Bankless DAO - The Lending Edition | DeFi Download

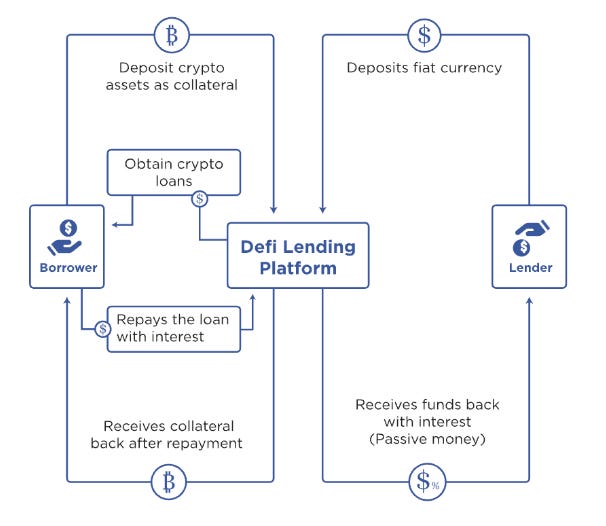

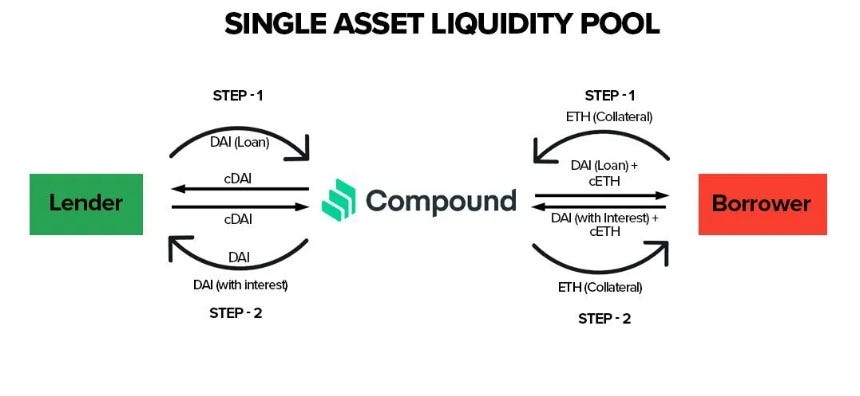

The Lending Edition | DeFi DownloadYour Trusted Source for 101s, Project Announcements, and Tokenomics Tutorials.Dear Bankless Nation 🏴, Welcome to the second edition of the DeFi Download! For our first issue, we focused on stablecoins, the foundational money lego. For this issue, we’re still sticking to the basics but we begin to explore a bit of what makes DeFi so revolutionary — in this case, lending markets. In traditional finance, lending markets are largely controlled by banks and other legacy financial players. These institutions determine who is eligible to borrow money (and in many cases who can lend money)— it’s a gated, permissioned system. As with all things DeFi, blockchain-based lending markets are not gated, allowing anyone to borrow assets against their deposited collateral. There is no loan officer determining your financial worth, your ability to get a loan. In DeFi, if you have the collateral, you have the ability to get a loan. And if you have assets to lend but aren’t interested in the sub 1% interest rates paid at your local credit union, DeFi also has a place for you too. This is the democratization of finance. Lending protocols vary widely in their operation. OG lending protocols like Aave and Compound essentially allow users to provide liquidity to earn yield (interest) or borrow against collateral they deposit, paying a stability fee (again, interest) for the pleasure of borrowing digital assets, most often stablecoins. While these legacy lending protocols tend to be more conservative in the assets that can be used as collateral, other lending protocols allow users to essentially use any digital asset as collateral for a loan. We’ll explore the benefits and risks of both types of protocols as well as some more advanced concepts like fixed interest rates and isolated pools. Also in this issue, you’ll get a great basic overview of the how, what, and why of lending protocols, but you’ll also learn about liquidity pools and automated loan coverage, the difference between APR and APY, and advanced tactics to leverage lending protocols to go short or long on assets. As you’ll understand after reading this issue, DeFi lending is about more than just earning a bit of yield on a deposit, it’s about becoming more self-sovereign. Money can’t buy you freedom, but the freedom of DeFi allows you to do more with your money. Contributors: BanklessDAO Writers Guild (Bl0ckb0y.eth, d0wnlore, Elemental, EthHunter, teeLEROO, siddhearta, hirokennelly.eth, Zero Mass, Jake and Stake)

This is the official newsletter of BanklessDAO. To unsubscribe, edit your settings. 🙏 Thanks to our Sponsor

The DeFi Download Guide to Decentralized Lending

Beginning with the case for DeFi lending, the role of stablecoins, moving to the basics, breaking down the various projects and risks, and then looking to the future and other advanced concepts, the DeFi Download Guide to Decentralized Lending will catch you up to speed on this fundamental DeFi money lego. The Case for Decentralized Lendingby Jake and Stake and teeLEROO You don’t pay attention to decentralized lending, until centralized lending leaves you feeling ripped off. It’s like censorship by media corporations: it doesn’t bother you until voices you care about disappear. Or eavesdropping by service providers. It’s fine until it is harmful. We believe there’s a better way to do things – using a trustless, permissionless, and transparent medium. It doesn’t mean we are immune to getting ripped off, muted, or otherwise harmed. These risks are the consequence of self-sovereignty; escaping the central authority is just the beginning. This issue of the DeFi Download takes on decentralized lending. Suppose you’re starting your own enterprise. It’s risky, but it’s the best way for you to provide for yourself, your family, and your community. You can’t rely on a payment stream from a third party employer. You have to create it yourself. However, there are some resources you can obtain through the traditional system:

But what happens when the resources required to execute your vision are beyond what’s available in your immediate circle? When the average business needs money, they’re not in a position to give up ownership by bringing on venture capital investors. No. If you need money, you have to stand in front of the centralized lender and plead your case. They ask if you have any assets, so you show proof of that you have, gathering statements proving your profitability. All to show them your polished business plan to let the lender know you’ve done the background work in your realm. It’s time consuming to gather, format, and submit your information; sometimes even re-submitting information because the bureaucracy of legacy systems is so overwhelming. Often, you’ll feel that your privacy is being breached when personal information is demanded and ultimately, the process feels like a fiction. A scrap of paper verifying employment, even if it terminates the day after the loan is signed, can put you over the top. Looking across the table, you know that the loan officer, the adjudicator, the bank, and the other suits do not share your incentives. If the loan is approved, you are locked into the fine print of the agreement, including the front loading of interest and other conditions benefitting the lender. The final step is to release the payments, but if you’re denied you have to move onto the next lender to repeat the song and dance. Decentralized lending can fix this. It allows anyone access to a loan, based solely on the assets in their wallet. It’s available 24/7/365 and doesn’t discriminate based on your looks. Everyone is assessed using the same parameters and it takes minutes to complete. The beauty of DeFi is that it makes access to sophisticated financial services as simple as accessing the internet, and DeFi lending outperforms TradFi lending in several ways:

Decentralized lending is in an early phase. It doesn’t offer everything centralized lending does, but it can outperform traditional finance’s inefficiencies and tap into the creative minds drawn to Web3. We think it’s inevitable. Read on to learn about the decentralized lending environment. Stablecoins’ Role in DeFi LendingIn our previous issue, we touched on one of the foundational building blocks of DeFi: the stablecoin. Stablecoins enable users to enter and exit positions on chain, allowing users to make directional, fiat-denominated bets on the market. This ability has been the primary use case for DeFi lending products like Maker, Compound, and Aave. These lending protocols + stablecoins allow users to make leveraged, directional, fiat-denominated bets on crypto assets. Stablecoins are the most popular assets in lending protocols. They’re particularly useful because they allow users to make directional bets on their collateral. They can increase positive or negative exposure to assets. Here are some strategies that you can use: Positive exposure

Negative Exposure

In the first case, you’re making a bet that the price of ETH will rise to be greater than the loan you’ve taken (plus interest). In the second case, you’re betting that the price of ETH will fall. This is equivalent to being long and short a stock respectively. Lending markets also offer an attractive yield for crypto investments because of the protocol’s need for liquidity. The demand for stablecoins on DeFi protocols is huge, so lending platforms incentivize users to add stablecoin liquidity (among other kinds) to their protocols through the use of yield farming incentives. Compound pioneered this approach through the use of its COMP token when the protocol used it to supercharge liquidity. Compound is largely credited with kicking off DeFi summer because the additional rewards led to a flood of new, active users. Other protocols soon followed suit, making yield farming incentives a standard growth strategy in the DeFi playbook. Users can deposit their stablecoins into lending protocols and earn a yield on their assets from corresponding borrowers. This allows users to hedge against market downturns by keeping their assets in cash-equivalents and to continue earning greater yields than that which can be found in the traditional financial system, like savings accounts. Put simply, without stablecoins, lending markets wouldn’t exist. DeFi Lending BasicsBy EthHunter, Elemental, and Jake and Stake with edits by hirokennelly.eth APR vs APYBy EthHunter APR is an abbreviation for Annual Percentage Rate and it represents the amount of yield (interest) a depositor earns in a calendar year on a given investment. For example, if you were to deposit 1,000 USD worth of DAI into Aave, which is offering a 5% APR on DAI deposits, the amount of yield earned on that deposit in one year would be $50, or 5% of the deposit. Often the best strategy is to redeposit the yield that is generated back into the principal to “compound” the yield to earn a bigger return, the “let it ride” scenario from blackjack. However, each protocol is different, and the protocol you deposited the principal into dictates your ability to withdraw your yield, and how often the yield is available to claim. It’s also important to note the transactions needed to claim yield rewards incur gas fees for both the redemption and staking or depositing back into the protocol. For small investors, the transaction fees often eliminate the yield generated from the deposit, thus making this form of return better suited for bigger investments. This brings the need for a new form of yield. Enter APY APY is an abbreviation for Annual Percentage Yield, which is just the product to solve that scenario, as it deposits the yield generated automatically to increase the principal amount of your investment. APY is the yield “auto compounded” into your original deposit for you at a predetermined interval. This creates a scenario in which more yield from your deposit is added to the base principal every cycle, stacking your bags and making the deposit amount increase over time. Understanding the difference between APR and APY will make a difference in your investment strategies and make you a more complete investor. Liquidity PoolsBy EthHunter Liquidity pools are an integral part of decentralized finance, as they allow the trading of assets on decentralized exchanges. Liquidity pools are a collection of token pairs or groups locked into smart contracts. Think USDC/ETH or DAI/USDC/USDT/FEI. These pools provide liquidity for trades that happen on the protocol and enable users to swap in and out of specific tokens that are within the pool. The deeper the pool liquidity, that is, the more of each token in the pool, the less a trade will affect the relative number of tokens in the pool and the price movement of the token when traded. In other words, more tokens in a pool means less slippage with each trade. Slippage is the amount of value lost in the trade from one token to another. The reason liquidity pools exist is to replace the old model of buying and selling assets known as “The Order Book”. This model has been used by traditional stock exchanges since inception. Buyers try to buy a particular asset for the lowest possible price while sellers try to maximize the amount they receive for the specific asset. This model has an open and close time where trading is possible, and it is necessary for a buyer and seller to find the price they are willing to work with before a deal can be made. Enter AMMs or Automated Market Makers. AMMs allow tokens to be traded by using liquidity pools instead of a market of buyers and sellers, and they are the key technology underpinning decentralized exchanges. AMMs enable users to trade automatically and permissionlessly without the need for an intermediary. That’s the true power of AMMs: crypto users are not beholden to centralized traders and order books. There are three general types of AMMs: those found on Uniswap, Curve, and Balancer. Uniswap’s model is the most common, and it allows users to create liquidity pools with any pair of tokens with a 50/50 ratio. Curve creates liquidity pools of similar assets, while Balancer allows for asset pools of up to eight different tokens. While the models are different, the effect is the same: systems that enable users to swap tokens with all the convenience of an Order Book model but with the 24/7 nature of the decentralized and permissionless blockchain. Stability Feeby Elemental The stability fee is the variable-rate annual fee charged on the balance of borrowed funds. It’s similar in concept to a credit card’s variable annual percentage rate, although in the case of borrowing DAI with a Maker Vault, for example, the stability fee continuously compounds every second. Credit cards typically compound (add the accrued interest amount to the outstanding principal balance) monthly. For example, if you borrow 1,000 DAI with a stability fee of 2.5%, after one year, you will owe Maker 1,025 DAI. If you pay off the loan in less than one year, your accrued interest owed will be proportionally less and calculated up to the second the payoff transaction is initiated. Collateralization Ratioby Elemental The collateralization ratio represents the value of the collateral committed to the loan divided by the value of the outstanding debt defined as a percentage. Lending protocols typically set minimum collateralization ratios that overcollateralize the debt. That is, they require significantly more collateral than they will lend. Most minimum collateralization ratios for borrowing Dai with a Maker Vault are between 150-185%.

For example, if you deposited $1,000 worth of ETH into a Maker Vault with a 150% minimum collateralization ratio, and you borrowed $500 in DAI:

You’re properly overcollateralized with a 200% collateralization ratio. If the collateralization ratio falls below the protocol’s required minimum for that loan (AKA the liquidation ratio), the loan will be considered undercollateralized and may be automatically liquidated. Borrowers can find themselves approaching the minimum ratio when the value of their deposited collateral falls. In the example loan above, if the price of ETH declines to where the deposited ETH collateral is now worth $750 while the $500 in DAI stablecoin debt remains constant:

Danger! This loan is at the minimum collateralization ratio and at risk of liquidation. Variable Interest Rate ModelInterest rate models are used to determine how much asset suppliers are paid for their contributions and how much borrowers must pay for the assets that are lent to them. The model has three variables it’s trying to balance:

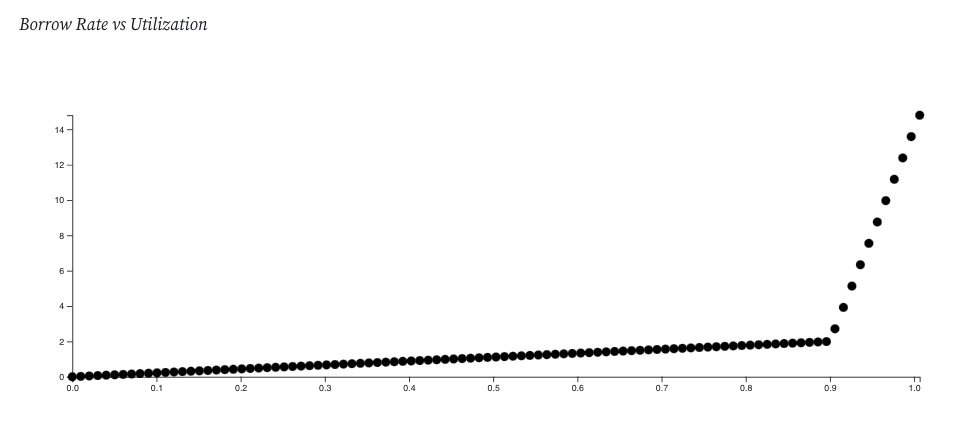

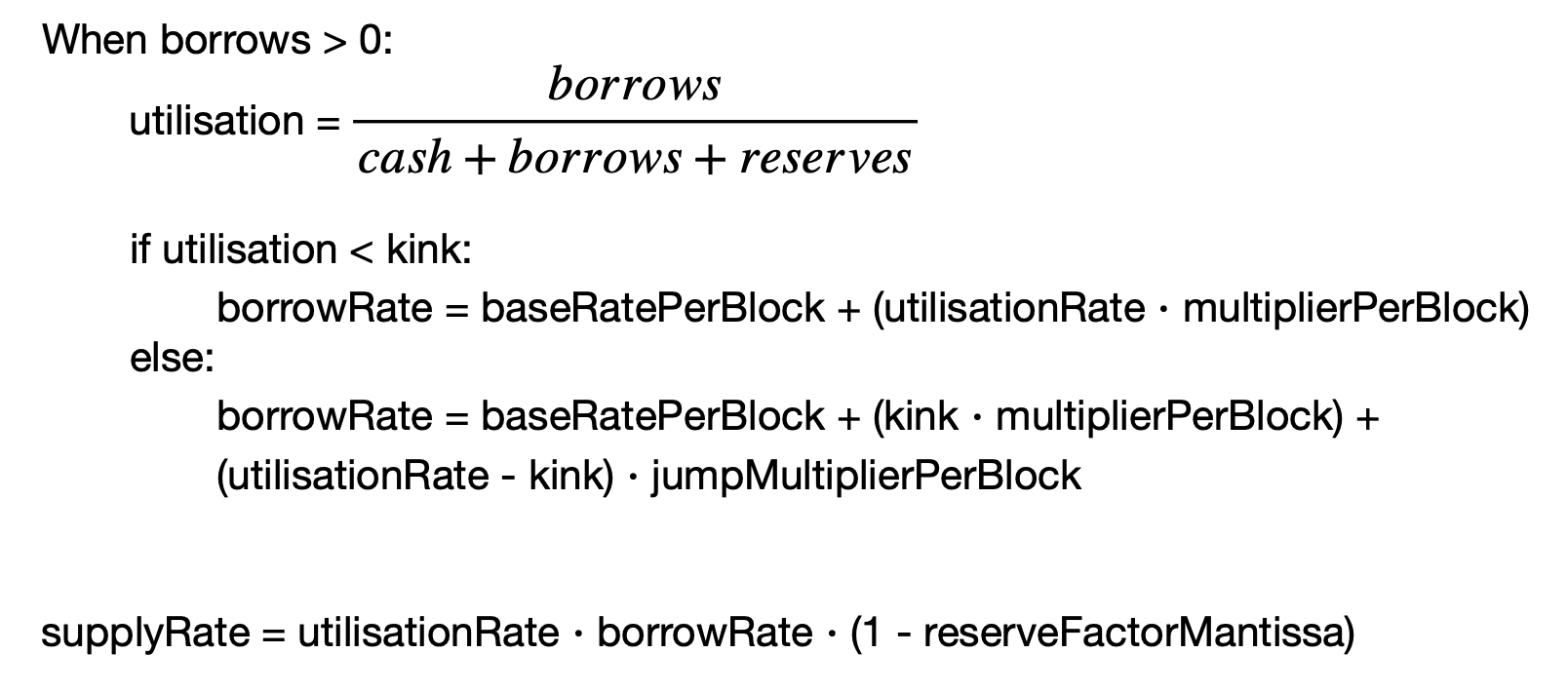

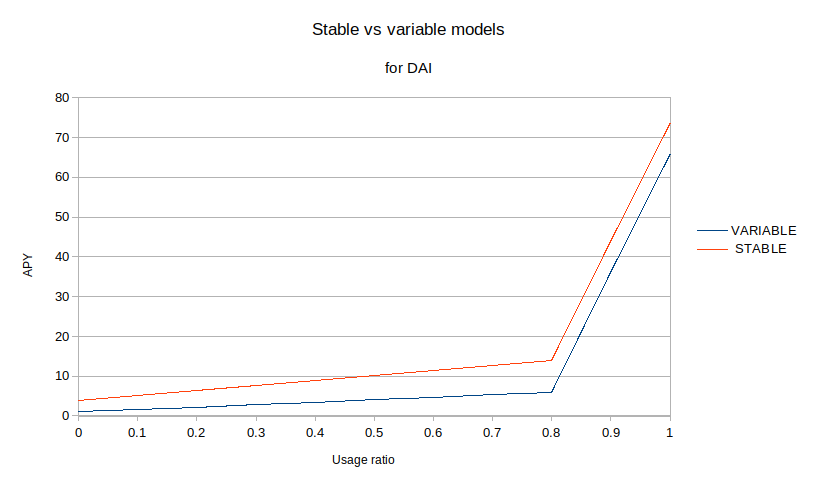

The common interest rate model found in DeFi is a piecewise function that renders two distinct slopes. The idea is to create an environment where the pool is capital efficient, but still has enough liquidity for people to enter and exit the pool. Different pools target different utilization ratios, but in general, the interest rate serves as a tool to maintain the target. Here’s an example from Compound: In the example above, the pool is targeting a 90% utilization rate, indicated by the kink at 90%. If the utilization rate is low (between 0% and 90%), the model will incentivize borrowing through low borrow rates. The rates will attract users to borrow assets from the pool, increasing utilization. But if the utilization rate is high (above 90%), the borrow rate changes dramatically making it more expensive to borrow. This incentivizes borrowers to return their assets and avoid the high rates bringing the utilization rate back to 90. The same dynamic exists between the supply rate and the utilization ratio, where suppliers are incentivized (through high yields) to deposit assets into the pools when the utilization rate is high and less incentivized to deposit assets when the utilization rate is low. The dynamic between these three parameters (the borrow rate, the supply rate, and the utilization ratio) balances the pool’s liquidity and increases the pool’s capital efficiency. With the Software Development Kit (SDK) provided by Market.xyz, anyone can spin up an isolated pool (more on this in the Isolated Pools section) and set the interest rate model of their choosing. All they have to do is set the following parameters in the contract:

Here’s the formula for APY calculation (borrowRate) with Market.xyz’s isolated pools: Liquidationsby Elemental When the value of the deposited collateral is at a level where the collateralization ratio falls below the minimum, the lending platform automatically sells the borrower’s collateral to pay off the outstanding debt and any fees or penalties that may be charged. Any collateral remaining after debts are paid is returned to the borrower. Continuing with the example loan above, your options for avoiding liquidation are to:

Liquidation Priceby Elemental This is the market price of the collateral token at which the value of the deposited collateral would fall below the loan’s minimum collateralization ratio. Most front-end interfaces for lending protocols will display the liquidation price, but you can calculate it manually with this formula:

Using our example from above, if the price of ETH was $2,000 when you opened the Vault by depositing 0.5 ETH ($1,000) to borrow 500 Dai:

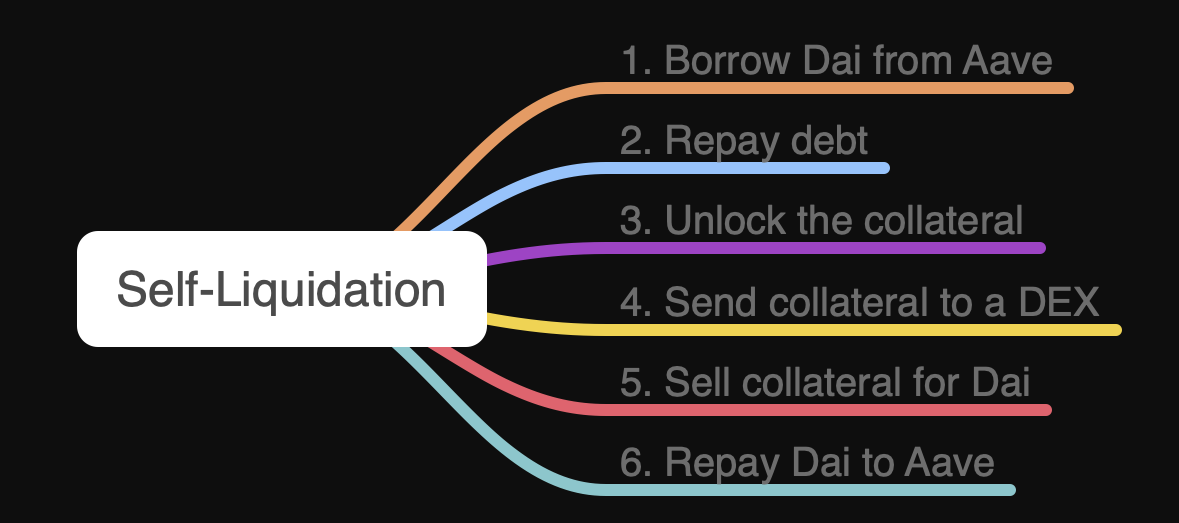

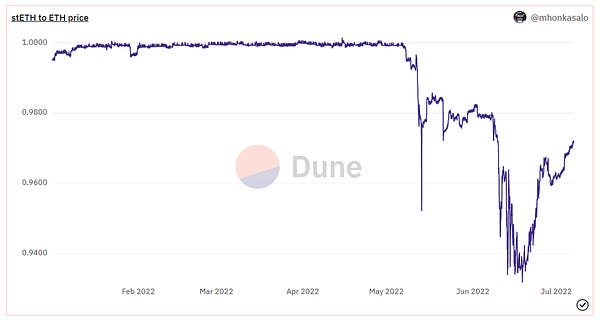

Recent price volatility with ETH shows how quickly leveraged borrowing can go from being properly overcollateralized to at risk of liquidation. It’s important to continually monitor the market price of your collateral and be ready to take action to avoid the risk of liquidation. Liquidation Penaltyby Elemental Many lending platforms add a percentage fee on top of the debt to be paid as a penalty for liquidation. This fee can often be avoided by manually selling collateral to pay off the debt before liquidation is triggered. Unfortunately, this likely means selling your collateral at a lower price than when you deposited it. Flash LoansDeFi lending has enabled the rise of “Flash Loans”. Flash loans allow users to borrow assets without providing collateral for a very limited amount of time (within the same block). These loans are typically used for arbitrage opportunities between different DeFi protocols. There is no risk of losing funds, because if the loan is not repaid in the same transaction, the loan is considered invalid. Pioneered by Aave, flash loans must be requested by a custom smart contract that pays back the loan plus interest in one transaction. These loans are primarily for developers, but tools like DeFi saver offer end users access to this new technology. They can be used to cover debt positions backed by falling collateral, without paying liquidation penalties. Given a position on the verge of liquidation, compare the cost of liquidation (13%) vs the cost of a flash loan (gas). From DeFi Saver:

Flash loans are incredible arbitrage tools uniquely enabled by blockchain technology, but there have been serious incidents of using them to exploit protocols via governance and reentrancy attacks. See these articles on Beanstalk and CREAM from Rekt News. Many of these attacks are possible without using flash loans, but flash loans reduce the capital required to perform them and allow attacks to scale. The frequency of attacks using flash loans has recently decreased in number, but the list of attacks is long. In general, these flash loan attacks surface exploits faster. Flash loans have directly led to the maturation of DeFi because the uncovering of one security hole allows other projects to find and patch the same vulnerability in their own system. ConclusionUltimately, flash loans offer a financial tool that would be completely unavailable (and useless) before blockchains. Flash loans can be used as a tool for large arbitrage opportunities, and create the ability for security researchers to perform penetration tests that would have been impossible without the necessary funds. Lending ProjectsMakerMaker has been considered the first DeFi project and has consistently held the greatest amount of ETH locked. Maker uses the stablecoin DAI to create collateralized debt positions. Users deposit governance-approved collateral in the Maker Vault, granting debtors the ability to mint/borrow DAI. These borrowers pay a “stability fee” on the USD-pegged DAI that serves as the loan’s interest rate. Maker loans are overcollateralized. They use a collateralization ratio of 150%, meaning they can borrow up to 66% of their collateral’s value. For example, users can deposit $9,000 worth of Ether to borrow $3,000 DAI to be safe, or go full degen, borrow $4,500 worth of DAI, and pray it only goes up. If the value of the collateral falls such that the collateralization ratio is below 150%, the position is subject to liquidation. During liquidation events, collateral is auctioned on the market to third-party actors, called “Keepers”, at a 3% discount to repay the borrower’s loan. These liquidations also incur a 13% penalty that is added to the vault’s total outstanding loan upon liquidation. Keepers can submit DAI during the auction to make a bid for the value of the vault. If the value of collateral falls too quickly, Maker mints and sells its governance token (MKR) to raise more collateral. To balance this mechanism and reduce MKR supply, a portion of extra DAI fees collected by the protocol are used to repurchase MKR which is subsequently burned. The rest of the extra DAI fees are sent to the DAO treasury. Maker also has a feature called the DAI Savings Rate, where DAI holders can deposit DAI to earn a variable interest rate generated from stability fees. Rates currently sit at 0.1% APR. Maker is one of the oldest DeFi projects in the space. They’ve been around since 2014, withstanding multiple market cycles. This has not only hardened their position in the market as one of the best protocols, but also the safest. Their contracts have been tested over the past 8 years and each year increases its [likelihood of survival](https://en.wikipedia.org/wiki/Lindy_effect#:~:text=The Lindy effect (also known,proportional to their current age.). CompoundLenders can deposit their collateral on Compound and earn a variable interest rate on their assets. This acts like a decentralized, crypto, savings account. Compound issues ERC20 cTokens in exchange for collateral. These cTokens are interest bearing tokens used to track the assets within Compound and increase in value compared to the underlying asset (based on the cToken-Token exchange rate). This exchange rate increases each block and can be used to calculate the total APR. The value of the borrowed amount must always be lower than the value of the collateral multiplied by its collateral factor. If the loan becomes greater than 50-75% of the collateral’s value, keepers can liquidate their positions at a 5% discount. Compound released their governance token COMP in June 2020, kicking off DeFi summer. They used COMP to incentivize liquidity on their platform. AaveAave issues aTokens to depositors. These are similar to Compound’s cTokens, but are redeemable for the underlying token at a 1:1 exchange rate. Depositors earn interest via aToken distributions from the Aave protocol. These tokens are continuously issued to holders at a variable or stable interest rate. Like other protocols, Aave offers overcollateralized loans. First, users deposit their tokens into Aave’s liquidity pools, at which point assets can be borrowed from the protocol. Each asset has its own liquidity pool within the Aave platform, with some assets considered ineligible for use as collateral. Aave uses the AAVE token as a collateral of last resort. If Aave collateral falls unexpectedly, the AAVE token is used to re-collateralize the system. Users can stake their AAVE tokens which sets them aside to serve as insurance in exchange for a yield. During a shortfall event, these tokens are sold on the market. Aave has also experimented with using a semi-fixed rate offering called “stable” interest rate loans. As interest rates fluctuate according to the interest rate curve, users can create loan positions where the rates won’t change—barring exceptional market conditions. During typical market conditions, the available stable rate may fluctuate, but once a user accepts the loan, the stable rate is set. Aave pioneered flash loans. These are loans that must be repaid within the same transaction. We’ll do a deeper dive on both flash loans and Aave’s stable interest rate mechanism below. Rari Fuse PoolsRari began as a yield farming aggregator, but transitioned into an isolated interest rate protocol. Fuse allows anyone to create a lending market using any ERC20 token. Pool creators choose parameters like interest rate curves, oracles, and collateral factors while users can borrow assets from or lend assets to the pool. This customizability allows users to provide liquidity for a variety of lending markets with different risk profiles. And because these pools are isolated, the risk profile of one pool will not directly affect other pools. Products like Compound and Aave are permissioned in that they control the kinds of assets that can be used as collateral. This is because they have one liquidity pool per asset. They cannot accept any asset, because it opens the entire protocol’s TVL to supply asset attacks (more in the Isolated Lending Pools section below). Alchemixby Elemental Alchemix is a DeFi lending platform that offers overcollateralized loans with two key features that make it different from most others. First, borrowers can’t automatically be liquidated by changing crypto prices. The second difference is that Alchemix offers what it calls self-repaying loans. Alchemix allows borrowers to take out loans up to 50% LTV (loan to value) on deposited crypto collateral, including DAI, ETH, wstETH, rETH, USDC, and USDT. This equates to a 200% minimum collateralization ratio. Borrowers are safe from automatic liquidation because Alchemix lends like-kind synthetic assets on collateral. For example, if you deposit ETH, you can borrow up to half of your deposited ETH’s value in alETH, a synthetic token that follows the same price as standard ETH. If the price of ETH (and, thus the total value of your collateral) falls, the price/value of the borrowed alETH falls proportionally. This keeps the LTV and collateralization ratio the same. This video from Alchemix provides a visual demonstration of how this works. The platform uses your collateral to earn yield on your behalf, which gradually pays off the balance of your debt. This is what Alchemix means by self-repaying loans. Essentially, it allows you to borrow the future yield on crypto assets deposited into its vaults. Alchemix also integrates with several yield farming aggregators and protocols, enabling borrowers to earn additional yield and ALCX governance tokens using their borrowed assets. Alchemix Finance enables borrowers to leverage the value of their crypto assets with greatly reduced liquidation risk. However, since the APY on the yield earned on collateral is variable, it’s difficult to determine when your self-repaying loan would be paid off. At the time of this writing, the APY on an ETH/alETH vault was 0.092%. Using the loan estimator on the platform’s legacy interface, if you deposited 10 ETH, your 5 alETH loan would be paid off on March 30, 2567. Technically self-repaying … over 545 years. Of course, yields fluctuate significantly depending on a wide range of market factors, so your results may vary. You can learn more, compare APYs, and DYOR on their website. Voltz ProtocolVoltz is bringing interest rate swaps to DeFi, which is a quadrillion dollar market ($1,000,000,000,000,000) in TradFi. Voltz creates liquidity for assets with interest rates. This allows the market to set the interest rates of the DeFi economy. Interest rate swap markets include liquidity providers, a fixed taker, and a variable taker. The fixed taker creates a position with a variable rate of return and exchanges it for a set amount, essentially creating a fixed rate. The variable taker is the buyer of this position. This offers the opportunity for fixed rate mortgages on-chain, new trading strategies, and generalizable, capital efficient fixed interest rates. The liquidity pool serves as a pricing oracle for the fixed/variable rate. Euler FinanceEuler also provides a market for niche assets. This time, these loans must be backed by large, reputable assets like stablecoins, ETH, and BTC. Euler uses Uniswap’s time-weighted average price (TWAP) oracles to create price feeds for the assets listed on the platform. Euler separates assets by tiers of risk. This limits the borrowing capacity of users to the risk profile of the assets they provide. If you supply ETH and BTC you can borrow a wider variety of assets than if you supply an unknown, small market-cap token. As an example, riskier assets can be borrowed and lent, but not used as collateral, preventing bad debt positions. From BanklessHQ:

Euler offers a wide variety of features taken from several of DeFi’s most innovative protocols in addition to some of its own:

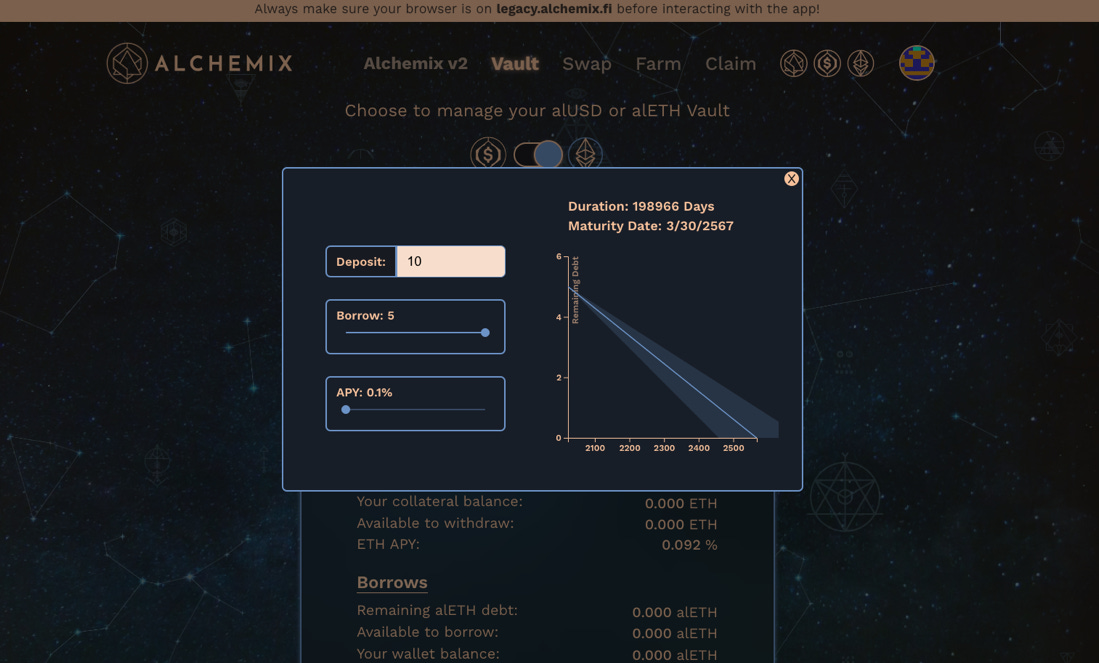

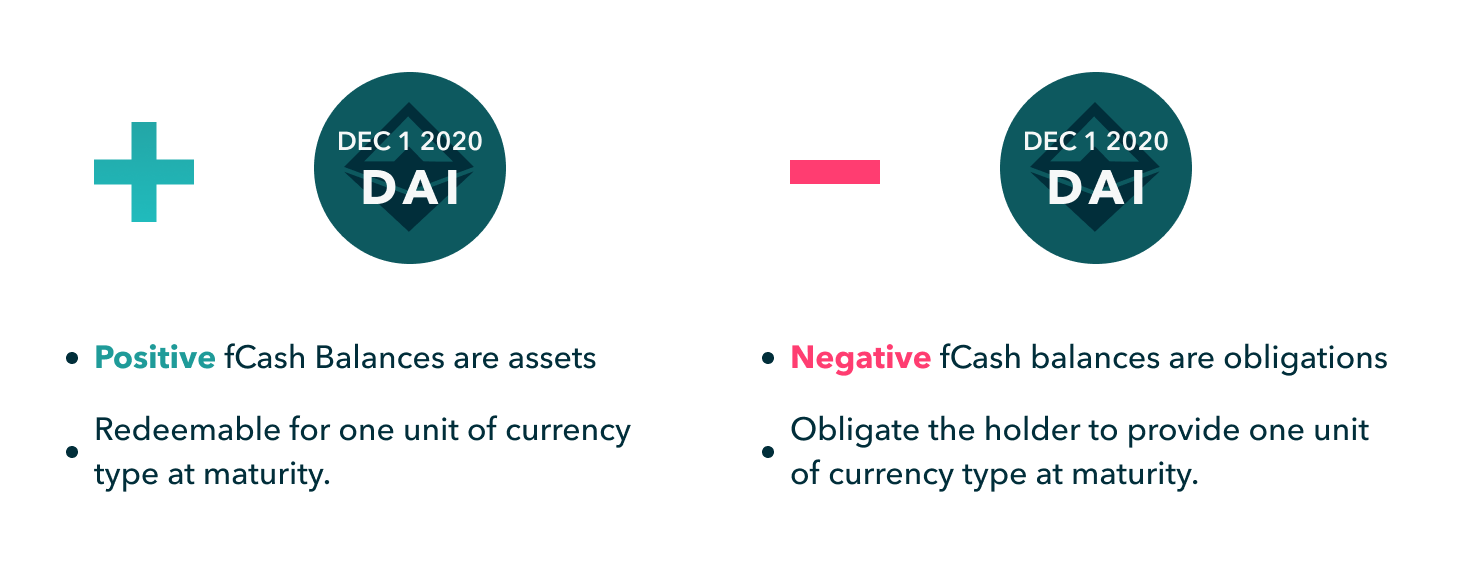

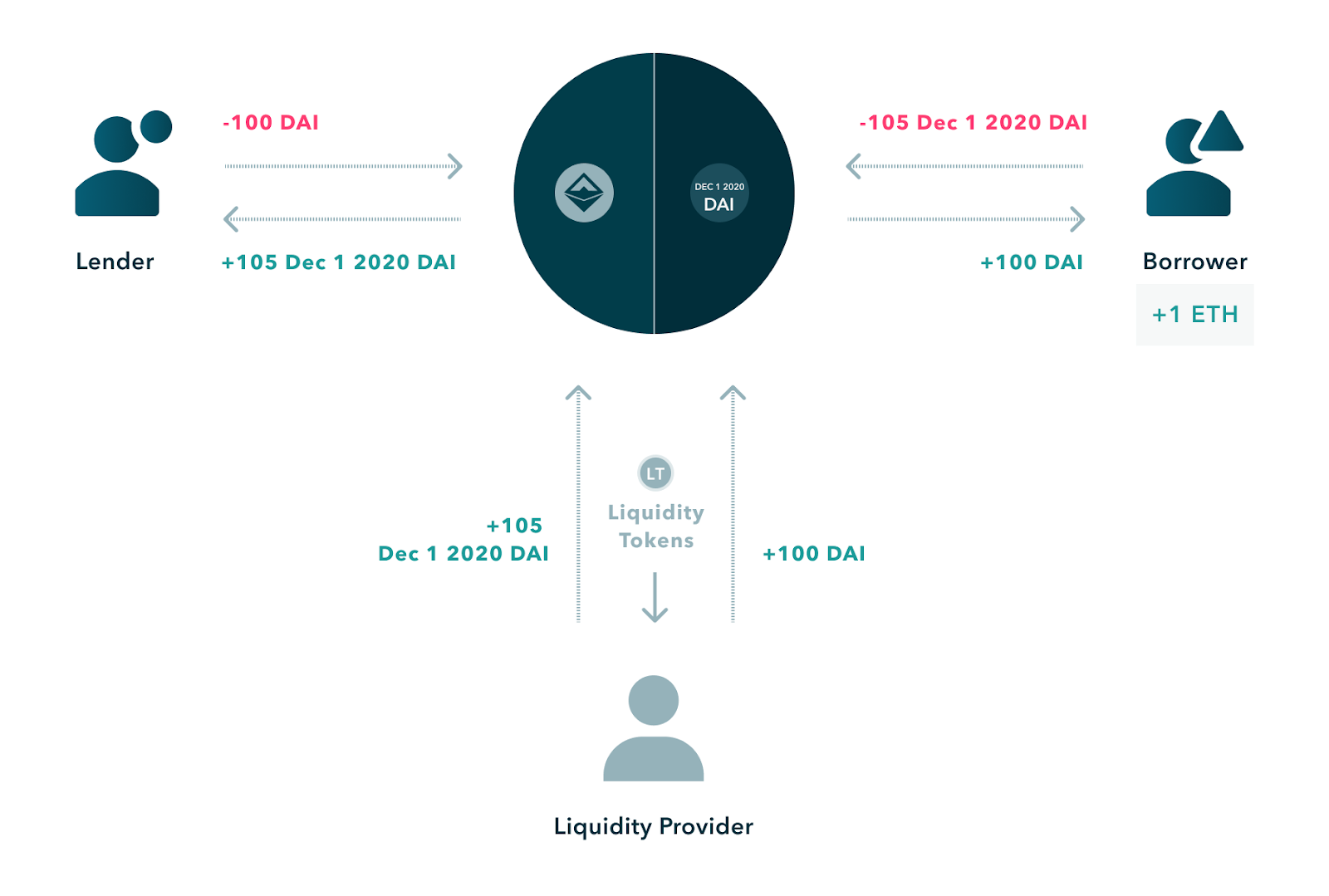

NotionalNotional a project offering fixed rate loans. They do this by keeping track of debits and credits via their fCash tokens. Upon execution of a loan, a lender and borrower each receive fCash balances with the latter receiving a negative sum. These balances represent the position, including interest payments.

Lenders exchange stablecoins for a derivative (fCash) and earn a fixed interest rate denominated in fCash. Borrowers overcollateralize by depositing approved assets, and then mint fCash that can be exchanged for cash via the liquidity pool. Upon maturity users can redeem/repay the balance associated with their positions with the derivative tokens (fCash tokens). For example, the exchange rate between USDC and fUSDC at the pre-specified maturity represents the fixed interest rate that users receive on Notional. If a borrower has a negative balance then their collateral will be used to cover their debts upon the loan’s maturity date. Notional utilizes liquidity pools (similar to Uniswap) to facilitate trading (lending/borrowing) and collects fees on user transactions. Each pool is denoted by the types of asset and the maturity date. An example pool would be a DAI/fDAI pool that matures on Dec 23, 2022. As a result, there are three different types of Notional users: lenders, borrowers, and liquidity providers. Liquidity providers serve as the counter-party to lenders and borrowers, receiving fees each time a trade is made. The risk for liquidity providers is impermanent loss (IL). This occurs when the exchange rate of the pool's assets (cash to fCash) is different from the rate at the time you added liquidity. Note that the yield for providing liquidity is in part incentivized by the NOTE token. Annual emission rates by currency are as follows:

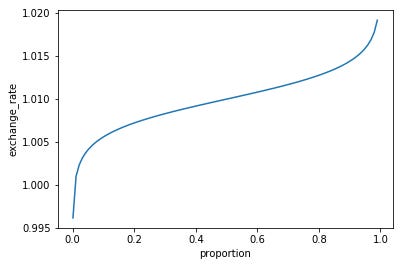

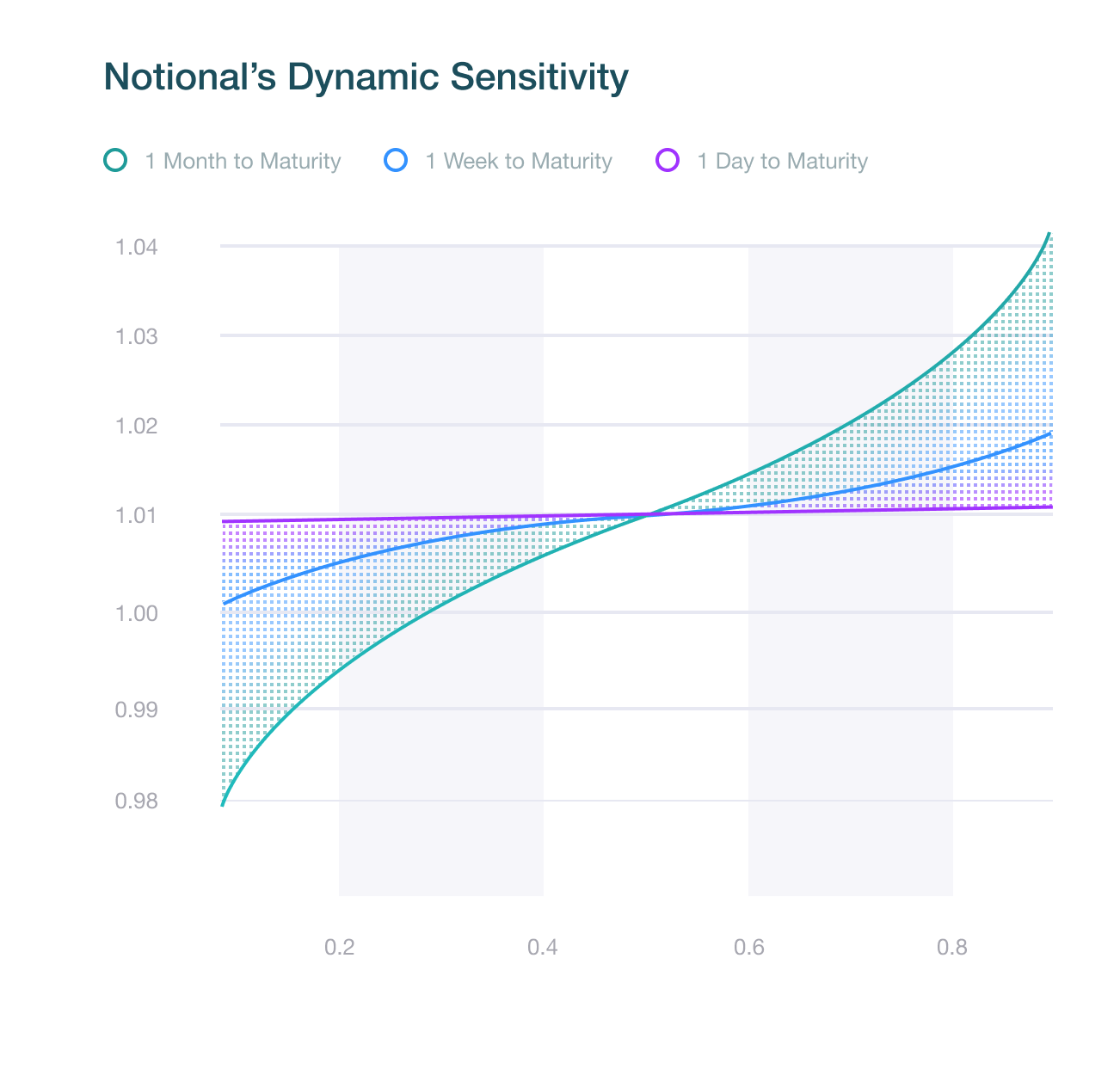

The curve of Notional AMMs must be flat for most cases to create reasonable levels of slippage, but steep enough at the ends to encourage equilibrium during market repricing events. As a result, when the price differences are large, the incentives are greater for traders. Here’s what the curve looks like: In the graph above, the exchange rate changes when there’s a difference between fCash and cash in the liquidity pool. The greater the difference, the more pronounced the exchange rate. This encourages traders to use the pool for arbitrage opportunities, bringing the price back to the center and giving liquidity providers trading fees. To prevent IL, Notional implements a series of pricing curves to reduce slippage as the pools reach maturity. All of these factors work together to ensure that fixed interest rates are available to the user. Trading fees give LPs profits, while the borrowers’ collateral can be used to repay lenders, improving the pools’ solvency and creating profit opportunities for the protocol. One risk here is Notional’s insolvency. If a borrower becomes insolvent, Notional uses their own funds to cover losses that occur. This represents a risk as the last backstop for user funds is the Notional Treasury which is managed by NOTE holders. Notional is making big moves in improving DeFi functionality. Traditional finance entities do not have as much of a use for variable interest rates as they do fixed interest rates. This makes fixed interest rates a “holy grail” for widespread DeFi adoption. Fixed rates give borrowers and lenders predictability. In order to plan financial decisions and targets, both users and institutions benefit from having predictable payments. If the rates suddenly increase or drop and the user isn’t prepared for it, the user would be financially stressed and may default on their loan. Intermediate/Advanced ConceptsIsolated PoolsWith the rebirth of governance tokens, users of DAOs and protocols have a set of assets that are sitting in their wallets and largely unused. Many holders are bullish on their tokens, but single cross-collateral pools only allow some assets to be used as collateral, leaving these holders with less utility than tokens like ETH and DAI. Isolated pools solve this problem by allowing any token to be used as collateral. Isolated pools allow anyone to create a lending market for any asset they choose and tune the parameters to the risk profile they see fit without contaminating the rest of the protocol’s TVL. The isolation of liquidity separates lending markets from each other, protecting safe pools from riskier pools. This is not the case for single cross-collateral pools like Compound. Imagine a scenario where any asset can be supplied to a single cross-collateral pool. A malicious attacker creates their own token, controlling the supply and the price of this asset. The attacker supplies this token to the lending protocol, increases its price, and borrows stable/reputable assets against it. Finally, the attacker refuses to pay back their loan because the collateral was worthless, whose only purpose was to steal funds. Isolated pools solve this problem by allowing reputable and non-reputable assets to be used as collateral by separating different lending markets. Pool creators can spin up isolated markets, but it’s up to the user to determine where they want to supply/borrow funds. And because the pools are isolated, this attack cannot spread to the entire protocol’s TVL. Where single cross-collateral pools have one liquidity pool per asset, isolated pools allow each asset to have a variety of lending markets, each with different risk profiles. If one pool becomes undercollateralized, it will not impact the safety of others. Where Aave and Compound allow anyone to become a lender, Fuse pushes the notion further. Fuse pools are easily customizable, leading to a large diversity of money markets. These markets also enable pool creators to get liquidity for niche assets. This ecosystem of pools gives rise to a variety of products with different risk profiles, allowing anyone to create their own version of Compound or Aave and essentially become their own lending protocol. But this is by no means a panacea. Malicious pool creators can target unsuspecting users. The attack mentioned above still holds true for isolated pools. Pools created with small market cap assets whose supply and price is controlled by an attacker are subject to the same vulnerability. Smart contract hacks and price feed manipulation are also risks. Rari Fuse pools were exploited for over 80 Million USD in April 2022. It’s up to the user to determine which pools are safe and which pools are too risky for them via collateralization ratios, approved collateral assets, and smart contract audits, among other factors. Fixed (or Stable) Interest Rate ModelFixed interest rate products make up over 80% of all derivative trading volume, and in 2019, 94% of US corporate bonds outstanding were issued at fixed rates. Fixed rate loans offer stability and predictability for the people who accept the loan terms. Borrowers do not need to pay as close attention to the markets to utilize these effectively. For instance, variable interest rate home loan applications make up 10.8% of all applications this year (source). Today, interest rates in DeFi are too volatile for traditional lending platforms to use. For instance, DAI borrowing rates have fluctuated between 0.5% and 20% annualized. Fixed interest rates have been created in two ways:

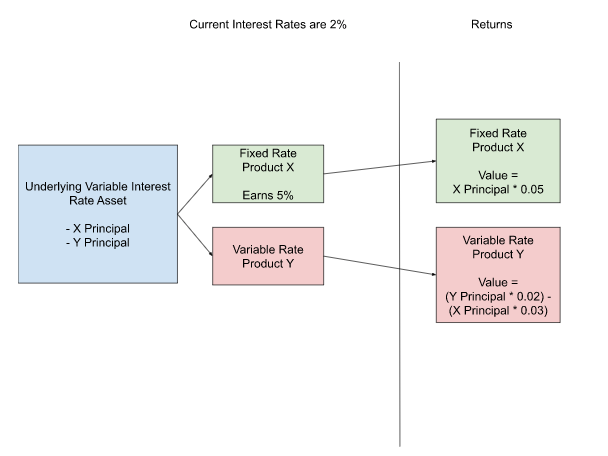

Fixed Rate LoansUsers can utilize Aave’s “stable” interest rates to borrow funds at a “point in time” rate determined by the protocol. While the available rate might change, once the loan is taken out, it is fixed. This allows borrowers to avoid the volatility of interest rates as a result of price action and macroeconomic dynamics. Typically the “stable” interest rate is higher than the variable interest rate in order to remain solvent in adverse market conditions, resulting in a “rebalancing event”. This rebalancing event will cause “stable” loans with lower interest rates to increase in order to satisfy stay solvent. This is why stable rate loans are not fixed rate loans. Stable rate loans typically hold their rate, but are liable to change and thus are not fixed. Using Aave as an example of the difference between stable and variable interest rates, at the same utilization ratio of 80%, the stable rate is ~13.9% where the variable interest rate is 6%. This is more than a 100% increase. Today, stable rate loans are not very popular in DeFi, but if we can turn stable interest rates into fixed interest rates, it could allow projects to bootstrap liquidity with less risk. Compare this to yield farming the form of governance token emissions which has been a common protocol strategy to attract liquidity. Presuming a project wants to increase liquidity for its token on a DEX, the project can use yield farming to incentivize users to supply tokens to the exchange. This is a popular strategy, but it’s expensive, especially at the beginning (yield farming incentives range from 5%-40% APR). It's also risky because yield farmers are free to dump their tokens and withdraw their liquidity. Fixed rate interest loans can fix this. Projects can instead borrow the necessary assets in order to stay solvent (at a fixed rate) and own their liquidity positions, without the costs of yield farming incentives nor the risk of liquidity providers leaving. Yield RedistributionProtocols can also use yield bearing assets to create secondary markets for interest rates. In general, there are two types:

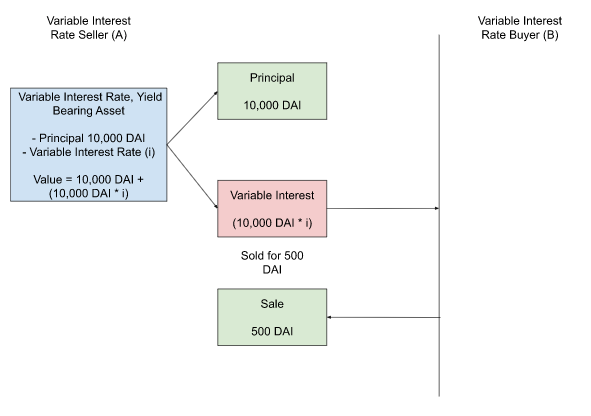

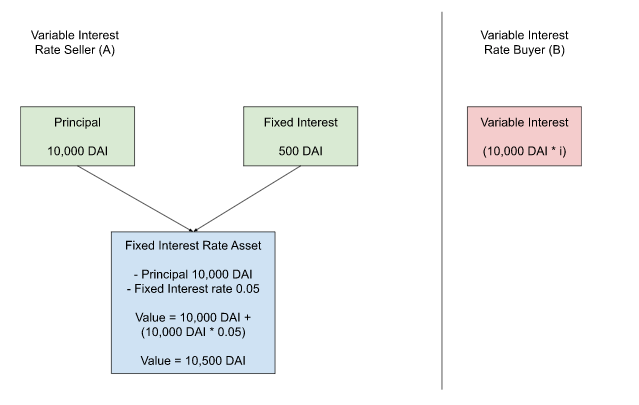

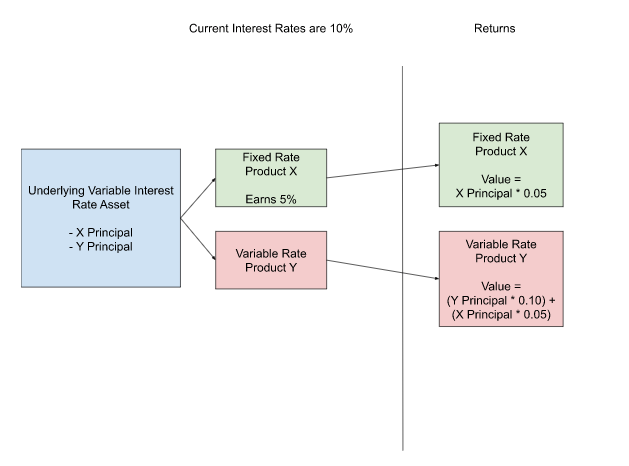

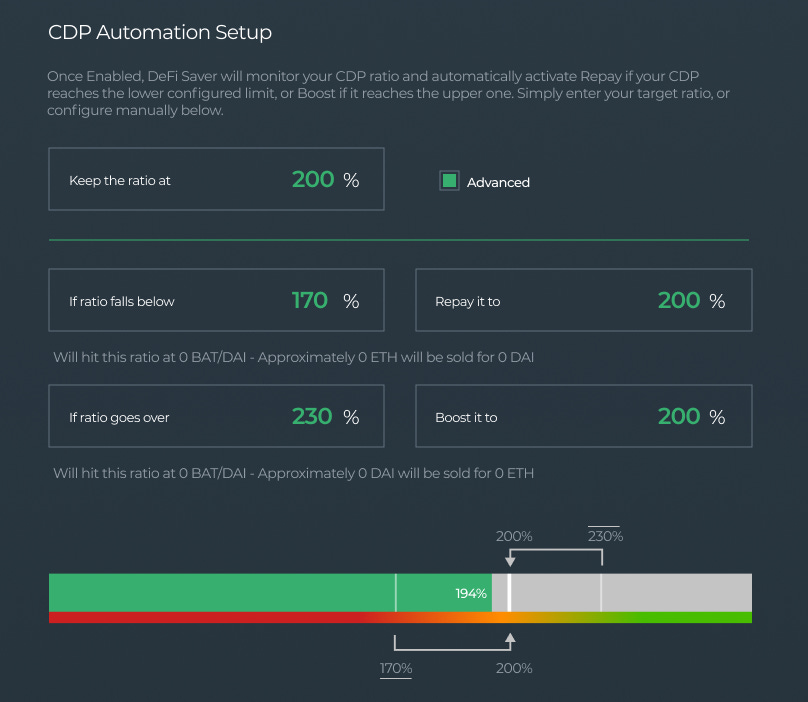

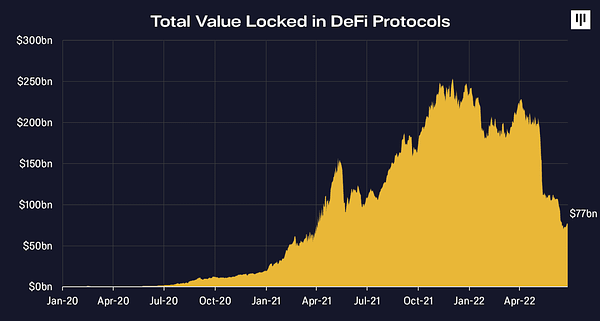

Let’s go through the first type: splitting the principal and interest. Given some yield bearing asset, let user A invest 10,000 DAI into Aave for one year and repackage the interest (i) to be earned on that position as a stand alone product. Now, suppose some user B is willing to buy the interest earned on that position for 500 DAI. Seller A makes 5% profit on the 10,000 DAI investment and keeps their principal. As a result, B takes on the directional risk of the variable interest on that position and the variable rate seller creates a position equivalent to a fixed rate asset. Similarly, structured products typically consist of two sets of products using the same underlying, variable-interest rate, yield-bearing asset. The first set X receives a fixed rate of 5% interest on their investment, the second set Y receives a floating rate of return on anything greater than 5%. If the total return is less than 5%, Y’s assets are used to make up the difference in returns for X, such that X will always receive a 5% return. Again, Y assumes risk that X does not. Fixed interest rates are a huge opportunity for DeFi and have been lauded as the next unlock for users. They offer users and institutions predictable cash flows, and allow crypto to enter a quadrillion dollar market. Be on the lookout for more products and protocols to enter this arena. It remains to be seen when fixed interest rates get popular adoption in crypto, but there’s no doubt that DeFi is speed-running the history of finance, and fixed interest rates are simply the next domino to fall. Automatic Loan CoverageDeFi Saver is an application that allows users to manage their assets across multiple DeFi protocols. Their dashboard enables users to manage positions across protocols like Maker, Compound, and Aave. Through DeFi Saver, you can create your own combination of transactions and provide automatic liquidation protection through their “Automation” feature. Automation is DeFi Saver’s mechanism to help you manage your collateralized debt positions (CDPs), providing you with automatic liquidation protection. Automation actively monitors users’ CDPs and leverages up or down depending on the price of the underlying collateral. Leveraging and deleveraging is done using “Boost” and “Repay” functions. So the automation system is useful for assets that you’re bullish on. These leveraging and deleveraging adjustments are made by DeFi Saver in a single transaction, powered by flash loans. As an example, users can submit ETH as collateral, and then configure a maximum and minimum collateralization ratio. Once enabled, Automation will generate DAI, buy more ETH, and add it to your CDP. This will increase your ETH exposure, decrease your DAI debt, and decrease your collateralization ratio. On the other hand if your ratio drops below your configured minimum collateralization ratio, some of your collateral (ETH) is removed from the CDP, swapped for DAI, and used to pay back debt, increasing your collateralization ratio. These adjustments are only made using collateral within your CDP/Vault, and the assets in your wallet cannot be accessed by Automation. Right now, users must have a CDP/Vault on the multi-collateral DAI version of the MakerDAO protocol with at least 40,000 DAI debt to enable Automation. This is a new innovation in finance made possible by smart contracts. Users can sleep well at night, knowing that if there is a large liquidation event, their positions will be covered without incurring high liquidation fees (Maker incurs a 13% fee on liquidated assets). Automation has run over 43,000 Repay and Boost transactions on behalf of users, with over $1.5b done in trade volume in automated transactions as of May 2021. There have not been any exploits in the contract, so far, but there is always the possibility of smart contract risk. DeFi-Nostradamus: A Glimpse Into the Future of DeFi Lending and Borrowingby Joe King I have no crystal ball and no prophetic talents, but I do have access to some of the brightest minds in DeFi and a news feed full of builders in the Web 3 space, so let’s tap into that mind share and take a look at the future of lending and borrowing in DeFi. Past and Present of DeFi Lending The summer of 2020 also referred to as “DeFi Summer '' brought the world of decentralized finance (DeFi) to the mainstream of crypto. Protocols such as: Compound, Aave, and Alchemix made waves across the Web 3 industry. These protocols allowed permissionless lending and borrowing to take place with notable celebrities from the world of traditional finance (like Mark Cuban) and crypto (such as Vitalik Buterin) to come out in support of these new financial tools available to the world. DeFi protocols have continued to iterate on lending and borrowing by allowing more collateral types, exotic token pairs, and even self repaying loans with Alchemix. The majority of these tools require you to overcollateralize, meaning if you want to borrow $100 of stablecoins, you need to deposit $150 or more of crypto collateral to the lending protocol. This ensures your loan amount stays collateralized to at least the value of the loan and if your loan were ever to approach that threshold, the smart contract sells your collateral to recoup the loan (plus some fees of course). What if in the future you could borrow without posting collateral? DeFi-Nostradamus’ View on the Future of DeFi One such future might be just around the corner with “credit-based” DeFi loans; similar to current bank loans, these would be made with no collateral and the interest rate would be variable based on one's credit worthiness. The idea of a “no collateral loan” is not groundbreaking in the traditional finance space where a bank can simply pull your credit from a reporting agency. But how could it be accomplished in the pseudonymous world of multiple wallet addresses and cartoon character avatars? Three mechanisms are currently being tested to allow for these type of loans: Flash Loans: These are already in use and have been expanding across DeFi. A flash loan is simply a loan that is taken and repaid in the same block; this allows users of these loans to arbitrage price differences across assets or protocols. These are sophisticated tools used mostly by crypto funds via the use of bots. A fee is paid for the temporary use of capital and all transactions are settled at once in a single block. As bots and the tools around block construction get more sophisticated the ability to use flash loans will become more and more useful for sophisticated actors. With the ETH 2.0 merge around the corner a new actor will enter the fray of validators: “block builders”. These block builders will get to order the transactions in each block allowing the ability for arbitrage spreads in trades, these flash loans will be a powerful tool for these actors to extract extra value when validating a block. Third Party Assessment: This is a similar model to the current financial system of “credit agencies” that monitor and maintain a database of everyone’s credit score, these agencies are queried by lenders to determine one’s credit worthiness; a better score means a better chance of being approved for the loan and a lower interest rate. This is just bridging the world of centralized finance into the decentralized world. The problem is bootstrapping enough of these third party actors to build a robust credit system in DeFi and how to uphold the ethos of “decentralization” when this system would rely on centralized third party actors. Crypto Native Credit Scores: In the blockchain space an idea being tested is “on chain credit worthiness”; this would allow a lender to examine all the activity of your wallet to determine if you are the type of person to repay your loan, what is the risk of default, and what rate to charge you for the loan. A glaring problem with this system is how to punish a bad actor for not repaying the loan and what is to stop a bad actor who could simply use a new wallet and never need to deal with the repercussions of the default. The future of crypto native credit scores will require creative thinking in solving these glaring issues. One solution is using a “zero knowledge proof of off chain data” where your real world ID could be linked to an encrypted Zero Knowledge Proof. Allowing your wallet to be associated with your real world identity without the other party knowing who you actually are. This would allow your lending and borrowing history to be tied to each wallet you use and would help create a trusted, but decentralized profile for each wallet associated with you. Another idea being used is “on chain credit integration” using a KYC (know your customer) credit score attached to a zero knowledge proof tied to your wallet or online identity; this requires a third party, but would allow you to choose your company of choice and would shield your personal information from lenders (imagine doing one credit check with a company of your choice and then using it for multiple loan companies who never know who you actually are). DeFi-Nostradamus Peers Deeper Into the Future Credit by Social Reputation A social reputation system is also being theorized, referred to as “A Personal Network Bootstrapping Collective”. This is a network effect idea where only trusted actors could participate, once a wallet address has been deemed a high credit person they could invite a friend to join the network. This makes the credit worthy wallet holder reputationally liable for the invitee, an example would be: you invite your friend to the network, they borrow some money, and then default on it; your friend would be out of the collective and your reputation would take a hit (like your credit score going down), this would affect your borrowing ability and interest rates on current loans (or could even get your thrown out of the club). NFTs as Collateral A popular tool of the rich is to buy assets like fine art, borrow money against the price of the art (for a fee of course), and use the money for other things; this allows you to access the money locked in an asset without paying those pesky capital gains taxes. Enter NFT borrowing! This system allows a user to lock up an NFT in a smart contract and borrow money against it for a fee (of course) and a monthly interest payment; this is very similar to the current model of over collateralized crypto borrowing mechanisms such as MakerDAO and Aave. Under this system, you could only borrow a portion of the value of the NFT and if the price of your NFT ever drops to 100% of the loan value, the protocol would sell your NFT and repay the loan to itself (plus a fee of course!). Unlike most tokens in crypto with an active price oracle that transmits the current price of each token to a smart contract, NFTs are only worth what another party is willing to pay for them. NFT Tech is new liquid matching engine that utilizes a bid order book for NFTs to transmit prices of popular NFT projects to smart contracts directly; this opens up NFTs for uses in many of DeFii’s current protocols and systems. Real World Assets in DeFi Real Estate started making headlines across the globe as companies began to “tokenize” real estate. Accomplished by selling a property to a company (such an LLC) and then creating an NFT or token that represents ownership of the company on the block chain. This is also being done with a staggering number of real world items such as stable coins backed by precious metals, venture investment shares as NFTs, music royalties, and even cars! Companies like Centrifuge allow you to bridge real world asset ownership into NFTs and then use them for borrowing and lending in places such as Aave and MakerDAO. To get these real world assets onto the blockchain the owner must “hash” the ownership document onto the blockchain and then an NFT is created once the hash of the document is locked into the “Tinlake” dApp. This allows users across the globe to access capital that may not have been possible before, this type of system opens up a 100 trillion dollar opportunity by bringing real world assets onto the block chain. Toward Better Lending and Borrowing DeFi has long been an innovation launch pad for new techniques and products across Web3 since its inception, and now DeFi entrepreneurs are actively building new protocols for lending. While we are theorizing about on-chain credit scores, social capital investment clubs, borrowing against real world assets, or tokenizing your home, the builders in this space are busy creating. The innovations in lending and borrowing continue to improve, month after month, and the future still looks bright for a Bankless world! Actions steps📖 Read The Stablecoin Edition | DeFi Download 📖 Read The Evolution from Crypto Pawn Shops ⛏️ Dig into Undercollateralized Lending with Goldfinch 🎧 Listen Disrupting a Quadrillion Dollar Market | Voltz Protocol 🙏 Sponsor: Oasis.app - Borrow Dai & Earn Project Releases 🎉

BanklessDAO Tax Guide

Zerion Wallet

Voltz Protocol Interest Rate Swaps

DeFi Saver on Optimism and Arbitrum

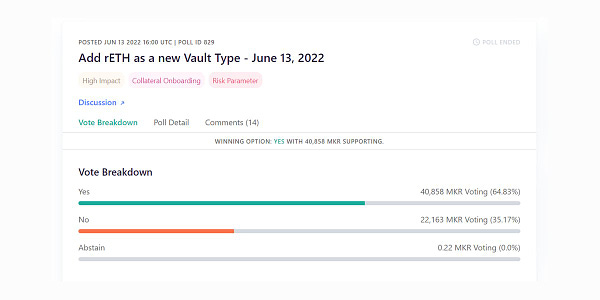

rETH has approved as Maker collateral

Circle Launches Euro Coin (EUROC)

Hop Tokens (HOP) are now claimable

dYdX V4 is on Cosmos

Uniswap acquires Genie

Tether Launches stablecoin GBP₮

ZigZag DEX Announces InvisibL3

Aave Launches stablecoin GHO

Chirping Birds

Coinbase Exchange @CoinbaseExch Our POND-USDT trading pair will now enter limit-only mode on @CoinbaseExch, Coinbase Pro and Advanced Trading. Limit orders can be placed and canceled, and matches may occur. Market orders cannot be submitted.    κασσάνδρα.eth @kassandraETH 👀👀👀How about that liquidity depth on @Uniswap for DAI/USDC ?! ($500m DAI -> USDC trade with negligible price impact) @ArrakisFinance is helping to unlock and illustrate the massive potential of Uni V3 https://t.co/pJHcmBKhZN  Tokenomics 101: PonzinomicsBy: Bl0ckb0y.eth Crypto has been called a ponzi many times before, but now that the market is down more than 70% from all time highs it's time to draw the line on what a ponzi truly is and how crypto can actually benefit from them. In a warning to investors about virtual currencies, the SEC states that, “A Ponzi scheme is an investment scam that involves the payment of purported returns to existing investors from funds contributed by new investors”. Additional to this description the SEC has noted these red flags:

One example of a ponzi scheme in the Web3 is the collapse of the Luna ecosystem: The project consists of an algorithmic stablecoin called TerraUSD ($UST) backed solely by its sister coin Terra ($LUNA), which holds staking and governance rights to the ecosystem. The mechanics of their algorithmic stablecoin allowed anyone to redeem a UST for $1 of Luna. Terra’s stablecoin is backed by another token whose value is driven by the community's sentiment. Luna consistently promised high staking rewards with a very complex strategy for how value would be captured to the token. At one point a whale decided to attack the protocol and sell high quantities of UST to lower its price and try to de-peg it. As UST fell below its peg at $1, there was a large bank run to redeem their UST for LUNA and then to sell the LUNA. As the UST reserve asset LUNA fell in price, so did trust in their stablecoin, causing it to further de-peg. Eventually this led to the collapse of the algorithmic stablecoin and 40 billion dollars in investors' funds being lost. This fall could be tied to a lending protocol called Anchor. They gave out high interest rates like a bank in order to bootstrap liquidity for their lending practice. An issue arose when Anchor should have lowered their rates but refused, leading to an abundance of capital in the protocol. If (like Aave or MAKER) they adjusted interest rates with demand the system may still be running and LUNA might have survived. Through promising unsustainably high rewards to users, the protocol was able to grow faster than it was able to maintain. In addition to the over financialization of the asset the project also built belief and cultivated a predatory community called the Lunatics to promote the value and discredit anyone who didn't believe in the system. Building a cult mentality around tokens is a common predatory part of the ecosystem. The Case for PonzisWhile the Luna debacle had clear signs of a ponzi scheme by obscuring their projects sustainable practices, that doesn’t mean that one should discredit a project that leverages a transparent ponzi strategy to fuel initial growth. Coined as Ponzionomics, the Web3 ecosystem has begun using tokens to leverage ponzi strategies for solving the cold start problem, the inherent issue for starting a new network. In Web2 we can see the prevalence of networks with platforms like Uber and Lyft, where the value of the application is based on the amount of riders and drivers who participate on the network. As more drivers join the app there is more value for riders to use the application because of the lower cost and higher availability, likewise, as more riders participate there are more opportunities for drivers to make money. The platform's ability to connect both sides of their network is what determines the value of the application for each of its stakeholders. But there is a core dilemma to all platforms and protocols that use these types of networks. In the rideshare example, riders will only use the platform if there are drivers available to pick them up, similarly, drivers will only use the platform if there are riders that will allow them to make money. So then how do you start the network? This is the cold start problem. Attempting to solve this problem and create more competitive networks, Uber and Lyft have spent the majority of their revenue subsidising rides and promoting driver programs to build up dense networks. Web3 protocols are no different. They too face this dilemma of trying to seed networks so their protocols can generate value for their users, but they have a new tool that they can use: tokens. As a new method for representing value on the internet, projects use token design to create incentives that align a diverse group of stakeholders around a single objective. Ponzinomics consists of using tokens in ponzi-style game theory to help create networks and solve the cold start problem. Productive PonzinomicsA classic example of ponzinomics can be seen in the Olympus protocol. Their objective is to build a community-owned, decentralised and censorship-resistant reserve currency that is asset backed with deep liquidity. In order to fulfil this objective, first they were in need of protocol owned liquidity. To incentivize this using ponzi-style game theory it has designed a set of actions that a OHM token holder can take to participate in the network. This diagram describes two stakeholders in the Olympus game for which they each have the option to stake, bond, or sell their OHM tokens. Staking and bonding promises extremely high and consistent returns to all token holders and actively contributes towards their objective of building their protocol owned liquidity while selling is detrimental to everyone. All participants in the network choosing to stake their tokens is the most dominant strategy,which also happens to be beneficial for the ecosystem. This led to the advent of a (3,3) meme in which users would socially signal that they would cooperate with each other on the network to support raising capital on the protocol. This method of socially recruiting people into the network used a shared affinity to sell a complex fee structure with high returns to uneducated investors, which raises almost every red flag that a ponzi can set off. As people joined the network and contributed their liquidity, through the (3,3) meme the tokens value began to grow faster than its fair market value, which led to a large restabilization in price. While some argue that a lot of people lost money which makes it unethical for Olympus to solve their cold start problem through this ponzinomics strategy. The project's smart contracts and mission is all auditable by anyone in the space to understand the tokens fair value. An investor might not be able to personably do that but it is their responsibility to try before engaging in an investment. The Problem With PonzinomicsA project that is currently in the process of seeding its community through ponzionomics is called STEPN. STEPN is a Web3 Fitness app where you can mint digital shoes to earn crypto from walking, jogging, and running. Currently they have been distributing $300-$400 a day worth of token rewards to users of their application, which is completely unsustainable. The only way token holders are able to make money is if more people decide to join the network and buy shoes or existing users decide to keep spending money to ‘upgrade’ their shoes. If they do not change anything in their economic policy and people start to lose faith in the system, it will eventually collapse. Here there are clear signs of a ponzi: High and consistent returns for a low risk activity like walking, along with a complex tokenomic strategy that a typical user might not understand. While STEPNs ponzionomics is aligning its users around an exercise brand, as of now there is no strong reason for joining and staying on the network. This is the problem in ponzionomics right now, here a network is being created, but without a clear sign of an end goal for what its purpose is. Capturing ValueInvestors and users need to ask whether the project is capturing the value that it is creating. When a token is originally created, it is worth nothing. But when a token is aligning a community of contributors around a single transparent objective, it is able to create value. Olympus is a prime example. It aligned its contributors by giving token holders a dominant strategy of staking or bonding, which brought in liquidity to the protocol to fuel Olympus’s mission of becoming a reserve currency. Through the ponzi-like distribution of their token they were able to exchange their token for a basket of cryptocurrencies that now supports the token's value. STEPN has not proved that it can capture any value yet. It could try to monetize its sports brand or find ways to connect members of its community. Until it is able to do that, it is simply just another token with potential value. Like Uber or Lyft, early high expenditures to build an initial network of drivers and riders without proving its monitizability, a project like STEPN could be similar. While it is using ponzinomics to try to build a network that could be monetizable, it has not proven that it will be yet. While any ponzi-like strategy gives the potential for some early investors to accrue more value than late investors. Wouldn't you think that is justified for the risk that they are taking? While it is not practised today this is the start of a new movement where the first participants could be rewarded for the risk that they are taking by joining an empty network. For example, if Uber or Lyft wanted to launch in a new city, instead of spending their cash on pushing out marketing campaigns, they could pull in an initial set of drivers and riders by rewarding them with tokens. Like stock in a company, these tokens could grant the users with platform voting rights, align them with skin in the game, and even be sold off for cash. It is important to remember that different types of communities require different types of ponzi games depending on the objective of the network. In order to be a successful participant in a new network users should:

If you want to keep exploring these topics…

⚠️ Security Scares: Osmosis Liquidity Pool BugAuthor: d0wnlore Osmosis is a blockchain built with Tendermint and the Cosmos SDK. Predominantly known for its integrated automated market maker (AMM) functionality and overlapping protocol to facilitate token swaps, Osmosis DEX, Osmosis is popular destination for exchanging tokens within the Cosmos ecosystem. On June 7 a major release in the Osmosis blockchain, version 9 otherwise known as Nitrogen, was released and deployed through validators in the Proof of Stake blockchain. Upon release a simple yet significant liquidity pool (LP) bug was discovered within minutes of deployment, which affected the AMM functionality and Osmosis DEX. The bug was a miscalculation performed whenever liquidity was added or removed in a liquidity pool in the AMM, which can lead to quickly draining an LP and giving an oversized amount of shares of a pool – and thus the underlying tokens – to the user that initiated the trade. Once reports of this bug surfaced, a series of events unfolded:

Wallets that were deemed to have exploited the bug intentionally were quickly analyzed by Osmosis to have been funded by centralized exchanges, likely tied to personal information linked to Know Your Customer (KYC) practices that could be leveraged in an arrest or legal case if needed (Osmosis had tweeted that law enforcement had been contacted). With the threat of punishment, most of the culpable wallets digitally signed letters of intent to give back some of the funds (about $2 million of the $5 million initially lost before the chain was halted). In the end Osmosis stated that they would cover unrecoverable and accidental use of the bug through the Osmosis developer fund and not the community pool. The bug likely made its way into the v9.0 release due to pre-release testing that focused more on advanced functionality being introduced in the major v9.0 upgrade. TakeawaysKYC RiskIn this Osmosis breach, centralized exchanges used their KYC information to help Osmosis track down the perpetrators. But the same information can be used against innocent users. Depending on the circumstances those exchanges may be obligated to hand over your personally identifiable information (PII) and undermine efforts to conceal your identity. A simple action such as initially funding your wallet through assets purchased in one of these exchanges, even from years ago, could compromise your identity in such circumstances. Protocol ResilienceIncidents like this can be an indicator on how likely a project will continue to weather the bear market. This bug could have led to much more damage if all parties surrounding the Osmosis ecosystem - developers, validators and community – weren’t as proactive in coming to quick solutions to stop continued exploitation of the bug and helping each other come to terms with what happened. Although Osmosis DEX has lost a significant amount of TVL since this attack – which may not be totally attributed to the attack itself, given the overall crypto market – it’s events like this that also become learning lessons for protocols and the crypto ecosystem as a whole. Human ErrorWriting bug-free and secure code is something all teams can and should strive for. But ultimately code and the processes that push out that code for consumption are fallible to bugs introduced by humans, whether it’s through new code that was just written or code that had been buggy and dormant in underlying parts of a protocol or applications, waiting for someone to discover the bug. Trusting code to handle any amount of your wealth has risks. But just like protocol teams can mitigate risks in releasing buggy code, you should look into steps to reduce your risk exposure should a protocol you use have an issue like that suffered by Osmosis. 🛠 BANK Utility (BanklessDAO token)With over 5,000 holders, BANK is one of the most widely held social tokens in crypto. So it bears asking, where are the best places to put our BANK to use? The five protocols below will allow you to deposit BANK in a liquidity pool and earn rewards. To get going, just click on the name, connect to the app, filter by BANK, and start earning passive income.   ⚖️ BalancerBalancer has two 80/20 liquidity pools, meaning that you are required to deposit 80% BANK and 20% ETH in the pool. There is one pool on Ethereum and another on Polygon. Once you’ve provided liquidity, you’ll receive LP tokens. Keep an eye out for opportunities to stake these LP tokens. There is nearly 500,000 USD in the two Balancer liquidity pools. 🍣 SushiSwapSushiSwap has a 50/50 BANK/ETH pool. As with Balancer, you will receive LP tokens, and while you can’t stake them on SushiSwap’s Onsen Farm yet, you may be able to in the future. Liquidity providers earn a .25% fee on all trades proportional to their pool share. The SushiSwap pool has a little over 100,000 USD in liquidity. ⏛ Rari Fuse PoolThe Rari Fuse Pool allows you to borrow against your BANK or earn huge APY by providing assets like DAI to the pool. At present, all borrowing is paused for this pool. There is over 450,000 USD deposited in the Pool 🦄 UniswapThe Uniswap V3 liquidity pool is 50/50 BANK/ETH, and provides a price oracle for the Rari Fuse Pool. By depositing in the Uniswap pool, you can earn fees and help enable borrowing on Rari. This pool currently has over 500,000 USD in liquidity. 🪐 ArrakisYou can also provide liquidity to the Arrakis Uniswap V3 pool. The ratio is about 2/1 BANK/ETH. This pool is new, and only has a bit more than $6,000 in liquidity. In the future, you may be able to stake your BANK/ETH LP tokens within the protocol to earn additional rewards. Lending TacticsBeginner TacticsHow to Earn COMP Tokens With Compound FinanceAuthor: DeFi Dad Intermediate TacticsHow to Borrow and Lend Any TokenAuthor: William Peaster How to Trade Interest Rates with DeFiAuthor: Will Nicoll How to take out an interest free loanAuthor: Kolten Bergeron How to earn yield with Frax FinanceAuthor: William M. Peaster Advanced TacticsHow to Take Out a Self-Repaying LoanAuthor: Scoopy Trooples 5 ways to earn fixed-rate yields on DeFiBankless Writer: William M. Peaster 🏆 BanklessDAO Cryptocurrency Challenge: Mid-Season UpdateIn a bear market environment, a good portfolio is one that isn’t in the red. Of all the Cryptocurrency Challenge competitors, only one can say that they’ve preserved their stake. Currently, Tommo is in the lead! With over a month remaining in the competition, it’s still up for grabs though. 1% behind Tommo is lawlm, and rounding out the top five we have pavel, Dane, and AAAAAAAAAAppl. Buying GMI was the best bet so far. This basket of high growth early stage DeFi protocols such as Convex, Tokemak, and Alchemix outperformed the other four options: the Arrakis BANK/ETH pool, BANK, the leveraged BANK position, and the BANK/stablecoin option. Stay tuned for the announcement of the winner at the end of Season 4! Get Plugged InEvent HighlightsETHCC 5 —Paris, France— The Ethereum Community Conference (EthCC) is the largest annual European Ethereum event focused on technology and community. Three intense days of conferences, networking, and learning. Covering many different subjects at different levels education through conferences and workshops. The Maison de la Mutualité will be accessible from 9 AM to 7 PM July 19-21, 2022. DeFi Security Summit —Stanford, California— is the inaugural DeFi security event to address pressing DeFi vulnerabilities and mitigation strategies. The summit includes discussions and talks about DeFi vulnerabilities, cross-chain security, and audits. Confirmed speakers include Aave Head of Smart Contracts, Emilion Frangella, Nexus Mutual Founder Hugh Karp, and Optimism Security Engineer John Mardlin. August 27-28, 2022, Paul & Mildred Berg Hall, Stanford University, Stanford, California, USA. DevCon Bogota—Bogota, Columbia—hosted by the Ethereum Foundation that’s geared toward developers, researchers, and movers within the Ethereum ecosystem. Devcon aims to deliver a holistic learning experience through panels and workshops. This conference is for builders of all kinds: developers, designers, researchers, client implementers, test engineers, infrastructure operators, community organizers, social economists, artists, and more. Oct 11-14 📌 Agora Bogotá Convention Center ETH San Francisco—San Francisco California—Hailed as the West Coast’s premier Ethereum event of 2022, ETH San Francisco unites blockchain and crypto enthusiasts, as well as developers, industry experts, and tech companies. Discover more Ethereum events around the world here and check out the ETHGlobal site to get more updates about this and other upcoming events. November 3-5, 2022, San Francisco, USA. Job OpportunitiesGet a job in crypto! Do you like solving hard problems, care about building more efficient markets for everybody, and want to work at the frontier of decentralized finance? Rook is looking for full time contributors, with salaries ranging from $169,000-$722,000. There are positions ranging from engineering, recruiting, product marketing, copywriting, and design. Sound interesting? Sign up for our referral program and go full-time DAO.

🙏Thanks to our SponsorOasis.appOasis.app was born as the frontend to access Maker Protocol and create DAI. It allows you to borrow DAI, exchange your tokens internally and multiply the exposure to your collateral (among the 30 available cryptoassets). Oasis.app is now the most trusted entry point to the Maker Protocol. The long term mission is to allow users to simply and easily deploy their capital into DeFi and manage it in one trusted place. 👉 Get started with the Oasis.app 👉 Follow them on Twitter 👉 Join their Discord If you liked this post from BanklessDAO, why not share it? |

Older messages

Facebook NFTs, Arc8 Mobile Money, and Chrono Glasses From Year 2352 | Decentralized Arts

Wednesday, July 6, 2022

BanklessDAO Weekly NFT and Cryptoart Newsletter

Building Season With Making Bank | BanklessDAO Weekly Rollup

Saturday, July 2, 2022

Catch Up With What Happened This Week in BanklessDAO

Non-Fungible Tokens | Decentralized Law

Friday, July 1, 2022

A Monthly Journal Covering the Crypto-Legal Space

DAOs Get in the Golden State of Mind

Thursday, June 30, 2022

You're reading State of the DAOs, the high-signal low-noise newsletter for understanding DAOs.

eBay and Hilton Bring on NFTs, Adidas Dives into the Metaverse | Decentralized Arts #44

Monday, June 27, 2022

Dear Bankless Nation, gm gm! Last week saw NFTs invade New York City. Alongside the main event, NFT.NYC, there was a succession of very interesting and spectacular side events and parties including

You Might Also Like

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏