Aziz Sunderji - The Week in Review

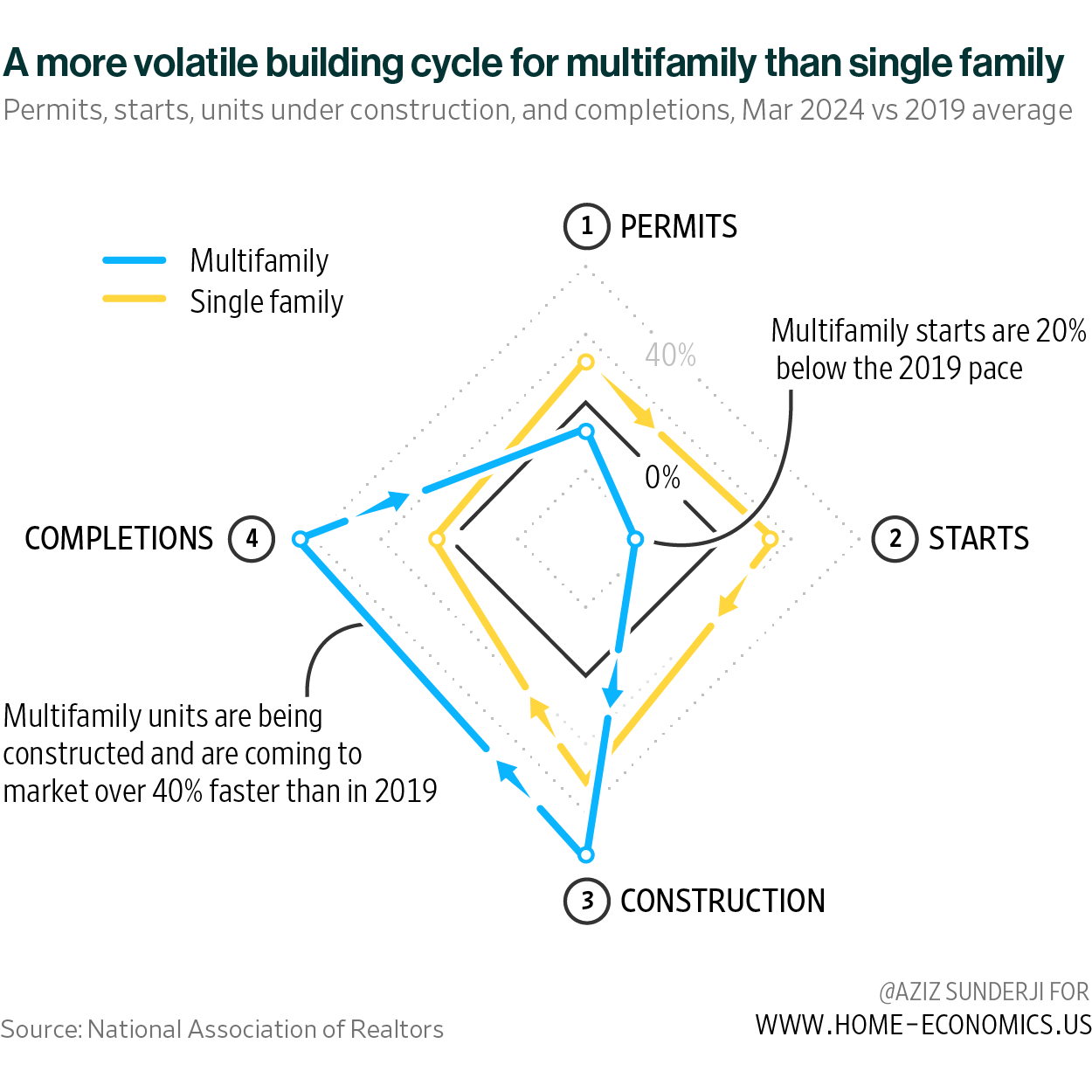

I hope you had a good week. This is the first edition of The Week in Review. Every Saturday, I’ll recap the three top news developments and what we think about them. Plus, some other stuff I came across and liked, and thought you might too. Articles with a ◎ are free. Those with a ◉ have free previews but are only accessible in full for paying subscribers. Upgrade your subscription here. News: Home construction tanked Builders of single homes are behaving differently from those who build apartment buildings (“multifamily”). In single family, activity at the various stages of construction (permits, starts, construction, completion) is declining towards 2019 levels. This has been happening gradually, but lurched downwards in the latest data (covering March). The multifamily cycle looks like a snake that just ate a goat: a skinny stream of permits and starts (far below 2019 levels), and a massive bulge of pandemic-delayed units passing through the construction-to-completion pipeline. We expect the construction industry to continue its gradual return to normalcy. In the single-family sector, this translates to a moderate decrease in permits, starts, construction, and completions. Meanwhile, the multifamily sector is likely to experience a decline in construction from its current exceptionally high levels, although completions will remain elevated in the near term. Unfortunately, this influx of new buildings entering the market is putting downward pressure on rents—bad news for landlords. However, there is reason for optimism on the horizon: leading indicators suggest that the current low levels of permits and starts are likely to persist for several more quarters. As a result, once construction has fully transitioned into completions, the supply/demand balance will become more favorable for operators.

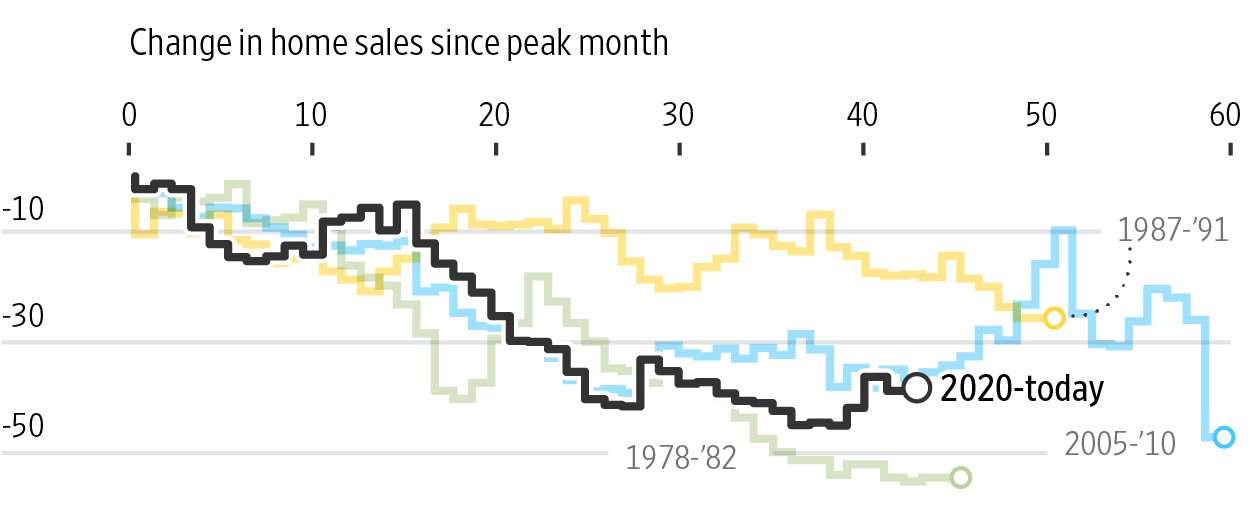

News: Home sales dropped, but only a little In March, existing home sales fell 4.3% from the prior month to a seasonally adjusted annualized rate of 4.19 million homes. This was below consensus expectations. It was the largest drop in over a year. Sales remain mired far below pre-pandemic levels, although still higher than the nadir reached last October. There were other signs of softness: inventory inched slightly (but remains very low) and prices dipped 0.5% (seasonally adjusted, as reported by Goldman Sachs). The jump in mortgage rates surely played a part in lower home sales. We think declining inflation will allow the Fed to cut 1-2 times this year, bringing down mortgage rates to 6% or below by year-end. This should unlock homes, alleviate financing costs, and boost home sales. Weekly mortgage applications (which lead sales by a month) suggest next month’s sales number should improve. Moreover: younger Millennials are a huge generation. They are rapidly forming households. Most have at least one child. These are prime home buyers. Sales should rise.

News: Treasury yields—and mortgage rates—surged (again) Last week’s surprisingly strong CPI data showed the Fed continues to struggle with the last mile problem with prices. They just won’t fall, at least not in any stable, consistent way. But there are two good reasons inflation is far more likely to fall than rise: shelter inflation will subside, and services inflation should drop as decelerating wages filter through to prices. If that happens, then the door reopens to substantial rate cuts (from the inflation side, not to mention growth weakening). Most people think this is unlikely, but most people also underestimate how quickly things can move (after all, rate cuts were priced out quickly—is it unreasonable to think they can be back on the table again soon?). 6% remains my end of year 30-year mortgage rate target. I talked about this extensively this week with Noah and John at Urban Digs, a New York-focused real estate analytics company.

Phew. You made it. This is the good part.

Home Economics is a reader-supported publication. Please consider upgrading to a paid subscription to support our work. Paying clients receive access to the full archive, forecasts, data sets, and exclusive in-depth analysis. This edition is free—you can forward it to colleagues who appreciate concise, data-driven housing analysis. |

Older messages

Home Starts? More like Home Stops

Tuesday, April 16, 2024

A sharp downturn in new and planned construction ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

One Home Price Index to Rule them All?

Thursday, April 4, 2024

Case-Shiller, FHFA, Zillow, the list goes on. But one is better than the rest. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Boomer-Millennial Housing Battle Cools

Wednesday, April 3, 2024

And other takeaways from NAR's Generational Trends Report ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Housing Market Rolls into Spring on a Weak Footing

Tuesday, March 26, 2024

The devil is in the details, again ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Home Sales: Strength Behind the Headlines

Friday, March 22, 2024

3 reasons the data was even better than widely reported ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Deporting Undocumented Workers Will Make Housing More Expensive

Monday, March 10, 2025

The effect will be most pronounced in Texas and California ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Viral "Jellyfish" Haircut Is 2025's Most Controversial Trend

Monday, March 10, 2025

So edgy. The Zoe Report Daily The Zoe Report 3.9.2025 The Viral "Jellyfish" Haircut Is 2025's Most Controversial Trend (Hair) The Viral "Jellyfish" Haircut Is 2025's Most

Reacher. Is. Back. And Alan Ritchson's Star is STILL Rising

Sunday, March 9, 2025

View in Browser Men's Health SHOP MVP EXCLUSIVES SUBSCRIBE THIS WEEK'S MUST-READ Reacher. Is. Back. and Alan Ritchson's Star is STILL Rising. Reacher. Is. Back. and Alan Ritchson's Star

12 Charming Movies to Watch This Spring

Sunday, March 9, 2025

The sun is shining, the tank is clean – it's time to watch some movies ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

10 Ways to Quiet Annoying Household Noises

Sunday, March 9, 2025

Digg Is Coming Back (Sort Of). Sometimes the that's noise bothering you is coming from inside the house. Not displaying correctly? View this newsletter online. TODAY'S FEATURED STORY 10 Ways to

The Weekly Wrap # 203

Sunday, March 9, 2025

03.09.2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekend: Introducing the Butt Mullet Dress 👀

Sunday, March 9, 2025

— Check out what we Skimm'd for you today March 9, 2025 Subscribe Read in browser Header Image But first: Join the waitlist for a new premium Skimm experience Update location or View forecast

Starting Thursday: Rediscover Inspiration Through Wordsworth

Sunday, March 9, 2025

Last chance to register for our next literary seminar starting March 13. March Literary Seminar: Timothy Donnelly on William Wordsworth Rediscover one of the most influential poets of all time with

5 little treats for these strange and uncertain times

Sunday, March 9, 2025

Little treat culture? In this economy?

RI#266 - Down the rabbit hole/ What is "feels-like" temp/ Realtime voice tutor

Sunday, March 9, 2025

Hello again! My name is Alex and every week I share with you the 5 most useful links for self-improvement and productivity that I have found on the web. ---------------------------------------- You are