Bankless DAO - DeFi for Good | DeFi Download

DeFi for Good | DeFi DownloadAn Argentine Case Study; Remittances; Economic Freedom; Regenerative Finance (ReFi); Gitcoin; KlimaDAODear Bankless Nation 🏴, SBF has given DeFi a bad name, but this week’s issue of the DeFi download is here to rectify that misconception, DeFi is a force for good. We first explore how Argentinians can make use of cryptocurrencies amidst the decades of economic turmoil their country has experienced to find some economic stability. Zooming out to the rest of the world we talk remittances and how, in an increasingly interconnected world, cryptocurrencies and DeFi make international transfers easy. Looking at the last decade of geopolitical events, economic freedom across the world has become threatened, but it is fortuitous that cryptocurrencies appeared on the world stage to solve these challenges. Switching gears from traditional economics, we take a look at Regenerative Finance (ReFi). DeFi has offered a new funding mechanism for public goods like open source software and environmental activism. This means solving the tragedy of the commons and incentivizing positive change to regenerate the world. This is the DeFi Download ⚡️ Contributors: BanklessDAO Writers Guild (0xzh, meesh, theconfusedcoin, Chameleon, Teeleroo, Austin Foss, Jake and Stake)

This is the official newsletter of BanklessDAO. To unsubscribe, edit your settings. DeFi for Good

An Argentine Case StudyAuthor: Jake and Stake Cryptocurrency is an emerging technology that has exploded in popularity over the past decade. It is becoming increasingly popular in countries around the world, and one of these countries is Argentina. Since the 1980’s, Argentina has experienced a turbulent financial history with periods of high inflation, economic uncertainty, and capital flight from the country.

But DeFi offers a way out for average Argentinian citizens.

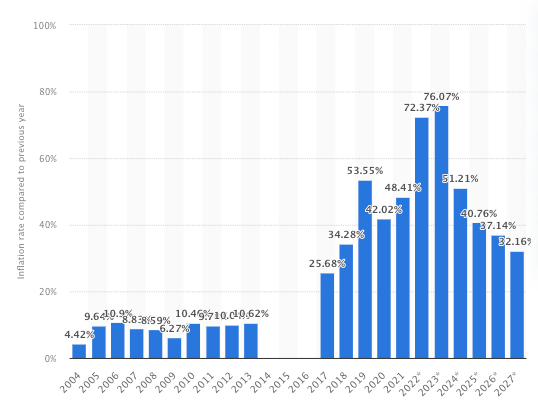

Cryptocurrency has proven to be an effective means of providing inflation protection and financial inclusion to the un- and under-banked populations of Argentina, particularly those living in rural areas, as they are often unable to access traditional financial institutions. InflationInflation has been a major issue in Argentina over the past two decades. According to a report from the IMF, the inflation rate of the Argentine’s peso (ARS) has been increasing dramatically with some estimating inflation to reach 100% by the end of 2022, making it one of the highest in the world. This level of inflation has caused significant economic hardship for generations of Argentinians. The prices for basic goods have skyrocketed and wages are failing to keep pace with rising costs — wages increased by only 6% in August 2022.

In this context, cryptocurrency has provided valuable protection for Argentinians against inflation. While cryptocurrencies have recently fallen in value compared to the Argentine Peso, many citizens expect assets like Bitcoin and Ether to eventually outperform the national currency. Cryptocurrencies like Bitcoin and Ether are designed to have a limited supply, meaning their value cannot be manipulated by central banks or governments—the key problem with the ARS. This credible neutrality makes them an ideal hedge against the hyperinflation seen in Argentina. Furthermore, cryptocurrency is internet-native, meaning it is accessible to anyone with an internet connection. Cryptocurrency has become an attractive option for Argentinians looking to protect their wealth against inflation.

According to Morning Consult, 33% of Argentines and 54% of Turks report buying or selling cryptocurrencies at least once a month. These are two countries with massive inflation numbers. Compare this to 16% in the United States, according to a separate survey by Morning Consult. Financial InclusionThe second benefit of cryptocurrency in Argentina is its potential to increase financial inclusion. Currently, access to financial services in the country is limited due to strict regulations, high fees, and lack of trust in the banking system. Cryptocurrency can provide an alternative form of payment that is accessible to all citizens regardless of their financial situation or location. According to official figures from the World Bank, 28% of Argentine adults remain unbanked and 33% lack access to a financial institution account. In stark contrast, internet penetration in Argentina amounted to 81% of the population. Like many developing countries, a lot of people have the internet, but not financial services. DeFi gives them access to these previously inaccessible products.

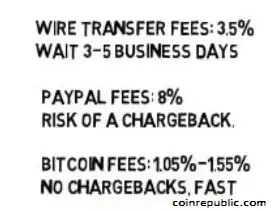

Cryptocurrency has provided an effective solution for these individuals, allowing them to store and transfer funds without the need for a bank account or credit card. RemittancesFurthermore, cryptocurrency transactions are often much cheaper than traditional banking services for international payments—many use low-fee chains like Tron and BNB. Most use the Binance centralized exchange itself. Sending money across borders often involves high fees and long processing times, which can be a significant burden for those who rely on remittances from abroad. Cryptocurrency can provide a cheaper and faster alternative for sending money across borders, reducing costs and processing times for those who need it most.

This has enabled many communities around the world to engage in international commerce and send money to family members living overseas, something that would have been extremely difficult without the use of cryptocurrency. As a result, cryptocurrency can provide a mechanism for capital flight from Argentina. Capital flight occurs when people move funds out of a country due to economic instability or political uncertainty. Blockchains provide a pseudonymous and secure way for citizens to move their funds out of the country without having to worry about government interference or confiscation. This could provide a much-needed lifeline for those who are looking to preserve their wealth in times of economic turmoil. Access to Digital DollarsThe introduction of cryptocurrency has also had a major impact on digital dollar access in Argentina. Argentinians typically save their money in dollars, and are thought to hold more dollars in cash or foreign financial institutions than any other population. But over the last three years, Argentinian citizen’s access to US dollars has been restricted by the government’s imposed currency controls. According to the New York Times, Argentines can legally purchase only $200 a month and have to pay hefty taxes on every transaction. However, crypto protocols such as Ethereum provide an effective means of circumventing these restrictions, allowing users to buy US dollars—via stablecoins—without the need for a bank account or credit card. This has enabled many Argentinians to access US dollars more easily than ever before and use them for international purchases or domestic investments. When houses are purchased with USD, it’s easier and safer to transport a usb stick than a suitcase full of $100 bills. Finally, cryptocurrencies such as Bitcoin have also enabled greater access to investment opportunities in Argentina. Cryptocurrencies have become increasingly popular as an investment vehicle due to their potential for rapid growth and low barriers to entry. Now Argentinians can invest in international opportunities without needing large amounts of capital or complicated investment strategies. Final WordsThe introduction of cryptocurrency in Argentina has had a major impact on both inflation and access to digital dollars. Cryptocurrencies such as Bitcoin and Ether have provided a valuable hedge against inflation and offer financial inclusion for unbanked and underbanked populations. Furthermore, they have provided an effective means of accessing US dollars and investment opportunities without state restrictions. As such, cryptocurrency has proven itself to be a valuable asset for those looking to protect their wealth and gain access to global markets in Argentina. There is also the potential for increased scams to steal user funds, but Argentina is increasingly becoming friendlier to cryptocurrency. The city of Buenos Aires and the province of Mendoza allow tax payments in crypto. But despite volatility and regulatory uncertainty (crypto is still not considered legal tender), it’s clear that cryptocurrency has the potential to provide a number of benefits to those living in Argentina, especially as it is adopted by more people and businesses in the country. When comparing an asset that goes up and down (crypto) with an asset that only ever goes down (ARS), it’s clear that many prefer the risks of crypto over the risks of the Argentine government. Remittances Using CryptoAuthor: theconfusedcoin Cross-border payments have always been a pain point. Limited options, high fees, excessive documentation, delayed timelines are some of the problems that plague this industry. With every passing year, the process gets more cumbersome and the fees more expensive. The thought of proving why you need to transfer your own money to someone is preposterous. Payment overlords preferred to keep this antiquated system unchanged in order to extract max fees from customers and retain control of the global financial system. Change was, however, inevitable. One of the primary use cases for crypto and blockchain technology is fast, trust-less, peer-to-peer remittances. Now we can transfer our own money to another person at a fraction of the cost, at ten times the speed, and without third parties. It’s hardly surprising that all major banks are against crypto and want it curtailed. Apart from the above there are a number of benefits to using cryptocurrencies for remittances. Here are a few: 1. SpeedDepending on the blockchain being used, crypto remittances take anywhere between a few seconds to a few minutes to reflect in the receiver's wallet. By comparison, a bank transfer takes at least 2-3 working days to reflect in the receiver's account. Imagine the opportunity cost incurred because you received your money two days late. 2. DocumentationBanks and other financial institutions require tons of documents to process a transaction. For businesses, the compliance requirement is even higher. Invoices, cause of remittance and KYC documents are just a few of the documents needed. Cryptocurrencies on the other hand allow you to remit money without the need for any documents. 3. No third-partyNormally remittances are done through a third party like a bank (JP Morgan) , a money exchanger (Western Union) or a payment wallet (PayPal). In this case you rely on a third-party to safely transfer your money. If, for some reason, this third-party doesn’t like the source of your funds, they can legally confiscate it —depending on the jurisdiction of the user and the platform. Cryptocurrencies solve this problem, remittances are purely peer-to-peer and there is no intermediary that can confiscate your funds. 4. Lower FeesRemittances through banks can cost anywhere between 3-3.5% while transfers through mobile wallets like PayPal can cost up-to 8%. Using cryptocurrencies like Bitcoin barely costs between 1-1.55%. Cryptocurrencies developed specifically for cross-border payments such as Stellar and XRP can cost as little as a few cents. 5. No down-timeBanks and financial institutions work only on weekdays and from 0900 to 1800. Crypto is not bounded by working hours. Remittances can be made at any time, any day. 6. Decentralised and SecureMost banks use centralised systems like SWIFT to facilitate payments. This means the entire security of the system is in the hands of one entity. If anything breaks there, your entire transaction is compromised. Cryptocurrencies like Bitcoin and Ethereum are some of the most robust in terms of decentralisation and security. They have a large number of active nodes and the difficulty to hack any node is extremely high; even if a blockchain network is hacked transactions on behalf of users cannot be made or altered. Further, even if one node is compromised, it doesn’t impact the ability of your transaction to go through at all, the cost of attacking a blockchain is engineered to be economically infeasible. 7. No Value RestrictionUsing options like PayPal limit the amount of money you can transfer. Banks also put some limitations depending on the type of account you have with them. With crypto, there is no such restriction. Unlimited amounts of money, be it $10 to $1,000,000 can be transferred without any hassle. 8. ConfiscationIf, for some reason, the bank believes that the source of your funds is not legitimate, they have the ability to confiscate your money until you show proof of legitimacy. Further, if money transferred to another person is deemed to contravene some act (OFAC, etc.), once again they reserve the right to confiscate it. With crypto, there’s no such fear. The money in your wallet is truly yours and no one can take it away without a court getting involved. 9. Safe refugeIn areas of conflict, the first system that oppressors go after is the monetary system. Innocent people are left with funds locked in banks and other institutions with no way to transfer it out, or, even worse, their funds are taken by the oppressors. Crypto offers a unique solution here as since the funds are always in your possession (reiterating the importance of self-custody), you can easily transfer them out of the country without having to rely on any local institution. This has helped numerous people in war torn areas like Syria and Afghanistan. With the above benefits it’s surprising that we haven’t moved to cryptocurrencies already. Regulatory hurdles make cross-border payments using crypto a bit of a hassle. Fiat off-ramps are not easily available and while it’s easy to transfer using a cryptocurrency, converting that into fiat to buy basic items is not straightforward. Often you have to once again rely on banks that take their own sweet time to convert the crypto into fiat and then transfer the money to your account. People have realised that legacy systems are at times holding back progress. Crypto and blockchain technology introduces a quick, decentralised, secure and trust-less alternative to the archaic payment industry. Slowly but surely, the transition is happening. Economic FreedomBy: Austin Foss An internal memo was once published to the Coinbase company blog authored by CEO Brian Armstrong, titled How crypto enables economic freedom. In it he credits four inherent properties for this core feature of cryptocurrencies.

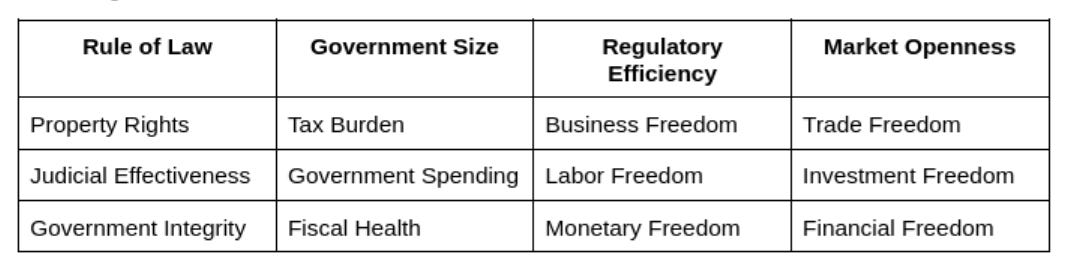

These he had drawn from a larger essay published by The Heritage Foundation titled The 12 Economic Freedoms: Policies for Lasting Progress and Prosperity, where twelve are listed under four categories: Brian's list of four doesn't cover all twelve and he does admit that cryptocurrencies don't impact things like "government integrity, tax policies, fiscal health, etc." Which aspects of economic freedom cryptocurrencies do impact, we have benefited greatly from crypto’s abilities. Catastrophic RemindersA year and a half prior another project called ShapeShift, founded by Erik Voorhees, published a similar article to their blog titled Financial Freedom with Crypto. While, Brian's memo explored how the properties of cryptocurrencies benefit economic freedom, ShapeShift's article reminds us to "not forget about the global events that sparked a need for an alternative to traditional finance...". From ShapeShift:

Of the three events ShapeShift listed Venezuela's occurred several years later in 2013, where "by 2018 inflation was estimated at 80,000%" and "that one-tenth of Venezuelans have fled the country" since then. Both Iceland's and Greece's problems started in 2008. Bitcoin's genesis and birth of cryptocurrencies in 2009 was well-timed in the wake of these events following the 2008 "Great Recession". Iceland's krona lost 50% of its value and their stock market lost 95% "when the country's three largest banks defaulted on tens of billions of dollars..." British and Dutch citizens lost €3.9 billion in Iceland’s financial crisis, in response, their governments compensated them for funds lost in Iceland. In 2011 Iceland held a vote to repay the UK and Netherlands for those losses, which was rejected. Iceland was sued for not making the repayment but ultimately won their case in 2013 in the European Free Trade Association Court. Note that in both 2011 and 2012 GDP grew by 3% and unemployment fell to approximately 5%. That's just a four year recovery. Greece's Debt CrisisGreece had a similar situation to Iceland, but because it was part of the European Union (EU) the Mediterranean country's situation unfolded much differently. By comparison Greece was still in the midst of a debt crisis well into 2015. On episode 185 of the Let's Talk Bitcoin podcast, in April of that year, blockchain educator Andreas Antonopoulos described the "vice" the Greek people were put in because their country had traded the nation's economic freedom for membership in the EU. Unlike Iceland, because they used the Euro Greece couldn't return to their Drachma currency to regain control of their monetary policies, or default on their debts, without pushing "Germany into hyperinflation." In order to keep their banks from defaulting, the EU would only continue propping up the Greek economy if harsh austerity measures on the population were required by their government. The Greek citizens had just elected a new party on the platform to negotiate easing the pressure of the austerity measures but this instead led to "a three week-shutdown of banks and a 60 euro per day cap on cash machine withdrawals." Andreas also described in that podcast how he had begun teaching friends and family how to use Bitcoin to try and get as much of their money out of the country as possible. He recognizes that this isn't a case where Bitcoin could fix Greece's national debt problem but if the technology was more well known and widely adopted at the time this could have been a prime opportunity for the economic freedom cryptocurrencies provide to prove its value to empower individuals in places where capital controls are imposed.  Greece is relevant to bitcoin because with bitcoin there can be no “bank holiday”, no capital controls, withdrawal limits or bail-ins. Limits on cash withdrawals weren't completely lifted until October 2018, and all other capital controls were lifted by the EU in August 2019. Compared to Iceland’s recovery, returning to 3% growth in GDP by 2011 following the 2008 recession, Greece’s GDP was negative or stagnant until 2017-2019, with ”modest” ~1.5% growth. Greeks who wanted to retain their economic freedom, while their government gave up the nation’s, could turn to cryptocurrencies. Women in the Middle-EastCoinDesk published an op-ed in August, 2021, titled How Blockchain Empowers Women in the Middle East where one of the first things mentioned is how "a significant number of women in the region remaining unbanked." However, access to information via the internet is widely accessible and present to some extent in underdeveloped nations. This creates a great opportunity for these women to gain some level of economic freedom. Earlier in May, 2021, Al Jazeera published a similar op-ed titled These Iranian women are crushing it in crypto. One was interested in trading, another started with mining but went on to work at a centralized exchange, and another worked on the community side by being "a frequent contributor to crypto podcasts..." Compounding the aforementioned obstacles for women's economic freedom in the middle east, all Iranians must contend with numerous international sanctions placed on their country. Sanctioned CountriesAfghanistanAnother country in the Middle East suffering under economic sanctions is Afghanistan. According to a report by Cointelegraph, when the Taliban regime took power they "restricted bank account withdrawals... to address the cash shortage caused by the United States sanctions." Although more than half the country is illiterate and internet access is nowhere near as widespread in developed countries some citizens have turned to cryptocurrencies.

CubaCube has been under US sanctions since 1962 and ever since then Cubans have been ostracized from global markets. Unable to use ubiquitous payment methods like Mastercard, Visa, or PayPal, a programmer from the Caribbean island nation wrote an op-ed for CoinDesk describing what it's like trying to earn a living. "More than 60 banks and payment platforms have rejected me." - Erich García Cruz According to him, most Cubans acquired cryptocurrency using WhatsApp or Telegram because all major exchanges were blocked by the sanctions. In response to these limitations, he built two remittance companies and estimates that as many as 20,000 Cubans use cryptocurrency on a daily basis. Cuba's central bank offered regulatory clarity on the topic by "Regulat[ing] the Use of Virtual Assets for Commercial Transactions." RussiaFollowing Russia's invasion of Ukraine several of their banks were sanctioned and talks of isolating them from the global SWIFT payment system began. Although there were rumors early on of Russia possibly accepting Bitcoin for oil payments, this didn't materialize, however regulatory clarity was communicated to help the Russian people adapt to these sanctions. In June the Russian head of the finance ministry's Financial Policy Department stated:

Unfortunately for many Russian citizens who might have started transitioning to cryptocurrencies, regardless of their own stance on the war, this life-line was eventually cut off when, in October, more sanctions were announced:

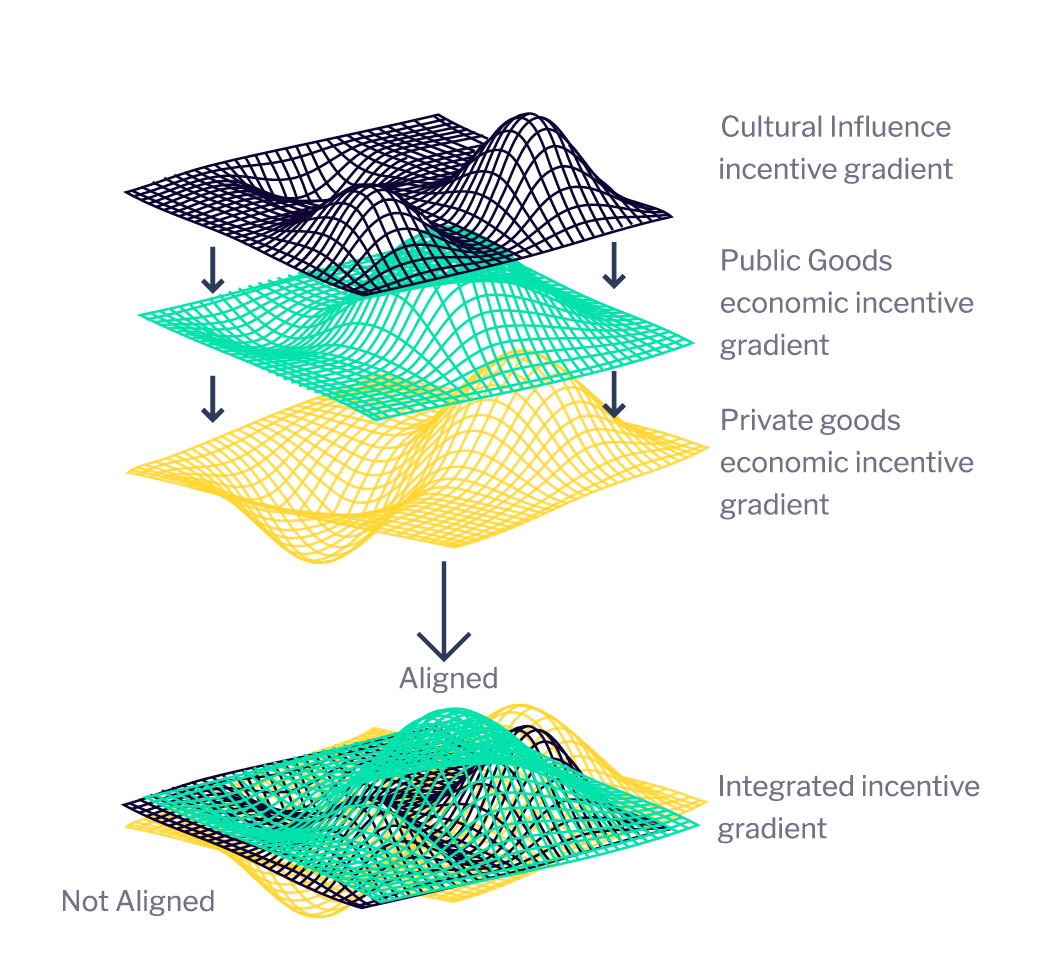

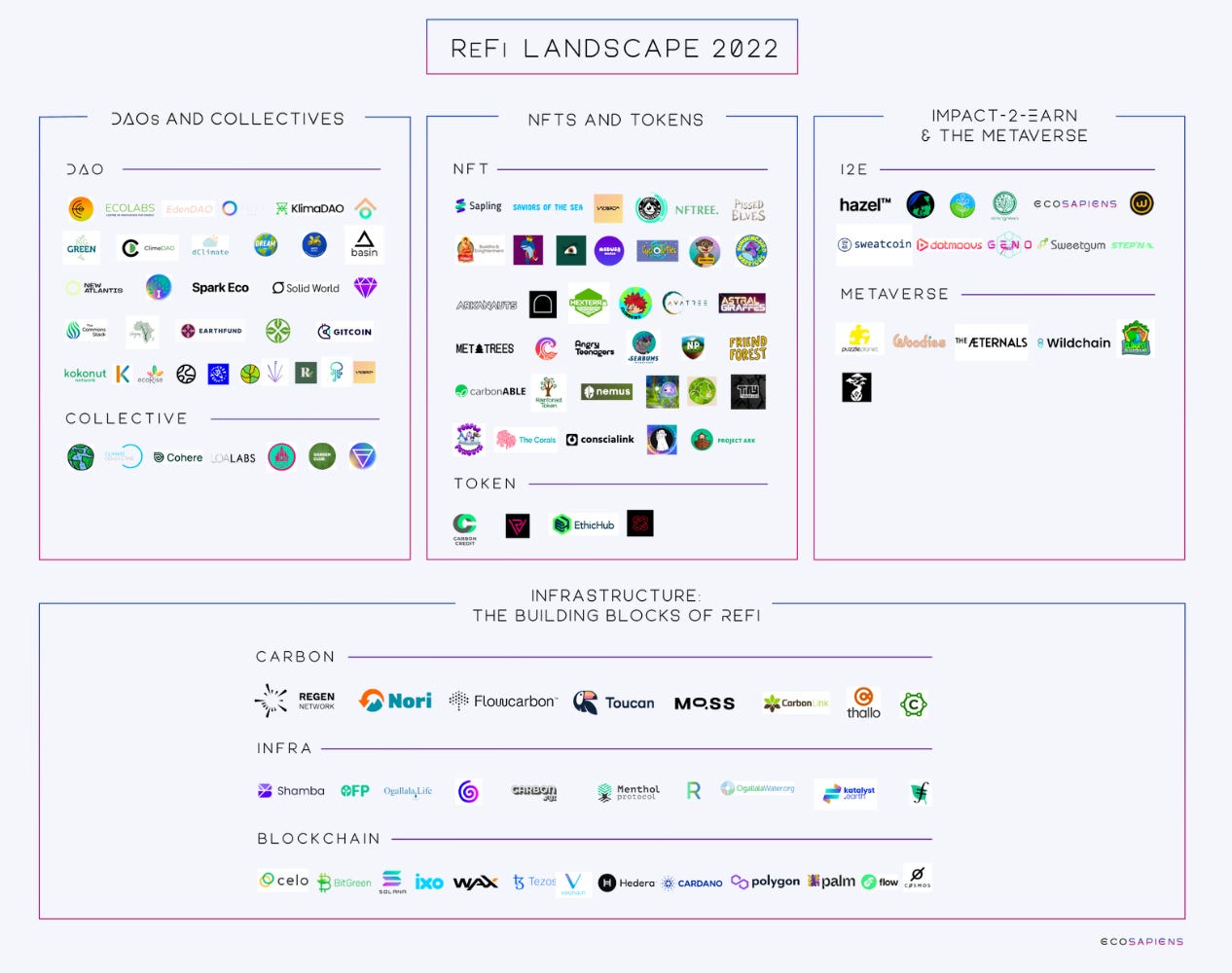

CoinDesk reported on how this affected one Russian, "Daniil Chebykin, coordinator of the project Omsk Civil Union, which is helping Russians to avoid recruitment to the war..." He was lucky to withdraw everything within a few weeks' notice, but his funds could have just as easily been seized as a consequence of the war. Why We're HereA common thread in all of these examples is just how early we still are in this space. Cryptocurrencies were very young when the Greek cash withdrawal limits were imposed in 2015, but now there is an abundance of educational material. But these modern examples show us how cryptocurrency, DeFi, and web3 can be used in times of economic crisis. While some say cryptocurrency is a scam, their value is obvious to the people around the world. By the time a crisis hits, it's usually too late to implement an escape route. It must have already been implemented, planned out, and practiced on a regular basis. With more and more people being onboarded to this parallel economy, built on the principles of economic freedom, each of our own escape routes become much easier to navigate.  Sometimes you gotta step back and realize how far Bitcoin has come. A decade of safe, fast, borderless transactions without a bank or government involved whatsoever. Reinventing Economics with ReFiAuthor: Meesh IntroductionWhether you’re a crypto maximalist or a passive observer, it would be an understatement to say that the media’s attention on decentralized finance (DeFi) has been less than favorable. But looking beyond the latest headlines, builders, innovators, and activists within the regenerative finance (ReFi) space are working towards the betterment of humanity. Specifically, ReFi serves as a new economic model for impactful initiatives by leveraging the capabilities of blockchain technology. This means no longer relying on inefficient traditional systems and outdated, siloed approaches. Let’s explore how ReFi projects are setting forth a path of economic resilience and regeneration. What is ReFi?Regenerative finance, or ReFi, is an economic paradigm that operates at the intersection of sustainability and web3. ReFi’s objective is based on the theory of regenerative economics—an economic system that works to regenerate capital assets (goods and services that contribute to our well-being)—while rooted in DeFi. The purpose of ReFi is to shift from the extractive economic model that plagues our planet and society, towards a future where profits and purpose are able to coexist. ReFi harnesses the power of DeFi for more than just the creation of money. Possibilities for impact could be anything from providing capital for humanitarian projects to delivering new tools for the unbanked in developing countries. In a basic sense, ReFi focuses on using capital to solve systemic issues, regenerate natural resources, and create public goods for civilization. How Does ReFi Work?The traditional business paradigm emphasizes resource extraction through a linear economic process—extracting, producing, consuming, and waste—leading to a depletion of finite resources. If this model continues, it’s only a matter of time until all natural resources are depleted. A regenerative economy would be the proposed solution. Instead of the unsustainable ‘take-make-waste’ model, proponents of a regenerative economy are focused on intentionally redesigning an outdated, pernicious system. Achieving a regenerative economy means designing out activities that cause negative externalities, extending the lifespan of products, and restoring natural resources. John Fullerton describes the ideal regenerative system as “self-organizing and self-sustaining.” But the current system’s traditional structures, bureaucratic red tape, and siloed operations make attaining a regenerative economy feel impossible. But what if there was already a system that eliminated silos, provided transparency, and removed a centralized entity? DeFi does just that. ReFi is anchored in DeFi with the philosophy of enabling regenerative economies. Through ReFi, global systemic issues can be reframed, where money is the tool for sustainable solutions. ReFi leverages capital to incentivize changes that produce positive externalities, placing value on regeneration instead of extraction. ReFi makes it possible to align traditionally fragmented incentives systems. According to Kevin Owicki’s Greenpilled, “with programmable blockchain-based economic systems, there’s a new opportunity to design crypto-economic incentive systems to be aligned with one another.” Creating a frictionless space for aligned action and human thriving. The outcome is a regenerative crypto-economic system, which is renewing and regenerating in forms of capital (i.e., social, material, financial, living, intellectual, experiential, spiritual, and cultural), meaning that they are creating more resources and are resilient against shock. Essentially a pluralistic financial infrastructure for the planet.

Traditional finance, or TradFi, approaches are too myopic to address the system failures that we’re facing. Focused on incentivisation of businesses that focus on optimizing short-term financial performance over long-term viability and sustainability, the outdated approach to value creation is no longer a fit for society. However, the goal of ReFi lies in redefining the process and purpose of value creation towards one of shared values—generating economic value in a way that also produces value for society by addressing its challenges. It becomes vital to achieving a mental shift, where the focus is redirected toward long-term financial prosperity via a regenerative global economy. Why do we need ReFi?ReFi’s value lies inherently in its thesis—to use money as an instrument to address systemic inequities and bring forth sustainable solutions. More importantly, ReFi emphasizes solutions that would result in a net positive rather than a net-zero effect. Since real impactful change can only be achieved by creating positive-sum solutions, yielding neutral outcomes would diminish the regenerative quality of ReFi. ReFi flips the script by throwing away the notion of accumulation in favor of circulation. Accumulating wealth is no longer the goal; rather, wealth is a means to the goal. The capabilities of purpose-driven missions, such as impact investing, are elevated through ReFi’s technology. With the ability to reach more people, increase transparency, and remove centralized bodies, ReFi is able to equitably circulate wealth into the ecosystem and regenerate parts of our economy that have historically been neglected. Although the regenerative economy can be conceptualized in terms of addressing climate change and Earth’s depleting resources (which are very important), ReFi’s scope of capabilities extends far beyond, aiming to invest in projects that create a public good. Public goods are non-excludable and non-rivalrous. These are resources that, for the most part, benefit civilization. Some examples of public goods are—public parks, streetlights, open-source software (e.g., Ethereum, Wikipedia), roads, and clean air—basically, things that we use and have come to depend on every day. In typical traditional economic fashion, those working towards creating public goods are disincentivized, either through a lack of monetary compensation or scalability. Through ReFi platforms, such as Gitcoin, projects working towards public goods are incentivized to continue innovating. ReFi offers us a glimpse into a flourishing future. A future where positive externalities are rewarded, economies are self-sustaining and regenerative, and financial prosperity is equitable and inclusive. ReFi has the potential to reshape the global economy and make tangible impacts on the lives of people and societies. In addition to being applied to concerns like environmental sustainability, ReFi has the potential to provide solutions for global poverty, healthcare, education, and a myriad of social issues. What does the future of ReFi look like?The future of ReFi looks bright as more developers, investors, and entrepreneurs are drawn to the concept of regenerative economics and its potential applications. At the time of writing, Gitcoin has provided over $72.4 million worth of funding to open-source software projects. In efforts to address global coordination efforts, Gitcoin and UNICEF are collaborating on a quadratic funding initiative as Gitcoin begins to transition to a decentralized protocol, allowing any community to coordinate its own grant funding rounds. Projects on the Celo blockchain ecosystem have collectively raised over $77 million in funding to support financial inclusion, cross-chain communication and interoperable security, and regenerative finance. Currently, there are over 100 ReFi projects and organizations building towards the mission of a regenerative future.

In the foreseeable future, we will see a proliferation of innovative ReFi projects, providing sustainable economic solutions and mobilizing funds for creating public goods—and that’s just the tip of the iceberg. As ReFi continues to grow, there will be a culture shift toward business expectations. Demands for a more regenerative economic system will prevail over conventional business complacency. Positive externalities imparted by ReFi could cause a ripple effect where we would see broad adoption of web3, leading to innovations toward a future where sustainability and prosperity coexist in perfect harmony. ReFi is, in effect, the answer to our decentralized call for reform, offering a path to economic resilience, regeneration, and a more equitable and inclusive global system. Regenerative Finance with GitcoinAuthor: 0xzh IntroductionGitcoin plays a pivotal role in the ReFi sector, where it has been able to lay the foundations for funding, coordination, and ImpactDAOs. Using a variety of key Web3 tools, open collaboration, and obsession with building (and funding) public goods, Gitcoin has helped to develop impactful ReFi ecosystems. Gitcoin has evolved over the years, providing funding of over $63 million to open-source software digital products. Gitcoin grants are based on quadratic funding, a way of matching contributions from the public with a pot of matching funds. Over 2,700 projects have received funding through Gitcoin Grants, like notable ReFi projects ReFi DAO, ReFi Spring, and Bloom Network. Gitcoin has become a growth hub for ReFi. Projects who may not have the most significant amount of funds may be able to grow their initial funding to much higher amounts with the help of the matching mechanism. Individuals who may not have a lot of money to spare can still make a lot of impact with their contributions which matter more when considered as a part of the total contributions to a project. Opportunities for ReFiThe utility of Gitcoin’s platform is manyfold. Gitcoin is the first platform on Ethereum to enable recurring payments on-chain. This makes funding of projects and payment of developers more seamless for users who look to automate the many processes typically required to fuel the growth of their projects. The EIP-1337 standard was used by Gitcoin Grants for subscriptions on Ethereum. This makes it possible to use one initial subscription transaction to support projects with recurring payments. Quadratic funding rounds take place once a quarter, giving the community opportunities to contribute funds to projects.

Benefits of quadratic funding include:

During the Gitcoin grant application period, people can present their causes for consideration. A fraud check takes place to ensure that people and projects are legitimate. Following this, crowdfunding of contributions takes place over a two week period. After the two weeks, calculations are completed to determine the amount of funding the projects get in matching governance. Gitcoin’s grants protocol is a workable version of Gitcoin Grants which could be used by people to create their own funding mechanisms in ReFi. The use of the protocol by a wider range of platforms could scale the funding opportunities available for projects in the ReFi space. Gitcoin DAO, Hackathons, and BountiesGitcoin DAO is described as a vessel for Gitcoin’s mission which is to build for human thriving. This requires the creation of a regenerative internet of value to enable human thriving for diverse groups of people around the world. GTC, the native token for Gitcoin, is Gitcoin’s governance token. It was instrumental in the creation and funding of Gitcoin DAO. Holders of GTC can vote on:

Gitcoin DAO’s governance approach empowers the community and maximizes neutrality in Gitcoin operations. Workstreams are used by the DAO to advance the vision of the DAO which in turn funds work streams through proposals. Gitcoin bounties helped to bring together a diverse range of talents, from developers to graphic designers and writers, who worked on GitHub issues and project deliverables. The pool of talent available on Gitcoin gives regenerative finance projects a quality talent pool to look to so that they may meet their development needs. Hackathon events on Gitcoin incentivise learning and collaboration needed to solve some of the biggest challenges ReFi projects face. Teams of builders join forces to build solutions to ReFi challenges so that they can gain exposure for their projects and win prizes for their solutions. Proponents of ReFi, such Hedera have used Gitcoin hackathons to encourage innovation in the ReFi space and support major ReFi events. Hedera’s hackathon for “Best ReFi and Sustainability Project on Hedera” was carried out in collaboration with Hedera and Hedera Foundation, giving developers the opportunity to create and implement Hedera applications in Sustainability and ReFi. Regenerative Cryptoeconomics and ImpactDAOsGitcoin founder, Kevin Owocki, embraces the concepts of regenerative cryptoeconomics in his book GreenPilled, made with the contributions of Gitcoin and other key players in the ReFi space. Regenerative cryptoeconomic systems serve to satisfy human needs, create positive externalities, and establish equilibrium. Many of the ImpactDAOs funded through Gitcoin Grants work towards accomplishing positive externalities for their ecosystems. The net positive externalities achieved by ImpactDAOs distinguishes them in nature from other types of DAOs, as building blocks of the ReFi movement. With the support of Gitcoin, ImpactDAO maps were created to visualize impact DAOs in web3 and how they relate to each other. The maps serve as frameworks to help people understand the space which continues to evolve rapidly. Using the maps, one can better understand not only how DAOs in the ReFi space operate in relation to each other but also the positive influence they create. The importance of Gitcoin’s involvement in the progression of impact DAOs cannot be understated. ImpactDAOs play a critical role in how the future of ReFi shapes up. Using cryptoeconomic models to tokenize a variety of resources (like intellectual property, culture, and material) in a DAO gives opportunities to measure the use of people’s time and contributions more accurately. DAOs can use the metrics to increase the impact of their operations in areas such as scientific research and climate change. Many of such DAOs have received funding from Gitcoin grant rounds. With values programmed into money, it can become easier to make economic systems based on the creation of net positive externalities. New economic models can be designed which support global public goods and development of opt-in systems for creators of digital and non-digital public goods. Gitcoin’s ReFi ReservoirGitcoin has served as a reservoir of opportunities for many of the early, impactful ReFi projects. ReFi DAO 2050 received an estimated $125,000 funding through Gitcoin Grants. It is a founder-led startup community that is building an ecosystem and protocol to catalyze a regenerative economy through 2050 and after. ReFi DAO is committed to building an ecosystem accelerator where people can collaborate to create public goods and scale climate solutions. ReFi DAO aims to develop tracks for its user journeys that end in Gitcoin grant rounds. New Atlantis is another ReFi project that received funding through the Gitcoin Grants programme. The project aims to support Marine Protected Areas (MPAs) with viable business models, using a biodiversity analytics platform to evaluate ecosystem health and generate biodiversity credits. Neptune Chain is building the first on-chain marketplace for nutrient offsets. Its marketplace on the polygon network is meant to help people easily acquire verified nutrient offsets. Many purport that trading programs help in the fight against pollution by offering more flexible alternatives to complying with regulations. With decentralized solutions, trading nutrient offsets can be much more transparent and inclusive in who it benefits. Rather than just benefitting governments and businesses, a wider scope of individuals and groups can benefit from more transparent trading of nutrient offsets. Carbon-Neutral Policy at GitcoinIt’s important to set precedent and lead by example as a key player in the ReFi space. A carbon-neutral policy was presented at Gitcoin after KlimaDAO helped Gitcoin to estimate its carbon emissions. The proposal called for Gitcoin DAO to become fully carbon-neutral and fully offset its on-chain energy usage for its GTC token and Grants program. The proposal for carbon-neutral policy at Gitcoin set the precedent for how DAOs in the ReFi space should approach their effects on the environment as they operate. Climate change is an essential element of regenerative cryptoeconomics as players in the space should cause no harm and create net positive externalities. ConclusionNot only does Gitcoin offer significant funding opportunities but it also provides a range of other solutions to ReFi’s greatest challenges. From hackathons with active participants to coding bounties, the possibilities go as far as the imagination on Gitcoin. It is a breeding ground for the ReFi projects of tomorrow which continues to evolve while staying true to the core principles of regenerative cryptoeconomics and the mission to build for human thriving. KlimaDAOAuthor: Teeleroo Regenerative Finance (ReFi) is about working to make the planet a better place, by focusing on ways to drive money towards initiatives that favor sustainability. The blockchain plays an important role in ReFi’s operation as its core features form pillars that make it good for solving global problems: being trustless, permissionless, and immutable. KlimaDAO is prominent in the ReFi conversation as it brings together two ideas: sustainability in energy use and blockchain technology. What is KlimaDAOKlimaDAO is a Polygon fork of OlympusDAO, which sees the OHM tokens representing a share of OlympusDAO’s treasury, and investors being rewarded for keeping their OHM locked. In KlimaDAO, the asset is a carbon credit and the token is $KLIMA. Bonding occurs when third-party verified carbon tokens, representing units of emissions, are deposited by users in the treasury. The project’s goal is to lock up enough carbon in its treasury that the market price of carbon assets increases, and therefore the cost of polluting increases. Currently, a company wanting to remain carbon neutral can purchase credits to offset their pollution. However, as the price of offsets increases, the cost of buying credits to offset polluting will eventually become too expensive, and it will make more sense for the company to change their practices to reduce emissions. Like in OlympusDAO, the mechanism to lock value in KlimaDAO and deliver on its project goals is complicated. This article explores the basics, including the confirmation that it’s complex and confusing. Moreover, with $KLIMA’s market cap in a dip of 99% from its all-time high, the finance-speak should be taken for what it is: an aspiration that has yet to come to fruition. Nonetheless, in crypto, we like to say that we’re early, and the apparent misfiring of a platform does not mean that the theory is unsound. We can look at the following rough description of how KlimaDAO works, and identify salient pieces that will live on. Carbon offset projects are verified by Verra, a third party that issues Verified Carbon Units (VCUs) representing one metric ton of carbon dioxide. The connection between these VCUs and the blockchain is Toucan; they keep a registry of tokenized carbon credits. This proof of reduced or removed carbon is what users deposit in KlimaDAO’s treasury in return for $KLIMA. How Do Its Tools Improve the Carbon MarketLeft to its own devices, the market will abuse a resource if there is no penalty. In the case of emitting greenhouse gasses, there is no incentive to change behaviors, even though emissions contribute to climate change that affects us all. A voluntary carbon market exists, whereby polluters can buy offset credits to reduce their carbon footprint. The credits represent projects that reduce the emission of greenhouse gasses. KlimaDAO sets out to solve some of the carbon market problems: 1. Transparency Market actors, and their behaviors, are veiled to the extent that the legal and regulatory systems allow. If the public wants to find out what’s going on with a large corporation, they must read disclosure statements and other doctored documents to uncover the relevant truths. The promise of the blockchain is that a public ledger will tell the ownership story. Not only to English-speaking lawyers, but to any human being with access to the internet. When a corporation makes a claim on a topic such as emission offsets, this can be verified on chain. 2. Immutability Unlike agreements between nations or corporations, smart contracts survive regime changes, takeovers, and other forces that nullify agreements. When a party uses the blockchain, it’s equivalent to announcing that they won’t be fabricating excuses to extinguish their obligations. An obligation on the public ledger, whether it be the transfer of BTC or carbon credits, is irreversible. In the case of pollution, nations and corporations are quick to evade responsibility. 3. Accessibility The voluntary offset market is a place where, in theory, anyone can buy credits to offset their emissions, but accessibility is an issue. Educated professionals with the time and resources to participate in the carbon market do, while the average human doesn’t. The blockchain is an upgrade because it provides global reach; anyone with internet access and a web3 wallet can participate in regenerative finance. 3. System Inefficiencies Markets are preyed on by the middlemen taking commissions wherever there is a transaction. The middlemen are not motivated to further the ends of the market. Rather, they want to extract the maximum profit by any means possible. The blockchain and smart contracts should remove the need for some parties, in the same way that DeFi sees efficiencies through the removal of intermediaries. KlimaDAO doesn’t remove the middleman problem, but it does represent progress. Long-term ViabilityKlimaDAO’s market cap has dropped from $1 billion to under $15 million in a year, which doesn’t bode well for the platform, but this metric doesn’t tell the entire story. The information gathered in operating the platform is essential to future endeavors with the same goals. It may be that a future protocol looking something like KlimaDAO moves the needle drastically. Further, ReFi is not built on the back of a single program, and any progress is positive. KlimaDAO’s dashboard paints a clear picture of its work to date, including over 500,000 credits brought on chain and retired. And equally as important, KlimaDAO is raising the public profile of ReFi. If its work with Polygon in addressing its network’s emissions gets more people talking about how the blockchain and Web3 have a role in combating planetary harm, then we can say the cause is being advanced. Actions steps📖 Read How crypto enables economic freedom | Brian Armstrong 📖 Read Crypto can fix public goods | Donovan Choy ⛏️ Dig into Quadratic Payments: A Primer | Vitalik 🎧 Listen Vitalik Buterin - Green Pill #1 | Bankless Shows Project Releases 🎉

BanklessHQ Acquires Earni.fi

1/ ⚡️ We Just Bought a $150M Tool⚡️

The Bankless team is excited to announce that we’ve just acquired @Earni_fi a tool that’s helped users claim over $150M in airdrops.

More on why this is huge for the Bankless Nation 👇 Ethereum Wallet Releases

Today, we are proud to announce a major step in the future of private key management with Casa.

We have redesigned our app, reimagined the membership experience, and now our members will be able to secure #ethereum alongside #bitcoin within Casa.  1/ Coming soon: one wallet for everything.

Excited to announce we are adding support for @ethereum and @0xPolygon! Avalanche AMM Trader Joe launches on Arbitrum

MakerDAO Offboards RENBTC-A Vault

This is an important notice to all RENBTC-A users.

In light of the uncertainty surrounding the Ren Protocol, and following Risk Core Unit’s recommendation, Maker Governance voted to offboard the RENBTC-A vault type.

🧵↓

1/ New MEV Relays released by Gnosis and Ultrasound Money

📢📢

We are proud to release two new relays as the Gnosis and @ultrasoundmoney communities.

Agnostic Relay 🤝 Ultra Sound Relay

🔗 agnostic-relay.net

🔗 relay.ultrasound.money

Details below 👇 🧵  big day for relay diversity!

the ultra sound relay

👉 relay.ultrasound.money

the agnostic relay, by @GnosisDAO

👉 agnostic-relay.net Aave Freezes Several Assets as Collateral

Aave’s freeze on borrowing and lending assets comes as the DeFi protocol upgrades its software.

@camlearnscrypto reports

Flashbots Open Sources Block Builder

Fidelity Crypto Launches Retail Crypto Trading

Fidelity Investments, one of the world's largest financial services providers, is launching a crypto trading and storage platform. Binance Proof of Reserves

As part of our ongoing commitment to transparency, we have provided new updates on #Binance’s Proof of Reserves.

Further updates for $ETH, $USDT, $USDC, #BUSD & #BNB will be coming in the near future.

Stay tuned. Binance Recovery Fund

To reduce further cascading negative effects of FTX, Binance is forming an industry recovery fund, to help projects who are otherwise strong, but in a liquidity crisis. More details to come soon. In the meantime, please contact Binance Labs if you think you qualify. 1/2 Uniswap Launches NFT Aggregator

1/ NFTs are officially live on Uniswap!! 🎨🦄

Starting today, you can trade NFTs across major marketplaces to find more listings and better prices.

We're also airdropping ~$5M USDC to historical Genie users

& offering gas rebates to the first 22,000 buyers. Stripe Crypto Onramp

Ledger Rolls Out ‘Crypto Life’ Debit Card Across UK and Europe

💳 The CL Card, powered by Ledger and provided by @BaanxGroup is now available in the UK & EU! 🇬🇧 🇪🇺

Holders can:

🔐 Make quick & safe transfers between the CL Card & Ledger Live.

🔸 Spend using crypto as collateral.

💰 Get up to 2% cashback.

👉 bit.ly/3F0CCxg Chirping Birds

The notion of "governance rights" as a narrative for why a token should be valuable is pathological. You're literally saying "I'm buying $X because later on someone might buy it from me and a bunch of other people to twist the protocol toward their special interests"  "To be sure, DeFi isn’t risk-free—code is subject to attack

(...)

But DeFi code grows stronger every day, owing partly to these battle scars. Leading protocols such as MakerDAO, Compound, and Clipper hold more than $15 billion, and their user funds have never been hacked."

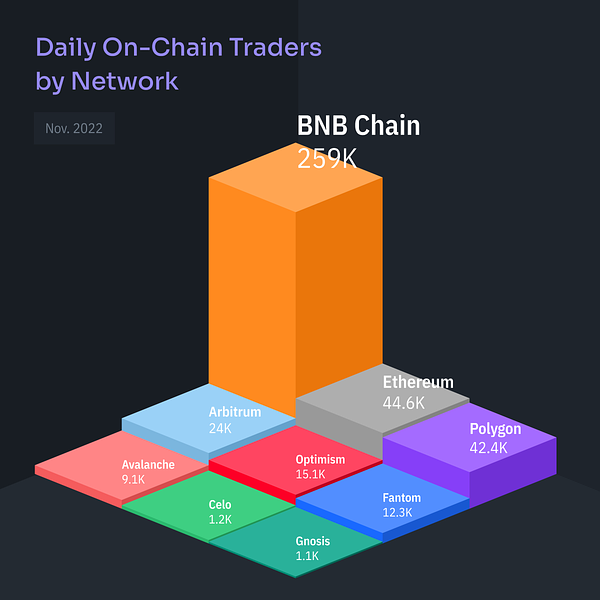

↓  How does daily on-chain trading look like in turbulent times? 👀

✅ Retail-focused BNB Chain is leading with ~250k daily traders.

✅ Polygon has almost the same amount of daily traders as Ethereum itself.

✅ Arbitrum > Optimism 🤔

Source: dex.guru/markets  2022 - not the year everyone wanted, but probably the year we deserved

for context; q4 2019 genesis had ~$60M of loans outstanding, Q4 2021 they had ~$50bn

we are back to effectively 0 cefi credit available in the industry, outside of Maple, which is emergent

ashes to ashes  If I want to take crypto seriously, I need to see an aggressive cultural shift that addresses its key plague - attracting grifters

I want to see a majority be hostile towards projects & founders that don't have a clear roadmap towards useful sustainability

No "I'm unbiased" BS  Bear market opportunities:

- Farm all of the airdrops

- Get familiar with AI tools

- Create content (written, audio, video)

- Learn to code

- Join a DAO

- Figure out how to manage a Discord server

- Read about DeFi and L2s

Wealth is sown in the bear, reaped in the bull.  Patrick Hillman(CSO BINANCE), said that Binance may not exist in 10 years because the #crypto market it is moving toward decentralized finance (DeFi) 🤔

Do you agree with Patrick Hillman❓  I constantly hear ''real yield narrative is almost over''

This makes zero sense

1️⃣ Real yield is not a narrative, it's a by product of a sustainable protocol.

2️⃣ Cashflow is king, regardless of what niche you are in.

TradFi or DeFi, cash flow positive businesses win everytime  in preparation for the new DAI Savings Rate update by maker dao, I just updated defillama to start tracking DSR yield  the most important use cases for ETH in 2-5 years will be:

1) in-protocol staking

2) collateral for on-chain borrows

3) economic collateral securing various on-chain apps

4) medium of exchange for NFTs and other digital goods

5) digital, censorship-resistant store of value  Next bull run, I have no doubt we will see DeFi TVL hit many trillions in TVL.

OpenAI seems to be excited about:

- lending/borrowing

- DEXs

- stablecoins

- insurance

Which DeFi protocols do you expect to cross the $100B mark, excluding their own native governance token?  It’s tempting to see a token that’s -95% and think it’s a steal.

Becareful of anchor bias - many tokens won’t reach their ATHs again

1. Look for projects with strong metrics and moats

Or

2. Be patient. Sit on the sidelines and wait for new narratives to form. Regen TacticsDonate to Gitcoin GrantsUltimate Guide to LedgerAuthor: Ryan Sean Adams 🛠 BANK Utility (BanklessDAO token)With over 5,000 holders, BANK is one of the most widely held social tokens in crypto. So it bears asking, where are the best places to put our BANK to use? The five protocols below will allow you to deposit BANK in a liquidity pool and earn rewards. To get going, just click on the name, connect to the app, filter by BANK, and start earning passive income.  Resident tokenomist @ffstrauf turns inward, analyzing BanklessDAO's $BANK token and showing us how a movement becomes an incentivized community of buidlers (Cov @dippudo) ⚖️ BalancerBalancer has two 80/20 liquidity pools, meaning that you are required to deposit 80% BANK and 20% ETH in the pool. There is one pool on Ethereum and another on Polygon. Once you’ve provided liquidity, you’ll receive LP tokens. Keep an eye out for opportunities to stake these LP tokens. There is nearly 500,000 USD in the two Balancer liquidity pools. 🍣 SushiSwapSushiSwap has a 50/50 BANK/ETH pool. As with Balancer, you will receive LP tokens, and while you can’t stake them on SushiSwap’s Onsen Farm yet, you may be able to in the future. Liquidity providers earn a .25% fee on all trades proportional to their pool share. The SushiSwap pool has a little over 100,000 USD in liquidity. ⏛ Rari Fuse Pool- Deprecated SoonThis will be deprecated soon. The Rari Fuse Pool allows you to borrow against your BANK or earn huge APY by providing assets like DAI to the pool. At present, all borrowing is paused for this pool. There is over 450,000 USD deposited in the Pool 🦄 UniswapThe Uniswap V3 liquidity pool is 50/50 BANK/ETH, and provides a price oracle for the Rari Fuse Pool. By depositing in the Uniswap pool, you can earn fees and help enable borrowing on Rari. This pool currently has over 500,000 USD in liquidity. 🪐 ArrakisYou can also provide liquidity to the Arrakis Uniswap V3 pool. The ratio is about 2/1 BANK/ETH. This pool is new, and only has a bit more than $6,000 in liquidity. In the future, you may be able to stake your BANK/ETH LP tokens within the protocol to earn additional rewards. Get Plugged In🧳 Job OpportunitiesGet a job in crypto! Do you like solving hard problems, care about building more efficient markets for everybody, and want to work at the frontier of decentralized finance? Rook is looking for full time contributors, with salaries ranging from $169,000-$722,000. There are positions ranging from engineering, recruiting, product marketing, copywriting, and design. Sound interesting? Sign up for our referral program and go full-time DAO.

|

Older messages

Emerging Web3 Innovations Take Art Basel by Storm | Decentralized Arts

Wednesday, December 7, 2022

Dear Bankless Nation, At its outset, NFT technology was little more than a protocol granting ownership rights over a piece of content attached to a hash stored on a blockchain. The original NFT

That’s Not a Bank; That’s an IOU | Bankless Publishing Recap

Tuesday, December 6, 2022

Top-shelf Educational Web3 Content Shipped Directly to Your Inbox

Improving the Guest Pass System | BanklessDAO Weekly Rollup

Saturday, December 3, 2022

Catch Up With What Happened This Week in BanklessDAO

Freshman Year in Web3 | State of the DAOs

Thursday, December 1, 2022

You're reading State of the DAOs, the high-signal low-noise newsletter for understanding DAOs.

The 10 Most Expensive NFTs | Decentralized Arts

Wednesday, November 30, 2022

Dear Bankless Nation, NFTs have come a long way since their inception. What once was a protocol slated for cryptoart, NFT technology has encompassed far more utility than the purposes for which it was

You Might Also Like

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

WuBlockchain Weekly: SEC Terminates Lawsuits Against Multiple Crypto Companies, Bitcoin Drops Below $80,000, OKX S…

Friday, February 28, 2025

On Friday, OKX market data revealed that BTC fell below $80000, reaching a low of $78258, with the current price at $80514, reflecting a 24-hour decline of 7.22%. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

FBI confirms North Korea-backed Lazarus hackers stole $1.5 billion from Bybit

Thursday, February 27, 2025

FBI tracks Ethereum laundering spree by North Korean hackers amid rising threat of cyber warfare in the crypto world. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with MicroStrategy Founder Michael Saylor: The Company Holding the Most Bitcoin in the World

Thursday, February 27, 2025

In this interview, Colin from WuBlockchain had an in-depth discussion with MicroStrategy founder Michael Saylor about the company's ongoing Bitcoin acquisition strategy, the growing adoption of

Abu Dhabi Invests $436.9M In Bitcoin ETF

Thursday, February 27, 2025

February 17th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Abu Dhabi Invests $436.9M In Bitcoin ETF Changpeng Zhao Sparks Meme Coin Rumours Coinbase Finally Lists POPCAT & PENGU

📈 BTC’s realised price (average acquisition price) reached an all-time high of $43,000; State of Wisconsin Invest…

Thursday, February 27, 2025

BTC's realised price reached an all-time high of $43000; Abu Dhabi's Mubadala Investment disclosed its BTC ETF holdings; South Korea to allow universities and charities to sell crypto donations

HashKey Exchange's Interpretation of the Hong Kong SFC Virtual Asset Roadmap

Thursday, February 27, 2025

We are pleased to see the Hong Kong government release the forward-looking and pragmatic “ASPI-Re” roadmap for advancing the virtual asset industry. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Argentina’s stock market plummets amid President Javier Milei’s LIBRA memecoin scandal

Thursday, February 27, 2025

Argentina's economic landscape shaken as Milei's LIBRA endorsement turns into multi-billion dollar fiasco. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Heated AMA Debate: 0G Team Responds to Allegations of CFX Soft Rug, Overvaluation, and Token Commitment Concerns

Thursday, February 27, 2025

This AMA primarily focused on the relationship between Conflux and 0G Labs, discussing 0G Labs' high valuation, fundraising structure, technical direction, and community concerns over transparency.

Pectra: Ethereum’s Next Major Upgrade

Thursday, February 27, 2025

Breaking down key changes included in Ethereum's Pectra hard-fork ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏