Highlights From The Comments On British Economic Decline

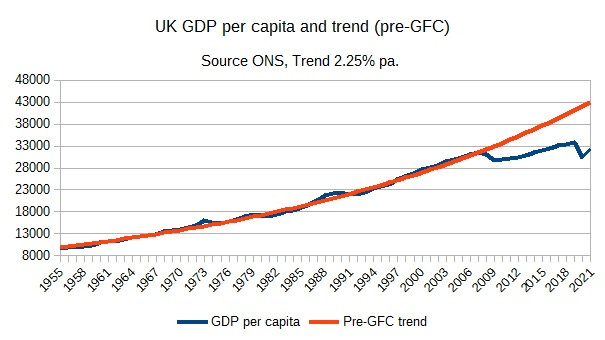

People are talking about British economic decline. Not just the decline from bestriding the world in the 19th century to today. A more recent, more profound decline, starting in the early 2000s, when it fell off the track of normal developed-economy growth. See for example this graph from We Are In An Unprecedented Era Of UK Relative Macroeconomic Decline:

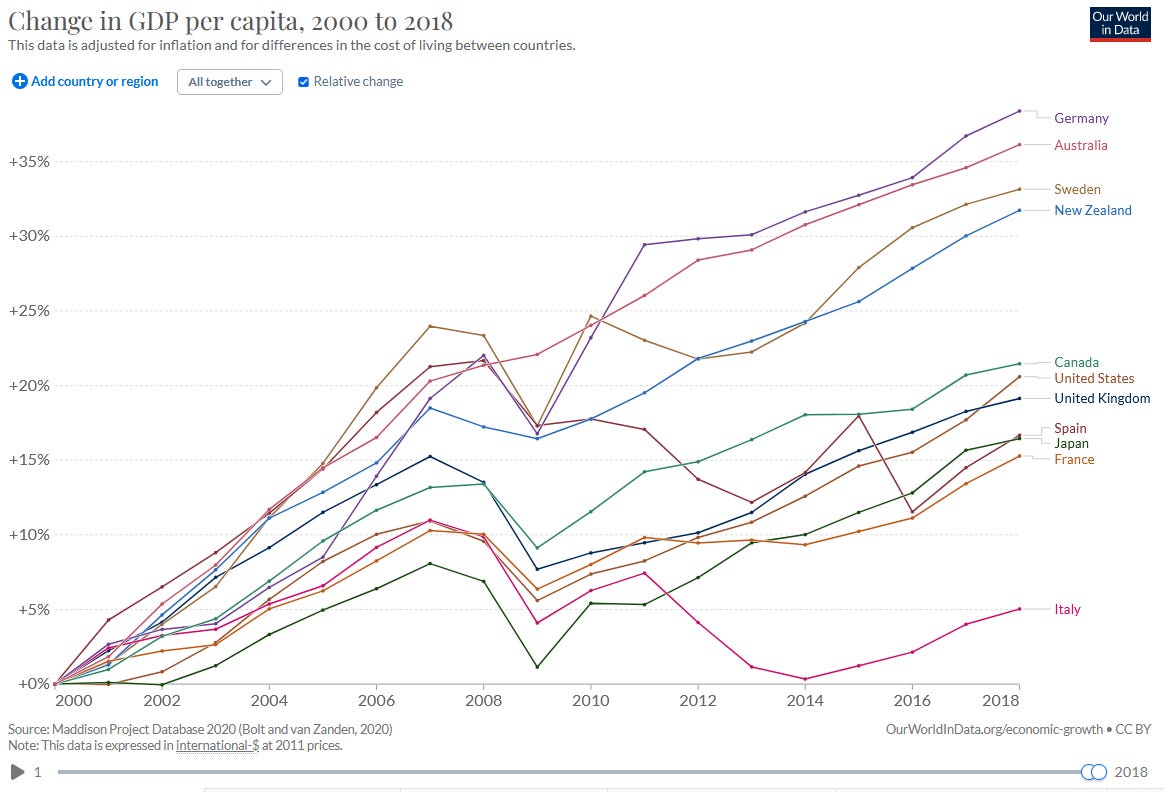

Or various articles like The Atlantic’s How The UK Became One Of The Poorest Countries In Western Europe and Foreign Policy’s Britain Is Much Worse Off Than It Understands - Things Weren’t Nearly This Bad In The 1970s . This isn’t clearly reflected in the GDP statistics, which show the UK growing at an average rate for developed countries between 2000 and today:

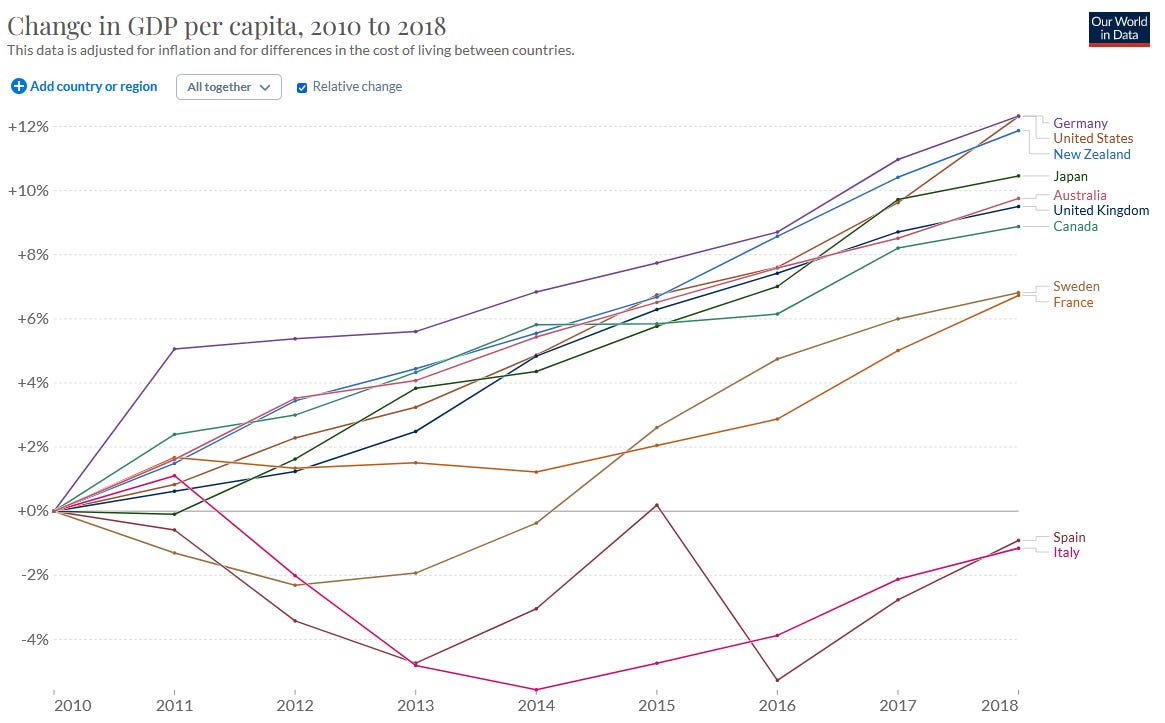

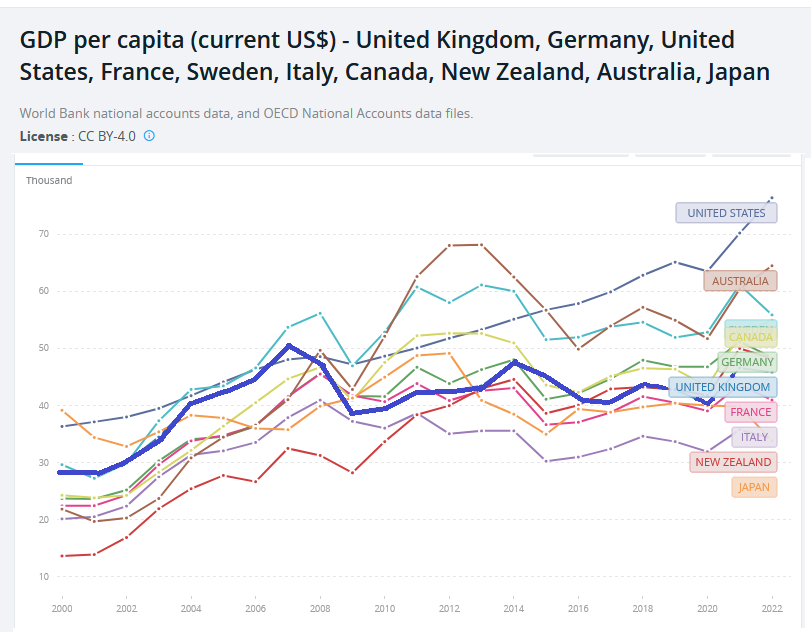

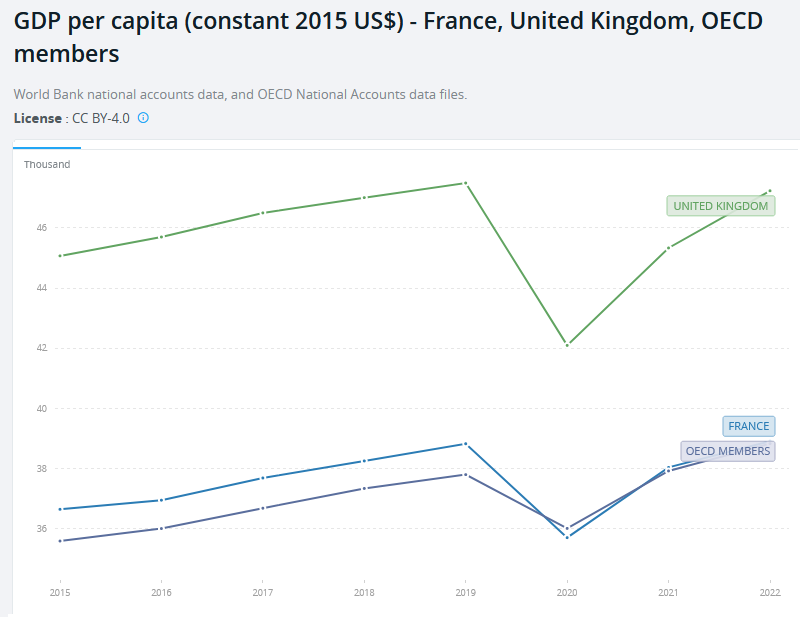

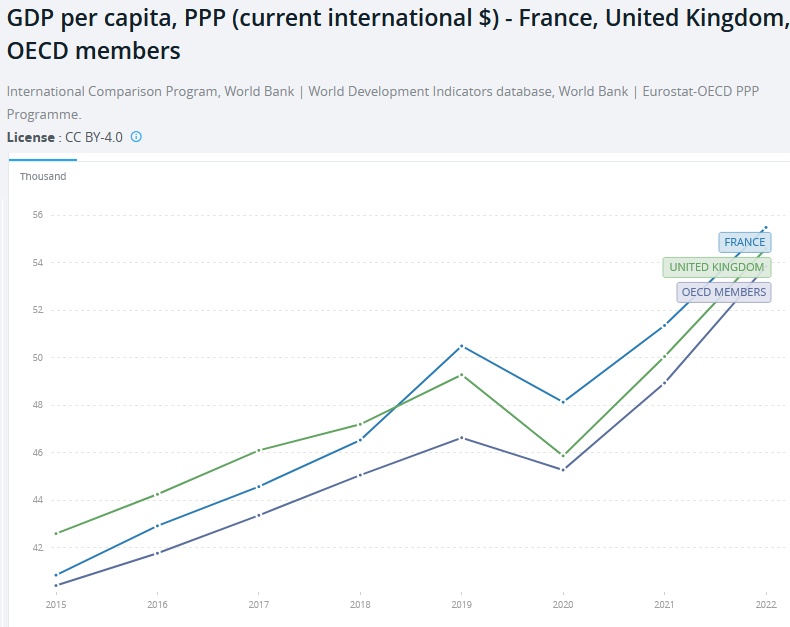

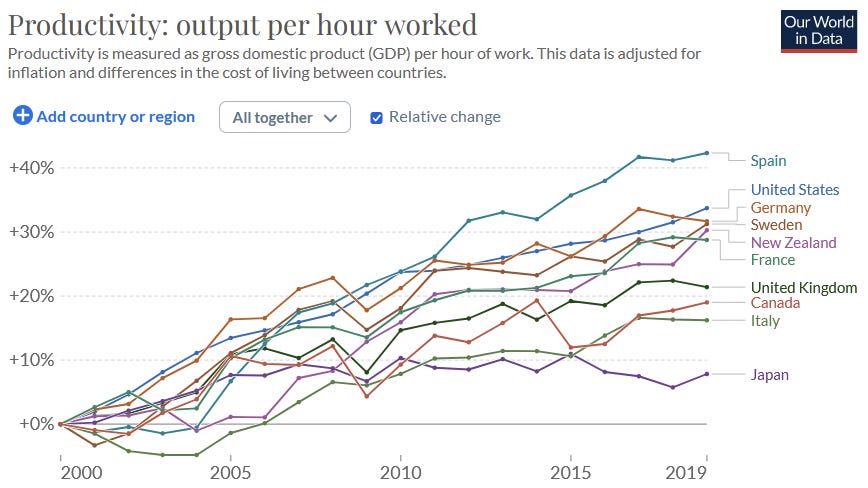

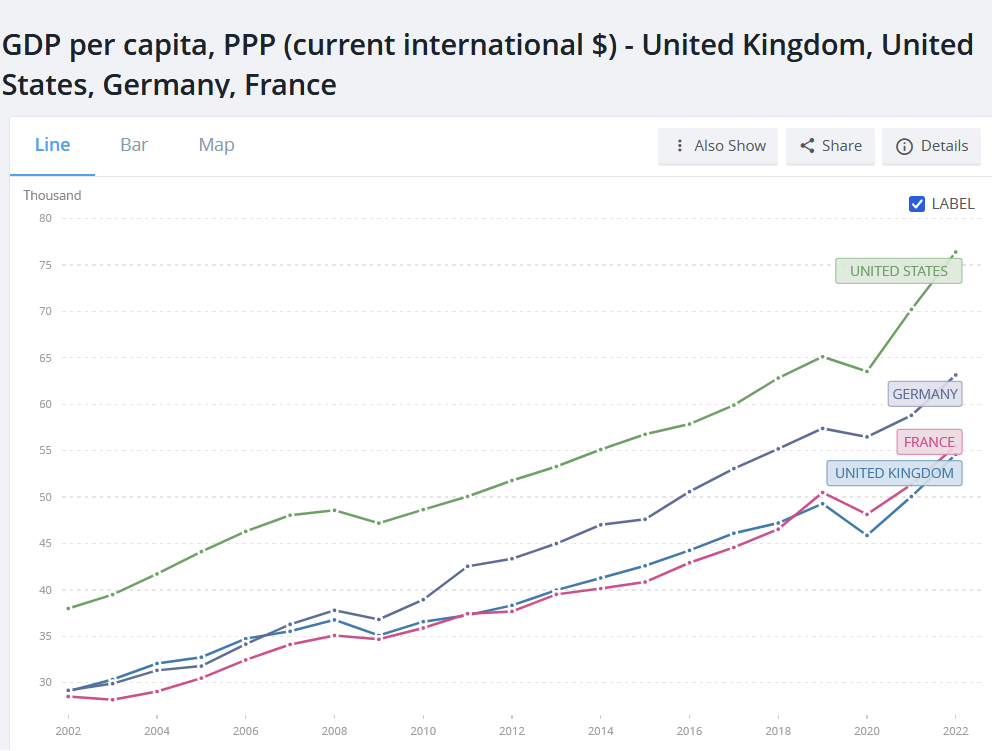

Or between 2010 and today: I prefer the Our World In Data graphs since they let you clearly show relative growth, but they only go up to 2018. A World Bank graph requires a little more interpretation, but goes up to 2022:

…and it also shows UK growth being about average. So what’s going on? I asked about this in an Open Thread. Here were some of your responses. Eric Rall writes:

Putting some numbers on the second graph:

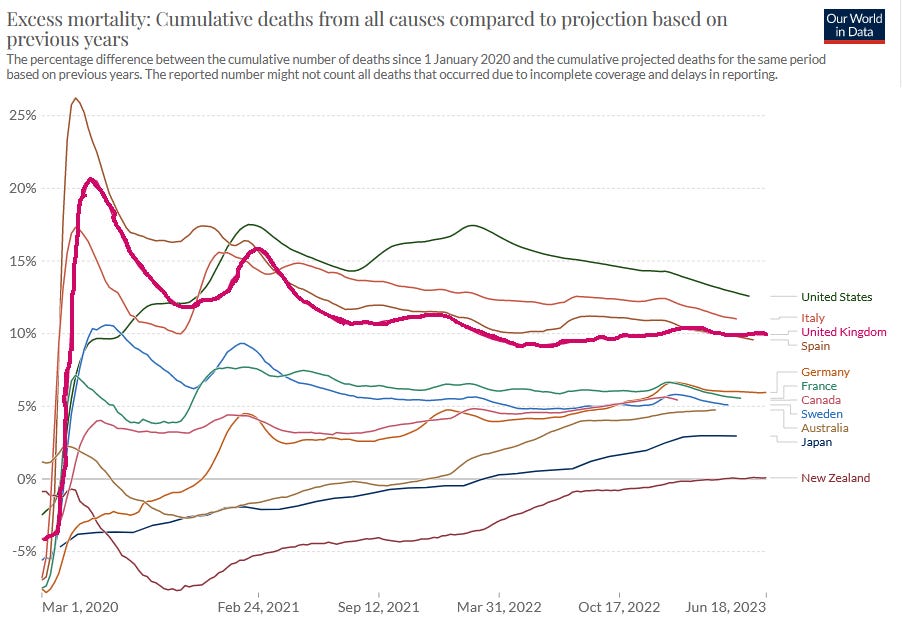

Is this because Britain had a worse COVID experience than other countries, or because they were having a normal COVID experience plus effects from Brexit? Hard to say. The UK did have an especially bad COVID epidemic, but the US had the worst of all but also had the highest GDP growth, so it doesn’t seem like bad COVID naturally translates into bad economy. Maybe it wasn’t the COVID itself, but the lockdowns?

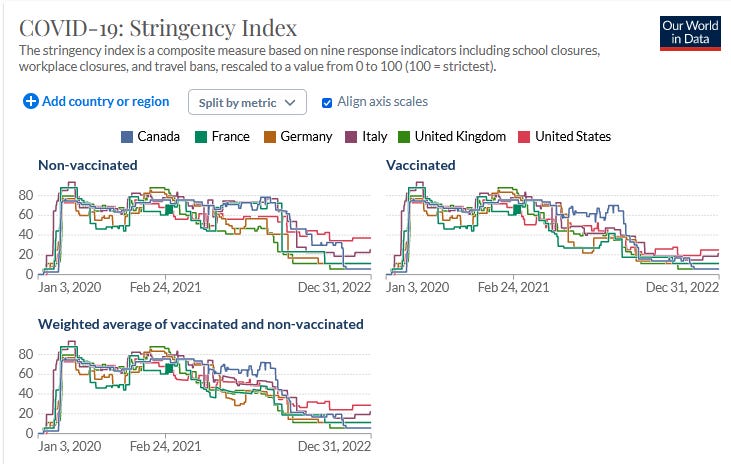

This isn’t the world’s most readable graph, but it suggests UK was no stricter than lots of other places. So maybe we can summarize Eric’s theory as “The British economy isn’t necessarily worse, but after Brexit, some goods cost more money, so the living standard affordable with the same amount of economic production has gone down.” Is this economically possible? Suppose that it costs more for Britain to import goods. Some of those goods will be raw materials, which will hurt industry, which will lower production, which should make market exchange rate GDP look worse. I don’t know enough macroeconomics to be able to tell if this should be happening. AH writes:

I’d be interested in seeing the “government decided to sit on industries in 1900” thesis fleshed out more. Also the “collapse of human capital after WWI”? Is this just saying lots of people died in WWI? If so, how come this didn’t happen in other deadly wars? For example, lots of Germans died in WWII, but Germany remained an economic powerhouse. Nolan Eoghan writes:

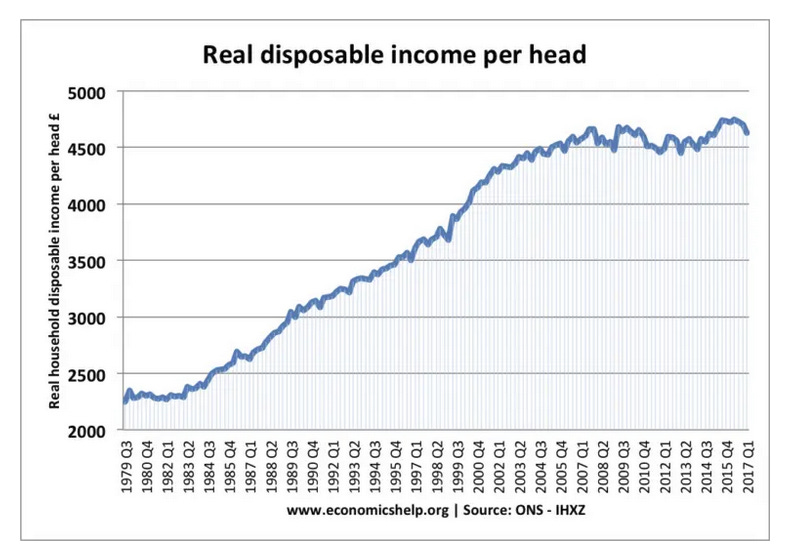

Here is what I was able to find for earnings:

But also:

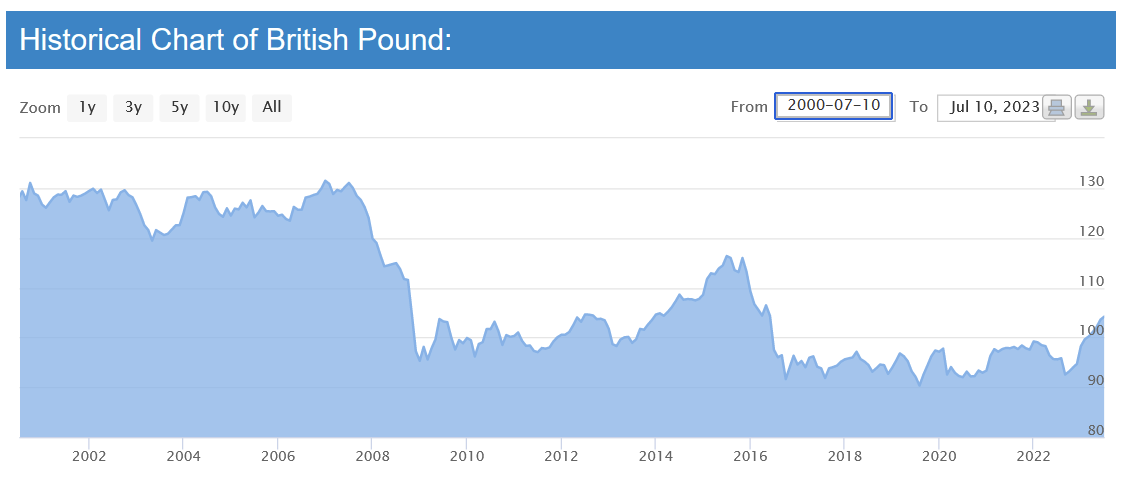

The first graph is nominal, the second is real. Was there a big decline in the value of the pound around this time?

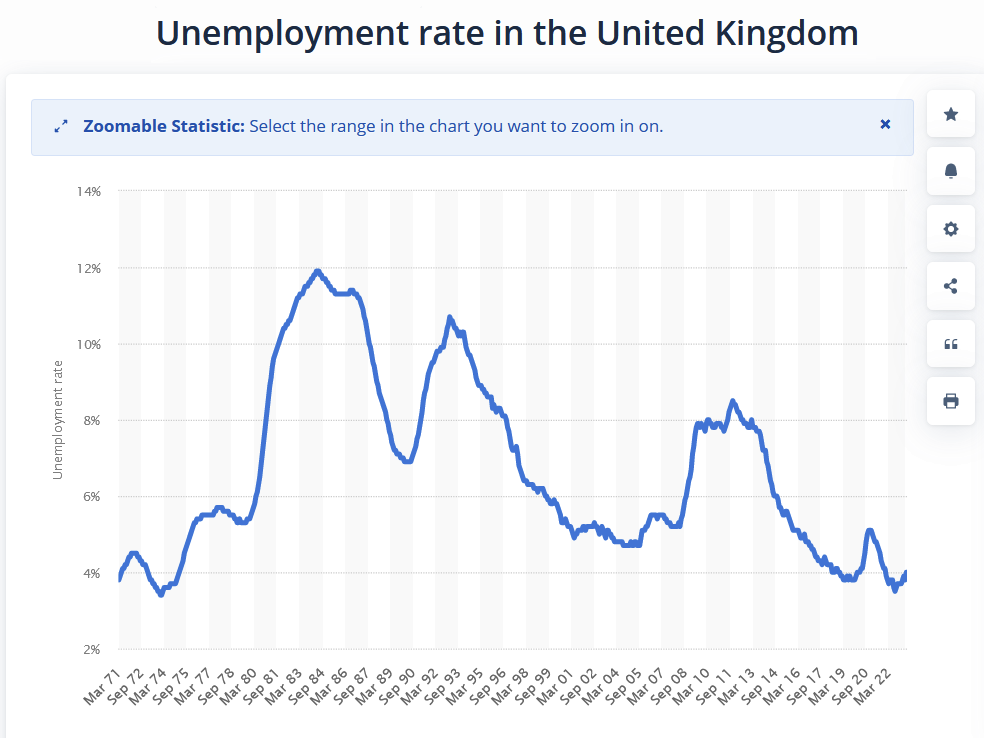

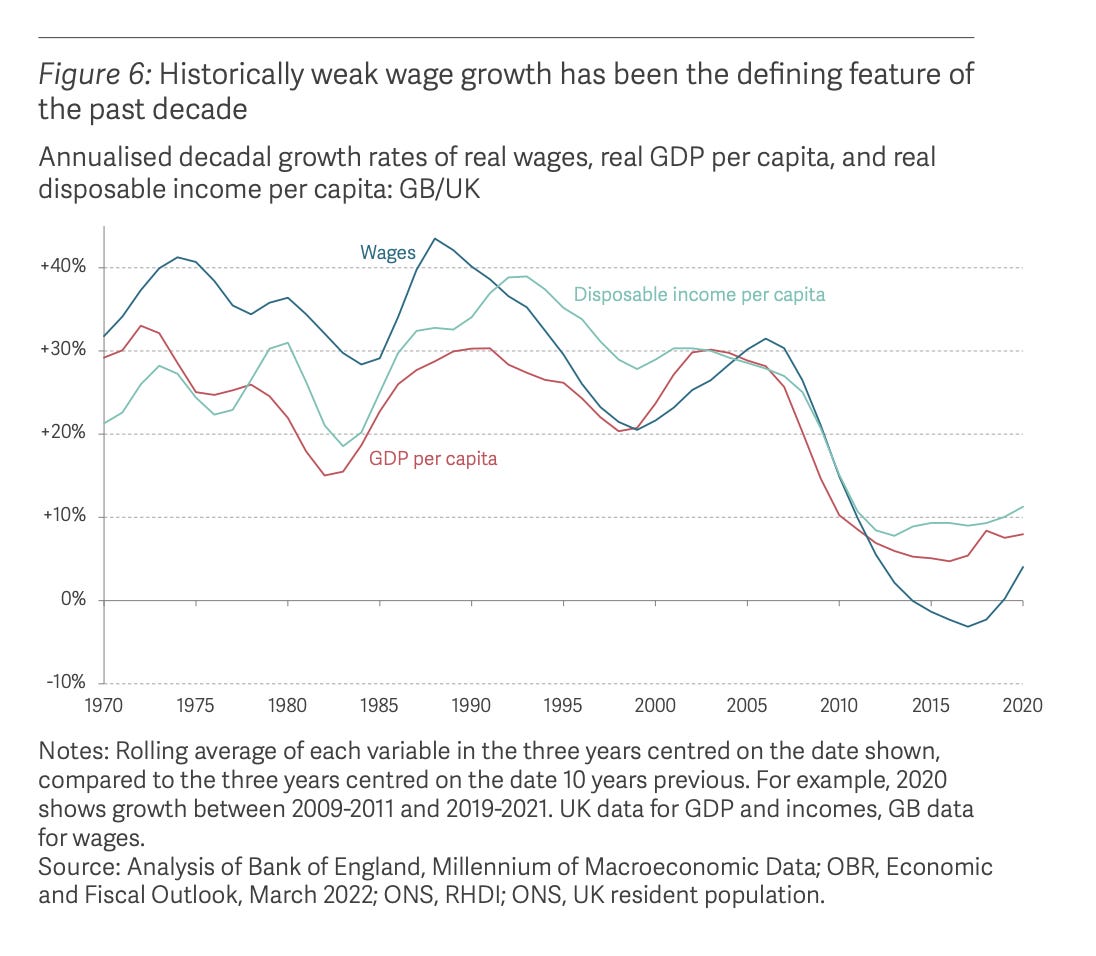

Yeah. Is that the whole story? This article calls it a “paradox” that GDP per capita is rising but wages are stagnant. It explains the paradox by arguing that rising GDP is coming from more workers being employed (ie unemployment rate going down), not by employed workers making more money. Instead of increasing productivity per worker, companies can just hire more workers. They attribute this pattern to a combination of Brexit (because companies have less capital to invest in productivity improvements) and austerity/welfare reform (which gets previously non-working people to work).

Smith writes:

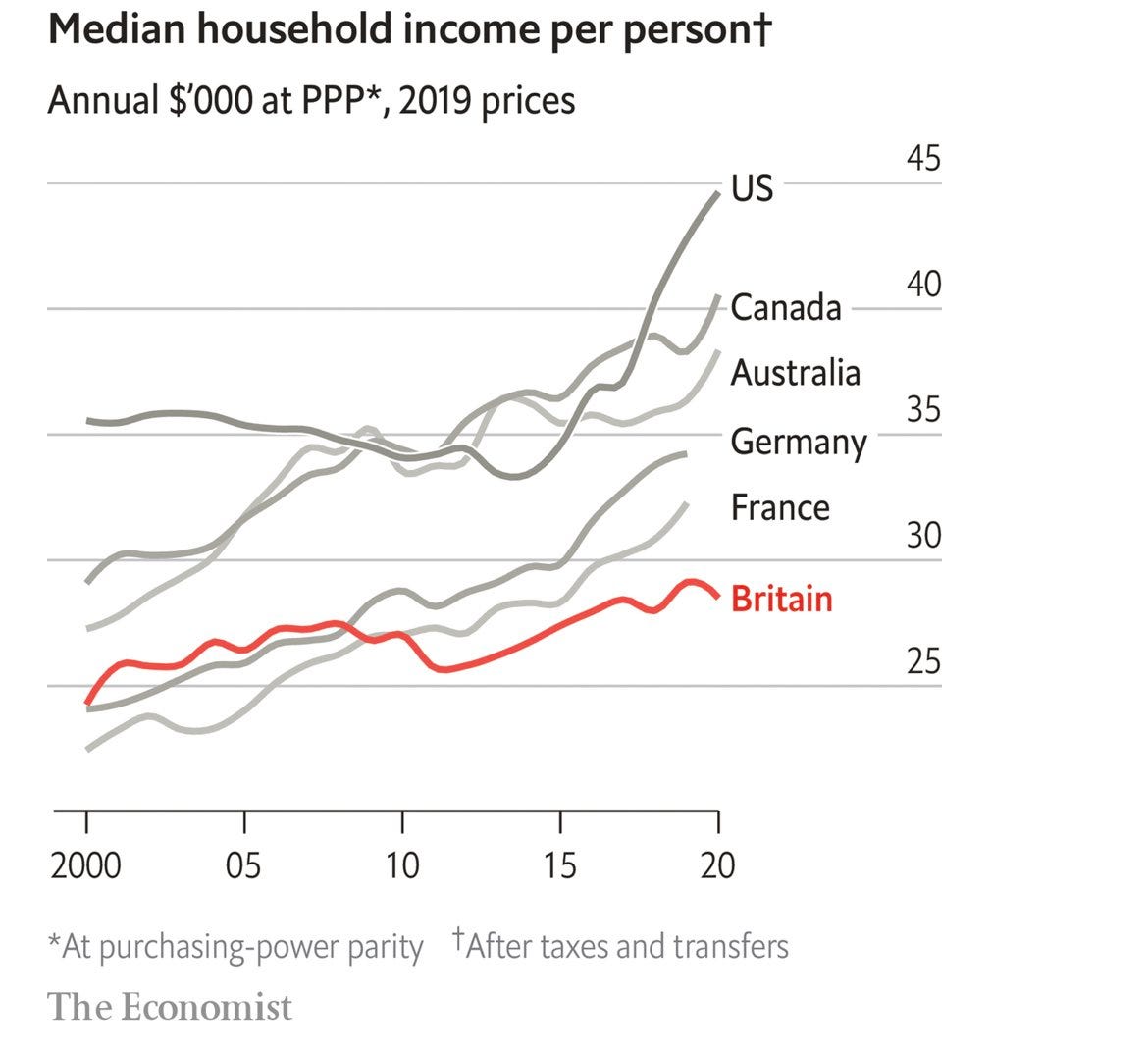

I don’t find the GDP stats listed here very convincing; in the context of the other GDP stats we’ve gone through, this looks more like Germany separating from Britain and France, rather than Britain doing anything unusual. But I appreciate the insight into how things feel. Why are salaries so much lower in Britain, though? And why aren’t more companies relocating to Britain to get cheap British workers? Citizen Penrose writes:

Tooze’s piece includes some graphs that express the problem more clearly than most of the ones I could find: As best I can tell, his explanation is: Britain has very low productivity growth. Probably this is because of declining public investment in R&D. Probably this is because of Tory-led austerity programs. I can’t find a clear graph of all country’s public R&D spending, but I think the US spends $100 billion and Britain spends about £15 billion = $20 billion. But the US economy is about 7x the size of Britain’s, so I think the US has less public R&D spending, as a percent of GDP, than Britain. So even if Britain’s public R&D spending is lower than before, why is this so catastrophic? I’d also like to understand more about how public R&D spending works. Is the government just funding basic research? Or are they helping companies make products? If the basic research, why are the benefits so limited to the individual country that the research is being done in? Erusian writes:

My summary: Britain is suffering a decline in productivity and income which isn’t fully reflected in nominal GDP statistics. This could be because it’s expressed in a declining pound, rather than in declining nominal wages/profits. I don’t know enough economics to feel like I have good intuitions about declining currency values. It could also be partly because post-recession economic growth happened more in new employment than in higher wages for the already-employed. Potential causes are Brexit, a dysfunctional real estate market, and underinvestment in R&D - but low confidence in all of these. You're currently a free subscriber to Astral Codex Ten. For the full experience, upgrade your subscription. |

Older messages

The Extinction Tournament

Thursday, July 20, 2023

...

Berkeley Meetup On Sunday, Special Guest Philip Tetlock

Wednesday, July 19, 2023

...

Contra The xAI Alignment Plan

Monday, July 17, 2023

Machine Alignment Monday 7/17/23

Open Thread 285

Monday, July 17, 2023

...

Contra The Social Model Of Disability

Sunday, July 16, 2023

...

You Might Also Like

Strategic Bitcoin Reserve And Digital Asset Stockpile | White House Crypto Summit

Saturday, March 8, 2025

Trump's new executive order mandates a comprehensive accounting of federal digital asset holdings. Forbes START INVESTING • Newsletters • MyForbes Presented by Nina Bambysheva Staff Writer, Forbes

Researchers rally for science in Seattle | Rad Power Bikes CEO departs

Saturday, March 8, 2025

What Alexa+ means for Amazon and its users ADVERTISEMENT GeekWire SPONSOR MESSAGE: Revisit defining moments, explore new challenges, and get a glimpse into what lies ahead for one of the world's

Survived Current

Saturday, March 8, 2025

Today, enjoy our audio and video picks Survived Current By Caroline Crampton • 8 Mar 2025 View in browser View in browser The full Browser recommends five articles, a video and a podcast. Today, enjoy

Daylight saving time can undermine your health and productivity

Saturday, March 8, 2025

+ aftermath of 19th-century pardons for insurrectionists

I Designed the Levi’s Ribcage Jeans

Saturday, March 8, 2025

Plus: What June Squibb can't live without. The Strategist Every product is independently selected by editors. If you buy something through our links, New York may earn an affiliate commission.

YOU LOVE TO SEE IT: Defrosting The Funding Freeze

Saturday, March 8, 2025

Aid money starts to flow, vital youth care is affirmed, a radical housing plan takes root, and desert water gets revolutionized. YOU LOVE TO SEE IT: Defrosting The Funding Freeze By Sam Pollak • 8 Mar

Rough Cuts

Saturday, March 8, 2025

March 08, 2025 The Weekend Reader Required Reading for Political Compulsives 1. Trump's Approval Rating Goes Underwater Whatever honeymoon the 47th president enjoyed has ended, and he doesn't

Weekend Briefing No. 578

Saturday, March 8, 2025

Tiny Experiments -- The Lazarus Group -- Food's New Frontier ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Your new crossword for Saturday Mar 08 ✏️

Saturday, March 8, 2025

View this email in your browser Happy Saturday, crossword fans! We have six new puzzles teed up for you this week! You can find all of our new crosswords in one place. Play the latest puzzle Click here

Russia Sanctions, Daylight Saving Drama, and a Sneaky Cat

Saturday, March 8, 2025

President Trump announced on Friday that he is "strongly considering" sanctions and tariffs on Russia until it agrees to a ceasefire and peace deal to end its three-year war with Ukraine. ͏