Aug 17: In-play "unstoppable", says Sportradar

Aug 17: In-play "unstoppable", says SportradarSportradar Q2, GAN analyst reaction, Flutter analyst reaction +MoreGood afternoon. On today’s agenda:

Sportradar Q2

On the money: In the US, CEO Carsten Koerl said Sportradar was now likely to hit profitability ahead of the previously forecasted date of 2025. He pointed to the progression on adj. EBITDA margins from minus 34% in Q321 to minus 19% in Q2 as proof of the operating leverage now being achieved in the US.

Rights inflation: the cost of rights rose 28% over the quarter to €48.7m due to new deals with the NHL, UEFA and the ATP. Departing CFO Alex Gersh said that sports rights profitability increases as the company accelerates sales while Koerl said Sportradar has “excellent visibility” over the next three years

War torn: Management noted that previous worries about the impact on revenues from the Russian-Ukrainian conflict were mitigated by growth elsewhere. **Sponsor’s message** Venture capital firm Yolo Investments manages €550m in capital across 80 of the most exciting companies in fintech, gaming & blockchain. Their Gaming Fund, regulated by Guernsey Financial Services Commission, a dedicated 29-company, €183m AUM portfolio has invested in fast-growth assets including Dabble, Kalamba, SimWin & ThriveFantasy. Entain’s record fine

Charge sheet: Social responsibility failures included being slow or not interacting at all with certain customers to minimize their risk of gambling harm.

Unacceptable: UKGC CEO Andrew Rhodes said the failures “were completely unacceptable”, adding that the loss of a license was a “very real possibility”.

Legacy issues: In a statement, Entain said it accepted that “certain legacy systems and processes” in the UK business in 2019 and 2020 were “not in line with the evolving regulatory expectations of the Commission”. No “criminal spend”: Entain added that the Commission’s statement found “no evidence of criminal spend” and had entered into the settlement with the Commission “in order to bring the matter to a close and avoid further costly and protracted legal proceedings”. Entain’s share price was down just over 3% at pixel time. GAN analyst reaction

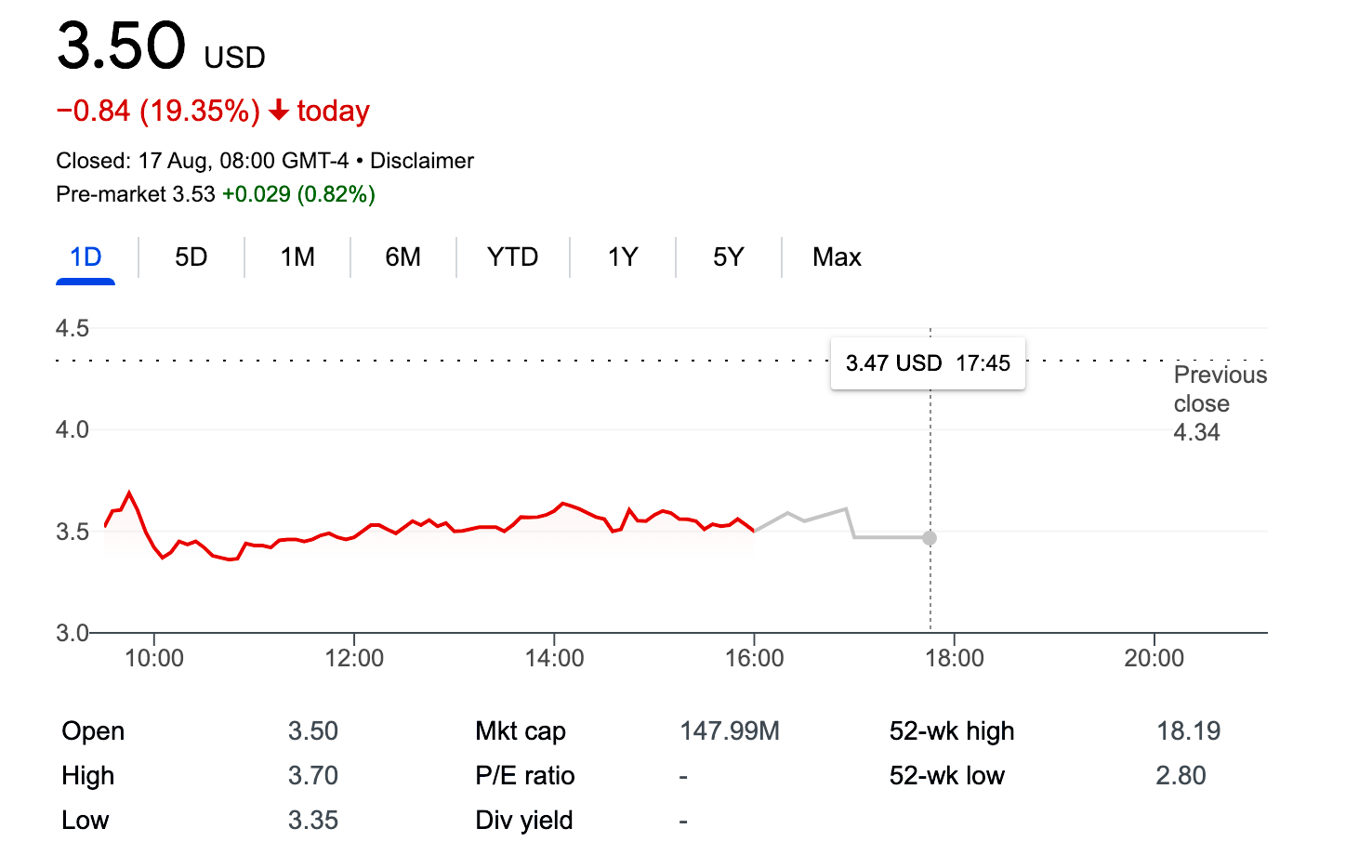

After a bruising day for its shares - down over 19% yesterday - analysts lowered their guidance for the operator/supplier with the team at Macquarie saying the results were “disappointing” and noting that the B2C guidance was now 14% lower than the target set in at the time of the Q1 earnings.

Rock the boat: More positive was the reaction from the team at B Riley who looked ahead to the launch of GAN’s sportsbook B2B product due to be road-tested with Red Rock Resorts in the Nevada locals market late this year.

🤕 GAN’s share price was down 19% yesterday Flutter analyst reaction

Rocket fuel: Looking at the 12% rally in the Flutter share price on Friday, the team at CBRE have “doubled down” on their outlook and raised their FY23 US revenue forecast by 27% to £3.18bn and EBITDA by 66% to £113m. The analysts cite the 1.5m of customers picked up by FanDuel in H1, a third of which came from pre-2021 states.

FuboTV investor dayHelp needed: Scott Butera, President of Gaming at FuboTV, said the macro environment and difficulty in accessing capital were the reasons for the group deciding to seek a sports-betting partner to develop its proposition. Burning down the house: The company was “committed” to developing the first watch-and-wager platform, Butera said, but developing and “operating a national sportsbook is capital intensive”.

Transaction iteration: All wagering transactions are done through its mobile app currently, but CEO David Gandler declined to put a timeline on when there would be a fully-integrated TV-mobile betting product.

Analysts in briefGenius Sports: The broader sector narrative about promotional spend decelerating continues, suggest the team at Credit Suisse in response to comments from Genius Sports management yesterday but the upcoming NFL season “will be telling”. Earnings in briefRaketech: Revenue was up 28.6% to €11.3m while adj. EBITDA increased 16.6% to €3.9m. Sports revenues of €1.3m were 31% of group revenues vs. 15.2% in Q221. Revenues in July were up 34.4% YoY to €3.9m. The company extended its revolving credit facility of €15m until September 2023. Playmaker: Pro forma revenue was up 10% to $7.4m while pro forma adj. EBITDA was down 14% to $1.9m. User sessions on Playmaker web properties increased 40% to 674m. The group agreed a $20m convertible loan with Beedie Capital in July Post-Q2 it completed the acquisitions of Juan Football and World Soccer Talk. Would you like to get your brand seen by more than 2,500 decision-making executives in the iGaming sector? How about positioning your business as a thought-leader in your area of expertise? Well, sponsorship opportunities at iGaming NEXT: Valletta ‘22 are still available. Built on three core pillars of content, networking opportunities and VIP hospitality, iGaming NEXT Valletta is rapidly cementing its reputation as the must-attend business event. In order to find out more about the available sponsorship opportunities, please contact iGaming NEXT at sales@igamingnext.com. DatalinesNew Jersey: Total GGR in July rose 6.6% YoY to $480.7m, land-based casino GGR was up 8% to $299m, online casino GGR was up 15.2% to $136.7m with Borgata leading market share at 31.4% of GGR, Golden Nugget in second with 25.3% and Resorts third with 22.3%.

NewslinesKinectify, a compliance and AML startup, has secured Seed round investment from OpenBet, Acies Investments, the Eastern Band of Cherokee Indians, Fifth Street Gaming, and Eilers & Krejcik. The amount was not disclosed. What we’re readingMaking a point: Disney pushes back on activist investor Third Point’s calls for ESPN spin-off, The hedge fund suggested such a move would give ESPN “more flexibility” in areas such as sports-betting. From Twitch to crypto casinos: How young players’ Twitch viewing is leading them to crypto casinos. On socialCalendar

Contact us

If you liked this post from Earnings+More, why not share it? |

Older messages

Aug 16: Genius Sports vs. the dollar

Tuesday, August 16, 2022

Genius Sports Q2, Inspired/AGS, GiG, GAN Q2s, EBET confirms restructure +More

Aug 15: Inspired makes $370m AGS bid

Monday, August 15, 2022

Inspired bid for AGS, Flutter analyst update, Disney OSB comments, the shares week, startup focus - WagerWire +More

Aug12: Weekend edition #59

Friday, August 12, 2022

Flutter says FanDuel hit profitability in Q2, 888 H1s, Super Group Q2, sector watch - financial trading +More

Aug 10: Catena seeks European exit?

Friday, August 12, 2022

Catena media strategic review, Wynn Resorts, Light & Wonder and Red Rock Resorts Q2s, earnings in brief +More

Aug 11: Entain makes all points east move

Friday, August 12, 2022

Entain H1, LeoVegas Q2, FOX Corp earnings call, earnings call in brief, Rank analyst update +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏