Do Older Americans Have A Harder Time Getting A Mortgage?

Welcome to Crime and Punishment: Why the Poor Stay Poor in America. I’m thrilled that you signed up to read my newsletter, and I hope that together, we can make a difference.

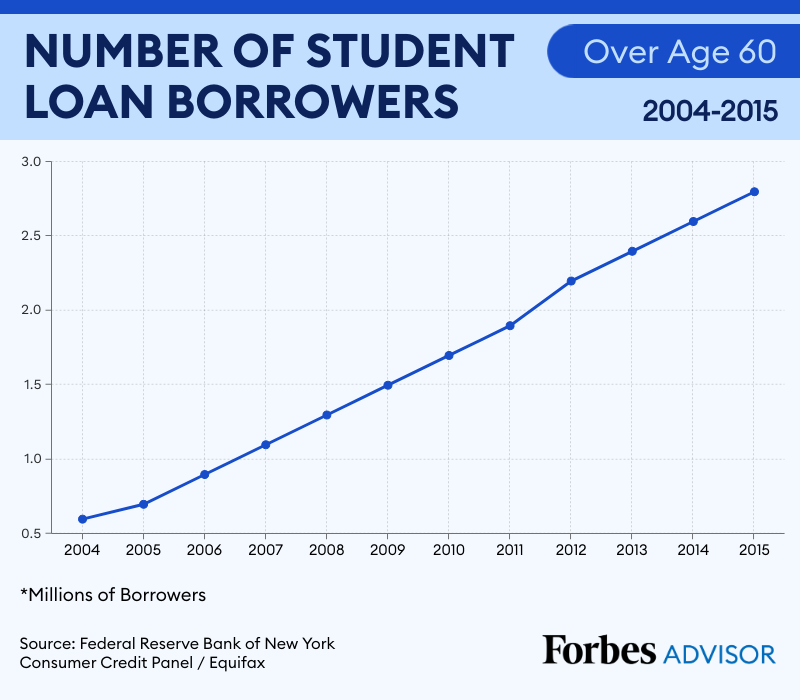

“In February, Natee Amornsiripanitch, an economist at the Federal Reserve Bank of Philadelphia, published an analysis of more than 9 million mortgage applications collected through the Home Mortgage Disclosure Act from 2018 to 2020. He found that rejection rates rose steadily with age, particularly accelerating for applicants over 70.” The New York Times, April 8, 2023 The reason mortgage rejection statistic rates for older Americans are important to explore is because of the dichotomy between what the law says, specifically in the Equal Credit Opportunity Act (ECOA), and what actually happens when lenders look at an application. The ECOA prohibits discrimination in lending on the usual array of factors like race, color, religion, national origin, sex or marital status, or age.¹ In fact, the Consumer Financial Protection Bureau (CFPB) has fleshed out this statutory requirement in a rule explaining what constitutes discrimination in lending and what doesn’t. On the other hand, lenders still have a legitimate need to determine an applicant’s credit-worthiness. So how are these two, competing goals reconciled? Not easily, it seems. And according to this new, extensive research on the increasing rate of mortgage denials for seniors, not necessarily in favor of those the law is trying to protect. It’s important to understand, though, that this same research shows a correlation between the age of the borrower and an increased rate of loan denial, not a causation between the two —a potential borrower’s age does not, in and of itself, cause the denial— and it doesn’t necessarily mean a lender is violating the law and discriminating against a senior when they are denied any type of mortgage loan. (Legal note: when a law is “neutral on its face”, but discriminates in its practical application, a court can rule the law unconstitutional). Of course, there are a number of other factors that determine whether a lender decides to approve an application for a new mortgage or one of the refinancing or equity line of credit options, like one’s income and amount of other debt. These figures are then calculated into your very own “debt-to-income ratio”, on which lenders rely heavily in making decisions. But there is a problem with using this metric as a primary decision-maker, particularly with today’s senior borrowers: those over 60 already have much more debt than in previous decades, including credit card debt, and second mortgages and lines of credit. People over 60 also have much more student loan debt, than say, 30 years ago, likely because they generously help their children and grandchildren with the soaring cost of education. Look at this 11 year increase! Unfortunately, more debt combined with a fixed, retirement income and maybe some investments does not demonstrate a strong enough credit risk for banks. The woman profiled in The Times article whose refinancing application on her primary residence was denied, had a “modest” retirement income plus a second home with its mortgage paid off that she rented, presumably providing additional passive income. (If you can access the full article, read some of the comments. Many can’t seem to believe this woman was denied a refinancing loan given her assets, but the author chimes in to correct some of the readers’ misinterpretations). Although the law directly and specifically prohibits discrimination in lending by age, this review of over 9 million mortgage applications submitted over a 2 year period, show that age does play a factor in the denials. In my refinancing heyday, when the rules perhaps were more lax and bent more often, and I had a good amount of equity in my home, I somehow qualified for whatever refinancing option lenders were pushing at the time…until the housing market crumbled in the Great Recession, my home was worth considerably less, and my fairly meager income couldn’t keep up with my increasing house payments. Also, I was younger then. The general idea, we are told, is to work as long as we are able (forget about how long we want to work), pay off our mortgage and other debt before we retire, save and invest for our golden years while we’re at it, and then we can retire to enjoy the freedom earned over the last 40 or 50 years…if our back is up to enjoying anything. For the most part, few seem to question this pre-set plan, and I guess it makes sense. But things happen: pensions are ripped away when a company declares bankruptcy, medical bills pile up even with insurance, a home needs repairs and even retrofitting if the retired want to “age in place”. Where do we get this money if borrowing is more difficult? ————————————————————————————————— Have you dipped into your retirement savings (if you have any), even before retiring? Have you refinanced your mortgage loan once or twice…or more? Should it be harder for seniors to borrow? Let me know in the Comment Section below! As always, I appreciate your interest and thoughtful ideas that make our Crime and Punishment community a welcoming space to visit and chat. There’s no time like the present to become a free or paid subscriber…and there’s no time like the New Year to Upgrade your free subscription to paid — it’s easy, and will allow me to continue and expand Crime and Punishment. Thanks in advance for your support! You’re on the free list for Crime and Punishment: Why the Poor Stay Poor In America. All posts are free for now, but if you’d like to get ahead of the crowd, feel free to support my work by becoming a paid subscriber. | |||||||||||||||||||||||||||||||||||||||||||||||||

Older messages

A Trio of Environmental Articles For Your Sunday/Monday Reads

Monday, April 3, 2023

Where Politics Meet Our Natural World

The Cost of Borrowing Is Sky High

Thursday, March 30, 2023

Listen now (11 min) | And Hurts the Middle Class And Poor the Most

Taxes and Poverty

Wednesday, March 22, 2023

Listen now (13 min) | How a Skewed Tax Code and Lopsided Auditing Hurt the Poor

A Mishmash of Monday Readings

Tuesday, March 14, 2023

Saving Dirt Roads, Banning Dollar Stores, A Bank Failure

Condominium Deconversion

Tuesday, March 7, 2023

Listen now (9 min) | Another Way Big Corporations Are Eating Into Private Home Ownership

You Might Also Like

Nicole Kidman's “Butter Biscuit” Hair Transformation Is A Perfect Color Refresh

Saturday, March 1, 2025

Just in time for spring. The Zoe Report Daily The Zoe Report 2.28.2025 Nicole Kidman's “Butter Biscuit” Hair Transformation Is A Perfect Color Refresh (Celebrity) Nicole Kidman's “Butter

David Beckham's Lifestyle Keeps Him Shredded at 50

Friday, February 28, 2025

View in Browser Men's Health SHOP MVP EXCLUSIVES SUBSCRIBE David Beckham's Lifestyle Keeps Him Shredded at 50 David Beckham's Lifestyle Keeps Him Shredded at 50 The soccer legend opens up

7 Home Upgrades That Require Zero Tools

Friday, February 28, 2025

Skype Is Dead. There are plenty of ways to make quick improvements to your house without a single hammer or screwdriver. Not displaying correctly? View this newsletter online. TODAY'S FEATURED

Heidi Klum Matched Her Red Thong To Her Shoes Like A Total Pro

Friday, February 28, 2025

Plus, the benefits of "brain flossing," your daily horoscope, and more. Feb. 28, 2025 Bustle Daily Here's every zodiac sign's horoscope for March 2025. ASTROLOGY Here's Your March

How Trans Teens Are Dealing With Trump 2.0, in Their Words

Friday, February 28, 2025

Today in style, self, culture, and power. The Cut February 28, 2025 POWER How Trans Teens Are Dealing With Trump 2.0, in Their Words “Being called your correct name and pronouns can be the difference

The Eater Oscars for best bites in film this year

Friday, February 28, 2025

An NYC cafe garners celebrity support after rent hike

The Must-See Movies The Oscars Overlooked

Friday, February 28, 2025

Plus: Celebrities pay tribute to Michelle Trachtenberg. • Feb. 28, 2025 Up Next Your complete guide to industry-shaping entertainment news, exclusive interviews with A-list celebs, and what you should

The Best Cropped Jackets for Spring, Styled by Us

Friday, February 28, 2025

Plus: What we carried in our bags at Fashion Week. The Cut Shop February 28, 2025 Every product is independently selected by our editors. Things you buy through our links may earn us a commission.

The chicken and the eggs

Friday, February 28, 2025

and where they both come from ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

March's Guest Editor: Kim Addonizio

Friday, February 28, 2025

Thank you for supporting Poem-a-Day ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏