The Signal - Bisleri says hello to Tata

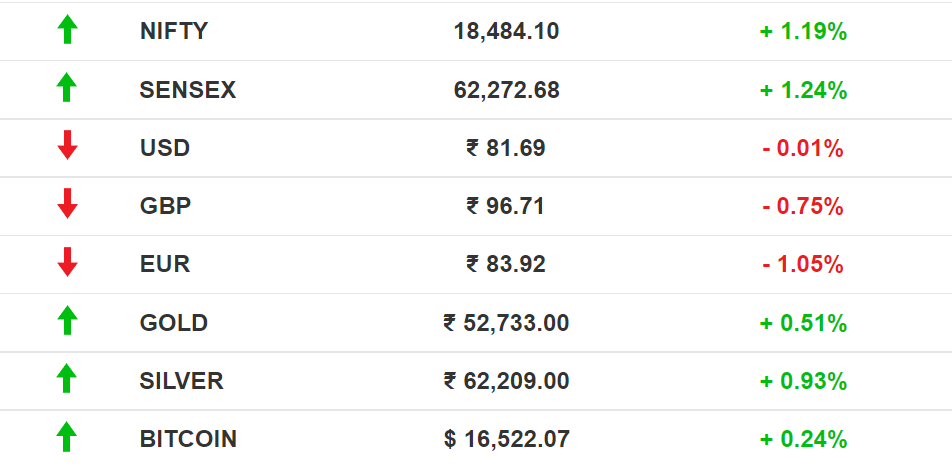

Bisleri says hello to TataAlso in today’s edition: Byju’s valuation tumble; Musk is pennywise and pound foolish; Adani courts benefactors; Amazon’s studio gambitGood morning! They say rats can survive an apocalypse, but did you know they can also (supposedly) survive consuming copious amounts of marijuana? The Times of India reports that cops in Mathura submitted a claim to a court that rats ate 581 kg of marijuana that was seized—and then went missing from police custody—in a local case. The district judge has rightly asked for proof. In 2021, the Kotwali Dehat police station had claimed that rodents consumed more than 1,400 cartons of confiscated liquor; a subsequent enquiry found that the liquor was sold to a local gangster named Bantu Yadav. A programming note: Dear reader, it was brainstorming week at the Signal. We were planning for the year ahead and will soon tell you all about the new initiatives and delightful stuff coming your way in the next few months. But that consumed quite a bit of our bandwidth and hence we will not be publishing our Saturday long read. The Intersection, however, will bring you the usual list of the best reads from across the world. If you enjoy reading us, why not give us a follow at @thesignaldotco on Twitter and Instagram. The Market Signal*Stocks: The US Federal Reserve cooling down on aggressive rate hikes brought cheer to investors. It was a good day for new-age insurance aggregator platform Policybazaar as its shares jumped 11.5%. Paytm's shares dropped 75%, which makes it the world’s worst for large IPOs in a decade, according to Bloomberg. Early Asia: The SGX Nifty sunk -0.24% lower than its previous close at 7.30 am India time. Hang Seng Index (-1.19%) and Nikkei 225 (-0.19%) also lagged. EDTECHQuestion Mark Over Byju’s Obscene ValuationIndia’s biggest edtech company hasn’t suffered a down round yet, but is it just a matter of time? Moneycontrol reports that Prosus—the Dutch arm of South African tech investor Naspers—recorded the value of its 9.67% stake in Byju’s at $578 million. This means the investor values the company at $5.97 billion. Byju’s was last valued at $22 billion in its October funding round. Prosus clarified that the value of its investment was determined by a third party firm. But different shareholders value a company differently, meaning other investors may not be on the same page as Prosus as far as Byju’s valuation is concerned. The edtech company had a woeful 2022, starting with revelations about funding that never came, ballooning losses, layoffs, and the company having to secure a loan from its subsidiary, Aakash Educational Services Limited. SOCIAL MEDIATwitter Scrambles For Spare ChangeThe world’s richest man can’t pay his bills. Or rather, doesn’t want to. Bills unpaid: Twitter owes hundreds of thousands of dollars to vendors. But since their services were sanctioned by the older management, Musk is refusing to clear them now. Cut cut cut: After letting go of more than 4,000 employees, the new management is reviewing every expense. Tech infra costs, real estate, travel, employee reimbursements, perks, and even cafeteria food are under the scanner. Even corporate cards were deactivated. Renegotiate or get out: Twitter is renegotiating all its contracts and agreements with the likes of NFL, Fox Sports, NBA and Conde Nast, reconsidering software vendor services and trying to strike new deals with Amazon and Oracle, whose services may be axed too if they don’t yield to Musk’s terms. BEVERAGESTata-Bisleri Deal Gathers SteamUbiquitous bottled water brand Bisleri now has a new home at the Tata Group. According to a report in The Economic Times, Tata Beverages has purchased the brand Bisleri from Ramesh Chauhan for ₹6,000 crore-₹7,000 crore. Chauhan, the 82-year-old chairman of Bisleri International, however, says the deal is not yet through even though talks are on. There are other contenders in the picture as well.

🎧 Bisleri International may soon become a Tata brand. The Ticketmaster-Taylor Swift snafu has drawn the attention of the US Senate antitrust panel. The Signal Daily is available on Spotify, Apple Podcasts, Amazon Music, and Google Podcasts, or wherever you listen to your podcasts. CONGLOMERATESGautam Adani Hunts For Deep PocketsLast month, we’d told you about Asia’s richest men and billionaire rivals, Gautam Adani and Mukesh Ambani, scouting for money to expand their empires. Adani was in talks with GIC and Temasek, among others, to raise $10 billion via stake sale either in group firms or associated entities. The infusion would go towards the conglomerate’s green energy, FMCG, ports, and cements businesses. Mint claims that Adani Group’s flagship, Adani Enterprises, is planning a follow-on public offering (FPO) of ₹10,000-20,000 crore ($1.2 billion-2.5 billion) for its green and digital businesses. Business Standard places the overall figure at $5 billion, adding that Adani approached a raft of west Asian funds to also reduce its leverage after banks (and research firm CreditSights) sounded the alarm over the group’s staggering debt. Adani Enterprises stock has skyrocketed 26x over the last five years. The sale would help cut its mountain of debt. STREAMINGIt’s Showtime for AmazonThe e-commerce juggernaut wants to make going to the movies cool again. Amazon intends to release 12-15 movies a year and has earmarked $1 billion for theatrical movie releases. 🍿🍿: Not too long ago, Amazon closed its acquisition of MGM, the moviemaker behind the James Bond franchise, to boost its Prime Video catalogue. Amazon Studios has dabbled with production and distributed movies such as Manchester By The Sea. It then replicated Netflix’s limited theatrical release model. Netflix’s Glass Onion will follow the same strategy. Amazon's aggressive push into theatrical releases could set a precedent. Bye bye: India is facing the repercussions of Amazon's disappointing third-quarter results. In September, we wrote about Amazon wanting to make a dent in the already-crowded food aggregator business. Amazon Foods, which at the time was just expanding, has now been placed on the backburner. The company is also axing its online learning platform Amazon Academy. FYIGeneral assembly: Asim Munir, who was ousted as intelligence chief by former PM Imran Khan, will succeed Qamar Javed Bajwa as Pakistan’s new army chief. No. 10: Malaysia’s longtime opposition leader Anwar Ibrahim was sworn in as the country’s tenth PM by King Sultan Abdullah after the general elections resulted in a hung parliament. Stickler: Tata-administered Air India has released a 40-plus page grooming circular for cabin crew, with detailed specifications for receding hairlines, top knots, earrings, bindi sizes, and more. New messiah alert: Binance chief Changpeng Zhao is planning a $1 billion recovery fund to buy distressed crypto assets. Reverse: Ford is recalling about 519,000 SUVs in the US over fire risks due to faulty fuel injectors. In the bag?: Online payments firm PhonePe may snap up buy-now-pay-later (BNPL) platform ZestMoney, according to the Economic Times. THE DAILY DIGIT$3.5 millionThe cost of a single dose of Hemgenix, a recently-approved gene therapy treatment for haemophilia—making it the world's most expensive drug. (CBS News) FWIWCat's in the bag: A ginger cat's adventure was cut short after TSA agents at New York's JFK Airport spotted tufts of orange fur poking out of a suitcase. The officials assumed the traveller to be a cat nabber… until the owner confirmed that the cat, named Smells, had sneaked into his luggage. The owner was then called in to collect the tabby, who was equally happy to be whisked away. Time goes by...: Slowly, if you're watching a World Cup match this time around. Most of the matches are crossing the 100-minute time limit, a far cry from a nail-biting 90-minute game. FIFA's referees have been directed to give players time to enjoy goals and unexpected delays such as injuries, VAR interventions, and substitutions. The "unnaturally lost time" just translates to more time on the field for players who need to cover more ground than they are used to. On a hope and a prayer: The Soviet-era Moskvich will grace Russian streets after two decades. The plant, which previously belonged to French carmaker Renault, will be designed by Chinese carmaker JAC. The automaker wants to take it slow—600 cars this year—as Russia struggles to revive its economy. Once a car that was associated with Russia, Moskvich declared bankruptcy in 2006. Will this attempt turn things around? Enjoy The Signal? Consider forwarding it to a friend, colleague, classmate or whoever you think might be interested. They can sign up here. Do you want the world to know your story? Tell it in The Signal. Write to us here for feedback on The Signal. |

Older messages

United they fall

Thursday, November 24, 2022

Also in today's edition: Trouble in Apple's main iPhone plant; Bob Iger's staying power; Musk isn't telling you everything about SBF; Govt may shut free food scheme

India’s crypto switch

Wednesday, November 23, 2022

Also in today's edition: Decentralised social media is hot; Amazon's voice becomes a whisper; South Korea flexes its guns; More tax scrutiny for investors

Bob in, Bob out

Tuesday, November 22, 2022

Also in today's edition: Twitter's app-store problem; More trouble for Jet Airways; Sebi turns angel shark; India is closely watching Nepal

The Musk & Trump show

Monday, November 21, 2022

Also in today's edition: The FTX saga continues; Breakthrough at COP27; Lowdown on India's new data protection bill; Drama in Zomato

The making of an international juggeRRRnaut

Saturday, November 19, 2022

How SS Rajamouli's latest blockbuster won over the US

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏