Earnings+More - Due Diligence #2

Good morning and welcome to Due Diligence, where the aim is to delve deeper into topics of importance to the sector. For our second edition, we take a look at the attempt to pivot into iCasino in the US and ask whether there is actually any space to pivot into. Plus, we review a selection of recent analyst takes. The iCasino pivotIn among the various US sports-betting market departures in recent months, a number of operators have indicated a more nuanced approach involving a pivot to iCasino. Yet, while this solves the problem of chasing the impossible OSB dream, it opens up further questions around short-term – and potentially long-term – viability. Off ramp: Already this NFL season, FuboTV and MaximBet have called it quits in the US sports-betting space, both citing “macroeconomic conditions”. But a more subtle shift has also taken place, with two prominent European names indicating a pivot to iCasino.

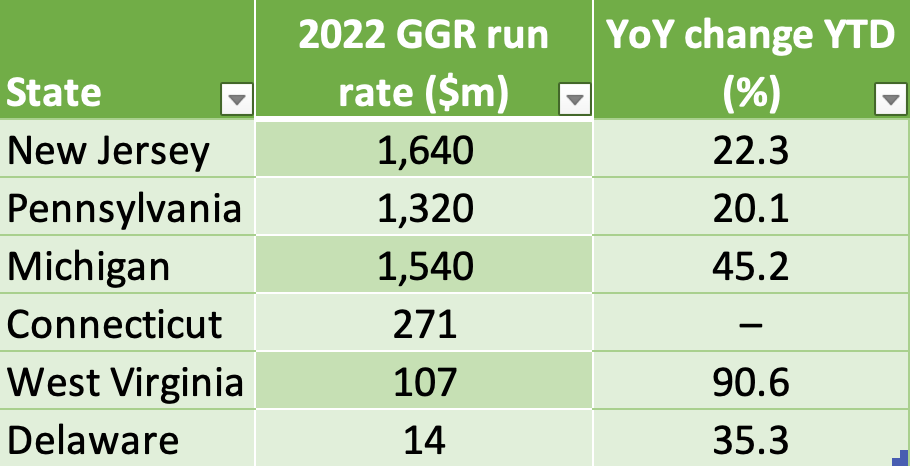

Target practice: The logic of iCasino’s attractiveness is backed up by the data from the iCasino states. According to Deutsche Bank, the estimate for 2022 total iCasino GGR is up 31.1% on 2021, at $4.89bn. Source: Deutsche Bank

Crowded houseYou’re not alone: Yet, this is already a well-trodden path, with all of the major OSB players also intimating their focus is turning towards less-capital-intensive iCasino operations. All of the big names have made mention of iCasino being a priority.

** SPONSOR’S MESSAGE** GiG is a leading gaming platform and sportsbook provider for online and land-based operators with digital aspirations. We deliver a full end-to-end solution through our award-winning iGaming and sportsbook solutions. Built for regulated markets and a top-class customer experience, GiG is pioneering the multi-platform era. If you are looking to expand your operations into new, profitable markets, our strategy is the solution. Find out more at sales@gig.com. No easy winsAn operator saying it will pivot is, of course, the easy part. As Gideon Bierer, managing partner at Partis, pointed out, problems start with what targets you are left with. “The toughest thing about pivoting to iGaming is that Michigan – almost one-third of the current iGaming market – is very hard to get into with only 15 skins, while Connecticut is impossible with only two,” he said.

Grab a sliceTAM-trum: Deutsche Bank noted the medium-term estimate for online casino TAM was “not without risk”; the team suggested the estimates relied upon the extraction of promo spend having no negative effect on GGR and also that the existing 5-year CAGR run rate of 3% continued. Neither is a given and nor is the addition of new iCasino states.

Castles made of sand: Paul Leyland at Regulus Partners noted another nuance around the arguments in favor of more liberalization, suggesting any new state will also be building iCasino revenues from other sources of consumer discretionary spend.

Is this really a pivot?Treading water: One consultancy source suggested that what 888 was doing by announcing its iCasino pivot was “putting on a pretty dress” but what it is actually admitting is that SI Sportsbook doesn’t have any prospect of making money.

Sunken dreams: It would be a bigger deal, Leyland added, if one of the larger US competitors did the same thing and effectively called time on the scale of their sports-betting ambitions. “If someone like Caesars was to genuinely pivot, it would mean giving up on the considerable sunk costs,” he said. Further reading: In October’s Deal Talk, E+M suggested this would be the last NFL season for a number of tier 2 and 3 brands. Yesterday on E+M: FSB technology “de-prioritizes” the US, blaming prohibitive costs. For a dollar and a dream: The claims of lottery tax largesse don’t stand up to scrutiny. Analyst takesInspired Entertainment: Roth Capital suggested that recent contract wins with Paddy Power and Betfred show how its UK high-street bookmaking footprint is “remarkably resilient”. Las Vegas and Macau: Deutsche Bank suggested in its 2023 sector preview note that next year could be the time that Macau gaming operators “get off the mat”, while in Las Vegas it predicted YoY declines. Online: EKG suggested the US online market is now a three-horse race, with the number of operators “competing in earnest” now depleted following market exits. Meanwhile, Morgan Stanley rebooted on the sector and suggested the turning point of profitability is “here”. DraftKings: After meeting with management, the team at JMP said the company is increasingly confident around the “compounding nature” of the client base. Macau: The granting of the new 10-year concessions is undoubtedly good news for the Macau market, but the uncertainties over the Covid advance in China mitigates the optimism. CalendarDec 23: Last E+M newsletter of the year Jan 2: E+M is back Jan 3: The startup month #6 Contact

|

Older messages

Jersey’s handle declines continue

Monday, December 19, 2022

Datalines – New Jersey, GAN's Wynn deal, Rank analyst takes, startup focus – SimWin Sports +More

GiG buys AskGamblers for €45m

Friday, December 16, 2022

GiG acquires chunk of Catena Media's European ops, XLMedia considers divisional sale, Bally's Chicago support +More

Deal talk #5

Tuesday, December 13, 2022

SPAC's highs and lows, 888's debt woes, Tilmann Fertitta's Wynn move +More

888’s bankers take a haircut

Monday, December 12, 2022

Banks pay the price for 888 debt, the shares week, New York casino plans, 2023 analyst takes, startup focus – Livespins +More

Weekend Edition #76

Friday, December 9, 2022

$31bn-valued Fanatics' fund raise, MGM gets an analyst upgrade, sector watch – financial affiliates +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏