Earnings+More - Sep 16: Weekend Edition #64

Kindred, US betting survey, US market entrants, Allwyn Q2 call, sector watch – crypto +More Thought bubbleA history lesson: In its response to the news this week that Australian financial crime watchdog Austrac was investigating Entain over potential anti-money-laundering breaches, the company said the incidents occurred in the “historical period” from July 2016 to June 2020. Less than a month ago, when the company was slapped with a record £17m licensing settlement by the UK Gambling Commission, it said the action was related to “alleged historical licensing breaches” dating back to, er, December 2019 and October 2020. We sense a pattern, so may we politely point Entain in the direction of William Faulkner. “The past is never dead. It's not even past." It’s all just a little bit of history repeating. Kindred

Marathon man: During its CMD presentation, Kindred noted it was subject to a licensing review by the UK Gambling Commission related to ongoing investigations over suspected compliance failures.

No comment: The UKGC would neither confirm nor deny the licensing review, while in Norway it should be recalled Kindred lost its legal case against the Norwegian state in June.

Just capital: During its nearly five-hours-long presentation, Kindred said its target for revenues in 2025 was £1.6bn while Q322 revenues would come in at between £270m-£280m. However, after a tough Q1 and Q2, it said Q3 underlying EBITDA would be down substantially at between £37m-42m vs. £84.8m in the prior-year period.

Somewhere over the rainbow: North America is the company’s “main focus” despite the business only generating £7.2m of revenue in Q2. CCO for North America Nils Andén said the aim was to hit 10% market share by 2026.

Acid test: The UK was the company’s biggest market in H122 and “the acid test” for any operator, according to Neil Banbury, UK general manager. Kindred has a 3% market share and Banbury claimed the company has shown it can “build a challenger brand in a very competitive market.”

** SPONSOR’S MESSAGE: BettingJobs is the global leading recruitment solutions provider to the iGaming, Sports Betting and Lotteries sectors. Boasting a 19-year track record supporting the iGaming industry with a team of experts and world-class knowledge, it’s no surprise BettingJobs is experiencing rapid growth with outstanding results! Our team of industry experts will be attending SBC Barcelona, running from 20th - 22nd of September 2022. Contact info@bettingjobs.com today to arrange a meeting at the event where we will be delighted to meet with new and existing connections” US betting survey

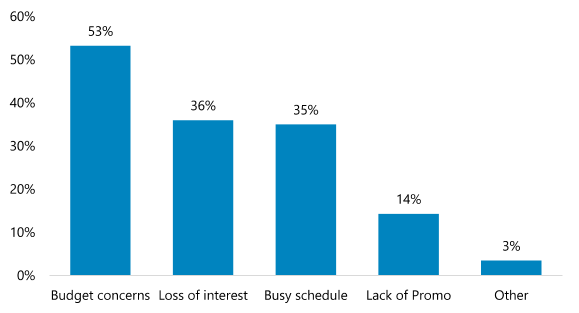

Good news/bad news: In line with the early evidence from GeoComply of a rise in betting activity at the start of the NFL season, a survey undertaken on behalf of Jefferies suggests 42% of bettors intend to spend more on gambling this NFL season compared to last. But 29% of the 2,183 respondents said they would spend less, and more than half of this cohort suggested budgetary concerns were the main cause.

💵53% of bettors who will spend less this season cite budget concerns Loyalty points: looking at the data for the average number of accounts, the survey found that 73% of respondents intended to keep only one or two accounts this season, with 11% saying they would keep three or more.

Other data points: 🔍88% of bettors sometimes, often or always compare prices on sportsbooks. 💰31% say promotions are very important when choosing a sportsbook. 📦21% place over half their wagers via parlays. 🏈18% place over half their wagers in-play App downloadsUp on the download: Looking at download data from the first week of the NFL, the team at JMP said there was “impressive” 63% YoY growth in sports-betting app downloads in week 1. The data was particularly good for DraftKings, which grabbed 48% download market share vs. 36% this time last year. See DraftKings’ New York handle advance below. DatalinesIllinois: GGR for July came in at $46.1m, up 12.8% MoM and 22.5% YoY, while handle of $516.4m was down 17.8% MoM but up 39.3% YoY.

New York wk to Sep 11: GGR for the first weekend of the NFL rose 18.5% WoW to $32.6m on a handle that rose 35.8% to $330m, the fourth highest weekly handle since opening.

US market entrants

Fanatics: It’s not often a marketing appointment is worthy of a Wall Street Journal article but such was the case with the announcement that Jason White is to join Fanatics to head up its sports-betting marketing effort. White joins from Paramount, where he was head of marketing for MTV, while previously he was at Beats and ad agency Wieden+Kennedy.

Disney/ESPN: Disney CEO Bob Chapek told Bloomberg earlier this week the company was “working” on a sports-betting app. “Sports betting is a part of what our younger, say, under-35 sports audience is telling us they want as part of their sports lifestyle,” he added.

SporttradeRing the bell: The first sports-betting trading marketplace in the US has launched in New Jersey. The subject of a E+M startup focus back in January has raised $36m in funding to date. The company is working on upcoming launches in CO, IN and LA. DraftKings/AmazonPrimetime: DraftKings has been named as the exclusive sponsor for Amazon Prime’s Thursday Night Football. The multi-year partnership will see DraftKings odds and sports-betting insight integrated into the pre-game programming, while the pair will also collaborate on TNF-themed offerings including same-game parlays. Further reading: PointsBet and WynnBet have opted not to extend their official betting partner deals with the NFL. Allwyn Q2 call

A whole new ball game: On the call to accompany its Q2 results released in late August, the company trumpeted its success in boosting online revenues for both lottery and online gaming. Across its main markets of the Czech Republic, Austria and Greece/Cyprus, the number of online customers has more than doubled over the past three years to nearly 1m.

Appealing: Talking about Camelot’s decision to end its appeal over the awarding of the UK National Lottery, Chvatal said it was good to achieve “clarity” and that the decision paved the way for the company to take over in April 2024.

Greek gifts: Since the end of Q2 Allwyn has further increased its stake in Opap to 50% (excluding treasury shares) and CFO Robert Morton said more share buying was “an option”. “We do think this is a great business and undervalued,” he said.

Recall, in Q2 revenues rose 23% YoY to €902m while adj. EBITDA was up 17% to €277m. Meanwhile, late last week the shareholders of the Cohn Robbins SPAC gave their go-ahead to the merger with Allwyn, which should see the company list in December. Further reading: see Tuesday’s Deal Talk for more on betting and gaming SPACs. Macau concessions

Seven and seven is: There were no surprises from the incumbent players with all six applying – Galaxy Entertainment, Melco Resorts, MGM China, Sands China, SJM and Wynn Macau. But with only six berths available, Genting’s involvement via an entity called GMM throws a potential spanner in the works.

Recall, Genting hit the news in mid-July when reports suggested it had turned down an approach from MGM for Genting Singapore. Sector watch – cryptoMerge here: The upgrade to the Ethereum blockchain known as the Merge (and, yes, we believe it is capitalized) occurred, depending on timezone, at some point between Wednesday and Thursday this week.

Going green: According to the Ethereum Foundation, moving to a PoS model vs. PoW will lead to 99.95% energy reduction. By way of contrast, the Bitcoin blockchain – which remains with a PoW model – uses as much energy as Belgium in sourcing coins.

Ill behavior: Experts believe the new PoS system guards against fraud while opening up the system for further innovation. They argue that it is also good news for applications built on the blockchain such as NFT marketplace OpenSea. Further reading: FTX’s Bankman-Fried continues to prop up struggling crypto players. Earnings in briefPartouche: GGR increased 10.8% YoY in Q3 to €167.9m. In the course of the quarter the group sold its stake in the Crans-Montana casino in Switzerland and closed its OSB and icasino operations in Belgium. It also acquired a stake in the Middelkerke casino, also in Belgium. The group generated €153m of the GGR figure from its French home market. Analysts in brief

NewslinesCalifornia vote: A survey undertaken by the Public Policy Institute of California has found only 34% of voters support Prop. 27 to legalize online sports-betting, with 54% against. The survey didn't ask the question about Prop. 26 to legalize retail betting. Trucking: Caesars has announced it is taking a sportsbook branded 18-wheeler on a tour around the US, stopping at sport events around the country. Imploding star: Star Entertainment has been found unsuitable to hold a casino license in New South Wales after a review that found the Star Sydney to be a haven for money laundering and organized crime. The New South Wales Independent Casino Commission called the review “shocking”. Star said it is reviewing the findings and will respond within 14 days. XLMedia has extended its partnership with Advance Local to provide betting content services to its MassLive.com portal in Massachusetts. Gaming Innovation Group has been granted a license to provide its PAM and sportsbook solution in Pennsylvania. What we’re readingOn the beach: Citi insists its new Malaga hub is no gimmick. On social Calendar

Contact us

If you liked this post from Earnings+More, why not share it? |

Older messages

Earnings+More pod #17

Thursday, September 15, 2022

Watch now (30 min) | Monsieur 10%

Deal Talk - September

Tuesday, September 13, 2022

Catena Media's strategic review, the month in transactions, where next for gaming SPACs? +More.

Sep 12: Lottery.com descends into chaos

Monday, September 12, 2022

Lottery.com funding and resignations, Allwyn float, the shares week - AGS, the week ahead, startup focus - Juice Reel +More

Sep 9: Weekend Edition #63

Friday, September 9, 2022

AGS nixes Inspired talks, FanDuel/Churchill Downs, LiveScore fundraise, Kambi M&A, sector watch - US TV sports +More

Earnings +More pod #16

Thursday, September 8, 2022

Watch now (31 min) | On the slate this week: LiveScore, betr and the new NFL season

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏