Net Interest - The Great Unwind

The Great UnwindPlus: Banks in Disguise (Naked Wines), JPMorgan's Reflexivity, Chinese Bank Protests

Welcome to another issue of Net Interest, my newsletter on financial sector themes. This week, the subject is Klarna. The company suffered a major reset of its valuation this week and we look at what happened. Paid subscribers also have access to additional content on breaking themes in the weekly More Net Interest section, this week on Naked Wines, JPMorgan and the Chinese Bank Protests. Today’s edition of Net Interest is brought to you by Third Bridge. Third Bridge Forum is the biggest archive of expert interviews in the world. Just last year over 16,000 investment professionals from 1,000 firms across private equity, public equity and credit downloaded over 500,000 interviews. The coverage is extensive – covering both public and private companies, in any sector, across all major geographies. I’ve seen it for myself – the insights Forum delivers are in-depth and unique. If you want to request a free trial visit thirdbridge.com/net. The Great UnwindIn his book, The Great Crash 1929, economist John Kenneth Galbraith introduced the concept of the bezzle. He defined it as the inventory of undiscovered embezzlement that exists in an economy – at any time amounting to many millions of dollars. He argued that in the good times, when people are “relaxed [and] trusting, and money is plentiful” the bezzle expands, and in a depression it shrinks. Galbraith recognised that the bezzle has a powerful stimulating effect on consumption. At its peak, everyone’s a winner – “the embezzler has his gain and the man who has been embezzled, oddly enough, feels no loss.” At this moment in the cycle, the embezzler spends more because he has more income, while the man he has embezzled spends as before because he doesn’t yet know that any of his assets are gone. “There is a net increase in psychic wealth,” suggests Galbraith. But undiscovered embezzlement isn’t the only source of psychic wealth. Charlie Munger takes the concept further. At a breakfast meeting in 2000, he identified other sources that don’t stem from illegal activities yet share the same cyclical characteristics and have the same impact on the economy. His insight was that rising asset prices can generate wealth effects whether or not those prices reflect real increases in earning capacity. Munger calls the gap that emerges the febezzle (the functional equivalent of the bezzle). The febezzle occupies a much larger space than Galbraith’s narrower formulation because it is not self-limiting: Only so much theft can go undetected but, with none of the same defences available to constrain asset prices, the febezzle can grow wildly.

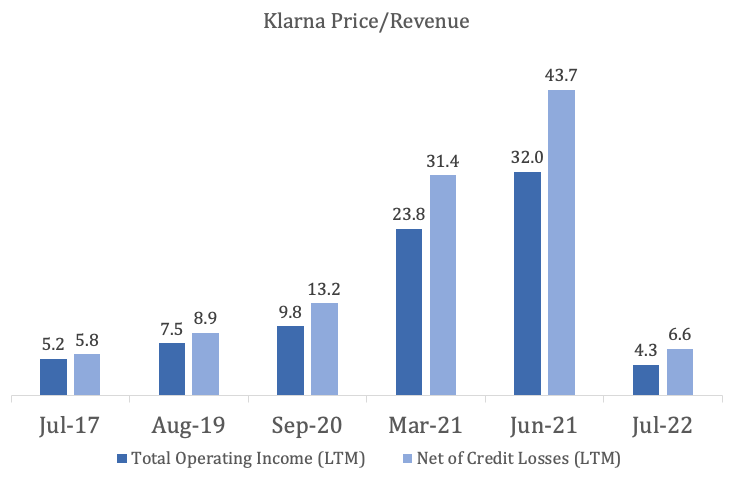

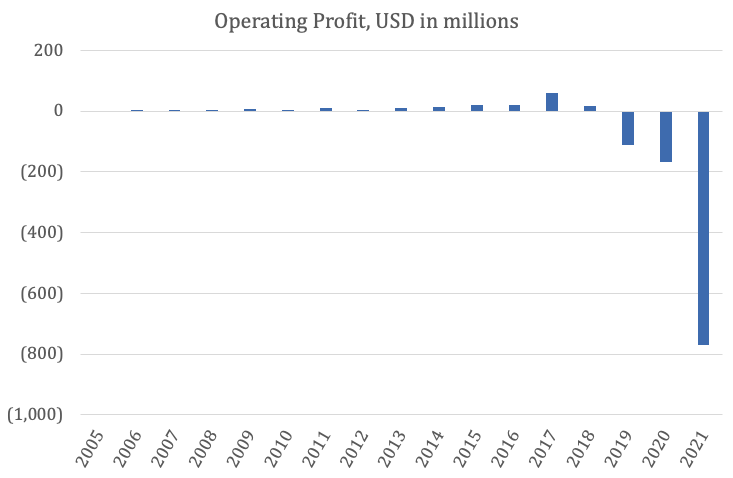

Munger made his speech in November 2000, in the window after the dotcom bubble had burst but before people fully recognised it. It is as relevant now. ¹ One way in which false wealth has been created in the current cycle is through the valuations that private companies have attracted. Nowhere has this been illustrated more vividly than at Klarna, Europe’s highest value fintech company. This week, a $40 billion debit crystallised in the febezzle as Klarna announced a new valuation of $5.9 billion (before the injection of new cash), down from its $45.6 billion valuation last summer. Klarna is an interesting case study because it had been around for many years before its valuation hit nose-bleed territory. We went through its founding story in an early edition of Net Interest, Buy Now Pay Later. The company was founded by Sebastian Siemiatkowski alongside two friends in 2005, towards the end of his time as a student at the Stockholm School of Economics. Here’s a picture of them sweating it out. The three saw huge problems in the way that online retail was conducted – debit cards had higher penetration than credit cards in Sweden but consumers didn’t like using them online for goods they were yet to receive. Their solution was an after-delivery payment product: Customers would provide Klarna with their details; Klarna would pay the merchant; and the customer would reimburse Klarna after 14 days on receipt of an invoice. They marketed it under the name Kreditor Europe. The business was profitable within six months. In the full year 2006, it made an operating profit of SEK559,000, equivalent to $76,000. Over time, it added other products – Pay Later which allows customers to split purchases into equal payments, Financing which allows larger purchases to be financed over 3-36 months and Prepayment, an evolution of the original product, giving customers time to pay after they’ve taken receipt of their purchase. At the end of 2021, the loan book was split 60% Pay Later, 34% Prepayment and 6% Financing. As the company grew, profits followed. Headcount grew to 1,380 by 2017; the loan book grew to SEK 14 billion; and operating profit grew to SEK 523 million, equivalent to $61 million. Along the way, the company changed its name and picked up a banking licence, allowing it to raise deposits. By 2017, it had SEK 8 billion of deposits on its balance sheet. In July 2017, it was valued at $2.5 billion. Being a bank has advantages and disadvantages. The main advantage is a cheaper source of funding. Deposit costs have averaged around 1.1% at Klarna over the past five years; that’s cheaper than the 7.7% coupon the company offered on a bond issue earlier this year. But being a bank also means you have to hoard a lot of capital, especially if you want to grow. Other startups can deploy their capital as they see fit; banks need to set it aside to cover a range of risks. Regulators insist that for every $100 that it wants to grow its assets, Klarna must set aside at least $11 of capital. At the end of 2021, the bank was required to hold SEK 7.8 billion in capital, equivalent to $865 million, according to regulatory filings. The trouble is that bank capital can be expensive to raise. There is an established framework for valuing banks. Jamie Dimon, Chairman and CEO of JPMorgan, references it in his annual shareholder letter: “As you know, we believe tangible book value per share is a good measure of the value we have created for our shareholders… The chart above shows that tangible book value ‘anchors’ the stock price.” Now, incumbent banks like JPMorgan tend not to grow as fast as the markets in which they operate, so they forfeit the growth premium that an emerging new business like Klarna merits. But the banking model imposes a constraint on growth and therefore on valuation. It’s a constraint fintech founders rail against. In an interview last year, Martin Gilbert, Chairman of Revolut (valued at $33 billion at the time) said, “We don’t want to be perceived as a bank because banks are rated at a far lower rating than a fintech business, so we really do need to keep that advantage of being seen as fast moving and fee-based rather than interest-based business.” Many fintech companies avoid the perception that they may be a bank by marketing themselves to the tech community. Before he left to join a buy-side firm last year, the senior equity research analyst at Goldman Sachs with responsibility for the Internet sector covered no fewer than 32 stocks. They included Alphabet (Google), Meta (Facebook) and Amazon – all classic tech companies – but they also included insurance company Lemonade and subprime lender Upstart. In their formative periods, most of this analyst’s stocks might be valued with reference to revenues. For financial companies, though, the concept of revenue is more nuanced. That’s because it’s easy for them to generate revenues: they can simply churn out underpriced credit – who wouldn’t want a piece of that?! The cost comes further down the line as credit write-offs. ² The divergence is especially stark in subprime lending segments, where revenues and credit losses are both elevated. And Buy Now Pay Later companies are active in that segment. According to a former Klarna executive interviewed by Third Bridge earlier this year, the average credit score of a customer using Buy Now Pay Later is probably somewhere around the 500 mark. Indeed, Klarna’s credit losses have been growing. In 2017, when the bank raised capital at a $2.5 billion valuation, realised loan losses stood at 3.2% of average loans. Fast forward to 2021, and they were at 6.6%. In 2021, overall credit losses exceeded even the amount of net interest income the bank booked on loans in that year. Nevertheless, Klarna became a major beneficiary of the shift in perception. The company was able to raise funds at higher and higher multiples of revenue. Its 2017 fundraising was done at a 5.2x multiple to revenue. That’s higher than where JPMorgan traded at the time (3.3x) but not materially so, given the divergent growth outlook. Klarna’s next fundraising was done in 2019 at a 7.5x multiple and last year its valuation hit the stratosphere at 32.0x. Net of credit losses, the 2021 multiple stretched to 44x revenue. With external capital now cheaper than internally generated capital (i.e. profits) Klarna was handed a unique opportunity to grow as quickly as it could. Minutes of board meetings going back three years are all publicly available and they make for interesting reading: capital raising is all the board seems to talk about! ³ And grow it did: Headcount grew from 1,380 in 2017 to over 7,500 in May this year; the loan book grew from SEK 14 billion to SEK 62 billion … and profits disappeared, as operating expenses ramped up from SEK 3.1 billion to SEK 15.9 billion. Along the way, the company used its inflated stock to reward employees. In 2020, it launched a restricted stock unit programme and also offered employees the chance to participate in the company’s equity via warrants. Some employees may even have had to pay tax based on the valuation of the stock they were awarded. When the company announced its latest fundraising this week, its chairman, Michael Moritz, stated that, “The shift in Klarna’s valuation is entirely due to investors suddenly voting in the opposite manner to the way they voted for the past few years.” That’s true, but the history of Klarna suggests it was the past few years that are the outliers rather than the present. Klarna has sufficient financial flexibility to manage the downturn and emerge from its growth surge with a solid franchise. The derating will affect some employees and venture capital investors, but won’t leave permanent damage elsewhere. But as a symbol of the excesses of the past few years, and the importance of narrative when it comes to valuation, Klarna ranks highly. 1 As we discussed a few weeks ago, in Dotcom 2.0, it took a long time for people to recognise that the bubble had burst. Online brokers would go on to win thousands more new customers even after the market had peaked. ETrade won almost a million new customers between March 2000 and December 2021. 2 There’s also an associated funding cost, but no sane analyst would neglect to offset that against revenue, would they? 3 My first job in equity research in the 1990s was as a Nordic banks analyst. In the days when information access still provided an edge (as long as it was legal) I discovered a source of monthly banking statistics available from the Sveriges Riksbank – the Swedish Central Bank. I had someone there fax them to me, dashed out to buy a Swedish-English dictionary from the local bookstore and, over the course of a weekend, I turned the information into a research note. Sadly, information provides less of an edge these days in public markets but I wonder how many people trawl through old annual reports and board minutes of Klarna, especially as they require neither a fax nor a Swedish-English dictionary to access. You’re on the free list for Net Interest. For the full experience, become a paying subscriber. |

Older messages

The Hedge Fund, the Bank and the Broker: How It All Fits Together

Friday, July 8, 2022

Plus: Countercyclical Buffers, Central Bank Stocks, Augmentum Fintech

Creating a Culture: The Case of Credit Suisse

Friday, July 1, 2022

Plus: Money Men, Pagaya, Research Budgets

Farmers That Finance the World

Friday, June 24, 2022

Plus: Inflation Accounting, Stress Tests, GameStop

How Markets Work

Friday, June 17, 2022

Plus: Norinchukin, US Mortgage Rates, Crypto Financial Crisis

A Marketer's Guide to Fund Management

Friday, June 10, 2022

Plus: Apple, Clearing Houses, Payment For Order Flow

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏