Earnings+More - Jun 27: Gaming stocks stage a rally

Jun 27: Gaming stocks stage a rallyThe shares week, New York weekly data, Las Vegas analyst update, startup focus - ParlayBay +MoreGood morning. To start your week:

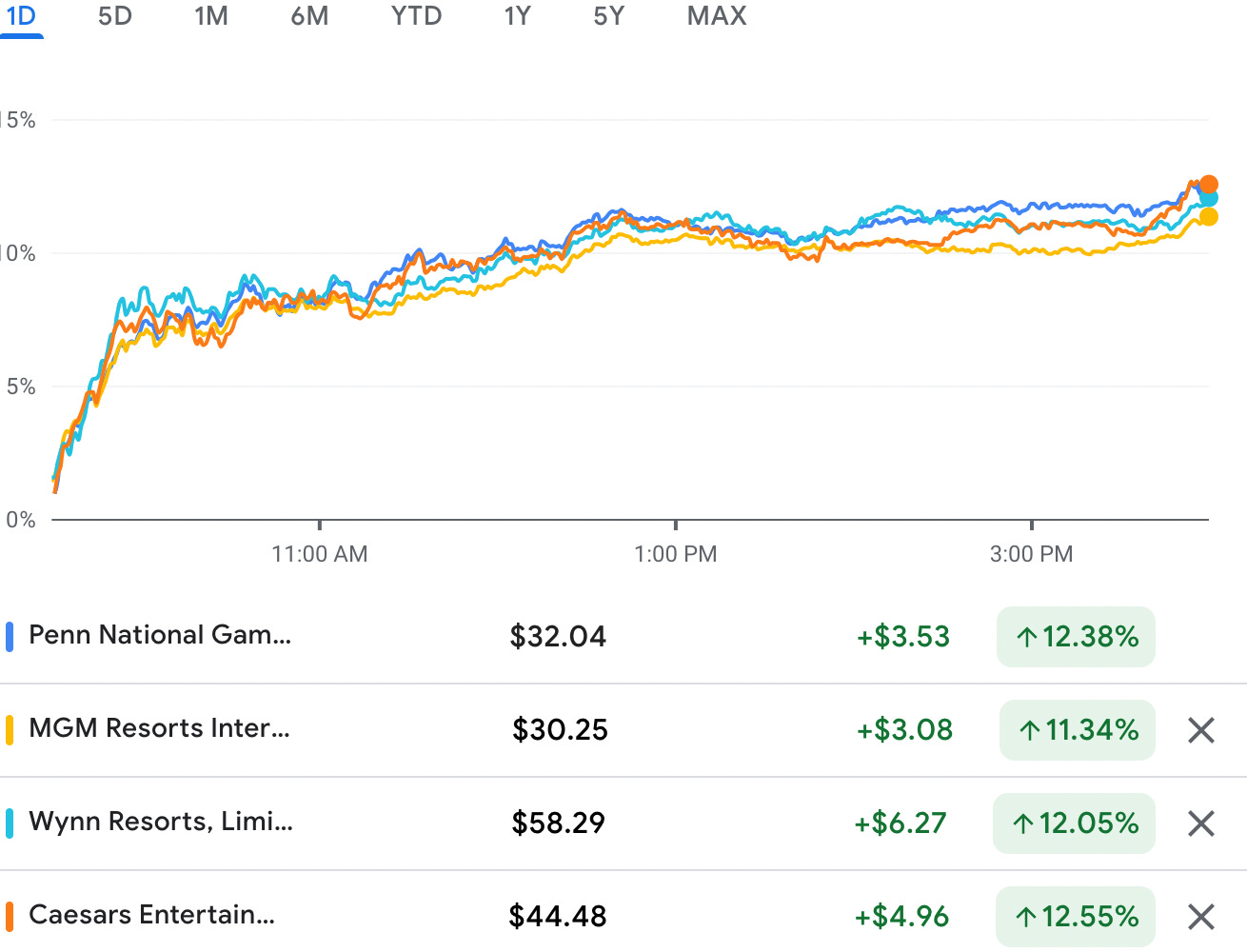

Money trees. Sign up now: The shares weekRelief rally: Friday was a good day for the gaming sector on the major indices as all the leading names enjoyed the benefits of the general optimism over equities and posted double-digit gains. Renaissance: The leading US OSB and igaming operators also enjoyed something of a rebound led by DraftKings, which rose over 8% on Friday and was up nearly 28% for the week and Rush Street Interactive, which enjoyed a 9%+ gain on Friday and was up nearly 21% for the week.

**Sponsor's message: Spotlight Sports Group (owned by Exponent Private Equity) is a leading technology, content and media business specialising in sports betting. The business recently released a new white paper detailing the opportunity for operators in the UK and Irish markets to grow their horse racing revenue on a global scale. Click here to download the full white paper. For more information visit: spotlightsportsgroup.com New York wk to Jun 19

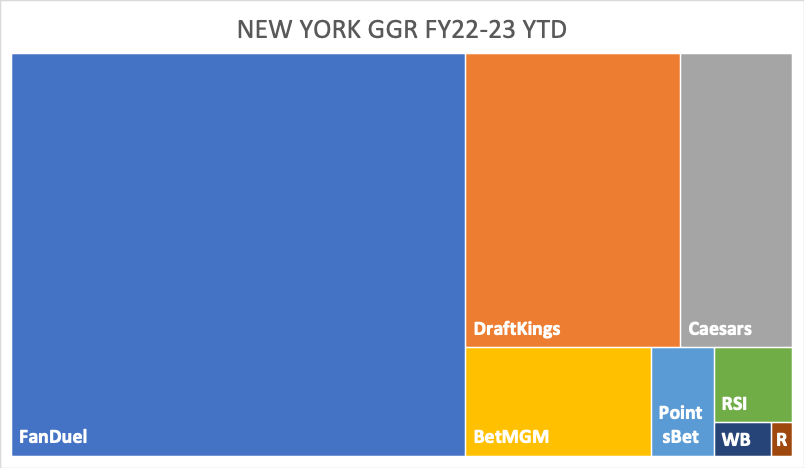

Leaders: FanDuel all but generated the entire handle for the week at $12.4m or a whopping 89%. DraftKings trailed in with $1.08m followed by PointsBet with $773k, BetMGM ($352k) and BetRivers with $329k.

ESPN and sports-bettingAcross the great divide: Speaking on a podcast from the Athletic last week, ESPN chairman Jimmy Pitaro suggested that the answer to the question of what's next for ESPN and betting was that the sports broadcaster thinks it could “potentially be doing more” and said, “is there a next frontier?” A big help: For Disney, he said a move into sports-betting would be neutral for the brand but for ESPN in particular, it was (something we need to be doing).

He added that ESPN had opportunities to “be a bit more aggressive in the space”. “But we’re just not there yet. We are being very thoughtful here. We have to get this right.” Bally share repurchaseMoving parts: Bally announced on Friday a $190m tender shares offer, lower than the previously suggested range of between $300m-$500m.

Low Fidelity: Wells Fargo’s decision follows the news last week that Bally’s lead investor Fidelity Investment had hired a law firm to investigate the group’s financial strategy in relation to the financing of its $1.7bn River West project in downtown Chicago. Las Vegas analyst updateDependencies: In Las Vegas, MGM’s, Caesars’ and Wynn’s 2023 figures will depend on the revenue mix from three segments: group/convention business, casino and US/international leisure, added the Wells Fargo team.

High-end: Wynn will fare best because relative to peers, the Wells Fargo team believes “it skews higher-end and more international,” even if Macau remains Wynn’s primary stock driver.

Macau updateHarsh: The DICJ said on Sunday that gaming companies must “strictly implement” all Covid prevention measures including reducing the number of casino personnel. This was in response to the news on Sunday that the number of cases in Macau has risen to 299 from 170 on Friday.

Further reading: The South China Morning Post ponders whether Macau’s gambling days are numbered. IGT investor worriesWake-up call: Investors are “exploring” the pending transition of the UK lottery from incumbent Camelot and its partner IGT to the Allwyn, the soon-to-list provider which is set to merge with the Cohn Robbins Holdings Corp SPAC.

Startup focus - ParlayBayWho, what, where and when: The ParlayBay idea was conceived in 2018 as a provider of sports-betting games which hopes to be commercializing its product suite as of this summer. The company has its hubs in Poland, Sweden, Malta and the UK. Funding backgrounder: ParlayBay has a list of private investors from the igaming sector. A capital raise is planned for Aug22. So what's new? In early June, ParlayBay formed an alliance with GRID Esports which will see the sports-betting games deployed in the esports vertical with data supplied by GRID. Under the arrangement, esports will be made available in the Fall across ParlayBay’s gaming catalog which includes Streak, Boss and Gekko. The longer pitch: Patrick Nordwall, CEO, who joined ParlayBay in February this year, says the company is “on a mission” to design real-month sports-betting games, all with an eye on the micro-betting area. “At the core”, he says, sit odds engines enabling the creation of betting games across single matches, single-player and cross-matches betting markets, as linear parlays, or “Tinder-like swipe left/right-to-engage experience”.

Keep it sweet: Nordwall says operators may “sweeten the deal” for the players even more by promoting this experience using free bets to “try new games and betting markets”, and use in-game promotional tools. NewslinesSpotlight Sports Group will supply its Superfeed content engine to Catena Media’s horseracing-focused sites GG.co.uk and racingtips.com as part of a new multi-year deal between the two groups. NeoGames has completed its $480m acquisition of Aspire Global whose shares will cease trading in Stockholm on July 4. Knockback: The Star Sydney’s bid for a further 1,000 gaming tables has been rejected by the New South Wales regulator which ruled that an expansion was not appropriate right now due to the pending report into its suitability as a licensee. Outta here: Ulrik Bengtsson is set to leave his position as CEO of William Hill as the group prepares to be integrated into 888’s corporate structure. Bengtsson joined William Hill in 2018 as chief digital officer and created the William Hill International division later that year and drove the acquisition of Swedish online casino MrGreen in 2019. What we’re readingLobby like you mean it: The Hard Rock is a big contributor to New York Gov. Kathy Hochul’s election fund. ‘We’re not a crypto conference’: NFT.NYC organizer is in denial. Easy tiger: Fintechs face a reckoning. On social  Calendar

Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

Jun 24: Weekend Edition #52

Friday, June 24, 2022

Fanatics/Tipico rumors, Bally legal threat, Jackpot.com funding news, sector watch - streaming, US gaming update +More

Jun 23: Earnings+More pod #13

Thursday, June 23, 2022

Watch now (25 min) | Here comes summer...

Jun 23: 888 raises debt to fund WHI deal

Thursday, June 23, 2022

888 trading update, Jefferies conference day 2, Fanatics owner sell NBA and NHL stakes to focus on OSB

Jun 27: Evolution to swallow Nolimit

Wednesday, June 22, 2022

Evolution acquires No Limit City, Jefferies conference takeaways, Macau's woes +More

Jun 20: Rank's UK storm warning

Monday, June 20, 2022

Rank profit warning, PointsBet's new investor, BetMGM signs on with Carnival, Kindred exits Germany, startup focus - Parlay Bay +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏