The Diff - Turning non-tradables into tradables

Welcome to the weekly free edition of The Diff. Last week, subscribers read a profile of FaZe Holdings, one of the most expensive-to-short stocks in existence, how rising customer acquisition costs can help a company maintain its competitive advantage, and why Goldman Sachs' arbitrage team was such a great source of hedge fund talent. Turning non-tradables into tradablesPlus! Grills, Ads, Pricing, Drops, Movies, Diff Jobs

Welcome to the free weekly edition of The Diff! This newsletter goes out to 40,127 readers, up 567 since last week. In this issue:

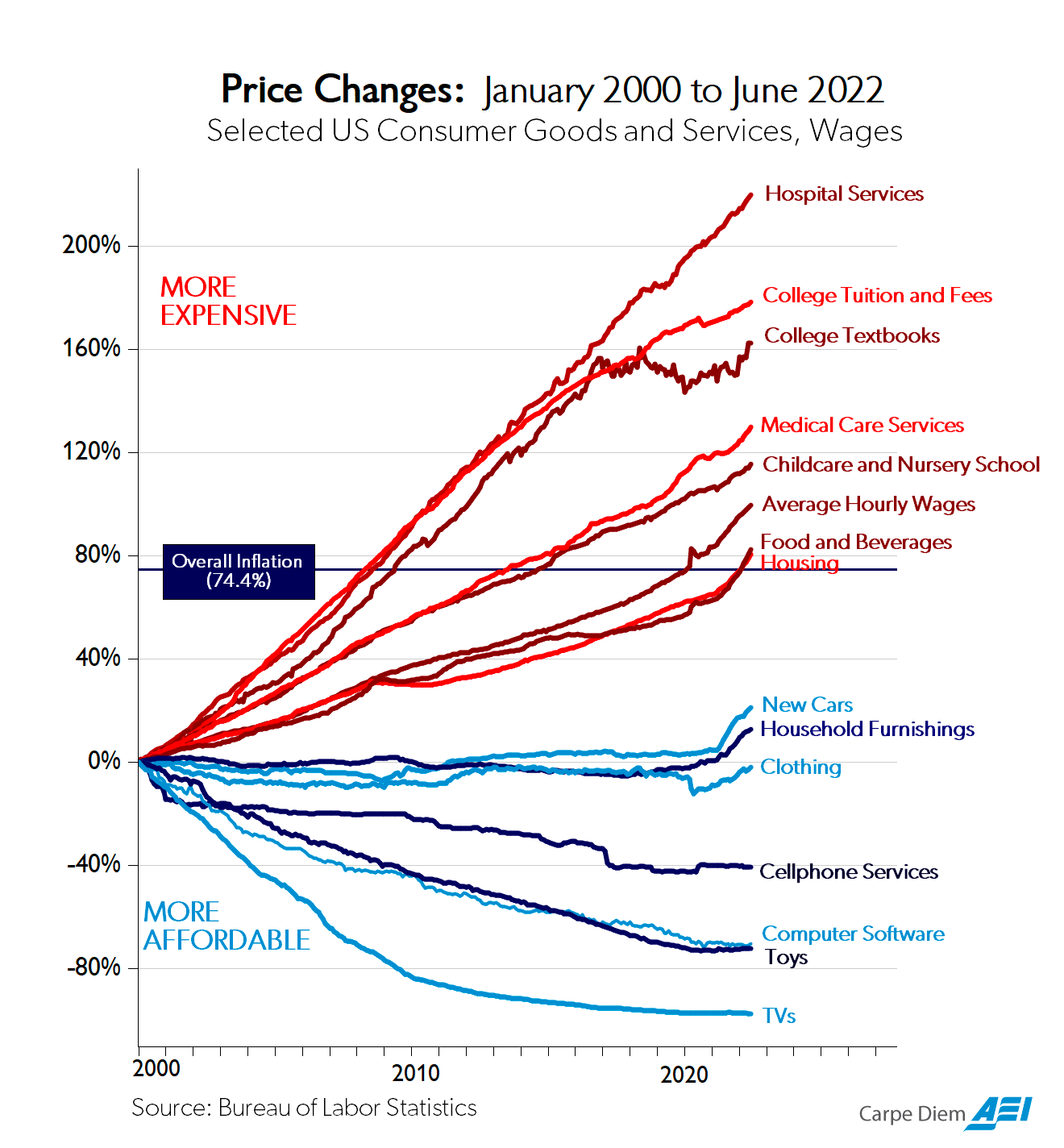

Turning non-tradables into tradablesIf you spend much time arguing about long-term inflation trends, you’ve almost certainly run into this chart before: There are three main explanations for what’s driving the bifurcation in the “chart of the century”:

The distinction between tradable and non-tradable goods is a useful one, but it’s important to avoid thinking of it as a static binary. It’s actually a dynamic continuum: products get more or less tradable over time, and the degree to which they’re sold on a global market rather than a local one also changes based on differences in transportation technology and even the nature of the product itself. “Non-tradable” is merely a statement that at a particular time, the transaction costs outweigh the mutual benefits of exchange. If you were applying this continuum analysis to the energy market historically, you’d probably treat electricity as a mostly-nontradable product, oil as a tradable one, and natural gas somewhere in between. Electricity tends to get generated close to where it’s being used, the cost of transporting oil is low relative to its overall cost, and natural gas can be moved through expensive, capital-intensive pipelines, which means that agreements to buy and sell it take place on multi-decade timescales. But there’s one sense in which electricity is very tradable indeed! This FT piece ($) talks about how the aluminum industry sometimes refers to its product as “solid electricity,” since that’s the dominant input into its costs. So aluminum smelting is one way to take a mostly-local product and put it on a global market. Data centers do this, too; it’s useful to locate them close to where the customers are, but within that limitation it’s even more useful to locate them where the cheap and stable electricity is; a data center is basically a way to export a hydroelectric dam’s output throughout us-1-east. Natural gas doesn’t just sit uneasily in the tradable-to-non-tradable continuum; it’s actually busily involved in the process of shifting from one end to the other. Natural gas was historically an inconvenient byproduct of oil extraction for a couple of reasons:

The natural gas can be injected back into the ground, but the most common solution is to flare (that is, to burn) the gas. In 2020, there were 435.03 million tonnes of carbon dioxide released from flaring. This isn’t just a waste of resources; flaring also doesn’t wholly combust methane into carbon dioxide, which means methane (that has an 80x more potent effect on warming than CO2) is released into the atmosphere. For these reasons, flare mitigation is a hot topic in the oil and gas industry. Chevron announced that they tied executive compensation and company bonuses to flare mitigation. Otherwise-flared natural gas is seemingly “non-tradable”, except for a novel solution from a startup, Crusoe Energy. They’re using this stranded natural gas to power data centers at the site of the oil well. The market for a solution like this is quite large: “[i]f half of the amount of gas flared annually was used for power generation, it could provide about [400 terrawhat-hours] of electricity” and the total “[g]lobal data center electricity use in 2020 was 200-250 [terrawhat-hours]”. The existence of Crusoe Energy is essentially the recognition that the transaction costs to bring the natural gas to market are too high, but that data is more portable than gas, and so by converting one into the other, they’re able to connect this supply of otherwise-flared gas to the demand for energized compute. (One of Crusoe’s co-founders started his career at a crypto HFT, and you might argue that Crusoe is also in the market-making business: instead of reducing the spread between bids and asks, they’re creating a market by bringing demand for computation to an oil field.) The business of turning non-tradable energy into a tradable resource isn’t going to decline alongside the oil business because it’s also important to renewables. Unlike with fossil fuels, the amount of electricity that renewables generate is variable, based on how much the wind blows or the sun shines, and so both the demand for and the supply of electricity will be fluctuating. Occasionally, the supply of renewable energy will outstrip the demand for electricity. In these circumstances, energy can either be stored in a battery, but it’s also possible, as happens occasionally on ERCOT, that prices go negative where the grid will pay for someone to take away load. This electricity is non-tradable, in the sense that nobody is demanding it, however, it’s turned into a tradable by using the surplus power to mine bitcoin.¹ There’s a number of reasons why crypto mining is particularly suitable for this use case:

The argument that bitcoin miners will make is that their presence on the grid allows renewables generators to build out a greater capacity of wind turbines and solar panels than would be feasible without their mining activities. Because of the price-sensitivity of bitcoin mining (essentially an arbitrage between the price of electricity and the price of bitcoin), they’re most willing to buy energy when it’s cheapest: when others aren’t buying. However, they’re also paid to shut down operations when demand spikes on the grid ($, Bloomberg). They’re providing a source of interruptible load to the grid, so they’re exerting a stabilizing force on demand volatility, which improves reliability for end customers. A neat detail to the story about crypto miners turning a non-tradable (electricity) into a tradable one (currency) is that some of the mining rigs have been moved into disused aluminum smelting facilities. So the electricity market’s shift from a non-tradable to tradable sector proceeds apace. And in more traditional natural gas use cases, there’s also growing tradability as LNG demand rises. Natural gas can be transported globally, at some cost. (This is a somewhat energy-intensive process, but LNG terminals have the nice benefit of having convenient access to natural gas as a power source.) LNG import terminals are an expensive asset, and in accounting terms they’re a fixed asset. But in physical terms, they aren’t necessarily: Germany is building more floating LNG import terminals, and while those are currently being used to replace a shortage of Russian gas, they’ll make the entire natural gas market more flexible over time. When demand shortfalls can be covered by moving a ship rather than building a multibillion dollar facility, they’ll be less acute—but the natural gas market will also be a more global one. European inflation is so high right now because of energy costs, and as those costs get set by global rather than regional changes in supply and demand, the world’s economic growth will be more synchronized. In the realm of international trade, you can frame tourism as converting something non-tradable; cultural capital and particularly striking geography, into something tradable by adding cheap transportation and auxiliary services. This again demonstrates the importance of portability to increasing tradability: just as the data center moves to the energy source, because bits are more portable than energy, it’s easier to move tourists to landmarks than the landmarks to the tourists. (With the notable exceptions of moving the Statue of Liberty to New York, relocating the Brighton Beach hotel, and creating mock-ups of famous landmarks in Macau and Las Vegas.) Services are generally considered non-tradable in the international context, but a lot of this depends on exactly what service is being sold and how it’s delivered. Business processes that used to be done in-person turn out to be doable in countries with low wages and a large English-speaking population, hence the rise of India’s IT sector. And as some aspects of healthcare shift from manipulating scalpels to controlling robots, surgery can get globalized, too, as long as there’s low enough network latency.² This, however, doesn’t represent a full escape from the fact that tradable goods are priced based on a global market while non-tradables are more expensive in places that are richer. Because any time a service job starts to get more tradable, the cost of the tradable piece declines—meaning that more of the price changes are dominated by the non-tradable portion. Cheaper computers and calculators reduced the cost of accounting, but also meant that more of that cost represented the price of hiring an accountant. Returning to the chart of the century, it’s not the case that housing, healthcare, and education will become particularly suited to international trade in the near future, but it’s worth pondering the ways in which they might become more tradable, and it’s healthy to assume that any contemporary notions on “non-tradable” won’t remain that way forever. What can plausibly defined as “tradable” asymptotically approaches “everything.” In the very long run, the global economy implicitly views regional variation in the costs of goods as an inefficiency, and works diligently to correct it. In a sense, a growing share of the value created in the economy consists of bits—matching goods and services to the people who want to consume them, and matching capital to the best place to deploy it, both entail adding an information layer on top of physical goods, and that information layer ends up constituting most of their value. As that value share goes up, the intrinsic mobility of bits means that more and more of the economy exists as a single global market. A Word From Our SponsorsTegus is the first port of call for M&A professionals and institutional investors ramping up on an industry or company. Get access to a database of 35,000+ expert call transcripts, spanning 5+ years, or schedule expert calls through the platform for a fraction of the usual cost. When thousands of research analysts are pooling their expert calls into an on-demand database, using Tegus is table stakes. It's the leading platform for due diligence and primary research. See the power of a Tegus subscription, and get up to data parity with your competitors, with a two week free trial through the Diff. ElsewhereI’m doing a fireside chat with Augvest next week. Topics include public and private markets, crypto, and unusual data sources. GrillsRecently-IPOed grill companies Weber and Traeger have lost 43% and 89% of their market values. Both companies went public with similar stories: exploding near-term demand because of the Covid boom in consumer durables, and a model that increasingly focused on long-duration recurring revenue rather than short-term sales. Recurring revenue models are easier to analyze, and tend to get and deserve higher multiples, but they're not a panacea: especially when there's an upfront purchase involved, and that purchase has some obsolescence risk and storage costs, it's possible for businesses to overshoot and end up with an oversupply of hard-to-move inventory. The other useful pattern here is that when one company in a given space goes public, there can be lots of reasons, but when multiple companies in the same business try to tap into the public markets at the same time, it's a good sign that people within the industry expect the secular-looking trend to be cyclical instead. (In addition to Weber and Traeger, BBQGuys tried to go public through a SPAC, and the Blackstone griddle company seems to be trying to unwind its own SPAC IPO.) For an earlier look at both companies, see this Diff writeup from around the time of the IPOs ($). AdsNetflix plans to run about four minutes of ads each hour for its ad-supported service, whose expected cost is roughly half of the cheapest ad-free plan. The interesting question to consider here is not just what the initial plan is, but what plan gives Netflix the optimal path going forward. They'll have some users churn from the ad-free plan to the ad-supported one, and they'll also hopefully have some people who sign up for the cheapest possible option, get used to the product, and then upgrade once they can afford it. So at one level, Netflix wants the ads to be annoying enough that they drive upgrades—but not so annoying that they lead to cancellations instead. Meanwhile, running a small number of untargeted ads initially is probably the right decision for them. Targeted ads need data, and the main solution to the chicken-and-egg problem of getting that data is to sell extremely cheap ads until there are enough advertisers that prices start to reflect the underlying economics of the ads. But untargeted branded ads sidestep this problem, because they're already hard to measure and are less dependent on granular data on user interactions and subsequent sales lift. So Netflix is trying to cost-effectively measure the user experience downside of ads first, and then determining the incremental revenue upside over time. PricingAttendance at Disney parks hasn't recovered to pre-pandemic levels, but revenue and profits are at an all-time high thanks to price increases and Disney's decision to charge for upgrades that used to be free ($, WSJ). Running a theme park is a capacity management business on at least three levels:

DropsCompanies have increasingly started launching products with time- and quantity-limited "drops" instead of more traditional releases ($, WSJ). Part of this is the general observation that artificial scarcity is a cheap form of marketing. But it also reflects the impact of social media: feeds implicitly weight content by how timely it is, and when something is going to be available only for a limited time, rather than being available indefinitely after it first hits the shelves, then that concentration of potential customer interest means the cadence of sales is more closely matched with the cadence of the media through which people find out about those sales. In any industry, there should be pressure for the overall industry timeline to be determined by whichever part of the supply chain combines lots of market power and a schedule all its own. Fashion is driven by PR and marketing, that naturally means that social media, the synthesis of both, sets the pace. MoviesA group of movie theaters is offering movie tickets for just $3 on "National Cinema Day," September 3rd. This is a bit similar to the idea of drops, but instead of tying it to one-time product availability, they're mostly focusing on one-time discount availability. Industries will sometimes coordinate on discounting events like this, especially if they're in a capacity-constrained business and the discount takes place during a demand lull. There isn't much opportunity cost in discounting at a time when theaters are likely to be empty, but there is some upside in getting people back in the habit of going to the movies. Diff JobsDiff JobsDiff Jobs is our service matching readers to job opportunities in the Diff network. We work with a range of companies, mostly venture-funded, with an emphasis on software and fintech but with breadth beyond that. If you're interested in pursuing a role, please reach out—if there's a potential match, we start with an introductory call to see if we have a good fit, and then a more in-depth discussion of what you've worked on. (Depending on the role, this can focus on work or side projects.) Diff Jobs is free for job applicants. Some of our current open roles:

1 You can think of the relationship between money and electrons as highly fungible for a crypto miner. Money is effectively a battery, because instead of storing value in electrons which you’ll sell later, you’re storing it in the ability to create extra electricity. 2 Healthcare actually gets tradable in two ways: medical tourism brings the patient to the cheap healthcare, and virtual medicine, where the healthcare system brings the skills to where they’re needed by converting them into bits. Surgeons from Brazil and Great Britain were able to collaborate on an operation using VR. Machine learning for preventative and diagnostic care also makes healthcare more tradable, in the sense that a large training set and an algorithm makes the “know-how to identify symptoms or early warning signs” more scalable than multiple years of human-to-human knowledge transfer. You’re a free subscriber to The Diff. For the full experience, become a paying subscriber.

|

Older messages

Longreads + Open Thread

Saturday, August 27, 2022

NEPA, FOIA, Xi, Cold Chain, China, Anglo Irish

Hand-Crafted Artisanal Liquidity Provision

Monday, August 22, 2022

Plus! Consolidation; Shareholder Activism; Cash Burn; PE and Software Compete to Eat the World; Reinsurer of Last Resort; Diff Jobs

Longreads + Open Thread

Monday, August 22, 2022

Midwits, News, Tracking, Gold, Futures; Goldman, pro and con

Inventing Demand

Monday, August 15, 2022

Plus! BNPL; Coopetition; Marketplaces and Ads; Last Mile, Last Users; Value and Rates; Diff Jobs

Longreads + Open Thread

Saturday, August 13, 2022

Style, Subcultures, Derivatives, Microsoft, Media, Square, Alexander

You Might Also Like

After inauguration, it's time to talk taxes

Wednesday, January 15, 2025

plus toad fashion + Post Malone ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Harry's Take 1-15-25 Stocks Look to Break Lower: Another Sign of a Top on December 16

Wednesday, January 15, 2025

Harry's Take January 15, 2025 Stocks Look to Break Lower: Another Sign of a Top on December 16 As we go into the new year, already with signs of a failed Santa Claus Rally and a failed first 5

🇺🇸 America's tariff future

Tuesday, January 14, 2025

A possible go-slow approach to tariffs, a spending worry for China, and the next obesity drugs | Finimize TOGETHER WITH Hi Reader, here's what you need to know for January 15th in 3:14 minutes. The

It’s a new year, get a new savings account

Tuesday, January 14, 2025

Earn more with high-yield options! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Private Equity Is Coming for Your 401(k)

Tuesday, January 14, 2025

The industry wants in on Americans' $13 trillion in savings ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

This Skateboarding Economist Suggests We Need More Skateparks And Less Capitalism

Tuesday, January 14, 2025

A skateboarder presented an unusual paper at this year's big meeting of American economists. View this email online Planet Money Skateonomics by Greg Rosalsky “The Skateboarding Ethic and the

Elon Musk Dreams, Mode Mobile Delivers

Tuesday, January 14, 2025

Join the EarnPhone revolution ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Shaping inflation expectations: the effects of monetary policy

Tuesday, January 14, 2025

Natalie Burr In economic theory, expectations of future inflation are an important determinant of inflation, making them a key variable of interest for monetary policy makers. But is there empirical

🌎 Another hottest year

Monday, January 13, 2025

Global temperatures crossed a threshold, oil prices bubbled up, and crypto's AI agents | Finimize Hi Reader, here's what you need to know for January 14th in 3:06 minutes. Oil prices climbed

Have you seen the Best Cars & Trucks of 2025?

Monday, January 13, 2025

Get a quote and protect your new wheels with Amica Insurance ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏