The Generalist - Modern Meditations: Sam Lessin

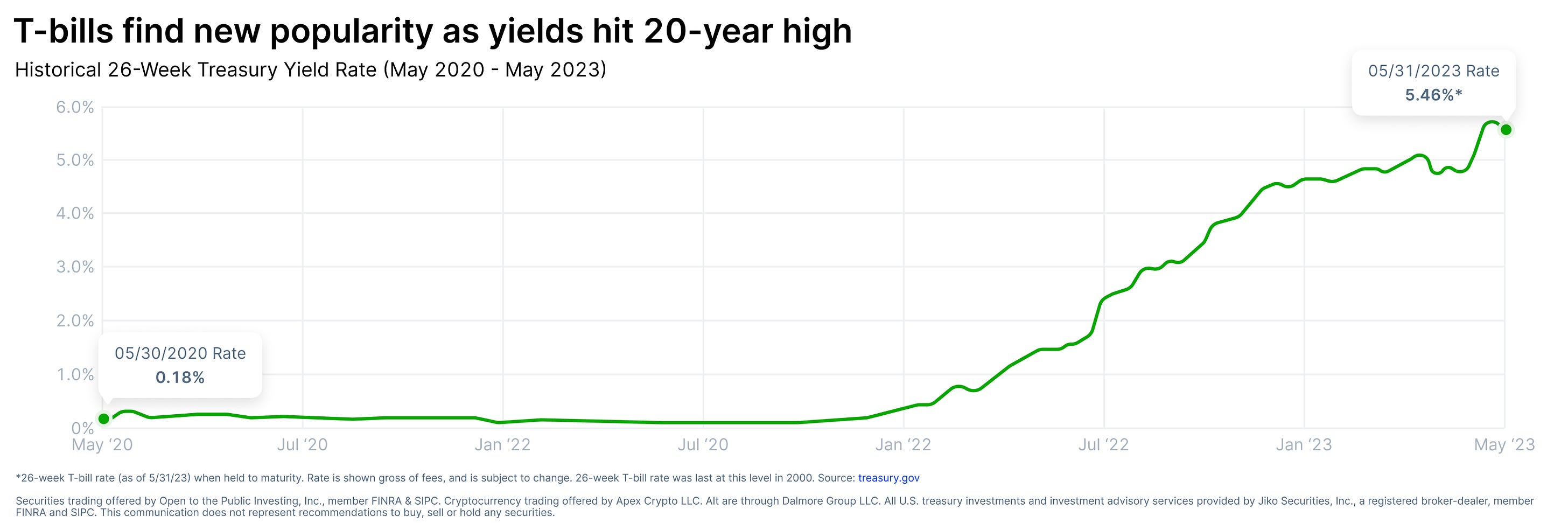

Modern Meditations: Sam LessinThe Slow Ventures GP on philosophy, empowering metrics, AI hype, and John Wick.Friends, It is a truth universally acknowledged that an investor in need of capital must portray themself as a contrarian. It is a part of Silicon Valley’s dance, and there is good reason for it. By definition, venture capitalists, at least at the early stage, invest in companies nearly destined for failure. The tiny scrambling upstart rarely unseats the fat, steady incumbent, and to reckon with that fact, to skew bad odds, technology’s most adventurous financiers must make sure that when they hit, they hit big. Barring strokes of luck and acts of god, the only way to secure this kind of “grand slam” is by taking a position contrary to the herd. There are different types of contrarianism, and some are rarer than others. The most common, unedifying version is the reflexive contrarian. This investor is less concerned with the fundamental merits of a particular investment or position, more so with where the rest of the market is positioned. Like a trader, this contrarian looks at the other side, calculates the odds, and picks their spot in hopes of generating either financial or social capital. As markets and moods change, they are happy to move, too. Sam Lessin is not this type of contrarian. The Slow Ventures General Partner and former Facebook Vice President is what one might term a true contrarian. He does not need to try and counterposition against convention; he simply seems to think differently, to see the world and the tech industry from an uncommon vantage. That talent has made him a very successful investor and a frequent firestarter of internet debates. As well as backing teams at Solana, Nextdoor, Ro, Robinhood, and Slack, he sparked uproar for calling Calendly links “the most raw/naked display of social capital dynamics in business” and has heralded “the end of venture capital as we know it.” Though he seems to take pleasure in going against the grain, through conversation, you quickly get the sense that his take on matters large and small comes from a place of real consideration, real thought. In this respect, he exemplifies Warren Buffett’s dictum on contrarianism: “A business or stock is [not] an intelligent purchase simply because it is unpopular; a contrarian approach is just as foolish as a follow-the-crowd strategy. What's required is thinking rather than polling.” Sam’s ability to authentically generate distinctive opinions is one I admire greatly. His willingness to share them, no matter how much mayhem they create, makes him an ideal subject for Modern Meditations. An ask: If you liked this article and wouldn’t mind “hearting” ❤️ it from the header above, I’d be incredibly grateful. Your feedback helps us understand which pieces are resonating, and what we should do more of. Thank you! Brought to you by PublicLock that rate down. Right now, you can take advantage of some of the highest Treasury yields since the early 2000s on Public. It only takes a few minutes to create your account, purchase government-backed Treasury bills, and start generating a historic 5%+ yield on your cash. Modern Meditations: Sam LessinActionable insightsIf you only have a few minutes to spare, here’s what investors, operators, and founders should know about Sam Lessin’s meditations.

What would you be doing if you didn’t work in tech?If you asked twelve year old Sam what he would do, he’d probably say make films. Moviemaking is an awful business, but it would be really fun. I've been particularly attracted to science fiction as a genre – both in film and book form. In fact, when I worked at Facebook, I made every new PM read Snow Crash. Ultimately, I think there are plenty of parallels between sci-fi and investing: you’re putting forward a thesis of how you think the world could change. Which current or historical figure has most impacted your thinking?I have two. My techie answer would be Claude Shannon. Information theory is one of the coolest topics ever — particularly when you consider how fundamental it is to how we live and think. I actually have a copy of the original Bell Labs manual where Shannon’s information theory paper was first published. My less obvious answer would be Michel Foucault. At Harvard, I went through a program called “Social Studies,” which is a mixture of history and economics. It ended up being unbelievably useful for understanding the last 50 years of the internet. Philosophers like Foucault didn’t speak in technical terms, of course, but they considered many of the societal problems technology dramatically accelerated. Obviously, Foucault has some pretty dark theories about the world. But he seems mostly right? What is the most significant thing you’ve changed your mind about over the past decade?When I started working in tech, I focused on whatever I thought was the fundamental problem. I would get frustrated with people I saw as “number optimizers.” Those are the people that would spend their time saying, “Oh, we’re going to make X metric go up” or “We’re going to growth-hack Y metric.” In the past, I thought that obsessing over metrics over-constrained the problem. I’ve changed my opinion. When you see how big companies run, you realize that for the majority of people metrics are extremely freeing. Without them, you’re forced to micromanage everything, which sucks for the people working on a project. It turns out that if you just say, “Hey Bob, make Z metric go up,” Bob often feels way better about it from a creative standpoint. That said, if you are going to be metrics-driven, make sure you pick the right ones. If you give Bob a certain metric to increase, he’s going to try like crazy to make it happen. You don’t want to find yourself with a paperclip optimization problem. Ultimately, focusing on metrics isn’t always the answer but the mental switch from seeing them as a prison to viewing them as freeing was a personal evolution. What craft are you spending a lifetime honing?The first thing that comes to mind is being a dad. We have three young children and figuring that out is a journey that changes a lot over time. Generally speaking, I don't think of myself as a craftsman. What I like to do is figure out how to learn things really quickly – to cut to the chase of what actually matters. In investing, I've been thematically right a few times, but I haven’t always won the biggest. There are times I’ve landed on the right narrative and been directionally correct. But I haven't made $10 billion on an investment and I think that's where you see true craftsmanship. Sure, some people get lucky. But the difference between the lucky and the good is that the really good investors go beyond. As an example, I was one of the earliest in Solana, but others came in bigger, later. True craftsmanship, where you go from being directionally right to specifically right, is not just “let’s just do the first seed” — but doubling, tripling, and quadrupling down throughout. What piece of art can you not stop thinking about?John Wick 4. It’s going to be awesome. To be honest, I don’t think there’s any piece of art that I can't stop thinking about but I am, truly, very excited for John Wick 4. What trait do you value most highly in others?Honesty, with themselves and with others. Honesty with others is table stakes. The harder thing is to be honest with yourself and introspective about reality. I think most people are very self delusional. As an investor, I see this all the time. Founders are all crazy – almost by definition. If they were too introspective all the time, they probably wouldn't be doing what they're doing. You want someone that can be strategically crazy but deeply reflective and introspective in other ways. It's a fine line. There are always exceptions, people who have been fabulously successful without having that internal honesty. I'll throw one name under the bus: Elon Musk. I think he’s a complete huckster. Even though I obviously missed out by not investing in him, he doesn't have that honesty trait that I care about. I help keep myself honest by soliciting feedback. I am very into sharing shitty ideas at high velocity and relying on others to keep me intellectually in check. I think that’s a mental position worth cultivating: one where you’re willing to be wrong on almost anything, all the time, without stressing it. Trying to avoid being wrong is a path to being intellectually dishonest with yourself and others. What is your most contrarian, high-conviction opinion?I have a lot of pretty contrarian opinions. It's kind of my bread and butter. I pride myself on being contrarian. One at the moment is: I think AI is a shitty place to invest. You have to separate the fact that the technology is cool, from where the economic leverage is. There is obviously leverage in AI, but it's almost certainly going to go to the big platforms. This is not a PC or internet-level disruption. This is an easy bolt on for the cloud providers, or for the companies who already have attention or data. There are going to be exceptions. Someone is going to build a $10 billion company out of AI. There will probably be a handful of them. But 99% of the value is going to the existing big players. In that respect, AI might look more like the mobile revolution. Unlike the PC and internet waves, mobile didn’t produce any $500 billion or $1 trillion companies. Sure, you had a few new apps like Instagram, but they were immediately swallowed up by bigger players. Uber is probably one of the only examples of a purely mobile company that became big. And it’s not even that big – it’s a $70 billion business that took a ton of capital. AI companies will need even more. What contemporary practice will our descendants judge us for most?Eating meat, but I'm totally going to keep doing it. What risk are we radically underestimating as a species? What are we overestimating?I think we're underestimating contemporary AI and overestimating AGI. Today’s AI has everything you need to destroy people's trust in each other, and completely splinter society. We don't need anything more fancy than what we have today. With AGI, everyone thinks we’re almost there. But we’re so far away. It's like the genome all over again. In the past, we thought we were so close to getting a copy of the genome. And then suddenly eighteen other things crop up, and all you’ve done is ended up further down the rabbit hole. I think AGI is a really cool intellectual, philosophical problem — but I don’t think we should view it as a practical one. If you had the power to assign a book for everyone on earth to read and understand, which book would you choose?The Lessons of History from Will and Ariel Durant. It’s so great, I felt sad I hadn’t read it sooner. If everyone read it, we’d have a civilization that was more honest about its history. How will future historians describe our current era?Imagine you wake up one morning, and all of a sudden you have superpowers. You can remember everything. You can speak to everyone on earth, for free. And you can process unbelievable amounts of data. We’re living in an adolescent superhero movie where the protagonist gets superpowers and they don’t know how to handle it. There’s no Professor X around to guide us. There was a period in the first half of the 18th century, where English people went crazy for gin. It was considered such a big deal that Parliament was forced to act. Thanks to legislation and rising grain prices, they eventually got a handle on it. I think that's what the internet and AI will be for us. It changes everything that we were biologically designed for, so we're completely fucked on it for a little while. But we'll figure it out. What do you consider your greatest achievement so far?Definitely, my kids. From an investment perspective, I’m proudest of the times I backed companies that no one else would. When money is scarce, that’s where you feel like you can have a real impact as a VC. The last thing anyone wants on their tombstone is “market participant.” Over the years, we’ve had some great returns in crypto, backing companies like Solana. There are some others that you won’t have heard of yet, that I’m extremely bullish on. I’m also proud of the companies I backed that might not have had the greatest financial return, but were culturally relevant. For example, I wrote the first and second check into Venmo – and then I got my dad to write the third check because no one would give them money. The financial return was fine, but it was a great cultural investment. PuzzlerRespond to this email for a hint.

A doff of the cap to Greg K, Rob S, Joshua K, Christian S, Kelly O, Vanshi T, Michael O, Shashwat N, Massimiliano B, Morihiko Y, Dan D, and Suyash G. All answered last week’s riddle correctly:

The answer? Lunch or dinner, of course. Until next time, Mario PS – Our previous article, “AI and The Burden of Knowledge,” is officially one of our most popular of the year! If you haven’t had a chance to check it out yet, I think you’ll like it. |

Older messages

AI and The Burden of Knowledge

Sunday, June 25, 2023

A story of superior intelligence and possible obsolescence.

Modern Meditations: Scott Belsky

Tuesday, June 20, 2023

The Adobe CPO on innovating from within, shipping slow, and AI.

Intercom’s AI Evolution

Sunday, May 21, 2023

An interview with co-founder and Chief Strategy Officer, Des Traynor.

Watershed: A Climate Pragmatist

Sunday, May 14, 2023

The $1 billion carbon accounting platform has attracted investment from Sequoia and Kleiner Perkins. Its greatest strength is its practical, market-driven approach to the climate crisis.

How Vanta Grew Through the Downturn

Friday, May 12, 2023

The trust management platform has used a venture capital winter to extend its lead.

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏