Earnings+More - Sep 5: UK big three's 'dollar faucet'

Sep 5: UK big three's 'dollar faucet'Flutter, Entain and 888 analyst updates, Ontario data analyst review, US regional and online update, Startup Focus - Dabble +MoreGood morning. On the agenda today:

UK big three analysis

We’ll be right back after the break: The US interests of Flutter and Entain dominate the prospects for each company as they continue to invest in their respective stateside positions, suggest the Peel Hunt team.

FlutterTurning on the taps: The “stand out” for Flutter is the potential for the “dollar faucet” to be turned on from 2023 onwards. Peel Hunt forecasts £72m of US EBITDA rising to £629m in FY26. With this in mind, they go on to suggest Entain is reaching a “valuation turning point” and they upgrade their target price to £160 vs. £145 previously. EntainDiversified: The analysts are also confident in the likelihood of Entain’s half-owned BetMGM venture hitting profitability in FY23, but they also point to the company’s new central and eastern European JV CEE Entain as a sign of its “increasing diversification”. 888Binary choice: Peel Hunt’s top pick remains 888 (house broker), which it says is the “most undervalued” of the trio but the issue for investors is “how much discount should be applied to reflect the high level of debt”. With a less developed US business, either “success of giving up” would be a positive for 888’s shares. **Sponsor’s message** Venture capital firm Yolo Investments manages €550m in capital across 80 of the most exciting companies in fintech, gaming & blockchain. Their Gaming Fund, regulated by Guernsey Financial Services Commission, a dedicated 29-company, €183m AUM portfolio has invested in fast-growth assets including Dabble, Kalamba, SimWin & ThriveFantasy. Ontario analyst view

The team at Regulus have looked deeper into the Ontario numbers and suggest the regulatory limbo of market leader Super Group means that ~C$30m of revenue was likely ‘missing’ from the first quarter’s total of C$162m.

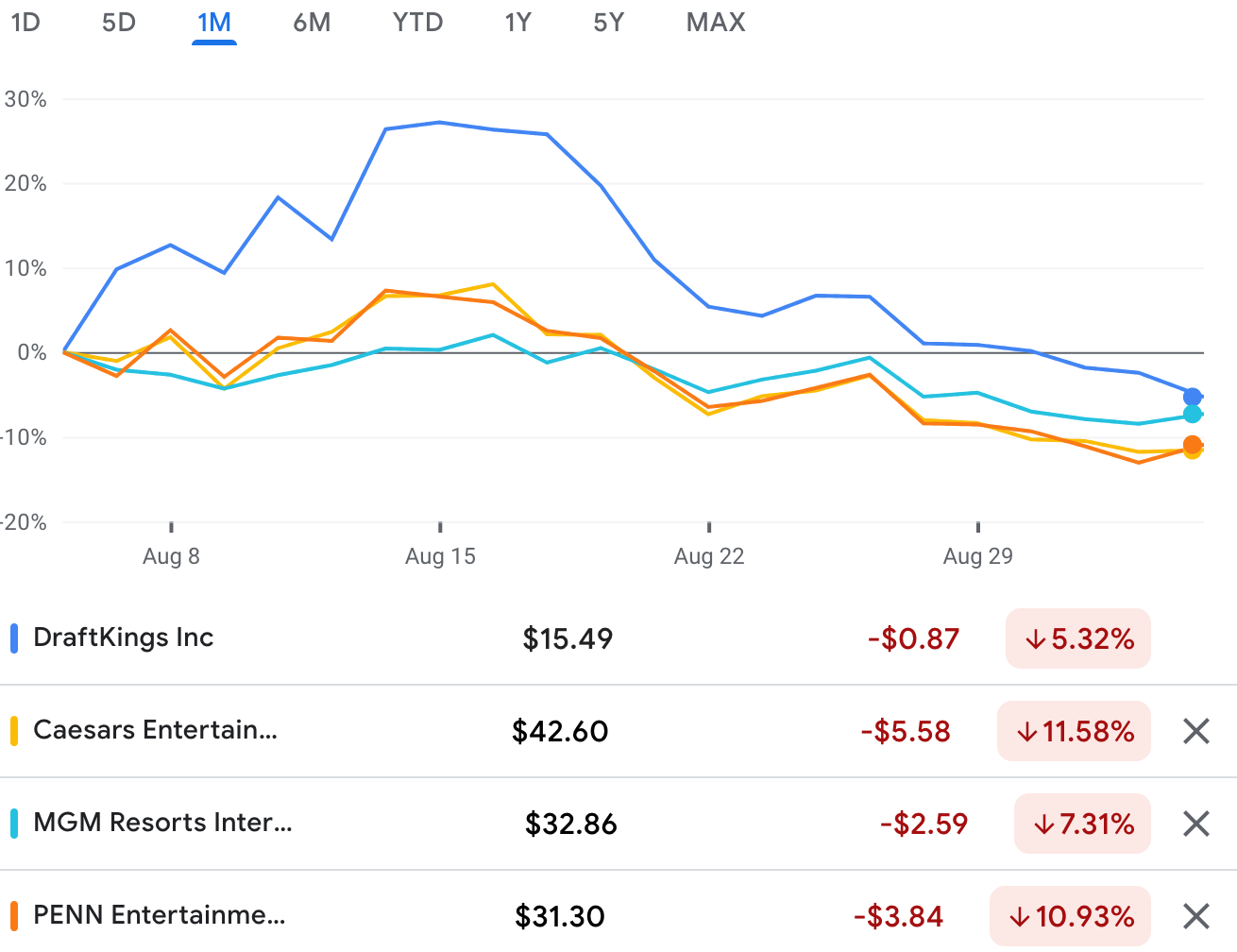

The shares week

Dog days of summer: The revival in gaming stocks in the first two weeks of August turned into a late slump in the last four days as the sector was dragged down once again by wider negative sentiment around the prospects for the macro picture.

Regional and online update

Growth of 8% YoY came from New Jersey while Delaware was up 34% but Nevada (-4%), Mississippi (-10%) and Louisiana (-8%) - outperformers in 2021 - were “growth laggards”. Macquarie expects August to be down 7% MoM due to seasonality with Q3 forecasts unchanged at $10.2bn (-1% YoY) and estimates for Q4 coming in at $9.7bn (-2% YoY).

The week aheadWhat we’re writing: Coming up tomorrow, the Startup Month for September will be looking at the new Joey Levy and Jake Paul-based micro-betting offering from Betr. Also in the same edition, there is an Inside the Raise feature on Kinectify talking to CEO Joseph Martin as well as investor Seth Young and with Ontario in the news, we have a startup (re)focus on Gaming News Canada. Check your inboxes tomorrow morning.

Startup focus - DabbleWho, what, where and when: The Twitter-meets-Sportsbet Australian-based sportsbook was formed in May 2020 and has been taking bets for a year. The company was founded by Jon and Dave Robin, who previously worked in social affiliates, CTO Scott Hutchens was previously CTO at bookmaker.com.au, CEO Tom Rundle most recently was COO at PointsBet. Funding backgrounder: $1m of pre-seed funding come from the Robins while a seed funding round was led by Yolo Group, who now own ~12.5% along with family and friends. The business is currently undertaking a $12m growth round. What's new? In the first 12 months of trading Dabble achieved 90k actives, $200m in handle and $16m NGR. The company is pleased with the early success of its Copy Bet function where players can “copy their mates”, says Jon Robin. “This is particularly popular for 15-leg parlays,” he adds. It also recently launched its first in-app live stream video watchalong. The longer pitch: Robin says the vision is to build a “global social media platform with local sportsbooks overlaid”. “Why shouldn't an MLB fan in Sydney be able to Copy Bet directly from someone in New York at the Yankees game? Global social liquidity is the end game,” he suggests.

California regulatory updateDOA: After talking to Brendan Bussmann of B Global, Truist note that both Democrats and Republicans have now come out and said “no-go” on mobile sports-betting, suggesting the measure backed by FanDuel and the like is unlikely to pass in November.

SBC/Oliver’s Wish Charity BoxingSeven bells: Those interested in watching well-known sector figures attempt to bash seven kinds of ordure out of each other get their chance with the SBC/Oliver’s Wish charity boxing event taking place on 11 November at the Hilton on Park Lane in London.

**Sponsor’s message ** Would you like to get your brand seen by more than 2,500 decision-making executives in the iGaming sector? How about positioning your business as a thought-leader in your area of expertise? Well, sponsorship opportunities at iGaming NEXT: Valletta ‘22 are still available. Built on three core pillars of content, networking opportunities and VIP hospitality, iGaming NEXT Valletta is rapidly cementing its reputation as the must-attend business event. In order to find out more about the available sponsorship opportunities, please contact iGaming NEXT at sales@igamingnext.com. NewslinesBetr has launched a F2P app available nationwide on the Apple and Google Play stores. As noted above, see tomorrow’s E+M startup month for more on Betr and its micro-betting proposition. IGT is redeeming $500m of the outstanding $1.1bn of senior secured notes due 2025 and the €500m of senior secured notes due 2024. Wild no more: Red Rock Resorts has announced a fourth casino closure, the Wild Wild West, six weeks after it said it would be demolishing three casinos which never reopened after the pandemic. According to the Nevada Independent, the company confirmed by email the casino would shut this coming Wednesday. Caesars has opened two new retail sportsbooks in Louisiana at its Harrah's New Orleans and Horseshoe Bossier City Hotel & Casino properties. What we’re readingSnap falls behind the times. “Spiegel understood that social media wasn’t about managing bloated profiles of ourselves, but about experimentation and play. On socialBrentFORD Dave, BrentFORD… Calendar

Contact us

If you liked this post from Earnings+More, why not share it? |

Older messages

Sep 2: Weekend Edition #62

Friday, September 2, 2022

PointsBet FY, Codere Online Q2, Kansas open, Ontario analyst reaction, sector watch - affiliates +More

Earnings+More pod #15

Friday, September 2, 2022

Watch now (24 min) | Transfer deadline day

Aug 30: Data extra - Ontario debut and Nevada July

Tuesday, August 30, 2022

The debut data is released by iGaming Ontario plus Nevada sees YoY falls in July.

Aug 30: IGT settles DoubleDown class action

Tuesday, August 30, 2022

IGT and DoubleDown reach settlement,

Aug 29: Exclusive - UKGC makes suicide info request of licensees

Monday, August 29, 2022

UKGC sends request for information on suicides linked to gambling, TwinSpires moves over in Michigan, BetMakers FY, startup focus - 4casters +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏