The Signal - Has Amartya Sen lost the debate?

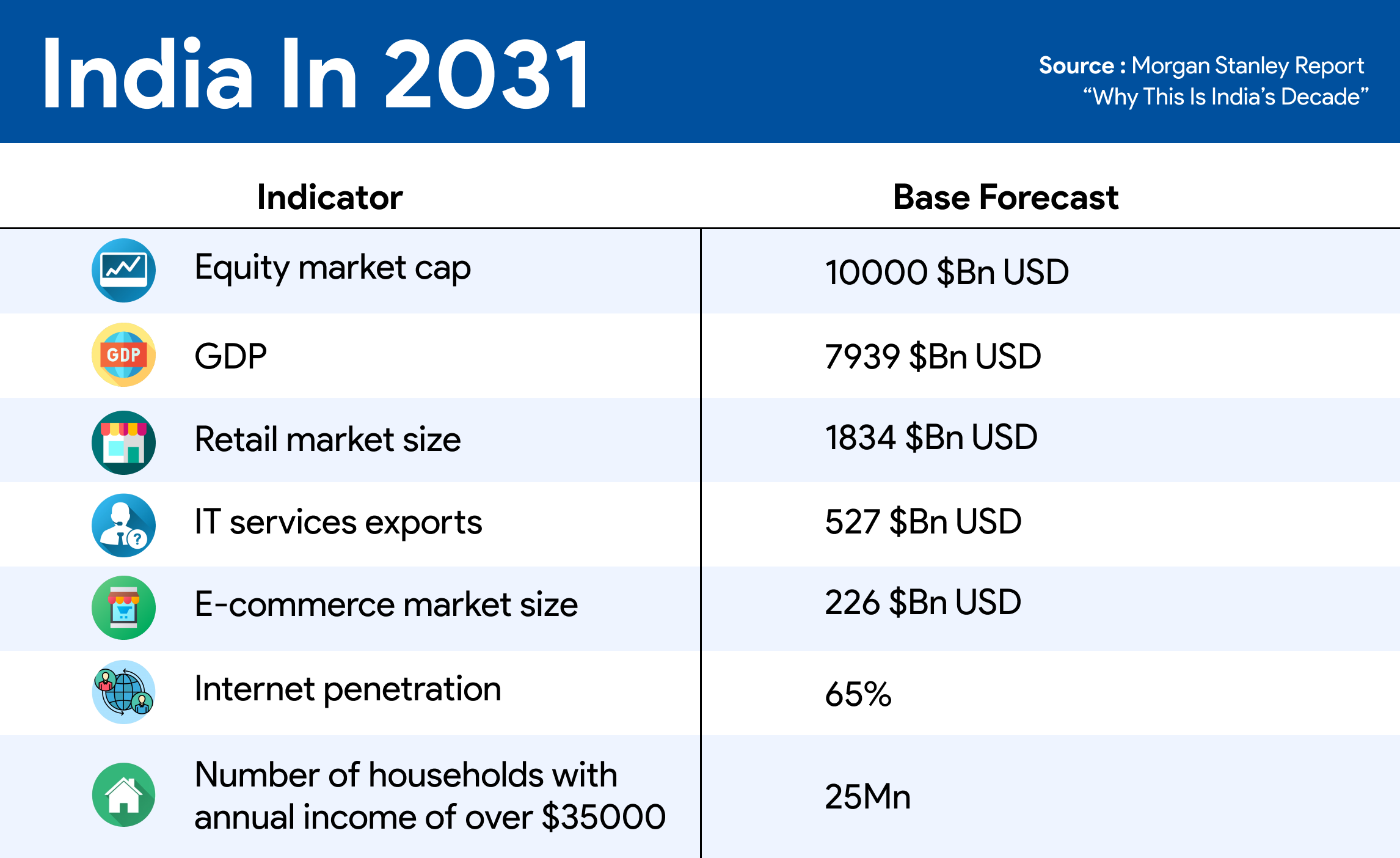

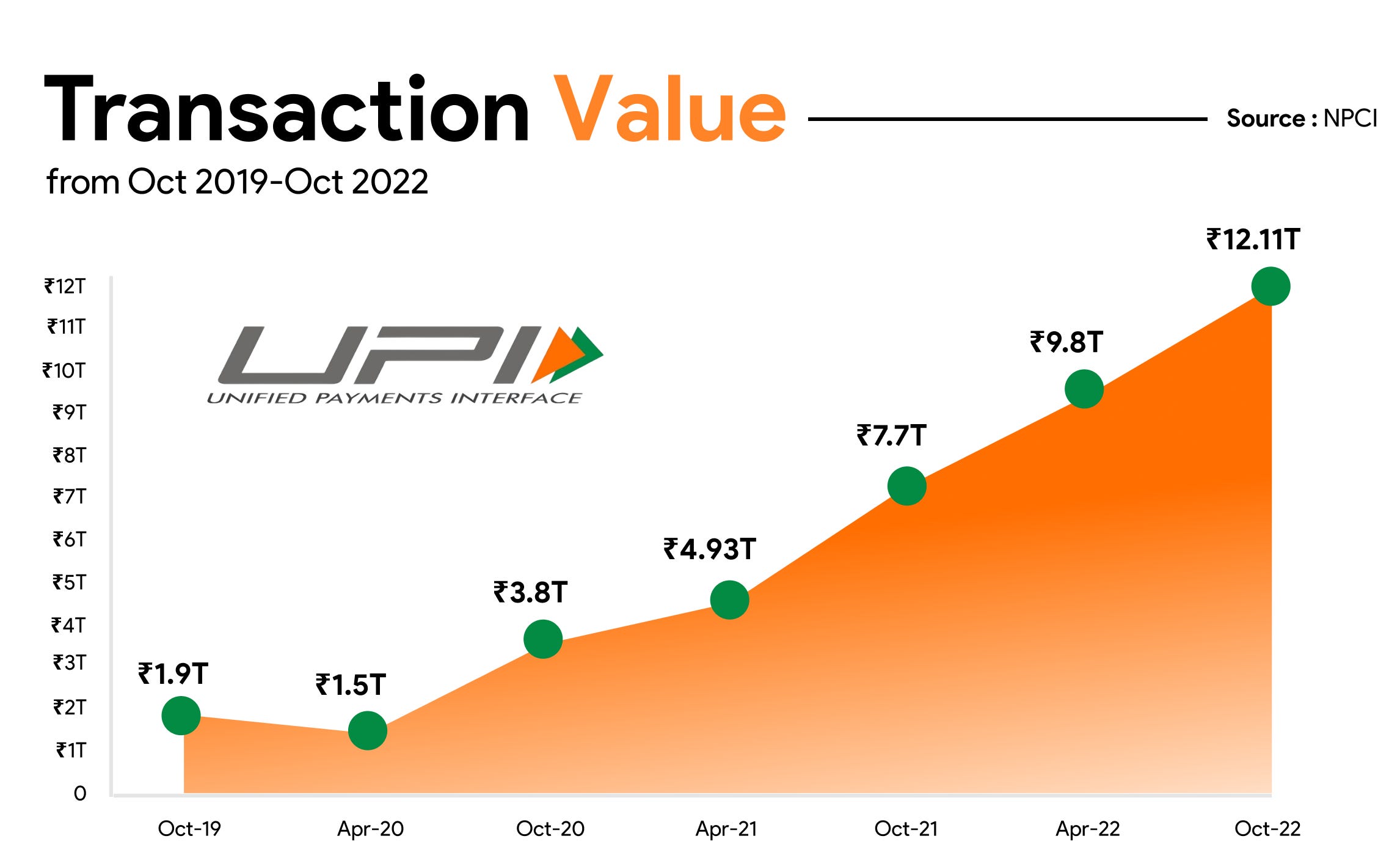

Has Amartya Sen lost the debate?Morgan Stanley says India’s shift to profits instead of redistribution will boost GDP growth and propel equity market cap to over $10 trillionGood morning! A big hello to readers who signed up this week. Welcome to The Intersection, The Signal's weekend edition. This weekend, we talk about why India could be poised to become the world’s third-largest economy by 2031. Also in today’s edition: we have curated the best weekend reads for you. Economists at the State Bank of India made a startling discovery during Diwali. In the festival week, cash in circulation in the country fell for the first time in 20 years. The season generally sees an increase in cash circulation as shopping hits its annual peak. It is not that markets were quiet and consumers did not buy stuff this year. It’s just that they were paying for their purchases electronically. “The Indian economy is going through a structural transformation,” SBI’s Ecowrap report said. “The small retail payments done through UPI/e-wallets holds around 11%-12% in the payment industry.” Digital transfers now form over 80% of all transactions, up from 11% in 2016. This structural shift is set to power India’s economy in the next few years as its heavy public investment in digital infrastructure is about to pay off. Digitisation of the economy, along with energy transmission and offshoring, supported by a government veering away from redistribution to profits will drive India’s growth in the next decade, according to Morgan Stanley. “These will make it the world’s third-largest economy and stock market before the end of the decade,” the US financial services giant forecast in a report titled Why This Is India’s Decade. Underpinning it will be the global trends of demographics, digitisation, decarbonisation, and deglobalisation. FlashbackMorgan Stanley’s prediction comes 20 years after another US superbank, Goldman Sachs, slotted India with a fast-growing bunch of emerging economies that would shift the global economic power away from the US and Europe. Those were the days immediately after the spectre of international terrorism visited the US with all its force. Aeroplanes not only brought the twin WTC towers crashing down on 9/11, but also devastated markets all over the world, and as the US prepared for vengeance, sowed doubts about growth prospects. Weeks later, in November 2001, Goldman Sachs’ global head of economic research, Jim O’Neill, proposed (pdf) the reordering of international economic policymaking, which was dominated by the Group of Seven countries, or G7, to accommodate emerging economies. “It is time for better global economic BRICs,” O’Neill wrote in his eponymously titled paper. The relative weight of Brazil, Russia, India and China (BRICs) in the global economy was set to rise from 8% to 14.2% in 10 years. They were already 23.3% of global GDP measured by purchasing power parity, he wrote. It was an unmistakable pointer to global investors that it was time they headed to new markets. Emerging markets, especially those in Asia, were poised for the next phase of value creation. The paper unambiguously recognised the rising clout of China even if it was more ambivalent about the other three, especially India. But it recognised the collective potential of the group. A follow-up paper (pdf) two years later forecast that BRICs would be collectively bigger than the G6—the US, Japan, the UK, France, Germany and Italy—in less than 40 years. It said China would overtake the US in 2041 and India would pass Japan’s economy in 2032. The formulation so captured policymakers’ imagination that leaders of BRICS (including South Africa) nations instituted an annual summit and even established a bank. True to the forecast, China is now the second-largest economy and India recently surpassed the UK as the fifth largest. Among the four, India, it said, would sustain the highest average growth rate (over 5%) for a long period of time. Between 2001 and 2021, India grew at an average annual growth rate of 6.08%, as per World Bank data. The key, Goldman Sachs suggested, was to focus on skilling a young workforce to reap the demographic dividend and keeping India open to trade and foreign investment. But like many countries, except China, India seemed to founder after the Global Financial Crisis of 2008-09. It was because the country turned to welfare and redistribution, says Morgan Stanley. Profits over redistributionThe conditions now are similar to that in the early 2000s. Asia was coming out of a currency crisis that gripped the region in the late 1990s. India cleaned up its balance sheet and put policies in place that pushed private investment, leading to the high growth phase of 2003-2007. The foundation of the country’s growth in the next few years would be the government, which has, beginning 2019, shifted focus from redistribution to profits. India’s growth slowed down because the share of profits in GDP peaked in 2007, a year after the rural job guarantee scheme MGNREGA (short for Mahatma Gandhi National Rural Employment Guarantee Act) was introduced. Structurally, raising wages does not work for India. “For India, a policy to boost profits—and then investments that create jobs and wages—appears to be a more reliable approach to generating higher real growth,” the report said. The policy choice between redistribution and fast growth was also the centrepiece of an intense debate between two stalwart economists, Nobel laureate Amartya Sen and Columbia University professor Jagdish Bhagwati, in 2013. It was also pitted as a contest between the Kerala and Gujarat models of development, Sen rooting for the former and Bhagwati backing the latter. Although it remained inconclusive then, Bhagwati seems to have eventually won over Indian policymakers. Economists believe that a country’s growth depends on what is known as total factor productivity (TFP). It is a measure of output against the input of capital and labour. If output rises at a rate faster than the rate of incremental capital employed and labour deployed, it means productivity is increasing. Technological improvements and innovations often help the same number of workers produce more and cut costs raising productivity. It is known as Solow residual and is based on Nobel Prize-winning economist Robert Solow’s work. In short, rising TFP helps fuel growth. Until now, China’s TFP at 4.1% was double that of India. But that is set to change as investments and employment rise. India will begin averaging a TFP of 3.4%, while China’s will drop to 1.2%, the report said. India has invested heavily in publicly funded and owned digital infrastructure. Morgan Stanley says Aadhaar, India Stack, the Open Network for Digital Commerce (ONDC) and the Open Credit Enablement Network (OCEN) would be key drivers of productivity and economic activity. The country’s transition to green energy will be yet another factor. Combined, these will bring supply chains to India. But crucial to these structural components of the new Indian economy is the base of government policy. Infosys founder and Aadhaar architect Nandan Nilekani has said that India was moving from a prepaid to a postpaid economy as digitisation will make it easier for lenders and sellers to assess the paying capacity of borrowers and buyers. Nilekani said that while the internet private sector, comprising companies such as Google and Facebook, was built on advertising revenue, India will build its companies based on transactions. It will drive the consumption cycle, he said. Lower corporate tax rates, government support such as the Productivity-Linked Incentive scheme, and changes to legal frameworks will help improve private-sector profits and attract capital. India will be among the only three economies in the world that will add $500 billion annually to its output to become a nearly $8 trillion economy by 2031, Morgan Stanley forecasts. Acche din, anyone? . ICYMIToke that: Thailand morphed into the Amsterdam of Asia when it legalised cannabis use in June this year. But panic set in soon after. Days after the bill was passed in the country, concerns mounted over loopholes—such as the absence of restrictions for minors, and pregnant and breastfeeding women. Thailand may head to the polls in May 2023, and it’s more likely than not that recreational use will become a hot button issue. Will the country’s booming cannabis industry survive? Lose some, win some: India’s trade volume with Moscow increased by 310% post the Russia-Ukraine war, although the trade value is significantly lower than those of China, Turkey, and Germany. The Russian economy also contracted much less than IMF estimates despite sanctions, thanks to high oil prices and global dependence on its commodities such as uranium, palladium, wheat, and yes, even diamonds. These and other insights make up The New York Times’ interactive on how Russia funds the ongoing war. Dancing with death: There’s something ironic about embalming—which preserves the deceased and gives them a lifelike appearance—facing a gradual death. For one, more Americans are opting for cremation than ever before. This story takes us through the art of embalming, revealing fascinating nuggets about high-index fluids (including one named ‘Purple Jesus’), and what it takes to be an embalmer at a time when people are also compressing ashes into diamonds or opting for “green burials”. Sole supremacy: Kanye West, formally known as Ye, has fallen from grace. And that spells bad news for his collaboration with Adidas—Yeezy—given his social currency. As it stands, it is a butterfly effect. Adidas stands to lose the goodwill it gained over the years, and this could directly impact the sneaker resale market. Or not. This article in The New York Times lists the possible consequences of West's meltdown. No laughing matter: The Onion is a 35-year-old publication that's become the internet's home of satire. Even as it entertained its loyalists, the editor-in-chief admits that their approach intrinsically changed once Donald Trump—who often blurred the lines between reality and satire—took over as US President. But satire, they believe, has become more important than ever. It's also why they decided to defend Anthony Novak, who was arrested for making fun of cops and filed a brief with the Supreme Court. This story in The Guardian profiles the folks behind the website. Under the scanner: AlphaBay was the “biggest cryptocurrency black market” on the dark web. A 26-year-old French-Canadian named Alexandre Cazes aka Alpha02, who lived in Bangkok to evade the US Drug Enforcement Administration, was the mastermind behind it all. What gave it away, you ask? The operator included his email address to welcome users to the dark web market. That, and two FBI agents who traced his crypto holdings. This is part two of Wired’s tell-all; we’d told you about part one of this cracker of a story last week. Enjoy The Signal? Consider forwarding it to a friend, colleague, classmate or whoever you think might be interested. They can sign up here. Want to advertise with us? We’d love to hear from you. Write to us here for feedback on The Signal. If you liked this post from The Signal, why not share it? |

Older messages

The murky concoction of NFTs and fantasy sports

Friday, November 4, 2022

Cricket NFT platforms FanCraze and Rario are testing the boundaries of a game of skill with their fantasy offerings.

Aditya Birla Group’s bling theory

Friday, November 4, 2022

Also in today's edition: World leaders ditch COP27; Musk needs Twitter to make money; Ad-supported Netflix is here; The online return policy window just got smaller

YouTube enters its Prime phase

Thursday, November 3, 2022

Also in today's edition: GM mustard sparks debate; India 🤝 China; Plastic isn't going anywhere; Sony's making $$$

Snap jumps on the Bharat bandwagon

Wednesday, November 2, 2022

Also in today's edition: Saudi Arabia in US crosshairs; Penguin experiences publisher's block; Accountability knocks on bosses' doors; Adobe's Figma moment

Twitter has tick fever

Tuesday, November 1, 2022

Also in today's edition: Big Tech's Halloween boogeyman; The great Indian middle-class squeeze; Carmakers on song; Rich Indians head for greener pastures

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏