Bitcoin sinks 4% to $20,400 as US producer prices show inflation easing

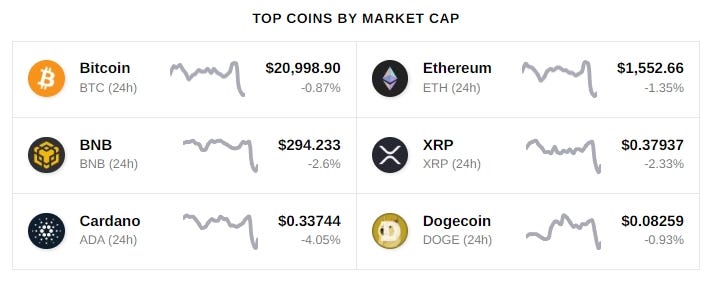

Bitcoin sinks 4% to $20,400 as US producer prices show inflation easingThe leading cryptocurrency tanked after news of better than expected producer inflation data.Happy Wednesday!The global crypto market cap is $976.3 billion with a 24-hour volume of $59.94 billion. The price of Bitcoin is $20,998.90 and BTC market dominance is 41.3%. The price of Ethereum is $1,552.66 and ETH market dominance is 19.4%. The best performing cryptoasset sector is Yield Farming, which gained 3%. Latest NewsBitcoin sinks 4% to $20,400 as US producer prices show inflation easingThe leading cryptocurrency tanked after news of better than expected producer inflation data. Spanish central bank approves digital Euro token EURMMonei to issue El Banco de España digital currency pilot to last up to 12 months. SEC crypto enforcement actions up 50% in 2022 – nearly half against ICOsOut of 127 enforcements actions launched since 2013, 73% alleged unregistered securities offering, 59% alleged fraud and 44% alleged both. Fox News host credits Bitcoin pump to ransomware hackersTucker Carlson speculates the White House was forced to buy Bitcoin to pay cyber attackers to release control of U.S. airspace. Every third member of the US Congress received money from FTXSam Bankman-Fried and other executives at FTX donated cash to 196 members of the new U.S. Congress. CryptoSlate Daily wMarket Update: Dogecoin, Shiba Inu post gains amid flat top 10 performanceThe wMarket Update condenses the most important price movements in the crypto markets over the reporting period, published 07:45 ET on weekdays. Mysterious investor bought RPL 10 minutes before Binance listingThe investor sold his RPL 10 minutes after the listing announcement and scooped $55,397 in profit. FTX defends move to appoint law firm Sullivan & Cromwell as advisorSeparate filings from FTX CEO John Ray III and the official Committee of unsecured creditors supported the move to retain Sullivan & Cromwell. Coinbase to halt operation in JapanThe exchange said leaving Japan is part of its restructuring process that will help it weather the bear market. Active crypto developers grew 5% YoY despite market declineThe study revealed a 3x increase in the number of Bitcoin monthly active developers and a 5x rise in the number of Ethereum developers. |

Older messages

Research: On-chain metrics continue signaling a Bitcoin bottom

Friday, January 20, 2023

On-chain Bitcoin metrics continue to suggest a market bottom, but it remains to be seen if the current cycle plays out the same as past cycles.

How to Make Profit in Bear Market?

Friday, November 11, 2022

Ad: Earn 22.2% APY guaranteed with MIDAS token.

Excited for the World's First Live Web3 Esports Event?

Thursday, October 20, 2022

Get FREE tickets online and reserve your spot now before it's too late 🔥

Get Excited for Istanbul Blockchain Week 2022

Monday, August 22, 2022

You'll never guess who's speaking at this event...

Join CryptoSlate at the most anticipated web3 event of 2022!

Wednesday, April 27, 2022

Remaining tickets available for the world's first NFT-enabled Web3 festival.

You Might Also Like

What is DeFAI? The AI-enabled DeFi narrative looking to take 2025 by storm

Wednesday, January 15, 2025

AI-driven DeFi projects aim to simplify finance with real-time insights, trading, and personalized strategies, but face hurdles in transparency and security. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

OKX Founder's Full Speech: "Always Hold Bitcoin"

Wednesday, January 15, 2025

January 14, 2025, OKX CEO Star delivered a speech via video link. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

JPMorgan believes Solana, XRP ETPs could attract $15 billion in net inflows

Tuesday, January 14, 2025

Both assets register $2.5 billion in assets under management currently, with a little over $500 million in inflows registered last year. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Coin Metrics’ 2025 Crypto Outlook

Tuesday, January 14, 2025

Key Trends & Outlooks Shaping Digital Assets in the Year Ahead ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin’s sharp rise and fall starts week with $418 million in liquidations

Monday, January 13, 2025

Crypto positions unwind with $245M in longs liquidated across major exchanges. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading i…

Monday, January 13, 2025

US-based entities hold 65% more BTC than non-US entities; Crypto.com launched stocks and ETFs trading in the US; South Korea is reportedly planning to gradually allow institutional crypto trading ͏ ͏ ͏

Crypto Crash Imminent As US DOJ Sells Over 69K BTC

Monday, January 13, 2025

Monday Jan 13, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Crypto Crash Imminent As US DOJ Sells Over 69K BTC Senator Lummis To Head New Crypto Subcommittee Dogecoin Fails To Break

2024 Cex Annual Report: Binance's lead narrowed, while Bybit spot and Bitget contracts grew significantly

Monday, January 13, 2025

In December, major exchanges recorded a 14% increase in spot trading volume, with Bitget leading at 102% growth, and a 6% rise in derivatives trading volume, where Gate saw the largest increase at 111%