Earnings+More - Weekend Edition #89

Weekend Edition #89Betr’s expanded offering, Light & Wonder dual track, Sportradar analyst reaction, New Jersey February +MoreGood morning. Welcome to this week’s weekender. In today’s edition:

I'm goin' to walk on up to the waterfront. Betr’s expanded waterfrontThe microbetting operator has announced it is adding more standard bet types to its offering. Keeping up with the Joneses: Betr launched a suite of core markets including pre-match and in-play options this week ahead of March Madness in the hope of reaching “product parity” with its competitors.

Keeping tabs: Speaking to E+M, Joey Levy, CEO, stated the startup was “still focused” on microbetting after what he said was a “highly successful” launch that had beat internal forecasts. He said the average user has bet over 31 times, while >15% have placed at least 50 bets.

** SPONSOR’S MESSAGE ** Venture capital firm Yolo Investments manages in excess of €600m in capital across 80 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. LNW chasing multiplesLight & Wonder eyes rival Aristocrat’s better multiple. Grass is greener: Analysts say the consultation launched this week to consider a dual listing of LNW’s shares in Sydney is an attempt to bridge a valuation gap between the Las Vegas-based firm and its Australia-based rival.

Background: Analysts at Truist noted substantial elements of the board and management previously worked at Aristocrat and are familiar with the Australian investment landscape. “We think a potential secondary listing there is largely about multiple arbitrage,” they added.

Analyst takes – SportradarThe share price falls this week are being viewed as an overreaction. Overdone: The post-results 13% fall in the share price was “punitive”, especially in light of what was a relatively modest 3% reduction in forecasted 2023 EBITDA, according to Deutsche Bank. The team pointed out “as a reminder” that Sportradar is “already profitable”, has a strong balance sheet (having paid off $220m of outstanding debt) and part of its investments are in AI, which is currently an investor favorite.

Churchill DownsThe team at JMP said the news that Kentucky has finally moved to outlaw unregulated gaming machines is an unalloyed positive for Churchill Downs, which runs historical racing machines in the state.

WC margins hit BetclicBetclic parent FL Entertainment enjoys strong Q4 thanks to the World Cup. Core margins: The World Cup enabled Betclic to record a 34% YoY rise in revenues to €244m with adj. EBITDA rising 39% to €52m in Q4, but CEO François Riahi said margins were “not so high” due to France reaching the final.

Earnings in briefOPAP: The Greek operator’s instant games and lottery revenues were up 15% and 5.5% respectively and sports betting was down 3% to €161m in Q4. Online casino revenues increased 29% to €61m.

Golden Matrix said its reverse takeover of MeridianBet is expected to complete in H1 as it reported FYQ1 revenue up 21%. Lottomatica’s FY22 revenue rose 17% to €1.4bn, with gaming up 93% to €725m and sports betting up 122% to €341m. Online revenues rose 17.5% to €329m, thanks to the acquisition of Betflag, and group revenues reached €281m in January and February, the group said in a trading update.

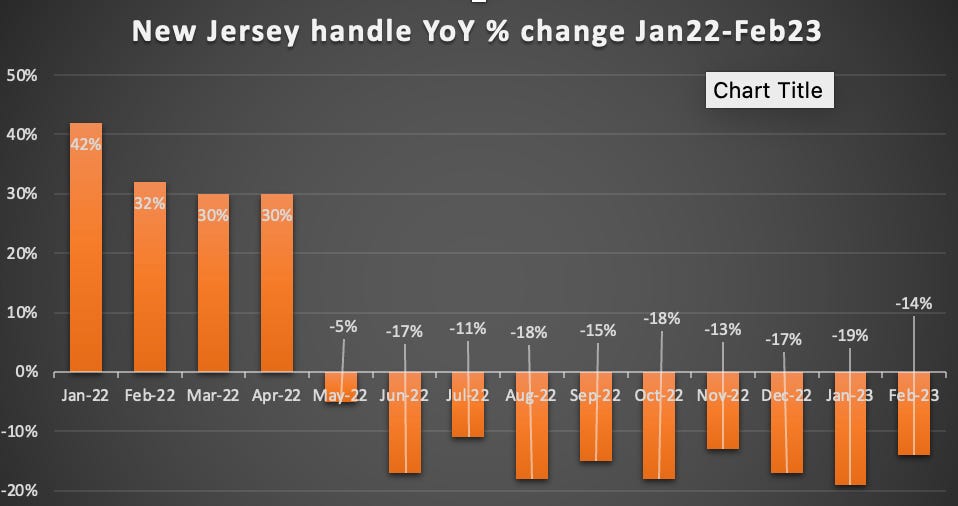

Datalines – New JerseyHold up: Sports-betting GGR rose 77% YoY to $55m in February as operators benefited from sharply increased hold, up to 7.2% from 6.5% in the prior-year period. Handle, however, was down YoY for the 10th straight month to $854m. 🤿 New Jersey’s handle continues to suffer the New York effect

More datalinesMassachusetts: The state went live with regulated mobile betting on March 10 and GeoComply said it processed 8 million geolocation transactions and 406k account openings during the weekend of March 10-12 .

Illinois: Sports-betting GGR reached $96m and handle exceeded $1bn for the fourth consecutive month in January. FanDuel grabbed just over half the GGR at $46m.

ICYMIOn Sharpr this week, the big news was that Riot Games is exploring potential betting partnerships for Valorant. Though an official statement from Riot said there was no change imminent to its policy of not allowing betting partners, it was evaluating opportunities. In Compliance+More this week, yesterday’s newsletter brought news of Barstool’s climbdown on its ‘Can’t Lose Parlay’.

In Earnings+More this week, the sector breathed a sigh of relief over the SVB collapse.

Words in your ear: In other news, +More Media announced it was now the publisher of the Gambling Files podcast with Jon Bruford and Fintan Costello. The latest episode sees Jon and Fintan chat casino collectibles with David Spragg.

Sector watch – sports TVThe long-predicted Chapter 11 bankruptcy of Diamond Sports throws the future of its Bally Sports-branded RSNs into doubt. The pre-pack Chapter 11 proceedings entered into by the Sinclair-owned Diamond Sports doesn’t mean its broadcasts go off the air, according to a statement from David Preschlack, CEO of the indebted Diamond Sports.

Whatever doesn’t kill you: Preschlack promised a swift return for Diamond Sports once it has negotiated a restructuring with its creditor, saying it will emerge from the restructuring process as a “stronger company”.

Channel switch: Should Diamond Sports not survive the Chapter 11 process, these efforts might be the precursor to the leagues taking over more ownership, although the rights might also move back to local affiliates stations as was the situation before the emergence of RSNs. **SPONSOR’S MESSAGE** Random Colour Animal creates intuitive, heuristically designed back-office systems and dashboards. Our UI and UX expertise helps iGaming clients achieve greater user engagement, service speed, team productivity and customer satisfaction. We research, wireframe, interactively prototype, test, design and brand in pre-development phase, enabling a smooth technical hand-over. Why you need to upgrade your back-office: https://randomcolouranimal.com/leading-from-the-back/ NewslinesFansUnite has completed its $3m placement led by Tekkorp. The Mack’s back: Mattress Mack has placed $3.6m on the Houston Cougars to win the NCAA Men’s Basketball Tournament, according to Fox Sports. What we’re readingVox: America’s bad bet on expanded sports betting. On socialNot Cool.  GAN-owned sportsbook @CoolbetCanada says it "will stop offering its services in Ontario on April 3rd."

Coolbet was among the first operators to launch in the province's regulated iGaming market last April, but is now exiting and asking players to request their withdrawals ASAP. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. Earnings+More is free today. But if you enjoyed this post, you can tell Earnings+More that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Sportradar’s game, set and match

Thursday, March 16, 2023

Sportradar CEO talks revenues and ATP, Playtech's Hard Rock deal, Jason Robins' taxonomy, Super Group and Inspired earnings +More

London’s lost listings luster

Tuesday, March 14, 2023

Flutter's desertion for foreign fields deals a blow to London and poses questions for rival Entain +More

Gambling’s relief at SVB rescue act

Monday, March 13, 2023

Gambling's limited exposure to SVB collapse, Sportradar's ATP deal, six launch in Mass, startup focus – ALT Sports Data +More

Weekend Edition #88

Friday, March 10, 2023

Genius Sports' NBA tracking, analysts' online doubts, sector watch – fan tokens, +More

Entain ‘diligent’ on market exits

Thursday, March 9, 2023

Entain reiterates on regulated markets, Betr Mass miss, Full House on the up, NeoGames' iLottery push +More

You Might Also Like

"Notes" of An Elder ― 3.28.25

Friday, March 28, 2025

You can't live a perfect day without doing something for someone who will never be able to repay you.

The Sorry Mess Of Indian Sports

Friday, March 28, 2025

Over 770 sports lawsuits in a decade reveal a governance crisis that threatens India's Olympic ambitions.

'They're like Switzerland': Brands walk tightrope between authenticity and political backlash

Friday, March 28, 2025

These days, brand marketers are tasked with showing up authentically and culturally relevant with the specter of political backlash looming large in the background. March 28, 2025 PRESENTED BY '

🔔Opening Bell Daily: Tesla vs. Trade War

Friday, March 28, 2025

Elon Musk's EV maker and its domestic production are relatively insulated from Trump's tariffs.

Meet the consultant with an idea that could revolutionize athletic apparel contracts

Friday, March 28, 2025

A fresh take on how athletic brands could transform college sports partnerships

Friction factory

Friday, March 28, 2025

Is Angstrom providing enough to help BetMGM win share? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

This page has generated $18 million

Friday, March 28, 2025

Launching a product? I'm helping startups build better products and reach product-market fit. To do that, we've built ProductMix and you should use it: https://rockethub.com/deal/productmix

Tesla’s Gain, America’s Loss

Friday, March 28, 2025

+ India has 13 more billionaires. Meanwhile, the US Embassy in India is cancelling visa appointments.

🔍 What You Should Pin to Your IG Account

Friday, March 28, 2025

March 27, 2025 | Read Online All Case Studies 🔍 At some point everyone wonders what they should pin to their IG profile. Is it your top videos? Is it info about you? I talked to other creators and

Copious coconuts and a canoe campaign

Friday, March 28, 2025

Weekender #54 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏