The Daily Gwei - Gas Guzzlers - The Daily Gwei #525

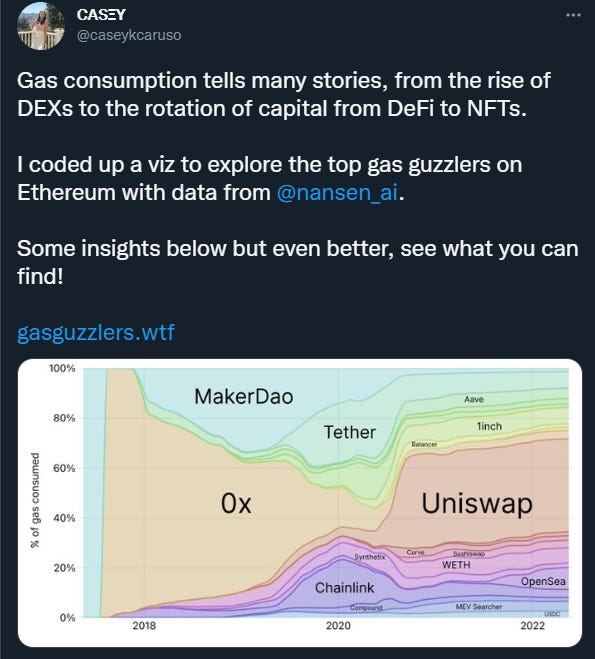

Usage of the Ethereum network has evolved dramatically over the years from being used almost exclusively for ICOs in 2017 to the emergence of DeFi in 2020 and then NFTs in 2021/2022. The usage has also become more distributed over time going from just a few apps in 2017/2018 dominating the network to a much more diverse set as you can see below. Casey’s chart clearly shows the extreme trends that have played out over the years with regards to Ethereum blockspace. I mean, just look at 2018 and 2019 - those years were dominated by 0x and MakerDao - 2 apps that now only take up a very small portion of Ethereum blockspace. Though this isn’t “bearish” for 0x or MakerDao since both of these apps are still heavily used, but it does clearly show how dramatic the change has been since 2018 in terms of how many new gas guzzlers we have now. What’s even cooler about this chart is we can spot where DeFi summer began by just looking at Uniswap’s share of gas consumed. Uniswap took off in usage during DeFi summer because of liquidity mining - everyone was farming “valueless governance tokens” and needed somewhere to sell them - Uniswap was the obvious choice. On top of this, many protocols opted to create a “pool 2” for their native token which was an incentivized pool that had liquidity for people to dump into - again, these pools were almost exclusively created on Uniswap. This all lead to a massive flywheel effect that led to a substantial increase in Uniswap’s general popularity and usage which in turn led to a large increase in Uniswap’s consumption of Ethereum gas. There’s also another reason why things have changed so dramatically over the years and that has to do with how smart contracts are coded. Back in the 2017-2020 era, smart contracts were quite gas inefficient because Ethereum gas fees were extremely low and developers didn’t feel the need to optimize their contracts. It wasn’t until DeFi summer of 2020 when developers started taking gas efficiency seriously which can be pointed to as a reason that some of the big name apps (0x and MakerDao) are now using much less gas even though they are bigger than in 2018/2019. Obviously going forward it’s going to be harder and harder to glean real insights from this chart as users continue to migrate to layer 2’s. I would even go as far as to say this chart won’t change very much from here on out - we’ll probably see layer 2’s themselves keep growing in layer 1 gas usage, but most new apps are now opting to deploy exclusively to layer 2’s which means they won’t show up on the layer 1 gas consumed chart at all. This is of course healthy for Ethereum since its vying to be a settlement network for layer 2’s. Ethereum blockspace is such a fascinating topic for me because we get to study things like the trends of gas consumption over time. Given Ethereum is still such a young network, we can expect these trends to evolve dramatically over the next few years and the Ethereum of today will most likely look very different to the Ethereum in 5 years - maybe I’ll do a follow-up post in 2027 to see where we’re at! Have a great weekend everyone, Enjoyed today’s piece? I send out a fresh one every week day - be sure to subscribe to receive it in your inbox! Join the Daily Gwei EcosystemAll information presented above is for educational purposes only and should not be taken as investment advice. If you liked this post from The Daily Gwei, why not share it? |

Older messages

A Red Letter Day - The Daily Gwei #524

Tuesday, August 9, 2022

Things just got (very) serious.

The ETH Milkshake Theory - The Daily Gwei #523

Wednesday, August 3, 2022

Banana, chocolate, or ETH flavored?

Poor Critics - The Daily Gwei #522

Monday, August 1, 2022

Ethereum critics leave a lot to be desired.

What's Your ENS? - The Daily Gwei #521

Friday, July 29, 2022

The future of finance is human-readable Ethereum.

Value Accrual - The Daily Gwei #520

Wednesday, July 27, 2022

Searching for the crypto-assets that actually accrue long-term value.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏