Bankless DAO - Alternative L1s | DeFi Download

Alternative L1s | DeFi DownloadExploring DeFi on Bitcoin, Solana, Cosmos, Polkadot, and Cardano; The Definitive EIP-1559 guide; Best Practices for Wallet SecurityDear Bankless Nation 🏴, The DeFi ecosystem is a vast landscape with an abundance of kingdoms. While we mostly cover activity in Ethereum’s domain, there’s a wide variety of blockchains that are worth lookin at. In this edition of the DeFi Download, we dig into some of these chains: Bitcoin, Solana, Polkadot, Cosmos, and Cardano to give you a taste of some the DeFi flavors that are out there. Next, Meesh takes a deep dive into one of the most impactful Ethereum Improvement Proposals on Ether tokenomics: EIP-1559. And after that, d0wnlore warns us about the dangers of fake wallet pop ups and how to keep your keys safe. Remember: not your keys, not your coins. Finally, we round out this edition with the latest DeFi releases and hottest Twitter takes takes. This is your plug for your DeFi needs! This is the DeFi Download! ⚡️ Contributors: BanklessDAO Writers Guild (0xzh, chickenramen, d0wnlore, EthHunter, meesh, Chameleon, Austin Foss, Jake and Stake)

This is the official newsletter of BanklessDAO. To unsubscribe, edit your settings. Alternative L1s (& Bitcoin)

BitcoinAuthor: EthHunter Bitcoin is the original, and still, the main crypto. So much so that every other one (13,000 and counting) are all considered ALT coins;alternative coins to Bitcoin. With a market share of around 35% of total value in the crypto ecosystem currently, it still maintains the largest portion of the market. In October of 2008, anonymous creator Satoshi Nakamoto released the now famous White Paper, on this new form of digital payment systems. Secured by “proof of work” which means complex computations need to be completed in quick succession to “mine” bitcoin blocks. With Bitcoin being the 1st, it inherently comes with a few trade offs. The major one, and the one we cover here is the lack of native chain DeFi dapps. Unlike other ecosystems, where there are developers constantly ideating on the concept,creating financial tools and applications to utilize these digital tokens in novel ways to create yield. Something needed to be created to not miss out on the party. wBTC or “Wrapped Bitcoin'' is an ERC20 token that allows BTC to be used on any EVM compatible blockchain, with Ethereum being the main utilization of the liquid wrapper. Each wBTC is backed by 1 BTC on Bitcoin’s blockchain, and the values are pegged to each other 1 wBTC=1 BTC. This allows Bitcoin to be used in all of the composable DeFi applications available on Ethereum and the subsequent L2s. One popular usage of wBTC is depositing it into something like Aave, and borrowing against the wBTC collateral for things like stablecoins to utilize in some form of yield strategy, all while earning interest on the locked wBTC. renBTC is another great example of a liquid wrapper of Bitcoin. In this case, BTC is deposited into the Ren Protocol, and the matching value of renBTC is minted as an ERC20 on Ethereum. However, please note that the current Ren network is being sunset. Minting has been disabled, and burning ("Release") will only be available for 30 days from the date of their announcement made on November 20th 2022. Users of renBTC have been instructed to burn (Release) their bridged assets and claim the backed BTC to avoid the risks of losing your assets. As the above states, wrapping and bridging assets don't come risk free. So for users wanting to stay on chain in Bitcoin, there are options available. For payments the Lightning Network has been created and is expanding to combat some of these issues. However, with the chain being old, the new products being built on, say Ethereum, cannot be built on Bitcoin, and users shouldnt expect to see any of the staple DeFi Dapps on Bitcoin, ever. Other concerns for the blockchain include regulation, and security issues as the mining rewards to secure the chain are smaller and smaller over time, potentially leaving the multi billion dollar ecosystem vulnerable. Considered “Digital Gold” it can be utilized in the same way basically. Buy it to hold, and consider it a speculative asset. There are only 23 million BTC total. Do you have one? SolanaAuthor: Jake and Stake Solana is touted as a low-latency (fast) smart contract blockchain. Gaining popularity during last year’s bull market, Solana offered a cheaper and faster alternative to Ethereum. Transaction MetricsSolana offers a maximum throughput of 50,000 TPS with block settlement times as low as 400 ms. Compare this to Visa which services ~24,000 transactions per second. ArchitectureSolana uses “Bonded Proof-of-Stake” consensus plus “Proof of History”. Nodes in the Solana network are constantly processing transactions locally and use a timestamp created with the SHA256 hashing algorithm to order these transactions. Every epoch, the Solana algorithm chooses a leader to sequence transactions received from the rest of the network. We won’t go into the technical details of this architecture, but if you want to learn more you can check out the solana whitepaper here. In general, transactions can be ordered without all nodes needing to agree simultaneously, keeping order within a decentralized network of computers. This allows Solana to process blocks in parallel and is the mechanism behind the fast transaction times. All Solana activity occurs on a single chain—no shards— and fees are paid in Solona’s native token SOL (◎) with fractions of SOL denominated in “lamports”. 1 lamport == 0.000000001 SOL In Solana, 50% of fees generated are burned and the other 50% goes to the chosen leader. You can watch the live the leader rotation at solanabeach.io. Solana DeFi EcosystemSolana offers similar DeFi products as Ethereum:

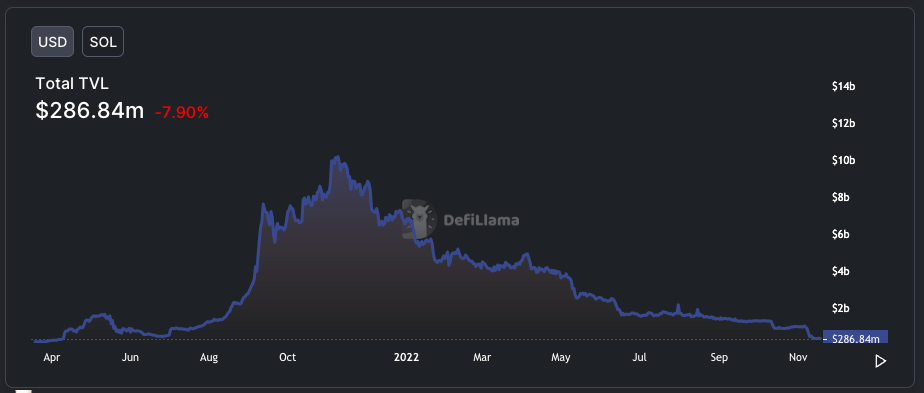

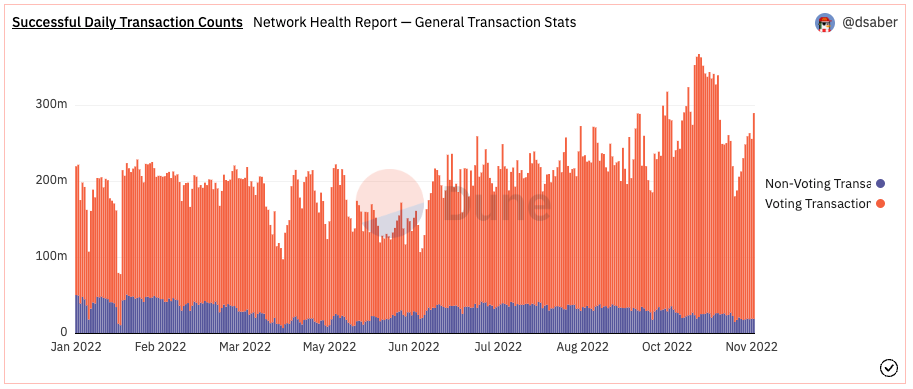

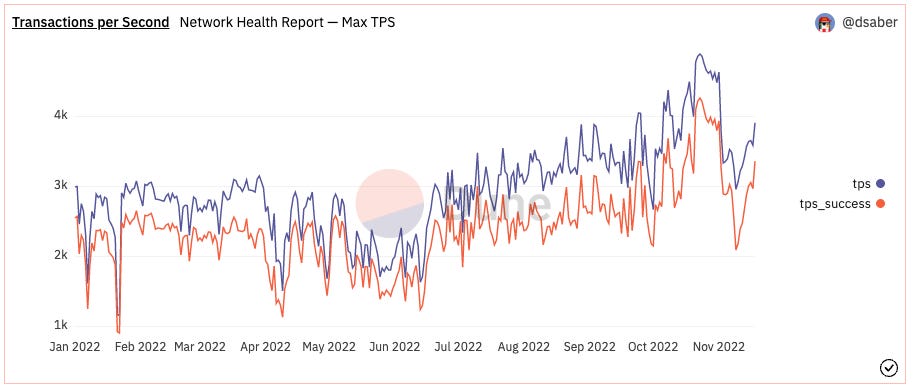

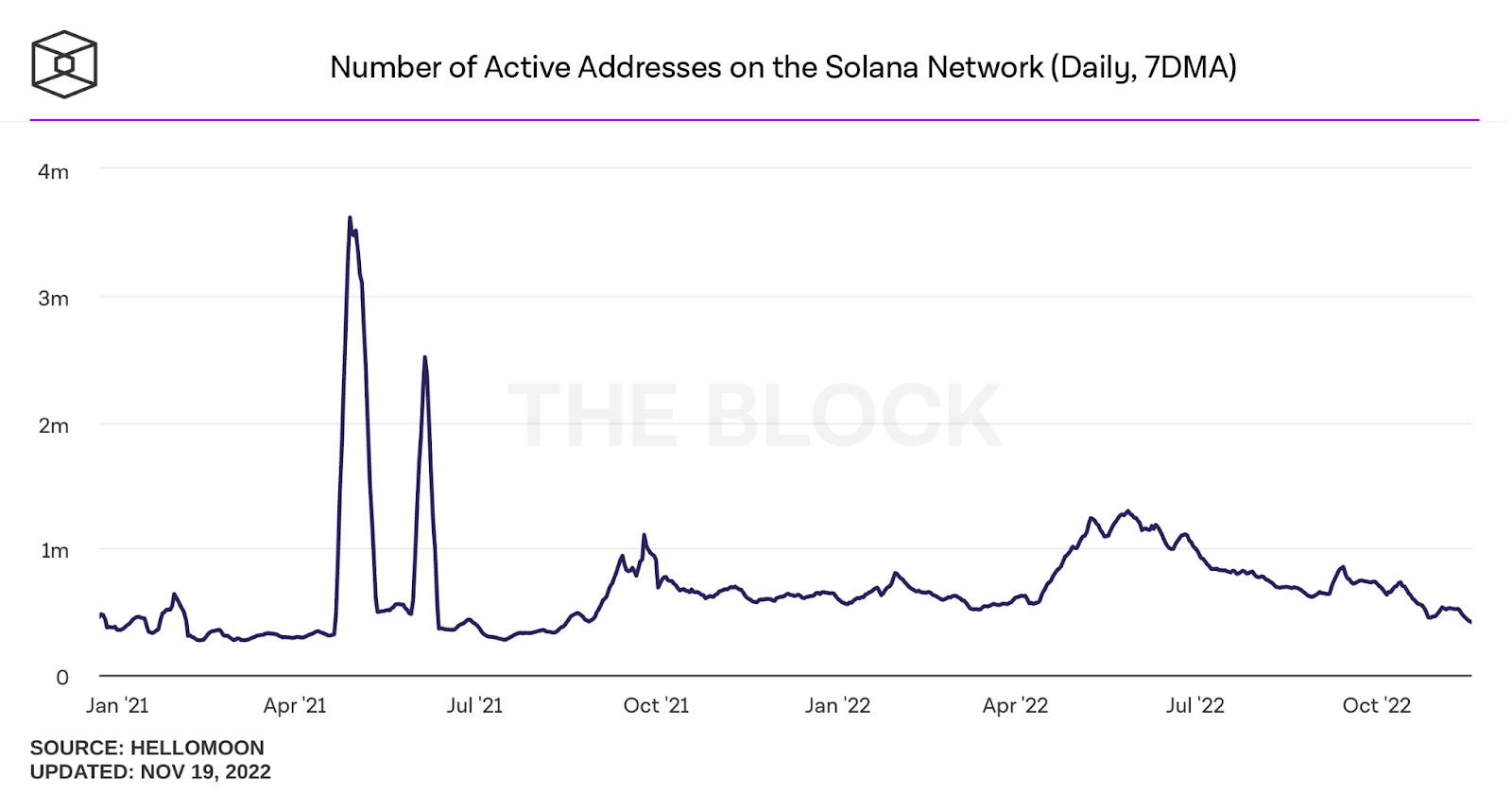

At the time of writing Solana has $286MM in TVL. This sharp decline of the last 12 months is due in large part to the macroeconomic conditions and the collapse of FTX. The largest protocol on Solana is the liquid staking service Marinade ($86MM). Following are decentralized exchanges Radium ($48MM) and Orca ($44MM). Daily transactions have been steady over the past 6 months at around 200m. Transactions per seconds have been relatively steadily You can check the network health at the Dune Dashboard here: https://dune.com/dsaber/solana-network-health-report Solana Active Addresses is hovering around 400K: Final WordsSolana offers high transactions per second to users and institutions. Scale is something Ethereum has struggled with, and Solana must fill that vacuum before Ethereum L2 solutions get wider adoption. For the most part, Solana does best when there is less activity and it’s yet to be seen whether Solana will be able to keep its scaling promises. At the time of writing, Solana only has one client, meaning all consensus participants are running the same software. As a result, bugs can have large ramifications. As bugs are discovered, the network suffers significant outages. According to Cointelegraph, Solana has suffered ten partial or full outages, with the most notable occurring between January 6th - January 12th of 2022. PolkadotAuthor: 0xzh Founded by Ethereum co-founder Gavin Wood, Polkadot distinguishes itself from other blockchains as a cross-chain platform that prioritizes interoperability. Thanks to its focus on enabling cross-chain communication with bridging technology, users of chains like Bitcoin and Ethereum are able to easily integrate into the Polkadot ecosystem and enjoy the best of many worlds. Polkadot was designed to solve challenges faced in other blockchain ecosystems. The challenges include interoperability, customization, scalability, on-chain governance, self upgradability, and security. The blockchain could be considered as a meta platform for developing your own blockchain. Creators of decentralized applications on Polkadot benefit from more customizable blockchains that are better tailored to the unique needs of their applications. This is possible because of the architecture of Polkadot which is composed of a main chain (relay chain) and sub-chains (parachains) that extend from it. This architecture, in combination with Substrate Software dDevelopment Kit, makes it easier for teams to customize blockchains for specific DeFi use cases instead of using one chain or development approach. Composability, Interoperability and Testing for DeFi ApplicationsThe exchange of information between parachains and the relay chain makes it possible for faster transactions to be executed between decentralized applications on the network. Thanks to the separation between the process required to add new transactions and the process required to validate transactions, transactions are sped up. Composability and InteroperabilityDeFi composability (permissionless interaction between different protocols) is dependent on shared security. The relationship between the relay chain (where transactions are finalized) and the parachains makes DeFi composability possible on Polkadot. Parachains connected to the relay chain benefit from the security provided by the validators of the relay chain which empowers them to build quickly, compared to less secure platforms. Polkadot attempts to provide a new approach to interoperability (cross-chain interactivity) with unique use cases built on its infrastructure. People are able to easily and quickly create DeFiapplications that can be used on chains across the wider ecosystem. Examples of this include parachains such as Moonbeam, Plasm, or Edgeware, which can be built on top of by teams, using runtime modules. Testing with KusamaKusama (also referred to as the canary network of Polkadot) was introduced as a middle ground between testnet and mainnet for experimentation with products to be released on Polkadot. The use of real money in the environment makes the experiments done in it as realistic as possible so that when the products are released on mainnet, people have a better idea of what to expect of launches. Kusama makes it possible to upgrade chains without forks. This allows for greater speed of innovation for the Polkadot blockchain and its blockchain. Its projects can essentially make updates on a constant basis (as long as they receive on-chain approval). Additionally, Polkadot and Kusama are both governed on chain. Major changes are done on chain with tokens as opposed to off-chain approaches. In some cases, projects run their products on both Kusama and Polkadot in parallel. Kusama becomes an informal lab or innovation arm for such projects. Liquid Staking, Auctions, Cross-Chain Virtual Machines, and Cubic VaultsLiquid staking is another key feature of Polkadot’s DeFi ecosystem that makes it different from other DeFi ecosystems. With liquidit staking, users of decentralized applications on the blockchain can stake cryptocurrencies and get immediate liquidity without worrying about a lockup period. The process of liquid staking allows users to receive synthetic tokens while staking. Composable Labs plays a critical role in making interoperability on Polkadot a success. The Composable Cross-chain Virtual Machine (Composable XCVM) provides an interface for using smart contracts across different Layer 1 and Layer 2 networks. The next iteration of applications could involve ecosystems of decentralized applications that are fluid in that the users of the applications can easily gain access to the assets and features of applications on blockchains outside of Polkadot. Auctions on Polkadot help to reduce the amount of scam projects in the ecosystem. The auction model requires projects to gather support to win auctions. Bids are made in open auctions, using the native DOT cryptocurrency with hopes of getting the highest bids to win. Cubic Vault could be compared to a bank without the banker. The infrastructure not only protects funds but also provides the assurance needed for builders to create new decentralized finance solutions for users of vaults. The vault can be given instructions which make it operate like an automated fund manager, moving funds between different pools to execute different types of strategies across a variety of ecosystems, from Cosmos, Ethereum, and Polkadot, to its canary network Kusama. The main features of the Cubic Vault technology include:

Decentralized Finance Applications on PolkadotThe Total Value Locked of DeFi platforms on Polkadot is outlined in the table below:

Users of Acala benefit from a DeFi hub and stablecoin known as aUSD. With the platform, one can interact with other blockchains connected to Polkadot to receive USD. Astar network connects Polkadot to Cosmos, Ethereum, and all major Layer 1 blockchains. The ASTR token is designed to be used for on-chain transaction fees, on-chain governance, staking, the creation of Layer 1 blockchain applications, and the creation of Layer 2 blockchain applications. Karura is made to operate in parallel to Acala, serving the users of Polkadot and Kusama communities. The bridging of Kusama to Polkadot makes full interoperability between Karura and Acala possible. It also launched its own blockchain with intentions of creating an automated market maker DEX like Uniswap. Like other projects on Polkadot, it offers liquid staking to users. Acala’s liquid staking feature is made to give users a liquid token that represents a staked asset. The liquid token increases as the underlying staked token earns more rewards. Stafi enables its users to stake without worrying about waiting for a period of time for their tokens to be unbounded. Holders of the staking token on the platform can receive an alternative token, rToken. Moonbeam is designed to make it easy to develop applications on Polkadot. Developers can use Moonbeam’s smart contracts and compatibility with Ethereum’s toolset to quickly build multi-chain decentralized applications. Moonriver was made to be an Ethereum compatible parachain on Polkadot. It also serves as a canary network (like Kusama). This means that it can be used for testing of decentralized finance applications in realistic economic conditions before being fully deployed on Moonbeam. The parachain’s native MOVR token is meant to be used for payment of transaction fees, incentivizing production of blocks to support the network, on-chain governance, and execution of smart contracts. Kintsugi serves as a canary network. The chain’s token, Kbtc, is maintained by a decentralized network of collateralized vaults and is 1:1 with Bitcoin. Kbtc creates many opportunities for Bitcoin liquidity to be injected into Kusama and parachains such as Shiden, Karura, and Moonriver. Like Kintsugi, Interlay helps to inject BTC liquidity into the Polkadot ecosystem with a Bitcoin bridge. The interBTC token is used as a medium of value transfer for this purpose. The 1:1 Bitcoin-backed asset is collateralized, interoperable, and censorship resistant. Not only does it provide a means of getting access to Bitcoin liquidity in Polkadot, it is also designed to be accessible on networks including Avalanche, Solana, Cosmos, and Ethereum. Parallel Finance offers lending, staking, and borrowing features for its users. Both Kusama and Polkadot assets are supported by its lending protocol. Heiko Finance acts as a sister network to Parallel Finance. The native HKO token offers several utilities including token governance, network utility, economic utility, staking and security, economic utility, and exogenous utility. Bifrost users can choose from a selection of interest-bearing derivative tokens. The users of the platform are also able to benefit from liquid staking, allowing them to participate in more DeFi activities than they would if they were not able to use their tokens while staking. Energy Web is at the intersection of the DeFi and energy sectors with over 50 projects across 25 countries that help to power zero-carbon economies. It is working with Parity Technologies on a relay chain to bridge the gap between the blockchain and energy sector. Genshiro users can earn, trade, and borrow with efficiency. Liquidity providers on the platform take part in liquidity farming, get extra yield from bailouts, and use non-custodial storage. Borrowers are able to take advantage of stablecoin generation and personalized interest. Traders on Genshiro may use leverage of up to 20x. CLV aims to be the one-stop application for decentralized finance applications on Polkadot. It offers a share of fees to people who build applications on it, and also has its own wallet for users to download. ConclusionThe Polkadot Kusama ecosystem has the benefit of learning from the phenomenal work of more established DeFi ecosystems such as Ethereum that have tried and tested many different concepts. This gives Polkadot a late starter advantage. From on-chain governance to team auctions, there are enhancements made that could benefit not just Polkadot as a relatively new player in the DeFi ecosystem, but also other blockchains in continual need of safe connections to other blockchains and funnels for token flow. CosmosAuthor: Austin Foss Cosmos launched their mainnet on March 13, 2019, and almost 6 weeks later, on April 22, ATOM token transfers were enabled. In the three and a half years since, the Cosmos ecosystem has grown to more than 200 apps and services including many in the DeFi category. Titled the "Internet of Blockchains", Cosmos is aiming to bring its own strategy to the blockchain scaling challenge.Now we’ll explore what makes Cosmos different from other layer ones (L1) blockchains and how DeFi has evolved in that ecosystem. Cosmos GenesisFive years earlier than the mainnet launch of the network it first had origins in the Tendermint white paper published by Jae Kwon in 2014. He and Ethan Buchmann founded All In Bits Inc. in 2017, doing business as Tendermint Inc. to further develop the PoS consensus technology that would later power the Cosmos Ecosystem. In the same year, Jae Kwon became the president of the newly founded venture firm called the Interchain Foundation (ICF) to help fund development and stewardship of the ecosystem. As of two months ago Ethereum has officially made the merge to PoS but unlike Cosmos's Tendermint Ethereum's strategy is called Casper. A technical deep dive was published from the ICF in 2017 by the current host of the Interchain.fm podcast, @Chjango, who summarizes both with the following properties. Tender Mint Core:

Casper:

It's because of these differences in each protocol's properties that allows the Cosmos network to scale by using a network of L1 blockchains without needing to use layer two methods like rollups. A new L1 created using the Cosmos SDK can communicate with other L1s using a standard "Inter-Blockchain Communication protocol" (IBC). Each of these L1s connected to the Cosmos Hub chain is called a zone. Resulting in the elimination of a major drawback to any app chain: isolation. An app chain in the Cosmos ecosystem can still communicate with the rest of the network. In the years following the Cosmos launch Jae Kwon stepped down from his role at Tendermint in 2020. Cosmos Like ChainsTwo chains that were created using elements of Cosmos but not connected directly to the greater Cosmos ecosystem are Polygon and Binance’s BNB Beacon Chain. Polygon used a forked version of Tendermint called Peppermint as part of their consensus protocol. It’s possible for Polygon to implement IBC and implement communication with the rest of the Cosmos Hub but for now they haven't. Peppermint's differences include:

Prior to Binance's EVM compatible Smart Chain (BSC) they originally launched their BNB Chain, now referred to as the BNB Beacon Chain, using a forked version of the Cosmos SDK. Similar to Polygon, while it has the capability to use IBC it has not been enabled for the wider Cosmos ecosystem. Binance has been using IBC to facilitate a bridge between its two BNB and BSC chains. At the start of October this year a critical vulnerability was used to hack the bridge. With the help of Ethan Buchman this vulnerability was fixed before repeat attacks could occur. ATOM TokenomicsNetwork security for Cosmos is produced by staking the ATOM token and delegating it to a validator that is building the network's blocks. Delegators get the network fees paid in ATOM and pay a commission back to the validator for producing a valid block. In addition to the fees paid in ATOM from user transactions, blocks contain a reward, issuing new ATOM tokens and making it slightly inflationary. ATOM's inflation rate is variable around the goal of having at least 67% of all ATOMs stakes; less than that inflation increases to a maximum of 20%, otherwise inflation decreases to a minimum of 7%. Late this year, in September, a proposal for an on-chain vote to implement an updated Atom 2.0 was published to the Cosmos forums along with a white paper authored by twelve contributors including Ethan Buchman. Atom 2.0 prompted a significant debate within Cosmos including a response by Jae Kwon on twitter.  FTX <--> Alameda compounding is exactly the kind of systemic risk that unchecked LS (liquid staking) will bring to Cosmos unless we are proactive in putting checks on it, such as by limiting ICA (interchain account) staking. Vote NoWithVeto on 82 to save Cosmos. On October 31 Jae submitted an alternative on chain vote for a new constitution called Atom One and a few days later it was also being discussed in the forums. Both votes ended on November 14 and both were rejected. Fundamentally, this debate is surrounding the unknown risk that introducing liquid staking to the Cosmos ecosystem brings with it; Atom 2.0 in favour of liquid staking and Atom One yes, but with a different framework than what was proposed in Atom 2.0. On her personal channel, the host of Interchain.fm, shared a twenty minute deep dive into the nuances of each proposal. Near the opening she addresses the Atom 2.0 white paper suggested change to issuance.

For the time being ATOM's tokenomics will stay the same. ToolingCosmos wallets function differently from Ethereum wallets, so if we want to interact with its ecosystem we won't be using MetaMask. Perhaps the most common wallet used is the Keplr wallet but there are a variety to choose from. In order to start using DeFi in Cosmos the first step is always to get funds into the ecosystem. Outside of transfering to a Cosmos address from a centralized exchange, you can bridge directly from Ethereum using a tool called Gravity Bridge, "neutral Ethereum to Cosmos bridge." TerraPerhaps the elephant in the room is the splash the collapse of the Terra DeFi ecosystem had on the crypto-industry in the first half of the year. Following the dramatic collapse of Terra in May, two chains have emerged representing two sides of the community: Terra Classic which maintains the old Luna token and Luna Class (LUNC). At the time of writing Terra 2.0's LUNA token is sitting at a market cap just short of $250MM, and LUNC is a little less than one billion. What happens to Terra next, if both projects will continue or just one, this is all still to be decided. CrescentFollowing Terra's collapse, the ripple effects emanating from UST's unwinding kicked off the 2022 bear market, bringing with it a trend of austerity in the crypto-ecosystem. A project called Emmeris, built and funded by Ignite, is still listed on the Cosmos home page under the Gravity DEX project although it has been put on hold since at least June.

Having IBC enabled blockchains does help the UX of DeFi users of multiple L1s but even traversing the different Cosmos zones can still be a bit of a learning curve. Paired with Emeris, Gravity DEX was originally aimed at enabling "...DeFi across multiple chains. Swaps and pools of digital assets between any connected blockchains..." to create a smoother UX. Now rebranded as Crescent and acting as its own Cosmos Zone and specialized DeFi app chain. Crescent is innovating as a DeFi platform by creating a hybrid AMM and order book DEX. At the time of writing its zone holds a market cap of nearly $32MM, and Crescent's native token (CRE) has a market cap of $14MM. OsmosisOsmosis is the most highly trafficked AMM in the Cosmos Hub ecosystem with $384MM of volume in the last months and a $501MM market cap of the zone's native OSMO token. From the Osmosis documentation their described value proposition is "Inspired by Balancer and Sunny Aggarwal's 'DAOfying Uniswap Automated Market Maker Pools', the goal for Osmosis is to provide the best-in-class tools that extend the use of AMMs within the Cosmos ecosystem..." Osmosis has implemented self governing liquidity pools that enables voting of parameters of each pool, like the fee structures, on an individual basis. Mars' Red BankA very new protocol in Cosmos, yet to launch, is Mars Protocol. From their documentation Mars Protocol is intended as "...a fully automated, on-chain credit facility..." Almost all existing crypto-lending DeFi protocols like Aave and MakerDAO use an over collateralized system. Having an under collateralized loan hasn't been explored in DeFi just yet. In the physical world, repossessions or getting law enforcement involved are both options when dealing with an unpaid loan; in Web3 there is no incentive keeping an anonymous account from borrowing and never repaying a loan. It could be interesting to see how this experiment plays out given the inherent risks of under-collateralized loans. Crypto.com/orgSimilar to Binance having developed two different chains, one developed using the Cosmos SDK and the other as a fork of go-ethereum, Crypto.com has deployed two of their own. In March, 2021, the first was called the Crypto.org chain and built using the Cosmos SDK. Eight months later their second chain called Cronos launched. Both Binance's BSC and Crypto.com's Cronos chain are EVM compatible, but instead of being a fork of go-ethereum it is built using a tool called Ethermint. Ethermint is developed by another Cosmos zone called Evmos and is "a Cosmos SDK library for running scalable and interoperable EVM chains". Both of Crypto.com's chains use the same CRO token that has a market cap of 1.6 billion USD. Relatively young for blockchains, their ecosystems are still developing and can be accessed most easily using their Crypto.com DeFi Wallet, or if you want to use MetaMask and connect to the Cronos network because it is EVM compatible. Kava Another EVM compatible Cosmos zone is Kava, a hybrid of both EVM and Cosmos SDK based chains. Users are able to connect to it using both Keplr and MetaMask wallets. Sushi SwapSushiSwap announced that it would be deploying to the Kava network. Any user should be conscious of high slippage depending on trading pairs as liquidity builds up. Users can access it through the same web app and simply select the Kava network from the drop down. CurveIn September Curve joined the Kava ecosystem and has collected more than $12MMof total deposits. Same as with SushiSwap users just have to navigate to the same front end they are familiar with and select Kava. Still Early Days for the CosmosFor a chain that has only been around for three and half years the technology and research behind Tendermint has had an outsized impact on the crypto ecosystem. It has provided an easy to use framework for centralized exchanges and independent projects to experiment quickly. Cosmos Zone TVL: Crescent: ~32,000,000 USD Osmosis: ~700,000,000 USD Crypto.com: ~1,538,000,000 USD Kava: ~529,000,000 USD Evmos: ~512,000,000 USD Gravity Bridge: ~35,000,000 USD One thing the Cosmos ecosystem has demonstrated is a lot of experimentation and new ideas for DeFi. CardanoAuthor: ChickenRamen As the bear market continues to rage on and as the builders build we are constantly seeing new things rise and fall. Whether it is something as small as a simple DeFi lending app to, in some cases, an entire L1 chain, DeFi and crypto as a whole is filled with uncertainty. Whether or not a certain dapp or chain will die within the span of a single day compared to if it can last for as long as the internet can, we can only know if we let it. The only real way we can test longevity is by seeing whether or not it could last a bear market, however as we saw with other projects this can be a very scary way to test something when it comes down to investors wanting to keep their money secure. And with the onset of older, more risk averse, people entering crypto, who of them would want to use a project that they have no idea will fail? They might rather use something that has been tested to work as it should. And that is where Cardano comes in. (I need something to get the work flowing so feel free to delete this if you want.) Cardano is a blockchain with a focus for academic assessment and scientific analysis. Originally started by Charles Hoskinson, someone who was one of the eight founders of Ethereum alongside Vitalik and Gavin Wood, who wanted to take a more commercial approach towards blockchains. After he left Ethereum in late 2014, he helped to create Input Output Hong Kong (IOHK) and thus, Cardano. One of the most notable parts of Cardano’s creation is that it had no venture capital assistance and as a result its growth is completely organic, and can do as it pleases without having to worry about monetary constraints. With that said, every single update and new feature has been tested by many different academics and researchers from all around the world to ensure that it can work in a way that is both efficient and sustainable as possible. ArchitectureCardano utilizes a consensus mechanism that they call Ouroboros which has been called “ the first provable PoS secure consensus mechanism” which was first implemented late 2017. Ouroboros has been fully peer reviewed before its first implementation and has been proven to work very well for itself over the past five years with many different changes along its journey. It works similarly to how delegated Proof of Stake (DPoS) functions however with many different key differences which are out of scope to describe here. All that you need to know is that Ouroboros is incredibly energy efficient, protected against all sorts of vulnerabilities, and helps to reward honest participants while also punishing bad actors. Something else that should also be mentioned is that Cardano is written in Haskell. While Haskell is typically mainly used by academics, it has also been around for the better part of over 30 years which means that there are a slew of different versions of Haskell, libraries for developers to utilize, and enough documentation to make stack overflow look like a children’s book. Not to mention that Haskell was made in a way that ensures that the programmer is programming things in a way that is efficient and isn't going to hinder the dapp any further. While Haskell is one of the oldest programming languages still utilized, it is also one of the least used programming languages for a variety of different reasons with too many of them to go over here. For those interested in learning more about how to develop on Cardano, I would recommend looking into Plutus and Marlowe, both languages made for producing smart contracts on the Cardano blockchain. TokenomicsCardano is currently ranked eight on CoinMarketCap and nine on Coingecko. Cardano currently has a market cap of about 15 billion dollars with a total of 45 billion tokens in its total supply and approximately 35 billion tokens or about 12 billion dollars. As of writing this, the current TVL of Cardano is 300 million dollars with most of that trading volume coming from centralized exchanges. With approximately 73% of the total tokens in supply being staked within the Cardano ecosystem and over 3000 total validators, Cardano is one of the most decentralized Proof of Stake blockchains out there. Considering how many validators Cardano has, it can process up to 250 transactions per second which is over 10x what Ethereum has at this current moment. This speed allows Cardano to feel almost seamless with how it does its transactions, especially when compared to Ethereum’s TPS, currently averaging around 11. When it comes down to the token distribution approximately 60% of the tokens minted were sent into circulation through its first ever ICO while over 10% was reserved for the development team and 31% was left for the total staking rewards. App Ecosystem When it comes down to DeFi dapps, the Cardano ecosystem is still in its infancy. However, the dapps that are currently deployed are far relatively more developed considering that smart contracts have only been possible on Cardano for just over a year. Both SundaeSwap and Minswap have been able to perform very well despite how small Cardano is compared to other lending platforms in other L1 and L2 blockchains. Not to mention that due to the Vasil hardfork, transaction speeds make transactions seem as if they are going at the speed of light so any transaction that happens near instantaneously. Other notable mentions include AADA which is a lending protocol that isn’t like most other lending protocols. Instead of functioning like a traditional DeFi lending dapp that you see on other chains such as Ethereum which instantly lend and receive rewards, AADA is going for a more manual approach towards lending meaning everything is set at a fixed rate compared to a floating rate that you would see on other lending platforms. ConclusionAll in all, Cardano is a fascinating chain to look into and something that I have been really interested in learning about and using for a while. I even wrote a 10 page paper about talking about the technical details for Cardano, parts of which I did include for this, however due to many different constraints I wasn't able to add as much as I would have wanted. For all those out there who are really interested in learning more about Cardano, I really do recommend looking into it yourself since there really is so much that is going on behind the scenes. On top of that, the research being made can actually benefit the whole of crypto, not just for Cardano’s sake. On top of that, more new dapps are being built so doing your own research can give you some great insight. Actions steps📖 Read Why Alt L1s Are Bullish [LITE] | David Hoffman ⛏️ Dig into The Limits to Blockchain Scalability | Vitalik 🎧 Listen The Cosmos Thesis with Sunny (Aggarwal & Zaki Manian) | Bankless Shows 🎧 Listen Everything you need to know about Solana (Santiago Santos & Konstantin Lomashuk) | Bankless Shows Tokenomics 101: The Definitive Guide to Understanding EIP-1559Author: Meesh IntroductionIt’s been two months since the Merge, but prior to one of the biggest events in blockchain history, there was a proposal that paved the way for the Ethereum transactions that we know today. That proposal, formerly known as the Ethereum Improvement Proposal 1559 (EIP-1559) was implemented onto the Ethereum mainnet as part of the London Hardfork on August 5, 2021. EIP-1559Having been touted as the proposal that would push Ethereum into becoming a deflationary asset, EIP-1559 changed Ethereum’s fee market mechanism and as a result, has made transactions more efficient. The EIP-1559 update has been significant in that it set forth the following updates:

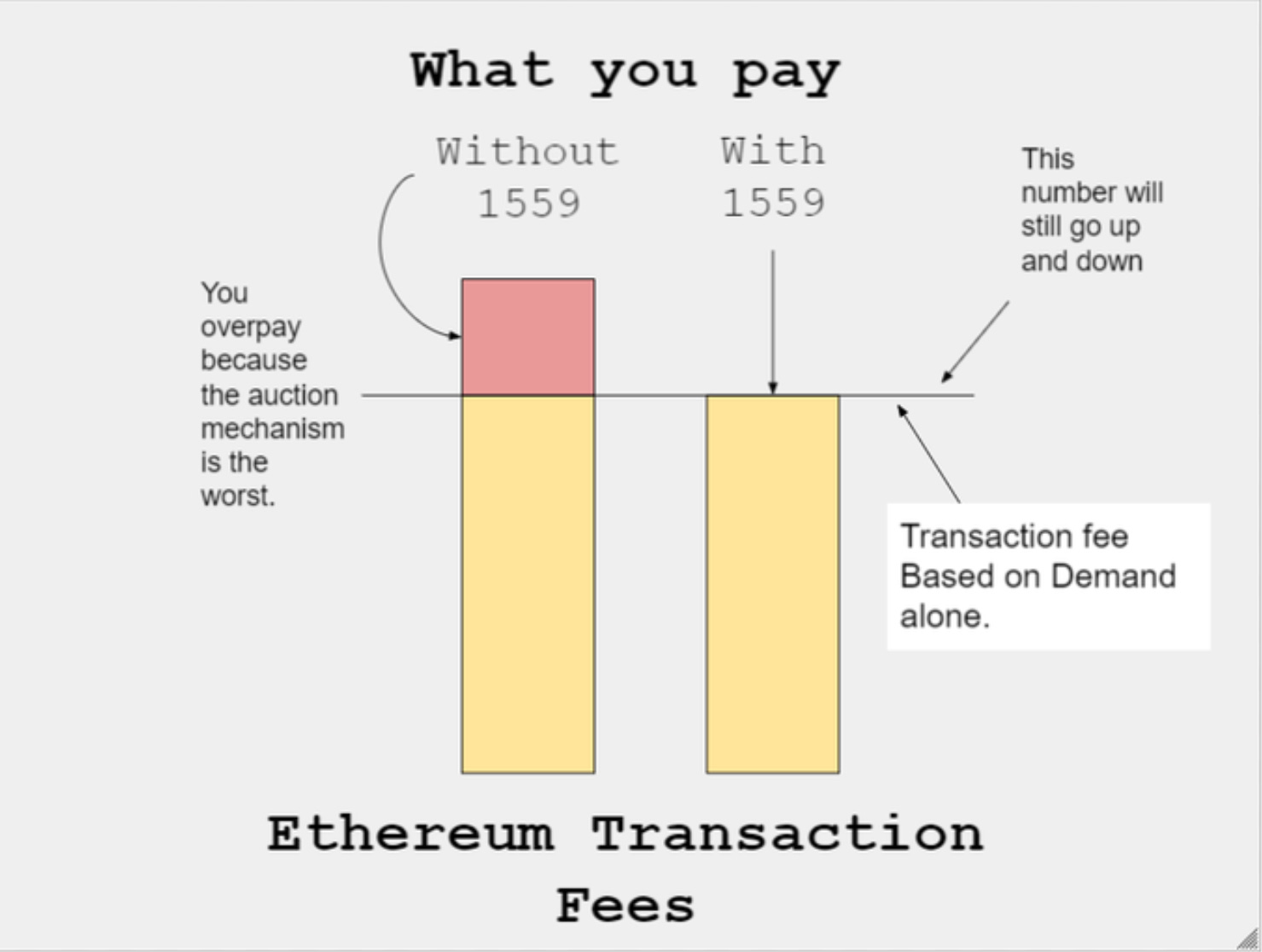

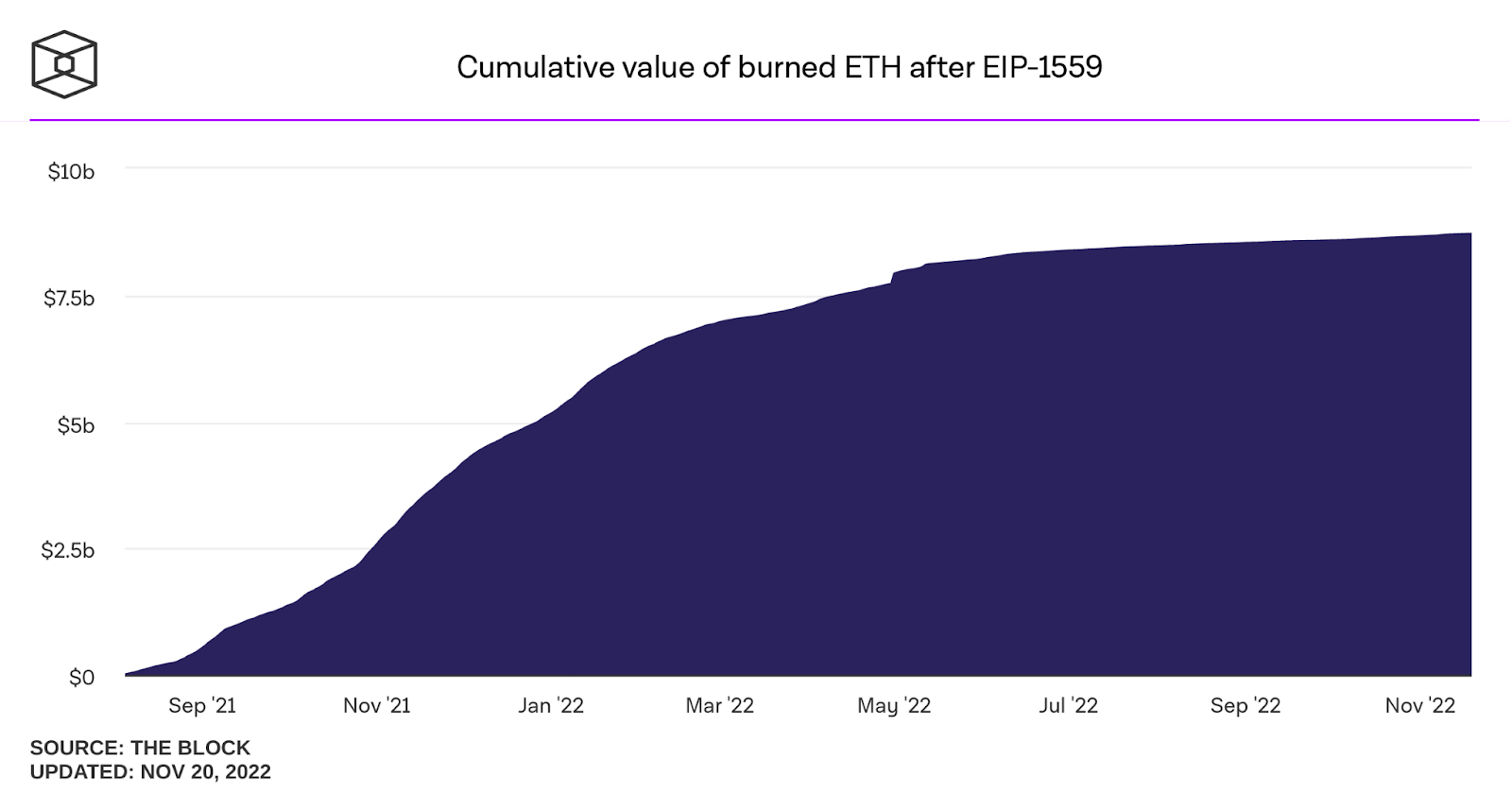

EIP-1559 essentially sets out to counterbalance an increasing Ethereum supply, reduce gas fee volatility, and increase transaction speeds. In hindsight, EIP-1559 served as a complimentary precursor to the Merge. Gas Price TransparencyBefore the implementation of EIP-1559, the Ethereum gas price market ran on a first-price auction model as the gas fee calculation. First-price auction allowed users to bid on gas, where the highest bidder would win the spot to have their transaction processed. The inefficiencies with the auction system don’t just lie in its supplementation to volatile gas prices, but also that there is no baseline for users to determine their auction prices. If this method were to continue, it would’ve exacerbated an unfair ecosystem, where those who could afford to pay higher gas prices would outbid other users, leaving the rest with longer wait times. EIP-1559 eliminated the first-price auction model and replaced it with a base fee and optional priority fee model. This eliminated user-set prices since the base fee is calculated by the protocol and is determined by network conditions. The optional priority fee is a “tip” that users can add to have their transactions processed faster. Another addition is that users have the ability to set an optional parameter known as the maxFeePerGas. In order for transactions to be successfully executed, the maxFeePerGas must be greater than the (base fee + priority fee). Once the transaction is completed, the user is then refunded the difference between the maxFeePerGas and the summation of the (base fee + priority fee). Although EIP-1559 made the gas transaction fee process more complex, the benefit of moving away from first-price auction to a flat-fee model is that it eliminates inefficiencies by making the next block’s fee transparent. Therefore allowing users to decide whether they are willing to pay the gas fee for the transaction. Fee-Burning MechanismPrior to EIP-1559, Ethereum issuance occurred with every transaction, leading to an uncontrolled increase in circulating Ether. Without the ability to limit the supply of circulating Ethereum, fear of imminent inflation was prevalent. With the implementation of EIP-1559, gas transaction fees are split into a base fee and a priority fee. The algorithmically determined base fee is the minimum gas price that every transaction must pay, which is burned by the protocol. The remaining priority fee gets paid to the validator, along with any interest from their staked Ethereum. In just over a month after the EIP-1559 update, approximately 386,466 ETH ($1.1 billion USD) has been burnt, putting Ethereum into a slight deflationary period. The combination of the EIP-1559 update along with Ethereum’s transition to a proof-of-stake (PoS) consensus mechanism has decreased the net supply of Ethereum, while gradually increasing the cumulative amount of ETH burned. While EIP-1559 plays a role in reducing the circulating supply of Ethereum, a fee-burning mechanism alone may not be enough to predict its deflationary impact. With other variables at play, such as transactions and network congestion, the more transactions that occur, the more the deflationary pressure from fee burning will have on Ethereum’s supply. This can be seen in Ethereum’s deflationary turn for the first time since The Merge. Due to a recent increase in network usage and market volatility following the collapse of cryptocurrency exchange FTX, it’s apparent that Ethereum’s deflationary quality depends on the degree of network usage. Variable Block SizePreviously, transactions on Ethereum were met with a hard cap per block. The nature of inflexible blocks proved to be highly inefficient because transactions often had to wait for several blocks before getting included. In an effort to prevent transaction delays for users due to the hard per-block gas limit, EIP-1559 replaced the hard cap with a flexible cap, allowing blocks to expand or contract based on network congestion. EIP-1559 doubled the block gas limit from 15 million gas to 30 million. This is where EIP-1559’s base fee calculations also come into play. The algorithmic base fee calculations encourage a block size of around 15 million gas, which is also known as the block gas set target. When blocks are smaller than the block gas set target, base fee prices will decrease. Subsequently, when blocks are larger base fees will increase, but only up to the new limit of 30 million gas. The intent of EIP-1559 is to match gas prices with the level of network congestion. Specifically, each block’s base fee will increase or decrease by 12.5% based on how full the block is relative to the previous block. For example, if a block is 100% full the base fee increases by 12.5%; if it’s 50% full the base fee stays the same; if it’s 0% full the base fee decreases by 12.5%. ConclusionOver a year after EIP-1559’s implementation, some thought-provoking implications come to mind about the ongoing effects provided by EIP-1559 coinciding with further developments within the Ethereum ecosystem, such as rollups and Layer 2 scaling solutions. A dynamic to consider is the possible effect of less on-chain activity due to rollups, leading to a decrease in the base fee burning mechanism, thus lessening the deflationary effects by EIP-1559. That is just one of many dynamics that could come into play as we continue making strides within the Ethereum ecosystem. Although many scenarios can play out, it’s safe to say that the execution of EIP-1559 was a successful step forward for the Ethereum community. Security Scares: Fake Wallets Across BlockchainsAuthor: d0wnlore With the popularity of Ethereum and EVM compatible chains came a proliferation of scam websites that trick non-custodial wallet users into giving up their private keys or mnemonic phrases. Such scam websites ask the user to connect their wallet and subsequently open a new window. This window will often appear as a wallet’s “import secrets” window in order to allow the user to continue using the website. However, these windows will just take and feed all input to a scammer’s database of secrets to be compromised later. MetaMask is the most masqueraded non-custodial wallet in the Ethereum ecosystem in such social engineering attacks. In fact, many of these scam websites will show links for “using” many non-custodial wallets other than MetaMask. But more often than not, all those links will just pop up a window that looks like MetaMask, as that is the most likely wallet to be installed by users. But the fake wallet scam exists outside of the EVM world as well. In particular, the Cosmos ecosystem faces the same issue due to the ubiquity of Keplr, arguably the most popular non-custodial wallet for blockchains built with the Cosmos SDK. These websites will often appear as the Keplr Dashboard, the Keplr interface outside of the traditional popup window that is used for actions like staking and voting on proposals. ScamThese websites will then prompt the user with a fake “import private key” window upon any action within the fake Keplr Dashboard website. The takeaway is that your private key or mnemonic phrase, regardless of blockchain, is the golden ticket that scammers will aim for and attempt to trick you into handing over. The social engineering playbook doesn’t change much across blockchains, with the main difference being a new veneer to look like a blockchain's most popular non-custodial wallet, such as MetaMask or Keplr. Always keep in mind what your non-custodial wallet appears as and think twice whenever you’re performing actions through it, such as asking why your wallet is now asking you for your private key when your account should have already been added to your wallet. Project Releases 🎉

Utopia Soft Launch on Fantom

Welcome... to Utopia! 🐝

Utopia has officially soft launched at topia.fi 👀

Check out the discord announcement below for details on what to expect when you #EnterUtopia! 🔥

Tag your fellow farmers to let them know! 👨🌾

$COMB $FTM #DeFi Liquidity Book Now Live on Trader Joe

Trader Joe presents: Liquidity Book 🌊📘

📘 Provide Liquidity on the most efficient AMM in Web3

🌊 Enhance your profitability with Surge Pricing

🗑️ Execute your Trading with zero slippage

🎨 And check out the new UI!

Now LIVE! 🚀 Calc Decentralized DCA Launches on Cosmos

👋 Hello world

✦ CALC V1 is here → app.calculated.fi

This sets the foundation for a responsible, decentralised DCA platform with some serious automation under the hood! 🏎️

First pairs:

#USK <--> #KUJI

#axlUSDC <--> #KUJI

#ATOM <--> #KUJI

#axlUSDC <--> #ATOM Stader Launches Automated Strategy Portfolio on BNB Chain

The wait is over!⏳

🤩Don't keep calm, 𝐁𝐍𝐁𝐱 𝐏𝐨𝐫𝐭𝐟𝐨𝐥𝐢𝐨𝐬 is finally live🤩

We've got a Low Risk - High Yield strategy for you🫵

⚡️Meet 𝐃𝐞𝐅𝐢 𝐒𝐢𝐦𝐩𝐥𝐞 𝐋𝐏 𝐀𝐜𝐜𝐨𝐮𝐧𝐭⚡️

Just deposit your #BNB & earn upto 14% yields

bnbchain.staderlabs.com/portfolios Allbridge Liquidity Pools for Transfer Between Chains

🔥 We are thrilled to launch the LP page for #AllbridgeCore!

✅ Larger liquidity pools will smoothen the user experience and make it more convenient to transfer value between chains.

👉 Visit core.allbridge.io/pools to become a liquidity provider! ChaChaSwap Offers Multi-Chain Automated Market Maker

🏁We’re so excited launching our next generation NFT AMM protocal #ChaChaSwap PUBLIC BETA on Ethereum Mainnet!🚀🚀

Create buy/sell pools and trade NFTs on

app.chachaswap.xyz

💃Let's SHAKE and start to earn!

👀Million $ChaCha Airdrop on the way...

mirror.xyz/0x54C762dB9054… Chirping Birds

imo what we really need is much better duration risk management for *SOLVENT* entities

so, exchanges should not be utilizing user deposits to earn returns, unless users explicitly request it

and lenders should operate with term deposits as the norm, instead of flexible deposits  CZ 🔶 Binance @cz_binance  The "centralized anything is evil by default, use defi and self-custody" ethos did very well this week, but remember that it too has risks: bugs in smart contract code.

Important to guard against it:

* Keep code simple

* Audits, formal verification, etc

* Defense in depth  Products that are bankrupt

Celsius

BlockFi

FTX

Voyager

Gemini Earn

Genesis

Products that are working fine

Uniswap

Yearn

Maker

Aave

Lido

Curve  Here's the reality, though. Even if we ignore the scammers, we still have to deal with the fact that so many (well-meaning) DeFi protocols have onboarded centralized collateral that can be rugged in the back end. The word "DeFi" is starting to lose its meaning, scammer or not.  What was SBF lobbying against? DeFi. 🤔

What would have prevented this? DeFi. 🤔

What exchanges already publish real-time proof-of-reserves? DeFi. 🤔

What will US regulators try to shut down? DeFi. 🤷♀️  Using unregulated CEX collapses as arguments for DeFi is effectively a strawman imo

CEXes are this weird worst of all worlds compromise between DeFi and TradFi

The real competition for DeFi is not CEXes but actual regulated finance, and IMO we are still losing big time  A centrally-regulated financial system has led to the status quo. If you're happy with the status quo, stay there and enjoy.

The rest of us are trying something else. We're not asking for your money or your permission.

You're welcome any time to join us. Alternative L1 TacticsUltimate Guide to LedgerAuthor: Ryan Sean Adams Solana Wallet GuideHow to Get Started on CosmosAuthor: William M. Peaster Polkadot Wallet Guide🛠 BANK Utility (BanklessDAO token)With over 5,000 holders, BANK is one of the most widely held social tokens in crypto. So it bears asking, where are the best places to put our BANK to use? The five protocols below will allow you to deposit BANK in a liquidity pool and earn rewards. To get going, just click on the name, connect to the app, filter by BANK, and start earning passive income.  Resident tokenomist @ffstrauf turns inward, analyzing BanklessDAO's $BANK token and showing us how a movement becomes an incentivized community of buidlers (Cov @dippudo) ⚖️ BalancerBalancer has two 80/20 liquidity pools, meaning that you are required to deposit 80% BANK and 20% ETH in the pool. There is one pool on Ethereum and another on Polygon. Once you’ve provided liquidity, you’ll receive LP tokens. Keep an eye out for opportunities to stake these LP tokens. There is nearly 500,000 USD in the two Balancer liquidity pools. 🍣 SushiSwapSushiSwap has a 50/50 BANK/ETH pool. As with Balancer, you will receive LP tokens, and while you can’t stake them on SushiSwap’s Onsen Farm yet, you may be able to in the future. Liquidity providers earn a .25% fee on all trades proportional to their pool share. The SushiSwap pool has a little over 100,000 USD in liquidity. ⏛ Rari Fuse Pool- Deprecated SoonThis will be deprecated soon. The Rari Fuse Pool allows you to borrow against your BANK or earn huge APY by providing assets like DAI to the pool. At present, all borrowing is paused for this pool. There is over 450,000 USD deposited in the Pool 🦄 UniswapThe Uniswap V3 liquidity pool is 50/50 BANK/ETH, and provides a price oracle for the Rari Fuse Pool. By depositing in the Uniswap pool, you can earn fees and help enable borrowing on Rari. This pool currently has over 500,000 USD in liquidity. 🪐 ArrakisYou can also provide liquidity to the Arrakis Uniswap V3 pool. The ratio is about 2/1 BANK/ETH. This pool is new, and only has a bit more than $6,000 in liquidity. In the future, you may be able to stake your BANK/ETH LP tokens within the protocol to earn additional rewards. Get Plugged In🧳 Job OpportunitiesGet a job in crypto! Do you like solving hard problems, care about building more efficient markets for everybody, and want to work at the frontier of decentralized finance? Rook is looking for full time contributors, with salaries ranging from $169,000-$722,000. There are positions ranging from engineering, recruiting, product marketing, copywriting, and design. Sound interesting? Sign up for our referral program and go full-time DAO.

|

Older messages

adidas and Nike Step Up Their Web3 Game | Decentralized Arts

Wednesday, November 23, 2022

Dear Bankless Nation, At the outset of the Bankless movement, we were charged to develop onramps to crypto—via education and media—to ease the transition for most users away from fiat. It was the

Your DAOctor Will See You Now | Bankless Publishing Recap

Tuesday, November 22, 2022

Top-shelf Educational Web3 Content Shipped Directly to Your Inbox

Getting to Know the Ombuds Office | BanklessDAO Weekly Rollup

Saturday, November 19, 2022

Catch Up With What Happened This Week in BanklessDAO

7 Essential DAO Skills | State of the DAOs

Thursday, November 17, 2022

You're reading State of the DAOs, the high-signal low-noise newsletter for understanding DAOs.

Refik Anadol Makes the Case for Human + Machine for Digital Art | Decentralized Arts

Wednesday, November 16, 2022

Dear Bankless Nation, What an incredible past couple of weeks in the wide world of web3! It appears that all eyes were watching the epic FTX meltdown. BanklessHQ had a strong write up about why the FTX

You Might Also Like

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

WuBlockchain Weekly: SEC Terminates Lawsuits Against Multiple Crypto Companies, Bitcoin Drops Below $80,000, OKX S…

Friday, February 28, 2025

On Friday, OKX market data revealed that BTC fell below $80000, reaching a low of $78258, with the current price at $80514, reflecting a 24-hour decline of 7.22%. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

FBI confirms North Korea-backed Lazarus hackers stole $1.5 billion from Bybit

Thursday, February 27, 2025

FBI tracks Ethereum laundering spree by North Korean hackers amid rising threat of cyber warfare in the crypto world. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with MicroStrategy Founder Michael Saylor: The Company Holding the Most Bitcoin in the World

Thursday, February 27, 2025

In this interview, Colin from WuBlockchain had an in-depth discussion with MicroStrategy founder Michael Saylor about the company's ongoing Bitcoin acquisition strategy, the growing adoption of

Abu Dhabi Invests $436.9M In Bitcoin ETF

Thursday, February 27, 2025

February 17th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Abu Dhabi Invests $436.9M In Bitcoin ETF Changpeng Zhao Sparks Meme Coin Rumours Coinbase Finally Lists POPCAT & PENGU

📈 BTC’s realised price (average acquisition price) reached an all-time high of $43,000; State of Wisconsin Invest…

Thursday, February 27, 2025

BTC's realised price reached an all-time high of $43000; Abu Dhabi's Mubadala Investment disclosed its BTC ETF holdings; South Korea to allow universities and charities to sell crypto donations

HashKey Exchange's Interpretation of the Hong Kong SFC Virtual Asset Roadmap

Thursday, February 27, 2025

We are pleased to see the Hong Kong government release the forward-looking and pragmatic “ASPI-Re” roadmap for advancing the virtual asset industry. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Argentina’s stock market plummets amid President Javier Milei’s LIBRA memecoin scandal

Thursday, February 27, 2025

Argentina's economic landscape shaken as Milei's LIBRA endorsement turns into multi-billion dollar fiasco. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Heated AMA Debate: 0G Team Responds to Allegations of CFX Soft Rug, Overvaluation, and Token Commitment Concerns

Thursday, February 27, 2025

This AMA primarily focused on the relationship between Conflux and 0G Labs, discussing 0G Labs' high valuation, fundraising structure, technical direction, and community concerns over transparency.