven versus API-driven interactions, demystify function calling in LLMs, and compare leading open-source frameworks powering autonomous AI actions

Saturday Stuff (March 8th)

Saturday, March 8, 2025

March 08, 2025 | Read Online Saturday Stuff (March 8th) What's up - happy Saturday. We made it! Here's some stuff for you to check out during your morning coffee ☕ #1 Claude Code was released

LUC #76: A Guide to Cloud Resource Optimization and Cost Management

Saturday, March 8, 2025

Plus, how do LLMs actually work, ACID clearly explained, and how SQL injections work and how to protect your system from them

Salesforce is Growing The Sales Team +20% For AI

Saturday, March 8, 2025

But they're not hiring any engineers To view this email as a web page, click here saastr daily newsletter Salesforce: We Are Hiring 0 Engineers This Year. But We're Growing The Sales Team +20%.

More Than a Coach: George Raveling’s Lasting Influence on Ryan Holiday

Saturday, March 8, 2025

"Go to bed each night saying, I have lived. If you wake up, treat it as a gift.'

Secondaries: $100B+ in 2024 and rising

Saturday, March 8, 2025

Also: Ranking the top investors of 2024; Recapping February's performance; Don't miss our webinars on private credit and the counter-drone industry... Read online | Don't want to receive

+20 customers a year for free per employee

Saturday, March 8, 2025

Launching a product? I'm helping startups build better products and reach product-market fit. To do that, we've built ProductMix and you should use it: https://rockethub.com/deal/productmix

Issue #55: AI's Pleasant Surprise: Sesame Unveiled

Friday, March 7, 2025

Issue #55: AI's Pleasant Surprise

🦅 Skyrocket your audience growth

Friday, March 7, 2025

One Time Promo ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Year of The Egg 🥚

Friday, March 7, 2025

RIP Skype, boutique eggs, and Happy Hour.