Earnings+More - Weekend Edition #85

Weekend Edition #85DraftKings’s profitability push, New Jersey’s January data, LeoVegas exits ‘smaller markets', the AGA state of the industry +MoreGood morning. In today’s edition:

DraftKings reassures on cashSector bellwether says it is making progress with cost-cutting as it improves next year’s guidance on losses. Pennywise: DraftKings issued new guidance on losses for 2023 of $400m at midpoint, down from $525m as it said it reflected a “meaningful slowdown” in fixed-costs growth. Revenues for 2023 were also nudged up to $2.95bn at midpoint. The company was keen to emphasize it would be exiting 2023 with >$700m in cash. Previous guidance had suggested it would exit this year with ~$500m.

Analyst takes: Truist said the beat and raise was more sizable than had been expected as they said they were “impressed” with the underlying profitability trends. Wells Fargo said they were “encouraged by this newfound austerity”.

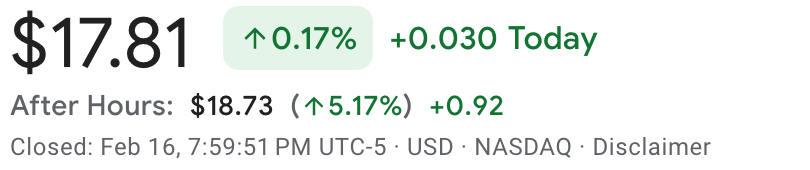

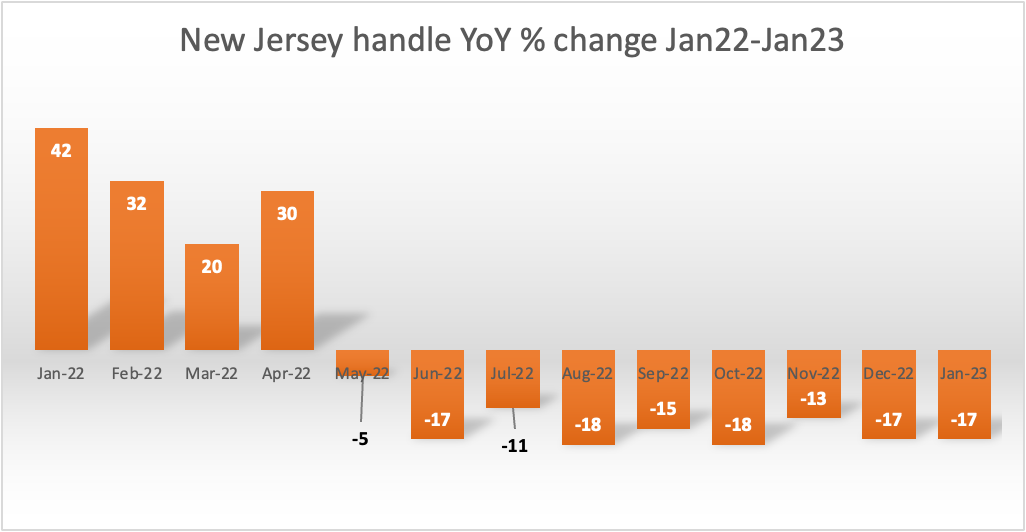

😎 The markets are likely to react well to the earnings, with trading AMC suggesting a 5% share price bump. DraftKings enjoyed a share price bounce in January as markets generally recovered ground on hopes that the Fed rate tightening cycle had turned. NOTE: DraftKings’ call is at 1.30pm ET. E+M will release an Earnings Extra later. ** SPONSOR’S MESSAGE ** BettingJobs is the global leading recruitment solutions provider to the iGaming, Sports Betting and Lotteries sectors. Boasting a 20-year track record supporting the iGaming industry, and with a team of experts and world class knowledge, it’s no surprise BettingJobs is experiencing rapid growth with outstanding results. Does your company have plans to expand teams to cope with strong growth and demand? Contact BettingJobs.com today where their dedicated team members will help you find exactly what you are looking for. Datalines – New JerseyJanuary’s figures show GGR growth across all betting and gaming sectors, but sports-betting handle continues to decline. Buoyancy aid: Land-based GGR was up 15.3% YoY to $211.7m, sports betting rose 20.2% to $72.3m and iCasino posted a 10.9% YoY increase to $152.9m as the market enjoyed a boosted start to the year.

💥 New York’s impact on sports-betting handle in New Jersey

LeoVegas’ small exitsRevenue was up an anemic 1% in Q4 to €99.5m as the company closed “smaller markets” after being swallowed by MGM. Clearing the decks: Without giving much detail, LeoVegas said in its Q4 earnings statement that it had closed markets in its rest-of-the-world segment, resulting in a 15% YoY revenue decrease. Adj. EBITDA tumbled by 68% to €3.7m.

Above and beyond: The company also revealed that its venture capital unit had divested itself of its 25% stake in BeyondPlay for €1.9m. It did not disclose who the buyer was but said it represented a 73% ROI. Further reading: This week’s Deal Talk took a look at what MGM might have in mind for LeoVegas. AGA State of the IndustryThe American Gaming Association says revenues topped the $60bn mark in 2022, up 13% on 2021’s $53bn. Bet boost: Slots generated just over half the total GGR figure at $34bn, a rise of 5% YoY, while sports-betting GGR was up 72.7% to $7.5bn with handle coming in at a record $93.2bn in 2022, fueled by launches in Louisiana, Maryland, New York and Kansas. iCasino GGR rose 35.2% YoY to $5bn.

To not boldly go: Asked if the strong revenues and higher number of younger players visiting land-based casinos would continue in 2023, AGA president and CEO Bill Miller said he did not want to make bold predictions, but noted that Las Vegas revenues were up 17% in 2022 and +25% in December.

Earnings in briefFDJ said the revamp of its retail outlets led to an 8% rise in stakes to €18.1bn, while OSB and instant digital games helped online stakes rise 16% to €2.5bn. Full-year revenues were up 9% to €2.5bn, with EBITDA up 13% to €590m.

Acroud: The affiliate and affiliate-platform provider announced an €18m writedown on its Highlight Media assets bought in 2016. It led to a post-tax loss of €18.4m. Better news came from its new paid media division (bought from Catena Media), which the company said was behind a 40% increase in NDCs.

** SPONSOR’S MESSAGE ** Venture capital firm Yolo Investments manages €550m in capital across 80 of the most exciting companies in fintech, gaming & blockchain. The Gaming Fund, regulated by the Guernsey Financial Services Commission, a dedicated 29-company, €183m AUM portfolio has invested in fast-growth assets including Dabble, Kalamba, SimWin & ThriveFantasy. Yolo Investments has just opened its fund to new investors as it looks to scale new cutting-edge concepts, including its exclusive high-roller land and live casino brand, Bombay Club, global banking network & OTC desk Aims Group. ICYMIMonkey business: Heading the mos-read editions this week was the E+M exclusive on Bally’s putting Monkey Knife Fight up for sale at a price that commentators believe is likely to be a fraction of the $90m it paid two years ago. Earnings+More this week:

Sharpr this week:

Compliance+More this week:

DatalinesThe Nevada Gaming Board has issued a Super Bowl betting correction, downgrading GGR on the game to $5.5m from $11.3m after incorrectly calculating hold. Elsewhere, Pennsylvania reported Super Bowl sports-betting GGR of $29.7m on handle that jumped 24% to $84.3m. New Jersey betting exchange Prophet Exchange reported record one-day betting volume of over $1m for the day of the game. NewslinesCORRECTION: Contrary to our previous item in Weekend Edition #83, Narrativa and Quarter4 are not working with AP on content. Apologies for any confusion caused. BetMGM and Aristocrat have announced a strategic partnership for online casino content. Meanwhile, MGM Resorts closed the $450m sale of operations of Gold Strike Casino in Tunica, Mississippi, to the Cherokee Nation. Full House Resorts will – finally – be opening its Temporary at America Place casino in Waukegan today. Caesars Entertainment and SL Green Realty announced a new Caesars Rewards partnership as part of their gaming license bid for Caesars Palace Times Square. The troubled Lottery.com has got another CEO. Mark Gustavson replaces Sohail Quraeshi while Edward Moffly has also resigned as interim CFO. Growth company newslinesBetr has launched a combat sports media brand Betr Combat and signed mixed martial arts personality Bo Nickal as a content creator. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. Earnings+More is free today. But if you enjoyed this post, you can tell Earnings+More that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

GiG goes for a split

Friday, February 17, 2023

GiG strategic review, Flutter's US listing idea, Caesars admits to Nevada app outage, Betty raises $5m +More

Deal Talk #7

Tuesday, February 14, 2023

Is the deal-making winter coming to a close? MGM sets a path ahead, the latest deals +More

Exclusive: Bally’s looking to sell Monkey Knife Fight

Tuesday, February 14, 2023

Bally's MKF sale deck, Bally's new CEO and Q4 earnings, Betsson Q4 earnings, Macau better than expected +More

CaliPlay legal tussle takes a turn

Monday, February 13, 2023

Caliente's CaliPlay complaint, Super Bowl thrills, DraftKings is the standout in the week ahead, startup focus – Deep CI, Iowa's de facto market exits +More

Weekend Edition #84

Friday, February 10, 2023

DraftKings' Sell note, FanDuel's New York dominance, Super Bowl set to break $1bn, Wynn's new notes +More

You Might Also Like

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

10 Trend Predictions for Coaches, Consultants & Experts in 2025

Wednesday, January 15, 2025

From platform shifts to portfolio careers: my thoughts on what's coming in the year ahead. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Breaking What Isn’t Broken: Lessons from USWNT Coach Emma Hayes

Wednesday, January 15, 2025

The moment we settle for what's comfortable, we stop evolving, learning, competing and getting better.

Refershing Campaigns

Wednesday, January 15, 2025

Oops.