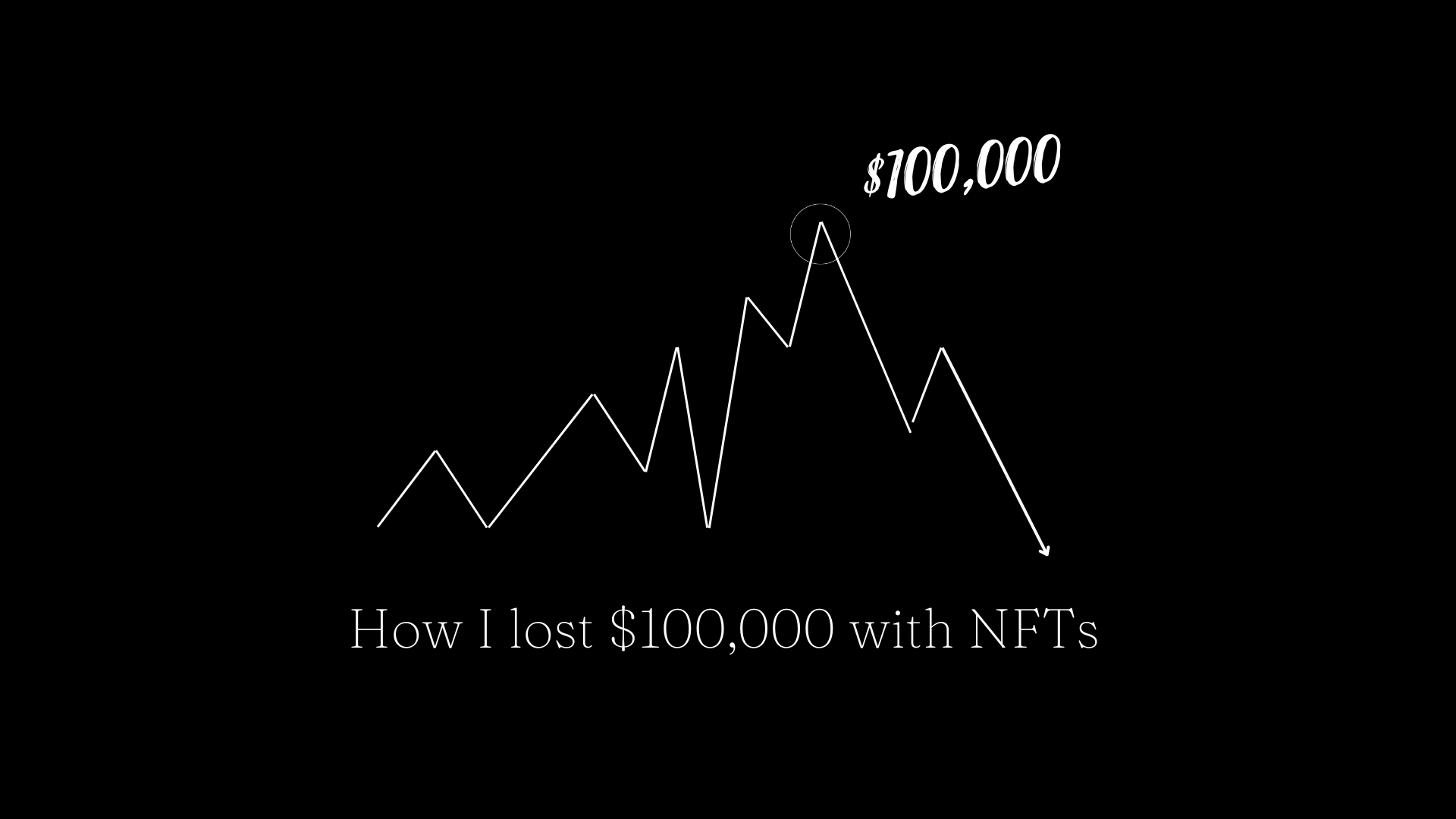

I Made $100K+ Overnight With An NFT And Lost It All

Hey there! If you want to join 1,413+ other readers learning about internet-native communities & life navigation, make sure to subscribe to this newsletter. Before we start: I’m pivoting a bit today. I wrote a lot about Web3 communities, but now feel the need to experiment with new topics and new tones. I was hesitant publishing this one, but many friends read it and told me it was the move to do, so here we are. Hope you guys enjoy 🤝 About a year ago, I lost almost $100K overnight. Like most beginners during the 2021 crypto craze, I made many mistakes when I first started buying NFTs. But the one I am gonna tell you about was my most expensive one, by far. Here’s how the story starts. BackgroundIn April 2021, I landed in San Francisco for the first time in my life. With a re-entry permit for the U.S. that was set to expire in a couple of weeks, I had made the choice to quit my job in France, break up with my girlfriend, and say goodbye to my friends to come to live in the heart of tech, where all my wildest dreams would (eventually) become a reality. When my mother left France for the U.S. years ago, giving me a green card on the way, I decided to stay a bit longer in Europe, moving from France and Belgium to the Netherlands, first going to school, then getting my first internship leading to my first job at an A.I. company. But to keep this Green Card, I had to live in the U.S. for more than 6 months a year unless I had good reasons. And after pushing back this moment for years, the customs were now forcing me to make a decision, and I was well decided to seize it. I booked my flight, hopped on a plane, and landed in SFO a Friday afternoon on April 2nd, with a loosely held plan, direction a room I had barely seen through a pixelized FaceTime 3 weeks prior, and the firm intention to make the most out of this experience. I was 23 and had in my bank account the result of summers working in jobs that seemed to compete to be the one who’d pay the least their employees and some extra dollars that I had miraculously saved from my $500/month internship salary, for a grand total of $9,300. This slim amount was just enough to give me a shot at my dream of living in the U.S. and keeping my green card. The clockwork started, and I had 3 months to It was the middle of Spring, and at that time, I was sure I wanted to work in the creator economy. Sure, everyone in 2021 wanted to become a creator, and the companies empowering those “soon-to-be-internet-millionaire” creators was raising millions by simply saying the term “Creator.” But, since the first time I heard about it, I knew it was the path I wanted to follow. The opportunity to make a living from your passion online was an opportunity I wouldn’t pass up - and 3 years later, I’m still pursuing the same quest. It was also around that time that I really got interested in crypto. After hearing about the concept of Social tokens by listening to a podcast from (my now friend) Alex Masmej, I read in the plane other articles mentioning these virtual currencies as the miracle solution for creators to monetize, and I completely fell down the rabbit hole. While I didn’t understand everything about this technology just yet, the idea of helping creators launch their own internet currency was quite appealing to me, and I quickly applied to companies that would hire me for my skills. Three months into the job search, and with the support of the OnDeck community, I found a job as a Head of Community & Content at one of the very few startups crazy enough to build a solution to help creators launch their Social tokens at that time: Coinvise. And just like that, in July 2021, I was now working full-time in crypto from San Francisco. Definitely a major turning point in my life. As the 4th employee, my role at Coinvise was pretty straightforward. I had to talk with Web3 creators and community builders, understand their needs, then write about how to solve those problems (eventually positioning Coinvise as the solution when it was the case). I quickly started spending most of my time talking with creators and builders in the space, immersing myself in this universe, understanding the language, and placing small bets by purchasing the tokens fueling the communities I was in touch with. Around August 2021, I had already talked with dozens of communities and managed to get a decent amount of tokens that were steadily increasing in value. Through all my investments, I had made a couple of hundred dollars, enough for me to think I had a future as a crypto investor. So when the trend around social tokens started slowly shifting to NFTs, I was excited to give it a try. The Non-Fungible Tokens felt like an easier way for creators and communities alike to engage their fans, and many creators I was talking to started asking me questions about them. Full of goodwill to help them and do my job right, in the first week of August, I dipped my toes in by purchasing my first NFTs: some pixelized Astrocryptids. It wasn’t that I specifically liked the art, but they were cheap enough for me to experiment with the whole process of buying them. Sure enough, their price dropped quickly after I bought them. A few weeks after this first experience, though, I started seeing friends of mine talking on Twitter about a new NFT collection that had just dropped: Loot (for Adventurers). These NFTs, created by Dom Hofmann, the founder of Vine, were a collection of text-based non-fungible tokens (NFTs) representing white words on a black background. There was a total of 8,000 of them, and they were free. People I trusted online seemed pretty excited about this one, and I only had to pay for the gas fees, so I decided to purchase one. Total of the operation: $300 spent in fees (😅) and a JPEG of some text in my crypto wallet. ~whAt a DeaL~ And that was that. To be honest, I don’t know what I was really expecting from this, except maybe being able to say I was an NFT collector to the creators I was talking to, and getting the right to join a soon-to-exist community. I continued my day, and didn’t pay much attention to this for the next 2 days. Until I started seeing my Twitter feed full of people talking about the project. Suddenly, it seemed like this collection was on its way to becoming THE next big thing in the NFT space. In days, journalists started to cover the rise of the collection, and new projects started to pop up here and there to fuel the growing universe of the Loot ecosystem. Someone had even created a social token (Adventure Gold or $AGLD for short), associated with the NFT, sending it automatically to everyone owning a Loot. Not sure of what I would find there, I checked my crypto wallet and found I had indeed received a transaction. I couldn’t believe my eyes. Almost overnight, I had made $4,000 just buying a JPEG online. Trust me, it was eu-phor-ic. That was it. I was a real crypto investor. Making dollars by clicking on a few buttons in my room. I started checking a bit more often my crypto wallet and Opensea to see the price at which people were now buying the NFT in the secondary market, slowly becoming addicted to the dopamine of seeing my net worth increasing every day. From there, things really started to go crazy. Only a few days after purchasing my Loot (for Adventurers) for $300, the bundle was now worth over $100K. Everyone, including mainstream media, was talking about Loot (for Adventurers). The average sale price for a Loot NFT had soared to over 21 ETH, or about $84,000 at the time, and the original 10,000 AGLD I had received had skyrocketed to $28,000. Suddenly, the stakes were much higher. From checking my wallet a couple of times a day, I then kept refreshing my account every minute like an adrenaline junky to see if I had become even richer than the seconds before, or if it all had just crashed. Because here’s the thing. Technically, I HAD those $35K and the NFT in my wallet. But until I had withdrawn the AGLD tokens and sold the NFT, the price could still drop to zero. It was a battle that started in my mind, between selling right away when the value was increasing minute after minute and missing the opportunity to make more money, or waiting, taking the risk of losing it all. It was my second NFT ever, I had no experience and decided to play. We were now Tuesday, and I had spent my day trying to figure out if, or rather when, I should sell. The thing is, when there’s that much money at stake and you’re only 23 years old with almost nothing in your bank account, the mental game is pretty tough. I was trying to find more information online, seeing what others were thinking, and reading what journalists were saying. My conclusion after those hours spent reading was: if even mainstream media covered the collection, it must be a solid project after all. I decided to hold a little longer. On Tuesday night, as I refresh the amount in my wallet one last time before trying to go to sleep, my brain keeps running, and I envision all the things I could do with all this money if I can sell them at the right time. As best I can, I turn off my phone and close my eyes. The night is (obviously) short, and at 5:30 AM, I’m fully awake. I quickly grab the phone on my nightstand, turn it on, open my crypto wallet, and check the amount displayed at the top of my screen: The 10,000 AGLD I have are now worth over $70,000. What happens in my head at this exact moment, you might ask? "OMFGGG!!! I didn't flinch under the pressure of selling too early, and I'm now richer than I've ever been. Let's go!' " But here we are again. Is NOW the right time to sell? Getting those $70,000 and an NFT worth at least as much is way above my wildest expectation, and the wise part of myself screams at me I should sell everything, take the money, and go enjoy life. But as I check the price of the past hours and see it constantly increasing, I can't help but think: Why on earth would it stop here? And this is how barely awake, I decided to play the game of money a little longer. And for the first few hours of the day, everything was going well. I started, as every other day, first checking my emails and Twitter, then going from call to call, eventually checking the price of the tokens between each call, seeing the price slowly fluctuating. Around 9:30 AM, a client asked me to work on a project in a short timeline, and I got completely absorbed by my work. When I finally got my head above water, it was already 1:00 PM. I checked my wallet again, and the AGLD tokens had completely plummeted, now getting back to $40,000. In less than 6 hours, I had just lost $30,000. Damn.. that hurts. Now, I know what you might think. I'm sure reading this, you're quietly thinking you would have done differently, that you would have sold at $70K when it was still time, and that it's crazy I even thought about holding for a little longer. But let's be honest. Many of you would have done the exact same thing. Because when there's that much money at stake, you don't make rational decisions anymore. You're seeing the numbers go up and truly think you can always "win a little bit more." You're seeing the hype getting stronger than ever, and you're one of the few who have the chance to be part of a movement that the world is watching with envy. Why on earth would you sell while it's going up? In retrospect, the answer is easy: because, inevitably, it'll go down. Down $30,000 and sick to my stomach, I decide to go out, grab my bike and go for a ride. The thoughts in my head are running as fast as I go down the hills of San Francisco under the adrenaline of someone who just lost $30,000. I now try to imagine all the scenarios in my head: Is it going to pump again? If I'm being honest with myself, is there a real reason for this success, or is it just the trending thing? Can I take the bet to risk it all in my situation? I stop in front of the ocean near the Palace of Fine Art, and after a 30min ride weighing the pros and cons, I decide It's time to stop playing the game. Sure, I could still wait a little longer, hoping it goes back to $70,000, but it's more than I can handle. I'm done with this game and I swap all the AGLD Tokens I have for ETH. I still decide to hold the NFT that is still getting sold for around 10 ETH (around 43k at that time) for a couple more days to see how it goes, convincing myself that if the project is indeed the next big thing, I'd still have the NFT. Over the next 48h, seeing the trend slowly fading, I decide to put the NFT on sale. And the same way I did for the AGLD in my wallet, I kept checking my Opensea account, hoping to get an email telling me a transaction had occurred and that the money would soon be transferred to my account. But none of this happened. One day, two days.. one month.. 3 months… After months of waiting for a notification, I had to face the reality: no one would buy it. And like this, I accepted my faith. Of the over $100,000 I was hoping to win between the NFT and AGLD tokens, most of it was lost due to my greed. A $100,000 Life-LessonLooking back at it, I now clearly see the impact these few months of investing in crypto (and, more specifically, my experience with the Loot NFTs) got on my life. See, growing up, I always thought I would become a renowned entrepreneur. That I would create something that people would really want, make a shit ton of money, and retire early. That was my plan all along, as I thought true wealth would be the answer to all my problems. All my life choices were optimized to be a millionaire the soonest as possible. Staying in France or coming to San Francisco? Easy choice. Embracing the comfort of a big company or risking it all for the potentially unlimited upsides of a small startup? Even easier. Going out with friends or staying home to work on a project? You get it. But here’s the thing. I’m not sure this is what I want anymore. Getting that much money at my finger so quickly got me to learn 2 important lessons:

Coming with less than $10,000 in the U.S. and earning some money in crypto after only a few months, there was already living the American dream. I could have withdrawn everything as soon as I won $20,000 or $30,000 and enjoyed life for a while. But I wasn’t satisfied. I always wanted “a little bit more” and decided to continue playing the money game. The thing is, the game never really stops. Each time you reach a new milestone, it becomes your new standard, and you start dreaming of new heights. As soon as you get the adrenaline of finally getting the thing you’ve desired for so long, this feeling of satisfaction vanishes. Trying to win the money game is a never-ending quest. And as the stakes grow, you increasingly sacrifice more and more aspects of your life in the pursuit of a single goal… one that might not be as worthy as you think. I for a long, optimized my life with the goal of winning this game. I was looking for meaning and freedom and thought money was the way to get there. Hint: it’s not. And so, while I technically lost money on the table, I still feel like I came out of this situation a winner. At only 23yo, I learned a lesson that many spend years learning, avoiding me wasting years of my life playing the wrong game. Today, I just want to control my life. I want to continue writing. Go on bike rides whenever I want. Travel with my girlfriend. And do all these things that don’t require a million dollars - far from it - to be happy. So before continuing your journey, I guess it’s worth asking yourself: What game do you really want to play? Speak soon, - Eliot PS: So, what did you think of this one? If you enjoyed today's edition, let me know here - It'll help me understand if I should write more about new topics (and it only takes you 10sec). Because so many of you asked advice on how to build and grow their internet community, I’ve decided to gather all my knowledge in a 40-pages guide, compiling the best practices I've discovered to launch, grow and monetize a community in Web3. I’m giving it away for free, all I ask is that you share this article with a friend that you think would enjoy it as well. If each one of you have just one friend subscribing to this newsletter, I’ll reach my goal of getting 3,000 readers by June. |

Older messages

The Art Of Sharing Context

Sunday, May 21, 2023

How To Show With Your Members What Your Community Is About

How To Drive Sales To The Roof

Sunday, May 14, 2023

There is a difference between a customer and a fan, and that is belonging.

Mastering The Skill Of Timing

Sunday, April 30, 2023

Internet builders often based all their success on execution, forgetting the importance of timing. Hint: they shouldn't.

From A Viral Tweet To $10,000 In 5 Days

Sunday, April 9, 2023

How Jackson Fall Grew A Community To Over 2k Members And Generated $10000 In 5 Days.

Building a $10,000 Web3 Educational Product

Sunday, April 2, 2023

How do you maintain a career doing what you love?

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏