The Signal - Double-Job trouble

Double-Job troubleAlso in today’s edition: Biscuit brand power; Crypto, PEs take the rap; US banks to follow government order on China; Reliance Retail presses on

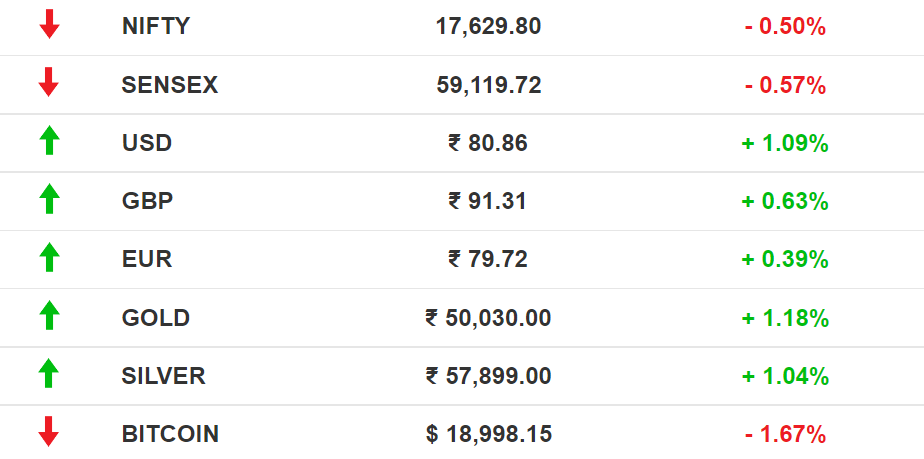

Good morning! Thums Up, the home-grown brand that was headed to extinction after Coca Cola acquired it, now commands a fifth of the Indian cola market. Rival Pepsi has only a 5% market share. Thums Up had become a billion-dollar brand in 2021, reports The Economic Times. It originally belonged to the Parle stable which owns Parle-G, the largest selling biscuit brand in the world. Read on to know what that one is up to. 🎧 A cheating scandal has rocked chess. Moonlighting is proving to be a dealbreaker for IT cos. The Signal Daily is available on Spotify, Apple Podcasts, Amazon Music, and Google Podcasts, or wherever you listen to your podcasts. If you enjoy reading us, why not give us a follow at @thesignaldotco on Twitter and Instagram. The Market Signal*Stocks: IPO-bound Oyo won't be happy about this one. Softbank, its largest investor, has slashed its internal valuation to $2.7 billion from $10 billion. Domestic equities dipped after the 75-basis point interest rate hike by the US Federal Reserve. Several European central banks have followed the Fed but Turkey, where prices are rising at 80%, slashed benchmark rates. The Indian rupee fell to a new low and the Bank of Japan began defending the yen for the first time since 1998. Early Asia: The SGX Nifty shrunk (-0.37%) at 7.30 am India time. The Hang Seng Index lagged (-0.13%). Nikkei 225 was shut on account of Autumnal Equinox Day. FMCGBiscuits Remains The Favourite ChoiceBiscuits are one of the cheapest ways of sating hunger, especially in times when food becomes scarce or prices rise. That helps low-priced biscuits such as Parle and Britannia transform into high-recall brands. So much so that Parle is using its brand power to sell merchandise products such as mugs and tote bags. Pandemic push: In April and May 2020 when the country shut down, Parle-G clocked its best ever sales in history as it almost became a staple for those toiling on Covid duty as well as those who made long inter-state treks to reach home. Meanwhile, broking firm Edelweiss believes that biscuits are a good bet for investors as well. It expects biscuits to help Britannia expand its reach in rural areas as well as benefit from lower palm oil and wheat prices. FINANCEOf Ponzis And PyramidsInsiders in the world of high finance are seeing Ponzi and pyramid schemes everywhere. Crypto: JP Morgan chief, Jamie Dimon, called crypto tokens as “decentralized Ponzi schemes”. Dimon, however, does not dismiss stablecoins if properly regulated. That brings us to Tether. A court has asked the token issuer to show how it backed USDT with US dollars. This is to disprove an allegation that it issued USDTs without enough dollars to prop up bitcoin valuation. Meanwhile, there is top leadership churn in the industry. PEs: Mikkel Svenstrup, CIO at Danish pension fund ATP, said that the private equity industry is now resembling a pyramid scheme. Svenstrup said funds are now merely passing portfolio companies from one to another at ever increasing valuations. Such tactics to hold up valuations are not uncommon when capital scarcity closely follows easy-money conditions. Remember the Global Financial Crisis of 2008-09? WORKSoftware Giants Want To Kill The MoonlightIt has happened. A side hustle will get you a pink slip at Wipro. The company fired 300 staff for clandestinely working for direct rivals. Fellow IT giant Infosys has also warned employees of termination if they took up work outside business hours, for rivals or not. Tata Consultancy Services has mandated its employees to work from office at least three days a week. There are outliers. Food tech company Swiggy gave the green signal to let employees take up a second job after securing an official nod. Also happening: Meta and Google are laying off staff without calling it mass layoffs. The tech giants are reorganising departments and asking employees to find new roles at the company within a time frame. Some are left with no roles and resentfully quit. Meanwhile, the Adani and Ambani groups have entered into a no-poaching pact.

BANKINGA Dove Among The HawksPowerful American bankers have pledged to quit China the moment the US government gives the signal which it would in the event of China attacking Taiwan. The chief executives of Citi, Bank of America and JP Morgan told a US House Committee they will follow whatever the government instructs them to do. High stakes: US and European banks pulled out of Russia after it was hit with sanctions for invading Ukraine. For the first time, a country’s central bank too was cut off from the international financial system. The sanctions upended the global economy, flinging several countries into an unprecedented inflationary spiral. Japan remains the last holdout for negative interest rates with Switzerland too raising rates from -0.25% to 0.5% on Thursday. The Bank of Japan said it will not raise rates for some time. BUSINESSIsha Ambani Goes ShoppingReliance Retail’s new leader Isha Ambani appears to be doubling down on beauty products & fast fashion. How? The company is looking to pick up rights for beauty and personal care products retailer Sephora from its current franchise holder Arvind Fashions. It’s also planning to open six mega clothing stores under a new brand that could compete with Marks & Spencer and H&M, which incidentally are under the Reliance Brands umbrella. Bonus: Sephora is a premium French beauty and skincare chain which already has a footprint in India with 24 stores in 12 cities. Blueprint: Earlier this year, Reliance Retail announced plans to run an e-commerce business and open 400 exclusive stores to take on the likes of Nykaa and Myntra. It bought a stake in Insight Cosmetics and partnered with Gap to become its official retailer. The company is taking a tiered approach and snapping up high-end brands to tap into the appetite for personal care and fashion, thanks to growing disposable incomes of younger generations. FYIBehind bars: The Supreme Court has sent former Fortis Healthcare promoters, Malvinder Singh and Shivinder Singh to prison for six months in the Daiichi-Fortis case. And another one: Swiss company Proton VPN is shutting down its servers in India in a move to protest the government's rule to collect information about its users. Crossover: Manesh Mahatme, the head of WhatsApp's India payment business, has left the company after 18 months to join Amazon India, according to Reuters. Sweeping action: The National Investigation Agency has arrested 100 people linked to the Popular Front of India, mostly in the South. Immersive: Google is taking aim at Dolby by developing new HDR and 3D audio formats for “premium media experiences”. New rules: Telecom minister Ashwini Vaishnaw has said India is working on at least three new laws to create a comprehensive digital regulatory framework. FWIWRacing fiesta: After two years, Formula One is back in Singapore with a bang. The ticket price is more expensive than other locations but the city is still expecting lots of tourists. Celebrities such as Green Day and Marshmello will perform at the event. If you’re planning to have a dekko, make sure you're carrying a fat wallet. A table at swish nightclubs and restaurants for the weekend will cost up to $70,000. Bond recruitment: Who is going to be the next James Bond? After Daniel Craig bid farewell to the iconic role, 007 producers Barbara Broccoli and Michael G are on the lookout for the next actor who can take up the title. But whoever signs the contract will have to play the part for at least 10-12 years. TV to gaming: Ted Lasso, the fictional character from a popular show on Apple TV+ is coming to FIFA 23, with his team AFC Richmond. EA, the parent company of FIFA, is trying to attract new audiences who are fans of the TV show. Enjoy The Signal? Consider forwarding it to a friend, colleague, classmate or whoever you think might be interested. They can sign up here. We recently got funded. For a full list of our investors, click here. Want to advertise with us? We’d love to hear from you. Write to us here for feedback on The Signal. If you liked this post from The Signal, why not share it? |

Older messages

Google’s choice

Thursday, September 22, 2022

Also in today's edition: Spotify's Audible ambitions; Facebook tries democracy; Luxury beats inflation; It's YouTube vs TikTok

Adani lays concrete plans

Wednesday, September 21, 2022

Also in today's edition: Apple's puppet; Bangalore baker trounces Amazon; Will NPCI cap it or cop out? Plant-based meats are uncool now

Aadhaar gets a security patch

Tuesday, September 20, 2022

Also in today's edition: VCs, PEs under Sebi's scanner; Apple TV's dilemma; The youth are done working; Jet 2.0 is waiting for engines

Nightmare for investors

Monday, September 19, 2022

Also in today's edition: China has caught the chill; Russian rock, Indian cut; I-bankers go corporate; SCO concludes

Rigs in the boondocks

Saturday, September 17, 2022

How the Ethereum Merge and crypto downturn affected the fortunes of India's small-town entrepreneurs

You Might Also Like

An easier way to share emails with friends

Tuesday, November 26, 2024

Every year we bring the highest quality software to RocketHub for an insane BFCM event. This year is no different! BFCM starts now so check the page below for one new lifetime deeaaal drop each day.

$25,000/mo from a boring niche news website

Tuesday, November 26, 2024

Don't overlook niche news...

Your "golden ticket in a chocolate bar" moment

Tuesday, November 26, 2024

A $250K+ affiliate is ready to work with you View in browser ClickBank Logo Ever heard of Charlie and the Chocolate Factory? The story begins with a brilliant chocolatier announcing that he will be

The Productize course is 48% off for the next 48 hours!

Monday, November 25, 2024

Save almost $250 on the web's best resource for learning how to productize your services and scale your way out of the "time for money" trap. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🌁#77: Amid Big Model Chaos: Small Models and Embeddings Steal the Spotlight

Monday, November 25, 2024

plus our usual collection of interesting articles, relevant news, and research papers. Dive in!

🦅 Masterclass with Jose Rosado - Confirmation

Monday, November 25, 2024

Add the event to your calendar ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🛍️ Advise.so Black Friday DEAL IS LIVE

Monday, November 25, 2024

GM Nerds You probably already know I run hands-down the BEST SEO community on the internet–certainly the most active by a mile. That's the Advise community, and it's 10/10. Currently it costs

$1 Million Blog (without Google) + Best Early Black Friday Deals!

Monday, November 25, 2024

What happens when you try to grow a website without even worrying about Google? Sure, you still might follow some of Google's best practices like building internal links...but you're really

The #1 Reason You’re Struggling on LinkedIn

Monday, November 25, 2024

Yo Reader, In yesterday's email, we talked about why most LinkedIn strategies flop harder than a bad infomercial. Today, let's dig deeper. Here's the cold, hard truth: Most people are stuck

Big, sexy, expensive... and great for your next product launch [Roundup]

Monday, November 25, 2024

Say goodbye to the traditional agency and hello to algorithm-driven results. No more slick-talking account managers or convoluted strategies. All-in-one Amazon Advertising solution, minus the fluff and