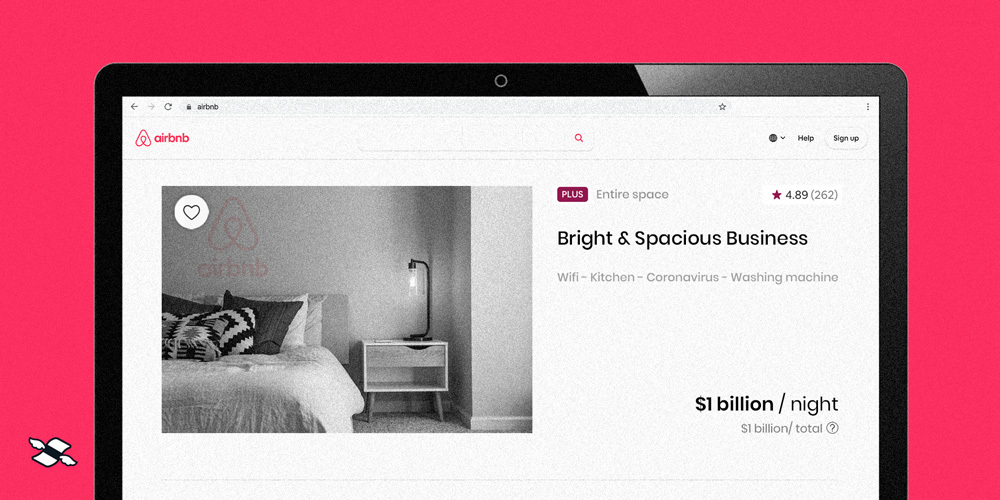

Finimize - 💰 Airbnb's 1 billion richer

|

|

|

|

|

|

|

|

|

|

|

|

Older messages

☠️ Dividends are doomed

Monday, April 6, 2020

| JPMorgan chimes in | Followed by Goldman Sachs | 🎧 Short on time? Listen to this brief SPONSORED BY Hi Newsletterest, here's what you need to know for April 7th in 3:13 minutes. 😇 In times of

📉 Stocks break records

Wednesday, April 1, 2020

| Not in a good way | British banks cut the cash | 🎧 Short on time? Listen to this brief SPONSORED BY Hi Newsletterest, here's what you need to know for April 2nd in 3:10 minutes. ☕️ Finimized over

You Might Also Like

Weathering the storm: the economic impact of floods and the role of adaptation

Friday, November 29, 2024

Rebecca Mari and Matteo Ficarra. Floods are the most costly natural disaster in Europe. In the UK, they account for around GBP1.4 billion in annual losses. Yet, evidence on the macroeconomic

$100 Off F.A.S.T Profits — Your Edge in the Markets!

Friday, November 29, 2024

You don't want to miss this ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦃 Chipmakers give thanks

Thursday, November 28, 2024

Potentially lighter tariffs was good news for chipmakers, France is down in the dumps, and an eternal flame | Finimize TOGETHER WITH Hi Reader, here's what you need to know for November 29th in 2:

John's Take 11-28-24 Puttin’ it on Plastic

Thursday, November 28, 2024

Puttin' it on Plastic by John Del Vecchio Thanksgiving is my favorite holiday each year, and fall is my favorite time of year. It's a good meal among loved ones and friends, and the Green Bay

Staying afloat: the impact of flooding on UK firms

Thursday, November 28, 2024

Benjamin Crampton, Rupert-Hu Gilman and Rebecca Mari. With climate change set to increase the frequency and intensity of flooding in the UK, it is important to deepen our understanding of the potential

🇺🇸 US inflation rose

Wednesday, November 27, 2024

US inflation sped up, German consumer confidence fell, and Champagne and turkey | Finimize Hi Reader, here's what you need to know for November 28th in 3:14 minutes. The US central bank's

Don’t think you can afford life insurance?

Wednesday, November 27, 2024

Term coverage is less expensive than you think ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What are you hiding Elon?? (Tesla’s secret 69% dividend)

Wednesday, November 27, 2024

It doesn't stop with Tesla... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Giving thanks for inflation, Paul Mescal and more

Wednesday, November 27, 2024

plus un-useless inventions + a weasel ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

💚 Holding space for career pivots

Wednesday, November 27, 2024

Including Ellevest financial planner Veronica Taylor's incredible story. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏