The Signal - Airfares'll stay up awhile

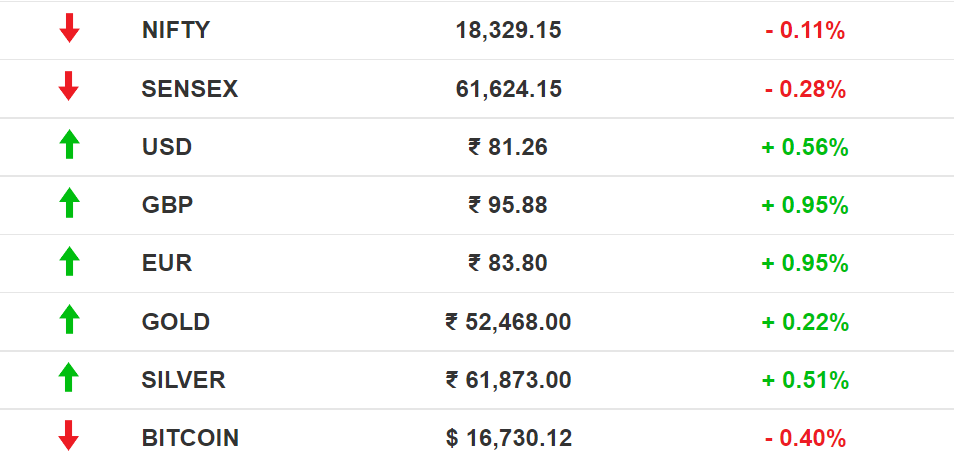

Airfares'll stay up awhileAlso in today’s edition: Climate tech jobs are calling; Ching’s Secret up for sale?; China is bailing out its real estate sector; Solana sinks after FTX blowupGood morning! Superhero fatigue is real, but so is the success of Black Panther: Wakanda Forever. The sequel to 2018’s Black Panther is a temporary salve for Marvel owner Disney, whose losses ballooned to $1.47 billion in the last quarter. Bloomberg reports that Wakanda Forever collected over $180 million in its opening weekend in the US and Canada—the highest in the region this year after Doctor Strange In The Multiverse of Madness. One-third of the audience comprised women over the age of 25. Shuri, Ramonda, Okoye, and the Dora Milaje would be most proud—and so would T’Challa himself. 🎧 FIFA World Cup 2022 host is now in the dock for data privacy concerns. The Signal Daily is available on Spotify, Apple Podcasts, Amazon Music, and Google Podcasts, or wherever you listen to your podcasts. If you enjoy reading us, why not give us a follow at @thesignaldotco on Twitter and Instagram. The Market Signal*Stocks: Kaynes Technologies India, an IoT electronics company, proves that a good business model and a sensibly-priced IPO can generate investor interest even in volatile times. Its public issue has been subscribed over 34 times, with the institutional segment bidding for nearly 100 times the number of shares on offer, reports Moneycontrol. The Financial Times reports that there is a surge in money flowing into high-risk leveraged exchange-traded funds globally. Flows into US leveraged long funds, which bet on stocks going up, were three times higher than into inverse funds, which bet on them falling. The Wall Street Journal, meanwhile, expects corporate earnings to be under pressure in the coming months. Early Asia: The SGX Nifty rose 0.24% higher than its previous close at 7.30 am India time. The Hang Seng Index lingered in the green (+1.75%). Nikkei 225 crawled downwards (-0.019%). LAYOFFSClimate Tech To The RescueThe industry is rolling out the red carpet for laid-off employees from tech cos such as Meta, Twitter, and Stripe. Startups such as Climate Draft, Terra.do, and Work on Climate are also providing learning resources to make the transition smoother. About 4,000 job openings for traditional roles such as software engineering are available. This brings us to... Moar job listings: Ever since New York City’s Pay Transparency Law, which requires companies to reveal minimum and maximum salary in job advertisements, went into effect, browsing these listings has a growing fan club. Well, Pay Transparency Law in India, @when? Bad taste: Even as enterprise software company Salesforce gears up to lay off 2,500 people, it has also tweaked its internal policies to make it easier for managers to terminate employees for performance issues without the involvement of HR. The company is already stingy with its severance pay. RETAILCapital Foods Is Looking For CapitalThe parent company of brands like Ching’s Secret and Smith & Jones is reportedly up for sale. Three major shareholders—General Atlantic, Invus Group, and founder-chairman Ajay Gupta—have tapped Goldman Sachs to find a suitor for either taking a minority stake or buying the company outright at a $1.5 billion-$2 billion valuation. Race to the top: The noodle market is crowded, with Ching’s Secret up against the likes of Nestle’s Maggi, ITC’s Yippie, and Hindustan Unilever’s Knorr. In the pastes and condiments category, Capital Foods competes with Mother's Recipe, Dabur, and ITC, among others. Who’s interested? FMCG giants have developed an appetite for shopping lately. Reliance Industries, Dabur India, and Pepsico have been nudged for a possible deal. Top Ramen maker Nissin Foods was in talks with the Mumbai-based company for a buyout. Nestle, Hindustan Unilever, ITC, and Tata Consumer Products, among others, have previously courted Capital Foods. AVIATION‘Vistara’ May Vanish Into Thin AirThe much-awaited consolidation and integration of the Tata Group’s aviation business has begun. Vistara and AirAsia will likely be retired. The group has already completed the consolidation of Air India Express and AirAsia India. Maharaja: The 75-year-old Air India will be the group’s only airline brand. With the consolidation, Air India will have a fleet of 233 aircraft, with a ~25% domestic and 54% international market share. Competition: IndiGo rules the domestic sky with a fleet of 279 planes and a market share of 55%.

🎧 Tata's effort to consolidate its airlines won't bring much respite for travelers. The Signal Daily is available on Spotify, Apple Podcasts, Amazon Music, and Google Podcasts, or wherever you listen to your podcasts. CHINAPatching The Hole In The WallAfter establishing himself as the paramount leader and filling key leadership positions with his trusted lieutenants, Chinese President Xi Jinping has moved to scale back Covid restrictions and the crackdown on the property sector. Jittery investors: Foreign investors and investment bankers are still wary. Meanwhile, China has put out a comprehensive roadmap of its new social credit system.  Here we go. A bunch of Chinese gov agencies just jointly released a draft of a new "Social Credit System Construction Act" for public comment. The doc is huge. 1/x Let’s talk now: Xi and US President Joe Biden met in Bali, Indonesia. Both made the right noises. A revival in US-China trade, slower rate hikes in the US, and state support to high-risk segments in China could be the aces for the global economy. The joker in the pack would still be Russia. And a Covid surge. CRYPTOCURRENCIESSolana Has A Great FallThe network effect of FTX’s collapse—and that of founder Sam Bankman-Fried (SBF)—continues as other crypto exchanges, especially Crypto.com, suffered heavy withdrawals. Additionally, Visa has decoupled from the bankrupt FTX. But maximum havoc was wreaked on Solana or SOL, the native token of the Solana blockchain. TheStreet reports that SOL tanked 95% from its November 2021 high of nearly $260; it’s now trading at $14.12. Reason? SOL is tied to Serum, the on-chain, decentralised finance (DeFi) exchange created by SBF. Serum was instrumental in keeping gas or transaction fees low on Solana. The negative association with FTX and Alameda—SBF’s trading firm, which also went under—spurred Solana developers into forking or reworking the codebase of Serum, more so because it turns out that Serum wasn’t as decentralised as SBF made it out to be. As we’d told you back in March, Solana itself is no DeFi champ. FYIPhilanthropic pledge: Amazon founder Jeff Bezos has told CNN that he plans to give away most of his wealth to charity. His company, meanwhile, is reportedly planning to lay off around 10,000 people in corporate and technology jobs. Some respite: India's retail inflation dipped to a three-month low of 6.77% in October, but it was still above the central bank’s comfort band of 2-6% for the 10th consecutive month. Hustlebro: Chief Twit Elon Musk says he’s working morning to night, seven days a week, while not recommending his schedule. The new TV?: Netflix will foray into streaming live events next year, with a Chris Rock stand-up comedy special sometime in early 2023. No headwinds: Kalrock Capital Partners, the investment firm part of the consortium reviving Jet Airways, has denied that multiple investigations into its promoter Florian Fritsch will impact its plans. A giant is born: The merger of L&T Infotech and Mindtree has been approved, making the new entity LTIMindtree India’s fifth-largest IT services provider by market cap and sixth-largest by revenue. Back online: India has lifted its ban on the free, open-source VLC media player about a month after the company sent a legal notice to the government. THE DAILY DIGIT$32 billionThat’s how much wealth the three co-founders of Singapore-headquartered tech company Sea Ltd have lost in total after the company’s shares slid 87% from their peak last year. (Bloomberg) FWIWThe longer the wait, the better the beef: If you’ve watched Jiro Dreams Of Sushi (do so if you haven’t already), you may have an idea about how long people are willing to wait to eat at Japan’s most vaunted establishments. But Asahiya takes the cake. The waitlist for the frozen Kobe beef croquettes ($1.8 apiece) served by the family-run butcher shop is 30 years. Affordability, beef quality, and the fact that local cows only eat locally-grown potato stems have a lot to do with it. Rise up: Hong Kong government officials are losing their tops after an anti-China protest song was played before the Asia Rugby final between Hong Kong and South Korea. The gaffe was the doing of a junior staffer who downloaded the wrong song from the internet. This takes us back to the era of songs dot peekay; if you know, you know. Regress: Pakistan’s Oscar contender, which also received a standing ovation at Cannes and bagged the jury prize at the film festival, may never be shown in its home country. Joyland, which depicts love between a man and a trans woman, was uncertified despite being cleared by censors. Blame extremist pushback. Director Saim Sadiq is set to challenge the decision, and we’re all for it. Enjoy The Signal? Consider forwarding it to a friend, colleague, classmate or whoever you think might be interested. They can sign up here. Do you want the world to know your story? Tell it in The Signal. Write to us here for feedback on The Signal. |

Older messages

Crypto’s Enron moment

Monday, November 14, 2022

Also in today's edition: Headwinds for Jet Airways 2.0; War looms large over G20 summit; Apple's privacy blooper; Twitter's up in flames

Enabling the differently abled

Saturday, November 12, 2022

India's digitisation drive picked up after demonetisation, which happened this month six years ago. Yet, apps and platforms ignore an important segment of the population

Netflix’s flirtation with live sports and Disney’s tough balancing act

Friday, November 11, 2022

Both companies are at different stages in their sports rights ambitions.

Can Mumbai become the next Bengaluru?

Friday, November 11, 2022

Also in today's edition: Titan's hinterland gambit; Musk takes on PayPal; Capital gains tax overhaul incoming; No “red wave” in the US midterms

Disney’s post-IPL reality check

Thursday, November 10, 2022

Also in today's edition: BSNL 🤝 TCS; Tesla gets the stepchild treatment; China's well-heeled look for an escape route; Binance-FTX enters saga territory

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏