Change My Mind: Density Increases Local But Decreases Global Prices

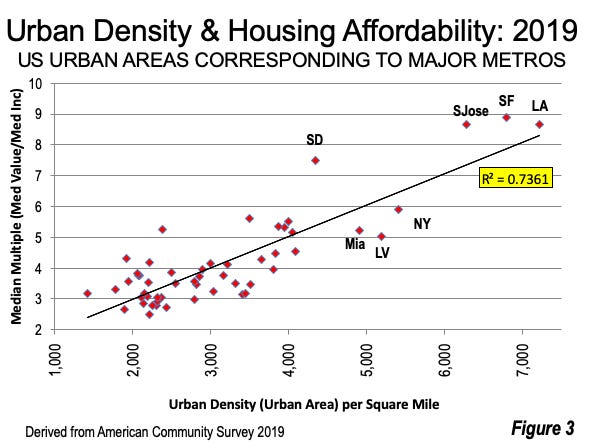

Matt Yglesias tries to debunk the claim that building more houses raises local house prices. He presents several studies showing that, at least on the marginal street-by-street level, this isn’t true. I’m nervous disagreeing with him, and his studies seem good. But I find looking for tiny effects on the margin less convincing than looking for gigantic effects at the tails. When you do that, he has to be wrong, right? The two densest US cities, ie the cities with the greatest housing supply per square kilometer, are New York City and San Francisco. These are also the 1st and 3rd most expensive cities in the US. The least dense US city, ie the city with the lowest housing supply, isn’t really a well-defined concept. But let’s say for the sake of argument that it’s a giant empty plain in the middle of North Dakota. House prices in giant empty plains in North Dakota are at rock bottom. Moving from intuitive thought experiments to real data, we find that indeed, the denser an area, the higher its house prices:

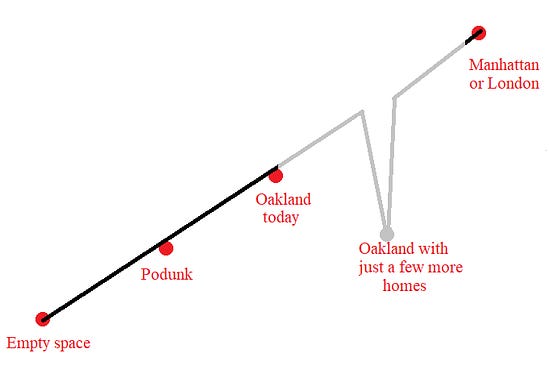

Could this be reverse causation - ie New York is very dense because its prices are so high (which incentivizes developers to squeeze the most out of every parcel of land)? Yes, obviously this is part of the effect. But equally obviously, it isn’t the full effect. Stripped of its density, Manhattan is just a little island off the US East Coast. There are plenty of little islands off the US East Coast - Maine alone has dozens - and none of them are as expensive to live in as Manhattan. Manhattan has a few extra natural amenities, like a river and a good harbor. But nobody moves to Manhattan for the harbor. They moving there because they want to be in a big city - with friends, jobs, museums, and nightlife. This induced demand effect is so strong that it overwhelms the fact that Manhattan has millions more houses than the empty North Dakota plain (or lower-tier cities like Des Moines or Cleveland). So empirically, as you move along the density spectrum from the empty North Dakota plain to Manhattan, housing prices go up. So I don’t understand why Matt believes that building a few new apartments in some city - a very small move along that spectrum - would do anything other than make local prices go up. For example, if my home city of Oakland (population 500,000) became ten times denser, it would build 4.5 million new units and end up about as dense as Manhattan or London. But Manhattan and London have the highest house prices in their respective countries, primarily because of their density and the opportunities density provides. I don’t see why Oakland being able to tell a different story of how it reached Manhattan/London density levels (“it was because we were YIMBYs and deliberately cultivated density to lower prices”) would make the end result any different from the real Manhattan or London. But if becoming just as big as Manhattan or London would make Oakland more expensive, shouldn’t we assume that a little step in that direction would make it a little bit less expensive? Wouldn’t the alternative be some kind of highly unparsimonious pricing function like this?: But doesn’t induced demand violate the economic law of supply and demand? Or doesn’t it (as Yglesias argues) allow an economic perpetual motion machine, where you just keep building houses and generate infinity money as the price of each keeps going up? No; I think the missing insight is that there’s some pool of geographically mobile Americans¹ who are looking for new housing (or who might start looking if the right situation presented itself). These people have various combinations of preferences and requirements. One common pattern is to prefer any big city - they would be happy to live in Seattle, or NYC, or the Bay, if the opportunity came up. Right now, more Americans prefer to live in big cities than there are housing units in big cities, so prices go up and these people can’t afford their dream. As new cities become “big” (by these people’s criteria), they’ll move to those cities, increasing demand. The fact that big cities remain more expensive than small villages suggests that there are many of these people and they’re currently under-served. So if Oakland became bigger, it would become a more appealing destination for these people at some rate (making it more expensive) and get more supply at some rate (making it less expensive). Since existing big dense cities are all very expensive, most likely in current conditions the first effect would win out, and Oakland would become more expensive. But it can’t do this forever - at some point, it will exhaust the pool of Americans who want to move to big cities (you’ll know this has happened when housing prices are no higher in big cities than anywhere else). So there’s not perpetual motion - just the ability to keep making money as long as there’s pent-up demand, like in every other part of the economy. And it doesn’t violate laws of supply and demand; if Oakland built more houses, this would lower the price of housing everywhere except Oakland: people who previously planned to move to NYC or SF would move to Oakland instead, lowering NYC/SF demand (and therefore prices). The overall effect would be that nationwide housing prices would go down, just like you would expect. But the decline would be uneven, and one way it would be uneven would be that housing prices in Oakland would go up. This isn’t an argument against YIMBYism. The effect of building more houses everywhere would be that prices would go down everywhere. But the effect of only building new houses in one city might not be that prices go down in that city. This is a coordination problem: if every city upzones together, they can all get lower house prices, but each city can minimize its own prices by refusing to cooperate and hoping everyone else does the hard work. This theory is a good match for higher-level management like Gavin Newsom’s gubernatorial interventions in California. Tell me why I’m wrong! 1 I’m limiting this to America because it’s approximately a self-contained housing market; I don’t think there are enough immigrants to really affect things. Thinking at a country level does make a difference - for example, I worry someone will bring up Tokyo as a counterexample. But I think Tokyo managed to build its way to low housing prices in the context of the rest of Japan also having good housing policy. Even if that isn’t true, Tokyo on its own is a quarter of the Japanese market, so it might be able to exhaust the entire pool of Japanese house-seekers by itself! You're currently a free subscriber to Astral Codex Ten. For the full experience, upgrade your subscription. |

Older messages

Open Thread 274

Monday, May 1, 2023

...

Highlights From The Comments On Nerds And Hipsters

Thursday, April 27, 2023

...

Mantic Monday 4/24/23

Tuesday, April 25, 2023

Using AIs to forecast // Low-information priors // Abortion pill access

Open Thread 273

Monday, April 24, 2023

...

Links For April 2023

Thursday, April 20, 2023

...

You Might Also Like

How to Keep Providing Gender-Affirming Care Despite Anti-Trans Attacks

Sunday, March 9, 2025

Using lessons learned defending abortion, some providers are digging in to serve their trans patients despite legal attacks. Most Read Columbia Bent Over Backward to Appease Right-Wing, Pro-Israel

Guest Newsletter: Five Books

Sunday, March 9, 2025

Five Books features in-depth author interviews recommending five books on a theme Guest Newsletter: Five Books By Sylvia Bishop • 9 Mar 2025 View in browser View in browser Five Books features in-depth

GeekWire's Most-Read Stories of the Week

Sunday, March 9, 2025

Catch up on the top tech stories from this past week. Here are the headlines that people have been reading on GeekWire. ADVERTISEMENT GeekWire SPONSOR MESSAGE: Revisit defining moments, explore new

10 Things That Delighted Us Last Week: From Seafoam-Green Tights to June Squibb’s Laundry Basket

Sunday, March 9, 2025

Plus: Half off CosRx's Snail Mucin Essence (today only!) The Strategist Logo Every product is independently selected by editors. If you buy something through our links, New York may earn an

🥣 Cereal Of The Damned 😈

Sunday, March 9, 2025

Wall Street corrupts an affordable housing program, hopeful parents lose embryos, dangers lurk in your pantry, and more from The Lever this week. 🥣 Cereal Of The Damned 😈 By The Lever • 9 Mar 2025 View

The Sunday — March 9

Sunday, March 9, 2025

This is the Tangle Sunday Edition, a brief roundup of our independent politics coverage plus some extra features for your Sunday morning reading. What the right is doodling. Steve Kelley | Creators

☕ Chance of clouds

Sunday, March 9, 2025

What is the future of weather forecasting? March 09, 2025 View Online | Sign Up | Shop Morning Brew Presented By Fatty15 Takashi Aoyama/Getty Images BROWSING Classifieds banner image The wackiest

Federal Leakers, Egg Investigations, and the Toughest Tongue Twister

Sunday, March 9, 2025

Homeland Security Secretary Kristi Noem said Friday that DHS has identified two “criminal leakers” within its ranks and will refer them to the Department of Justice for felony prosecutions. ͏ ͏ ͏

Strategic Bitcoin Reserve And Digital Asset Stockpile | White House Crypto Summit

Saturday, March 8, 2025

Trump's new executive order mandates a comprehensive accounting of federal digital asset holdings. Forbes START INVESTING • Newsletters • MyForbes Presented by Nina Bambysheva Staff Writer, Forbes

Researchers rally for science in Seattle | Rad Power Bikes CEO departs

Saturday, March 8, 2025

What Alexa+ means for Amazon and its users ADVERTISEMENT GeekWire SPONSOR MESSAGE: Revisit defining moments, explore new challenges, and get a glimpse into what lies ahead for one of the world's