Earnings+More - Penn overshadowed by Portnoy storm

Penn overshadowed by Portnoy stormBarstool storm looms large, Rush Street on its Connecticut exit, Lottomatica’s debut drop, bet365’s Ohio move examined +MoreGood afternoon. On today’s agenda:

Slip of the PennPenn’s mildly disappointing earnings are overshadowed by another Portnoy social media storm. Mintz edition: An overnight social media storm surrounding the sacking of a Barstool Sports personality Ben Mintz over the broadcasting of a racial slur was the unplanned prelude to Penn’s Q1 earnings statement.

Under the influence: Snowden was joined on the call by Erika Ayers, CEO at Barstool Sports, who defended the company’s record. “In some ways we’re a media company and in other ways we are a collection of influencers.”

The knitting: With the earnings, CFO Felicia Hendrix said that interactive losses in Q2 and Q3 would be worse than the Q1 loss but that adj. EBITDA profits in Q4 would “more than offset” cumulative losses through the year.

Props: Snowden spoke about the launch of the proprietary platform with theScore Bet in Ontario, noting that the product was improving month on month. He noted the Barstool sportsbook platform, by way of contrast, has been “frozen” for the last six months ahead of its proprietary launch later this year.

Gray returners: The enhanced Penn Play loyalty scheme was boosted by interactive, with total numbers up 13% with 350k new customers in Q1. In land-based, the company saw a return to pre-pandemic levels of the 65+ demographic.

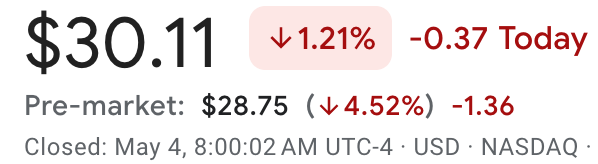

🍕 Penn Entertainment shares off by nearly 5% pre-open Portnoy’s ‘press conference’Poison Penn: Taking to Twitter, Portnoy said the decision “sucks”. “Not in my wildest dreams did I think I'd be sitting here being like we had to fire Ben Mintz. Penn felt differently.”

** SPONSOR’S MESSAGE ** Founded in 2013, Metric Gaming is based in Las Vegas and London and developed the industry’s first truly multi-tenant sportsbook platform, purpose-built to support operators across multiple territories, regions or States. Metric is proud to be partnered with both Racebook HQ and Lacerta Sports (powered by Starlizard) and will roll out innovative MTS solutions for both racing and sports in 2023, including soccer and four main US sports. To find out more, please visit www.metricgaming.com Rush to profitsProfitability the concern as Rush Street explains Connecticut exit. End of the affair: CEO Richard Schwartz said the partnership with the Connecticut lottery was “not the right fit” for the company, adding that resources could be spent more efficiently elsewhere. RSI announced it would be calling a halt to the deal in late March.

Share of voice: Asked whether Rush Street is considering other state exits, Schwartz said the company was “constantly evaluating” both existing and new markets. But he acknowledged Rush Street doesn’t have the most nationally recognized brand vs. its competitors.

RSI insisted once more its strength lay in iCasino, which helped drive a 20% rise in Q1 revenues to $162m, and Schwartz and Sauers expressed confidence that the vertical would enable the group to reach EBITDA profitability in H2.

Latin love: In Colombia revenues grew 40% in local currency, and 20% when factoring FX headwinds, and the group was building to a “deliberate and measured ramp” in Mexico, a market that was “not much different than Colombia a few years back”. “We love that region,” Sauers said. Shares watchLottomatica took a tumble on its first day of trading in Milan, down 8% from its float price. CEO Guglielmo Angelozzi told the FT he was not concerned about the opening day fall. “This is a marathon, not a sprint,” he said. “We are listing at a discounted valuation, but we are betting on longer-term growth. We have no regrets.” Datalines – OhioAll day and all of the night: Looking at the Q1 numbers, the team at EKG once again noted how bet365 appears to have dug deep to achieve a respectable ~5% GGR market share from a ~7% share of turnover.

Earnings in briefAccel Entertainment: Defying the macro uncertainty, route gaming operator Accel said revenue rose 49% YoY to $293m, while the number of gaming locations rose 41% to 3.6k and the number of terminals was up 72% to over 23k. Adj. EBITDA was up 31% to $46m.

Gaming Innovation Group’s media division helped the group grow revenues 49% to a record €28m in Q1, while adj. EBITDA grew 75% to €12m. CEO Richard Brown said the AskGamblers acquisition from last year had been turned around in quick time, with the asset seeing month-on-month growth.

EveryMatrix: The gaming-to-sports provider said it had signed deals with Bet-at-home and the Hungarian lottery during Q1 as revenues rose 69% to €23.5m, while EBITDA was up 119% YoY to €10.5m. GGR across its operator partners was up 77% to €374m. Analyst takesCaesars Entertainment: In digital, Caesars will reach “sustainable profitability” even with less revenues than its peers due to its recent cost discipline and the strength of the brands, suggested the team at CBRE. Moreover, they have faith in the company’s chance of grabbing market share in iCasino via standalone apps and the promised new PAM and single wallet.

Flutter: The team at JMP indicated the 8% growth seen ex-North America was “testament to management’s ability” in international markets despite occasional bouts of “regulatory noise”. Meanwhile, in the US, FanDuel keeps “adding gold medals to the trophy case” following the grabbing of pole positions in Ohio and Massachusetts. ** SPONSOR’S MESSAGE** BettingJobs is the global leading recruitment solutions provider to the iGaming, Sports Betting and Lotteries sectors. Boasting a 20-year track record supporting the iGaming industry, and with a team of experts and world class knowledge, it’s no surprise BettingJobs is experiencing rapid growth with outstanding results. Does your company have plans to expand teams to cope with strong growth and demand? Contact BettingJobs.com today where their dedicated team members will help you find exactly what you are looking for. NewslinesLight & Wonder will make its debut with its Authentic Gaming Live Dealer product in Michigan and Ontario with Rush Street Interactive. Mobile live-dealer provider Playgon Games has completed its previously announced brokered private placement of 10% unsecured convertible debentures, raising CA$2.5m. FansUnite has sold its Scotland-focused bookmaking brand McBookie to an unnamed third party for CA$5m. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. Earnings+More is free today. But if you enjoyed this post, you can tell Earnings+More that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Flutter means to stay ahead

Wednesday, May 3, 2023

Flutter's market leadership, Caesars suggests digital losses are history, VICI's positive outlook, Kambi's convertible repayment +More

Move fast and break down barriers

Tuesday, May 2, 2023

Female founders makes their move, Wagr's no cash sale, startup survey, inside the raise – Prophet Exchange +More

MGM continues to build

Tuesday, May 2, 2023

MGM's expansion plans on all fronts, analysts react +More

Gambling’s big earnings week

Monday, May 1, 2023

MGM, Caesars, Flutter and DraftKings to report, GLP call recap, Churchill Downs share reaction, startup focus – BettorTakes +More

UK sector gets regulatory ‘clarity’

Friday, April 28, 2023

UK gambling policy reaction, Flutter approval, PointsBet sales chat, Kambi share price action, sector watch – tokens +More

You Might Also Like

Topic 32: What is Qwen-Agent framework? Inside the Qwen family

Wednesday, March 19, 2025

we discuss the timeline of Qwen models, focusing on their agentic capabilities and how they compete with other models, and also explore what is Qwen-Agent framework and how you can use it

🦅 This will help you from being stopped by imposter syndrome

Wednesday, March 19, 2025

xAI's first acquisition | Instagram tests AI-generated comments | Facebook Stories now eligible for creator monetization

From $0 to $12 Million Per Year With Fat Joe

Wednesday, March 19, 2025

This week, we're excited to have Joe Davies from FatJoe.com on the Niche Pursuits Podcast. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Skype is dead, but SORA changes everything😲(read ASAP)

Wednesday, March 19, 2025

View in browser ClickBank Hi there, You may have heard that after 22 years, Microsoft is killing off Skype and replacing it with Teams 😬 but let's be honest... this isn't exactly exciting news.

You’re the heart of social—we see you

Wednesday, March 19, 2025

And you deserve better tools, better support, and better balance. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Here’s the One Investment That Can Change Your Life in 2025

Wednesday, March 19, 2025

The Biggest Opportunity of 2025

Founder Weekly - Issue 677

Wednesday, March 19, 2025

March 19, 2025 | Read Online Founder Weekly (Issue 677 March 19 2025) Welcome to issue 677 & of Founder Weekly. Let's get straight to the links this week. Google purchased Nest ($3.2B), Amazon

A look at the categories for this year's Greater Good Awards

Wednesday, March 19, 2025

As companies tackle pressing issues like wellness, sustainability and local community betterment, their efforts often go unnoticed despite their powerful impact. The Greater Good Awards offer a

Google just released AI Mode...

Wednesday, March 19, 2025

Google released its newest AI search feature this month, but not everyone has access to it (yet). It's called AI Mode. To use it, you have to be in the US, over the age of 18, and opt-in via Labs—

Nvidia’s AI Supercomputers for Your Desk 🖥️

Wednesday, March 19, 2025

PLUS: Google's AI has some medical advice for you.