Jul 22: Kindred hails 'promising' Dutch start as profits plummet

Jul 22: Kindred hails 'promising' Dutch start as profits plummetKindred Q2, Las Vegas Sands analyst reaction, sector watch - cashless payments +More.Good morning. On a podcast this week, famed angel investor Jason Calacanis noted that when it comes to the environment for tech investment right now, investors are now asking ‘where are the profits’ versus the previous concern for growth. This is, of course, the same equation for the online operators in the US. But as Calacanis noted, the “pendulum will swing back” and growth will once again be the top concern. The only question that remains is when that day comes. Kindred Q2

Lowlands high: Along with the absence of the Netherlands, Kindred variously blamed UK affordability measures, the timing of last year’s Euros and the World Cup being shifted to the end of the year for its poor Q2 performance. But it has high expectations for its Netherlands relaunch achieved in early July.

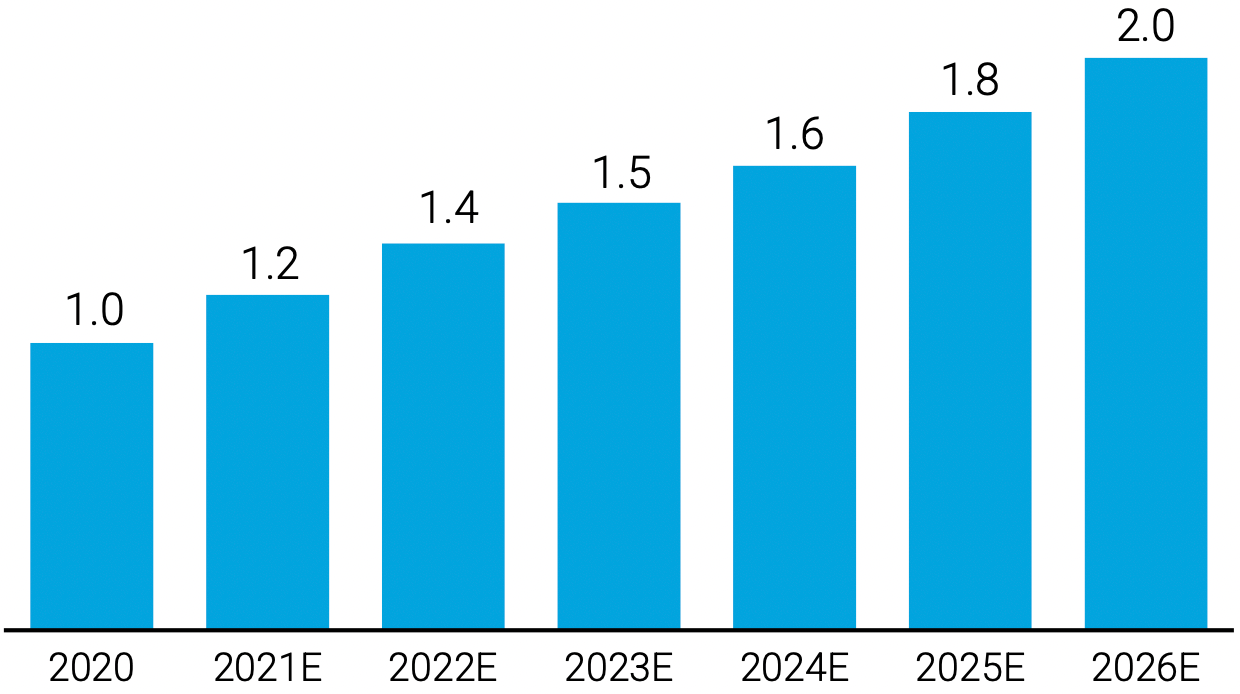

Immature: Dutch marketing spend will account for c20% of forecast sales and Tjarnstrom pointed to the relative immaturity of the media environment there.

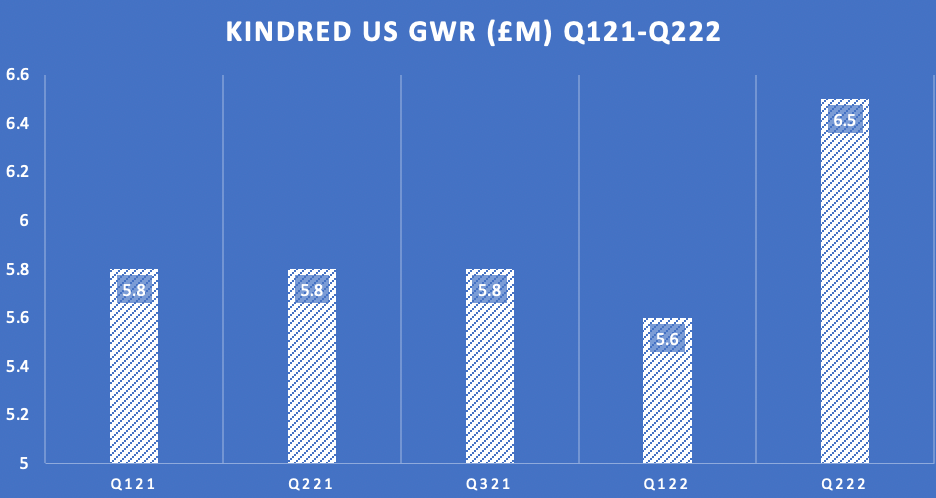

Projected Netherlands gross win 2020-2026 (€bn) Playing the multiples: In North America - where revenues stood at £7.2m - Tjarnstrom said it will be launching its in-house platform in New Jersey in Q3. But he noted the company wasn’t aiming to enter every state.

On the beach: OSB suffered across all EU markets because of a lack of major sporting events this summer; Nordics was down 2%, central and eastern Europe down 11%. Meanwhile, other major markets such as France have been hit by searing heat that is “more conducive to the beach than betting”. **Sponsor’s message**: Venture capital firm Yolo Investments manages €550m in capital across 80 of the most exciting companies in fintech, gaming & blockchain. Their Gaming Fund, regulated by Guernsey Financial Services Commission, a dedicated 29-company, €183m AUM portfolio has invested in fast-growth assets including Dabble, Kalamba, SimWin & ThriveFantasy. LVS analyst reaction

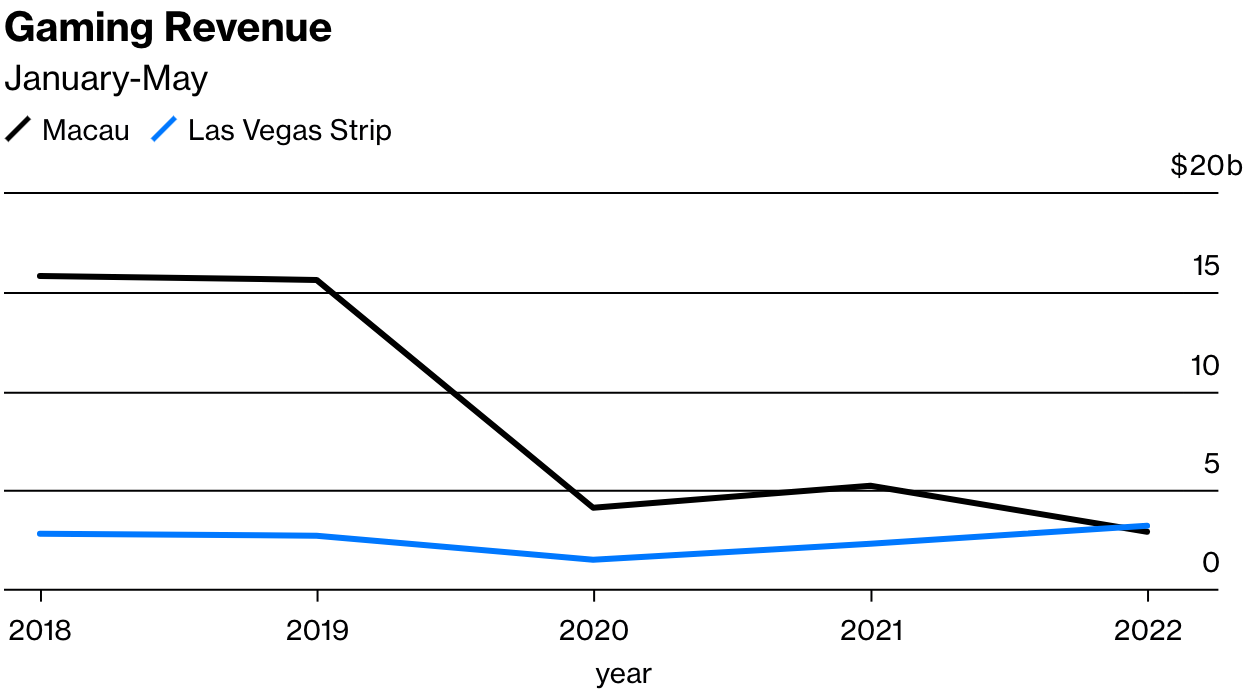

Compare/contrast: For all that MBS provided the positives in its Q2 earnings, Macau suffered $110m of adj. EBITDA losses, a worse-than-forecast outcome caused by a shortfall at the Venetian. With casinos in Macau only reopening this weekend, the position in Q3 will also be lower than previously forecast.

Reversing course: Noting the momentum in Singapore “more than offsets Macau bouncing along the bottom”, the team at Wells Fargo said while full Macau reopening timing was “a complete guess”, they could imagine a scenario where post the Chinese Communist Party meeting in Q4, there might be a “tacit” easing of its zero-Covid policy.

Further reading: “In 2019 gambling revenue was six times that of Las Vegas. This year Vegas is ahead.” Sector watch - cashlessOut of date: A point of controversy contained within the UK White Paper leak came in the proposed provisions for land-based gaming with the government apparently “not convinced’ about the consumer protection element of direct card payments on machines.

John Acres, founder and CEO of cashless payments provider Acres Technology, says that after a year of cashless operations across thousands of gaming machines his company has seen no increase in reported problem gambling.

First principles: Michaels points out that the “first question” the legislatures or gaming commissions in the US ask with regard to cashless is responsible gaming and once the safeguards are explained, “concerns quickly fade away”. “The notion that using cash to gamble is more responsible than digital payments is completely nonsensical,” he says.

The end of cash? Both Acres and Michaels note the decline of cash in other retail environments while, as Michaels adds, “without a doubt” the rollout of online sports betting and online gaming has encouraged regulators to get more comfortable with the responsible gaming protections offered by digital payments.

Big takeaway: Acres says the biggest driver of cashless gaming is consumer demand. “People are accustomed to the convenience of cashless in everyday life and want it everywhere, especially in the younger demographics.” DatalinesLouisiana: Land-based GGR fell 9.7% YoY and -7.8% QoQ to $200.1m. On a same-store basis, the total was 3.5% above 2019. For Q2, GGR was down 8.7%. Sports-betting net revenue came in at $10.9m from $132.4m of handle. Mobile handle was down 20.2% to $113.7m while retail handle fell 34.3% to $18.7m. NewslinesNuvei has partnered with the mobile payment platform Fonix to provide payment services for Eyas Gaming’s Merkur Slots and Merkur Casino brands in the UK. Eyas Gaming is a new igaming venture backed by the Gauselmann Group and launched by Bede Gaming co-founders Joe Saumarez Smith and Michael Brady. 888Africa has announced it will operate its online gambling products on the Sportingtech platform. 888 has a minority stake in the 888Africa venture. Belgium will introduce weekly deposit limits of €200 from October. Players will be able to request higher and lower deposit limits. Higher limits will be allowed if players meet credit reference checks with authorization given three days after the request is made. What we’re listening toLong-time angel investor Jason Calacanis on Bloomberg Odd Lots. “I believe the overwhelming majority of tokens are securities, but they’re being dumped onto retail investors. And this is being done explicitly by venture firms.” On social  Calendar

Contact us

If you liked this post from Earnings+More, why not share it? |

Older messages

Aug 5: Earnings extra - DraftKings looks to market share gains

Friday, August 5, 2022

Draftkings and Century Casinos release Q2 earnings

Jul 25: Promo spend lowest since start 2021

Friday, August 5, 2022

Promo spend analysis, the shares week, the week ahead, startup focus - STX, Bettor Opinions funding news +More.

Jul 27: Boyd upbeat as clouds gather

Friday, August 5, 2022

Boyd Gaming Q2, Underdog Fantasy fundraise, Kambi Q2, XL Media trading update, Bally analyst renewal +More

Jul 29: Weekend Edition #57

Friday, August 5, 2022

PointsBet Q4, Churchill Downs Q2, VICI Q2, Nevada June, $1bn lottery, sector watch - streaming +More

Aug 1: CaliPlay float latest victim of debt crunch

Friday, August 5, 2022

Playtech/Caliente, the week ahead, Lottery.com, the shares week, GLP earnings call, Lottomatica H1, startup focus - Betswap +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏