Earnings+More - Wynn’s November bounce

Wynn’s November bounceThe shares month, World Cup balls, Betclic on the up, Ontario Lottery dressing down, startup focus – Prophet +MoreGood morning. To start your week:

The shares monthWynn Resorts leads November sector bounce with a 28% rise. November spawned a monster: Investors appear to have taken the positives from the news from Macau, where the award of gaming concessions has been balanced by continued issues with China’s Zero Covid policy. But Wynn has also benefited from the news that Tilmann Ferrtitta has built up a stake in the business.

🔥 Sector leaders enjoy a good November Duel purpose: With two separate investor bases joined by a common hope over the prospects for online in the US, Flutter had the better of the month over DraftKings, helped by the news over the arbitration settlement with FOX and its FanDuel investor day.

🥊 The big dipper: DraftKings vs. Flutter

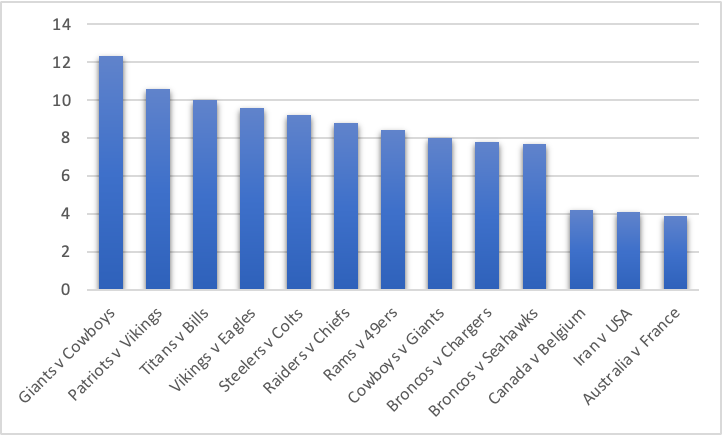

**Sponsor's message: Spotlight Sports Group is a leading technology, content and media business specialising in sports betting. Working with the largest media companies in the world, including AS.com and Advance Local, Spotlight Sports Group offers fully managed solutions that allow publishers to maximize revenue across their highly valuable sports betting audiences. For more information visit: spotlightsportsgroup.com 888 debt raisePeter/Paul: As was pre-announced last week, 888 is to market €200m of debt with the proceeds going entirely towards paying off the same amount of existing sterling-denominated indebtedness. It noted there was no guarantee the new mixture of fixed and floating rate notes would find willing buyers. World Cup ballsData from GeoComply shows how some World Cup group stage games compared with a selection of this season’s biggest NFL matchups. Having a moment: The data from a selection of key matches during the group stages suggests the World Cup is attracting a decent level of betting activity going by the geolocation statistics.

🏈 vs⚽ GeoComply checks for key NFL games vs. World Cup Betclic’s BAH-humbugOnline gaming revenues rose 5.5% to €591m, with adj. EBITDA up 8.4% to $150.8m, despite subsidiary Bet-at-home’s German and Austrian troubles. Troubles at home: FL Entertainment’s Betclic brand saw revenues rise 15%, helping to offset Bet-at-home’s (BAH) 11% drop caused by the forced exit from Austria in Oct21. Such is the extent of the issues with BAH that in September the company said it may not have the liquidity to meet its obligations.

Ontario Lottery’s slapOLG was criticized for poor casino performance by the Auditor General even as the province’s digital GGR for igaming shot up 65% in Q3 to CA$267m. Imbalancing act: Ontario Lottery and Gaming’s online GGR was up 7% to CA$108m in Q3, ex-iLottery, while OLG’s digital turnover had grown 270% to CA$511m in 2021-22 vs. 2019-20. However, the AG’s report bemoaned the fact that the province retained more than 45% of OLG’s digital revenues but only 5.7% of commercial operators’.

Everyone’s a critic: The report showed that OLG generated CA$4.5bn in revenues in 2021-22 but net profits for the province were down 3.6% to CA$1.5bn. The report was highly critical of OLG for agreeing to reductions in revenue commitments from Hard Rock International, Gateway Casinos and Great Canadian. The week aheadStartup month: The latest edition of the Earnings+More Startup Month will be sent tomorrow, including an interview with Meredith McPherron, CEO at Drive by DraftKings, a look at why investors are so keen on growth companies in the gambling regtech space and an Inside the Raise feature on Dabble. Analyst takesDraftKings: After meeting management, the team at JMP noted that CFO Jason Park was keen to emphasize the “compounding nature” of customer cohort profits and noted that DraftKings was pessimistic about any of Florida, Texas or California launching before mid-2025.

IGT: In lottery, the team at Credit Suisse suggested IGT has a distinct advantage in being able to provide an end-to-end solution for states via its new Omnia system, an “all-inclusive” platform bringing together retail solutions, cashless, player data and iLottery capability. Startup focus – ProphetWho, what, where and when: Founded in 2018 by CEO Dean Sisun and COO Jake Benzaquen, Prophet Exchange claims to be the first sports-betting exchange in the United States having launched in New Jersey at the end of August. It intends to expand its footprint in further states in 2023. Funding backgrounder: Prophet Exchange has previously completed a Seed funding round led by Sharp Alpha for an undisclosed amount. The pitch: Sisun says Prophet Exchange is “delivering freedom” to sports bettors, suggesting punters in New Jersey are seeing between 10% and 20% better returns than with traditional sportsbooks. “We are solving common pain points in the sports-betting industry,” he suggests.

What will success look like? Sisun says Prophet Exchange sees interest continuing to grow in both the understanding and anticipation of what betting exchanges will bring to the US market.

Regulatory linesIreland: The Gambling Regulation Bill released late last week has caused some consternation when it comes to the wording around advertising and marketing. Specifically, catch-all provisions around “not offering inducements” would appear to suggest all forms of promotion and advertising might be prohibited.

DatalinesColorado: Sports-betting GGR was down 29% MoM to $36.5m in October, while handle of $526.6m was the second-highest total after January's $573m. Operators spent $15.4m in promotions. Parlays generated $16.8m from stakes of $92m or a 18.3% hold. New York: Sport-betting GGR dropped 16% to $34.6m while handle increased 25% to $429.2m for the week ending 27 November. FanDuel led with 49.7%, followed by DraftKings (32%), Caesars Sportsbook (8%) and BetMGM (7%). Virginia: Sports-betting GGR dropped 6% to $45.5m in October, with handle rising 34% YoY to a monthly record of $528m. NewslinesTabcorp Holdings is hoping to raise $290m of new debt to pay off debts and fund potential M&A opportunities following the demerger of its lottery and keno divisions in June. Facebook has confirmed that its written permission will be needed for companies wanting to run gambling ads and provide evidence that the activities promoted are regulated and will not target under-18s. What we’re readingWanted: NYC rat Czar. Cathie Wood isn’t losing faith. Open-door policy: the UK living with the consequences of its policies on online gambling. CalendarDec 6: The Startup Month #5 Dec 13: Deal Talk #5 Dec 20: Due Diligence #2 Contact

|

Older messages

Weekend Edition #75

Friday, December 2, 2022

VICI takes full ownership of two MGM properties, ESPN's sports-betting uncertainty, illegal betting survey +More

888’s debt ‘priority’

Wednesday, November 30, 2022

888 will seek to lessen debt load, DraftKings' HORSE move, Nevada pushes on in October +More

888 admits to debt woes

Tuesday, November 29, 2022

888 blames economy for leverage issues, Maryland off to a strong start, Macau concession reaction +More

UK White Paper ‘imminent’

Monday, November 28, 2022

UK White Paper 'coming soon', Macau concessions awards, Lottomatica pushes on, startup focus – FanPower +More

Thanksgiving Weekend Edition #74

Friday, November 25, 2022

Entain looking ripe for MGM bid? Kindred's regulatory woes, Super Group hits Ontario switch hitch, GAN loses CFO +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏