Earnings+More - Caesars & DraftKings lead sector bounce

Caesars & DraftKings lead sector bounceThe shares week, US sportsbooks hold analysis, startup focus – OSAI, the week ahead including FanDuel +MoreGood morning. Today’s agenda features:

The shares weekCaesars and DraftKings were the sector’s headline beneficiaries from the wider market melt-up last week. Show of faith: The rising tide on Thursday and Friday lifted two specific sector boats, as Caesars Entertainment rose over 23% on the week and DraftKings regained ground with a 29% advance.

🚀 Caesars ended the week up over 23% Bouncebackability: DraftKings managed to retain most of the ground it lost in the immediate aftermath of its Q3 earning when it shipped nearly 28% of its value.

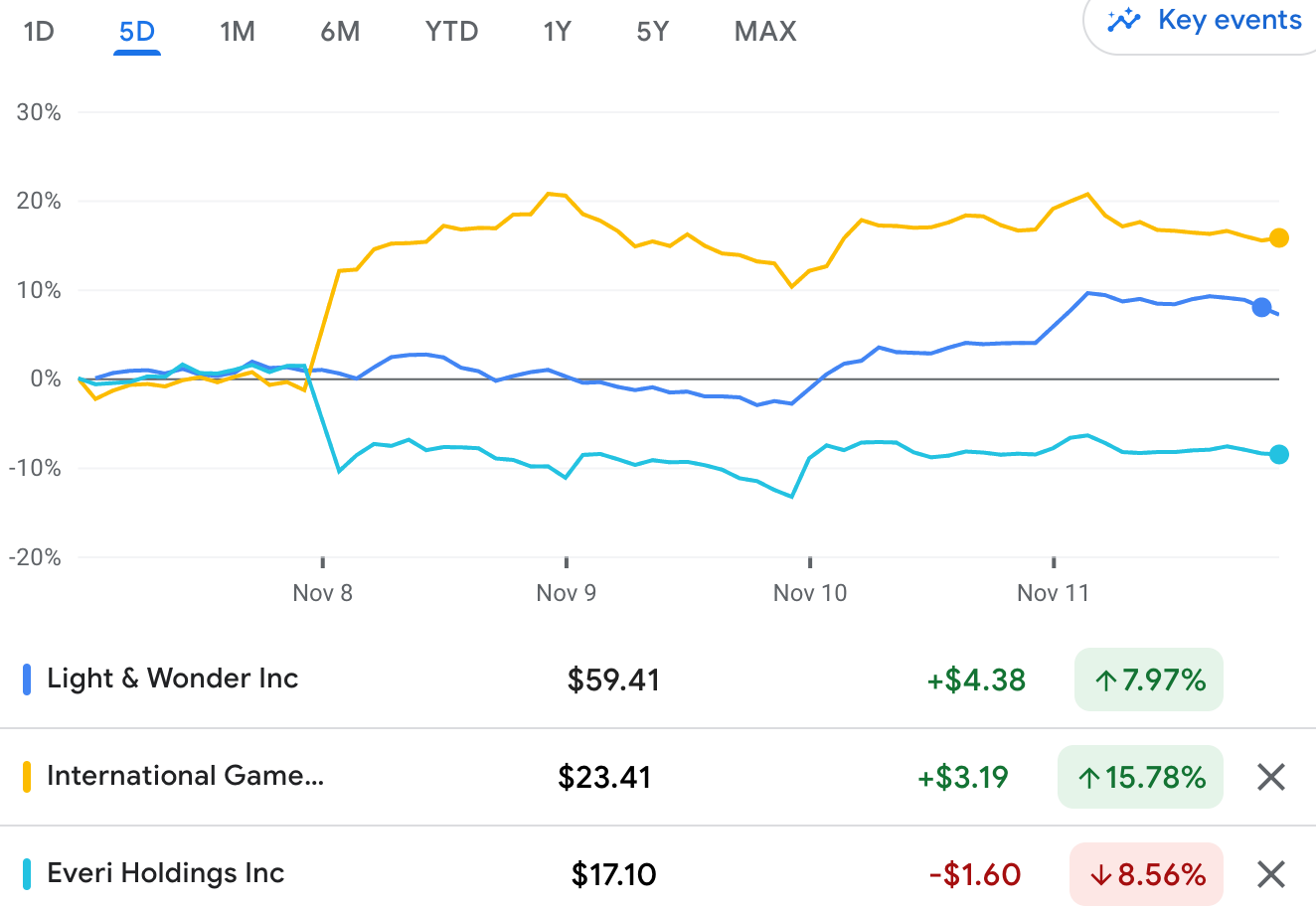

🚀Risk on: investors appeared to regain their faith in DraftKings Supply lines: Analysts at Jefferies noted a curious divergence in share price reactions with the suppliers last week. With Light & Wonder, initial investor worries on the day of earnings saw the shares fall 3% before the wider market recovery came to the rescue.

🪓LNW, IGT and Everi’s share price reaction last week to Q3 earnings

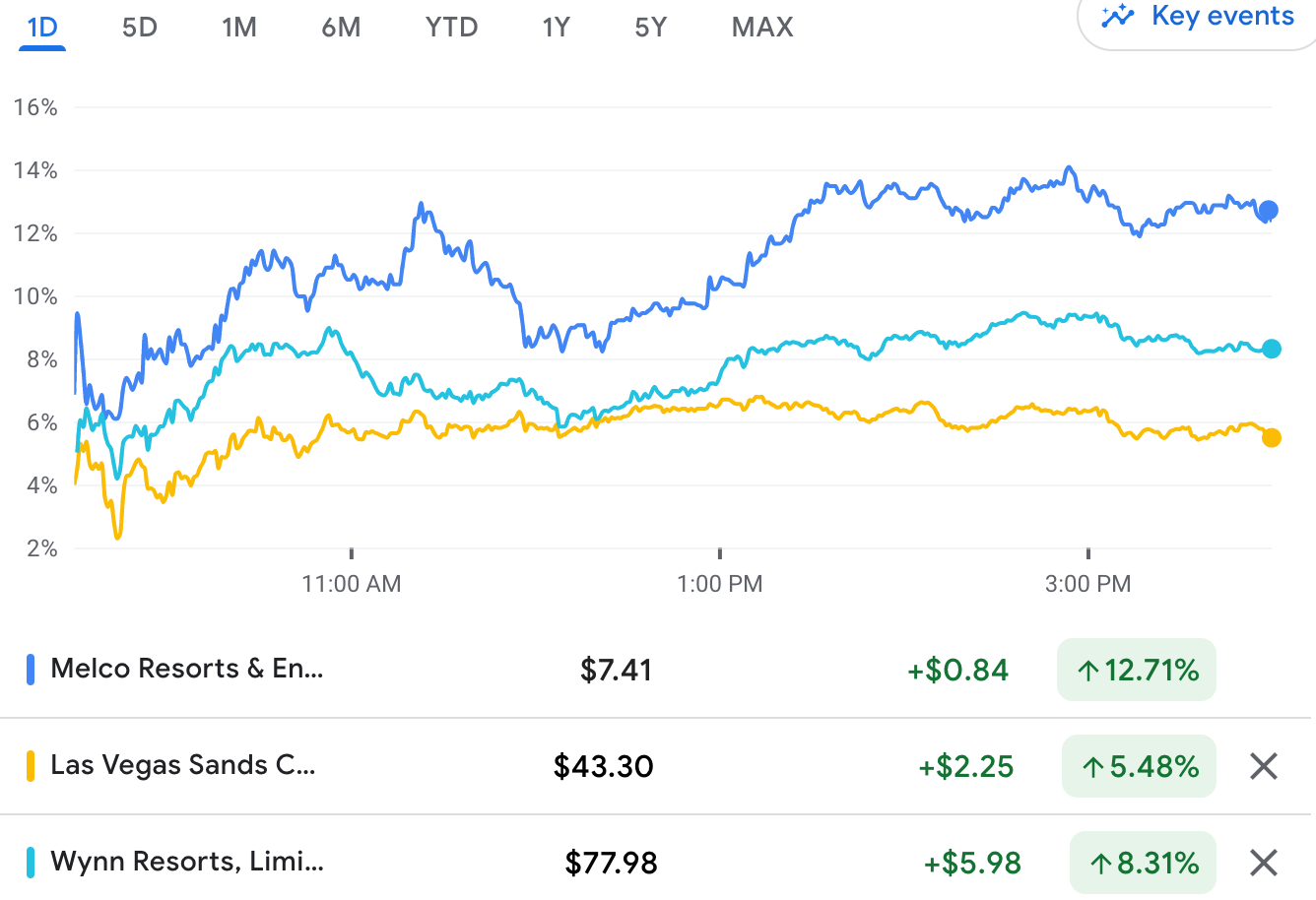

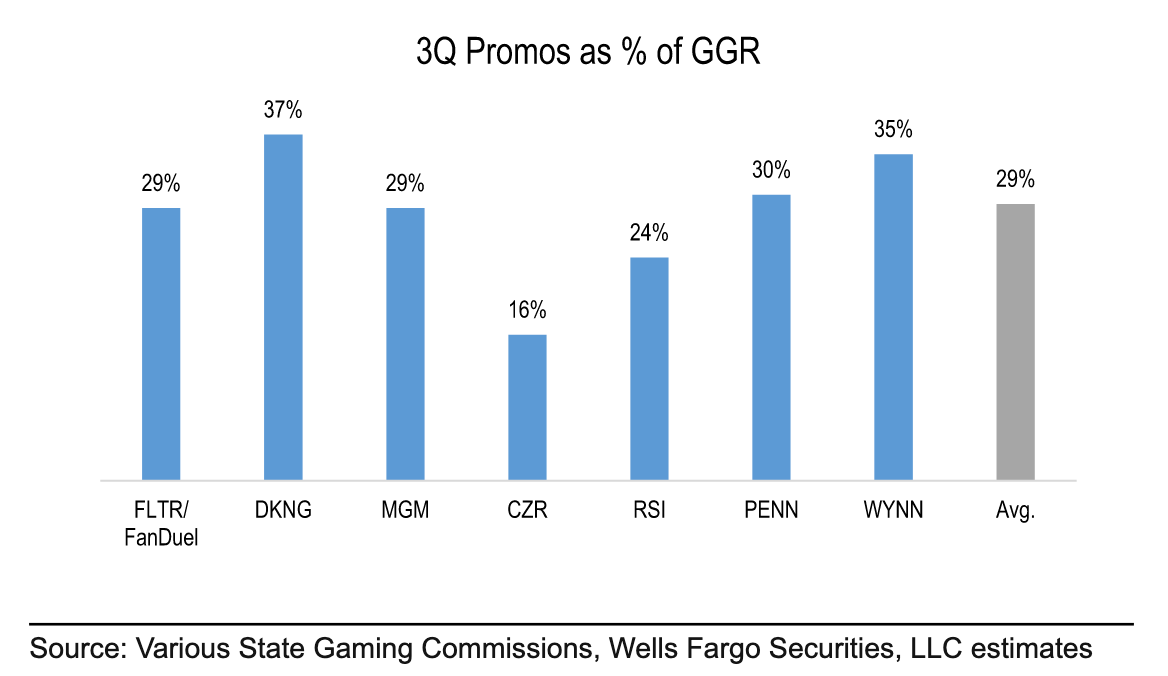

Eastern front: There was also a relief rally for Macau-focused stocks on Friday, with Melco Resorts rising nearly 13%, Wynn Resorts up over 8% and Las Vegas Sands up over 5% on the potential for the Chinese authorities to relax its Covid restrictions. 😷Hopes of a relaxation of Zero Covid in China help Macau stocks **Sponsor's message: Spotlight Sports Group is a leading technology, content and media business specialising in sports betting. Working with the largest media companies in the world, including AS.com and Advance Local, Spotlight Sports Group offers fully managed solutions that allow publishers to maximize revenue across their highly valuable sports betting audiences. For more information visit: spotlightsportsgroup.com Analyst takesUS sportsbooks: High hold of 11.5% in September and 10.3% across Q3 means the US books are on a hot streak, suggested the team at Wells Fargo. Still, they added that even with this high hold, promotional spend “ticked higher”.

🏁 Caesars was the only top brand to significantly cut back on marketing in Q3 Call rewindAGS: When pushed for a forecast for unit sales in 2023, CEO David Lopez was somewhat coy about specifics, but noted the company had momentum from this year and that at G2E customers were “pretty hot” on AGS products.

Raketech: A growing element of the affiliate provider’s business is its affiliation cloud business, though CEO Oscar Mühlbach admitted to capacity constraints. “We currently cannot onboard as many customers as we hoped,” he said. “We are doing everything we can to speed this up and accelerate this opportunity.

Acroud: Talking about the recent acquisition of Catena Media’s paid media arm, CEO Robert Andersson was keen to talk about what he saw as the benefits of paid over SEO. “If you look at SEO, there's a lot of hard work going into ranking a website, getting the visibility on Google in order to generate revenue from that,” he said.

The week aheadGAN, Sportradar and an investor day from FanDuel are the highlights, while the largest affiliate groups take center stage at the end of the week. Analysts will look to see if GAN has been able to address its B2C and B2B issues when it publishes its Q3s this evening.

Affiliate week: Better Collective will be closely watched on Thursday following the news that it has shed 10% of its workforce stateside. Recall, in Q221 the group set a revenue target of $100m from the US.

Due Diligence #1: On Tuesday, E+M launches our latest monthly edition, which is aimed at taking an in-depth look at a selected major topic within the global sector.

Startup focus – OSAIWho, what, where and when: OSAI was launched by CEO and founder Roman Garin in 2020 with a vision to automate sports-data capture and enhance the sports-viewing experience through machine learning, artificial intelligence and computer vision. The company is currently focused on table tennis, snooker and eSports. Funding backgrounder: OSAI has been bootstrapped since launch. The pitch: Garin says OSAI’s technology is highly versatile, but its biggest benefit is that “with one platform it addresses key challenges such as automating data capture, increasing viewership and engagement for broadcasters and opening new revenue opportunities for operators”.

What will success look like? Garin says OSAI is “not seeking to exit” currently and will focus on its goals of “transforming live sports experiences and merging physical and online worlds”. DatalinesNew York: Sports-betting GGR rose 14.7% to $39m, while handle was up 2.3% to $353.3m for the week ending Nov 6.

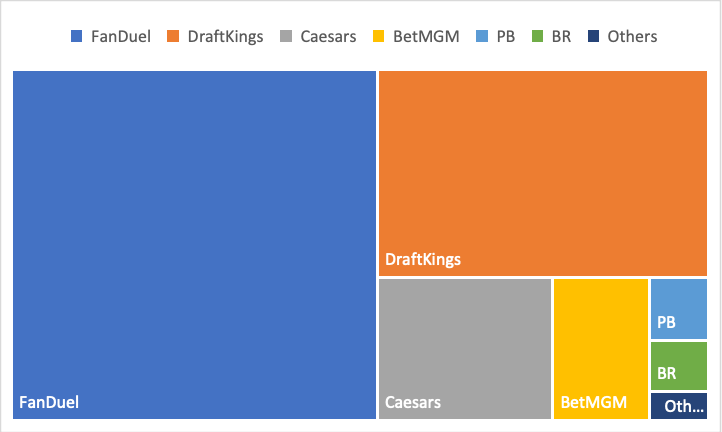

🍎 FanDuel leads with 52% of the New York market in October Earnings in briefPaysafe: Q3 revenues increased 4% to $366m (10% on constant currency), adj. EBITDA was down 10% to $95.5m (-5% cc). Volumes were up 5% to $32.5bn, thanks to strong OSB and iCasino growth (+45%) in the Americas, but there was continued softness in Europe. NewslinesA senior manager at LeoVegas has been arrested for insider trading in relation to the group’s acquisition by MGM, the Swedish newspaper Aftonbladet is reporting. Sweden’s Economic Authority opened its insider trading investigation into the MGM-LeoVegas transaction in June last year. The New York Jets has asked the Delaware Court of Chancery to appoint a receiver for Fubo Gaming in regard to the collection of a seven-figure sponsorship fee that is allegedly overdue by more than a month, according to SportsHandle. Games developer Raw iGaming has acquired the casual games studio Spigo for an undisclosed sum. Spigo’s parent company is the Malta-licensed Lady Luck Games, which reported Q2 revenue and EBITDA losses of SEK9.4m and SEK8.2m respectively. What we’re readingEyes on Delaware: “The collapse of Sam Bankman-Fried’s crypto empire has been chaotic, fast and full of unknowns.” On socialCalendar

Contact

|

Older messages

Weekend Edition #72

Friday, November 11, 2022

Genius Sports' NFL in-play bounce, Endeavor open for business, NeoGames' iLottery hopes, sector watch – crypto exchanges +More

Flutter on a roll

Thursday, November 10, 2022

Flutter on a US high, California says 'no', GiG's aggressive approach, IGT's Powerball boost, Full House eyes Temp opening +More

Billings: ‘Tilmann got a bargain’

Thursday, November 10, 2022

Wynn Resorts's record Vegas profits, Light & Wonder transformed, Inspired's FX woes +More

Deal Talk #4

Tuesday, November 8, 2022

Flutter wins the (Fan)duel with FOX, MGM and Entain tensions ramp up, Kindred buyer left hanging +More

Ruling clears FanDuel IPO path

Monday, November 7, 2022

FanDuel IPO implications from arbitration ruling, DraftKings mauled, Mattress Mack cleans up +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏