Mantic Monday 7/31/23: Room Temperature Superforecaster

Surely Nobody’s Going To Rig A US Election To Make A BuckKalshi is a legal prediction market trying to comply with regulations. They asked their regulator, the CFTC, for permission to make prediction markets about the upcoming elections. In grand regulatory tradition, CFTC has drawn this out into an excruciating yearlong process that has aggravated everyone involved. Last month was the Comments Stage, when the public gets a chance to submit comments on the pending decision. A total of 1380 comments were submitted, although 180 of those were by a person named Chris Greenwood who somehow submitted the same message 180 times. This is probably a metaphor for something. Most comments seemed to be anti-Kalshi. Some big anti-market and anti-gambling organizations urged their audiences to participate, especially a group called Better Markets. Most of these people’s talking points involved gambling on elections being a threat to democracy: what if it incentivized people to rig elections? Is this a realistic fear? There are already so many people who have very very very strong opinions about who should win US elections that adding some gamblers to the mix won’t matter much. The maximum bet a normal person (as opposed to a big Wall Street firm) can make is $250,000. There are already thousands of businesses and millions of individuals who have more than $250,000 riding on the outcome of US elections, just because politicians sometimes make laws that affect the economy. But also, have you seen people lately? People have so so many reasons to want to rig US elections. Big Wall Street firms can bet more on Kalshi, up to $100 million, but big Wall Street firms already have hundreds of millions of dollars at stake in elections based on who passes the next Sarbanes-Oxley or whatever. In fact, the whole reason for Wall Street to gamble $100 million on an election is to hedge the risk that Bernie Sanders will get elected and cost them $100 million. Allowing election bets makes Wall Street less interested in elections, not more! Britain already has legalized election betting. But British elections are still rigged by special interests and the media and the Lizardman Conspiracy and all the usual people who rig elections. Nobody worries about guys who have put $1000 on Labour at the local Paddy Power. Still, many people had strong emotions about the possibility of gamblers destroying our democracy. I’ll mostly skip over these in favor of other more interesting comments, like:

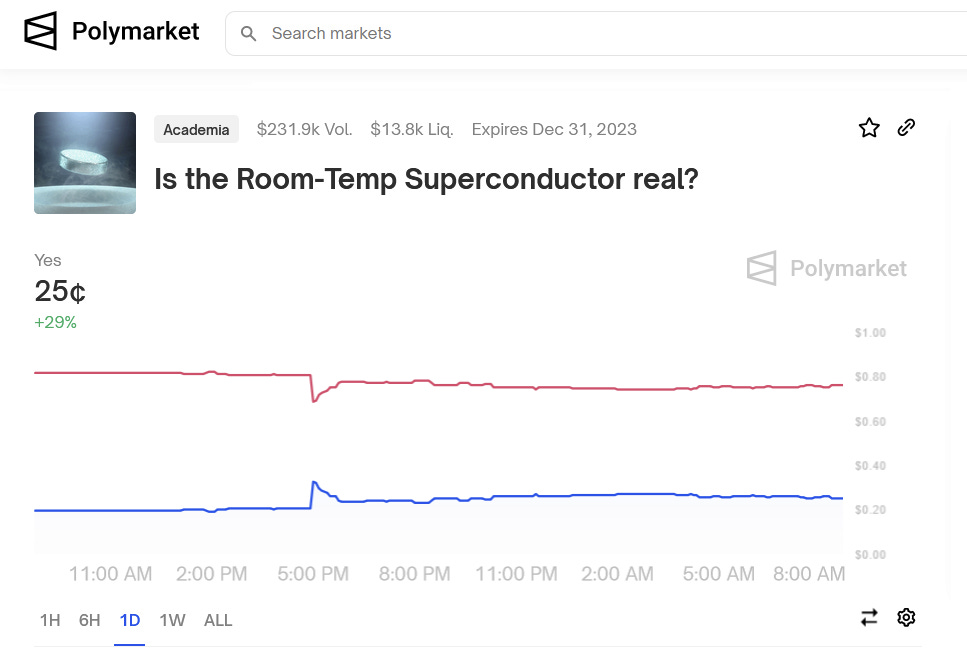

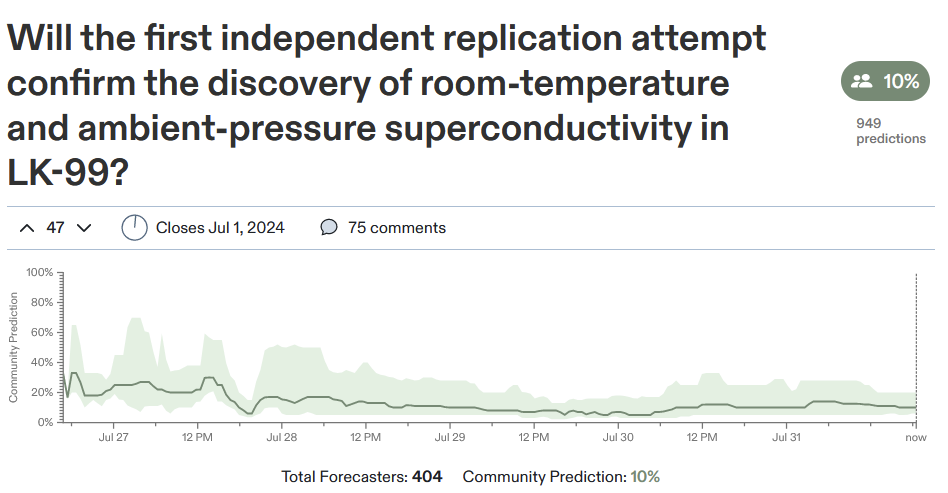

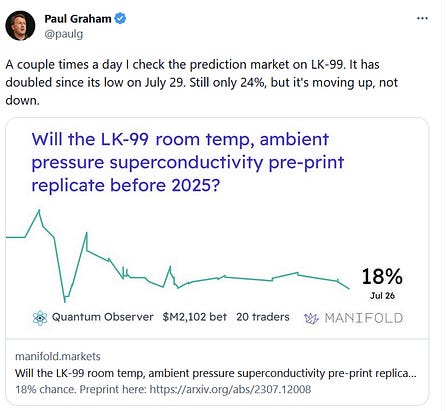

Manifest 2023Manifold Markets is sponsoring Manifest, an “inaugural forecasting & prediction market conference”, to be held at the Rose Garden Inn, Berkeley, California the weekend of September 22. Their website is short on details, but listed speakers and guests of honor are: …now that I think about it I do remember vaguely agreeing to something like this, though I’m not currently planning to give any particular speeches. But Aella and Robert are great - and although I’ve never met the third guy, it seems appropriate for a conference called Manifest to feature someone named Destiny. Manifold tends to do things on impulse and fill in the details later, so the schedule looks sparse. But usually the things they throw together last-minute end up being pretty good, so I’m looking forward to this. Tickets cost $220, but can also be purchased with mana (Manifold Markets’ play money), at least until the CFTC notices. It looks like there’s an arbitrage you can use to get the tickets at a 10% discount - I think this is less likely to be a mistake than a preference to have people who can spot arbitrages 10% over-represented at the conference compared to everyone else. Room Temperature SuperforecasterMaybe the long-awaited killer app for prediction markets is . . . debating superconductors? First, the markets: I’m heartened to see these two very big markets ($200,000+ volume, 2,000+ traders) within 1% of each other (as of time of writing). This is a really difficult question without an obvious prior, so the level of convergence suggests the markets really are doing their job… …but Metaculus is much lower, probably because the other two are asking if any replication will be positive, and Metaculus is asking if the first replication attempt will be. It’s bad news that these numbers are so different, and suggests a high chance that this stays confusing and comes down to finicky resolution criteria. Still, this has gotten lots of people checking the prediction markets, including Paul Graham: …and around 500 others, according to the Manifold Active Users graph (source): Aside from headline numbers, I’ve also appreciated prediction market comment sections as a good place to stay up to date on the latest developments (including a link to this thread) Elsewhere In ForecastingNYPost: Blind Mystic Baba Vanga Makes Terrifying Nuclear Disaster Prediction For 2023:

Big if true. In what sense did she predict 9/11? Another article gives the exact text of the 1989 prediction:

This is a 1989 prediction! If you’re calling airplanes “steel birds” in 1989, you’re just hoping that people forget you lived when airplanes already existed and then get impressed with you for predicting them. Come on! (you could argue that the second half is about Assistant Secretary of State John Wolf and Deputy Secretary of Defense Paul Wolfowitz howling for war with Iraq from within the Bush administration, but Ass. Sec Wolf played a minimal role in the war buildup so I think if you are being very strict in your interpretation there was really only one wolf involved.) Anyway, Vanga’s other predictions for 2023 include:

Again, big if true. PredictIt Gets Another Stay Of ExecutionIn 2014, researchers at a New Zealand university created PredictIt, a real-money prediction market focusing on US politics. Real-money prediction markets are somewhere between unregulated futures exchanges and gambling. The US restricts both these things, so it restricts prediction markets too. PredictIt asked the CFTC, the relevant regulatory body, to let them operate anyway, arguing that they were academically valuable and would limit bets to relatively small amounts of money. The CFTC agreed and granted them a “no action letter”, a not-really-binding commitment agreeing not to bother them as long as they followed certain rules. In 2022, Kalshi, a more savvy prediction market with more friends in government, applied to be a fully-regulated futures exchange. Either because of direct action from Kalshi to crush competitors, or just to tie up loose ends, the CFTC revoked their no-action letter against PredictIt and told them to shut down. PredictIt sued the CFTC, saying their decision was “arbitrary and capricious” and violated federal regulations saying agencies had to explain their actions and give people a chance to respond. The original court that was hearing the lawsuit dragged its feet, so PredictIt appealed to the Fifth Circuit Court of Appeals, who issued a preliminary injunction allowing them to keep operating. Now the Appeals Court rules in their favor (article, court opinion), accepting most of the legal philosophy behind their challenge, like:

I don’t know whether this means things are looking good for PredictIt, or whether this means the CFTC will start a new case with its better action and the court will agree that it is better. The decision didn’t seem to move the market on overall lawsuit success. Although I like the result of this decision, I’m worried about the ruling that no-action letters constitute binding commitments whose amendment or cancellation requires careful agency action with every t crossed and every i dotted. Why would any government agency ever give a no-action letter now? The Mantis Of Wall StreetI ran into some finance people at the NYC meetup this week and asked why they weren’t using more advanced forecasting technology - prediction markets, superforecaster tournaments, calibration training, that kind of thing. A common reply was “who says we aren’t using it?” When I asked for details, the two types of answers I got were:

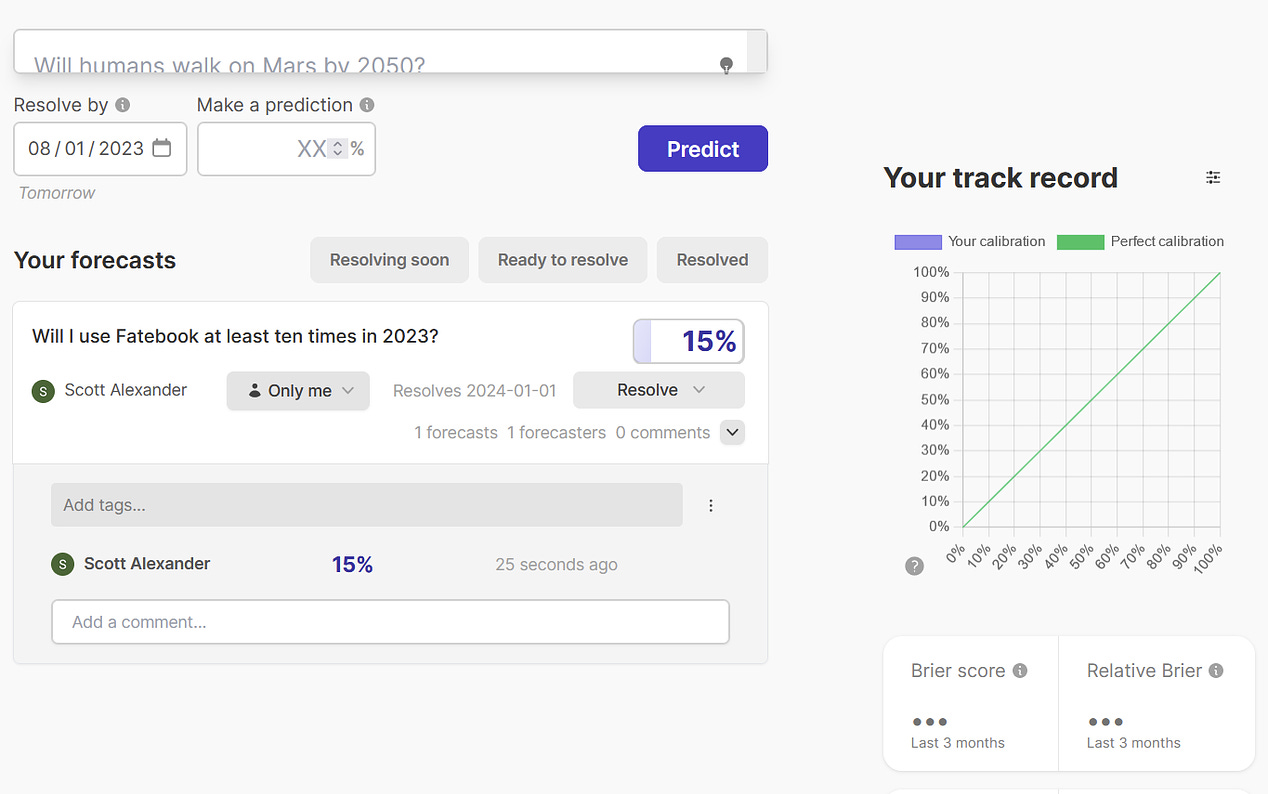

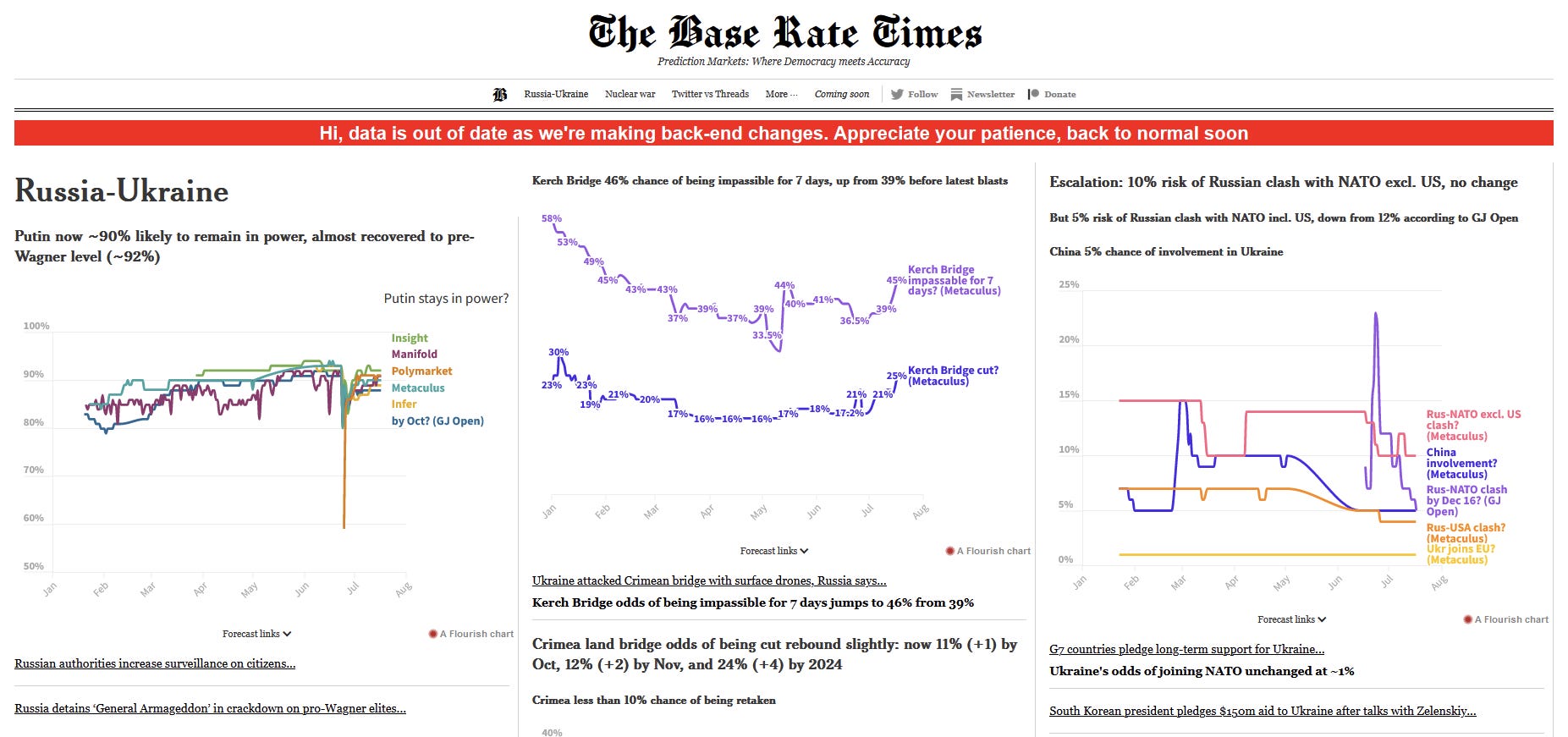

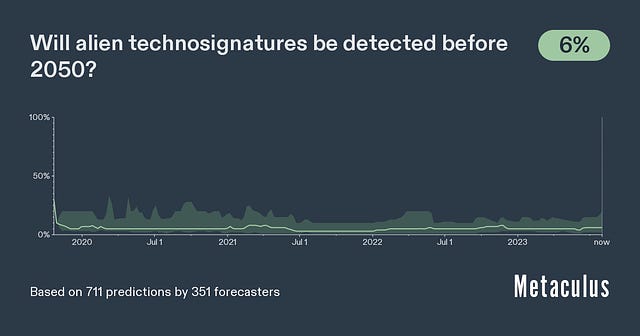

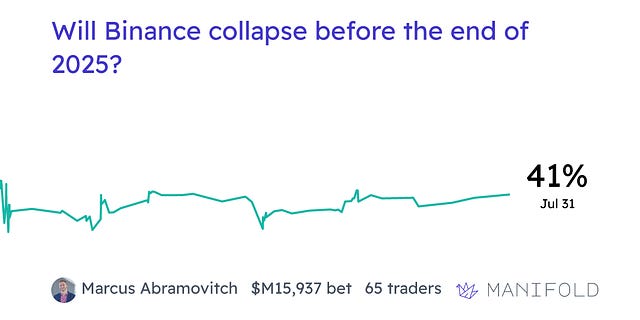

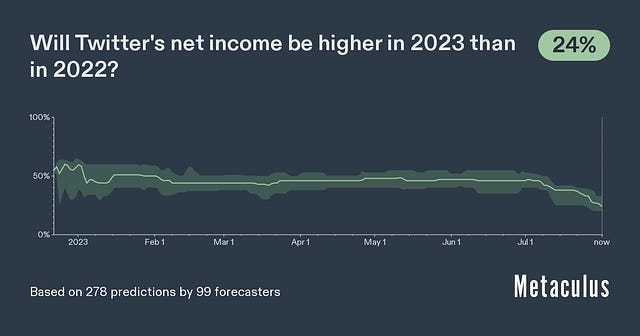

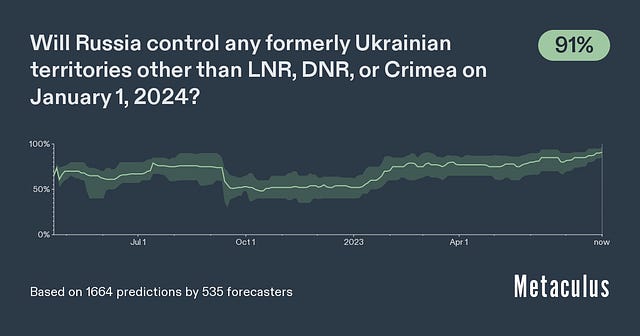

I asked someone if they were doing some kind of formal corporate partnership deal with Metaculus and they said they didn’t know it was an option. Seems like a potential opportunity! Fatebook, RatebookFatebook (site, explanatory post) is a site by Adam Binks of Sage, intended to make it easy to make your own predictions (including about your personal life). Then you can track your calibration and Brier score: Fatebook is pretty similar to the old PredictionBook.io website, but the PredictionBook team says they’re getting to the end of their ability to maintain the site and that Fatebook is a worthy successor. There’s a function to import your PredictionBook history onto Fatebook. Also check out The Base Rate Times, a prediction-market-based news panel thing: This Month In The MarketsMetaculus considers UFOs: This covers literal UFOs, SETI, and Avi Loeb’s work trying to recover anomalous meteorites, plus any other way aliens might make themselves known to us in the next 27 years. SEC vs. Coinbase. I was surprised the Ripple ruling didn’t move the market more. Sorry for two crypto markets in a row, but it seems important that an exchange with tens of billions of dollars on it has 41% chance of collapsing in the next few years. Looks like the most recent round of Twitter changes really hurt. Some evidence that Russia’s position in Ukraine is looking better than expected earlier this year I thought they had already passed this bill, but they’ve only passed part of it. You can see the details in the comments. The rise and fall of Threads. Shorts1: The Existential Risk Persuasion Tournament (see here) is releasing some more information and some corollaries of their outcomes - see for example Who’s Right About Inputs Into The Bio Anchors Model? I’ll combine some of these with a Highlights From The Comments post once they get all of them out. 2: A story about how insider trading on a prediction market almost leaked the big AI risk statement before it was supposed to become public. 3: At an ACX meetup, I was asked why journalists don’t cite prediction markets more often, ie “The new paper says there is a room temperature superconductor, but experts are skeptical, and the forecasting engine Metaculus says there is only a 10% chance it will replicate”. I didn’t have a good answer; do any journalists have an opinion on this? You're currently a free subscriber to Astral Codex Ten. For the full experience, upgrade your subscription. |

Older messages

Open Thread 287

Sunday, July 30, 2023

....

Your Book Review: On the Marble Cliffs

Friday, July 28, 2023

Finalist #11 in the Book Review Contest

Bad Definitions Of "Democracy" And "Accountability" Shade Into Totalitarianism

Friday, July 28, 2023

...

New York Meetup On Sunday

Wednesday, July 26, 2023

...

Highlights From The Comments On Social Model Of Disability

Tuesday, July 25, 2023

...

You Might Also Like

Surprise! People don't want AI deciding who gets a kidney transplant and who dies or endures years of misery [Mon Mar 10 2025]

Monday, March 10, 2025

Hi The Register Subscriber | Log in The Register Daily Headlines 10 March 2025 AI Surprise! People don't want AI deciding who gets a kidney transplant and who dies or endures years of misery

How to Keep Providing Gender-Affirming Care Despite Anti-Trans Attacks

Sunday, March 9, 2025

Using lessons learned defending abortion, some providers are digging in to serve their trans patients despite legal attacks. Most Read Columbia Bent Over Backward to Appease Right-Wing, Pro-Israel

Guest Newsletter: Five Books

Sunday, March 9, 2025

Five Books features in-depth author interviews recommending five books on a theme Guest Newsletter: Five Books By Sylvia Bishop • 9 Mar 2025 View in browser View in browser Five Books features in-depth

GeekWire's Most-Read Stories of the Week

Sunday, March 9, 2025

Catch up on the top tech stories from this past week. Here are the headlines that people have been reading on GeekWire. ADVERTISEMENT GeekWire SPONSOR MESSAGE: Revisit defining moments, explore new

10 Things That Delighted Us Last Week: From Seafoam-Green Tights to June Squibb’s Laundry Basket

Sunday, March 9, 2025

Plus: Half off CosRx's Snail Mucin Essence (today only!) The Strategist Logo Every product is independently selected by editors. If you buy something through our links, New York may earn an

🥣 Cereal Of The Damned 😈

Sunday, March 9, 2025

Wall Street corrupts an affordable housing program, hopeful parents lose embryos, dangers lurk in your pantry, and more from The Lever this week. 🥣 Cereal Of The Damned 😈 By The Lever • 9 Mar 2025 View

The Sunday — March 9

Sunday, March 9, 2025

This is the Tangle Sunday Edition, a brief roundup of our independent politics coverage plus some extra features for your Sunday morning reading. What the right is doodling. Steve Kelley | Creators

☕ Chance of clouds

Sunday, March 9, 2025

What is the future of weather forecasting? March 09, 2025 View Online | Sign Up | Shop Morning Brew Presented By Fatty15 Takashi Aoyama/Getty Images BROWSING Classifieds banner image The wackiest

Federal Leakers, Egg Investigations, and the Toughest Tongue Twister

Sunday, March 9, 2025

Homeland Security Secretary Kristi Noem said Friday that DHS has identified two “criminal leakers” within its ranks and will refer them to the Department of Justice for felony prosecutions. ͏ ͏ ͏

Strategic Bitcoin Reserve And Digital Asset Stockpile | White House Crypto Summit

Saturday, March 8, 2025

Trump's new executive order mandates a comprehensive accounting of federal digital asset holdings. Forbes START INVESTING • Newsletters • MyForbes Presented by Nina Bambysheva Staff Writer, Forbes