Medical Debt Is Crushing Millions of Americans

Welcome to Crime and Punishment: Why the Poor Stay Poor in America. I’m thrilled that you signed up to read my newsletter, and I hope that together, we can make a difference.

It’s easy to think that if you have health insurance, you will not have medical bills to pay out of pocket — isn’t that why you’re paying those hefty premiums? Unfortunately, medical bills, regardless of insurance coverage, often turn into medical debt. According to a 2022 CNBC article, over 55% of all adults in the United States have some medical debt, and at least half of that number have over $10,000 in medical expense debt. This article also explains why, despite insurance, medical bills can turn into medical debt because of high deductibles, high premiums costs (even when subsidized on the Affordable Care Act Exchange) and the “highest in the industrialized world” drug prices. Let’s start with monthly premium costs and deductibles. If you are a married couple and make over $73,240 combined, you are not eligible for any government subsidies for your health insurance premiums on the Affordable Care Marketplace. Say each person in this couple has what today is considered a lower-wage job, making about $40,000 a year, totaling $80,000 in combined Adjusted Gross Income. This couple gets zero health care subsidies from the federal government. By the way, if you earn $40,000 per year, you are making roughly, between $20-$21 per hour and working 40 hours a week. Obviously, one or both individuals of this couple may have health insurance from their employer, but many do not because they are self-employed or gig workers… or the company they work for classifies their jobs as ineligible for health insurance to save costs. Without premium subsidies given in the form of tax credits, the average monthly premium for this couple is $834 (I’ve chosen their age as 30, because the lower your adult age, the lower the premiums). And the average deductible, which must be paid out of pocket before insurance kicks in, is anywhere from $2,000 to over $4,000, depending on the type of plan and insurance company. Generally, the higher the monthly premium, the lower the deductible, and the lower the monthly premium, the higher the deductible. On the positive side, there are at least two, major benefits provided by the Affordable Care Act that consumers did not have before:

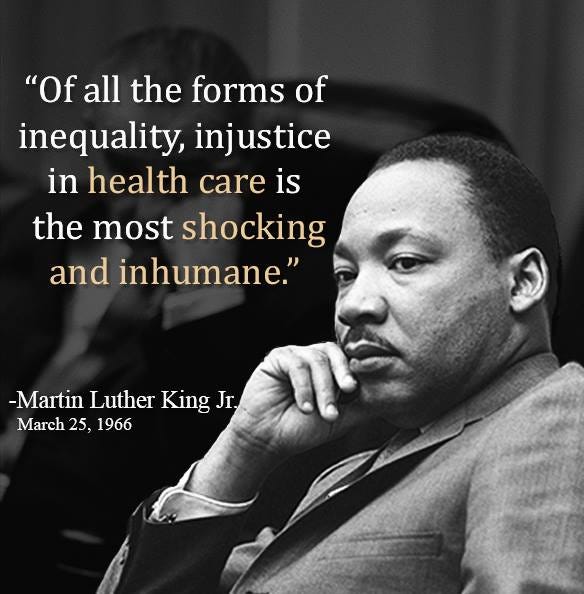

According to an October 2022 report by the Kaiser Family Foundation (KFF), even with employer provided health insurance, a family pays an average of over $6,000 annually toward premiums and still has co-pays, co-insurance payments and an average of nearly $2,000 for a deductible. Given the low income threshold for premium subsidies, co-pays, deductibles in the thousands of dollars per year and the good possibility of co-insurance payments, you can better understand why average working Americans can easily accumulate medical debt, regardless if their health insurance is provided by their employer or purchased on the ACA exchange. Talking in generalities and using statistics, however, is not usually the best way to illustrate a point. But examining a real-life scenario with real people helps more of us better understand how economic issues, in particular, affect us all. A recent ProPublic article does exactly that, but its focus is not on our country’s health insurance system, but rather the usury interest rates on car title loans. This investigative report examines the car title “pawn business”, legal in Georgia and several other states, and focuses on a few individuals caught in its debt cycle, a business model described as “obviously immoral but not illegal”. One man mentioned in the story had just retired at age 63 and was looking forward to spending time with his wife, children and grandchildren at their family home in Savannah. Unfortunately, his wife became gravely ill and accumulated thousands in medical bills, presumably not paid under their health insurance. For unexplained reasons, he was unable to refinance his home to pay off this debt, and desperate, he pawned the title to his truck in exchange for about $10,000 in cash. His monthly loan payments totaled a bit over $1,000, but he had not been told that these payments only covered the triple digit interest rate charged for the pawn of his car title. Four years later, his wife had died, and he had paid nearly $25,000 in interest and nothing toward the principal balance. Even after declaring Chapter 13 bankruptcy, he was forced to pay back this “loan” in full and at the original terms because Georgia law deems title pawn businesses to be secured creditors. Neither medical bills nor medical debt should exist in the United States in the twenty-first century. We do not need health insurance of any kind or cost, what we need is quality health care. If you are not wealthy enough to pay the exorbitant costs to for-profit companies to keep you alive and relatively healthy, you are punished with debt, bankruptcy and even your life or those of your loved ones. As one of my readers eloquently stated in the comment section of this newsletter:

Senator Bernie Sanders (I Vt.), has been tirelessly fighting for government run health care his entire career, and he’s not stopping now. This year, he and 14 other senators again introduced a “Medicare for All” bill to the Senate. This proposed bill also upgrades our current Medicare system to include vision, dental and hearing aid coverage.

What might convince you that our country needs at least Medicare for All, the steadily rising cost of health insurance premiums and deductibles, that millions of people are overwhelmed with medical bills and debt, the personal stories of people whose lives are ruined by getting sick? Or nothing at all? I’d love to hear your thoughts in the Comment Section below. All comments are welcome! As always, I appreciate your interest and thoughtful ideas that make our Crime and Punishment community a welcoming space to visit and chat. There’s no time like the present to become a free or paid subscriber—thanks in advance for your support! You’re on the free list for Crime and Punishment: Why the Poor Stay Poor In America. All posts are free for now, but if you’d like to get ahead of the crowd, feel free to support my work by becoming a paid subscriber. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Older messages

Holiday Reading: Why We Need Other Animals

Thursday, November 24, 2022

And Why They May...Or May Not Need Us

Urban Sprawl With Little Regulation

Thursday, November 17, 2022

Listen now (8 min) | Is This What the Middle Class Really Wants?

There's Still Time...

Tuesday, November 8, 2022

Listen now (4 min) | To Make Your Voice Heard!

Are Secret Algorithms Responsible For Your Rent Hike?

Sunday, November 6, 2022

Listen now (7 min) | And Other Sundry Issues Affecting Our Housing Market

Those Dastardly "Hidden Fees"

Friday, October 28, 2022

And Why It's Important To Target Them Now

You Might Also Like

Hit the Courts This Spring in Our Favorite Tennis Shoes

Saturday, March 1, 2025

If you have trouble reading this message, view it in a browser. Men's Health The Check Out Welcome to The Check Out, our newsletter that gives you a deeper look at some of our editors' favorite

"I Might Not Be Getting Anything Done, But At Least I'm Not Having Fun"

Saturday, March 1, 2025

Do Americans actually resist pleasure? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

“Fog” by Emma Lazarus

Saturday, March 1, 2025

Light silken curtain, colorless and soft, / Dreamlike before me floating! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

savourites 96

Saturday, March 1, 2025

escaping the city | abandoning my phone | olive oil ice cream ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

5-Bullet Friday — How to Choose Peace of Mind Over Productivity, Guinean Beats for Winding Down, Lessons from Legendary Coach Raveling, and a New Chapter from THE NO BOOK

Saturday, March 1, 2025

"Easy, relaxed, breathing always leads to surprise: at how centred we already are, how unhurried we are underneath it all." — David Whyte ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Nicole Kidman's “Butter Biscuit” Hair Transformation Is A Perfect Color Refresh

Saturday, March 1, 2025

Just in time for spring. The Zoe Report Daily The Zoe Report 2.28.2025 Nicole Kidman's “Butter Biscuit” Hair Transformation Is A Perfect Color Refresh (Celebrity) Nicole Kidman's “Butter

David Beckham's Lifestyle Keeps Him Shredded at 50

Friday, February 28, 2025

View in Browser Men's Health SHOP MVP EXCLUSIVES SUBSCRIBE David Beckham's Lifestyle Keeps Him Shredded at 50 David Beckham's Lifestyle Keeps Him Shredded at 50 The soccer legend opens up

7 Home Upgrades That Require Zero Tools

Friday, February 28, 2025

Skype Is Dead. There are plenty of ways to make quick improvements to your house without a single hammer or screwdriver. Not displaying correctly? View this newsletter online. TODAY'S FEATURED

Heidi Klum Matched Her Red Thong To Her Shoes Like A Total Pro

Friday, February 28, 2025

Plus, the benefits of "brain flossing," your daily horoscope, and more. Feb. 28, 2025 Bustle Daily Here's every zodiac sign's horoscope for March 2025. ASTROLOGY Here's Your March

How Trans Teens Are Dealing With Trump 2.0, in Their Words

Friday, February 28, 2025

Today in style, self, culture, and power. The Cut February 28, 2025 POWER How Trans Teens Are Dealing With Trump 2.0, in Their Words “Being called your correct name and pronouns can be the difference