Aziz Sunderji - One Explanation for Booming US Growth

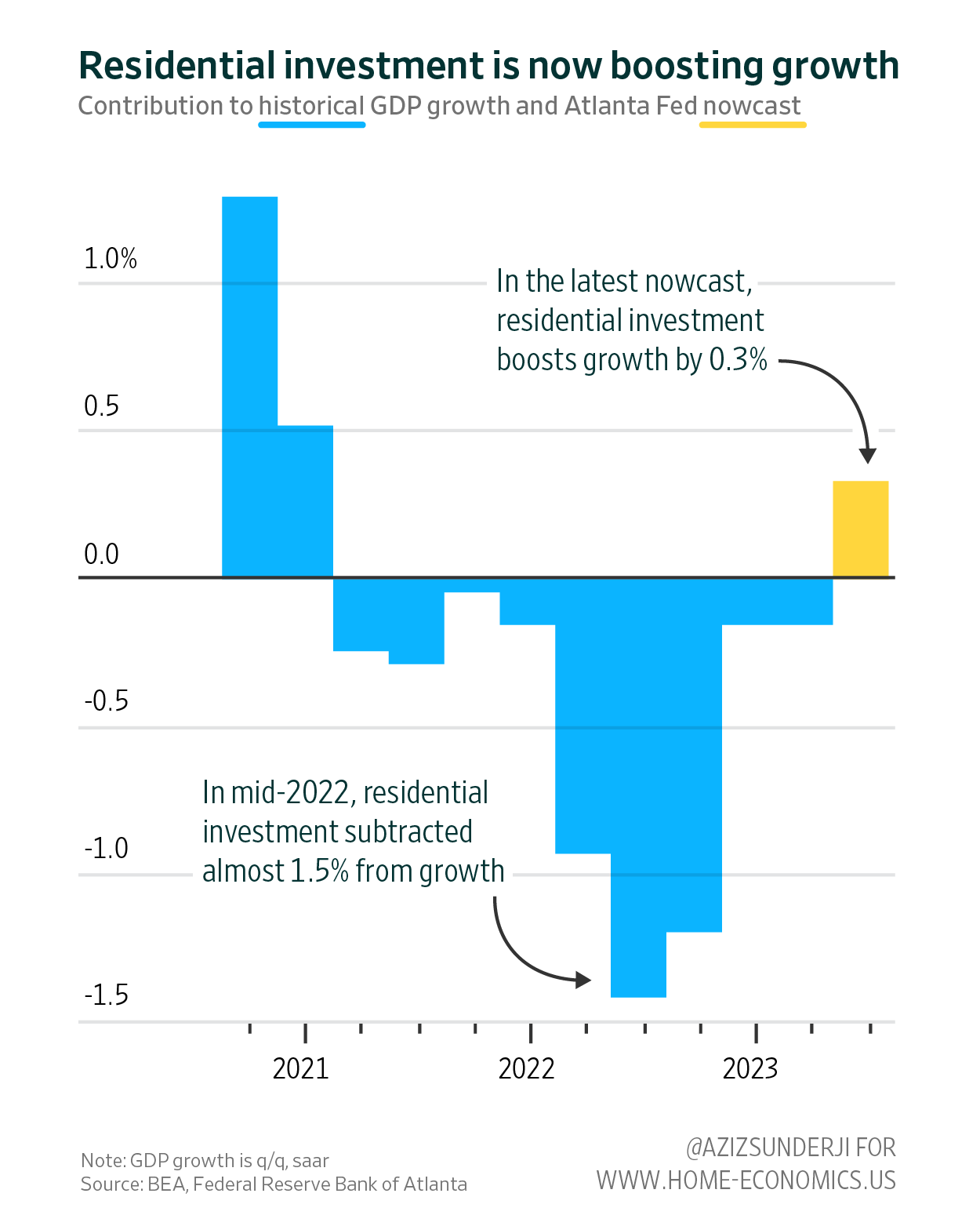

One Explanation for Booming US GrowthWeak home construction was hurting the economy last year—not anymoreHi! I’m Aziz. My newsletter contextualizes America’s housing market using data visualization—hit reply and let me know what you think. When we talk about the housing market, we typically focus on transactions and prices. But from the perspective of economic growth, transactions are essentially meaningless. What really moves the growth needle is residential investment—the construction of new homes. Construction has quietly flipped from dragging on growth to adding to it. That’s one reason the US economy is, by some estimates, now growing at the fastest pace in over 20 years. Housing-related activity is contributing to the bristling pace of economic growth. By some estimates, the economy is on track to expand by 5.6% this quarter. This would amount to the fastest growth (outside the pandemic) in over 20 years. America is leaving other major economies in the dust. It’s surprising that housing is boosting growth. When we think of housing activity, we typically think of home sales. The number of home sales being sold these days is as low as the during the darkest days of the 2008 crisis. By most measures, housing is in a deep freeze. But sales are almost entirely irrelevant for growth. The only measurable activity that comes from one person selling their home to another are fees for the lawyers, brokers, and other intermediaries (plus the spending associated with moving into a new home, which probably amounts to a tiny 0.25% of GDP). Instead, the impact of housing on economic growth occurs via two other channels. Housing adds to economic growth through investment and consumptionThe first way that housing adds to growth is through “residential investment”: the construction of new single-family and multifamily structures, home remodeling, and the production of manufactured homes. Construction is related to home sales, in the sense that rising sales and prices spur builders to break ground on new projects. But unlike home sales, residential investment results in measurable transactions that constitute economic activity. In the country’s economic ledger (the national income and product accounts, or NIPA) residential investment appears under “gross private domestic investment”, alongside other items like corporate spending on research and development, and factory upgrades. The second way housing drives growth is through consumer spending on “housing and utilities”: the rents and utilities paid by renters, and for owners, the ownership cost imputed from these rents, plus utilities. Housing services are a NIPA line item under “services” spending—alongside other items like healthcare and transportation. Housing consumption is a bigger part of the economy than residential investmentThese days, the size of the US economy—that is, the value of all the transactions occurring in one year—add up to about $27 trillion. Housing spending—on rent, ownership costs, and utilities—constitute a little over $3trn (around 11% of the total). In the overall economic pie, the slice attributed to housing consumption is more than twice as large as for housing investment. But investment is much more important for growthEven though residential investment is a smaller part of the economy than housing consumption, it’s much more important in determining the change in the size of the economy from one period to another (economic growth). That’s because investment is far more volatile. People need a roof overhead year-in and year-out—but home builders will only build new homes if conditions are right. The volatile “investment” part of housing is what’s helping growth these daysOne reason the economy is expanding so rapidly is that residential investment—mainly, new home construction—is rising. In particular, it’s the building of new single family homes (SFH), rather than multi-family units (ie, duplexes, triplexes, and apartment buildings), that’s adding to GDP. Apartment construction is at a 50 year high, but SFH construction is a much larger market and a much larger employer. Cynics might rightly point out that real-time GDP trackers estimate that residential investment is slated to add only 0.3% of the almost 6% growth in Q3. But the important thing is that housing is no longer a drag on the economy. Consider what happened last year: after the Fed hiked rates, single-family home starts plunged. This subtracted almost 1.5% from growth (a big effect, since this time last year, GDP only grew by a tad over 3%). So the additional 0.3% of growth from housing is, in reality, a very substantial swing of +1.8% from this time last year. Thanks for reading. If you’d like to support my work, please follow me on Twitter and consider becoming a paying subscriber. |

Older messages

Home Price Whiplash

Tuesday, September 5, 2023

A normal housing cycle plays out over a decade. This one took three years.

Inventory Squeeze to get even Squeezier

Friday, August 25, 2023

People are aging and staying in their homes longer

Expensive housing is a secular trend, not a cyclical one

Friday, August 4, 2023

Most of the increase in monthly mortgage payments is from higher prices, not higher interest rates

The Monstrous Share of Housing in the Household Budget

Monday, July 24, 2023

Analyzing the Bureau of Labor Statistics' Consumer Expenditure Report since 1984

Does seasonality still matter for housing?

Tuesday, July 18, 2023

New listings are tracking mortgage rates more than anything else

You Might Also Like

6 Most Common Tax Myths, Debunked

Saturday, March 8, 2025

How to Finally Stick With a Fitness Habit. Avoid costly mistakes in the days and weeks leading up to April 15. Not displaying correctly? View this newsletter online. TODAY'S FEATURED STORY Six of

Weekend: My Partner Can’t Stand My Good Friend 😳

Saturday, March 8, 2025

— Check out what we Skimm'd for you today March 8, 2025 Subscribe Read in browser Header Image But first: this is your sign to throw away your old bras Update location or View forecast EDITOR'S

Your Body NEEDS to Cardio Row! Here Are Some Options.

Saturday, March 8, 2025

If you have trouble reading this message, view it in a browser. Men's Health The Check Out Welcome to The Check Out, our newsletter that gives you a deeper look at some of our editors' favorite

What Do You Really Need?

Saturday, March 8, 2025

Is opposing consumerism lacking gratitude? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

“Otway” by Phoebe Cary

Saturday, March 8, 2025

Poet, whose lays our memory still / Back from the past is bringing, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Cameron Diaz Returned To Fashion Week In A Fabulous Little Red Dress

Saturday, March 8, 2025

WOW. The Zoe Report Daily The Zoe Report 3.7.2025 Cameron Diaz's Asymmetrical Red Dress Lit Up The Stella McCartney Fall 2025 Show (Celebrity) Cameron Diaz Returned To Fashion Week In A Fabulous

5-Bullet Friday — Breaking the Sperm Bank, D-Cycloserine, Tools for Grumpy Elbows, and Wisdom from Seth Godin

Saturday, March 8, 2025

“If you're feeling creative, do the errands tomorrow. If you're fit and healthy, take a day to go surfing. When inspiration strikes, write it down." ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Inside Alex Pereira's Training for Saturday's UFC 313 Showdown

Friday, March 7, 2025

View in Browser Men's Health SHOP MVP EXCLUSIVES SUBSCRIBE Inside Alex Pereira's Training for Saturday's UFC 313 Showdown Inside Alex Pereira's Training for Saturday's UFC 313

Update Your Android Devices Now 🚨

Friday, March 7, 2025

This TikTok Cleaning Method Might Have Broken My Fan. The security update includes fixes for two zero-day exploits. Not displaying correctly? View this newsletter online. TODAY'S FEATURED STORY

EmRata's Itty-Bitty Bikini Just Brought Back This "Cheugy" 2010s Trend

Friday, March 7, 2025

Plus, everything you need to know about Venus retrograde, your daily horoscope, and more. Mar. 7, 2025 Bustle Daily New books from Emily Henry, Karen Russell, and Kate Folk are among Bustle's best