Let’s start the week with a note of praise for 5-year-old Lila Varisco. Lila, who lives in Westport, Massachusetts, tried to do her part to boost retail sales when, during a car ride, her mom had given her her phone to play games. That’s when Lila went on Amazon and ordered more than $3,000 in merchandise, including 10 kids’ motorcycles and 10 pairs of cowgirl boots, which arrived two days later. Sadly, they’re all being returned.

In today’s edition:

—Jeena Sharma, Erin Cabrey

|

|

Office Space/20th Century Studios via Giphy

Let’s get to know each other better: If you had $300 that you could either spend on a pair of business formal pants for work or a couple of comfy athleisure outfits, which would you choose?

Well, if you think like most consumers do right now, chances are you picked the latter.

Old-school office attire may be on its way to an early retirement as most employees are still either working in hybrid (office and home) roles or are simply choosing to dress more casually.

Inditex’s latest earnings from Massimo Dutti, its mid-range office wear brand, took a hit, dropping 9.6% in the past fiscal year. The company that also owns Zara revealed revenue from the brand was at $1.7 billion, a 16% dip from 2019. Currently, Massimo Dutti is the only Inditex brand that still hasn’t recovered from losses incurred during the pandemic.

Experts believe the brand is not alone in its low sales numbers as mid-ranged office wear as a category has been impacted by both hybrid work-driven consumer habits and the cost-of-living crisis. While both budget and high-end office wear seem to be safe, mid-priced retail brands that want to stay relevant will either have to pivot their strategy to become a value brand or a high-end one.

“What we’ve seen is [hybrid work] leads to a much more casual environment because a lot of places have people coming back to work Tuesday through Thursday, while Monday and Friday are flexible. Since it’s flexible, the office is slightly empty, and so you can see people really wearing casual clothes to work,” Michael Prendergast, managing director at Alvarez & Marsal Consumer Retail Group, told Retail Brew.

Keep reading here.—JS

|

|

|

You know it, we know it: Sending relevant, engaging messaging is *crucial* for your business. Sending messages at precisely the right time, across the right combination of channels and devices, can maximize customer engagement, revenue, and lifetime value.

The pros at Listrak, the industry’s leading customer engagement platform, know a thing or two about helping retailers send the right messages across the right channels.

Listrak’s 2023 Cross-Channel Benchmark Report looks back at top marketing campaigns of 2022 to uncover top strategic opportunities—including click-through rates, conversion rates, and revenue per send for both email and text message marketing.

Their experts also share:

- key actions that boost customer lifetime value by 30%

- previously overlooked channels that are making a comeback

- what retailers need to do right now (yes, right now!) to prepare for the 2023 holiday season

Get these industry insights when you download the full report.

|

|

Amelia Kinsinger

Is the direct to consumer model dying? If you look at Allbirds’s recent stock stumble, it would seem like it.

Just a couple weeks ago, the footwear retailer reported a 47% dip in its shares and attributed the slow growth to its DTC channels, among other factors. In fact, its current revamp plan includes adding more wholesale partners.

But Allbirds alone is not responsible for this seeming downfall of DTC. Retailers Nike and Adidas have also pulled back from DTC-focused strategies in favor of wholesale ones. Per David Schneidman, senior director at Alvarez & Marsal Consumer Retail Group, a key reason behind the market slowing down is the high cost per acquisition.

“With the current economic volatility, brands need to be tighter with their cash and their burn…it cannot be a place where you live and die because you will have to get into diversifying your revenue channels, particularly with wholesale and retail,” Schneidman told Retail Brew.

Omnichannel is also something the aforementioned brands have relied on as a long-term strategy. But it wasn’t always like this.

DTC’s origins

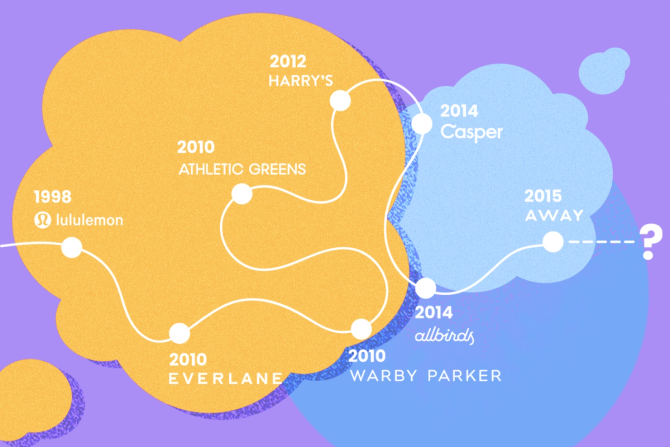

Once upon time, the industry had a rosier view of DTC brands, which started gaining traction around the early 2010s, with the likes of Everlane, Warby Parker, Casper, and Away leading the charge.

Away, for instance, notched $12 million in sales during its first year after launch in 2016, subsequently turning that into $125 million in revenue by 2018. Likewise, California-based Everlane, which got its start in 2010 as a largely online company, has generated over $100 million in sales in its first six years.

DTC sales in the US alone hit ~$111 billion in 2020, up from $76.6 billion in 2019. So what has gone wrong?

Keep reading here.—JS

|

|

Macy's

Retailers named new execs in March, and many, from Glossier and Nike to Diageo, looked inward to fill their top roles. We rounded which retail execs moved up—and which moved on—in March:

-

Starbucks’ new CEO Laxman Narasimhan, a former PepsiCo exec, took the helm of the coffee giant on March 20 after serving as interim CEO since October. Despite holding the company’s top spot, Narasimhan said he plans to serve as a barista in different stores for four hours each month.

-

Macy’s announced CEO Jeff Gennette will retire in February 2024, set to be replaced by Bloomingdale’s head Tony Spring.

-

LVMH shook up its beauty biz this month, naming Stéphane Rinderknech as the chairman and CEO of LVMH Beauty. The former L’Oréal USA president and CEO joined LVMH in May 2022 to lead its hospitality excellence division. Guerlain head Véronique Courtois also moved to become president and CEO of Parfums Christian Dior, replaced by Make Up For Ever CEO Gabrielle Saint-Genis Rodriguez.

-

Spirits giant Diageo promoted COO Debra Crew to CEO effective July 1, the first woman to hold the position, after current CEO Ivan Menezes announced his retirement.

-

Glossier made several C-suite moves, adding Chanel vet Chitra Balireddi as its chief commercial officer, and promoting Marie Suter from SVP, creative director to chief creative officer, and Kleo Mack, previously its VP of brand, to CMO.

-

Former GNC CEO Josh Burris took over as chief executive at teen clothing retailer Rue21. Burris left GNC in January, though a replacement has yet to be named, with executives currently reporting to its board of directors.

-

Five Below tapped CFO Kenneth Bull as its COO. He’ll serve in both roles until the discount retailer selects a new CFO.

Keep reading here.—EC

|

|

Today’s top retail reads.

Ode to Roy: The understated “stealth wealth” fashion that defines HBO’s Succession. (WWD)

Wool steam ahead: How Pendleton, the Oregon blanket and apparel brand, has thrived for more than a century. (CBS News)

Charms offensive: Cereal brands like Cinnamon Toast Crunch and Lucky Charms are expanding beyond the cereal aisle into items like cake mixes, ice cream, and yogurt. “The bullseye for Cinnamon Toast Crunch is older tweens and teens who grow up with the flavor and might want more of it,” said Ricardo Fernandez, president of US morning foods at General Mills. (Fast Company)

|

|

Want to take your relationship with Retail Brew to the next level? Throughout the year, we will gather fellow retail leaders for discussion and dinner in NYC.

Apply now for a chance to partake in an evening of conversation about the most pressing issues retailers face today—oh, and some great food.

Sign up today.

|

|

-

Starbucks fired an employee of a Buffalo store who helped lead one of its first successful union drives, claiming it was because she’d been “on a progressive disciplinary track.” News of her termination drew a tweet from Bernie Sanders demanding her reinstatement.

-

Walmart laid off more than 600 fulfillment center employees.

-

McDonald’s closed its corporate offices for the first three days of this week and instructed employees to cancel in-person meetings with vendors there as it prepared to issue layoff notices.

-

Bed Bath & Beyond was sued by its former CEO over unpaid severance.

-

Kleinfeld bridal emporium co-founder Hedda Kleinfeld Schachter, a pioneer of the bridal industry, died at 99.

|

|

At the mall, it’s where band tees are the only tees. In Retail Brew, it’s where we invite readers to weigh in on a trending retail topic.

On March 27, Adidas asked the US Trademark Office to reject an application from the Black Lives Matter Global Network Foundation to trademark a logo that featured three stripes, which are, of course, an element of the Adidas logo.

But a few days later, Adidas withdrew the objection, and while the company did not comment on why, Reuters reported that “a source close to the company said the rapid about-turn was triggered by concern that people could misinterpret Adidas’s trademark objection as criticism of Black Lives Matter’s mission.”

You tell us: Do you think that Adidas made the right decision to withdraw its opposition to a Black Lives Matter logo with three stripes? Cast your vote here.

Circling back: Last week, we asked whether you, like more people nowadays, are using buy now, pay later (BNPL) for everyday purchases like groceries and home goods as opposed to more discretionary purchases like electronics. Most of you seem pretty flush, with only 3.3% of you using BNPL for everyday purchases like groceries and 20% of you using BNPL, but not for everyday items. Three out of four (75%) of you don’t use BNPL at all, while 1.7% didn’t know or weren’t sure.

|

|

Catch up on the Retail Brew stories you may have missed.

|

|

|

Written by

Jeena Sharma and Erin Cabrey

Was this email forwarded to you? Sign up

here.

Take The Brew to work

Get smarter in just 5 minutes

Business education without the BS

Interested in podcasts?

|

ADVERTISE

//

CAREERS

//

SHOP 10% OFF

//

FAQ

Update your email preferences or unsubscribe

here.

View our privacy policy

here.

Copyright ©

2023

Morning Brew. All rights reserved.

22 W 19th St, 4th Floor, New York, NY 10011

|

|