Aziz Sunderji - The Uneasy US Housing Stalemate

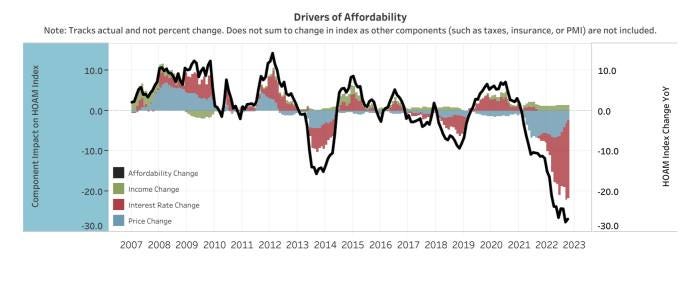

Originally published in the Financial Times on January 12, 2023. Spare a thought for the American first-time homebuyer, for whom things have rarely looked so grim. US home prices rose 40 per cent during the pandemic. Mortgage rates haven’t been this high in 15 years. Wages are higher, but not nearly enough to compensate for these factors. You can see the challenges starkly in the Atlanta Fed’s affordability tracker: Unsurprisingly, this has resulted in US home sales falling off a cliff. The drop has been more rapid than even the decline in 2007-08: So far, in these respects, this looks like a classic rapid correction from an overheated market. As Jay Powell recently described it at a Brookings event:

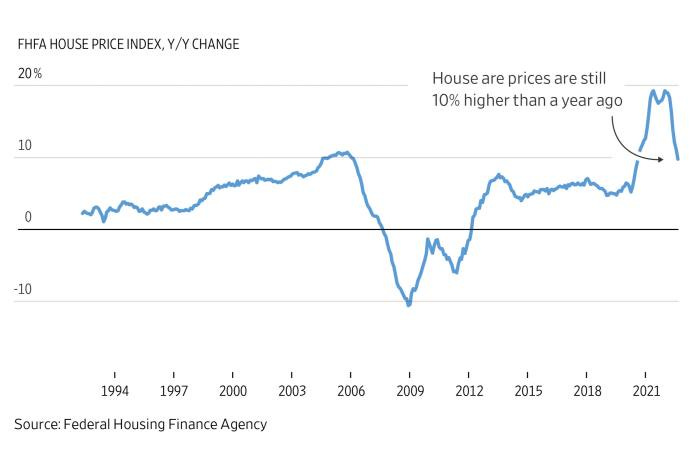

But here’s where things get a bit weird: the bubble is clearly deflating, if not popping, through activity — homes are changing hands at the slowest pace since 2012. But prices have hardly budged. From the peak in June, prices are down only 1 per cent — and they are still up 10 per cent from a year ago. This is obviously bad news for prospective home buyers, but also for the Fed: higher home prices push up rental prices and the imputed cost of owning a home (“owner-equivalent rent”). Together, these constitute more than 40 per cent of core CPI attributed to shelter costs. Real estate folks think supply explains the surprisingly modest price drop. For one, there is a lack of housing inventory. This is partly a long run trend but is getting worse. Given population growth and household formation the US was short of 3.8mn housing units by late 2020, according to Freddie Mac’s chief economist Sam Khater. This secular lack of homes is being exacerbated by cyclical factors. Since you can’t take your mortgage with you, nobody wants to move and reset their loans at much higher rates. Would-be sellers are therefore sitting on the sidelines. From the WSJ:

Fannie Mae estimates that at the end of October, more than 80 per cent of all borrowers had a mortgage rate that was at least 200 basis points below market rates, “by far the largest share in decades”. Taylor Marr, deputy chief economist at real estate listings service Redfin, reckons that mortgage rates will help depress home sales down to the lowest since 2011:

So homeowners are not opting to sell. But they are not being forced out, either. In the pandemic housing boom, lending standards never dropped to 2008 levels — today’s average homeowner is of much higher quality and sitting on a bigger equity cushion. According to the Mortgage Bankers Association, less than 10 per cent of new mortgages are adjustable rate mortgages. Mortgage resets, the powder keg that set off the 2008 crisis, therefore won’t be a major factor. Here’s Joel Kan, the Mortgage Bankers Association’s deputy chief economist, in Yahoo Finance:

On the demand side, lower affordability is decreasing demand, but maybe not as much as one would expect. Household balance sheets are in decent shape, and unemployment is (for now) low. Home builders are also helping foot the cost of more expensive mortgages through buy downs. The result is a stalemate: would-be buyers are deterred by high prices and financing costs, and would-be sellers have little incentive to sell at lower prices, or to sell at all. So where do we go from here? Forecasts are all over the map — KPMG is calling for a 20 per cent fall, and Goldman Sachs for a 7.5 per cent drop, while the Mortgage Bankers Association and the National Association of Realtors think prices will actually rise, though not by much. Calling for anything but much lower prices after the recent boom in home prices and soaring mortgage rates does sound a bit insane. But in the 1970s and 1980s — the last time the Fed was ratcheting up rates to deal with inflation — nominal prices didn’t actually fall. So if history repeats itself, it could eventually be lower mortgage rates alone — not lower prices — that eventually puts an end to the stalemate between buyers and sellers. |

Older messages

Why are we always unprepared for recessions?

Thursday, January 27, 2022

When the economy sputters, stimulus should kick in automatically

Social media is the best and the worst

Tuesday, January 25, 2022

My New Year's experiment based on the empirical evidence

The ultimate productivity hack

Tuesday, January 25, 2022

It has less to do with the state of your inbox than your state of mind

The changing structure of the US workforce

Tuesday, January 25, 2022

The transition to services explains so much about our world today

Is college really getting more expensive?

Tuesday, January 25, 2022

The rising cost of college reflects the rising earnings power of the highly educated

You Might Also Like

Weekend: Introducing the Butt Mullet Dress 👀

Sunday, March 9, 2025

— Check out what we Skimm'd for you today March 9, 2025 Subscribe Read in browser Header Image But first: Join the waitlist for a new premium Skimm experience Update location or View forecast

Starting Thursday: Rediscover Inspiration Through Wordsworth

Sunday, March 9, 2025

Last chance to register for our next literary seminar starting March 13. March Literary Seminar: Timothy Donnelly on William Wordsworth Rediscover one of the most influential poets of all time with

5 little treats for these strange and uncertain times

Sunday, March 9, 2025

Little treat culture? In this economy?

RI#266 - Down the rabbit hole/ What is "feels-like" temp/ Realtime voice tutor

Sunday, March 9, 2025

Hello again! My name is Alex and every week I share with you the 5 most useful links for self-improvement and productivity that I have found on the web. ---------------------------------------- You are

Chaos Theory: How Trump is Destroying the Economy

Sunday, March 9, 2025

Trump's erratic, chaotic governing style is dragging down the economy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Chicken Shed Chronicles.

Sunday, March 9, 2025

Inspiration For You. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

“Hymn of Nature” by Felicia Dorothea Hemans

Sunday, March 9, 2025

O! Blest art thou whose steps may rove ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Claim Your Special Men's Health Offer Today!

Sunday, March 9, 2025

Subscribe to Men's Health today! Men's Health logo Get stronger, smarter, better 1 year of print mag + digital mag access Men's Health Magazine is the essential read for active, successful,

The 2025 Color Trends You *Should* Be Wearing Right Now

Sunday, March 9, 2025

They pack a playful punch. The Zoe Report Daily The Zoe Report 3.8.2025 The 2025 Color Trends You *Should* Be Wearing Right Now (Trends) The 2025 Color Trends You *Should* Be Wearing Right Now They

6 Most Common Tax Myths, Debunked

Saturday, March 8, 2025

How to Finally Stick With a Fitness Habit. Avoid costly mistakes in the days and weeks leading up to April 15. Not displaying correctly? View this newsletter online. TODAY'S FEATURED STORY Six of