These insurers are screwing the public on climate change

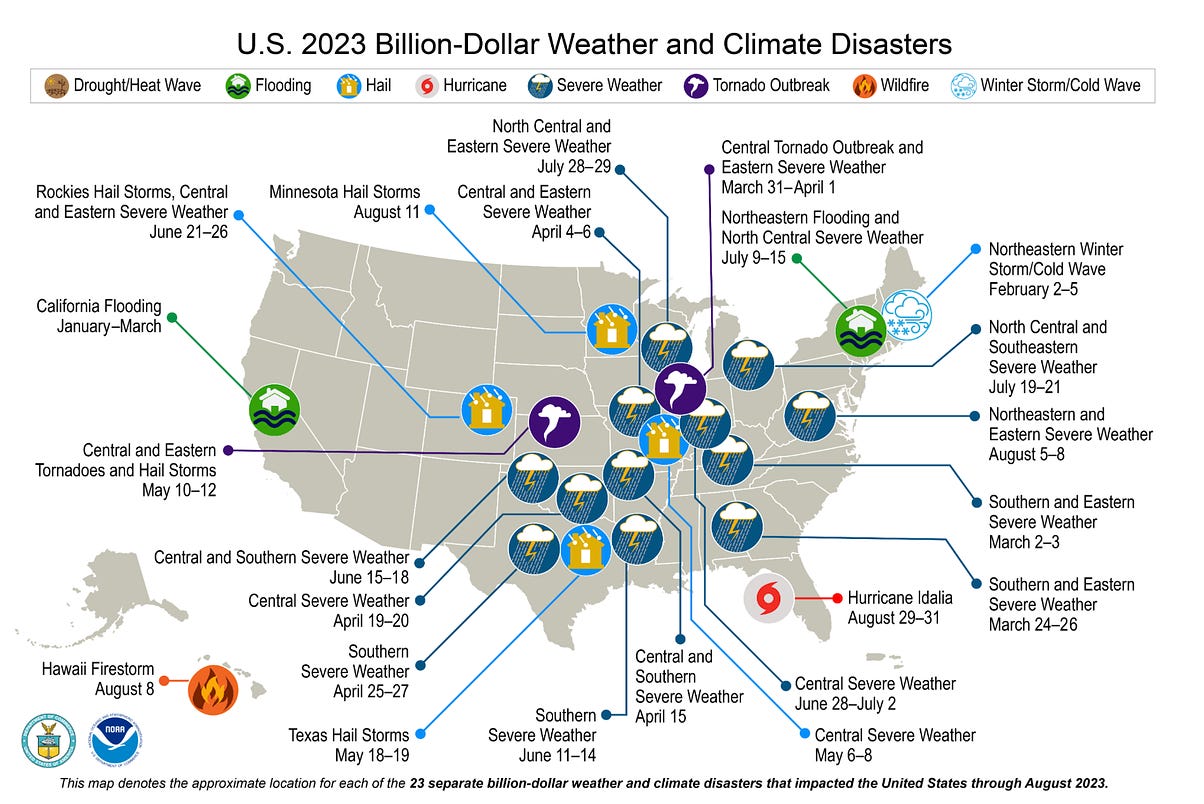

Welcome back to HEATED—Arielle here. Emily has gone back to D.C., leaving me all alone in uninsured California (more on that below). These insurers are screwing the public on climate changeWhile major U.S. insurers drop coverage for people vulnerable to climate change, they're also investing billions in the companies that fuel it.Here’s something everyone needs to understand about climate change: In addition to being an existential threat to life on Earth, it also costs a lot of money. Already this year, the U.S. has seen more climate disasters costing over $1 billion than ever before. The National Oceanic and Atmospheric Administration announced on Monday that the U.S. has already seen a record-breaking 23 weather disasters costing more than $1 billion in 2023, with a total cost of $57.6 billion so far.

The cost of these disasters has always fallen on individuals. But right now, we pay using a system designed to spread out those costs among the population. We pay taxes to local, state and federal governments, for example, which are then charged with covering much of the recovery cost. Those of us who own property also also pay premiums to insurance companies, which are then charged with covering some of the cost of rebuilding. After this year’s extreme weather, however, some U.S. insurance companies no longer want to fully participate in this system. As the Washington Post reported earlier this month, “At least five large U.S. property insurers have told regulators that extreme weather patterns caused by climate change have led them to stop writing coverages in some regions, exclude protections from various weather events and raise monthly premiums.”

One could argue that these companies are acting responsibly. Clearly, these insurers understand the risks of climate change, and understand that it’s not financially viable to insure properties in climate-vulnerable areas. But here’s our question: If these insurance companies truly understand climate risk—and if they are truly acting responsibly—why are they still underwriting and investing in fossil fuel projects, and supporting the expansion of fossil fuel production around the world? Passing the costs of climate change down to consumersInsurance companies may claim to be acting responsibly by pulling coverage for climate-vulnerable areas. But these same insurance companies are a major part of the reason these areas are so climate-vulnerable in the first place. In 2019 alone, the U.S. insurance industry invested $582 billion in oil, gas, coal, utilities, and other fossil fuel-related activities, according to a S&P Global report. That’s a slight increase from the $519 billion fossil-fuel investments in 2018. The combined trillion comes from customer payments, because insurance companies don’t just sit on our premiums—they reinvest them to turn a profit. And that staggering sum isn’t the only way insurance companies profit from the fossil fuel industry. They also underwrite fossil fuel projects, making it possible for them to exist in the first place. Coal mines, oil drilling, gas fields, tar sands, and more all need insurance coverage before investors and banks will consider financing their projects. Though insurance companies usually hide which fossil fuel projects they underwrite, some public records requests have revealed at least one. In June, watchdog nonprofit Public Citizen obtained records revealing that AIG, Liberty Mutual, and others issued insurance policies in April to a methane gas terminal in Freeport, Texas. That same facility exploded last year, releasing tons of toxic pollution into the air of surrounding communities.

“Fossil fuel companies cannot operate without insurance, which means insurers are critical gatekeepers of climate chaos,” said nonprofit consumer advocacy group Public Citizen, in a statement. Insurance companies don’t have to insure new fossil fuel projects; and indeed, some don’t. More than one-third of insurers globally have stopped investing in new coal projects, according to climate nonprofit Insure Our Future Campaign. AIG and Travelers in the US, as well as a few smaller insurers, have joined the ranks of insurers who no longer support coal. But overall, Americans lag well behind their international peers in divesting from fossil fuel projects. British insurer Aviva has significantly restricted its coverage of new oil and gas projects, followed by French insurer AXA, German Allianz, and Swiss reinsurer Swiss Re. In contrast, “not a single U.S. insurer has ruled out support for oil and gas expansion projects,” according to Insure Our Future’s 2022 Scorecard. The obvious reason U.S. insurers have not ruled out supporting new fossil fuel projects is because they are profitable in the short-term. But now, the consequences of those projects are coming home to roost. Natural disasters cost U.S. insurers $101.3 billion last year, including $50 billion in damages from Hurricane Ian. This year, the extreme weather has already cost insurance companies $40 billion, the third-highest amount of losses on record. The wildfires in Lahaina, Hawaii alone are estimated to cost between $4 to 6 billion, according to catastrophe risk modeling firm Moody’s. At least 75 percent of those costs are expected to be covered by insurance. But instead of cutting the problem off at the source, insurers have decided to pass the long-term cost of disasters down to consumers. Here are some of the worst offenders. State Farm: $30B in fossil fuels while dropping coverage for climate vulnerableState Farm pledges to a good neighbor, but it’s the number one industry investor in fossil fuels, according to the most recent data. In 2019 alone, State Farm invested $30 billion in coal, oil, gas, and other fossil fuel projects. The company has made no promises to stop supporting fossil fuels—in fact, State Farm shares lobbyists with a bevy of oil and gas companies like ExxonMobil, according to a Guardian report. That investment strategy is backfiring as climate disasters become too expensive for the nation’s largest home insurer. In May, State Farm stopped insuring new California homeowners because of “rapidly growing catastrophe exposure.” At the same time, it requested a 28 percent rate increase from the California Department of Insurance. That doesn’t stop the company from making various climate pledges on its sustainability website, including a 50 percent reduction in greenhouse gas emissions by 2030. “Our efforts to…lessen our carbon footprint is just another example of State Farm’s pledge to be a good neighbor,” said Jenny Greminger, vice president of public affairs. So if State Farm is concerned enough about the climate crisis to reassess its disaster coverage, why isn’t it reassessing its fossil fuel investments, too? State Farm did not respond to HEATED’s request for comment. American International Group: $24.2B in fossil fuels while dropping coverage for climate vulnerableAs of last year, AIG is one of the only insurers in the U.S. to stop insuring or investing in new coal projects. The company also publicly acknowledges that “climate change poses a major and unprecedented threat to human health.” That concern for climate is driven by profit losses—AIG lost around $450 million due to Hurricane Ian last year. But AIG is still also one of the world’s largest investors in fossil fuels—and has the highest percentage of its assets in fossil fuels. The company invested $24.2 billion in fossil fuels in 2019, according to records from the California Department of Insurance. The company also continues to underwrite oil and gas projects, including the Freeport LNG terminal in Texas and the Ichthys LNG project in Australia. That coverage paid off in a modest profit in 2021: AIG made up to $675 million in premiums for covering the fossil fuel industry, according to Public Citizen and consulting firm Insuramore. But those profits weren’t enough to offset their losses—last year, AIG stopped covering new California homeowners because of wildfire costs. This spring, AIG limited homeowners insurance in 200 disaster-prone zip codes, including in New York and Florida. So why is AIG still investing so much in fossil fuels, despite acknowledging the losses from climate change? An AIG spokesperson declined to comment. Allstate: $7B in fossil fuels while dropping coverage for climate vulnerableThe Illinois-based company committed last year to net zero emissions by 2030, and a net zero investment portfolio by the end of 2025. Allstate also said it committed $469 million from 2021 to 2022 in “climate-related opportunities”. That climate support looks small compared to Allstate’s $7 billion fossil fuel investments in 2019. And while it’s pledged to reach a net zero investment portfolio in two years, Allstate hasn’t pledged to stop insuring new fossil fuel projects. CEO Tom Wilson has been one of the more outspoken industry leaders on climate change. Wilson previously called for the Biden administration to create a federal program to cover climate costs. “You really need disaster protection because if the weather keeps getting worse, the private market for those really big events is going to be too expensive,” he told Reuters in 2020. This year, Wilson made good on his prediction when Allstate decided to drop coverage for new homeowners in California. At the same time, Allstate requested a nearly 40 percent rate increase from the California Department of Insurance. Like State Farm, Allstate said the rising costs of wildfires were too much for their bottom line. But if climate change is such a problem for its bottom line, then why is Allstate investing in new fossil fuel projects? Allstate did not respond to HEATED’s request for comment. Further reading

Catch of the day: Joey and Nala think they’re sisters, says reader Andy, even though Joey is a golden retriever and Nala is a chocolate lab. We agree, because family’s where you find it. Sweet dreams, sisters. Want to see your furry (or non-furry!) friend in HEATED? Send a picture and some words to catchoftheday@heated.world. You're currently a free subscriber to HEATED. For the full experience, upgrade your subscription. |

Older messages

Why did this climate scientist chain herself to a pipeline?

Tuesday, September 12, 2023

Rose Abramoff is determined to stop fossil fuels from destroying a livable climate, no matter the personal cost.

What you won't hear at India's G20

Thursday, September 7, 2023

As they arrive in New Delhi, world leaders will be talking a big game on climate. They won't be talking about their crackdowns on climate protesters.

Al Gore's new TED talk is out

Tuesday, September 5, 2023

The former vice president's powerful presentation couldn't have come at a more crucial time.

Why climate denial could still be taught at Texas schools

Tuesday, August 29, 2023

PragerU doesn't need official approval to spread climate denial in public schools, a Texas State Teachers Association representative tells HEATED.

How Vivek Ramaswamy makes money from climate denial

Tuesday, August 29, 2023

At Wednesday's debate, Ramaswamy said he was the "only candidate who's not bought and paid for." That couldn't be further from the truth.

You Might Also Like

Kendall Jenner's Sheer Oscars After-Party Gown Stole The Night

Tuesday, March 4, 2025

A perfect risqué fashion moment. The Zoe Report Daily The Zoe Report 3.3.2025 Now that award show season has come to an end, it's time to look back at the red carpet trends, especially from last

The FDA Just Issued a Recall on a Supplement — Because it Contains an ED Drug

Monday, March 3, 2025

View in Browser Men's Health SHOP MVP EXCLUSIVES SUBSCRIBE The FDA Just Issued a Recall on a Supplement — Because It Contains an ED Drug The FDA Just Issued a Recall on a Supplement — Because It

10 Ways You're Damaging Your House Without Realizing It

Monday, March 3, 2025

Lenovo Is Showing off Quirky Laptop Prototypes. Don't cause trouble for yourself. Not displaying correctly? View this newsletter online. TODAY'S FEATURED STORY 10 Ways You're Damaging Your

There Is Only One Aimee Lou Wood

Monday, March 3, 2025

Today in style, self, culture, and power. The Cut March 3, 2025 ENCOUNTER There Is Only One Aimee Lou Wood A Sex Education fan favorite, she's now breaking into Hollywood on The White Lotus. Get

Kylie's Bedazzled Bra, Doja Cat's Diamond Naked Dress, & Other Oscars Looks

Monday, March 3, 2025

Plus, meet the women choosing petty revenge, your daily horoscope, and more. Mar. 3, 2025 Bustle Daily Rise Above? These Proudly Petty Women Would Rather Fight Back PAYBACK Rise Above? These Proudly

The World’s 50 Best Restaurants is launching a new list

Monday, March 3, 2025

A gunman opened fire into an NYC bar

Solidarity Or Generational Theft?

Monday, March 3, 2025

How should housing folks think about helping seniors stay in their communities? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Banality of Elon Musk

Monday, March 3, 2025

Or, the world we get when we reward thoughtlessness ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

“In life I’m no longer capable of love,” by Diane Seuss

Monday, March 3, 2025

of that old feeling of being / in love, such a rusty / feeling, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Your dishwasher isn’t a magician

Monday, March 3, 2025

— Check out what we Skimm'd for you today March 3, 2025 Subscribe Read in browser Together with brad's deals But first: 10 Amazon Prime benefits you may not know about Update location or View