Net Interest - Peak Pod

He’s not authorised to begin trading yet but, behind the scenes, Bobby Jain is getting ready. Formerly an executive at Millennium Management and a veteran of Credit Suisse, Jain is laying the groundwork for the largest hedge fund launch in history. By the time he starts, Jain is expected to have raised as much as $10 billion of client money. In preparation, he’s touring the world, locking down office space and securing talent; already he’s made a number of high-profile hires (all while overseeing his influential think tank, Jain Family Institute). What’s unusual about Jain is that, unlike hedge fund moguls of the past, he has no Big Trade to his name. He didn’t make a fortune betting against the Bank of England or shorting subprime. He’s not the best business analyst in the industry or arbitrage trader or distressed credit investor, nor does he have a special mathematical algorithm for beating the market. In fact, he’s known less for his money-making skills than for his risk management and organisational skills. But in the current hedge fund landscape, it’s risk management that pays. Investing clients can get market exposure (known as beta in the industry) for free through index funds. A stable stream of alpha (excess return) is more valuable and commands a significant pricing premium. The type of platform that Jain plans to launch, similar to the one he managed at Millennium, is the closest thing the market has right now to an alpha machine. We looked at platforms such as Jain’s in So You Want to Launch a Hedge Fund? back in April. Known as multi-manager funds, they comprise a bunch of investment teams all operating autonomously under the umbrella of an overall firm. Capital is allocated from the centre as are the teams’ risk parameters. The approach was pioneered in part by Ken Griffin. He set up his firm, Citadel Advisors, in 1990 with $4.6 million of capital (a fraction of what Bobby Jain hopes to start with, but then Griffin was barely out of college). Ten years later, one of his executives told Institutional Investor magazine that his goal was “to see if we can turn the investment process into widget making.” And that’s what he did. Griffin recruited teams with narrow specialisations and backed them to trade their niche. Their job was not to take market risk but to outperform a benchmark by a few percentage points and not lose money. If they performed well, they were allocated more capital; if they performed poorly, capital was withdrawn or, worse, they were fired. Returns were aggregated in a central pool managed out of Chicago. One such specialisation was banking stocks; as a sell-side research analyst, I would regularly compare notes with the Citadel team (or “pod” as these teams became known) about the banks we followed. Dmitry Balyasny, founder of Balyasny Asset Management is a more recent entrant to the industry. He attributes the model to a trading view of markets as distinct from an investing view (emphasis added):

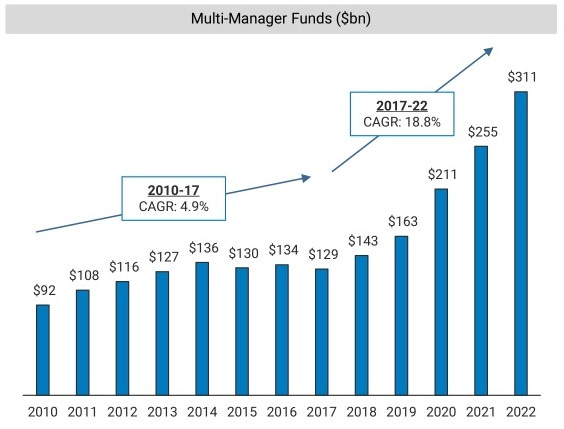

My contact at Citadel clearly performed well because he was retained at the firm for more than ten years, before leaving to join Balyasny as Head of Equities. His trajectory reflects the overall growth in the multi-manager space. Citadel now runs $61.0 billion of capital, and Millennium – the other big player in the field – manages $59.3 billion. Point72 Asset Management is number three with $30.6 billion and Balyasny is fourth, with $19.5 billion. Millennium itself has over 300 distinct investment teams operating within its walls. Pod inflation has increased the number of teams looking at financial stocks from one at Citadel 20 years ago to eight or nine at Millennium today in London alone.

Because of leverage, the footprint these firms leave in markets is even greater than their assets under management suggest. In aggregate, the four largest firms had over $1 trillion of exposure at the end of March, according to regulatory filings. The forty or so firms that operate the multi-manager model may command only 8% of hedge fund assets but, according to Goldman Sachs, they account for 27% of the holdings of US equities (up from 14% in 2014). This makes them “one of the largest gravitational forces in markets,” according to investment professional Patrick O’Shaughnessy – and therefore worth understanding. So far, the model has worked extremely well. Citadel is ranked the most profitable hedge fund firm of all time (defined by the cumulative net gains it has produced for clients since inception) and Millennium has generated an average calendar-year return of 14% for the past 33 years, with only one loss year in 2008.¹ But the question Bobby Jain will no doubt get on his roadshow of potential investors is whether the growth of the platform model – and more specifically the alpha it is able to capture – can be sustained. Ken Griffin thinks not. “The stories of markets are always stories of cycles and strategies that come and go in terms of popularity,” he said in a recent interview. “Clearly right now the multi-strategy managers are very much in vogue. When you’re most popular is probably when you’re reaching the top of the cycle.” To understand more about the multi-manager fund model and how the cycle may play out, read on. Subscribe to Net Interest to read the rest.Become a paying subscriber of Net Interest to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Five Families

Friday, September 8, 2023

Inside the Brokerage Industry

Rising Beta

Friday, August 25, 2023

Plus: Beal Bank, Sculptor

LTCM: 25 Years On

Friday, August 18, 2023

The (real) reasons Long-Term Capital Management failed

The End of an Experiment

Friday, July 28, 2023

The Public Life of a Hedge Fund

The Parable of Angelo Mozilo

Friday, July 21, 2023

Plus! The Quarter After the Quarter Before: US Bank Earnings

You Might Also Like

Economic Lessons from the Last Few Singularities

Monday, December 23, 2024

Plus! Conflicts and Confluence; Bonds; Empire Building; China; The Capital and Talent Cycle Economic Lessons from the Last Few Singularities By Byrne Hobart • 23 Dec 2024 View in browser View in

Don't Miss This NYSE IPO Opportunity

Monday, December 23, 2024

Urgent: Unique IPO Opportunity in a Multi-Billion Dollar Industry ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Look what this top trader shared on Fox Business

Sunday, December 22, 2024

Get your copy today ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Longreads + Open Thread

Saturday, December 21, 2024

Inflation, AI, Linkrot, Data, Research, Pod Shops, Life Advice, Nvidia Longreads + Open Thread By Byrne Hobart • 21 Dec 2024 View in browser View in browser This issue of The Diff is brought to you by

Post-Election Market Warning: Here's what's next...

Saturday, December 21, 2024

Urgent warning issued... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⭕️ A tech play with a nice ring to it

Friday, December 20, 2024

Finimize TOGETHER WITH Hi Reader, here's what you need to know for December 21st in 3:07 minutes. Novo Nordisk shares slimmed way down as investors felt disappointed by the firm's latest

Imagine finally becoming a homeowner

Friday, December 20, 2024

Find the mortgage lender that fits your needs and wants ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Check, Please

Friday, December 20, 2024

The Business of Restaurant Payments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Market Rally Indicator Just Turned Green

Friday, December 20, 2024

Free Stock Ticker Inside ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚔️ Google's AI competition

Thursday, December 19, 2024

Perplexity tripled in value, the greenback hit a two-year high, and your holiday party playlist | Finimize TOGETHER WITH Hi Reader, here's what you need to know for December 19th in 3:02 minutes.