Astral Codex Ten - Mantic Monday 10/17/22

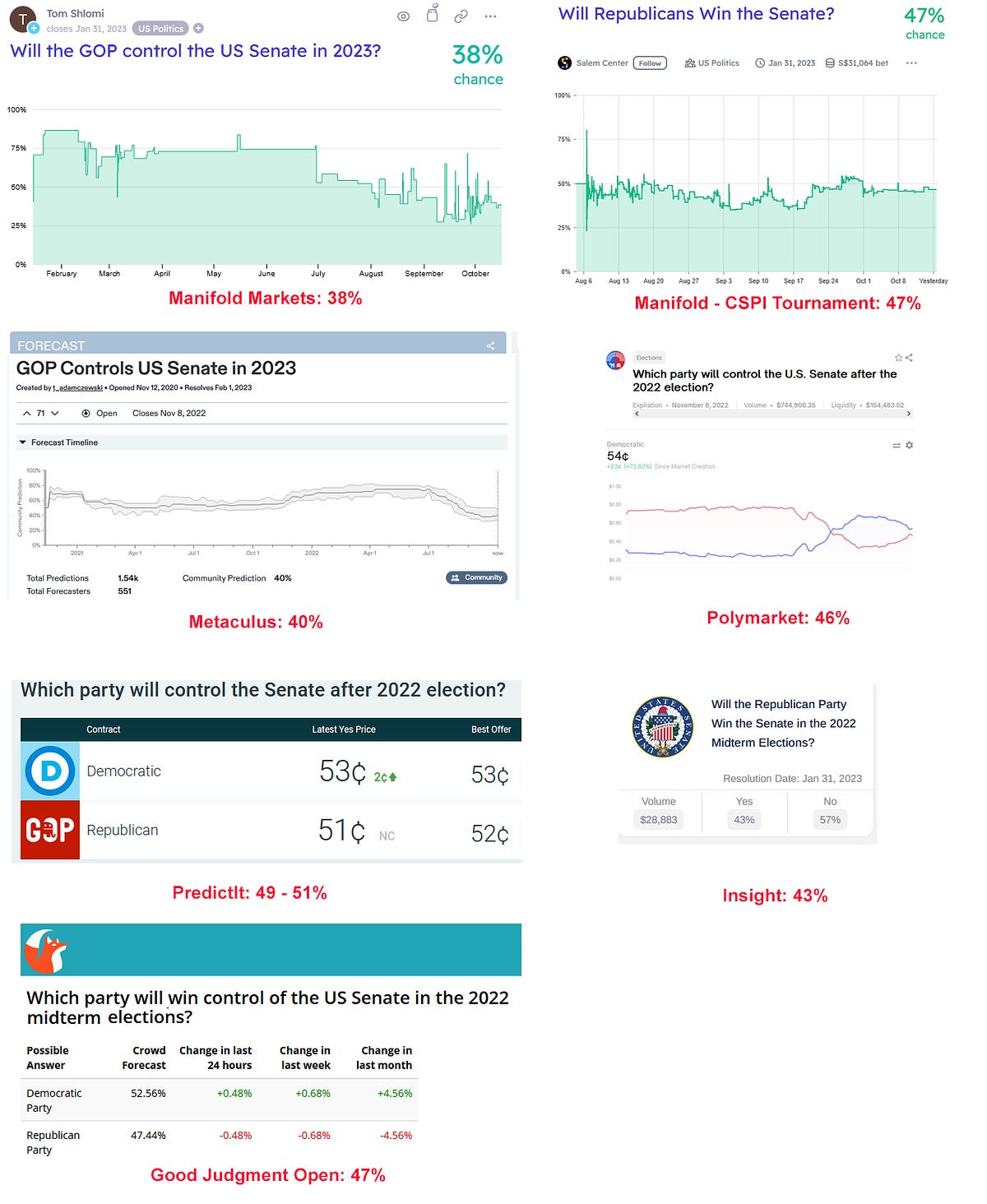

Mantic Monday 10/17/22What do Sam Altman, Matt Bruenig, and the Sacramento Kings have in common? -- Are the polls wrong? -- CFTC vs. EverybodyMidterm ExaminationPolls this year look bad for Senate Republicans. Pollsters’ simulations give them a 22% chance (Economist), 34% chance (538), or 37% chance (RaceToTheWH) of taking power. Even Mitch McConnell has admitted he has only “a 50-50 proposition” of winning. But polls did pretty badly last election. ”Least accurate in 40 years”, said Politico. On average they overestimated Biden’s support by four points, maybe because Republicans distrust pollsters and refuse to answer their questions. Might the same thing be happening this year? If so, does it give Republicans reason for optimism? Prediction markets say . . . kind of! The lowest forecaster is higher than the highest pollster! Taking 538 as an example, forecasters range from 5 pp higher (Manifold) to 17 pp higher (PredictIt). Tournaments and real-money markets tend to give higher numbers than play-money sites. I would go with 47% on this one, based on the convergence between GJO, CSPI, and Polymarket. CFTC vs. PredictIt (and everyone else), Part IIThe Commodity Futures Trading Commission is the US agency regulating prediction markets. In August, they told PredictIt (the biggest political prediction market) to shut down, effective in February. Now a motley group of stakeholders are suing the CFTC for a stay of execution. Plaintiffs include:

You can find the complaint here. The plaintiffs write:

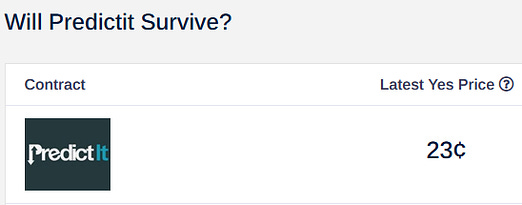

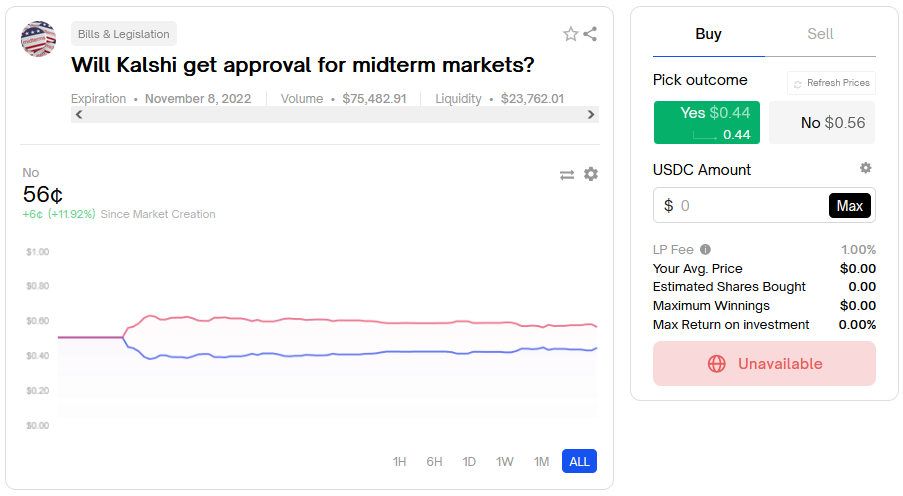

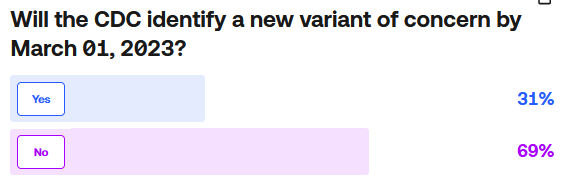

I am not a lawyer, but it sounds kind of like they’re saying “the decision was bad, and the Administrative Procedure Act says regulators shouldn’t do bad things”. I am split between the part of me which hates government regulators doing bad things, and the part of me which feels like this is how you get a cover-your-ass-ocracy that never does anything at all without fifteen layers of paperwork and ten triillion dollars per action. Whatever. At least this time it’s in my favor. Of course there are prediction markets about it:

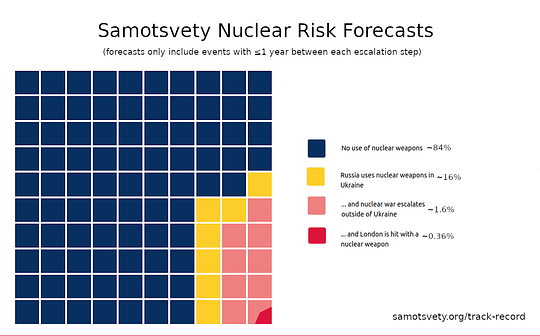

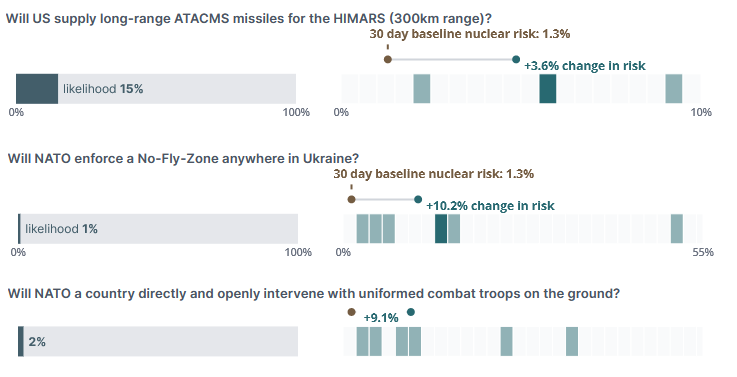

Nuclear Warcasting, Part 2Samotsvety Forecasting is a team made of top prediction market players and tournament winners, vaguely affiliated with effective altruism, who make predictions in the public interest. Earlier this year, they got attention for forecasting the risk of nuclear war - in particular, they said there was an a 0.01% per month chance of London getting nuked this spring. Since then, most of the fear has crystallized into a specific scenario. Suppose Russia is losing very badly in Ukraine. Putin, fearing a coup or revolution at home if he gives up, decides to use a tactical nuclear weapon, ie a “small” nuke more suited to winning battles than destroying cities. He nukes a Ukrainian battlefield position. The West is enraged at this violation of the nuclear taboo and feels like it needs to respond decisively - maybe by nuking something on Russia’s side, or through some other act of extreme escalation. Then Russia feels like they need to respond, and eventually it escalates to strikes on major cities and global nuclear war. There are reasons for doubt. Tactical nukes wouldn’t really be useful in Ukraine; the battle lines are too spread out and there’s no single place where a nuclear explosion could take out a substantial portion of Ukraine’s forces. In the past, nuclear powers have accepted lost wars gracefully rather than turning to nukes. And the Russians deny it, and saying this is all just Western propaganda intended to scare people. Amid this uncertainty, Samotsvety has published an update: now they are at 16% chance that “Russia uses any type of nuclear weapon in Ukraine in the next year”, and 0.02% per month of a strike on London. Although they didn’t mention it this time, they previously said the risk of a strike on San Francisco was a little over half that of London; I don’t know if that’s changed. See also Dan Keys’ comment here for some skepticism of Samotsvety’s process. Swift Centre is a lot like Samotsvety; they’re a collection of top forecasters brought together by EA to make important predictions. They also took a swing at the nuclear question, and said 9.1% chance of a hostile nuclear detonation in Europe in the next six months. They didn’t calculate the risk that this would spread to global war, but they did discuss how different scenarios would bring the risk up or down: One of my hopes for forecasting is that it eventually becomes so well-validated that decision-makers can take these kinds of considerations into account: “Should we sent ATACMS missiles to Ukraine? It would have such-and-such benefits, but also increase the risk of nuclear escalation by 3.6%, is it worth it?” We can’t directly compare Samotsvety and Swift because they’re predicting over different time periods. But assuming that there’s more risk in the next six months than in the six months after that, I think Samotsvety is a little higher but they’re not embarrassingly far off. Metaculus is a bit more optimistic than either, believing there’s only a 4% chance of detonation in Ukraine in 2023 and a 7% chance of any use in the next ~year. Max Tegmark is going much higher than anyone else and says 16% chance of global nuclear war. Kalshi Applies For Election MarketsKalshi is a regulated and fully-legal prediction market with good lobbyists and a compliance team. This means the CFTC probably won’t randomly shut them down one day. But it also means they can only create new markets with CFTC permission. In July, Kalshi asked the CFTC for permission to make midterm election prediction markets - specifically, which party will win control of the House and Senate. The CFTC has said they will make a decision by October 28 (which doesn’t leave much time for predicting to happen before the November 8 election, but I guess it sets a precedent). September was the Request For Comment period, when the CFTC solicited comments from stakeholders about what they should do. Kalshi tried really hard to get lots of people to send in positive assessments - I know this because of how many people asked me “why is the CEO of Kalshi emailing me about this thing?” Their strategy seems to have worked; among the people who wrote to the CFTC in support were:

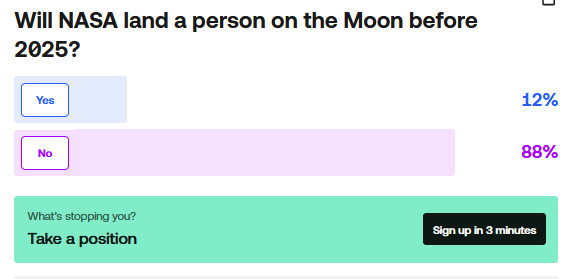

I personally declined to comment because I was still angry at Kalshi for (suspectedly!) having a role in the PredictIt decision. Now I feel kind of childish for this, because many other equally angry people swallowed their pride and agreed to send the positive comments for the good of forecasting in general - including the CEO of the company that runs PredictIt! Others including Moskovitz wrote pro-Kalshi comment but recommended that CFTC also approve other markets. Whatever, too late to change things now. I may also have sent a kind of petty email insulting the Kalshi people when they asked, which I feel slightly bad about. Oh well. As the Dalai Lama says, “don’t be petty and vengeful, but if you are, at least blog about it publicly to maximize its future deterrent effect.” I couldn’t find too many comments in opposition, but one came from a group called Better Markets, which wrote a very long argument saying this was too close to gambling and was a further step towards “the deeply troubling trend toward the Of course there are prediction markets about it:

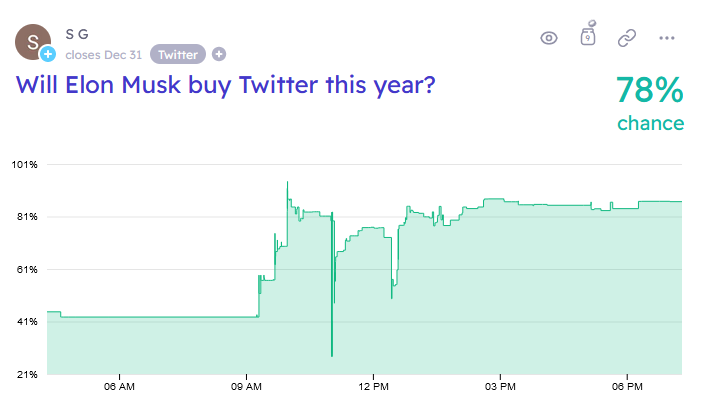

…but they disagree pretty heavily. Given that Polymarket has $75,000 of real money and Manifold has $3,000 of fake money, I’m trusting Polymarket here. Extremely related: Aristotle, the company that runs PredictIt, has also applied to the CFTC to operate election markets. They’re using the name Aristotle Exchange, so I don’t know if this is for PredictIt or some potential future project. They seem pretty serious about this and a very under-invested-in market on Manifold gives them a 53% chance of success by next year. Dustin Moskovitz’s comment on Kalshi very weakly suggests that Polymarket might be interested in this as well, although I haven’t heard anything more substantial about this. ManifastFirst of all, thanks to the Substack team for making Manifold Markets embed easily in Substack! Taking advantage of their hard work: Okay, 78% chance, but here’s what I find interesting: Compare this to Twitter’s stock price (source: Yahoo Finance) The stock price started rising at about 11:50 (I assume this is EDT); the first article I can find on the switch was Bloomberg published at 12:08. My Manifold is set to Pacific Time, so offset by three hours. It looks like the first people started trading on the news around 12:20, and the change had been fully priced in by 12:50. So Manifolders started trading on the news about 30 minutes after the stock market and 12 minutes after the media picked it up, and had fully priced it in within half an hour. This is really encouraging! I had previously worried that play money wasn’t enough of an incentive to obsessively price in breaking news, but at least on this one big question it is. This Week In MarketsApparently inspired by Dominic Cummings predicting 50-50. Polymarket is even more bearish. I’m really surprised by this - I thought I remembered hearing this was implausible and many years away. It looks like some of the probability comes from a group called Upside Foods which might get approved next year, but their website seems designed to avoid giving readers any relevant information whatsoever. From the description:

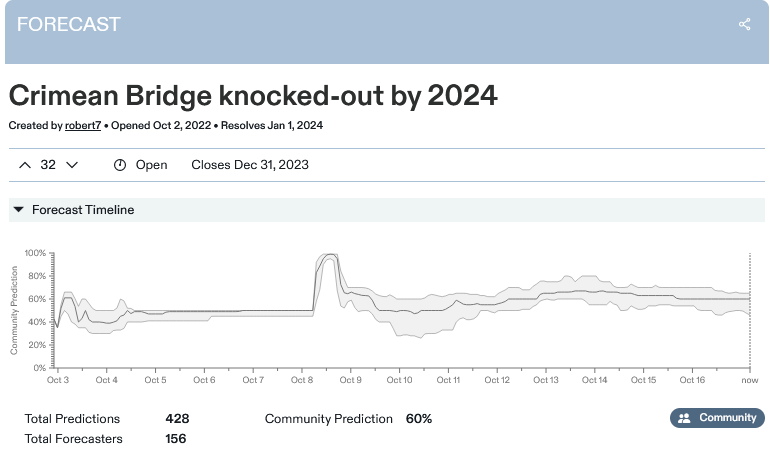

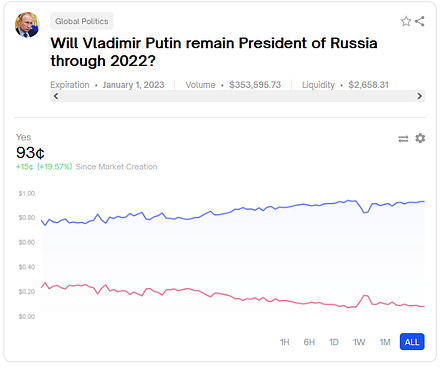

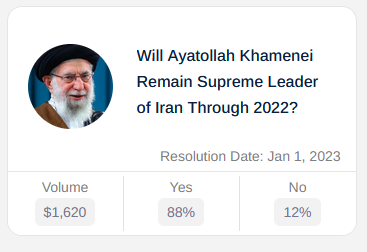

This is one of the kind of “predict the course of AI development” applications people were excited about using prediction markets for, so I’m happy to see a pretty liquid market trying it. See the Technical AI Timelines group for many others. There are also markets for the same question re: 2022 (16%) and 2024 (34%) Source: Metaculus. Although the recent blast took out a few lanes, others are still open, so the market hasn’t resolved yet. Source: Polymarket. The timeline doesn’t seem to be displaying, but the little spike in NO was on September 12 - I’m not sure what happened then. No obvious change for the mobilization on September 21. The overall story here is just Putin’s chances getting better as the year comes closer to ending without him being deposed. Manifold broadly agrees. Source: Kalshi Source: Kalshi Source: Insight, but note low volume Short Links1: Less Wrong’s Petrov Day celebration caused prediction-market-related drama. 2: Kalshi now on Bloomberg terminal:  Kalshi forecasts have found a new home: the Bloomberg Terminal.

Accurate forecasting is imperative to alpha. This partnership with Bloomberg allows traders to use our CPI and Fed forecasts when formulating their trading strategies.

More on this Bloomberg x Kalshi partnership: 3: Avraham Eisenberg is a frequent prediction market player whose insights and stories been featured here several times. He recently achieved every trader’s dream - perpetrating a financial scheme convoluted enough to make it into Matt Levine’s newsletter (he also made $114 million). Unclear at this point whether it was a crime, Karlstack gives more details, including some detective work connecting it to Eisenberg, here’s Eisenberg’s own statement where he says he’ll return some of the money. I’m mentioning this because I’ve talked about using prediction-market-winning as a proxy for other kinds of skill and intelligence, and I guess executing a $114 million crypto heist is a kind of skill/intelligence. 4: Dynomight on the dangers of conditional prediction markets. 5: Nuno Sempere newsletter September. 6: Most new prediction markets are scams, doomed, or weird crypto cruft, and I promote them out of this category only after a long history of success - but for the record, here are the new ones I've heard about recently: Mojito, Zeitgeist, Seer You’re a free subscriber to Astral Codex Ten. For the full experience, become a paid subscriber. |

Older messages

Open Thread 246

Monday, October 17, 2022

...

Highlights From The Comments On The Central Valley

Thursday, October 13, 2022

...

Links For October

Wednesday, October 12, 2022

...

Sign in to Astral Codex Ten

Monday, October 10, 2022

. Here's a link to sign in to Astral Codex Ten. This link can only be used once and expires after 24 hours. If expired, please try logging in again here. Sign in now © 2022 Scott Alexander 548

Highlights From The Comments On Columbus Day

Monday, October 10, 2022

...

You Might Also Like

How to Keep Providing Gender-Affirming Care Despite Anti-Trans Attacks

Sunday, March 9, 2025

Using lessons learned defending abortion, some providers are digging in to serve their trans patients despite legal attacks. Most Read Columbia Bent Over Backward to Appease Right-Wing, Pro-Israel

Guest Newsletter: Five Books

Sunday, March 9, 2025

Five Books features in-depth author interviews recommending five books on a theme Guest Newsletter: Five Books By Sylvia Bishop • 9 Mar 2025 View in browser View in browser Five Books features in-depth

GeekWire's Most-Read Stories of the Week

Sunday, March 9, 2025

Catch up on the top tech stories from this past week. Here are the headlines that people have been reading on GeekWire. ADVERTISEMENT GeekWire SPONSOR MESSAGE: Revisit defining moments, explore new

10 Things That Delighted Us Last Week: From Seafoam-Green Tights to June Squibb’s Laundry Basket

Sunday, March 9, 2025

Plus: Half off CosRx's Snail Mucin Essence (today only!) The Strategist Logo Every product is independently selected by editors. If you buy something through our links, New York may earn an

🥣 Cereal Of The Damned 😈

Sunday, March 9, 2025

Wall Street corrupts an affordable housing program, hopeful parents lose embryos, dangers lurk in your pantry, and more from The Lever this week. 🥣 Cereal Of The Damned 😈 By The Lever • 9 Mar 2025 View

The Sunday — March 9

Sunday, March 9, 2025

This is the Tangle Sunday Edition, a brief roundup of our independent politics coverage plus some extra features for your Sunday morning reading. What the right is doodling. Steve Kelley | Creators

☕ Chance of clouds

Sunday, March 9, 2025

What is the future of weather forecasting? March 09, 2025 View Online | Sign Up | Shop Morning Brew Presented By Fatty15 Takashi Aoyama/Getty Images BROWSING Classifieds banner image The wackiest

Federal Leakers, Egg Investigations, and the Toughest Tongue Twister

Sunday, March 9, 2025

Homeland Security Secretary Kristi Noem said Friday that DHS has identified two “criminal leakers” within its ranks and will refer them to the Department of Justice for felony prosecutions. ͏ ͏ ͏

Strategic Bitcoin Reserve And Digital Asset Stockpile | White House Crypto Summit

Saturday, March 8, 2025

Trump's new executive order mandates a comprehensive accounting of federal digital asset holdings. Forbes START INVESTING • Newsletters • MyForbes Presented by Nina Bambysheva Staff Writer, Forbes

Researchers rally for science in Seattle | Rad Power Bikes CEO departs

Saturday, March 8, 2025

What Alexa+ means for Amazon and its users ADVERTISEMENT GeekWire SPONSOR MESSAGE: Revisit defining moments, explore new challenges, and get a glimpse into what lies ahead for one of the world's