Lenny's Newsletter - How to activate your investor network

Below is a peek at today’s subscriber-only post. Subscribe today and get access to this issue—and every issue. How to activate your investor networkExamples and tactics for getting the most out of your investors👋 Hey, I’m Lenny and welcome to a 🔒 subscriber-only edition 🔒 of my weekly newsletter. Each week I tackle reader questions about product, growth, working with humans, and anything else that’s stressing you out about work. As an angel investor, you often get asks from founders—but you rarely get an ask this personalized, crisp, and easy to act on: Of his many superpowers, Sam Corcos (CEO of Levels) is in a league of his own when it comes to leveraging his investor network to help him build his company. I’ve never seen anything like it. I believe this one skill has contributed significantly to his company’s success. So I asked Sam to share his in-the-weeds advice about how to make the most of your investor network. Boy did he deliver. If you’re a founder, this post is for you. Note, I’m an angel investor in Levels, which is how I uncovered this superpower. If you’d like to go deeper, Levels shares their previous investor updates and all-hands meetings publicly, and you can follow Sam on Twitter and LinkedIn. Enjoy! I talk to a lot of founders who feel like they were sold a bill of goods by their “value add” investor, who ends up doing very little for them. I can tell you from personal experience that it’s almost always the founder’s fault that they aren’t getting value from their investors. From June 27, 2019, to October 26, 2022 (about 3 years and 4 months), I personally sent 2,626 requests to our investor network. Of those emails sent out, 1,664 received a response, and 1,151 were able to deliver on what was asked. Investors have very little context into what your company is doing or what you need help with, so it’s unreasonable to expect them to proactively find ways to add value. You need to learn how to ask. This might sound simple, but it actually takes a lot of practice, and most founders are not good at it. I think activating one’s investor network is one of the biggest untapped sources of value at most startups. In this article, we’ll go over a few tactics for how to build a great investor network and how to activate them to get as much value as possible. Executive summary

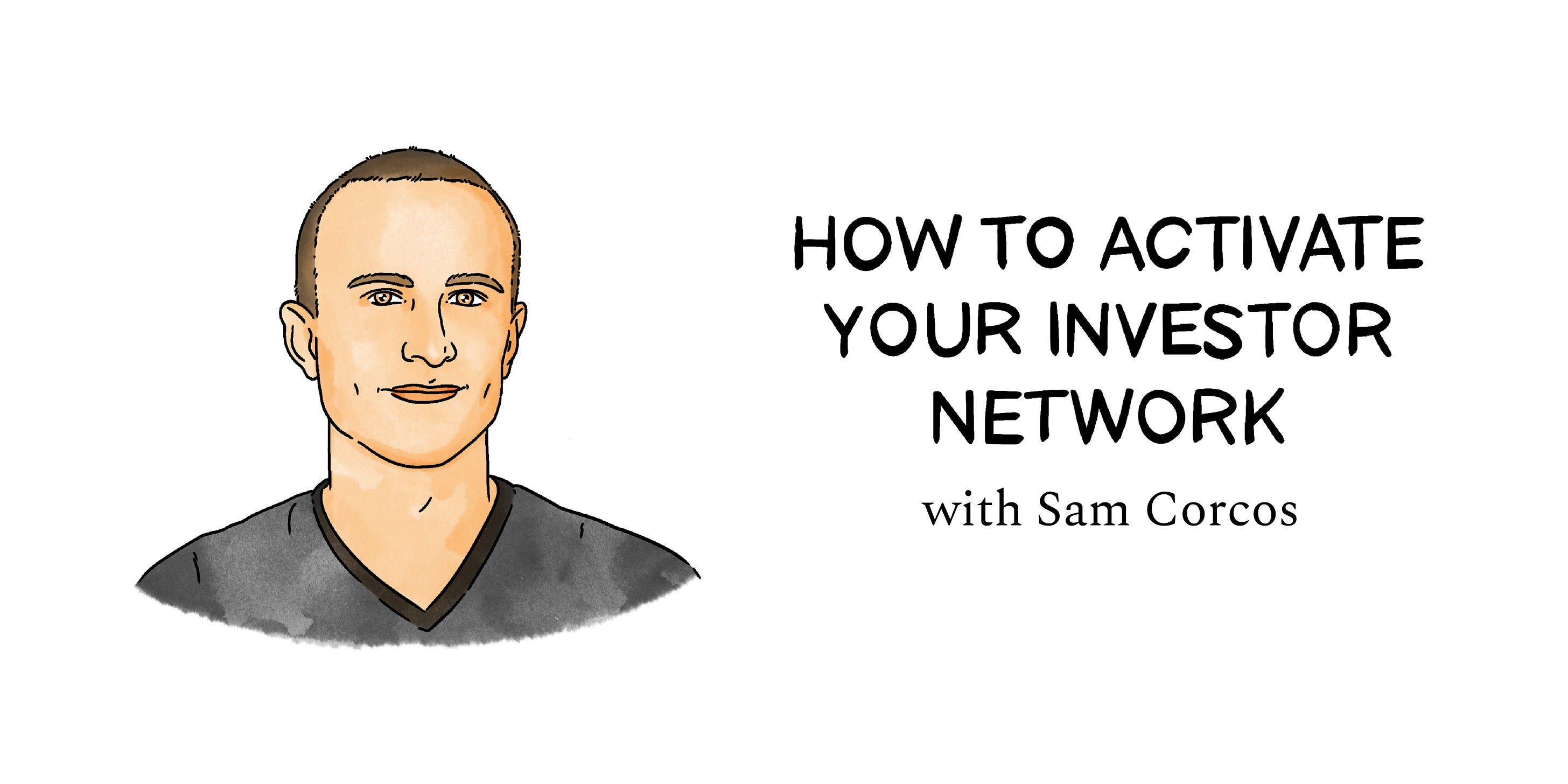

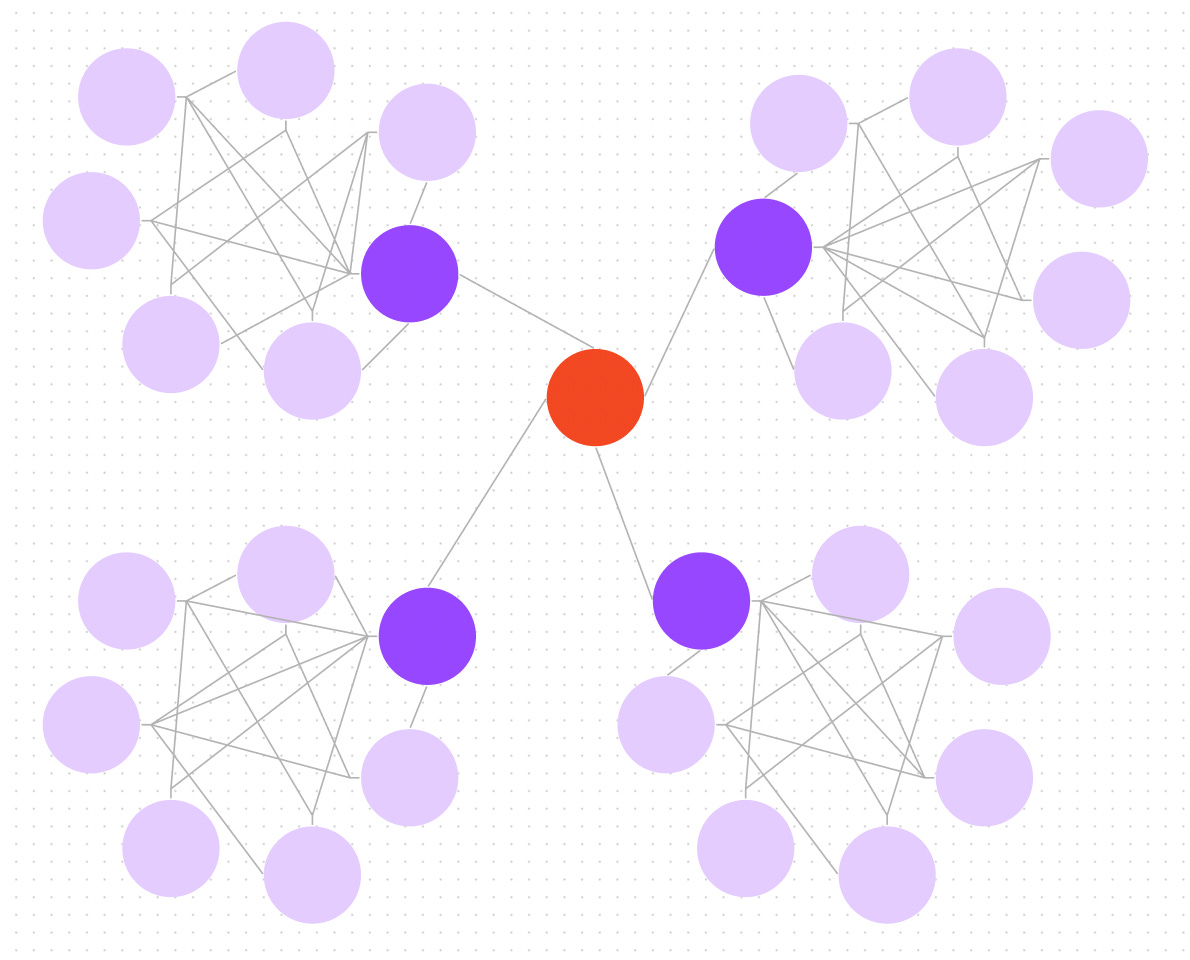

First, build a great investor networkWhat makes an investor network great? Just like with hiring, it’s about getting the right people on board; doing it right takes time. If you develop the skill of activating your investor network, it’ll be well worth the time. The place we should start is at a higher level of abstraction, and think about networks and graphs in general. The way you structure a network has significant implications for how the network performs. We’ll only cover the high-level concepts here, but if you want to do a deeper dive on network theory, I discussed these concepts in more detail in the podcast episodes I did of Funded with Jason Yeh (Part 1, Part 2). Eigenvector centralityTo build a really powerful network, you should optimize for what is known as eigenvector centrality:

In other words, it’s not “how many people you know”; it’s “how many people all the people you know, know.” When people think about how well-networked or popular someone is, they typically think about it through the lens of degree centrality. A person with high degree centrality is a mayor of a small town, or the most popular kid in high school. Within the context of a network where everyone knows each other, they are the most connected person in that dense network: A failure mode of building a network that is optimized for degree centrality is that everyone ends up being similar, and it’s extremely limiting when you have a request that is outside of your normal area of influence. For example, if you create an amazing network of financiers, that’s probably helpful for fundraising, but not if you need to hire engineers, find a mentor for product strategy, or any of the thousands of other kinds of problems you’ll need to solve as a founder. It’s for this reason that you want to focus your attention on adding new people to the network from other dense networks that you don’t already have access to. The ideal network for a founder is one where you know the person with the highest degree centrality in each network: There’s a lot of evidence that this is true, both from personal experience and academia. For a deeper dive on this, I recommend reading the classic 1973 paper by Mark Granovetter, “The Strength of Weak Ties.” Setting up your network this way significantly increases the chances that you’ll be successful in activating your investors, because you have access to the most possible surface area of connections and expertise. To give you a sense of the diversity of backgrounds of the people we optimized for when building our investor network, here are the backgrounds of the first 15 people in alphabetical order. For reference, these cover only about 5% of the people we have engaged as investors and don’t even get us beyond the letter “a” alphabetically:

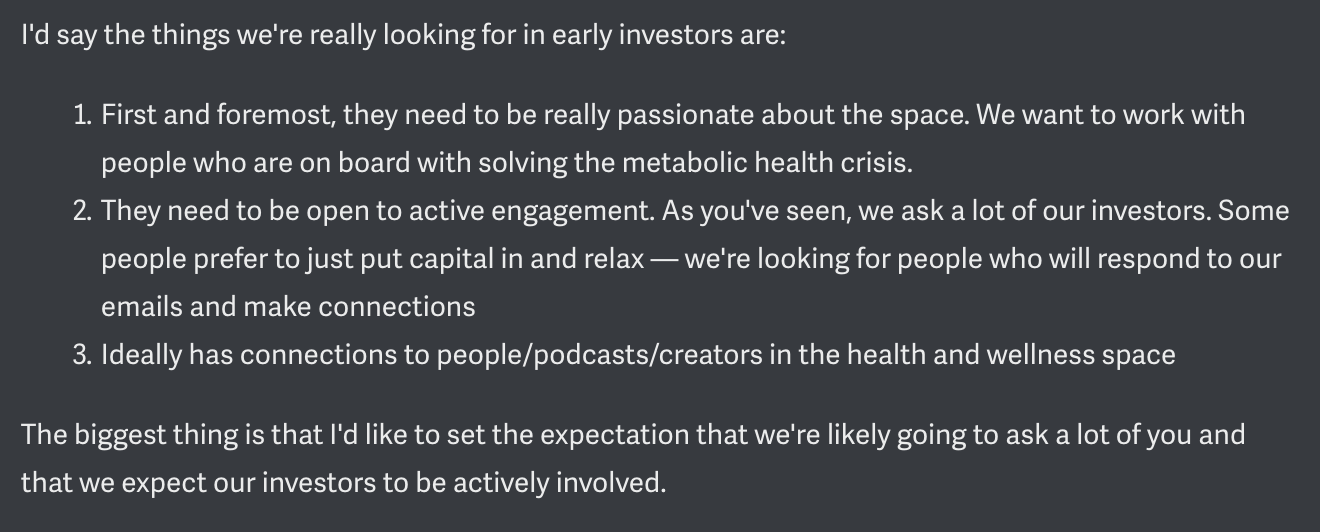

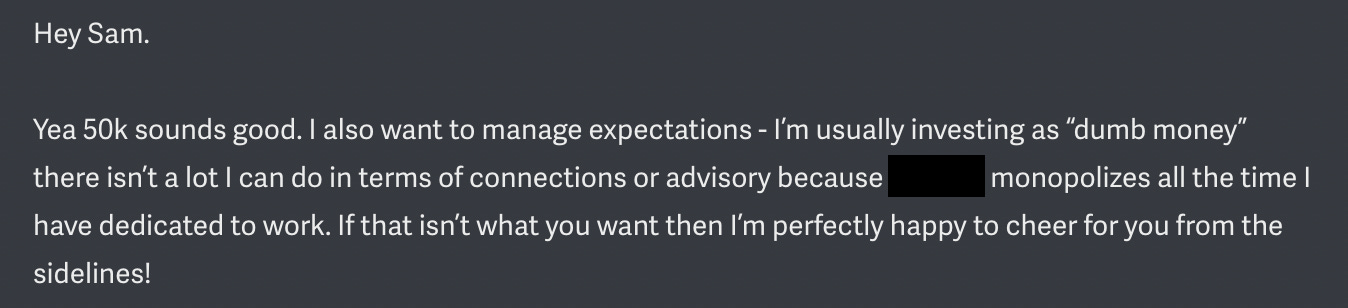

You should also give some attention to other networks you may need to access in the future, no matter how unrelated they might seem today. Having a single entry point into a network is infinitely more valuable than having zero. It makes a huge difference if you know one professional basketball player, one person who is an insurance industry executive, or one person in state government. It’s always best to have every possible type of diversity of people on your cap table. Some of our highest-value angel investors were people with little to no public persona. These tend to be early employees at post-IPO companies who have some liquidity and more time available. Some of our most trajectory-changing advice came from people like Alex Cunningham, Ellen DaSilva, Razvan Roman, Alexey Komissarouk, and other active operators who are under the radar but have a lot to contribute. For some people, you’ll only be able to get their attention for a few minutes per month. Others, you can ask for a few hours per quarter. Having a mix of both is a huge asset. Set expectationsIt’s also important to set expectations early. Ideally, you should be thinking about building your investor network as solving for a matching problem rather than a sales problem (i.e. you’re looking to find the right match, not convince them to join). If you expect your investors to be actively involved, you should let them know before you accept their money. This is really important because it gives you permission to hold them accountable to what they’ve agreed to, and many investors will opt out (example below). That’s fine! People have different priorities and availability. It’s not personal. Here’s an actual snippet that I’ve sent to several investors to set early expectations: For example, here’s a conversation I had with a potential investor where, after setting clear expectations that we’d like them to be actively involved, they opted out because they didn’t have bandwidth. And there’s nothing wrong with that! Where these situations get tricky is when those expectations aren’t set early on and one side feels like the other is being unreasonable. Then, activate your networkOnce you have a network of capable investors involved, you need to spend time extracting value from your cap table. Don’t expect this will happen automatically; it takes serious work, but it’s worth the effort.  Think we need a new role within startups scaling fast.

Investor Value Extraction Officer

Your cap tables are filled with knowledge, network, intros, expertise.

A dedicated rep to work with CEO to mine cap table relentlessly and on demand.

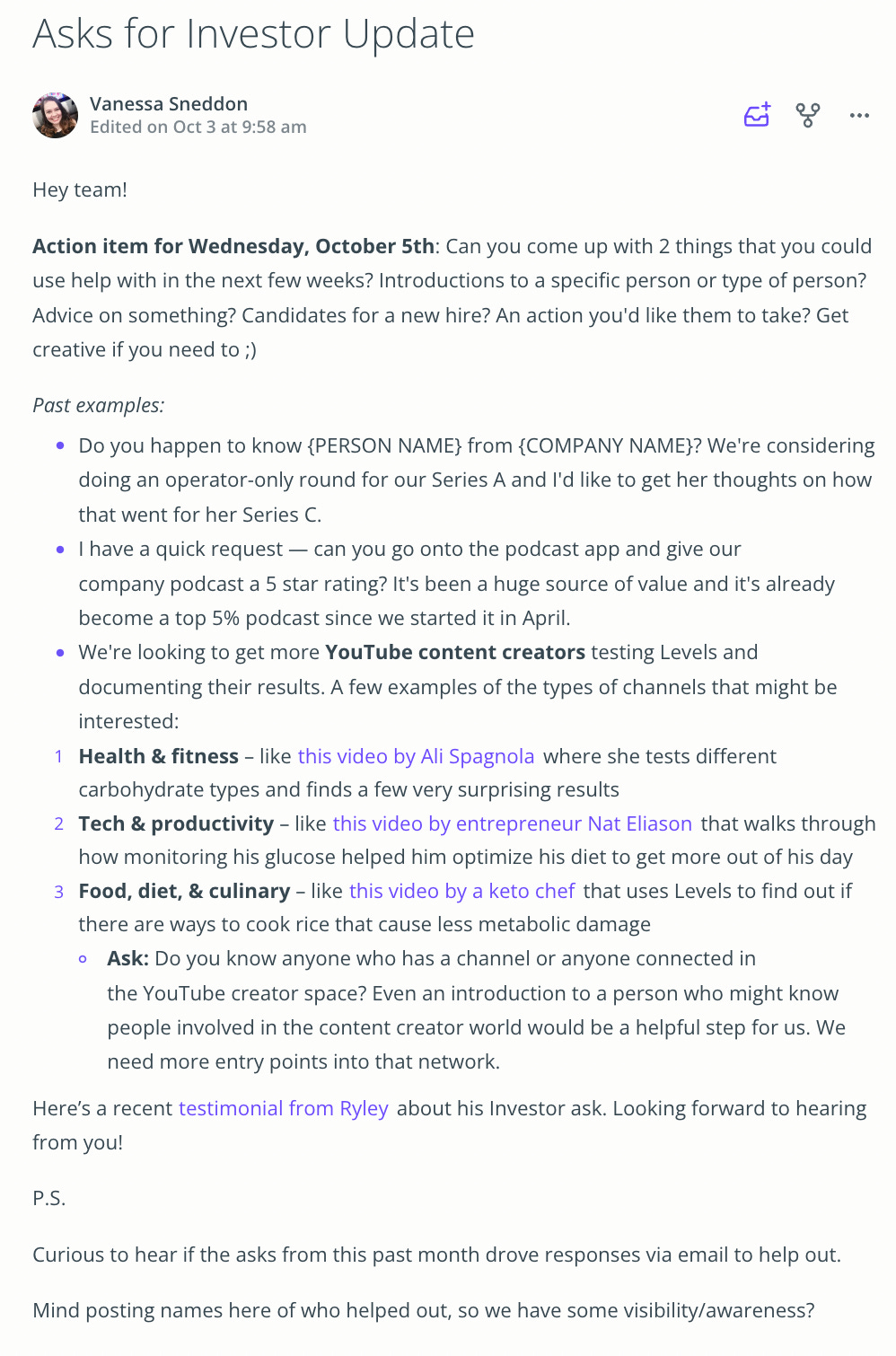

🚀 Here are a few tactical things to keep in mind. Abundance mindsetThe first thing is to remember that investor requests are not like precious gems. Many founders think you only get a certain number of “chips” to cash in with your investors (this is an analogy I’ve heard many times). This mindset is not accurate, but it tends to develop after a series of unresponded-to emails to their investors. But most of the time, the investors aren’t responding because the asks are bad. In general, people like being helpful—especially investors! It’s a big part of their job. You know the joy you experience when you’re able to help out another founder? By not asking for things, you’re denying other people that joy. Personally, I love it when I’m able to make an easy intro or give some quick advice to someone that changes the trajectory of their project. Set them up for success by making good asks. What to askAs a founder, you should always know what you and your team need. I have a snippet in TextExpander called “asks” that I paste in anytime someone says, “How can I be helpful?” in an email, which I then pare down to just the requests that are relevant to them. Most people would be shocked at how many times that simple action has led to significant value creation. Every month, my EA sends a message to our team asking them for two things that they could use help with. The responses are consolidated and added to our investor update, and I add them to my list as well. You should make it easy for your team to tell you what they need, but you should also do the work yourself. If you’re the founder, you likely have the most context of anyone else at the company, so your investor asks are probably the highest-leverage in the organization. If you can’t think of anything you need help with, you’re not thinking hard enough. Everyone at every stage needs support. How to askYou should approach your investor asks like you would approach building a product. Think about it from the perspective of the person receiving the request. How do you make it easy for them? If I had to simplify what makes for a good investor ask into three main concepts, they would be:

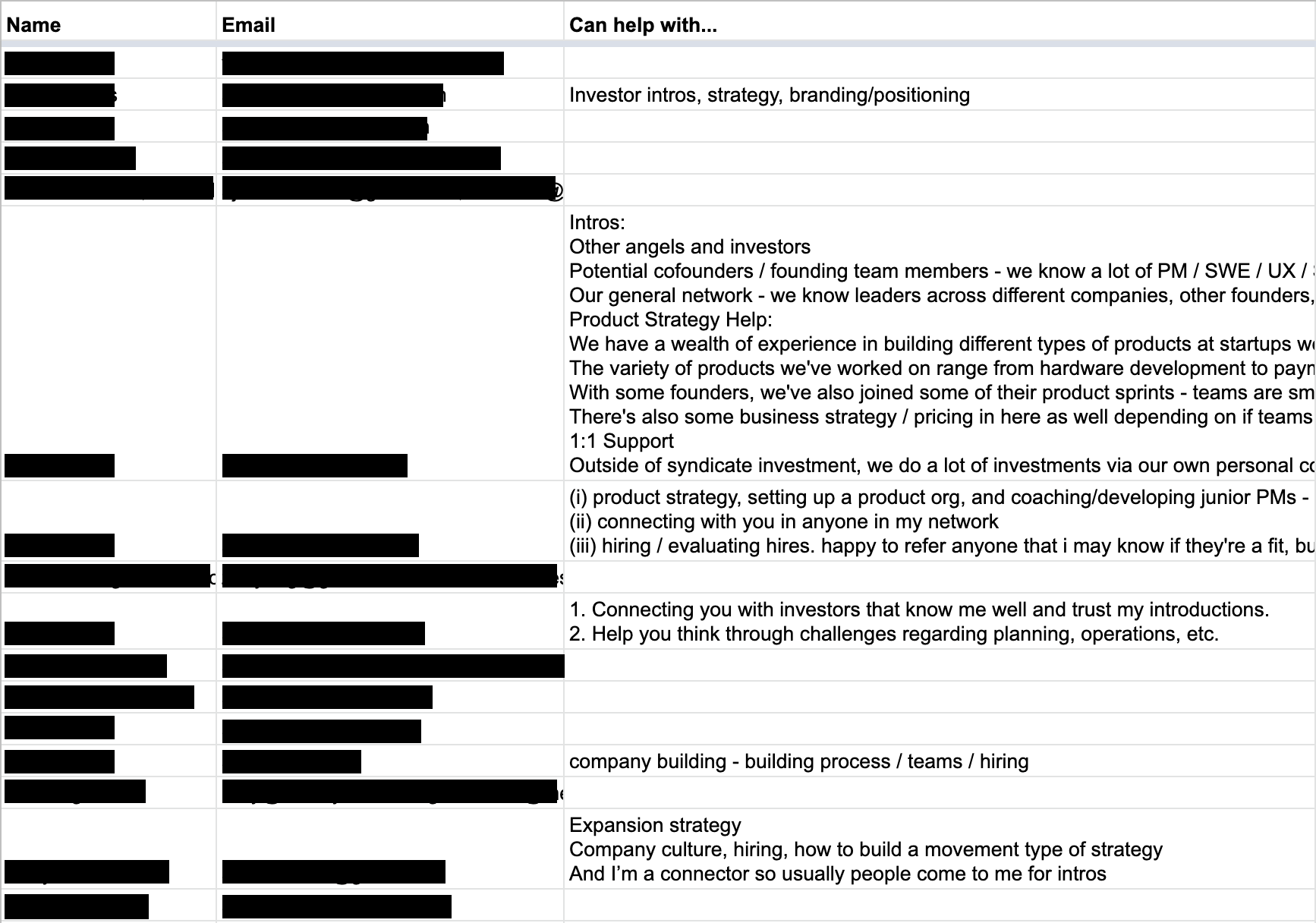

Instead of going through each of these concepts individually, we’ll go through a bunch of examples below to show you what a good investor ask looks like. On a tactical level, we don’t use any special tooling other than email and a list of our investors in a Google Sheet. Anytime we need to send out an investor ask, I skim the list and I personally send an email to each person who I think might be able to contribute. That’s all. No need to overcomplicate it. I find it helpful to ask each investor what kinds of things they typically help with and write them down (I was impressed with one investor in particular who maintains a Notion doc with everything he can help with), but in general, whenever I have an ask, I spend 5 to 10 minutes looking through the list of people and sending emails to the folks who I think might be willing and able to help. Here’s a redacted screenshot of a subset of the Google Sheet: Computers are good at remembering things (like maintaining a list of everyone you have access to), and humans are good at connecting the dots. In my experience, it’s best to use computers for keeping lists of things and use one’s brain to do anything involving people, like crafting and sending asks. The hard part is committing to put in the work. No tool can help with that. Examples1. Tom, who leads Partnerships for us at Levels, started working on a marketplace project, and he was looking for advice from people who have built marketplaces in the past. We happen to have two people on our cap table who are legitimately world experts on marketplaces—Jeff Jordan from a16z and Sander Daniels from Thumbtack. This is the email we sent to each of them asking for their time:... Subscribe to Lenny's Newsletter to read the rest.Become a paying subscriber of Lenny's Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

How to hit revenue targets in a recession | Sahil Mansuri (Bravado)

Sunday, December 4, 2022

Listen now (87 min) | Sahil Mansuri is the CEO of Bravado, the world's largest online sales community. Sahil is passionate about sales, and his experience dates all the way back to 2008, working

The ultimate guide to SEO | Ethan Smith (Graphite)

Thursday, December 1, 2022

Listen now (91 min) | Ethan Smith is the CEO of Graphite, a boutique growth agency that's helped companies like MasterClass, Thumbtack, Robinhood, Medium, and Honey develop and execute their SEO

Lenny’s Newsletter Holiday Gift Guide 2022

Tuesday, November 29, 2022

The items below are products that I've used and found to be amazing, along with a bunch sprinkled in that I discovered through this killer Twitter thread.

How to be the best coach to product people | Petra Wille (Strong Product People)

Sunday, November 27, 2022

Listen now (72 min) | Petra Wille is an independent product leadership coach who's been helping product teams expand their skill sets since 2013. She's also the author of Strong Product People,

Startup to exit: Lessons from a first-time founder

Tuesday, November 22, 2022

Why VC funding is like a drug, when building in stealth is a mistake, what to do when you lose conviction, how to approach selling your company, and more

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏