Coin Metrics’ State of the Network: Issue 189

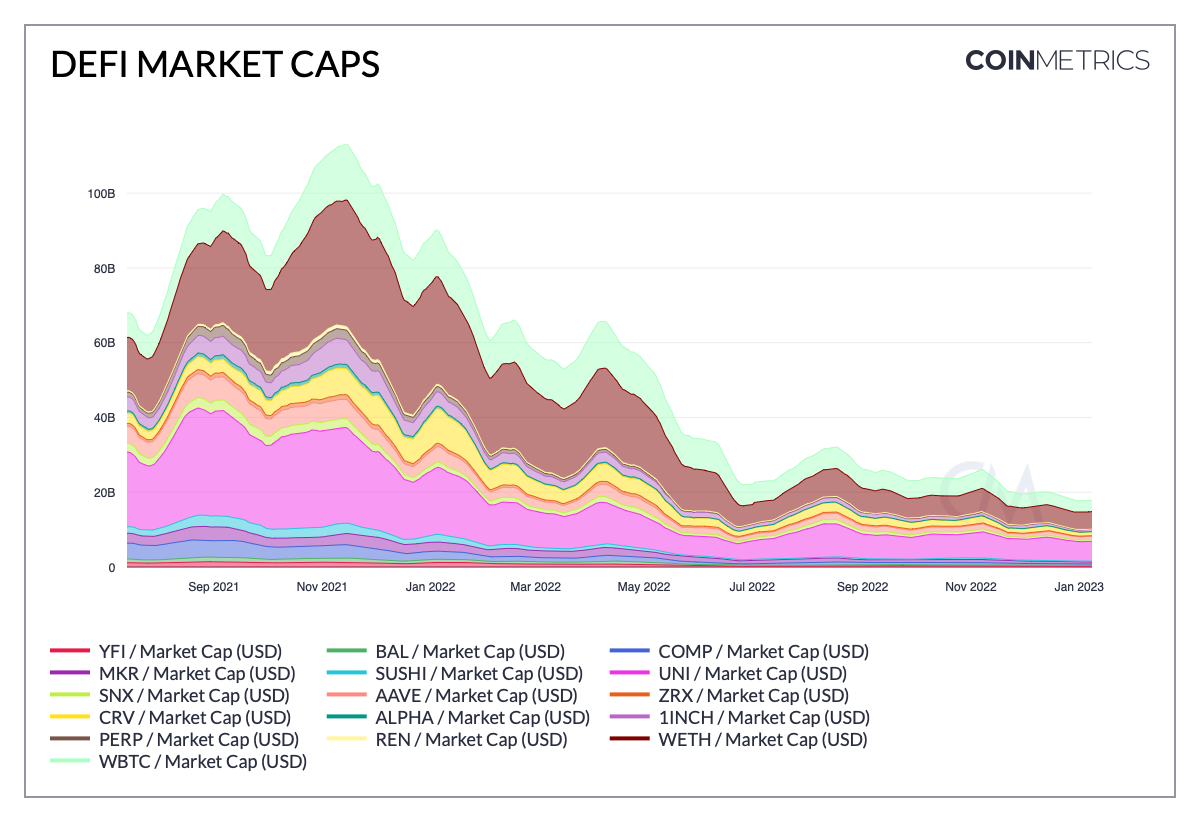

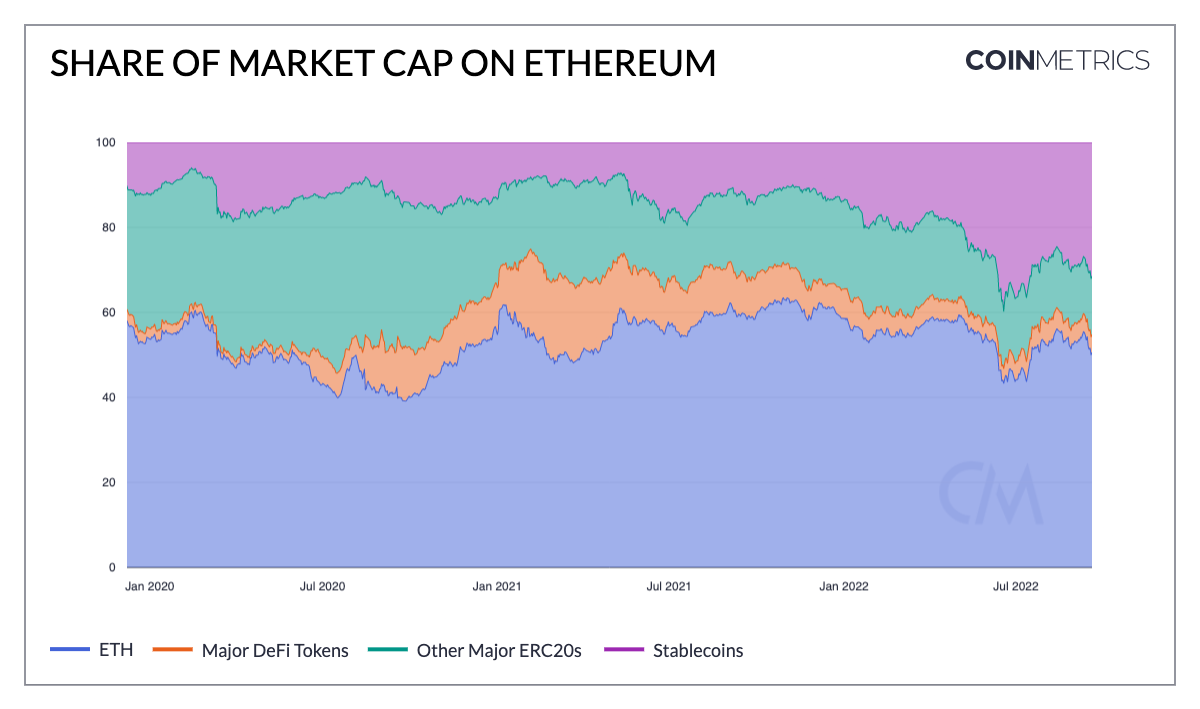

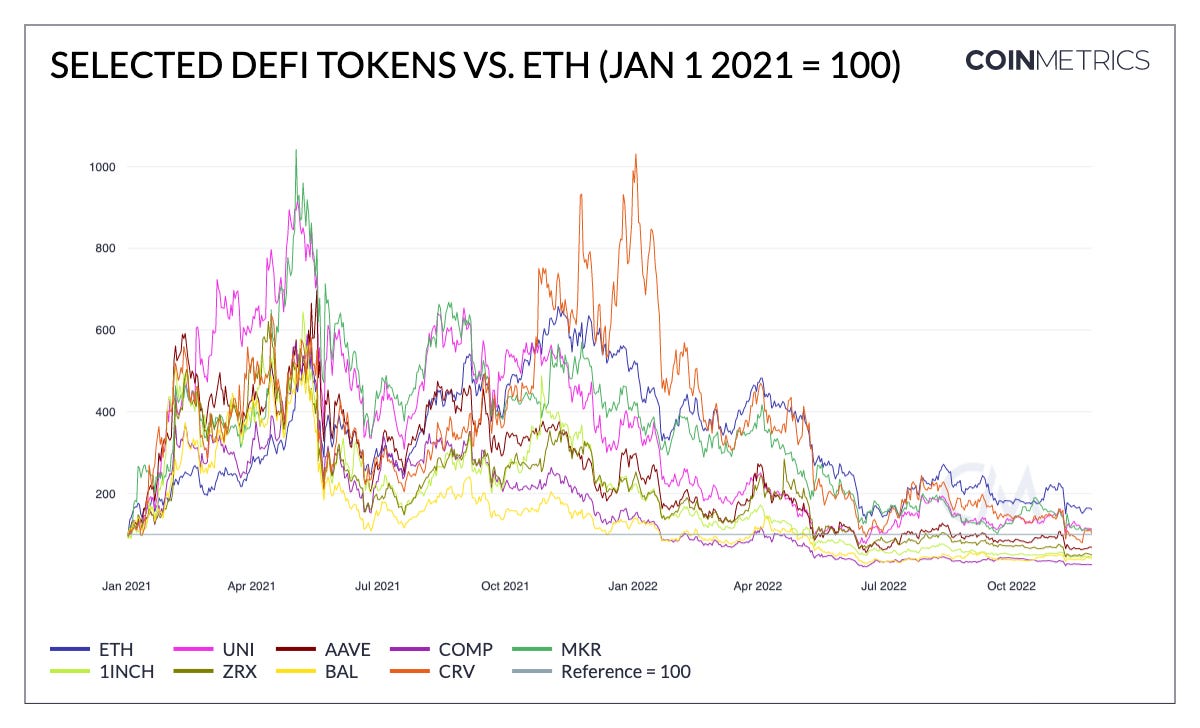

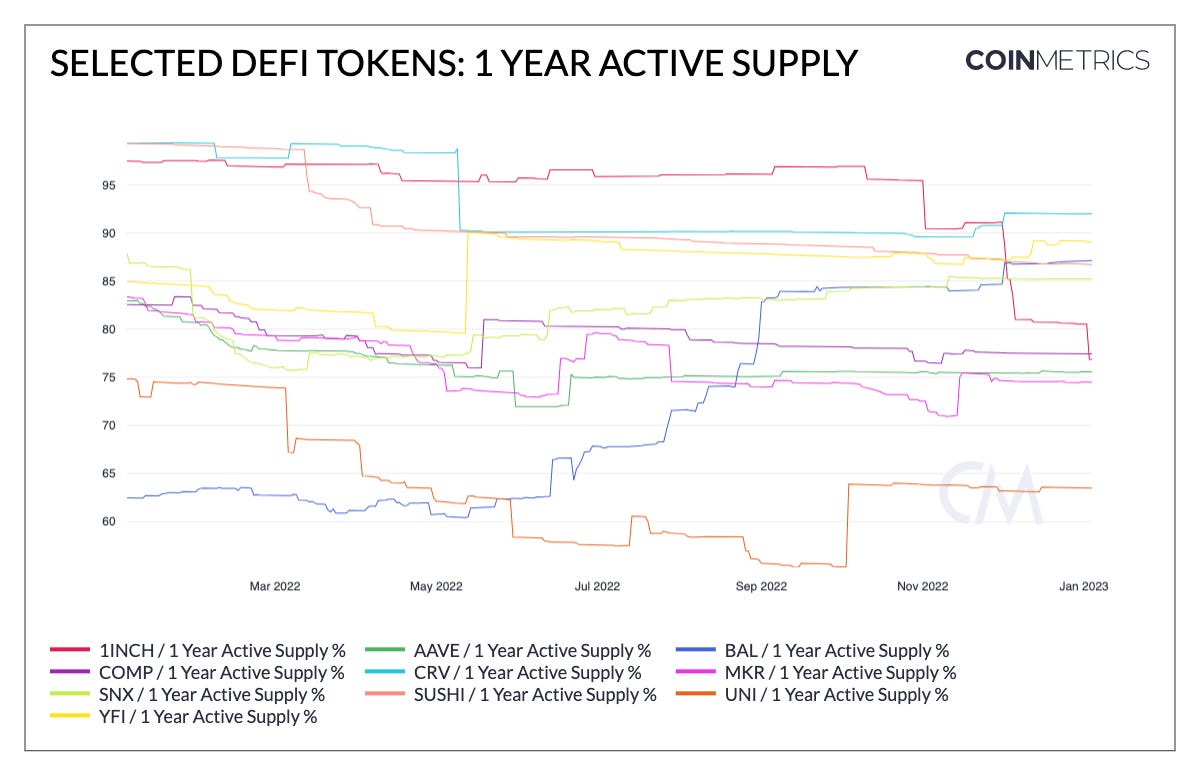

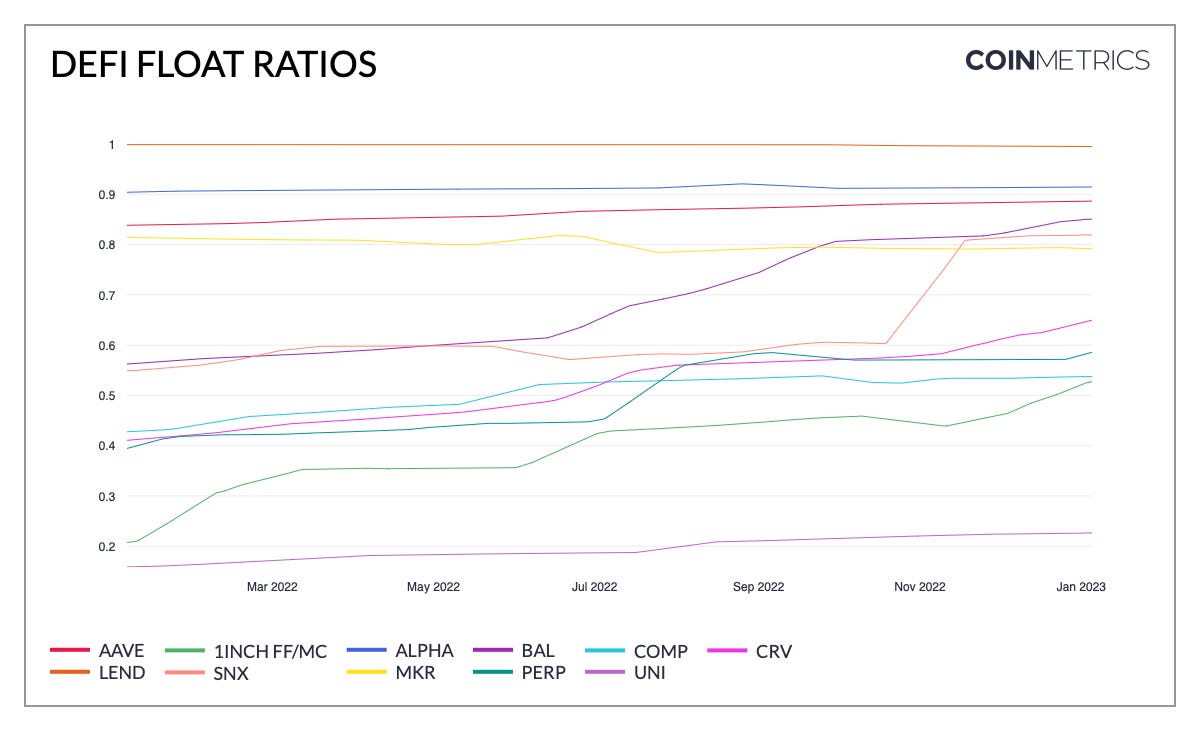

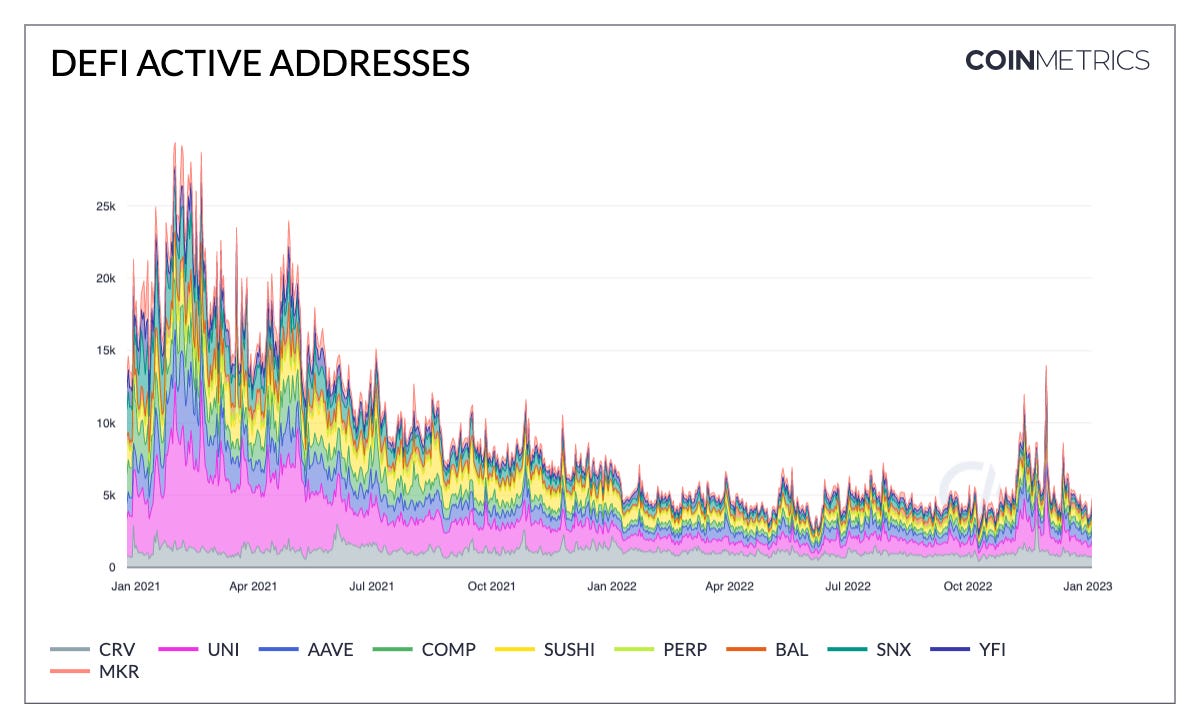

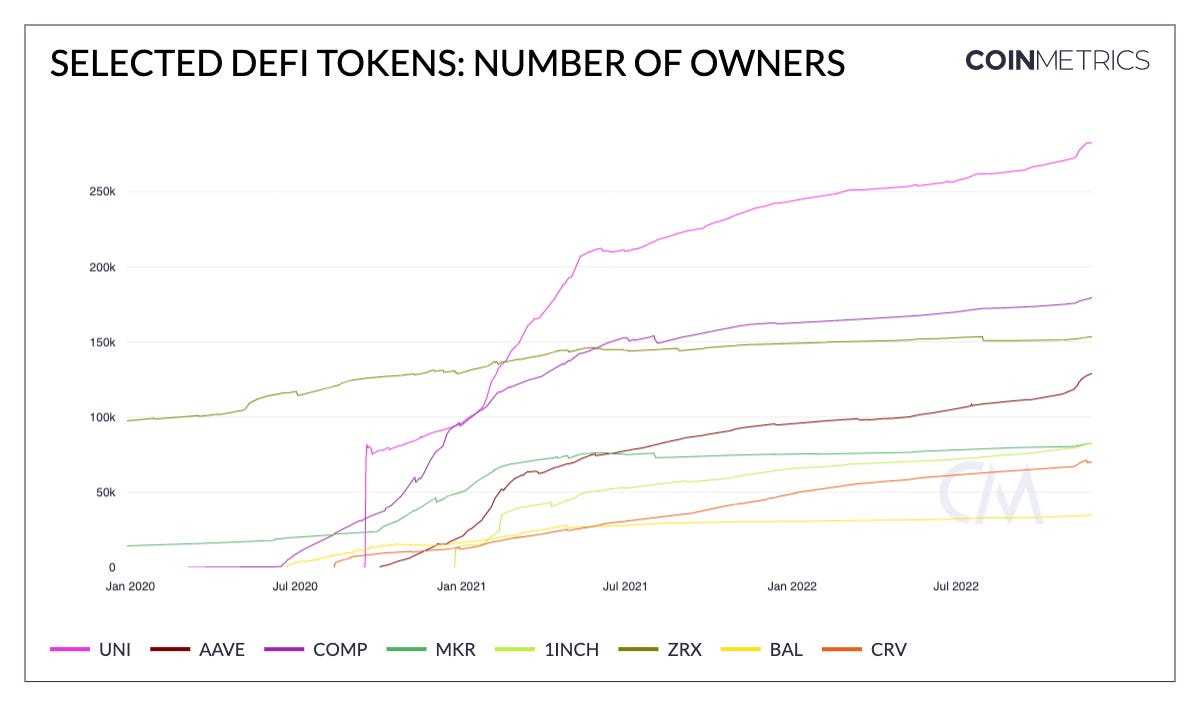

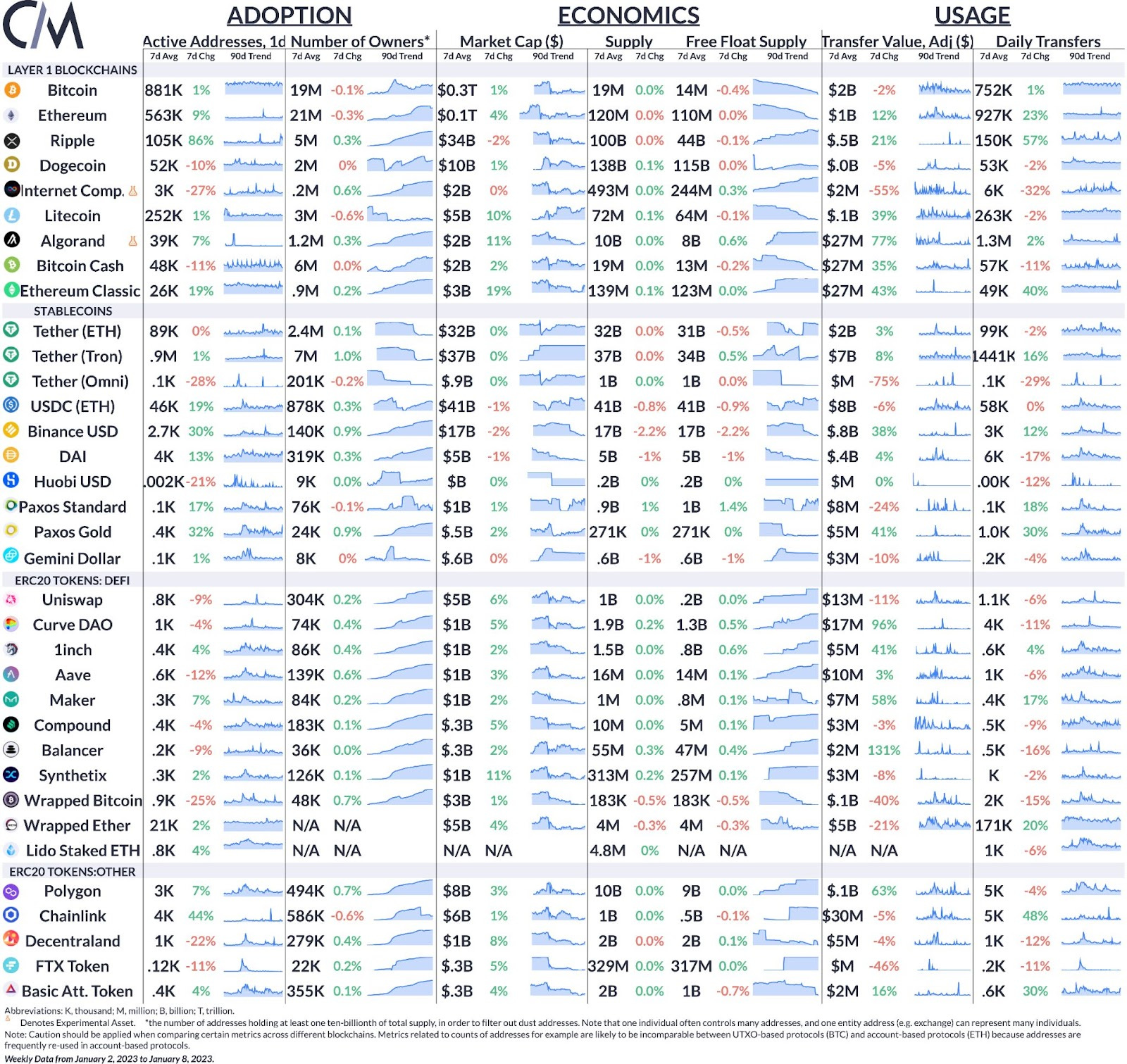

Get the best data-driven crypto insights and analysis every week: The State of DeFi Tokens in 2023By Matías Andrade and Kyle Waters Decentralized finance (DeFi) is a rapidly growing application of blockchain technology that aims to provide financial services, such as access to crypto-collateralized loans, yield on investments, and derivative products, with billions of dollars worth of cryptocurrency locked up in various DeFi protocols. At the heart of these protocols are DeFi tokens, which are digital assets that are used to facilitate governance and economic incentives within these protocols. In this issue of the State of The Network, we take a look at the latest developments of tokens in the DeFi space, including market dynamics, supply statistics and measures of adoption. A Year to BuildAs shown in the chart, the aggregate market cap for DeFi tokens has experienced a significant decline over the past few months. This decline can be attributed to a number of factors, including rising interest rates which introduce competition against yield-bearing DeFi products, overall macroeconomic uncertainty and tech rut, and recent unwinding of malinvestments within the crypto space. Source: Coin Metrics Network Data Despite the recent decline, the DeFi ecosystem has seen tremendous growth over the past few years. In January 2020, the overall DeFi ecosystem was worth under $2 billion. Today, it is worth around $18 billion, although it is still below its peak valuation of around $100 billion. The previous bull-run likely helped spur investment in protocol development and, in spite of the decline, had a huge impact in helping fund ecosystem development. It is important to note that while the aggregate market cap may fluctuate, the underlying innovation and infrastructure development spurred by these lofty valuations is likely to create persistent value among some (but probably not all) of the projects. Source: Coin Metrics Formula Builder One of the interesting dynamics playing out on the Ethereum blockchain—the smart contract platform with the most significant amount of DeFi activity—is the weight of the tokens’ market cap compared to the base-layer asset, ETH. As a consequence of recent months’ market performance, savvy investors have parked their wealth in stablecoins while eschewing riskier assets, as seen in the increasing share of total value that stablecoins command. During the 2021 spring bull market, DeFi tokens’ share of market capitalization bulged on Ethereum. Source: Coin Metrics Formula Builder In spite of this development, it is also worth noting the relative performance of ETH compared to various DeFi tokens. It is clear that investors’ risk appetite has tightened considerably, but as they reconsider their holdings they are growing more selective as well. So far, ETH has held its value more effectively than DeFi tokens. Supply Side TokenomicsOne of the most important issues to consider when judging the relative performance of DeFi tokens, and particularly when making inferences about future performance, is the relative amount of tokens held by treasuries, developers or early investors. While most tokens release most of the supply to be traded in the market freely, most also have a lock-up period where certain investors are given early or discounted access to purchase a token with the condition that these tokens must be held for a minimum period. Depending on the amount of tokens that are held in lock-up, upon release they can have a significant impact on the markets, especially if token owners wish to realize their returns by liquidating their holdings. With this in mind, we can take a look at our 1–year active supply percentage metric to estimate the percentage of supply that isn’t actively traded. Source: Coin Metrics Network Data We can also consider a measure of these effects that we borrow from traditional financial markets called the float ratio. This ratio refers to the share of assets that is available for trade on the market, and can help one estimate the potential future risk of a large asset holder from liquidating their tokens, causing significant volatility and price swings. Source: Coin Metrics Formula Builder In the context of DeFi tokens, the float ratio can be used to protect one’s investments from volatility by identifying tokens with a low float ratio. It is interesting to note that, while the float ratios and 1–year active supply charts are different interpretations of the same idea, they are mostly in agreement with each other. We can see a relatively low 1–year active supply as well as a low-float ratio for UNI, lending coherence to this idea. UNI has a 4-year release schedule for the 1B UNI tokens minted in the genesis of the token in 2020. Similarly, we can see that float ratios have been trending higher during the last year, which is indicative of supply being progressively unlocked. AdoptionThe number of addresses interacting with DeFi tokens has fallen since the beginning of 2021. However, when measuring the adoption of DeFi applications, looking at active addresses interacting with DeFi tokens is a very rough proxy. This is because protocol usage is generally separate from protocol governance (usually in the form of a decentralized autonomous organization, or DAO). For example, a user of Uniswap does not need to own the UNI token to interact with the Uniswap smart contract and trade assets (unless UNI is a one of the tokens being traded). Source: Coin Metrics Network Data It is also helpful to look at the number of owners of DeFi tokens to assess adoption and interest. A decentralized owner base can be advantageous in the context of a DAO because it implies a broader voter base with diversity of perspectives over issues. Most tokens showed a slow upward trend in owners on-chain in 2022, before jumping markedly in November as many users moved their tokens off exchange. Uniswap’s UNI remains one of the most popular DeFi tokens, with over 280K unique addresses owning the token. UNI was famously first distributed via an airdrop to historical protocol users in September 2020, and has grown its owner base since. Source: Coin Metrics Formula Builder ConclusionAs an emerging industry with uncertain cash flows, DeFi tokens suffered through a period of investor de-risking in 2022. There are some possible catalysts that might help reboot interest in DeFi tokens in 2023. Firstly, some projects might continue to experiment with underlying token dynamics. Last year, the MakerDAO community debated revisions to the dynamics of the MKR token including the addition of a staking mechanism. On the regulatory side, any movement towards clarification on the issue of token securities vs. commodities would be welcomed progress in the industry, including the potential adoption of new disclosure frameworks for token issuers. With the acute awareness of centralized agents' recent failures, expectations are high for DeFi to excel in 2023. Indeed, the CMBI Decentralized Finance Sector Even index (CMBIDFIE)—an even-weighted basket of all assets in the decentralized finance sector of datonomy—is up 14% to start the new year. DeFi observers will be watching token performance closely—but, as we’ve described in this piece, it is important to detach DeFi tokens from the underlying adoption of the protocols. With DeFi token data, it is possible to paint a broad picture of the space but more fine-tuned protocol data is needed for proper due diligence and adoption analysis. To this end, we look forward to expanding our breadth of DeFi analyses in 2023. Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro Bitcoin active addresses rose 1% over the week to 881K per day. Active addresses on Ethereum increased by 9% over the week, averaging 563K per day. Paxos Gold (PAXG), a gold-backed stablecoin, had increased on-chain activity as the spot price of gold reached $1,850 per .9995 fine ounces, the highest level since spring 2022. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2023 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

Coin Metrics’ State of the Network: Issue 188

Wednesday, January 4, 2023

Wednesday, January 4th, 2023

Coin Metrics' State of the Network: Issue 187

Tuesday, December 27, 2022

Tuesday, December 27th, 2022

Coin Metrics’ State of the Network: Issue 186

Tuesday, December 20, 2022

Tuesday, December 20th, 2022

Coin Metrics' State of the Network: Issue 185

Tuesday, December 13, 2022

Tuesday, December 13th, 2022

Coin Metrics’ State of the Network: Issue 184

Tuesday, December 6, 2022

Tuesday, December 6th, 2022

You Might Also Like

Weekly Project Updates: Berachain Deposits Surpass $1.1 Billion, Movement Secures $100 Million in Series B Funding…

Saturday, January 11, 2025

On Friday, the proportion of the USD0/USD0++ Pool on Curve, with a Total Value Locked (TVL) of $245 million, tilted severely. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Ethereum and Solana staking no longer classified as collective investment schemes in the UK

Friday, January 10, 2025

The UK Treasury's amendments are part of the government's recent plans to foster crypto innovation. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

WuBlockchain Weekly: U.S. Government Authorized to Sell $6.5 Billion Worth of Bitcoin, Pro-Crypto Pierre Poilievre…

Friday, January 10, 2025

The US government has received approval to liquidate 69000 Bitcoins (valued at $6.5 billion) seized from the “Silk Road” darknet market, a government official confirmed to DB News on Thursday. ͏ ͏ ͏ ͏

US Government can now sell $6.5 billion Silk Road Bitcoin before Trump enters office

Thursday, January 9, 2025

Federal court ruling accelerates sale of Silk Road Bitcoin as market watches closely. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: TGEs Look To Heat Up Crypto In 2025

Thursday, January 9, 2025

Monday Jan 6, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR TGEs To Heat Up Crypto In 2025 Solana Remains Skeptical About AI Agents BTC Looks To Regain Momentum, DOGE & SUI Surge UK

Mining News in December: Ethiopia's Rise, Huaqiang North Mining Machine Prices Rise, Oilfield Giant Invests in Bit…

Thursday, January 9, 2025

Title sponsored by Bitdeer, a NASDAQ-listed mining company. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Let's Make Money from Farming

Thursday, January 9, 2025

CRYPTODAY 140 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Ripple CEO Brad Garlinghouse hails Donald Trump meeting as US crypto engagement grows

Wednesday, January 8, 2025

Trump's pro-crypto stance sees Ripple and other crypto leaders engaging in transformative talks at Mar-a-Lago. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Weekly active addresses on L2s were 5x higher than on Ethereum; Ethena plans to launch iUS…

Wednesday, January 8, 2025

Weekly active addresses on L2s were 5x higher than on Ethereum. Ethena plans to launch iUSDe for financial institutions in February. Solayer launched the Solayer Foundation and LAYER governance token ͏

DeFi & L1L2 Weekly — 📈 Weekly active addresses on L2s were 5x higher than on Ethereum; Ethena plans to launch iUS…

Wednesday, January 8, 2025

Weekly active addresses on L2s were 5x higher than on Ethereum. Ethena plans to launch iUSDe for financial institutions in February. Solayer launched the Solayer Foundation and LAYER governance token ͏