The Generalist - Generalist Capital: New Epics

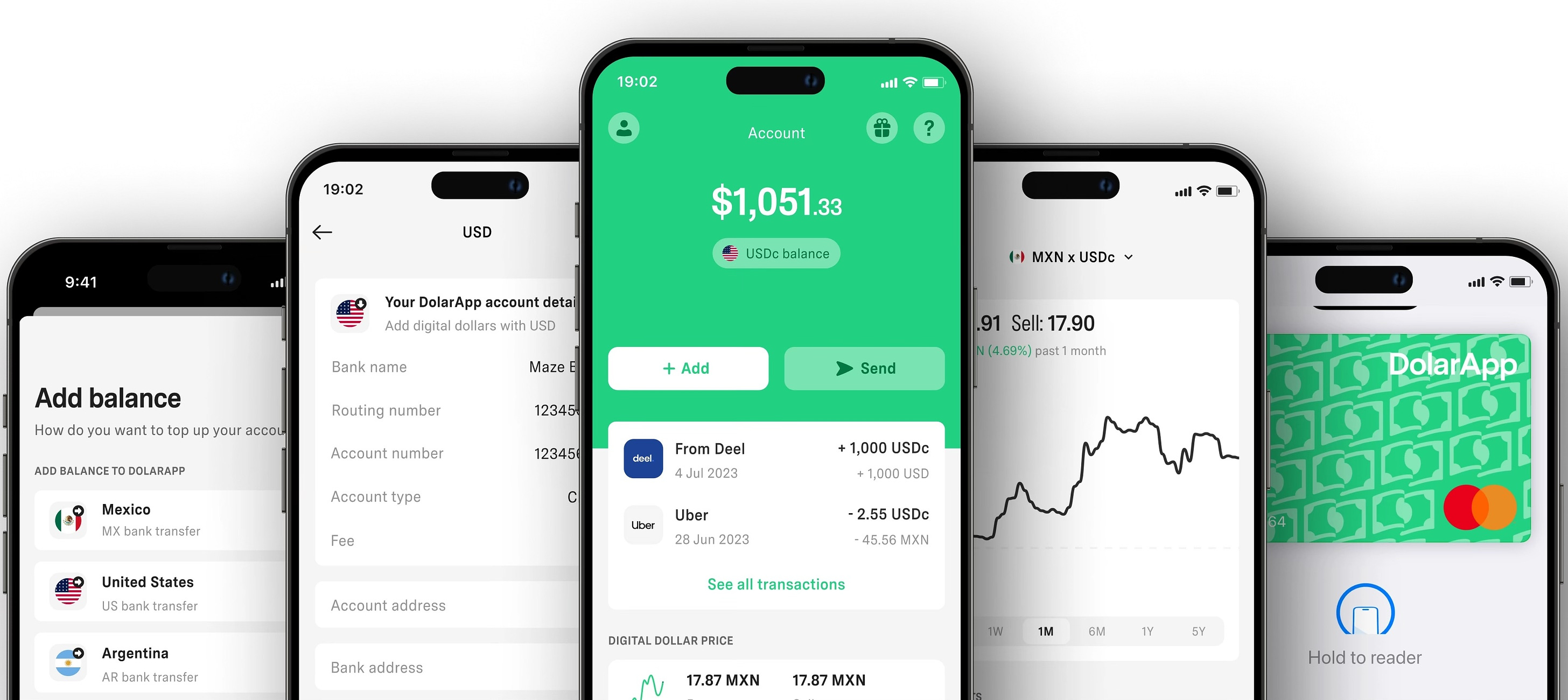

Generalist Capital: New EpicsWe’ve backed ten startups building at the frontier in the two years since founding Generalist Capital. Here’s who we’ve invested in and why we’re excited.Friends, The Generalist’s mission is to act as a translator for innovation. Progress is messy, and the frontier is almost always blurred by a shimmering veil. Our work is driven by a desire to deeply understand the players, organizations, patterns, and technology pushing our world forward. By doing so, we hope to raise the standard of conversation around these topics, lay the groundwork for better ideas, and bring forward more people to chip away at the Tunnel of Knowledge’s far edge. One of the core theses of our approach is that to fulfill that mission, you have to be a player in the game yourself. While you can learn much from watching and listening to great entrepreneurs and technologists, there is no substitute for being a tangible part of their story. This was one of the motivations behind launching Generalist Capital in 2022. (Another motivation? I thought it would be really fun.) Nearly two years after Generalist Capital received its first LP investment, I can say that belief has been borne out. As well as being even more fun than I’d hoped, Generalist Capital has been a vehicle to understand innovation from a different, deeper vantage. It has introduced me to promising technologies earlier, helped me better understand the intensity of building a high-growth startup, and provided a different vantage from which to observe market dynamics and its participants. It is one thing to interview a VC or CEO and another to co-invest alongside them and think through new challenges together. As Sapiens author Yuval Noah Harari has noted, every company is a kind of fiction. They are a collection of people united by the promise of a narrative, a story about themselves, the market they operate in, and the world of the future that they are helping to make. Startups are particularly this way. In the early days there is nothing but the story – expressed through a pitch deck, memo, or sketch on the back of the napkin. It is only through time and contact with the market that startups take on greater and greater realism – though there is always a part of them that remains in the narrative realm. Because of our work at The Generalist, I can’t help but think of the ten companies we have invested in as stories. All of them have characteristics in common. They are stories of ambition, intelligence, and slim odds; tales of zealotry and apostasy, of unreasonableness and the dividends of unreasonableness; they tell of persistent struggle, unlikely victory, and the desire to build something bigger than oneself. Yet, they are very different, too, each with their own protagonists and enemies, each facing and manifesting a particular view of the world to come. In today’s piece, we’re sharing nine stories – one is not yet ready to be told. I hope they provide a glimpse into intriguing markets, entrepreneurs, and the improvements they are looking to bring to our lives. A small ask: If you liked this piece, I’d be grateful if you’d consider tapping the ❤️ above! It helps us understand which pieces you like best and supports our growth. Thank you! Brought to you by IntercomAt Intercom, we believe that customer service is in need of radical change. We also believe that we are that change. Intercom is a complete, AI and human customer service platform—and the only platform to combine a help desk, AI chatbot, and proactive support tools. Our platform also comes equipped with a fully featured inbox, ticketing, a help center, and a messenger, making it not only complete—but also the most powerful support platform. On the planet. We've got every single tool you need, all in one place, enhanced with AI. So you can give every single customer the fastest, most personalized experience imaginable. See what we’re up to at intercom.com DolarAppA stable, borderless bankI first discovered DolarApp in a news article and was immediately intrigued by its pragmatic use of crypto to solve an acute real-world problem. It is deeply unfair that residents of countries with unstable economies see their earning power impacted through no fault of their own. Over the past decade, Argentina has experienced six recessions. It ended 2023 with 211% of inflation, 25.5% of which arrived in December alone. As a citizen of Buenos Aires or Rosario, what are you supposed to do? Every day, the money you earn is worth less and less; the pesos you have saved continue to leak value. DolarApp offers a solution using stablecoins and crypto infrastructure. Founders Fernando Terrés, Zach Garman, and Álvaro Correa have built a borderless neobank that makes it easy for users to convert their local currency into dollar-pegged stablecoins, preserving the value of the money they earn. By joining DolarApp, consumers in Argentina, Mexico, and Colombia can save, spend, and send money without worrying about domestic inflation, brutal exchange rates, or high cross-border payment fees. While DolarApp is currently operating in those three Latin American countries, its market opportunity extends much further. People around the world face the same kinds of problems as Argentinians and have few good solutions. On paper, this also looked like an ideal team to solve this problem, with all three founders hailing from fellow neobank Revolut. But it was in meeting CEO Fernando that I got most excited about DolarApp. Within a few minutes, it became clear that this was a founder with extremely crisp thinking, unmistakable ferocity, and a forward propulsion that I could feel through the screen. In the fifteen months since Generalist Capital’s investment, I’ve seen those traits in much greater fidelity and witnessed how deep they go. DolarApp is currently on a breakout trajectory, processing more than $500 million on an annualized basis and growing 10x year-over-year. It’s expanded from Mexico to Argentina to Colombia, with more to come. Its growth is a testament to the demand for this kind of solution and the care DolarApp’s founders put into building a high-leverage culture. Today, DolarApp’s team is still only about twenty people. FoundryMaximizing our species’ most valuable resourceComputing power is quickly becoming the world’s most valuable resource, eclipsing human labor. An interesting indication of this point arrived last year when venture capitalist Steve Jurvetson remarked that Google was now spending more on computing than people, based on private conversations with former employees and leadership candidates. While firmer data is needed to corroborate Jurvetson’s claim, there is no doubting the direction of travel. As AI has taken off, computing power is increasingly becoming our most important asset. It is the key that unlocks scalable, ever-improving intelligence and boundless productivity. So, how do we make the best use of it? Foundry is driven to help civilization maximize its most precious resource. Jared Quincy Davis and his team have built a cloud for AI that is easy to set up, simple to adjust, safe, and cost-efficient. That offering has grown at a breakneck pace since it launched, with Foundry orchestrating computing power for Fortune 1000s, leading research institutions, and AI startups. The company’s traction is thanks to the high talent density of its team and novel technical approach – one that Jared first began devising as a PhD in Computer Science at Stanford and as a research scientist at DeepMind. As that background suggests, Jared has remarkable intelligence and domain expertise. Unusually, Foundry’s CEO also has impressive commercial bonafides, having worked at KKR, BCG, and Khosla Ventures. It’s rare to find this combination of extremely high-level technical acumen and business nous in a single package. In my conversations with Jared, he possesses extreme grit and determination. I am far from the only one to recognize these traits; there’s a reason why Foundry’s angels and advisors include Eric Schmidt, David Velez, and Jeff Dean. Level up your investing IQ for $22 per monthJoin our premium newsletter, Generalist+ to raise your investing game in 2024. By becoming a member, you’ll unlock access to exclusive interviews with legendary venture capitalists and leading founders. NG CashBanking Brazil’s next generation (and beyond)Though only 26 years old, Mario Augusto Sá is already a serial entrepreneur. Over a decade ago, he and his friends founded Neagle, a YouTube channel that has since become one of the most popular in his native Brazil, with approximately 12 million followers. As an undergraduate, he convinced his college professor to team up and build Trampolin. That banking-as-a-service platform was acquired by Stone, a Nasdaq-listed financial company, in 2021. NG Cash is Mario’s third major entrepreneurial endeavor – one that neatly builds on his previous experience. NG Cash is a neobank geared towards Brazil’s underserved teenagers. It’s a demographic Mario knows well from his time as a creator and a market he understands from building Trampolin. NG Cash offers a digital bank account, prepaid cards, and easy peer-to-peer payments for Brazil’s Gen Z. It also provides educational content to help this younger generation improve their financial literacy. That combination has helped NG Cash quickly become the leading financial product in its market. Last year was a breakout one for the company, with NG Cash growing its core metrics 10x. It reached 650K accounts, hit an annualized volume of $175 million, and became the 30th most popular financial app in Brazil’s app stores. Critically, NG Cash has acquired customers economically thanks to its partnerships with Neagle and other creators and its deep understanding of Gen Z culture. Because of that, NG Cash feels like a young, vibrant consumer brand. NG Cash’s next goal is to hit 1 million active users. Mario is a special entrepreneur with an extremely high ceiling and a unique understanding of his market. Efficient Capital LabsA venture-alternative for global companiesOver the past few years, “revenue-based financing” (RBF) has emerged as a viable venture capital alternative. Rather than selling equity to finance their growth, many companies rely on RBF providers. These companies provide debt based on their customers’ revenue. As clients recognize expected revenue, RBF providers are paid back with interest. The result is a win/win: companies get growth financing without dilution, and RBF providers earn money on the loan provided. Few people understand the world of fintech lending better than Kaustav Das. After 14 years at American Express, Kaustav served as the Chief Risk Officer at three venture-backed startups: Kabbage, Petal, and QuadPay. Through those experiences, Kaustav learned the intricacies of underwriting high-growth startups, as well as the pitfalls. Kaustav brings that experience to Efficient Capital Labs (ECL), an RBF provider with a distinctive value proposition. While most existing RBF offerings underwrite companies based on their domestic books, ECL analyzes a firm’s entire global operations. Kaustav believes you can’t properly assess a company’s risk profile just by looking at their US numbers, for example. You also need to account for their divisions overseas. Only by doing this can you provide the best possible rate and offer profitable loans. So far, that innovation is bearing fruit. In the past year, ECL has originated $30 million in loans with $0 in losses. The company has scaled key metrics 12x year-over-year and is seeing a repeat rate of more than 70%, indicating that its customers see strong value in its offering. It’s done this while offering RBF to companies with operations spanning 15 countries and counting. ECL has found particular traction in markets with less mature venture capital ecosystems, such as India. RBF can be a tricky game to play. If you don’t have your underwriting dialed in, it’s easy to produce artificial traction: handing out low-cost money but never getting it back. What’s exciting about ECL is that it seems particularly strong at this potential weak point. It has a CEO with a robust risk background and an innovative approach to underwriting. If it can scale its operations while maintaining its exemplary record, it has the potential to become a new standard in lending for global companies. ConfigAccelerating the construction of hard thingsThere’s a saying in startup circles, “Hardware is hard.” While software engineers can ship a product and gradually refine it, fixing bugs and improving subpar features, their hardware counterparts have no such latitude. Whatever you ship is irremediable until you release a new version. James Proud experienced the rewards and difficulties of shipping a hardware product as the CEO of Hello, the maker of “Sense,” a contactless sleep and ambient environment sensor. It was a formative experience. Hello raised over $40 million and was sold in stores like Target and Best Buy. But it was still a struggle, influenced, in part, by the lack of software tooling for hardware makers like Hello. Keeping track of the development lifecycle required a string of disconnected, general-purpose tools. Ultimately, Hello shuttered in 2017. James’ new company, Config, solves many of the problems that made building a hardware startup so hard. Config makes managing the hardware development lifecycle easy, consolidating design management, vendor communication, internal collaboration, and tracking materials in one elegant platform. Instead of jumping between spreadsheets, docs, and crufty legacy tools, companies like Mill and Humane (both early customers) can streamline development with Config. Critically, James’ company also integrates with existing CAD software – meaning that hardware teams don’t have to ditch the parts of their workflow that work well. As we’ve written about elsewhere in The Generalist, I believe the AI boom will breathe fresh life into the world of hardware. We’re seeing the early signs of this through consumer products like Humane, Rabbit, Tab, and Rewind, and I expect we’ll see many more. Though less likely to garner mainstream attention, similar generativeness will also hit enterprise hardware. In time, I expect Config will be the solution of choice for existing hardware giants, but in the interim, it has a chance of becoming the natural platform for this cohort of insurgents. These hardware innovators expect best-in-class software tooling: Config provides it. Beyond the compelling market dynamics, James is an entrepreneur I’m excited to work with and learn from. He has deep technical ability, missionary zeal, and a seriousness that immediately makes it clear that he will not be easily deterred. PrivyOnboarding the next billion users to cryptoCrypto consumer experiences are among the least user-friendly in the world. They involve long strings of letters and numbers, secret passphrases, something called “wallets,” and impossible-to-decipher transactions that might – if you’re not careful – siphon your entire balance. Unless you’re extremely motivated, any one of these impediments is enough to deter you from trying out the newest crypto experience. Even as someone who has spent a long time using crypto apps, I find myself mentally gearing up when trying out a new one or logging into an account I haven’t used in a while. If crypto is going to become an enduring global movement with broad utility, it needs to fix this onboarding and usability problem. Privy is building the solution. Founders Henri Stern and Asta Li have built an elegant infrastructure product that makes it easy for web3 builders to add intuitive authentication flows and embedded wallets to their apps. Once up and running with Privy, a crypto project can onboard users via their email addresses, social accounts, or wallets. Privy’s embedded wallets make it easy for novices to receive and interact with crypto assets for the first time. In the long run, Privy plans to create a range of products that help users take greater control over their online privacy. Though we overlapped at college and have mutual friends, I only got to know Henri shortly after he founded Privy. I was struck by his seemingly effortless intelligence, deep cryptographic knowledge, charisma, and quiet intensity. He is so amiable that it can be easy to miss this last point, but once you see it, you will not unsee it. Henri is someone who wants to win. He is also extremely pragmatic about the crypto industry. Despite previously working as a research scientist at Protocol Labs and studying under industry experts like Dan Boneh, Henri is the furthest thing from a “degen.” Perhaps because of his understanding of the core technology, he is thoughtful about the industry’s promise and challenges. That circumspection has allowed Privy to navigate the crypto winter and emerge stronger for it. In the last thirteen months, Privy has scaled from 0 users onboarded to 1.96 million. It has onboarded big crypto brands like OpenSea, Zora, Blackbird, Friendtech, and Courtyard, helping users from over 150 countries transact millions of dollars. Powerful tailwinds position Privy well for the coming years. Ethereum’s shift to a proof-of-stake model has opened up faster and lower-cost transactions – necessary for scaling crypto consumer applications. If that does happen (we are seeing early signs already), infrastructure like Privy will only become more essential. t2Power to the creatorsToward the end of 2021, I sensed movement in the social media category. A few different factors suggested that a challenging category might be becoming more hospitable to newcomers: bone-deep consumer exhaustion with existing solutions, effervescence around the “metaverse” as a next-generation alternative, engagement with “social tokens,” more creator-friendly platforms like Substack, and signs of weakness among the old guard. I wrote about these shifts in 2022 and 2023 with a haziness that revealed I wasn’t sure where this market was headed next. Truthfully, I still don’t. It feels like we are in the early stages of a potential shift that could take some time to play out. Even the decline of X (formerly Twitter) – and the many ankle-biters that have arisen to lay claim to its throne – has not clarified social media’s future. T2 represents one of the most audacious, original, and humane visions of the future of online connection. Founded in 2021 by former architect Mengyao Han, t2 is a full-stack reimagining of social media. Instead of short, snappy, polarizing posts, it encourages its community to write, read, and think deeply. Because t2 is built on the blockchain, users own all of their contributions – and can be rewarded via token economies that incentivize participation, moderation, and reading. The result is a combination of Reddit x Substack x Mirror – but that feels wholly distinct. Though it’s still early days, t2 is seeing encouraging signs of early product-market fit among its initial base, with its user base growing 45% month-over-month. Mengyao’s team has partnered with Lens Protocol, a decentralized social graph by the Aave team, serving as a de facto publishing home for this community. Social media has played an oversized role in our lives over the past decade and a half. It has influenced how we communicate, learn, think, and see the world. Often, its influence has been for worse rather than better. We need more ambitious, original thinkers to experiment at this frontier – qualities Mengyao and her team possess in abundance. BreezeCrypto’s answer to American ExpressMillie Yang and Peng Du are trying to solve one of crypto’s most intractable problems: how to spend it. If you’re a crypto holder today and want to use it as a currency to make a purchase, your options are limited. In all likelihood, you’ll have to send tokens from your wallet to an exchange like Coinbase, trade them for fiat-like dollars, and cash out to a traditional bank account like Chase. Depending on your bank, the whole process can take days. The tediousness of the “off-ramping” process limits the utility of crypto, making it unusable for most purchases. Breeze is looking to fix this issue for both consumers and enterprises. Above all, Millie and Peng – who met while working as engineers at Stripe – want to build the systems necessary to make crypto a functional means of exchange. Today, that entails back-end infrastructure that makes it easier for vendors to accept and process crypto payments. Breeze also expects to roll out consumer-facing solutions, potentially spanning rewards and points. If all goes well, Breeze could look like crypto’s answer to American Express in a few years: a reliable payment method bolstered by unique perks. Though that’s undoubtedly an ambitious goal, the contours and some promising early traction are there. As well as having strong expertise in payment primitives, one of the main attractions of the Breeze team is its pragmatism. Millie and Peng have closely assessed various crypto payment opportunities, successfully avoiding attractive mirages and money-sucks. They’ve landed on a thoughtful, high-potential approach that plays to their fundamental strengths and recognizes market realities. VantaKeeping the internet safeLong-time readers of The Generalist will know I love Vanta. We’ve written not one but two case studies about the company (the latter in which we shared that we had invested). I continue to admire what CEO Christina Cacioppo and her team are building. Fundamentally, Christina has created a new, important category that helps make the internet safer. In simple terms, Vanta helps companies demonstrate their security bonafides. That involves streamlining SOC 2 certification (and dozens of other frameworks), automating security reviews, and showcasing their security information in real time. Vanta’s product suite isn’t only essential in helping companies win new customers (no one wants to work with a partner that can’t keep their data safe), it is tangibly catalyzing a safer internet with fewer leaks and breaches. The last year saw Vanta level up across dimensions. Most eye-catching, it hit $100 million in annual recurring revenue and nearly doubled its customer base to 7,000 companies. That includes large enterprises like Atlassian, Chili Piper, Flo Health, and Quora. I was especially excited to see Vanta grow its addressable market by internationalizing itself. It’s aggressively pursued growth in Europe and Australia, resulting in nearly 25% of its customers coming from outside the US. I’m excited to see this farsighted maneuver bear fruit in the years to come. By becoming the global standard, Vanta improves the service it can offer international companies and becomes the natural choice for newcomers in each domestic market. Vanta also strengthened its product and leadership team, bringing aboard a new Chief Product Officer, Chief Financial Officer, and Chief Information Security Officer. Product innovations have also come at quite a clip, with the company shipping more than 260 features, including major improvements like its Trust Center functionality. Christina Cacioppo is one of the most impressive founders I’ve met through my work at The Generalist, blending extremely high IQ, strategic acumen, and emotional intelligence. She seems to have the rare ability to think at a high level, get into the weeds on any part of her business, and possess a frighteningly fast learning rate. I think Vanta has a shot at being a generational company led by a CEO compounding as quickly as her business. PuzzlerRespond to this email for a hint.

Well played to Michael O, Sabrina F, Krishna N, Scott M, Sheridan J, Victor de A, and Vasudha B for correctly answering our last Puzzler:

The answer? Leaves! Until next time, Mario You're currently a free subscriber to The Generalist. For the full experience, upgrade your subscription. |

Older messages

CEOs on Their Least Popular But Most Impactful Decisions

Tuesday, January 23, 2024

Great leadership requires making tough choices.

Modern Meditations: Kirsten Green

Thursday, January 18, 2024

The Forerunner Ventures founder on vulnerability, patience, and human psychology.

Reid Hoffman on Signals and Mirages

Tuesday, January 16, 2024

And why the AI “oasis” may bear technology's sweetest fruit.

“The single most important thing you need to do as a CEO”

Tuesday, January 9, 2024

In this edition of The Braintrust, eight unicorn founders share the strategies they use to master new parts of their business.

The Year AI Gets a Better Body

Thursday, January 4, 2024

Sam Altman and Jony Ive are working on a new AI hardware device. The search for innovative form factors for the technology may be one of the most important stories of 2024.

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏