Popular Information - Corporate profit bonanza

A handful of billionaires are tightening their grip on the information ecosystem.

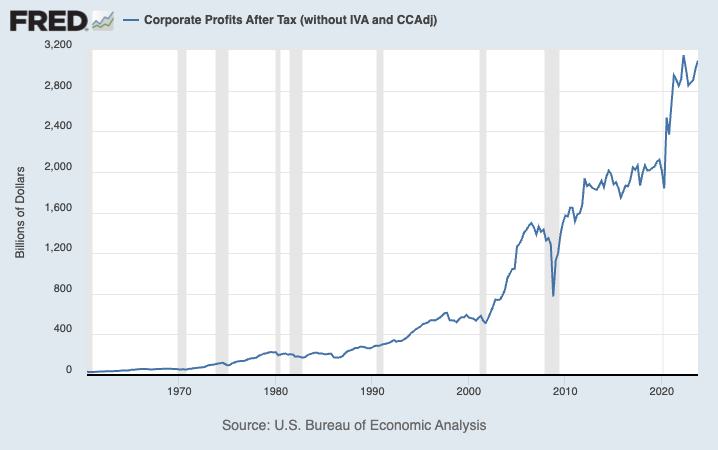

Popular Information takes on the powerful, and we've proven this approach can have a real impact. The billionaires consolidating their power are increasingly hostile to our work. That's why we need your help. Popular Information has 319,000 readers, but only a small percentage are paid subscribers. If more readers upgrade to paid, Popular Information can invest in alternative growth strategies, reach more people, and produce more groundbreaking accountability journalism. Support from readers like you keeps Popular Information paywall-free and available to everyone — whether or not they can afford to pay for news. So, if you can, please upgrade your subscription. It's $6 per month or $50 for a year. Thanks, Judd In the last three months of 2023, after-tax corporate profits reached an all-time high of $2.8 trillion. This is part of a long-term growth in corporate profits that began in the 1980s, picked up steam at the turn of the millennium, and exploded since 2020. Notably, the surge in corporate profits since 2020 has been fueled, in part, by expanding corporate profit margins. Last year, corporate profit margins (excluding the financial sector) were over 15%, a level not seen since the 1950s. This is because the increases in prices for goods and services have outpaced the increase in costs — both labor and non-labor — for corporations. According to an analysis from the Groundwork Collaborative, "corporate profits drove 53 percent of inflation during the second and third quarters of 2023 and more than one-third since the start of the pandemic." In the four decades prior to the pandemic, corporate profits contributed to just 11% of price increases. Theoretically, this should not happen. Corporations should not be able to dramatically increase their profit margins by increasing prices because competitors should step in with lower prices and steal market share. So what's going on? Greg Ip, who writes about economics for the Wall Street Journal, suggests that corporations are collectively taking advantage of consumer psychology. Supply shocks related to the pandemic created widespread cost increases that consumers accepted. Although those supply shocks have dissipated, many businesses have maintained higher prices anyway. "If people are paying $3 for a dozen eggs last week, they’ll pay $3 this week. And firms take advantage of that," Yale University economist Mike Sinkinson explained. This kind of informal collusion works best in concentrated industries. The Groundwork Collective highlights the diaper industry, where "Procter & Gamble Co. (P&G) and Kimberly-Clark Corp. control 70 percent of the domestic market." Since the onset of the pandemic, "[d]iaper prices have increased by more than 30 percent" — from $16.50 per package to nearly $21. This was initially driven by an increase in the price of wood pulp, a key input for diapers but also paper towels and toilet paper. But since January 2023, prices for wood pulp have declined by 25%. But P&G and Kimberly-Clark are not reducing diaper prices. Instead, they are bragging to investors about their massive profits. In July 2023, P&G "predicted $800 million in windfall profits because of declining input costs." In October 2023, Kimberly-Clark acknowledged that its input costs were coming down, but said that its products were still "priced appropriately." Similar dynamics are playing out in many other industries, including "new and used cars, groceries, and housing." How corporations are using their windfallIt's possible for corporate profits to be used productively to fuel innovation and growth. But that doesn't appear to be happening. Economist Christian Weller notes that corporations are using their record profits "mainly to pay dividends to their shareholders and building up their stockpiles of cash." Between December 2019 and December 2023, non-financial corporations used almost half of their pre-tax profits (48.9%) to pay dividends to investors. That is the highest share of corporate profits devoted to dividends since the 1950s. The same group of corporations now has $7.2 trillion in cash, up from $6.1 trillion in 2019, adjusted for inflation. Meanwhile, capital expenditures — which is a key way corporations invest in the future — are at historic lows relative to profits. The path forwardIn light of these record corporate profits, the government has a few choices. It could choose to raise corporate tax rates and use the funds to help people in need, such as children in poverty. In March, President Biden released a proposal that would raise the corporate tax rate from 21% to 28%. Biden’s proposal also includes raising the minimum tax for corporations with $1 billion in profits or more from 15% to 21%. The government could also choose to maintain the current corporate tax rate of 21 percent, which was established by the Trump Administration in 2017 in the Tax Cuts and Jobs Act. Trump wants voters to believe that if he is reelected, he will not prioritize corporate tax cuts. In January, Bloomberg reported that Trump plans to “keep[] corporate tax levels unchanged in an appeal to working and middle[-]class voters.” Stephen Moore, an economic advisor to Trump, told the Washington Post that Trump “said that he really wants to focus more on small businesses than corporations” and that “he’s fine with the corporate rate where it is.” The government could also choose to cut the corporate tax rate even further and facilitate even larger corporate profits. Trump has expressed interest in lower corporate tax rates, perhaps as low as 15%. Project 2025, a blueprint for Trump created by the Heritage Foundation and a large coalition of conservative groups, suggests cutting the corporate income tax rate to 18%. |

Older messages

UPDATE: New smear campaign puts first Muslim appellate nominee in jeopardy

Monday, April 1, 2024

Republicans first attempted to sink the nomination of Adeel Mangi, who would be the first Muslim American to serve on a federal appellate court, on allegations that he was an anti-semitic terrorist

These 50 companies have donated over $23 million to election deniers since January 6, 2021

Thursday, March 28, 2024

Donald Trump lost the 2020 election. Then, according to the report of the bipartisan January 6 Commission, Trump engaged in a "multi-part conspiracy to overturn the lawful results of the 2020

Let's chat

Wednesday, March 27, 2024

March has been a busy month for Popular Information. Here are a few highlights: Today, however, I want to hear from you. What's on your mind? Wh… ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Inside the squatting hysteria

Tuesday, March 26, 2024

On March 17, a provocateur named Leonel Moreno posted a video on TikTok where he purports to give instructions on how people can successfully "squat" in other people's houses. It was one

The secret to changing Trump's mind

Monday, March 25, 2024

On August 6, 2020, then-President Donald Trump issued an executive order "addressing the threat posed by TikTok," the popular social network run by ByteDance, a Chinese company. According to

You Might Also Like

Courts order Trump to pay USAID − will he listen?

Monday, March 10, 2025

+ a nation of homebodies

Redfin to be acquired by Rocket Companies in $1.75B deal

Monday, March 10, 2025

Breaking News from GeekWire GeekWire.com | View in browser Rocket Companies agreed to acquire Seattle-based Redfin in a $1.75 billion deal that will bring together the nation's largest mortgage

Musk Has Triggered A Corporate Deregulation Bomb

Monday, March 10, 2025

A Delaware bill would award Elon Musk $56 billion, shield corporate executives from liability, and strip away voting power from shareholders. Forward this email to others so they can sign up “

☕ Can’t stop, won’t stop

Monday, March 10, 2025

Why DeepSeek hasn't slowed Nvidia's roll. March 10, 2025 View Online | Sign Up Tech Brew Presented By Notion It's Monday. So much is happening all the time, so you'd be forgiven for

Trump's war on the First Amendment

Monday, March 10, 2025

Plus: Giant white houses everywhere, a woman in chains, and love. View this email in your browser March 10, 2025 Trump, in a navy suit and red tie, is seen from the shoulders up. His mouth is open in

Veterans Administration therapists forced to provide mental health counseling in open cubicles

Monday, March 10, 2025

As part of the Trump administration's frenzied push to end remote work arrangements for federal government workers, the Veterans Administration (VA) is forcing therapists to provide mental health

Armed Man Shot Near White House, Russian Spy Ring, and Jet Lightning

Monday, March 10, 2025

Secret Service agents shot and wounded an “armed man” a block from the White House shortly after midnight Sunday while President Trump was away for the weekend. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Numlock News: March 10, 2025 • Crater, Mickey 17, Hurricane

Monday, March 10, 2025

By Walt Hickey ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Open Thread 372

Monday, March 10, 2025

... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

☕ Spending spree

Monday, March 10, 2025

European markets are outpacing the US... March 10, 2025 View Online | Sign Up | Shop Morning Brew Presented By Tubi Good morning, and Happy Mario Day (MAR10). Traditional celebrations include: reckless